Professional Documents

Culture Documents

Assignment No. 2 (Fall 2022)

Uploaded by

Bluewings Travel &ToursOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment No. 2 (Fall 2022)

Uploaded by

Bluewings Travel &ToursCopyright:

Available Formats

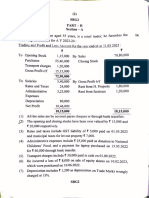

BSAF 5 – Taxation – Fall 2022 Assignment no.

Question no. 01:-

Ahmer Ghazi has been working as director production in Delta Pakistan Limited (DPL)

for last three years. He received following monthly emoluments from DPL during the

year ended 30 June 2022.

Basic Salary - Rs 650,000

House Rent Allowance - Rs 95,000

Medical Allowance - Rs 70,000

(i). Health insurance for him and his family members. The amount of annual premium

paid by DPL was Rs. 50,000

(ii). Return air ticket for Dubai worth Rs. 180,000 for him and his family as a reward for

achieving the production target

(iii). Loan of Rs. 5 million was given to him on 1 August 2021 at 6% per annum

(iv). Withholding tax of Rs. 1,500,000 deducted from his salary was reimbursed to him

(v). On 30 October 2020 Ahmer Ghazi let out his apartment at a monthly rent of Rs.

30,000 to his friend. The fair market rent of the apartment is Rs. 40,000 per month

(vi). He is a part time singer and earned Rs. 225,000 by allowing a private TV channel

to use his song in a TV drama.

Required:

Under the provisions of the Income Tax Ordinance, 2001 and Rules made thereunder,

compute the following for the year ended 30 June 2022.

a. Total income

b. Taxable income

c. Net tax payable or refundable

Date to Submit: December 24, 2022 at 11:10 AM

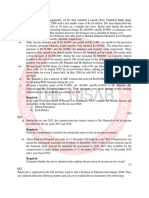

BSAF 5 – Taxation – Fall 2022 Assignment no. 2

Question no. 02:-

Taqi Ahmed is working as Director Marketing with Zee Textiles Limited (ZTL) for the last

twenty five years. Details of his monthly emoluments during the year ended 30 June

2022 are as under:

Basic Salary - Rs 440,000

Conveyance Allowance - Rs 44,000

Medical Allowance - Rs 44,000

In addition to the above, Taqi Ahmed has provided the following information:

(i). He and his family members are covered under the health insurance policy in accord

ance with the terms of employment. The amount of annual premium paid by ZTL was Rs.

200,000.

(ii). During the year, daily allowance of Rs. 400,000 was received to meet the expenses

for working on a assignments at ZTL’s factories located in Lahore and Multan.

(iii). On 31 July 2022, the HR Committee approved a performance bonus for all employe

es for the year ended 30 June 2022. Taqi received Rs. 1,200,000 as performance bonus

on 15 August 2022.

(iv). On 31 March 2022, in recognition of completion of twenty five years of his service w

ith ZTL, the board of directors approved to waive the outstanding amount of loan taken

by Taqi Ahmed. This interest free loan of Rs. 2,500,000 was taken on 1 January 2019

and was repayable in fifty equal monthly instalments commencing from May 2019. The

prescribed benchmark rate is 10% per annum.

(v). During the year, he received Rs. 100,000 for attending board meetings of ZTL. No t

ax was withheld from this amount.

vi). Amount of tax withheld by ZTL from his salary amounted to Rs. 2,000,000.

Other information relevant to tax year 2022 is as under:

(i) Salary is transferred to the bank account on 10th of the following month.

Date to Submit: December 24, 2022 at 11:10 AM

BSAF 5 – Taxation – Fall 2022 Assignment no. 2

(ii) 10% annual increase was given to him effective 1st July in each of the last three years.

(iii) Taqi has given his house on rent to his cousin at annual rent of Rs. 1,500,000. The

rent was inclusive of amenities and utilities of Rs. 25,000 per month. However, annual

rent for a similar house with same amenities and utilities, in the vicinity, is Rs. 1,800,000.

Required:

Under the provisions of the Income Tax Ordinance, 2001 and Rules made thereunder,

compute under correct head of income, the total income, the taxable income and net tax

payable by or refundable to Taqi Ahmed for the year ended 30 June 2022.

