Professional Documents

Culture Documents

Final Sahulat Takaful Savings Plan English

Uploaded by

MinahilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Sahulat Takaful Savings Plan English

Uploaded by

MinahilCopyright:

Available Formats

IGI Life - WTO Just when you wondered if your family Takaful coverage can get more

interesting! In comes Family Takaful Saholat Takaful Savings Plan. IGI Life -

Window Takaful Operations’ unique offering, which gives you the flexibility

What are the benefits of surplus sharing?

Participants of the Takaful fund as per the terms and conditions of the Waqf, can

be entitled to a share of the fund in the form of surplus.

Takaful Conservative Strategy

The underlying assets include Shariah compliant government and/or other secured

investments. There will be no exposure to stock market under this strategy.

Death Benefit

Death Benefit payable is sum covered or account value in PIA, whichever is higher

PLUS

Important Details

Eligibility and Membership Term

Age

18-45

Sum Covered (PKR)

10,000,000

How to Claim

Filing a Claim

This is a brochure, not a contract. The detailed terms and conditions are stated in the PMD.

Saholat Takaful The accumulated account value of Top-Up amounts The minimum entry age of the Covered Person is 18 years and maximum is 65 Disclaimer

to choose your investment size based on your annual contribution, all while PLUS

46-55 5,000,000 1. This product is underwritten by IGI Life - Window Takaful Operations.

This entitlement of surplus is in addition to the conventional benefits of the Shariah Compliant Government Securities and/or years. The minimum membership term is 10 years, subject to a maximum attained Our claim settlement procedure is prompt and hassle-free. It is advisable to

availing the same product features. The Saholat Takaful Savings Plan is a proof Takaful plan. other Shariah Compliant fixed income investments: 100% Surplus (if any) as per PTF memberships of WTO age of 85 years. The supplementary benefits will terminate at the age mentioned 56-60 1,500,000

Savings Plan

consult our Customer Services services.life@IGI.COM.PK team for detailed

that IGI Life WTO’s Takaful plans are empower the members by giving the right in the supplementary benefit. It could be at an earlier date depending upon the 2. It is not guaranteed by Bank Alfalah Limited or any of its affiliates, and it is

assistance while filing your membership claim.

to choose on how much they invest with 100% Shariah Compliant way. IGI Life Window Takaful Operations calculate the surplus (if any) at the end of each Takaful Balanced Strategy Basic Sum Covered benefit term available. not a product of Bank Alfalah Limited, hence IGI Life - Window Takaful

year with the requisite approval from the Shariah Advisor and appointed actuary. This strategy seeks steady growth in capital through a combination of investments This is the amount payable on the death of the participant. The sum covered will be However, based on the information disclosed in the application form, or for Operations is responsible for all the underwriting risks.

Uniquely designed for Bank Alfalah customers, the Saholat Takaful Savings Plan a multiple of basic contribution depending on the age of the participant as follows: Here is a simple step-by-step procedure to be followed when you make a claim.

in Shariah Compliant stocks, government securities and/or other secured Contribution Payment Term sum covered higher than those in the above table IGI Life WTO reserves the

is designed to offer them Takaful benefits along with growth of funds to meet The Plan consists of two parts: investments. The mix of underlying assets would be: The minimum contribution payment term is 10 years and the maximum can go up right to call for medical exams and tests. 3. The applicant/participant fully agrees and understands that Bank Alfalah

their multiple savings and protection needs. Multiples of Basic Contribution STEP 1: INTIMATION

Age to the membership term chosen. Limited is acting as a corporate Takaful agent of IGI Life - Window Takaful

A claim can be lodged directly without any delay through visiting IGI Life Window Operations and shall under no circumstances whatsoever be held responsible

1. Participant’s Investment Account (PIA) Shariah Compliant Stock Market Funds: 0 to 40% Minimum Maximum Contribution Allocation

What is Saholat Takaful Savings Plan? Takaful Operations Website Online Claim Intimation by filling given fields which or liable for the representations and/or undertakings made by IGI Life -

Participant’s Investment Account (PIA) is an investment management Shariah Compliant Government Securities and/or Minimum Basic Contribution

Saholat Takaful Savings Plan is a regular contribution family Takaful plan, which Up to 55 5 40 % of Contribution shall be transmitted to Claims Department immediately. Window Takaful Operations in relation to their Saholat Takaful Savings Plan

arrangement between participant and Window Takaful Operator. The Window other Shariah Compliant fixed income investments: 60 to 100% The minimum collected Basic Contribution is as follows:

offers a complete financial solution to all of your investment and protection needs. Membership Year

Takaful Operator manages the investments on behalf of the participant in 56 to 60 5 15 Takaful product and/or any benefit or loss arising out of it.

