Professional Documents

Culture Documents

LCC-L2 Saturday Class-2 Depreciation (S) (221022)

Uploaded by

wu alanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LCC-L2 Saturday Class-2 Depreciation (S) (221022)

Uploaded by

wu alanCopyright:

Available Formats

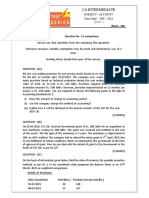

Depreciation

Question 1

On 1 April 2021 Lynn purchased two motor vehicles for business use on credit from Villa Motors Limited. The

vehicles cost $12,000 each.

Depreciation is charged on the motor vehicles at 20% per annum by the diminishing (reducing) balance method.

A full year’s depreciation is charged in the year of purchase but no depreciation is charged in the year of sale.

On 23 January 2023 one of the motor vehicles was sold for $6,500.

Required

(a) Show the journal entry to record the purchase of the motor vehicles on 1 April 2021.

Dates and narratives are not required.

Journal

2021 Dr Cr

$ $

(b) Prepare the provision for depreciation account for the years ended on 31 March 2022 and 2023.

Provision for Depreciation account

Date Details $ Date Details $

(c) Prepare the disposal account.

Disposal account

Date Details $ Date Details $

Question 2

Reddit is in business. His financial year ends on 30 April. He depreciates his non-current assets each year.

On 1 May 2023 the balances in Reddit’s ledger included the following:

$

Equipment at cost 8,600

Provision for depreciation of equipment 3,260

The equipment is being depreciated at 20% per annum using the straight line method, calculated from the date

of purchase. No depreciation is to be charged in the year of disposal.

On 31 October 2023 equipment which had cost $2,000 on 1 May 2021 was sold for $750 cash.

On 1 November 2023 equipment costing $3,400 was purchased on credit from New4U.

Required

Write up the following accounts in the ledger of Reddit for the year ended 30 April 2024.

Balance the accounts where necessary and bring the balances down on 1 May 2024.

Equipment account

$ $

Provision for depreciation of equipment account

$ $

Disposal of equipment account

$ $

Question 3

Colour Manufacturing provided the following information at 1 June 2017.

Machinery – Cost $18,100

– Accumulated depreciation $ 8,350

On 1 January 2018 a machine was sold for $3,000 cash. The machine was purchased on 1 September 2015 for $6,600

On 1 March 2018 a new machine costing $9,900 was purchased.

Depreciation is charged for each month of ownership at 20% per annum on a straight line basis.

(a) Calculate for the machine disposed of:

(i) the total amount of depreciation charged

(ii) the profit or loss on disposal.

$ $

(b) Calculate the total depreciation charge on machinery for the year ended 31 May 2018.

$ $

(c) Prepare an extract of the statement of financial position at 31 May 2018 showing machinery only.

Colour Manufacturing

Statement of financial position at 31 May 2018

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Bad Debt To Manufacturing Practise Q 3Document10 pagesBad Debt To Manufacturing Practise Q 3Zin MgNo ratings yet

- LCC-L2 Saturday Class-2b Depreciation (S) (291022)Document3 pagesLCC-L2 Saturday Class-2b Depreciation (S) (291022)wu alanNo ratings yet

- Sir Kahlil Far 1 Batch 4Document6 pagesSir Kahlil Far 1 Batch 4Asim MahmoodNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- DEPRECIATION2Document2 pagesDEPRECIATION2PearlNo ratings yet

- F5 BAFS Final - 1920 - DraftDocument3 pagesF5 BAFS Final - 1920 - Draft4E-27 Tsoi Cheuk Ying (Ada)No ratings yet

- Assignment 2Document5 pagesAssignment 2Baburam AdNo ratings yet

- Depreciation UDDocument20 pagesDepreciation UDrizwan ul hassanNo ratings yet

- P76983 LCCI Level 3 Certificate in Financial Accounting ASE20097 RBDocument8 pagesP76983 LCCI Level 3 Certificate in Financial Accounting ASE20097 RBhlaingminnlatt149No ratings yet

- Far Sir Khalil Batch 1Document7 pagesFar Sir Khalil Batch 1Asim MahmoodNo ratings yet

- Tanible Non Current Assets - Short Questions Part IDocument5 pagesTanible Non Current Assets - Short Questions Part Isaba anwarNo ratings yet

- Disposal of Non-Current AssetsDocument3 pagesDisposal of Non-Current AssetsTawanda Tatenda Herbert100% (1)

- Accounts Ol Combined QuestionsDocument20 pagesAccounts Ol Combined Questionsnajla nistharNo ratings yet

