Professional Documents

Culture Documents

Question No 06 Chapter No 12 - D.K Goal 11 Class

Uploaded by

Nafe MOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question No 06 Chapter No 12 - D.K Goal 11 Class

Uploaded by

Nafe MCopyright:

Available Formats

Checkout Hindi version of Tutor's Tips

Exquisite handcrafted sarees

Taneira Sarees

Menu

Tutor's Tips > Textbook Solution > D.K Goal +1 New ISC

Accountancy > Chapter No. 12. Depreciation >

Question No 06 Chapter No 12 – D.K Goal 11 Class

Question No 06 Chapter No 12 –

D.K Goal 11 Class

June 6, 2021 Shubham Sharma

Question No 06 Chapter No 12

Question No 06 Chapter No 12

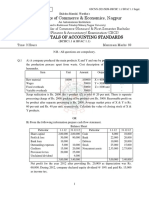

06. A company purchased on 1st July 2015

machinery costing 30,000. it purchases further

machinery on 1st January 2016 costing 20,000

and on 1st October 2016 costing 10,000. on 1st

April 2017, the machinery installed on 1st July

2015 become absolute and was sold for 3,000

Show the Machinery Account for 3 years

charging depreciation by Dxed installment

Method at 10% per annum. Accounts are closed

on 31st March every year.

The solution of Question No 06

Chapter No 12: –

Dr. Plant & Machinery A/c Cr.

Date Particulars J.F. Amount Date Particulars J.F. Amount

By

1st To Bank 31st Deprecation

30,000 2,750

Jul.2015 A/c Mar2016 A/c(2,250

+500)

1st To Bank 31st By Balance

20,000 47,250

Jan.2016 A/c Mar2016 C/d

50,000 50,000

To By

1st Apr 31st

Balance 47,250 Deprecation 5,500

2016 Mar2017

b/f A/c

1st Oct To Bank 31st By Balance

10,000 53,250

2016 A/c Mar2017 C/d

57,250 57,250

To By

1st Apr 1st Apr

Balance 51,750 Deprecation 3,000

2017 2017

b/f A/c

1st Apr

By Loss A/c 21,750

2017

By

31st Deprecation

3,000

Mar2018 A/c(2,000 +

1,000)

1st Apr By Balance

24,000

2017 C/d

51,750 51,750

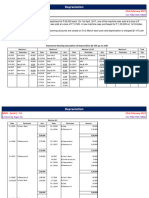

Working Note:

Calculation of Depreciation

Statement Showing pro:t or loss on the sale of

Machinery

Particulars Amount

Plant value of Equipment as on 1st Jul, 2015 30,000

Less: – Amount of Depreciation

charged on the year 2015-16

30,000 *10%* 9/12 2,250

Amount of Depreciation charged on

the year 2016-17

30,000 *10%* 12/12 3,000

Book value of asset as of 31st Dec

24,750

2018

Sale Price of Machinery 3,000

Loss on the sale of the asset 21,750

Depreciation | Meaning |

Methods | Examples

Deprecation is a very simple and scoring chapter

for all class 11 students. It is just a conceptual

chapter. SO are you ready to learn more new

concepts? Let’s start. Meaning of Depreciation:

Depreciation means the decrease in the value …

Continue reading

Tutor's Tips 5

Comment if you have any question.

Also, Check out the solved question of all

Chapters: –

D K Goel – New ISC Accountancy -

(Class 11 – ICSE)- Solution

Chapter 1 Evolution of Accounting & Basic

Accounting Terms

Chapter 2 Accounting Equations

Chapter 3 Meaning and Objectives of Accounting

Chapter 4 Double Entry System

Chapter 5 Books of Original Entry – Journal

Chapter 6 Accounting for Goods and Service Tax

(GST) (Coming soon)

Chapter 7 Books of Original Entry – Cash Book

(Coming soon)

Chapter 8 Books of Original Entry – Special Purpose

Subsidiary Books (Coming soon)

Chapter 9 Ledger (Coming soon)

Chapter 10 Trial Balance and Errors (Coming soon)

Chapter 11 Bank Reconciliation Statement (Coming

soon)

Chapter 12 Depreciation (Coming soon)

Chapter 13 Bills of Exchange (Coming soon)

Chapter 14 Generally Accepted Accounting

Principles(GAAP)

Chapter 15 Bases of Accounting

Chapter 16 Accounting Standards and International

Financial Reporting Standard(IFRS) (Coming soon)

Chapter 17 Capital and Revenue

Chapter 18 Provisions and Reserves

Chapter 19 Final Accounts (Coming soon)

Chapter 20 Final Accounts – With Adjustments

(Coming soon)

Chapter 21 Errors and their Recti:cation (Coming

soon)

Chapter 22 Accounts from Incomplete Records –

Single Entry System (Coming soon)

Chapter 23 Accounts of Not-for-Pro:t Organisations

(Coming soon)

Chapter 24 Computerised Accounting System

(Coming soon)

Chapter 25 Introduction to Accounting Information

System (Coming soon)

Check out the Accountancy Class +1 by D.K.