Additionally, investments as well as protection are done in a Shariah compliant Plan A Plan B http://igilife.com.pk/claim-intimation/

light of the principles of Wakalat-ul-Istismar (as approved by the Shariah Takaful Aggressive Strategy Plan Minimum Contribution

manner. Investments are made in non-interest bearing instruments, which are also 60 onwards 5 5 1 55.0% 55.0% 4. Should the applicant/participant proceed to subscribe to this Saholat Takaful

Advisor) in lieu of a pre-determined fee on the total value of PIA. This strategy seeks to provide long-term capital growth mainly through investments

safe and secure. A 25,000 OR send intimation letter from the Participant/ Claimant (as the case may be) Savings Plan Takaful product he/she shall do so on a voluntary basis at his/her

in Shariah Compliant equities. The mix of underlying assets here would be: 2 80.0% 80.0%

Maturity Benefit under his / her signature giving particulars of loss (death, Disability or Sickness) sole risk and Bank Alfalah Limited shall have no responsibility or liability

The Plan is being offered by IGI Life - Window Takaful Operations and has been The PIA of a participant is created on the effective date of the membership. B 100,000

On completion of the membership term, the available PIA value along with the 3 95.0% 95.0% with Cause, Date, Place and Name of Covered Person. Always remember to mention whatsoever in respect of any disputes and/or claims arising out of or in

exclusively designed for Bank Alfalah customers. It is only available through Bank The contributions made towards the Plan (net of all charges) will be applied Shariah Compliant Stock Market Funds: 60 to 70%

account value of Top-Up amount (if any) and surplus (if any) will be payable to the current address and contact number of the claimant while submitting respect hereof, or as a consequence of the investment performance of the

Alfalah’s branches. to buy units at the applicable offer price in the PIA in the desired investment Shariah Compliant Government Securities and/or 4 and onwards 100.0% 100.0%

the participant in lump sum. For the following modes of contribution payment: intimation. fund comprising of contributions from the applicant/participant and/or for

sub-accounts. At the beginning of each month, charges/fee will be deducted other Shariah Compliant fixed income investments: 30 to 40%

The concept of Takaful Complete Surrender: The participant has the right to fully surrender his/her • Annual Top-Up 100.0% 100.0% any other reason whatsoever.

along with the Takaful contributions from the PIA and same shall be credited

Takaful is an age old Islamic concept of mutual help and support blended with membership by redeeming all the units in the PIA. In case of complete surrender, the • Semi-Annual Claim must be lodged within 30 days of date of loss.

to the Individual Family Takaful Participant’s Fund (Individual PTF). The participant will be given the choice of creating his/her own investment mix

modern concepts of actuarial science, underwriting and investment under the units will be redeemed at the bid price and the membership will be terminated. • Quarterly 5. The contributions in the Plan are invested in the mentioned growth fund and

by indicating, in the application, the percentage of contribution he/she wishes

supervision of Shariah Advisor. It is a Shariah compliant way of supporting each In case of complete surrender of the membership, units in the PIA will be to allocate to buy units in each investment strategy. The sum of these percentages Extra Allocation of Contribution STEP 2: COMPLETE THE CLAIM FORM ALONG WITH RELEVANT DOCUMENTS the past performance of fund is not necessarily a guide to future performance.

Partial Withdrawal: Partial withdrawals can be made from the Account Value anytime For Top-Up payments: Minimum payment is PKR 100,000 with no limit on the The longer the Plan is continued, the higher the rewards will be. The Plan offers Upon intimation of loss, IGI Life Window Takaful Operations will provide relevant

other in case of death, disability or disease. encashed at bid price immediately after the receipt of complete Application must be 100%.

during the membership term by redeeming a limited number of units as per the terms maximum. extra unit allocation starting from the 6th year onwards. The extra unit 6. Any forecast made is not necessarily indicative of future or likely performance

of Surrender. After surrender, membership will be terminated. However, the claim forms for filing along with evidence of loss i.e. Death Certificate, Original

How does it work? and conditions. The amount withdrawn is considered a permanent withdrawal and allocations are as follows: of the funds and neither IGI Life - Window Takaful Operations nor Bank Alfalah

participant can also opt to withdraw funds partially. Each basic contribution (net of allocation fee) paid towards the Plan will be Membership Document, CNIC of Covered Person and nominee(s), Hospital Record,

does not have to be repaid. A partial withdrawal will reduce the Death Benefit by Contribution Indexation Limited will incur any liability for the same.

