Professional Documents

Culture Documents

Finance Activity 1

Uploaded by

jovibonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Activity 1

Uploaded by

jovibonCopyright:

Available Formats

Bon Rian Despabeladero

Finance

1.

INCOME STATEMENT

AS OF THE YEAR 2009

SALES: $760,000 CASH SALES: $760,000

LESS: LESS: COSTS ($300,000)

SALES RETURNS AND

ALLOWANCES: ($690,000) TOTAL

NET PROFIT/LOSS: $460,000

COST OF SALES: $300,000

RETURN CREDITS: ($690,000)

TOTAL TOTAL

NET PROFIT/LOSS: ($230,000) PROFIT/LOSS: ($230,000)

Using the accrual basis of accounting a financial Using the cash basis method although same results

manager can see what happens to the business can be achieved it does not always depict the

accurately as transactions are recorded when they accurate current state of the business because

occur this will lead to a faithful and actual transactions are recorded when cash changes

condition of the business to be reflected in it’s hands this will often result in overstating or

financial statements. understating the cash of the business as a financial

manager this could hurt more rather than help the

business.

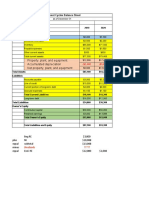

2. A. INCOME STATEMENT

CATHY CHEN ACCOUNTING SERVICES

For the year ended Dec. 31 2012

REVENUES

Accounting Revenues $360,000

EXPENSES

Salary Expense $ 92,000

Salary tax and benefit expense $ 34,600

Office supplies Expense $ 10,400

Travel and Entertainment Exp. $ 17,000

Rent Expense(2,700x12) $ 32,400

Depreciation Expense $ 15,600

Interest Expense $ 15,000

TOTAL EXPENSES $ 217,000

INCOME BEFORE TAX $ 143,000

INCOME LESS TAX $ 108,000

NET PROFIT $ 35,000

B. Ms. Cathy Chen’s financial performance during the year 2012 ended with a Net profit of $35,000

considering it is her first year in business is acceptable.

You might also like

- Bab-2 MK2018Document15 pagesBab-2 MK2018CalistaNo ratings yet

- Financial Plan: 7.1 Important AssumptionsDocument21 pagesFinancial Plan: 7.1 Important Assumptionsaira eau claire orbeNo ratings yet

- Our LogisticsDocument4 pagesOur LogisticssanderNo ratings yet

- Assignment Part OneDocument3 pagesAssignment Part Onetovi0821No ratings yet

- Nama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityDocument10 pagesNama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityAliea YenemiaNo ratings yet

- Problem Cash FlowDocument3 pagesProblem Cash FlowKimberly AnneNo ratings yet

- REPO1601085S Rose Revenue Management ReworkedDocument33 pagesREPO1601085S Rose Revenue Management ReworkedSonali SahooNo ratings yet

- Case 1 Group1 7A1Document6 pagesCase 1 Group1 7A1ruruNo ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- Revenue SummaryDocument1 pageRevenue SummaryELIJAHNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Afif Juwandira-1162003016-Jawaban UTS Semester GenapDocument10 pagesAfif Juwandira-1162003016-Jawaban UTS Semester GenapYusuf AssegafNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- Tugas AlimDocument3 pagesTugas AlimHappy MichaelNo ratings yet

- 2 .Accounting Statements, Taxes, and Cash FlowDocument27 pages2 .Accounting Statements, Taxes, and Cash FlowBussines LearnNo ratings yet

- RWJJ Chapter 2: Solutions To Assigned Questions and ProblemsDocument9 pagesRWJJ Chapter 2: Solutions To Assigned Questions and ProblemsvzzrNo ratings yet

- Business Consultation - Talking GAAP CaseDocument4 pagesBusiness Consultation - Talking GAAP Casethales lumertzNo ratings yet

- Homework #1 - Ratio AnalysisDocument9 pagesHomework #1 - Ratio Analysisfgdsafds100% (1)

- Peanut FinancialsDocument4 pagesPeanut FinancialsTertius Du ToitNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- MAS II (Unit 1-4)Document40 pagesMAS II (Unit 1-4)lena cpaNo ratings yet

- Business Model: Expenditure Amount Income AmountDocument2 pagesBusiness Model: Expenditure Amount Income AmountAnkur DharodNo ratings yet

- Mashmglons Print PostDocument9 pagesMashmglons Print Postankush diwanNo ratings yet

- The Basic Financial Statements & Recording Process: DR Asma Abdul RehmanDocument45 pagesThe Basic Financial Statements & Recording Process: DR Asma Abdul RehmanMuskan binte RaisNo ratings yet