- Schedule of Non Current Assets - AsDocument4 pagesSchedule of Non Current Assets - AsMUSTHARI KHANNo ratings yet

- CH9 11複習考題目Document8 pagesCH9 11複習考題目邱品榛No ratings yet

- Review QuestionsDocument3 pagesReview QuestionsAriaNo ratings yet

- Tutorial QS IAS 16 Property, Plant and Equipment (PPE)Document2 pagesTutorial QS IAS 16 Property, Plant and Equipment (PPE)PuneetNo ratings yet

- Provision For Depreciation & DisposalDocument3 pagesProvision For Depreciation & DisposalKristen NallanNo ratings yet

- Test One Week Before AnnualDocument4 pagesTest One Week Before AnnualGodfreyFrankMwakalingaNo ratings yet

- CAF Test2 Accounts June23 R2 (Que)Document4 pagesCAF Test2 Accounts June23 R2 (Que)AISHWARYA DESHMUKHNo ratings yet

- Preparing Financial StatementsDocument15 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- DepreciationDocument18 pagesDepreciationManuthi HewawasamNo ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- Fadm / Group Case Study/ Joyo IncDocument3 pagesFadm / Group Case Study/ Joyo IncS GuptaNo ratings yet

- Cambridge, 2nd Ed. - Depreciation and DisposalDocument3 pagesCambridge, 2nd Ed. - Depreciation and DisposalShannen LyeNo ratings yet

- Revision Questions 2020 MayDocument21 pagesRevision Questions 2020 MayGodfreyFrankMwakalingaNo ratings yet

- TUT1Document1 pageTUT1Liwena DelinNo ratings yet

- B Com 2023 Examination PaperDocument9 pagesB Com 2023 Examination PaperAkshitaNo ratings yet

- FA Sample PaperDocument10 pagesFA Sample PaperThe ShiningNo ratings yet

- Tutorial Chpater 10-11 Part BDocument32 pagesTutorial Chpater 10-11 Part BKate BNo ratings yet

- Term Exam - PaperDocument11 pagesTerm Exam - Paperhamna wahabNo ratings yet

- RTP PDFDocument45 pagesRTP PDFsumanmehtaNo ratings yet

- ACC 2101 CA1 With TemplateDocument8 pagesACC 2101 CA1 With TemplatedeboevaniaNo ratings yet

- CAF 1 IA ModelPaperDocument7 pagesCAF 1 IA ModelPaperAli RehanNo ratings yet

- CAF 1 IA Spring 2020 PDFDocument6 pagesCAF 1 IA Spring 2020 PDFWaseim KhanNo ratings yet

- B02 Final Exam Review QuestionsDocument8 pagesB02 Final Exam Review QuestionsnigaroNo ratings yet

- 1.trial Balance and Ledger AccountsDocument3 pages1.trial Balance and Ledger AccountsDhairya AilaniNo ratings yet

- Poa T - 6Document2 pagesPoa T - 6SHEVENA A/P VIJIANNo ratings yet

- Test 3 - Chap 24Document7 pagesTest 3 - Chap 24Bhushan SawantNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 1 PDFDocument13 pages11 Sample Papers Accountancy 2020 English Medium Set 1 PDFpriyaNo ratings yet

- 2021 Revision QuestionsDocument10 pages2021 Revision QuestionsTawanda Tatenda HerbertNo ratings yet

- 8 Source A4: 9706/33/INSERT/O/N/21 © UCLES 2021Document2 pages8 Source A4: 9706/33/INSERT/O/N/21 © UCLES 2021Ayesha sheikhNo ratings yet

- Mid Term QPDocument8 pagesMid Term QPawaisawais95138No ratings yet

- Tutorial 8Document6 pagesTutorial 8Waruna PrabhaswaraNo ratings yet

- XI Account QPDocument7 pagesXI Account QPtanushsoni37No ratings yet

- CPA 1 - Financial AccountingDocument8 pagesCPA 1 - Financial AccountingPurity muchobella100% (1)

- Acct CH.7 H.W.Document8 pagesAcct CH.7 H.W.j8noelNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- SKANS School of Accountancy Financial Accounting and Reporting-IIDocument11 pagesSKANS School of Accountancy Financial Accounting and Reporting-IImaryNo ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document8 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Saram Shykh PRODUCTIONSNo ratings yet

- Final Requirment (Case Study)Document2 pagesFinal Requirment (Case Study)Gerry SajolNo ratings yet

- Test 2 - Chap 8,10,11 & 12Document9 pagesTest 2 - Chap 8,10,11 & 12Bhushan SawantNo ratings yet