Retakaful Retakaful applied to buy units in the desired investment sub-account(s). The units will be Police Report and Post Mortem Report (in case of accident only) or any other

Recoveries the amount of partial withdrawal. The minimum amount to be withdrawn is PKR Indexation is an optional feature offered in this Plan. Under this feature, your % of Contribution

Contributions The maturity benefit is the accumulated account value in the PIA at the purchased at the offer price, announced by Window Takaful Operator on a daily Membership Year requirement as called by IGI Life Window Takaful Operations based upon the

10,000 provided that the remaining amounts in the PIA account are as follow. contributions and sum covered will increase by a fixed amount every year 7. All Takaful claims, charges and payments relating to the Takaful membership

maturity date. basis. The sub-accounts will be managed by Window Takaful Operator’s investment Plan A Plan B nature of events. Forms can be directly downloaded from our website.

leading to a better cash value accumulation and consequently a higher maturity shall be the sole and exclusive responsibility of IGI Life - Window Takaful

Claims team comprising of experts who will adjust the mix of the underlying investments

Plan Minimum Contribution benefit. Even once opted, you still have a right to decline the option and 6 to 10 3.0% 3.0% Operations. However, service charges and taxes will be applicable as per the

2. Individual Family Takaful Participant’s Fund (Individual PTF) - in the light of changing economic conditions and investment opportunities. http://igilife.com.pk/investor-relations/claim-forms/

continue paying level contribution subject to certain terms and conditions. Bank's 'Schedule of Charges' and shall be subject to taxation laws as stipulated

Participant Participant Takaful also known as the Waqf Fund A 25,000 11 to 15 5.0% 5.0%

Fund - Waqf Window Takaful Operator has established a fund namely ‘Individual Family Each of the above strategies offers an investment sub-account consisting of Arrange for medical bills/reports for medical related claims: In case of by the relevant authorities.

B 100,000 Charges 16 to 20 7.0% 7.0%

Takaful Participants’ Fund’ (Individual PTF) as per the Waqf Rules. funds managed by various asset management companies. IGI Life WTO may change hospitalization or medical related claims, produce all medical bills (original) and

The following charges apply on the Plan:

the list of asset management companies and/or funds in future for more 21 and onwards 10.0% 10.0% medical report (photocopies) issued by the attending provider.

Optional Supplementary Benefits*

Allocation Fee Participant Takaful Takaful contributions will be taken by deduction of units from the PIA and variety/spread of risk under each strategy.

Investment Account Contribution Following optional supplementary benefits are available, which may be attached

deposited as donation into the Individual PTF (in other words, the ‘cost of Bid/Offer Spread 5%

Attestation: Documents can be submitted in original or photocopies, attested

to the basic membership to enhance the coverage level and submission of

insurance’ charges will be deducted from the PIA and will be credited to the Transfers between Investment Funds Wakalatul Istismar Fee 0.125% of PIA value per month Illustration of Benefits by a Gazetted Government Official/Issuing authority. Original copies of documents

satisfactory evidence of coverage:

Individual PTF). A participant can also switch his/her account value among different strategies. Sample Illustration Plan A & B:

Wakalatul Istismar

Takaful Operator Fee • Additional Protection Benefit (APB): APB enhances the benefit payable on Mudarib Share 40% share in the investment income of the Individual PTF

may be called for inspection.

Fees In that event, units from one strategy will be redeemed at prevailing bid price Age: 35 years, Membership Term: 20 years, Contribution: 250,000, Sum Covered

participant's death, whether due to accidental or non-accidental causes. The

Window Takaful Operator will charge a fee from the Individual PTF to cover and allocated to the desired strategy at the bid price. This way a participant can Multiple: 21

APB sum covered is payable in a single lump sum in addition to any other Window Takaful Operator’s STEP 3: SUBMIT REQUIRED DOCUMENTS ALONG WITH THE CLAIM FORM

its expenses for underwriting, administration and general management of change gears in view of the changing financial condition and maximise returns. 35% of each month’s Takaful contributions (Tabarru or COI)

death benefit payable under the basic membership. Fee in Takaful Contributions The Original documents & forms (hard copy) properly completed, signed and

Operator’s Sub Modarib Share the Individual PTF. A nominal processing fee is applicable at each switch.

