Professional Documents

Culture Documents

BUSN 625 Week 5 Chapter 14 Problems

BUSN 625 Week 5 Chapter 14 Problems

Uploaded by

Kristin Davis0 ratings0% found this document useful (0 votes)

4 views2 pagesThis document contains sample problems and solutions from Chapter 14 of a managerial finance textbook. It includes calculations of weighted average cost of capital (WACC), cost of equity, and debt ratios for three companies - Weston Industries, Shadow Corp, and Jenkins Corp. The problems walk through determining each component of WACC and how ratios and borrowing levels impact the overall WACC and cost of equity.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains sample problems and solutions from Chapter 14 of a managerial finance textbook. It includes calculations of weighted average cost of capital (WACC), cost of equity, and debt ratios for three companies - Weston Industries, Shadow Corp, and Jenkins Corp. The problems walk through determining each component of WACC and how ratios and borrowing levels impact the overall WACC and cost of equity.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesBUSN 625 Week 5 Chapter 14 Problems

BUSN 625 Week 5 Chapter 14 Problems

Uploaded by

Kristin DavisThis document contains sample problems and solutions from Chapter 14 of a managerial finance textbook. It includes calculations of weighted average cost of capital (WACC), cost of equity, and debt ratios for three companies - Weston Industries, Shadow Corp, and Jenkins Corp. The problems walk through determining each component of WACC and how ratios and borrowing levels impact the overall WACC and cost of equity.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

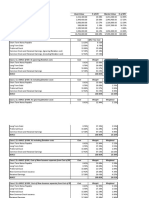

BUSN 625: Managerial Finance

Chapter 14 Problems

14.12 Weston Industries

Debt Ratio 1.4

Equity Ratio 2.4

WACC 8.30%

Cost of Debt 5.40%

Tax Rate 24.00%

a) Weston's Cost of Equity 14.17%

Step 1 - Finding Debt Component of WACC 2.39%

Step 2 - Finding Equity Component of WACC 5.91%

Step 3 - Finding Cost of Equity Capital 14.17%

b) Weston's Unlevered Cost of Equity Capital 9.68%

Step 1 - 106.40%

Step 2 15.08%

Step 3 9.68%

c) Cost of Equity With Debt/Equity Ratio=2 16.19%

c) Cost of Equity With Debt/Equity Ratio=1 12.94%

c) Cost of Equity With Debt/Equity Ratio=0 9.68%

14.13 Shadow Corp

Current Debt Level 0.00%

Est. Borrowing Rate 5.75%

Tax Rate 22.00%

WACC 8.90%

a) Firm's Cost of Equity Capital 8.90%

b) Cost of Equity Capital@25% Debt Level 9.72%

c) Cost of Equity Capital@50% Debt Level 11.36%

d(a) WACC@25% Debt Level 8.41%

d(b) WACC@50% Debt Level 7.92%

14.21 - Jenkins Corp

Equity Market Value $ 6.40

Debt@Market Value $ 2.60

Total Debt&Equity $ 9.00

Cost of Debt 7.50%

Company's Beta 1.10

T-Bills Rate 4.00%

Market Return 11.00%

a) What is Jenkins Debt-Equity Ratio 0.4063

b) What is Jenkins WACC 10.49%

Step 1: Find the Cost of Equity 11.70%

Step2: Jenkins WACC 10.49%

c) What is Jenkins WACC@All Equity 11.70%

You might also like

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDocument4 pagesThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalAditya Mukherjee100% (1)

- Solutions Manual To Accompany Engineering Economy 6th Edition 9780073205342Document7 pagesSolutions Manual To Accompany Engineering Economy 6th Edition 9780073205342CrystalDavisntgrw100% (75)

- Marriott Corporation - K - AbridgedDocument9 pagesMarriott Corporation - K - AbridgedDurgaprasad Velamala100% (5)

- Chapter 14. CH 14-07 Build A Model: B B (1+ (1-T) (D/S) )Document6 pagesChapter 14. CH 14-07 Build A Model: B B (1+ (1-T) (D/S) )Herlambang Prayoga100% (1)

- Chapter 11Document17 pagesChapter 11mark lee100% (1)

- Zycus CalculationsDocument3 pagesZycus CalculationsDarshan ShethNo ratings yet

- Session 5 Topic 8 - IpackDocument3 pagesSession 5 Topic 8 - IpackHoneylyn SM AranetaNo ratings yet

- Lancaster Engineering IncDocument2 pagesLancaster Engineering IncMamunoor RashidNo ratings yet

- BE Aerospace Case SolutionDocument31 pagesBE Aerospace Case SolutionFaima AkterNo ratings yet

- Exercises and Answers Chapter 3Document12 pagesExercises and Answers Chapter 3MerleNo ratings yet

- AE 315 Case Study 1 Curt Manufacturing Solution Support MJBTDocument4 pagesAE 315 Case Study 1 Curt Manufacturing Solution Support MJBTArly Kurt TorresNo ratings yet

- DF1 601 Individual AssignmentDocument5 pagesDF1 601 Individual AssignmentIan KipropNo ratings yet

- Corporate Finance 4b WACCDocument25 pagesCorporate Finance 4b WACCMeghana ErapagaNo ratings yet

- A. What Is The Company's Cost of Equity Capital?Document8 pagesA. What Is The Company's Cost of Equity Capital?thalibritNo ratings yet