- Financial Accounting and Reporting-IIDocument6 pagesFinancial Accounting and Reporting-IIZahidNo ratings yet

- Chapter 7 To Chapter 9: CorrectDocument10 pagesChapter 7 To Chapter 9: CorrectChaiz MineNo ratings yet

- As Depreciation PP SumsDocument29 pagesAs Depreciation PP SumsMangesh RahateNo ratings yet

- PoetryDocument5 pagesPoetryKhalika JaspiNo ratings yet

- Sally Tour: TOUR ITINRARY With QuoteDocument2 pagesSally Tour: TOUR ITINRARY With QuoteGuillermo Gundayao Jr.No ratings yet

- Surviving Hetzers G13Document42 pagesSurviving Hetzers G13Mercedes Gomez Martinez100% (2)

- Simple Yellow CartoonDocument1 pageSimple Yellow CartoonIdeza SabadoNo ratings yet

- ConsignmentDocument2 pagesConsignmentKanniha SuryavanshiNo ratings yet

- Addressing Flood Challenges in Ghana: A Case of The Accra MetropolisDocument8 pagesAddressing Flood Challenges in Ghana: A Case of The Accra MetropoliswiseNo ratings yet

- Mock 10 Econ PPR 2Document4 pagesMock 10 Econ PPR 2binoNo ratings yet

- CTC VoucherDocument56 pagesCTC VoucherJames Hydoe ElanNo ratings yet

- Chapter (2) Industry and Competitive AnalysisDocument16 pagesChapter (2) Industry and Competitive Analysisfsherif423No ratings yet

- 3rd Periodic Test - Mapeh 9Document3 pages3rd Periodic Test - Mapeh 9Rap Arante90% (30)

- People vs. PinlacDocument7 pagesPeople vs. PinlacGeenea VidalNo ratings yet

- Assets Book Value Estimated Realizable ValuesDocument3 pagesAssets Book Value Estimated Realizable ValuesEllyza SerranoNo ratings yet

- WN On LTC Rules 2023 SBDocument4 pagesWN On LTC Rules 2023 SBpankajpandey1No ratings yet

- Warhammer Armies: The Army of The NorseDocument39 pagesWarhammer Armies: The Army of The NorseAndy Kirkwood100% (2)

- 13th Format SEX Format-1-1: Share This DocumentDocument1 page13th Format SEX Format-1-1: Share This DocumentDove LogahNo ratings yet

- Anglais OverconsumptionDocument3 pagesAnglais OverconsumptionAnas HoussiniNo ratings yet

- Farhat Ziadeh - Winds Blow Where Ships Do Not Wish To GoDocument32 pagesFarhat Ziadeh - Winds Blow Where Ships Do Not Wish To GoabshlimonNo ratings yet

- HRM in NestleDocument21 pagesHRM in NestleKrishna Jakhetiya100% (1)

- Gouri MohammadDocument3 pagesGouri MohammadMizana KabeerNo ratings yet

- Entrepreneurship: The Entrepreneur, The Individual That SteersDocument11 pagesEntrepreneurship: The Entrepreneur, The Individual That SteersJohn Paulo Sayo0% (1)

- Henry Garrett Ranking TechniquesDocument3 pagesHenry Garrett Ranking TechniquesSyed Zia-ur Rahman100% (1)

- ReinsuranceDocument142 pagesReinsuranceabhishek pathakNo ratings yet

- Yahoo Tabs AbbDocument85 pagesYahoo Tabs AbbKelli R. GrantNo ratings yet

- Aradau Security Materiality SDDocument22 pagesAradau Security Materiality SDTalleres NómadaNo ratings yet

- Service Index PDF - PHP Content Id 2378053&content Tid 388906138&content Type TempDocument2 pagesService Index PDF - PHP Content Id 2378053&content Tid 388906138&content Type Tempshiripalsingh0167No ratings yet

- Mysteel IO Daily - 2Document6 pagesMysteel IO Daily - 2ArvandMadan CoNo ratings yet

- Memorandum of Inderstanding Ups and GoldcoastDocument3 pagesMemorandum of Inderstanding Ups and Goldcoastred_21No ratings yet

- The Giver Quiz 7-8Document2 pagesThe Giver Quiz 7-8roxanaietiNo ratings yet

- Table 2: Fast Tenses ChartDocument5 pagesTable 2: Fast Tenses ChartAngel Julian HernandezNo ratings yet

- La Bugal BLaan Tribal Association Inc. vs. RamosDocument62 pagesLa Bugal BLaan Tribal Association Inc. vs. RamosAKnownKneeMouseeNo ratings yet