Goal (Arya Publication) from their oIcial

Site.

D K Goel accountancy +1 –

ISC_Accounts_11_20_Image

Question No 42 Chapter No

11 – D.K Goal 11 Class

Related

Question No 18 Chapter Question No 07 Chapter

No 12 – D.K Goal 11 Class No 12 – D.K Goal 11 Class

June 8, 2021 June 6, 2021

In "Chapter No. 12. In "Chapter No. 12.

Depreciation" Depreciation"

Question No 22 Chapter

No 12 – D.K Goal 11 Class

June 9, 2021

In "Chapter No. 12.

Depreciation"

Chapter No. 12. Depreciation, D.K Goal +1 New ISC

Accountancy

Question 40 Chapter 5 of +2 Part-1 – USHA

Publication 12 Class Part – 1

Question No 07 Chapter No 12 – D.K Goal 11

Class

Leave a Reply

Your email address will not be published. Required

:elds are marked *

Comment *

Name *

Email *

Website

Save my name, email, and website in this browser

for the next time I comment.

Post Comment

Search

Search... Search

Question No 27 Chapter No 13 – Unimax 11 Class

Question No 26 Chapter No 13 – Unimax 11 Class

Question No 25 Chapter No 13 – Unimax 11 Class

Question No 24 Chapter No 13 – Unimax 11 Class

Question No 23 Chapter No 13 – Unimax 11 Class

About Tutor's Tips

We are here to improve your knowledge in all :nancial

& Business related topics and to get better carrier

opportunities. The author has about to 10-year

Experience in the tuition Business. It is very diicult to

teach more students in a personal touch.

TutorsTips.com or TutorsTips.in (Hindi Version) is free

of cost for all the students and professionals who want

to clear their basic and advance concepts which are

related to professional accountants. Read more

Publisher wise Book Solution

Usha Publications

Unimax Publications

T.S. Grewal's- Sultan Chand

D K Goel - Arya Publications

Board wise Book Solution

PSEB

CBSE

ISC

Class wise Book Solution

Class +1

Class +2

Get in Touch with us

Subscribe to get noti:cations

Animation’s Resource websites

All Icons and images used on my website were

downloaded from the following website please go and

download free:-

Freepik Flaticon

Terms & Conditions Privacy policy

Disclaimer Contact Us About us

Copyright 2021-2022 Tutors Tips All rights

reserved

Proudly powered by WordPress | Education Hub

by WEN Themes

You might also like

- Body Wash Base Guide Recipe PDFDocument2 pagesBody Wash Base Guide Recipe PDFTanmay PatelNo ratings yet

- Auditing Problems EmpleoDocument19 pagesAuditing Problems EmpleoGloria Bernal BonifacioNo ratings yet

- 01 Childrenswear Safety Manual 2009 - ClothingDocument57 pages01 Childrenswear Safety Manual 2009 - Clothingmorshed_mahamud705538% (8)

- Drive Engineering - Practical Implementation SEW Disc Brakes 09202218 - G1Document90 pagesDrive Engineering - Practical Implementation SEW Disc Brakes 09202218 - G1Anonymous ntE0hG2TPNo ratings yet

- Chapter 15 From Textbook T.S. Grewal (2018) For Class 11 ACCOUNTANCYDocument59 pagesChapter 15 From Textbook T.S. Grewal (2018) For Class 11 ACCOUNTANCYvkbm42100% (2)

- Basic DWDM Components.Document16 pagesBasic DWDM Components.Pradeep Kumar SahuNo ratings yet

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- T.S. Grewal (2018) For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial StatementsDocument97 pagesT.S. Grewal (2018) For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial Statementssumitha ganesan0% (1)

- AnswerDocument83 pagesAnswerTavnish SinghNo ratings yet

- Account 16Document41 pagesAccount 16divineauramasterNo ratings yet

- 3531 24773 Textbooksolution PDFDocument42 pages3531 24773 Textbooksolution PDFADITYA BANSALNo ratings yet

- Depreciation (110,500 20%) 21,780 Depreciation (3,660 10%) 366Document1 pageDepreciation (110,500 20%) 21,780 Depreciation (3,660 10%) 366Ali MohamedNo ratings yet