Contributions

• Accidental Death Benefit (ADB): ADB pays a lump sum amount in case of witnessed must be submitted with IGI Life Window Takaful Operations Head Office

Membership

9% Unit 11% Unit

Contribution

13% Unit

for the Year

Fund

Cumulative

Administration Fee PKR 200 per month

Regular

accidental death of the participant. In case of death due to an accident, while Growth Rate Growth Rate Growth Rate within 90 days after the loss for which the claim is made.

Years

Basic

Paid

Commission and Investment income, earned in the Individual PTF, will be shared between the Unit Price Publication

Management Expenses performing Hajj/Umrah, the benefit shall be doubled without any additional Surrender Charge (all years) Nil

Death Cash Death Cash Death Cash

Window Takaful Operator (by acting as Mudharib) and Individual PTF, in Unit prices under all strategies may be viewed at www.igilife.com.pk

contribution. Benefit Value Benefit Value Benefit Value STEP 4: SETTLEMENT

Surplus accordance with the Mudharabah Rules. Fund Switching Fee PKR 500

Distribution (if any) • Waiver of Contribution (WoC) – Disability: WoC waives the future contributions A claim is settled as soon as requirements to the satisfaction of IGI Life Window

Top-Up Contributions Processing Fee PKR 500 on each partial withdrawal and complete surrender

5 250,000 1,250,000 5,250,000 1,165,684 5,250,000 1,229,233 5,250,000 1,295,765

in case of permanent total disability due to sickness and accident of the Takaful Operations are submitted at its Head Office.

Life | Window Takaful Operations

Death and other benefits (covered under supplementary benefits) will be The Plan is a regular contribution plan, but a participant may top-up the regular 10 250,000 2,500,000 5,250,000 3,107,620 5,250,000 3,455,463 5,250,000 3,843,939

covered person up to the end of term.

Free Look Period paid from the Individual PTF. contributions by depositing surplus funds as lump sum contributions in the membership. 15 250,000 3,750,000 5,951,296 5,950,796 7,018,345 7,017,845 8,290,194 8,289,694 IGI Life Insurance Limited

• Income Benefit - Death: A monthly income benefit will be provided following NOTE:

If you cancel your membership within a free look period of 14 days from the date These lump sum contributions, called ‘Top-Up Amounts’, can be made at any time. 20 250,000 5,000,000 10,065,301 10,065,301 12,634,815 12,634,815 15,931,188 15,931,188 7th Floor, The Forum, Suite No. 701-713, G-20, Block 9,

the death of the participant up to the end of the elected term. Non-Medical Limits Kindly ensure that in case of claim by Participant, all documents and forms are

of receipt of the Participant’s Membership Document (PMD), you are entitled for Unit Accumulation and Investment Strategies Top-Up payments will increase the PIA account value of the membership, but will not Khayaban-e-Jami, Clifton, Karachi– 75600, Pakistan.

• Income Benefit - Disability: A monthly income benefit will be provided following No medical exam or tests will be required for the following sum covered, given signed by you as per signature affixed by you on your Membership’s original

a full refund of contribution less any expenses incurred by IGI Life WTO in Participants will have the option to allocate their contributions to the following affect the basic sum covered. The amount of Top-Up is subject to the minimum and UAN: (+92-21) 111-111-711 | Tel: (+92-21) 35360040 | Fax: (+92-21) 35290042

the permanent total disability of the participant up to the end of the elected term. that the participant is in good health: Proposal Form/CNIC.

connection with your medical or clinical examinations. investment strategies, according to their individual risk-return appetite: maximum limits as determined by the Takaful Operator from time to time. E-mail: vitality@igi.com.pk | Web: www.igilifevitality.com.pk

*Additional contribution will be charged for each optional supplementary benefit.