- Understanding Financial Statements: Student - Feedback@sti - EduDocument6 pagesUnderstanding Financial Statements: Student - Feedback@sti - Eduvince mendozaNo ratings yet

- Bus 5111 Week 3 Assignment FinancicalDocument3 pagesBus 5111 Week 3 Assignment FinancicalMohamedNo ratings yet

- Solutions To Chapter 15 Questions - Managing Current AssetsDocument5 pagesSolutions To Chapter 15 Questions - Managing Current AssetsSyeda MiznaNo ratings yet

- Assignment 17Document8 pagesAssignment 17Nicolas ErnestoNo ratings yet

- Introduction To Accounting and Business: Discussion QuestionsDocument52 pagesIntroduction To Accounting and Business: Discussion QuestionsVĩnh TríNo ratings yet

- AKL 2 - Tugas 5 Marselinus A H T (A31113316)Document4 pagesAKL 2 - Tugas 5 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Financial PlanDocument12 pagesFinancial PlanNico BoialterNo ratings yet

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- Blue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlDocument4 pagesBlue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlKimberley WrightNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Latihan Soal Sesi 2 - Muhammad Naufal Ramadhan - 215020307111091Document4 pagesLatihan Soal Sesi 2 - Muhammad Naufal Ramadhan - 215020307111091MUHAMMAD NAUFAL RAMADHANNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- Some Solved Problems and Statement From Tabular AnalysisDocument9 pagesSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNo ratings yet

- Solution Manual For Essentials of Corporate Finance 10th by RossDocument38 pagesSolution Manual For Essentials of Corporate Finance 10th by Rossjohnniewalshhtlw100% (20)

- Computron Industries Ratio Analysis For ClassDocument8 pagesComputron Industries Ratio Analysis For ClassRishabh JainNo ratings yet

- PPP Key Ratio Analysis I Cba June 122019Document33 pagesPPP Key Ratio Analysis I Cba June 122019Kelvin Namaona NgondoNo ratings yet

- Name: Avishchal Shivneel Chand Student ID: S11171687Document3 pagesName: Avishchal Shivneel Chand Student ID: S11171687Avishchal ChandNo ratings yet

- ASSIGNMENT 2 Group 9Document6 pagesASSIGNMENT 2 Group 9Haroon Z. ChoudhryNo ratings yet

- EfnDocument6 pagesEfnHaroon Z. ChoudhryNo ratings yet

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- Tutoring Business Plan ExampleDocument23 pagesTutoring Business Plan Example24 Alvarez, Daniela Joy G.No ratings yet

- INTEGRATIVE PROBLEM 2-17 and Solution For ReviewDocument11 pagesINTEGRATIVE PROBLEM 2-17 and Solution For ReviewNoor NabiNo ratings yet

- ANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)Document13 pagesANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)senzo scholarNo ratings yet

- Exercise 3. Cash Flows Statements and WorkingDocument8 pagesExercise 3. Cash Flows Statements and WorkingQuang Dũng NguyễnNo ratings yet

- Account Excess FV Over BV $ 200,000 Allocations: TotalDocument6 pagesAccount Excess FV Over BV $ 200,000 Allocations: TotalMcKenzie WNo ratings yet

- Stress TestDocument4 pagesStress Testapi-403965812No ratings yet

- Class Case 1 Quick LunchDocument4 pagesClass Case 1 Quick Lunch9ry5gsghybNo ratings yet

- SETON HOTEL Business Plan Example 2020Document29 pagesSETON HOTEL Business Plan Example 2020Ayesha ChoiNo ratings yet

- Financial Analysis Exercise PDFDocument2 pagesFinancial Analysis Exercise PDFKharen BermudezNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- Activity 2 Capital BudgetingDocument13 pagesActivity 2 Capital BudgetingjovibonNo ratings yet

- Finma Group 5 Capital Budgeting - Part 1-12-14Document4 pagesFinma Group 5 Capital Budgeting - Part 1-12-14jovibonNo ratings yet

- Group 8 Capital BudgetingDocument18 pagesGroup 8 Capital BudgetingjovibonNo ratings yet

- Activity 2 Assigned Problems 1Document6 pagesActivity 2 Assigned Problems 1jovibonNo ratings yet

- Learning Task 1 Supply and Demand CurvesDocument4 pagesLearning Task 1 Supply and Demand CurvesjovibonNo ratings yet

- Level 5 Assignment 1 Activity 2Document1 pageLevel 5 Assignment 1 Activity 2jovibonNo ratings yet

- Level 5 Assignment 1 Activity 3Document1 pageLevel 5 Assignment 1 Activity 3jovibonNo ratings yet

- Level 5 Assignment 1 CompleteDocument8 pagesLevel 5 Assignment 1 CompletejovibonNo ratings yet