Professional Documents

Culture Documents

Answer Scheme For Tutorial Questions - Leases

Uploaded by

MoriatyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer Scheme For Tutorial Questions - Leases

Uploaded by

MoriatyCopyright:

Available Formats

Answer Scheme – Leases

a) The lease is a finance lease because:

i) The title is transferred to lessee at the end of the lease period;

ii) There is a bargain purchase option; and

iii) The present value of the minimum lease payment (PVMLP) amounts to almost

substantially all the fair value of the equipment.

b) PVMLP = (25,000 x 3.791) + (20,000 x 0.621)

= 94,775 + 12,420

= 107,195

PVMLP = 107,195

FV = 110,000

The lower amount between FV and PVMLP is RM107,195. Therefore, the initial amount of

the assets is RM107,195

c) Total finance charge of the lease:

RM

Total instalment = 25,000 x 5 125,000

PVMLP 107,195

Total finance charge 17,805

d) Prepare the journal entries for the year 2022.

Dr Cr

RM RM

1 Jan

2022 Dr Lease equipment 107,195

Cr Lease liability 107,195

31 Dec

2022 Dr Lease interest expenses 10,720

Cr Lease liability 10,720

(107,195 x 10%)

Dr Depreciation expenses 13,399

Cr Accumulated depreciation 13,399

(107,195 / 8)

Dr Lease liability 25,000

Cr Bank 25,000

e) Show the charges in the Statement of Profit or Loss from year 2022 until year 2026.

Statement of Comprehensive Income for the year ended 31 Dec

2022 2023 2024 2025 2026

RM RM RM RM RM

Depreciation expenses 13,399 13,399 13,399 13,399 13,399

Finance charge 10,720 9,291 7,721 5,993 4,081

Service charge 5,000 5,000 5,000 5,000 5,000

Tutorial Question 2

a) The lease is finance lease because:

i) The term constitutes the ‘major part’ of the equipment estimated useful life (10 lease

period/12 useful life = 83%)

ii) The present value of the minimum lease payment (PVMLP) amounts to almost

substantially all the fair value of the equipment.

b) Compute the amount of each of the following items:

i) Lease receivable at inception of the lease

PVMLP = (125,000 + (125,000 x 5.75902)) + (37,500 x 0.38554)

= 844,878 + 14,457

= 859,335

ii) The selling price = 859,335

iii) Cost of sales = 525,000

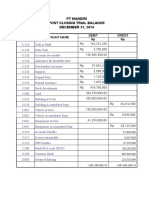

c) Prepare a 10-year lease amortization schedule.

Annual Lease Lease

Beginning of Lease

payment plus Interest (10%) receivable

Year receivable

Residual Value recovery

a b c

RM RM RM RM

Initial PV - - - 859,335

1 125,000 - 125,000 734,335

2 125,000 73,434 51,566 682,769

3 125,000 68,277 56,723 626,046

4 125,000 62,605 62,395 563,650

5 125,000 56,365 68,635 495,016

6 125,000 49,502 75,498 419,518

7 125,000 41,952 83,048 336,470

8 125,000 33,647 91,353 245,117

9 125,000 24,512 100,488 144,628

10 125,000 14,463 110,537 34,091

End of year 10 37,500 3,409 34,091 0

1,287,500 428,165 859,335 5,140,976

d) Prepare all of Tawakal Berhad' s journal entries for the first year of the lease.