Life | Window Takaful Operations

You might also like

- 16-75 BWE, Bodywork Electrical System: Overview - Sheet 1Document13 pages16-75 BWE, Bodywork Electrical System: Overview - Sheet 1lilik sukristianto100% (1)

- Wall Street Prep Premium Exam Flashcards QuizletDocument1 pageWall Street Prep Premium Exam Flashcards QuizletRaghadNo ratings yet

- Barclays PDFDocument1 pageBarclays PDFmrelfeNo ratings yet

- BarclaysDocument1 pageBarclaysEtherikal CommanderNo ratings yet

- The Eklavya - Content NumerologyDocument39 pagesThe Eklavya - Content Numerologyduck taleNo ratings yet

- Mark Fisher - The Logical Trader. Applying A Method To The Madness PDFDocument138 pagesMark Fisher - The Logical Trader. Applying A Method To The Madness PDFsjn1180% (5)

- 060 SkillFront The Lean Six Sigma FrameworkDocument241 pages060 SkillFront The Lean Six Sigma FrameworkSnics Desarrollo HumanoNo ratings yet

- British Columbia Film Annual Activity Report 2006/2007Document19 pagesBritish Columbia Film Annual Activity Report 2006/2007showbc100% (1)

- 15060966-Liebherr Th1-d504 Base Engine Workshop Manual PDFDocument462 pages15060966-Liebherr Th1-d504 Base Engine Workshop Manual PDFZoltán Szecsődi100% (7)

- 016 SkillFront ISO IEC 27001 Information SecurityDocument63 pages016 SkillFront ISO IEC 27001 Information Securitythiyaga1988No ratings yet

- Institutional Order Flow and The Hurdles To Superior PerformanceDocument9 pagesInstitutional Order Flow and The Hurdles To Superior PerformanceWayne H WagnerNo ratings yet

- 016 SkillFront ISO IEC 27001 Information SecurityDocument63 pages016 SkillFront ISO IEC 27001 Information SecurityAbNo ratings yet

- Winfield ManagementDocument5 pagesWinfield Managementmadhav1111No ratings yet

- 023 SkillFront ISO 9001 Quality Management StandardsDocument89 pages023 SkillFront ISO 9001 Quality Management StandardsGibran JuniansyahNo ratings yet

- 040 SkillFront ISO IEC 20000 IT Service Management SystemsDocument80 pages040 SkillFront ISO IEC 20000 IT Service Management SystemsAriel TatumNo ratings yet

- Internship Report NIB BankDocument19 pagesInternship Report NIB Bankazeem bhatti83% (12)

- CPF Annual Report 2020Document22 pagesCPF Annual Report 2020AlioNo ratings yet

- Telemetron ANG 2018 MDocument55 pagesTelemetron ANG 2018 MneubatenNo ratings yet

- Corona Kavach Insurance BrochureDocument5 pagesCorona Kavach Insurance Brochurekishore2648No ratings yet

- Healthcare Plus Policy: Icicilombard 1800 2666Document2 pagesHealthcare Plus Policy: Icicilombard 1800 2666Baby SivaNo ratings yet

- New Smart Samriddhi Brochure 09.03.2021Document12 pagesNew Smart Samriddhi Brochure 09.03.2021GAJALAKSHMI LNo ratings yet

- Annex 8 Salary Matrix ToolDocument3 pagesAnnex 8 Salary Matrix ToolAbah IcanNo ratings yet

- Leave Taken: Form of Leave Account Under The Revised Leave Rules 1981Document2 pagesLeave Taken: Form of Leave Account Under The Revised Leave Rules 1981Ubaid KhalilNo ratings yet

- Leaflet - HDFC Banking & Financial Services Fund (NFO)Document4 pagesLeaflet - HDFC Banking & Financial Services Fund (NFO)rakeshNo ratings yet

- Mediclaim ArticleDocument7 pagesMediclaim ArticleJay SinhaNo ratings yet

- XMGlobal No Deposit Trading Bonus Terms and ConditionsDocument4 pagesXMGlobal No Deposit Trading Bonus Terms and ConditionsNoe IchsanNo ratings yet

- Star Outpatient Care Insurance Policy Brochure v.1 Ebook PDFDocument6 pagesStar Outpatient Care Insurance Policy Brochure v.1 Ebook PDFlalith mohanNo ratings yet

- WHITEBOARD - AcctgDocument1 pageWHITEBOARD - Acctgkhyla Marie NooraNo ratings yet

- Admit Card 1Document2 pagesAdmit Card 1Himanshi GuptaNo ratings yet

- MCKon JV GovDocument8 pagesMCKon JV GovDeepak M NadigerNo ratings yet

- General Budget Support: General Questions and Answers: L BudDocument6 pagesGeneral Budget Support: General Questions and Answers: L BudChremataNo ratings yet

