Professional Documents

Culture Documents

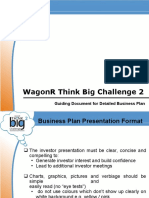

Guide Document For Business Plan PPT Preparation For Referrence

Guide Document For Business Plan PPT Preparation For Referrence

Uploaded by

SapuniiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guide Document For Business Plan PPT Preparation For Referrence

Guide Document For Business Plan PPT Preparation For Referrence

Uploaded by

SapuniiCopyright:

Available Formats

Business Plan

The presentation should ideally be of 16-20 slides that delivers a 360 degree perspective on the

key elements of the business.

While your business would be having significant technology or technology-enabled components,

the presentation itself should be business oriented.

The following components should be included in the slide presentation-

» Elevator Pitch

» Vision & Mission Statement

» Market & Industry Environment

» Value Proposition, Key Products/Services and Differentiation

» Competitive Scenario and Entry Barriers

» Business Model and Sales/Marketing Strategy

» Market Traction

» Management Team

» Organisation

» Financials

» Exit

» Capital

» Risk & Gaps

1] Elevator Pitch (1 slide)

A 5 line quick pitch on

What does the Company do?

What new benefits do you provide and/or what pain points are addressed?

How are you differentiated from competitors on a sustainable basis?

2] Vision and Mission Statement (1 slide)

Please define the Vision and Mission statement of the Company.

The management team's vision for the business needs to be powerful and realistic enough to rally

employees, customers, investors and the industry around it. At IDG Ventures, we partner with

businesses that have the potential to be market leaders in their category.

3] Market and Industry Environment (2 slides)

Help us learn more about the specific market segments that you are targeting and the industry

that you operate in.

This would include relevant facts of the market such as market definition, key segments, size of

target segments, growth rates, key market trends and challenges/issues the market is facing.

Please briefly note the critical success factors for a company in this market.

Source: IDG Ventures

A visual illustration of the market place with names of various participants, such as competition,

vendors, distributors and customers would paint a picture of the environment.

4] Value Proposition, Key Products/Services and Differentiation (2 slides)

Use this section to convince us that a very large number of sticky customers will repeatedly pay

you good amounts of money to enable you to build a sustainable, profitable and scalable

business.

Tell us why the customer is passionate about each of your products/services; what benefits does

the target customer get and/or what pain point is addressed. Also, briefly note the profile of your

typical customer.

Describe your key products/services today and the roadmap for the next two to three years.

Explain how your business is deeply differentiated on a sustainable basis; for instance by way of

a unique business model, technology or industry partnerships.

5] Competitive Scenario and Entry Barriers (1-2 slides)

Please provide a table describing the competitive scenario with separate columns for competitor

name, business line, geography, representative customer list, key strengths and weaknesses of

each competitor.

A thorough understanding of the competition will demonstrate an awareness of the environment

and the resulting opportunities and threats.

Highlight why an extremely well-funded new entrant in your market will not succeed in

dislodging your position.

6] Business Model and Sales/Marketing Strategy (2 slides)

Note the important revenue and cost drivers of your business.

Please describe the sales/marketing strategy ensuring that you include

1. a) Overall product/brand positioning

2. b) Sales & distribution strategy

3. c) Key business development alliances & partnerships

4. d) Pricing approach

7] Market Traction (1-2 slides)

The best possible validation of your business strategy is a list of repeatedly and well paying

quality customers. So please use this section to tell us about your customer wins and historical

traction with key accounts.

For example, as applicable to your business, please provide metrics such as your key accounts,

number of unique users, distribution partners, average revenue per account/user and any other

metric you consider important for measuring traction of your business.

Source: IDG Ventures

Please forecast your projections on each of the above metrics for the next four quarters.

8] Management Team (1-2 slides)

This is a vital section of the business plan. Our belief is that good teams are rarer than great

ideas.

We are looking for solid management teams that demonstrate strong ethical standards,

entrepreneurial mindset, a history of achievements, formidable domain expertise, proven

chemistry between founders and perseverance.

Please share with us specific facts about your team's past (with ex-employer/venture names, role

descriptions and timelines included) and why it will be able to meet the challenges posed by a

very dynamic market environment.

9] Organization (1-2 slides)

Do tell us about your organization's human resource structure, number of employees and

locations. Please include information on the constitution of your Board of Directors and if

applicable your Board of Advisors.

10] Financials (1 slide)

Please provide all currency figures in USD only.

This section should include audited annual high level Profit and Loss statement for the last three

years (if applicable) and projections for the following three years.

Kindly list the main 3 or 4 assumptions underlying the financial projections. Please break down

the revenues by the main business lines/products/services as applicable.

11] Exit (1 slide)

Please provide all currency figures in USD only.