Dr Cr

RM RM

Beginning Dr Lease receivable 859,335

Cr Equipment 859,335

Dr Bank 125,000

Cr Lease receivable 125,000

End of first year Dr Lease receivable 73,434

Cr Interest income 73,434

You might also like

- Financial Accounting AssignmentDocument7 pagesFinancial Accounting AssignmentharutotsukassaNo ratings yet

- Jawaban Mentoring AK2 UAS 2011-2012 GenapDocument4 pagesJawaban Mentoring AK2 UAS 2011-2012 GenapBernardusNo ratings yet

- IFRS 16 Leases tutorialDocument4 pagesIFRS 16 Leases tutorial嘉慧No ratings yet

- Faf Tutorial 3 Ifrs 16Document4 pagesFaf Tutorial 3 Ifrs 16嘉慧No ratings yet

- Fm-Nov-Dec 2012Document14 pagesFm-Nov-Dec 2012banglauserNo ratings yet

- Test 2 Jan2023 - Tapah Q2 FS SSDocument4 pagesTest 2 Jan2023 - Tapah Q2 FS SSNajmuddin AzuddinNo ratings yet

- Fa Pilot Paper AnswerDocument11 pagesFa Pilot Paper Answer刘宝英No ratings yet

- Take Home Examination Bdfa1103Document7 pagesTake Home Examination Bdfa1103zul arifNo ratings yet

- Test Far510 Sept 2019 SSDocument4 pagesTest Far510 Sept 2019 SS2022478048No ratings yet

- Finance lease calculation and journal entriesDocument8 pagesFinance lease calculation and journal entriesAdilla KhulaidahNo ratings yet

- SS1 - Tenang Bhd Financial Statements AnalysisDocument9 pagesSS1 - Tenang Bhd Financial Statements AnalysisAFIZA JASMANNo ratings yet

- Lala Trading's financial statements for year ended 2018Document4 pagesLala Trading's financial statements for year ended 2018GIROLYDIA EDDYNo ratings yet

- Cpa 8Document13 pagesCpa 8justinorchidsNo ratings yet

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- Revision College NotesDocument24 pagesRevision College NotesRiyaNo ratings yet

- Dr-Acc. Depreciation RM 25 Mill CR - Building RM25 MillDocument7 pagesDr-Acc. Depreciation RM 25 Mill CR - Building RM25 MillsyuhadahNo ratings yet

- Costing SolutionDocument2 pagesCosting SolutionANo ratings yet

- San-Clemente-Palace-2Document19 pagesSan-Clemente-Palace-2liubomyr1romanivNo ratings yet

- Online open-book exam requires more comprehensive answersDocument5 pagesOnline open-book exam requires more comprehensive answersRishiaendra CoolNo ratings yet

- Ch08 - Principles of Capital InvestmentDocument7 pagesCh08 - Principles of Capital InvestmentStevin GeorgeNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument5 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriestarunyadavfutureNo ratings yet

- FAR270 - FEB 2022 SolutionDocument8 pagesFAR270 - FEB 2022 SolutionNur Fatin AmirahNo ratings yet

- Acct 414 Spring 2006 Lease ExampleDocument3 pagesAcct 414 Spring 2006 Lease ExamplePaul GeorgeNo ratings yet

- Depreciation AnswersDocument13 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (2)

- Depreciation AnswersDocument22 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (1)

- LC032ALP000EVDocument36 pagesLC032ALP000EVAttia FatimaNo ratings yet

- Practice Set 9 BondsDocument11 pagesPractice Set 9 BondsVivek JainNo ratings yet

- Accounting for PPE, Investment Property, Intangible AssetsDocument6 pagesAccounting for PPE, Investment Property, Intangible AssetsNur Athirah Binti MahdirNo ratings yet

- Ass Intacc 3 - GonzagaDocument12 pagesAss Intacc 3 - GonzagaLalaine Keendra GonzagaNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- Lite Inc. (B)Document22 pagesLite Inc. (B)sankalp_iimNo ratings yet

- Zeal Pak Cement Factory Ltd. Project Feasibility StudyDocument38 pagesZeal Pak Cement Factory Ltd. Project Feasibility StudyIrfan NasrullahNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- 70097bos210422 Final P2aDocument12 pages70097bos210422 Final P2aVipul JainNo ratings yet

- Test - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswersDocument10 pagesTest - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswerswinNo ratings yet