- Assure Analytics State of The SPV Report 2022Document43 pagesAssure Analytics State of The SPV Report 2022tempppppNo ratings yet

- No Place Left To SqueezeDocument8 pagesNo Place Left To SqueezedesikanNo ratings yet

- GST Invoice Format 1Document1 pageGST Invoice Format 1arvindNo ratings yet

- Tahdco RFP Skill Training 2019 20Document31 pagesTahdco RFP Skill Training 2019 20JackobNo ratings yet

- PKPK - Annual Report - 2015Document42 pagesPKPK - Annual Report - 2015kun henderyNo ratings yet

- Chapter 4 - Business Size and GrowthDocument3 pagesChapter 4 - Business Size and GrowthkatyNo ratings yet

- Admit CardDocument2 pagesAdmit Cardrounak opNo ratings yet

- ECO Insights 210122 Week AheadDocument2 pagesECO Insights 210122 Week Aheadamit shahNo ratings yet

- GTN Investor PresentationDocument14 pagesGTN Investor PresentationrubensteinNo ratings yet

- Concurrent Managers SolutionDocument2 pagesConcurrent Managers SolutionMukarram KhanNo ratings yet

- Csrrajasthangov in Companies Act 2013 HTMLDocument3 pagesCsrrajasthangov in Companies Act 2013 HTMLgautham VNo ratings yet

- Unit 7 The Firm and Its Customers - The EconomyDocument1 pageUnit 7 The Firm and Its Customers - The EconomyOğuzhan IzgiNo ratings yet

- Chapter 3 - Franchises and Co-OperativesDocument2 pagesChapter 3 - Franchises and Co-OperativeskatyNo ratings yet

- R34Y2019N01A0039Document7 pagesR34Y2019N01A0039Jessica EsparzaNo ratings yet

- StarHealthAssureInsurancePolicy ProposalFormDocument4 pagesStarHealthAssureInsurancePolicy ProposalFormPradeep KumarNo ratings yet

- Selina Kaylo, 29/F Scott Sommer, 64/M: Basic Ophthalmologic ExamDocument1 pageSelina Kaylo, 29/F Scott Sommer, 64/M: Basic Ophthalmologic ExamLuke Matthew MondaresNo ratings yet

- Market Map 2022Document1 pageMarket Map 2022ameliavtamiNo ratings yet

- F3 Course NotesDocument278 pagesF3 Course NotesShayan GooneratneNo ratings yet

- d81b (1) NiDocument244 pagesd81b (1) NiHein UlyNo ratings yet

- DBS 4.7% - PG 15 To 18Document37 pagesDBS 4.7% - PG 15 To 18Invest StockNo ratings yet

- Fight Klub Terminator StarterDocument6 pagesFight Klub Terminator Starterfactorgames2011No ratings yet

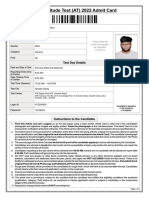

- IPM Aptitude Test (AT) 2022 Admit CardDocument3 pagesIPM Aptitude Test (AT) 2022 Admit CardDOOR PHONENo ratings yet

- IPM Aptitude Test (AT) 2022 Admit CardDocument3 pagesIPM Aptitude Test (AT) 2022 Admit Cardtrinaam sikkaNo ratings yet

- AAUW Policy Guide To Equal Pay in The StatesDocument4 pagesAAUW Policy Guide To Equal Pay in The StatesRaisa S.No ratings yet

- Effie India 2019: Control Sheet: Summary of The Total Entries SubmittedDocument2 pagesEffie India 2019: Control Sheet: Summary of The Total Entries SubmittedmehboobghaiNo ratings yet

- Dupont Corporation: Sale of Performance Coatings Student Preparation GuideDocument1 pageDupont Corporation: Sale of Performance Coatings Student Preparation GuideTrade OnNo ratings yet

- State of Nevada: License For Educational PersonnelDocument2 pagesState of Nevada: License For Educational Personnelapi-255136418No ratings yet

- Federal Child Welfare Grant Program Matrix TableDocument2 pagesFederal Child Welfare Grant Program Matrix TableBeverly TranNo ratings yet

- 07 08 10Document44 pages07 08 10GiantNickel WashingtonNo ratings yet

- Basic InvoiceDocument1 pageBasic InvoiceNoahoodNo ratings yet

- Teachers and The Law: Do I Have A Contract?Document12 pagesTeachers and The Law: Do I Have A Contract?Anitha PrabakarNo ratings yet