Venture capitalists invest with a definite intent of exiting the investment within a defined time

frame ranging from 3 to 7 years. Exit may occur in the form of the Company making an IPO

(Initial Public Offering) or an M & A (Merger & Acquisition).

Please list the 4 or 5 most likely acquirers of your business and why would they be interested in

acquiring your Company?

Do provide a few examples of recent exit valuations in this market (IPO and/or M & A).

12] Capital (1 slide)

Please provide all currency figures in USD only.

Tell us how much money you are raising and give us a high level breakdown of how you will

deploy these funds across the various business streams/segments/functions of your Company.

Source: IDG Ventures

Please specify the current capital shareholding structure and the history of earlier funding; dates

of such transactions, amounts raised, the pre-money valuations applicable and the equity stake

allotted.

13] Risks and Gaps (1 slide)

Share with us the specific risks that your venture and market/industry face. What are the likely

reasons that would cause your Company to under-achieve its targets? (These may be company-

specific and market-specific reasons). What steps are being taken to mitigate these risks?

Finally, share with us the gaps that exist in your Company today. Those could be in the strategy,

business model, customer traction, talent, technology, operations etc. By sharing with us your

perspective on gaps that exist you would allow us to work with you in bridging them and

enabling your Company to achieve its vision. Truly, this section may be used to compellingly

demonstrate the maturity of the management team.

Source: IDG Ventures

You might also like

- Sample: Business Plan Business NameDocument10 pagesSample: Business Plan Business NameDan688No ratings yet

- Bis Plan StepsDocument3 pagesBis Plan StepsIndratapolNo ratings yet

- Business Plan Template SMEToolkit EnglishDocument11 pagesBusiness Plan Template SMEToolkit EnglishKhaleeq Shahzada0% (1)

- The Following Represents A Structural Outline For A Business Feasibility Study: Cover SheetDocument6 pagesThe Following Represents A Structural Outline For A Business Feasibility Study: Cover SheetAbo AbasNo ratings yet

- Business Plan Outline Mumbai Angels: 1) Elevator Pitch (1 Slide)Document1 pageBusiness Plan Outline Mumbai Angels: 1) Elevator Pitch (1 Slide)Pulkit MittalNo ratings yet

- Business Plan Outline: Cover Page and Table of ContentsDocument4 pagesBusiness Plan Outline: Cover Page and Table of ContentsAjith MenonNo ratings yet

- New Venture Creation Assessment 20-21 DocDocument8 pagesNew Venture Creation Assessment 20-21 DocNoman SiddiquiNo ratings yet

- Business Plan TemplateDocument7 pagesBusiness Plan TemplateRohan LabdeNo ratings yet

- Pure A: Business Plan For "Business Name"Document7 pagesPure A: Business Plan For "Business Name"arcelio emiyaNo ratings yet

- Business PlanDocument7 pagesBusiness PlanJohn Exequiel Bantugon AranasNo ratings yet

- There Are 10 Main Elements of A Business PlanDocument2 pagesThere Are 10 Main Elements of A Business PlanadeadendkidNo ratings yet

- Every Business Needs To Have A Written Business PlanDocument6 pagesEvery Business Needs To Have A Written Business PlanRaymond Gregorio TrinidadNo ratings yet

- Start UpDocument7 pagesStart UpLoveBabbarNo ratings yet

- Writing The Business Plan IDG VenturesDocument9 pagesWriting The Business Plan IDG VentureswindevilNo ratings yet

- The Following 10 Sections Need To Be Included in Your Business PlanDocument9 pagesThe Following 10 Sections Need To Be Included in Your Business PlanYatin BhatiaNo ratings yet

- Business Plan - ScriptDocument13 pagesBusiness Plan - Scriptanon_74547466680% (5)

- Business Plan With Social Impact StatementDocument14 pagesBusiness Plan With Social Impact StatementPastor Deaundrea Williams-GreenNo ratings yet

- The Business Development Plan (BDP)Document10 pagesThe Business Development Plan (BDP)ma10cent1No ratings yet

- Business Plan TemplateDocument8 pagesBusiness Plan TemplatejonjelymNo ratings yet

- GMart B PlanDocument15 pagesGMart B PlandextergkNo ratings yet

- Outline For A Venture Capital ProposalDocument6 pagesOutline For A Venture Capital ProposalAnonymous 7ToIbgEANt100% (1)

- Business Plan Format ContentsDocument9 pagesBusiness Plan Format ContentsRaeden BeritanNo ratings yet

- Business Plan GuideDocument9 pagesBusiness Plan GuideJennievy Irish R. DinerosNo ratings yet

- The Hospitality Business Plan - FinalDocument144 pagesThe Hospitality Business Plan - Finalkdfohasfowdesh75% (4)