Date to Submit: December 24, 2022 at 11:10 AM

You might also like

- Entertainment Law Outline Winter 2008Document129 pagesEntertainment Law Outline Winter 2008downsowf100% (1)

- Guidebook On Life InsuranceDocument105 pagesGuidebook On Life InsuranceElearnmarketsNo ratings yet

- 3 Sem Bcom - Business Ethics PDFDocument119 pages3 Sem Bcom - Business Ethics PDFAnkit Dubey81% (48)

- Military Regimes in PakistanDocument20 pagesMilitary Regimes in PakistanMuhammad SiddiquiNo ratings yet

- High Level MCQDocument160 pagesHigh Level MCQT-ushar banarsiNo ratings yet

- 31.29.60.31-Special Purpose Steam TurbineDocument29 pages31.29.60.31-Special Purpose Steam Turbinemansih457No ratings yet

- SMEs (Students Guide)Document11 pagesSMEs (Students Guide)Erica CaliuagNo ratings yet

- 146.lacson v. PosadasDocument3 pages146.lacson v. PosadasAnonymous AUdGvYNo ratings yet

- Concept Evolution Foundation - 1.2Document277 pagesConcept Evolution Foundation - 1.2abre1get522175% (4)

- NullDocument5 pagesNullAshar HammadNo ratings yet

- Dac 212 Ass.1Document3 pagesDac 212 Ass.1Nickson AkolaNo ratings yet

- CAF 2 TAX Spring 2022Document6 pagesCAF 2 TAX Spring 2022Sumair IqbalNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- Term Test 1Document5 pagesTerm Test 1lalshahbaz57No ratings yet

- Tax Mid Term Draft: 15 MarksDocument4 pagesTax Mid Term Draft: 15 MarksWaasfa100% (1)

- Final Examination On F-206Document3 pagesFinal Examination On F-206Rafia TasnimNo ratings yet

- STT Mock Test S-24 Question PaperDocument8 pagesSTT Mock Test S-24 Question PaperabdullahNo ratings yet

- Assignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsDocument2 pagesAssignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsWaasfaNo ratings yet

- Caf 6 All PDFDocument80 pagesCaf 6 All PDFMuhammad Yahya100% (1)

- Test 5Document2 pagesTest 5ls786580302No ratings yet

- Caf Pac Mock With Solutions Compiled by Saboor AhmadDocument124 pagesCaf Pac Mock With Solutions Compiled by Saboor AhmadkamrankhanlagharisahabNo ratings yet

- Inp 2234 Tax Question PaperDocument11 pagesInp 2234 Tax Question PaperAnshit BahediaNo ratings yet

- TAXATION ASSIGNMENT 1 - 2 QuestionsDocument2 pagesTAXATION ASSIGNMENT 1 - 2 QuestionsFarman AliNo ratings yet

- CAF 2 TAX Autumn 2020Document6 pagesCAF 2 TAX Autumn 2020duocarecoNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- TAX Mock September 2023Document64 pagesTAX Mock September 2023Saqib IqbalNo ratings yet

- Practice Set (Questions) - IAS 19 PDFDocument3 pagesPractice Set (Questions) - IAS 19 PDFAli HaiderNo ratings yet

- ACC315A JAN 2023 Taxation CAT 1Document2 pagesACC315A JAN 2023 Taxation CAT 1Abuk AyulNo ratings yet

- CAF 2 - Energizer - Day 1 - March 2023Document14 pagesCAF 2 - Energizer - Day 1 - March 2023Muhammad Ahsan RiazNo ratings yet

- Eco 11Document4 pagesEco 11Deepak GautamNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- CAF 2 TAX Autumn 2022Document6 pagesCAF 2 TAX Autumn 2022QasimNo ratings yet

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57No ratings yet

- IAS 19 - Class Practice (Questions)Document3 pagesIAS 19 - Class Practice (Questions)Muhammed NaqiNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- Question-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamDocument4 pagesQuestion-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamMuhammad ArslanNo ratings yet

- Eco 11Document4 pagesEco 11ps5927510No ratings yet

- Division B - Descriptive Questions Question No. 1 Is CompulsoryDocument5 pagesDivision B - Descriptive Questions Question No. 1 Is CompulsoryUrvashi RNo ratings yet

- Salary - PaperDocument5 pagesSalary - PaperVenkataRajuNo ratings yet

- Income From SalaryDocument10 pagesIncome From SalaryShubham BajajNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- Practice Set (Questions) - IFRIC 14Document3 pagesPractice Set (Questions) - IFRIC 14kashan.ahmed1985No ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- Salary Mock March-24Document3 pagesSalary Mock March-24syedameerhamza762No ratings yet

- Test Paper-2 Master Question PGBPDocument3 pagesTest Paper-2 Master Question PGBPyeidaindschemeNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha MamDocument9 pagesAditya Sharma - II Mid Term Paper Shikha MamAditya SharmaNo ratings yet

- 71668bos57670 Inter p4q PDFDocument11 pages71668bos57670 Inter p4q PDFmonikaNo ratings yet