- Depreciation WorksheetDocument17 pagesDepreciation WorksheetMayank VermaNo ratings yet

- Year Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)Document11 pagesYear Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)anon_573519739No ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- ACC211 Week 4-5 SIMDocument22 pagesACC211 Week 4-5 SIMIvan Pacificar BioreNo ratings yet

- C4 Depreciation SolutionsDocument8 pagesC4 Depreciation SolutionsSiva SankariNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Admission of Partner (Isc) PDFDocument183 pagesAdmission of Partner (Isc) PDFRiddhima Das100% (1)

- Business Accounting 1A - Assignment 1 - 0Document4 pagesBusiness Accounting 1A - Assignment 1 - 0DxdNo ratings yet

- DepreciationDocument21 pagesDepreciationxvfidxwmgNo ratings yet

- Chapter 26 - Review QuestionsDocument7 pagesChapter 26 - Review QuestionsAli MohamedNo ratings yet

- Guideline Answers: Executive ProgrammeDocument70 pagesGuideline Answers: Executive ProgrammeRiya GoyalNo ratings yet

- AccountsA MTP Foundation Oct19Document10 pagesAccountsA MTP Foundation Oct19backuphpdv6No ratings yet

- Spring 2017 - MGT101 - 1Document11 pagesSpring 2017 - MGT101 - 1jaydee1000No ratings yet

- Adjusting Entries For Bad DebtsDocument6 pagesAdjusting Entries For Bad DebtsKristine IvyNo ratings yet

- AB Hospitality BusinessDocument15 pagesAB Hospitality BusinessAfrin rahman miliNo ratings yet

- Accounts Compiler by Rahul Malkan Sir-73-98Document26 pagesAccounts Compiler by Rahul Malkan Sir-73-98sanketNo ratings yet

- Acc q2 SANSDocument11 pagesAcc q2 SANSTanvir AnjumNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- 72222bos58192 P1aDocument11 pages72222bos58192 P1aSufiyan MominNo ratings yet

- CorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DADocument3 pagesCorporateAccounting Costing March2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 28A260DAMubin Shaikh NooruNo ratings yet

- AFA End Examination 2021-2022Document6 pagesAFA End Examination 2021-2022sebastian mlingwaNo ratings yet

- Tax AccountingDocument12 pagesTax AccountingMohamed HanyNo ratings yet

- Acct101-3 - (Your Name)Document9 pagesAcct101-3 - (Your Name)Vedanshi BihaniNo ratings yet

- Banking Insurance Sem. I Choice Base R 2016 81301 Financial Accounting I Q.P.CODE 59346Document7 pagesBanking Insurance Sem. I Choice Base R 2016 81301 Financial Accounting I Q.P.CODE 59346Ali HassanNo ratings yet

- Ca Ipcc Accounts Suggested Answers May 2016 PDFDocument16 pagesCa Ipcc Accounts Suggested Answers May 2016 PDFMahavir ShahNo ratings yet

- Financial Accounting II MinDocument4 pagesFinancial Accounting II MinAsna Rachal ShibuNo ratings yet

- Profit Screening 3Document4 pagesProfit Screening 3ankitNo ratings yet

- Bond Retirement Prior To Maturity A. Illustration 1 - Straight LineDocument27 pagesBond Retirement Prior To Maturity A. Illustration 1 - Straight Linephoebelyn acdogNo ratings yet

- Additional Illustrations-15Document15 pagesAdditional Illustrations-15Gulneer LambaNo ratings yet

- A) Date Description Debit $ Credit $Document5 pagesA) Date Description Debit $ Credit $simranNo ratings yet

- Transaction ReportDocument1 pageTransaction ReportNaeem MalikNo ratings yet

- MTP May21 ADocument11 pagesMTP May21 Aomkar sawantNo ratings yet

- Book Value (Carrying Value) at 2020 25,000 Remaining Life 10 YrsDocument5 pagesBook Value (Carrying Value) at 2020 25,000 Remaining Life 10 YrsMichael PanizaNo ratings yet

- Q.4-Question and SolutionDocument4 pagesQ.4-Question and SolutionFIROZ KHANNo ratings yet

- Jawaban 3.1 SD 3.7Document16 pagesJawaban 3.1 SD 3.7KaitoNo ratings yet

- Solved Pu 2 Annual QP Accountancy 2024Document10 pagesSolved Pu 2 Annual QP Accountancy 2024tommyvercetti880055No ratings yet

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- FinAct ARDocument15 pagesFinAct ARnanaNo ratings yet

