Professional Documents

Culture Documents

Revision Exercises

Uploaded by

Fahed Madi0 ratings0% found this document useful (0 votes)

8 views1 pageThe standard deviation of returns on Stock X is 0.24 based on the probability distribution and returns provided in the bear, normal and bull markets.

The expected return of a portfolio investing $1,200,000 in Stock A and $800,000 in Stock B can be calculated based on the probability of each economic state and the corresponding returns for each stock.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe standard deviation of returns on Stock X is 0.24 based on the probability distribution and returns provided in the bear, normal and bull markets.

The expected return of a portfolio investing $1,200,000 in Stock A and $800,000 in Stock B can be calculated based on the probability of each economic state and the corresponding returns for each stock.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageRevision Exercises

Uploaded by

Fahed MadiThe standard deviation of returns on Stock X is 0.24 based on the probability distribution and returns provided in the bear, normal and bull markets.

The expected return of a portfolio investing $1,200,000 in Stock A and $800,000 in Stock B can be calculated based on the probability of each economic state and the corresponding returns for each stock.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

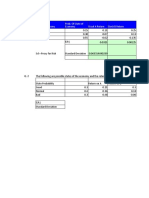

Question 1: Consider the following probability distribution of returns for

Stock X.

Bear Market Normal Market Bull Market

Probability 0.2 0.5 0.3

Stock X Return -0.20 0.18 0.50

What is the standard deviation of returns on Stock X?

Question 2: The Probability Distribution Of Returns For Stocks A And B Are

Given In The Table Below. If You Invest $1,200,000 In Stock A And

$800,000 In Stock B, Calculate The Expected Return Of Your Portfolio.

State of Economy Probability of state Stock A's Return Stock B's Return

Boom 0.20 40% 28%

Normal 0.40 25% 12%

Slow Down 0.30 0% 7%

Recession 0.10 -20% 0%

You might also like

- NA - Ma Roki Fajri Aulia Rahma Putri Ahmad Habibie Matkul Manajemen KeuanganDocument2 pagesNA - Ma Roki Fajri Aulia Rahma Putri Ahmad Habibie Matkul Manajemen Keuangankota lainNo ratings yet

- Exercise Ch11 RiskReturnDocument2 pagesExercise Ch11 RiskReturnPeterNo ratings yet

- State of Economy Probability ReturnDocument1 pageState of Economy Probability ReturnArman ShahNo ratings yet

- Financial Management - Assignment Ch8 - Abdullah Bin Amir - Section ADocument2 pagesFinancial Management - Assignment Ch8 - Abdullah Bin Amir - Section AAbdullah AmirNo ratings yet

- Assignment 4Document2 pagesAssignment 4Phước NgọcNo ratings yet

- International Economics 4Th Edition Feenstra Solutions Manual Full Chapter PDFDocument26 pagesInternational Economics 4Th Edition Feenstra Solutions Manual Full Chapter PDFRebeccaBartlettqfam100% (8)

- International Economics 4th Edition Feenstra Solutions ManualDocument18 pagesInternational Economics 4th Edition Feenstra Solutions Manualalanfideliaabxk100% (27)

- Latihan Soal Sesi 3 - Nastiti Kartika DewiDocument26 pagesLatihan Soal Sesi 3 - Nastiti Kartika DewiNastiti KartikaNo ratings yet

- Questions - Risk and Return - IIDocument3 pagesQuestions - Risk and Return - IIRuchitha PrakashNo ratings yet

- Chapter Eight End of Chapter Useful Questions and SolutionsDocument18 pagesChapter Eight End of Chapter Useful Questions and SolutionsAbhinav AgarwalNo ratings yet

- ACC501 Assignment 2 Solution Fall 2020 SolutionDocument3 pagesACC501 Assignment 2 Solution Fall 2020 SolutionMian SarimNo ratings yet

- Optimal Capital StructureDocument11 pagesOptimal Capital StructureHassan ChaudhryNo ratings yet

- Af 212 - Review Questions 2022 2Document3 pagesAf 212 - Review Questions 2022 2Mwamba HarunaNo ratings yet

- Ques Risk and Return & CAPM (S-17Revised)Document6 pagesQues Risk and Return & CAPM (S-17Revised)Najia SiddiquiNo ratings yet

- Chapter 11 P7 P10 1617252729Document7 pagesChapter 11 P7 P10 1617252729Dawson Dela CruzNo ratings yet

- 3 - Portfolio Risk ReturnDocument26 pages3 - Portfolio Risk ReturnSIDDHARTH SNNo ratings yet

- Risk and Return The Capital Asset Pricing Model (Capm)Document47 pagesRisk and Return The Capital Asset Pricing Model (Capm)Bussines LearnNo ratings yet

- Standard Deviation on Individual Security = σ = √σ: Risk Return Problems Problem 1Document3 pagesStandard Deviation on Individual Security = σ = √σ: Risk Return Problems Problem 1jakia yasminNo ratings yet

- China Dev Industrial Bank - MM JKT REGULER 43 - Raha, Febri Hartini, Irma WulandDocument31 pagesChina Dev Industrial Bank - MM JKT REGULER 43 - Raha, Febri Hartini, Irma WulandRini Ramdhiani MuchtarNo ratings yet

- VI. Decision AnalysisDocument5 pagesVI. Decision AnalysisGalang, Princess T.No ratings yet

- Mini Case Chapter 6 - Week 3Document6 pagesMini Case Chapter 6 - Week 3georgejane100% (3)

- Review Chapter12 - 14Document1 pageReview Chapter12 - 14minhhunghb789No ratings yet