- Commercialization Plan CleanDocument9 pagesCommercialization Plan CleanSaravanan Elangovan100% (2)

- The Business Plan FormatDocument8 pagesThe Business Plan FormatImran RehmanNo ratings yet

- Venture CapitalDocument6 pagesVenture CapitalArchit_R_Shah_3192No ratings yet

- Biz Plan TemplateDocument7 pagesBiz Plan TemplatealiztradeNo ratings yet

- Simple Business Plan TemplateDocument6 pagesSimple Business Plan Templatemar bernardinoNo ratings yet

- Simple Business Plan Template1Document6 pagesSimple Business Plan Template1justine omilaNo ratings yet

- Business Plan Cover Page: OwnersDocument14 pagesBusiness Plan Cover Page: OwnersAudel Zynel BantilesNo ratings yet

- DocumentDocument16 pagesDocumentShivkant SinghNo ratings yet

- Rental Service For Event Equipment Introduce New Products/services Demand & SupplyDocument4 pagesRental Service For Event Equipment Introduce New Products/services Demand & SupplyShelley AndersonNo ratings yet

- Business Plan Guide: Objective of This GuideDocument12 pagesBusiness Plan Guide: Objective of This GuidePaul HarrisNo ratings yet

- Entrep Mid ExamDocument4 pagesEntrep Mid Exambsrem.deguzmanarvinmNo ratings yet

- Writing A Business PlanDocument8 pagesWriting A Business Planজয় সোমNo ratings yet

- Business Plan: Executive SummaryDocument19 pagesBusiness Plan: Executive SummaryAngela HernandezNo ratings yet

- Assignment of Entrepreneurship MGMT 3101Document5 pagesAssignment of Entrepreneurship MGMT 3101Tasebe GetachewNo ratings yet

- Chapter 5 PresentationDocument35 pagesChapter 5 PresentationSabeur Dammak100% (1)

- Final CRM Project Manual Final (2022S2)Document9 pagesFinal CRM Project Manual Final (2022S2)yue xuNo ratings yet

- Sample Business Plan FormatDocument4 pagesSample Business Plan FormatRozekmal NeliatiNo ratings yet

- EURION - Sample Business PlanDocument8 pagesEURION - Sample Business PlanEurion ConstellationNo ratings yet

- Business Plan Template NYDocument11 pagesBusiness Plan Template NYAmarNathHNo ratings yet

- NYSTARTUP! 2015 Business Plan TemplateDocument10 pagesNYSTARTUP! 2015 Business Plan TemplatesefdeniNo ratings yet

- Business PlanDocument5 pagesBusiness PlanseoulmaarNo ratings yet

- Preparing Business Plan: Mohit Gupta Assistant Professor Department of Business Management PAU, LudhianaDocument38 pagesPreparing Business Plan: Mohit Gupta Assistant Professor Department of Business Management PAU, LudhianaRomi GrewalNo ratings yet

- LiveDocument31 pagesLivebkaaljdaelvNo ratings yet

- Format FINAL PROJECTDocument13 pagesFormat FINAL PROJECTsaadahaibe66No ratings yet

- Business Plan TemplateDocument13 pagesBusiness Plan Templatepiusmbugua01No ratings yet

- Business Plan GuidelinesDocument6 pagesBusiness Plan GuidelineshananNo ratings yet

- Wagonr Think Big Challenge 2: Guiding Document For Detailed Business PlanDocument19 pagesWagonr Think Big Challenge 2: Guiding Document For Detailed Business PlanAayush JhaNo ratings yet

- Business Plan DataDocument6 pagesBusiness Plan DataDhruv KhannaNo ratings yet

- Business Plan TemplateDocument9 pagesBusiness Plan Templateloysaserentas27No ratings yet

- Ent530 - Business Plan Report Guideline - 13.07.2023 PDFDocument13 pagesEnt530 - Business Plan Report Guideline - 13.07.2023 PDFNur Athirah Binti MahdirNo ratings yet

- The Business Plan FormatDocument9 pagesThe Business Plan FormatJoy CamaclangNo ratings yet

- The Pitch: Creating A Sellable Business Plan PresentationDocument22 pagesThe Pitch: Creating A Sellable Business Plan PresentationAndre Ant WilliamsNo ratings yet

- Sample Bussiness Plan For EntruprenerDocument21 pagesSample Bussiness Plan For EntruprenerRavi BotveNo ratings yet

- Budget2011-12 Guidelines Ist DraftDocument15 pagesBudget2011-12 Guidelines Ist DraftDiya KrishnaNo ratings yet

- Business ProposalDocument4 pagesBusiness Proposalwchloe09266No ratings yet