- Everything23 Quikbooks LerningffffDocument23 pagesEverything23 Quikbooks LerningffffAnkur GoyalNo ratings yet

- COVID Vaccination PlanDocument230 pagesCOVID Vaccination PlanHNN100% (1)

- May 5 Presentation: Comparing Public and Private Employee Compensaton and Retrement Benefits in CaliforniaDocument9 pagesMay 5 Presentation: Comparing Public and Private Employee Compensaton and Retrement Benefits in Californiasmf 4LAKidsNo ratings yet

- YearDocument1 pageYearMinahilNo ratings yet

- QuizDocument2 pagesQuizMinahilNo ratings yet

- CommunicationDocument3 pagesCommunicationMinahilNo ratings yet

- ChartDocument1 pageChartMinahilNo ratings yet

- Quiz 1Document2 pagesQuiz 1MinahilNo ratings yet

- Reserve Tranche PositionDocument4 pagesReserve Tranche PositionAbhijeet PatilNo ratings yet

- Nigerian - Banks Fitch Mar17Document12 pagesNigerian - Banks Fitch Mar17Funso Ade100% (1)

- ICRRS Guidelines - BB - Version 2.0Document25 pagesICRRS Guidelines - BB - Version 2.0Optimistic EyeNo ratings yet

- AnnuitiesDocument74 pagesAnnuitiesbingNo ratings yet

- Saif's Internship Report On Credt Management of Janata Bank and Dhaka Bank LimitedDocument72 pagesSaif's Internship Report On Credt Management of Janata Bank and Dhaka Bank LimitedGobinda sahaNo ratings yet

- FR AS ScannerDocument144 pagesFR AS ScannerPooja GuptaNo ratings yet

- Paper 10 Managing Finances: June 2011 - Study Guide Certified Accounting Technician ExaminationDocument10 pagesPaper 10 Managing Finances: June 2011 - Study Guide Certified Accounting Technician ExaminationFaysal MasoodNo ratings yet

- (9781788115827 - Encyclopedia of Islamic Insurance, Takaful and Retakaful) Chapter 1 - Understanding The Pillars of TakafulDocument51 pages(9781788115827 - Encyclopedia of Islamic Insurance, Takaful and Retakaful) Chapter 1 - Understanding The Pillars of TakafulSharifah FadylawatyNo ratings yet

- Joy MovieDocument2 pagesJoy MovieJohn PagdilaoNo ratings yet

- Relative ValuationDocument94 pagesRelative ValuationParvesh AghiNo ratings yet

- Actg328 Msa2Document1,344 pagesActg328 Msa2Carol PagalNo ratings yet

- Agrarian Reform Program of The PhilippinesDocument18 pagesAgrarian Reform Program of The PhilippinesJeremarchDomingoNo ratings yet

- Yangshan Port Project ManagementDocument34 pagesYangshan Port Project ManagementChiranjibi Mohanty100% (1)

- C.V. - Dr.S.VELAYUTHAMDocument9 pagesC.V. - Dr.S.VELAYUTHAMManickam GajapathyNo ratings yet

- Markets For LemonDocument2 pagesMarkets For Lemonp11No ratings yet

- FINC1302 - Exer&Asgnt - Revised 5 Feb 2020Document24 pagesFINC1302 - Exer&Asgnt - Revised 5 Feb 2020faqehaNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 3 QuarterDocument4 pagesFundamentals of Accountancy Business and Management 1 11 3 QuarterPaulo Amposta CarpioNo ratings yet

- Province of Antique Unadjusted Trial Balance As of August 2017 All FundsDocument4 pagesProvince of Antique Unadjusted Trial Balance As of August 2017 All FundsDom Minix del RosarioNo ratings yet

- Midterm Exam On AUDIT PROBLEMS PPE AND INVESTMENTSDocument28 pagesMidterm Exam On AUDIT PROBLEMS PPE AND INVESTMENTSReginald ValenciaNo ratings yet

- Jay Rothstein - Strategic SourcingDocument2 pagesJay Rothstein - Strategic SourcingJay RothsteinNo ratings yet

- Quaterly Report3Document3 pagesQuaterly Report3api-257610307No ratings yet

- Ringkasan AKL1Document98 pagesRingkasan AKL1BagoesadhiNo ratings yet

- Trafo AbbDocument8 pagesTrafo Abbaisya mutia syafiiNo ratings yet