- CR MA-2022 Suggested AnswersDocument13 pagesCR MA-2022 Suggested Answershumayun kabirNo ratings yet

- Financial Performance Evaluation of Smithson PlcDocument5 pagesFinancial Performance Evaluation of Smithson PlcAyesha SheheryarNo ratings yet

- Kunci Jawaban 3Document18 pagesKunci Jawaban 3Mar YaniNo ratings yet

- Answer Key ACCTG 202Document3 pagesAnswer Key ACCTG 202Sanilyn DomingoNo ratings yet

- Book-Keeping and Accounts Level 2/series 2-2009Document13 pagesBook-Keeping and Accounts Level 2/series 2-2009Hein Linn Kyaw60% (10)

- AssignmentDocument6 pagesAssignmentAnkita KumariNo ratings yet

- UTS MK 15 Sep 18Document14 pagesUTS MK 15 Sep 18Anonymous KyYdMhfaKXNo ratings yet

- F9 Mock Exam June 2020 - Answers PDFDocument9 pagesF9 Mock Exam June 2020 - Answers PDFNguyễn Quốc TuấnNo ratings yet

- Investment decision NPV proforma machine XDocument3 pagesInvestment decision NPV proforma machine XElena MiciNo ratings yet

- Assigment 4 Tutor Financial Accounting II - Audry Martarini Putri - 210169622Document8 pagesAssigment 4 Tutor Financial Accounting II - Audry Martarini Putri - 210169622Oshin MenNo ratings yet

- Jawaban Soal No. 1 Jurnal Koreksi A) Sebelum Penutupan BukuDocument13 pagesJawaban Soal No. 1 Jurnal Koreksi A) Sebelum Penutupan BukuAbdurahman YafieNo ratings yet

- Management and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFDocument38 pagesManagement and Cost Accounting 10th Edition Drury Solutions Manual Full Chapter PDFirisdavid3n8lg100% (9)

- Management and Cost Accounting 10th Edition Drury Solutions ManualDocument17 pagesManagement and Cost Accounting 10th Edition Drury Solutions Manualeliasvykh6in8100% (27)

- Answer Key Chapter 8 FranchiseDocument8 pagesAnswer Key Chapter 8 Franchisekaren perrerasNo ratings yet

- SM 9Document12 pagesSM 9wtfNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Knitware Ms FormatDocument29 pagesKnitware Ms FormatMD. Borhan UddinNo ratings yet

- CMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionDocument4 pagesCMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionAlinah AquinoNo ratings yet

- 2008 LCCI Level1 Book-Keeping (1517-4)Document13 pages2008 LCCI Level1 Book-Keeping (1517-4)JessieChuk100% (2)

- MFA Test 1 SolutionDocument4 pagesMFA Test 1 SolutionMuhammad ImranNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Answer Scheme Tutorial Questions - Accounting Non-Profit OrganizationDocument7 pagesAnswer Scheme Tutorial Questions - Accounting Non-Profit OrganizationMoriatyNo ratings yet

- Non-Profit Accounting for Sports ClubDocument1 pageNon-Profit Accounting for Sports ClubMoriatyNo ratings yet

- Tutorial Questions - Accounting Non-Profit OrganizationDocument3 pagesTutorial Questions - Accounting Non-Profit OrganizationMoriatyNo ratings yet

- Tutorial Questions - LeasesDocument1 pageTutorial Questions - LeasesMoriatyNo ratings yet

- Discussion QuestionsDocument22 pagesDiscussion QuestionsAndhikaa Nesansa NNo ratings yet

- Translation Gains and Losses Under Current and Temporal MethodsDocument10 pagesTranslation Gains and Losses Under Current and Temporal MethodsnahorrNo ratings yet

- Sol Man Chapter 5 Corporate Liquidation Reorganization Acctg For Special TransactionsDocument6 pagesSol Man Chapter 5 Corporate Liquidation Reorganization Acctg For Special TransactionsAngel Clarisse JariolNo ratings yet