- Module 5 Answer KeysDocument5 pagesModule 5 Answer KeysJaspreetNo ratings yet

- 5 DepDocument2 pages5 Depshreyash436No ratings yet

- Ch4 Completing The Accounting Cycle ACC101Document9 pagesCh4 Completing The Accounting Cycle ACC101Muhammad KridliNo ratings yet

- Accounting Project (CompletedDocument20 pagesAccounting Project (CompletedRajesh KumarNo ratings yet

- Accounts SamplepaperDocument29 pagesAccounts SamplepaperPawni JadhavNo ratings yet

- Kendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 3 AccountancyDocument3 pagesKendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 3 AccountancyManaswi WareNo ratings yet

- Sessional 1 Solved Sample 1Document4 pagesSessional 1 Solved Sample 1Mîñåk ŞhïïNo ratings yet

- 72034bos57955 p1 6Document12 pages72034bos57955 p1 6Fs printNo ratings yet

- Fac511s - Financial Accounting 101 - 2nd Opp - Jan 2020Document6 pagesFac511s - Financial Accounting 101 - 2nd Opp - Jan 2020Uno VeiiNo ratings yet

- ,667 Monthly Depreciation X 11 Months From Feb 1 To December 31, 2015)Document2 pages,667 Monthly Depreciation X 11 Months From Feb 1 To December 31, 2015)Garp BarrocaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Visco GraphDocument4 pagesVisco GraphwamlinaNo ratings yet

- Software Requirements CompressDocument9 pagesSoftware Requirements CompressApni Duniya100% (1)

- GSM Rtu Controller Rtu5011 v2 PDFDocument27 pagesGSM Rtu Controller Rtu5011 v2 PDFAbdul GhaniNo ratings yet

- 4612 4621 Vitamin D Supplementation For Osteoporosis in Older AdultsDocument10 pages4612 4621 Vitamin D Supplementation For Osteoporosis in Older AdultsMohammedNo ratings yet

- (FORD) Manual de Propietario Ford Ranger 1998Document160 pages(FORD) Manual de Propietario Ford Ranger 1998Marly Salas GonzalezNo ratings yet

- Datasheet d801001Document6 pagesDatasheet d801001Hammad HussainNo ratings yet

- Fractal Approach in RoboticsDocument20 pagesFractal Approach in RoboticsSmileyNo ratings yet

- WikipediaDocument29 pagesWikipediaradhakodirekka8732No ratings yet

- Basic Customer Service SkillsDocument90 pagesBasic Customer Service SkillsGillian Delos ReyesNo ratings yet

- Harvester Main MenuDocument3 pagesHarvester Main MenuWonderboy DickinsonNo ratings yet

- 329 Cryogenic Valves September 2016Document8 pages329 Cryogenic Valves September 2016TututSlengeanTapiSopanNo ratings yet

- Airline and Airport Master - OdsDocument333 pagesAirline and Airport Master - OdsGiri KumarNo ratings yet

- Oleg Losev NegativeDocument2 pagesOleg Losev NegativeRyan LizardoNo ratings yet

- Mini Test 2 - HSDocument4 pagesMini Test 2 - HSNgan Nguyen ThuNo ratings yet

- PL SQL Exercise6Document2 pagesPL SQL Exercise6Nishant AndhaleNo ratings yet

- Vocabulary: ExileDocument5 pagesVocabulary: ExileWael MadyNo ratings yet

- Coca-Cola BeverageDocument17 pagesCoca-Cola BeverageMahmood SadiqNo ratings yet

- Libra Office Question Answer EnglishDocument11 pagesLibra Office Question Answer EnglishAndrew ParkarNo ratings yet

- Zencrack Installation and ExecutionDocument48 pagesZencrack Installation and ExecutionJu waNo ratings yet

- Noten - Detective Conan - Case ClosedDocument2 pagesNoten - Detective Conan - Case ClosedBLU-NYTE GamingNo ratings yet

- Contemporary Philippine MusicDocument11 pagesContemporary Philippine MusicmattyuuNo ratings yet

- Thermo Exam QuestionsDocument4 pagesThermo Exam QuestionssiskieoNo ratings yet

- InflibnetDocument3 pagesInflibnetSuhotra GuptaNo ratings yet

- Akebono NVH White PaperDocument4 pagesAkebono NVH White Paperapi-3702571100% (1)

- Effect of Water On Quality and Preservation of FoodDocument10 pagesEffect of Water On Quality and Preservation of FoodrupinisinnanNo ratings yet

- 2 Issues in Language LearningDocument30 pages2 Issues in Language LearningEva JakupcevicNo ratings yet