- Tax Mid Term (Q) S24Document5 pagesTax Mid Term (Q) S24abdulazeem_cfeNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- DT Smart WorkDocument15 pagesDT Smart WorkmaacmampadNo ratings yet

- Dac 212:principles of Taxation Revision Questions Topics 1-4Document6 pagesDac 212:principles of Taxation Revision Questions Topics 1-4Nickson AkolaNo ratings yet

- Income Tax Practice QuestionsDocument18 pagesIncome Tax Practice QuestionsNuman Rox0% (2)

- Kenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationDocument5 pagesKenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationJoe 254No ratings yet

- Aditya Sharma - II Mid Term Paper Shikha Mam 1Document11 pagesAditya Sharma - II Mid Term Paper Shikha Mam 1Aditya SharmaNo ratings yet

- SAHODAYAModel Question Acc SET 2Document9 pagesSAHODAYAModel Question Acc SET 2aamiralishiasbackup1No ratings yet

- 71240bos57247 P7aDocument27 pages71240bos57247 P7abhagirath prakrutNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- Acct 2005 Practice Exam 2Document17 pagesAcct 2005 Practice Exam 2laujenny64No ratings yet

- 50500bos40223 L1directtaxDocument22 pages50500bos40223 L1directtaxSrishti AgrawalNo ratings yet

- Inter Test Paper 4 - SalaryDocument3 pagesInter Test Paper 4 - SalarySrushti Agarwal100% (1)

- Mock 6 - CFAP 6 - June 23Document5 pagesMock 6 - CFAP 6 - June 23Dawood ZahidNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- 26 So Ping Bun v. Court of Appeals PDFDocument5 pages26 So Ping Bun v. Court of Appeals PDFAbegail GaledoNo ratings yet

- Chap 4Document15 pagesChap 4Tran Pham Quoc ThuyNo ratings yet

- CS Foundation - Cyber LawsDocument30 pagesCS Foundation - Cyber Lawsuma mishraNo ratings yet

- Broadband Every Home PlanDocument2 pagesBroadband Every Home PlanssvpdxNo ratings yet

- Gruen V Gruen Case Brief PropertyDocument3 pagesGruen V Gruen Case Brief PropertyMissy MeyerNo ratings yet

- Internship Report 2023-2Document64 pagesInternship Report 2023-2Kajal Dnyaneshwar MhasalNo ratings yet

- Bastion User Guide enDocument54 pagesBastion User Guide engfcentral.storeNo ratings yet

- 4-2 PFM-SARD Rev 21mar2012 by Jiro TsunodaDocument13 pages4-2 PFM-SARD Rev 21mar2012 by Jiro TsunodaButch D. de la CruzNo ratings yet

- Global Timesheet GuidanceDocument3 pagesGlobal Timesheet GuidanceprakashNo ratings yet

- To What Extent Has S.15 (1) of The Contracts Act Modified The Common Law Concept of Misrepresentation.Document4 pagesTo What Extent Has S.15 (1) of The Contracts Act Modified The Common Law Concept of Misrepresentation.deonyago7No ratings yet

- Great Pacific Life Insurance Corp Vs CADocument7 pagesGreat Pacific Life Insurance Corp Vs CALeigh BarcelonaNo ratings yet

- Advisory Opinion No. 2021-027 - SGDDocument6 pagesAdvisory Opinion No. 2021-027 - SGDDan Warren NuestroNo ratings yet

- Khalistan MovementDocument18 pagesKhalistan MovementVaibhavvashishtNo ratings yet

- Global Issues EqualityDocument4 pagesGlobal Issues EqualityayuNo ratings yet

- ANSYS Inc. Licensing GuideDocument20 pagesANSYS Inc. Licensing Guidekamal waniNo ratings yet

- Induction For New Leaders and Managers: Human Resources and Organisational DevelopmentDocument18 pagesInduction For New Leaders and Managers: Human Resources and Organisational DevelopmentHemanshi BharmaniNo ratings yet

- Dwnload Full Statistics For Social Workers 8th Edition Weinbach Test Bank PDFDocument35 pagesDwnload Full Statistics For Social Workers 8th Edition Weinbach Test Bank PDFmasonh7dswebb100% (11)

- Healing and AtonementDocument3 pagesHealing and AtonementmarknassefNo ratings yet

- Double-Headed Eagle - WikipediaDocument10 pagesDouble-Headed Eagle - Wikipediakrenari68No ratings yet

- Company Account Review Questions-1Document3 pagesCompany Account Review Questions-1JustineNo ratings yet

- Common GoodDocument13 pagesCommon GoodXyzzielleNo ratings yet

- A Study of HDFC Mutual FundsDocument71 pagesA Study of HDFC Mutual FundsUzmaamehendiartNo ratings yet