- Demo Qs Topic 5 Part 1Document6 pagesDemo Qs Topic 5 Part 1Triet NguyenNo ratings yet

- Risk and ReturnDocument7 pagesRisk and Returnsofia garcinesNo ratings yet

- Company Financial ManagementDocument8 pagesCompany Financial ManagementMiconNo ratings yet

- Quantitative AnalysisDocument6 pagesQuantitative AnalysisUSD 654No ratings yet

- Risk and Return: Portfolio Theory and Assets Pricing Models: Problem 1Document3 pagesRisk and Return: Portfolio Theory and Assets Pricing Models: Problem 1anubha srivastavaNo ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementMiconNo ratings yet

- Nama: Redi Perdiansyah NIM: 55120110139 Quiz Ke: 9: Stock X Stock y Stock ZDocument5 pagesNama: Redi Perdiansyah NIM: 55120110139 Quiz Ke: 9: Stock X Stock y Stock ZFikky Chandra SilabanNo ratings yet

- Practice ExcerciseDocument17 pagesPractice ExcerciseStella ShineNo ratings yet

- FIN 301 B Porter Rachna Chapter 8-3 Soln.Document2 pagesFIN 301 B Porter Rachna Chapter 8-3 Soln.Hà My Trần HoàngNo ratings yet

- Ch06 ShowDocument51 pagesCh06 ShowMahmoud AbdullahNo ratings yet

- Estimating Risk and Return On Assets: S A R Q P I. QuestionsDocument13 pagesEstimating Risk and Return On Assets: S A R Q P I. QuestionsRonieOlarteNo ratings yet

- Lecture 5 - OptimizationDocument6 pagesLecture 5 - Optimizationmzhao8No ratings yet

- Risk, Return, and The Capital Asset Pricing ModelDocument52 pagesRisk, Return, and The Capital Asset Pricing ModelFaryal ShahidNo ratings yet

- Variance, StdDev and Expected ReturnDocument4 pagesVariance, StdDev and Expected Returnkapil gargNo ratings yet

- Chapter 8 Emba 503Document6 pagesChapter 8 Emba 503Arifur NayeemNo ratings yet

- Return and ReturnDocument9 pagesReturn and ReturnInaas ZulfiqarNo ratings yet

- Chapter 3 4Document16 pagesChapter 3 4Hanah Rys Keziah VelaNo ratings yet

- D - Tutorial 4 (Solutions)Document12 pagesD - Tutorial 4 (Solutions)AlfieNo ratings yet

- Ross CH 13Document23 pagesRoss CH 13miftahulamalahNo ratings yet

- Seminar 5Document6 pagesSeminar 5EnnyNo ratings yet

- Topic 5 - Risk & ReturnDocument29 pagesTopic 5 - Risk & ReturnNidhi SinghNo ratings yet

- Investment Strategy CaseDocument16 pagesInvestment Strategy Caseamitgurus100% (2)

- Tutorial 4: Portfolio TheoryDocument19 pagesTutorial 4: Portfolio TheorystellaNo ratings yet

- 2 YhhhjdrfgDocument5 pages2 YhhhjdrfgPeishi OngNo ratings yet

- Chapter Twelve QuestionsDocument3 pagesChapter Twelve QuestionsabguyNo ratings yet

- Chapter 6assignmentDocument6 pagesChapter 6assignmentUnni KuttanNo ratings yet

- 12.2 Payoff Table For The Real Estate InvestmentsDocument5 pages12.2 Payoff Table For The Real Estate Investmentsahammed akibNo ratings yet

- Chapter 3 Part 3Document30 pagesChapter 3 Part 3Aditya GhoshNo ratings yet

- Chapter 11: The Cost of Capital Solutions To ProblemsDocument2 pagesChapter 11: The Cost of Capital Solutions To Problemsjhoana_seseNo ratings yet

- DT.22.2 FM Final ExaminationDocument35 pagesDT.22.2 FM Final ExaminationJericho GeranceNo ratings yet

- Ebit - Eps Analysis: No Debt Case With DebtDocument3 pagesEbit - Eps Analysis: No Debt Case With DebtParvesh AghiNo ratings yet

- Chapter 4 Exercises: Date Stock PriceDocument2 pagesChapter 4 Exercises: Date Stock PriceLy PhanNo ratings yet

- Portfolio QuestionsDocument3 pagesPortfolio QuestionsMeshack MateNo ratings yet

- Chapter 4 Risk and Return ExerciseDocument2 pagesChapter 4 Risk and Return ExerciseLy PhanNo ratings yet

- Cailin Chen Question 9: (10 Points)Document5 pagesCailin Chen Question 9: (10 Points)Manuel BoahenNo ratings yet

- Chapter 13: Capital Structure and Leverage Comprehensive/Spreadsheet Problem 1Document26 pagesChapter 13: Capital Structure and Leverage Comprehensive/Spreadsheet Problem 1Rand Al-akamNo ratings yet

- Tutorial Set 9 SolutionsDocument8 pagesTutorial Set 9 SolutionsRabinNo ratings yet

- Mean Median and ModeDocument3 pagesMean Median and ModeFahed MadiNo ratings yet

- Chapter 6 Part TwoDocument3 pagesChapter 6 Part TwoFahed MadiNo ratings yet

- Chapter 7 Part OneDocument7 pagesChapter 7 Part OneFahed MadiNo ratings yet

- The Normal Probability DistributionDocument3 pagesThe Normal Probability DistributionFahed MadiNo ratings yet