- IAS 16 Property, Plant and EquipmentDocument7 pagesIAS 16 Property, Plant and EquipmentEric Agyenim-BoatengNo ratings yet

- Cost and Financial Management QuizDocument3 pagesCost and Financial Management QuizNeha ArifNo ratings yet

- UIN: 104L098V03 Page 1 of 4Document4 pagesUIN: 104L098V03 Page 1 of 4sajeet sahNo ratings yet

- Icici Prudential PMS PerformanceDocument74 pagesIcici Prudential PMS PerformanceDhanraj MNo ratings yet

- Government Grant ActivitiesDocument5 pagesGovernment Grant Activitiesjoong wanNo ratings yet

- Financial Reporting and Analysis QuestionsDocument16 pagesFinancial Reporting and Analysis QuestionsPareshNo ratings yet

- Broker Business PlanDocument18 pagesBroker Business PlanJulie FlanaganNo ratings yet

- ISA 580 MindMapDocument1 pageISA 580 MindMapAli HaiderNo ratings yet

- Credit and Credit Risk Analysis of Rupali Bank LimitedDocument105 pagesCredit and Credit Risk Analysis of Rupali Bank Limitedkhansha ComputersNo ratings yet

- TVM QuestionsDocument2 pagesTVM QuestionsMuhammed RafiudeenNo ratings yet

- Buczek 20081130 Bonded Promissory Note HSBC & BESTBUYDocument1 pageBuczek 20081130 Bonded Promissory Note HSBC & BESTBUYBob HurtNo ratings yet

- Financial Risk Management Fs Analysis Students CopyDocument7 pagesFinancial Risk Management Fs Analysis Students Copyshai santiagoNo ratings yet

- CHAPTER 27 - Calculating The Cost of CapitalDocument45 pagesCHAPTER 27 - Calculating The Cost of CapitalPatricia Bianca ArceoNo ratings yet

- FIN104 Tutorial Questions - Week 2 Cost of Capital and Opportunity CostDocument4 pagesFIN104 Tutorial Questions - Week 2 Cost of Capital and Opportunity CostZijingNo ratings yet

- Yes Bank EvaluationDocument11 pagesYes Bank EvaluationPRAMODH VMNNo ratings yet

- IAS 40 Investment PropertyDocument27 pagesIAS 40 Investment PropertyRavi BerliaNo ratings yet

- List of Scheduled Commercial Banks: Annexure IDocument2 pagesList of Scheduled Commercial Banks: Annexure IEr Nitin SinghNo ratings yet

- Mutual Fund Investment From An Individual's PerspectiveDocument89 pagesMutual Fund Investment From An Individual's PerspectiveSAJIDA SHAIKHNo ratings yet

- MCQs - Overview of MA and Cost ClassificationsDocument6 pagesMCQs - Overview of MA and Cost ClassificationsĐạt NguyễnNo ratings yet

- Project Report On Mutual Fund Schemes of SBIDocument43 pagesProject Report On Mutual Fund Schemes of SBIRonak Jain100% (2)

- Bank Branch Audit HandbookDocument151 pagesBank Branch Audit Handbookdhruv KhandelwalNo ratings yet

- Statement of Cash FlowDocument12 pagesStatement of Cash FlowgailNo ratings yet

- Chapter 5 - Lect NoteDocument8 pagesChapter 5 - Lect Noteorazza_jpm8817No ratings yet

- Accounting concepts, journal entries and financial statementsDocument3 pagesAccounting concepts, journal entries and financial statementsRNo ratings yet

- Sales ResumeDocument1 pageSales Resumeapi-517062850No ratings yet

- Accounting For Compound Financial InstrumentsDocument2 pagesAccounting For Compound Financial InstrumentsleneNo ratings yet

- Article IFRS 3 Business Combinations PDFDocument14 pagesArticle IFRS 3 Business Combinations PDFEhsanulNo ratings yet