- WACC Calculation Comparable Companies Unlevered Beta Capital StructureDocument1 pageWACC Calculation Comparable Companies Unlevered Beta Capital StructureIkramNo ratings yet

- Marriott Cost of Capital DataDocument18 pagesMarriott Cost of Capital DataSaadatNo ratings yet

- Cost ofDocument14 pagesCost ofrajjoNo ratings yet

- Problems 1-24: Input Boxes in TanDocument35 pagesProblems 1-24: Input Boxes in TanThảo NhiNo ratings yet

- FM - Lucky-Cement - Cost-of-Capital - Solutions by DeanDocument3 pagesFM - Lucky-Cement - Cost-of-Capital - Solutions by DeanKristine Nitzkie SalazarNo ratings yet

- Mayes 8e CH11 SolutionsDocument22 pagesMayes 8e CH11 SolutionsRamez AhmedNo ratings yet

- DCF PDFDocument2 pagesDCF PDFMd Rasel Uddin ACMANo ratings yet

- Revision Excel SheetsDocument9 pagesRevision Excel SheetsPhan Phúc NguyênNo ratings yet

- CalculatingtheWACC 911bb13Document5 pagesCalculatingtheWACC 911bb13Live ExpertNo ratings yet

- Historicals: Terminal Growth Rate: 2.5% EV/EBIT Exit MultipleDocument10 pagesHistoricals: Terminal Growth Rate: 2.5% EV/EBIT Exit MultipleMary NingNo ratings yet

- Total 5 Marks: Question 1 BDocument8 pagesTotal 5 Marks: Question 1 Bshaneice_lewisNo ratings yet

- COST OF CAPITAL SpecificDocument11 pagesCOST OF CAPITAL SpecificKanika MaheshwariNo ratings yet

- CPKDocument6 pagesCPKBilly GemaNo ratings yet

- Extra Material On CFDocument127 pagesExtra Material On CFPanosMavrNo ratings yet

- Mattel - Financial ModelDocument13 pagesMattel - Financial Modelharshwardhan.singh202No ratings yet

- Par Value Coupon Interest N Avrage Discount Flotation Cost TaxDocument13 pagesPar Value Coupon Interest N Avrage Discount Flotation Cost TaxGhina NabilaNo ratings yet

- MAD AssignmentDocument4 pagesMAD AssignmentSWETHA LAGISETTINo ratings yet

- Solved Problem 14.1: The Above Is Obtained Using The Following StepsDocument3 pagesSolved Problem 14.1: The Above Is Obtained Using The Following StepsArjun Jaideep BhatnagarNo ratings yet

- 12 40Document10 pages12 40Gonçalo AlmeidaNo ratings yet

- Stuti Mehta pgmb2149 FinanceDocument12 pagesStuti Mehta pgmb2149 FinanceStutiNo ratings yet

- DCF ModelDocument58 pagesDCF Modelishaan0311No ratings yet

- Session-1 CF-2Document13 pagesSession-1 CF-2rajyalakshmiNo ratings yet

- Session 12 (Chap1, 4, 5 of Titman, 2014)Document14 pagesSession 12 (Chap1, 4, 5 of Titman, 2014)Thu Hiền KhươngNo ratings yet

- w6 - Cost of Capital - Capital StructureDocument3 pagesw6 - Cost of Capital - Capital StructureMooqyNo ratings yet

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered Betahassan1993No ratings yet

- Latihan Soal Uas FMDocument13 pagesLatihan Soal Uas FMNatally LangfeldtNo ratings yet

- Charlene DulayDocument19 pagesCharlene DulayJerome MontoyaNo ratings yet

- Midsem Sol - WACC QuestionDocument2 pagesMidsem Sol - WACC QuestionSarthak JainNo ratings yet

- P07A - Cost of CapitalDocument3 pagesP07A - Cost of CapitalL1588AshishNo ratings yet

- t7 Borrowing CostDocument3 pagest7 Borrowing CostShirley VunNo ratings yet

- Financial Plan TemplateDocument104 pagesFinancial Plan Templatewerewolf2010No ratings yet

- Income Based Valuation Unit Exam Answer Key NewDocument6 pagesIncome Based Valuation Unit Exam Answer Key NewAMIKO OHYANo ratings yet

- Capital Structure and Leverage (D. Bañas)Document6 pagesCapital Structure and Leverage (D. Bañas)DAISYBELLE S. BAÑASNo ratings yet

- 37906cost of CapitalDocument6 pages37906cost of CapitalSimra SalmanNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Debt LevelDocument3 pagesDebt Levelsultan altamashNo ratings yet

- FM WaccDocument8 pagesFM WaccJyothish JbNo ratings yet

- Risk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskDocument12 pagesRisk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskrajjoNo ratings yet

- Risk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskDocument12 pagesRisk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskrajjoNo ratings yet

- Capital Structure: Debt To Total Capitalization Equity To Total CapitalizationDocument2 pagesCapital Structure: Debt To Total Capitalization Equity To Total CapitalizationAcxel Andres AltuveNo ratings yet

- WACC CalculatorDocument11 pagesWACC CalculatorshountyNo ratings yet

- Emv Case Study 1Document8 pagesEmv Case Study 1ViddhiNo ratings yet