Professional Documents

Culture Documents

Pa Section 4843.1 - Return by Taxpayer - OCR

Uploaded by

BlaiberteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pa Section 4843.1 - Return by Taxpayer - OCR

Uploaded by

BlaiberteCopyright:

Available Formats

72 Pa. Stat. § 4843.

1

Section 4843.1 - Return by taxpayer

(a) For the purpose of ascertaining the amount of tax payable under this act, every resident liable to pay such

tax shall, each year, on or before such date as shall be fixed by the board for the revision of taxes or the county

commissioners transmit to the board for the revision of taxes, or the county commissioners, upon a form

prescribed, prepared and furnished by the board of revision of taxes, or the county commissioners, a return

certified as provided in this act:

(1) The aggregate actual value of each part of the different classes of property made taxable by this act, held,

owned or possessed by such resident as of the date fixed annually, in the manner provided herein, either in hi

own right or as trustee, agent, attorney-in-fact or in any other capacity for the use, benefit or advantage of am

other person, copartnership, unincorporated association, company, limited partnership, joint-stock associatior

or corporation.

(2) Such other relevant information as may be required by the board of revision of taxes, or county

commissioners, concerning each of the different classes of property enumerated in this act owned, held or in

any manner possessed by such resident.

(b) The return so made shall be certified to, by the person making the same, if an individual; and in the case of

copartnership, unincorporated association and joint-stock association and companies, by some member thereof

and in the case of limited partnerships and corporations, by the president, chairman or treasurer thereof.

(c) The tax imposed by this act shall be due and payable at the same time, and subject to the same conditions a<

to discounts, penalties and interest, as in the case of real property taxes imposed by the county for county

purposes, and in cities coextensive with counties for city and county purposes.

(d) Any person who wilfully fails or refuses to file any return containing the information required by this act

shall be guilty of a misdemeanor, and upon conviction thereof, shall be sentenced to pay a fine of not more thai

five hundred dollars ($500), or to undergo imprisonment for not more than six months, or both.

72 PS. §4843.1

1913, June 17, P.L. 507, § 4.1, added 1947, July 3, P.L. 1249, § 1. Amended 1978, Oct. 4, P.L. 994, No. 206, §

1, imd. effective.

casetext

You might also like

- Foreclosure Reform Law - Nevada Ab284 Is Now in Effect - Oct 1 2011 - Affidavit of Authority RequiredDocument20 pagesForeclosure Reform Law - Nevada Ab284 Is Now in Effect - Oct 1 2011 - Affidavit of Authority Required83jjmackNo ratings yet

- Patent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeFrom EverandPatent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeNo ratings yet

- The Revenue Recovery Act, 1890 - Arrangement of SectionsDocument5 pagesThe Revenue Recovery Act, 1890 - Arrangement of SectionsVinod Kumar SharmaNo ratings yet

- Revenue Recovery Act, 1890Document6 pagesRevenue Recovery Act, 1890Haseeb HassanNo ratings yet

- The Universal Copyright Convention (1988)From EverandThe Universal Copyright Convention (1988)No ratings yet

- Chit Funds ActDocument47 pagesChit Funds Actrkaran22No ratings yet

- Republic Act 3765Document2 pagesRepublic Act 3765Dianne YcoNo ratings yet

- Grove Park Declaration of Protective CovenantsDocument22 pagesGrove Park Declaration of Protective CovenantscarterrealtyNo ratings yet

- BankruptcyAct June28 1934Document3 pagesBankruptcyAct June28 1934ncwazzyNo ratings yet

- Æ - CCCCC CC CC CCCCCCCCC: CC C CC CDocument4 pagesÆ - CCCCC CC CC CCCCCCCCC: CC C CC CKeisha Zwit De GuzmanNo ratings yet

- Pakistan Ordinance of Zakat and UshrDocument43 pagesPakistan Ordinance of Zakat and UshrSyed Asghar AliNo ratings yet

- Revenue Recovery Act, 1890 PDFDocument7 pagesRevenue Recovery Act, 1890 PDFKinjal ShahNo ratings yet

- HB 343Document22 pagesHB 343samtlevinNo ratings yet

- 365722-2023-Bataan Revenue Code of 202320230911-25-m5b4p0Document43 pages365722-2023-Bataan Revenue Code of 202320230911-25-m5b4p0Ren Mar CruzNo ratings yet

- 01 Organization and Function of The Bureau of Internal RevenueDocument5 pages01 Organization and Function of The Bureau of Internal RevenuefelixacctNo ratings yet

- Batas Pambansa BLGDocument10 pagesBatas Pambansa BLGDessa ReyesNo ratings yet

- Date of Issue: 3 The Chargor: CAIN WAKA SINGH of Post Office Box Number 73, RongweDocument26 pagesDate of Issue: 3 The Chargor: CAIN WAKA SINGH of Post Office Box Number 73, RongweBarzini BrasiNo ratings yet

- Declaration of Real Property by The Owner or AdministratorDocument10 pagesDeclaration of Real Property by The Owner or AdministratorXhaNo ratings yet

- Secure Promissory NoteDocument3 pagesSecure Promissory Noterhett.emmanuel.serfinoNo ratings yet

- Abandoned Property ActDocument24 pagesAbandoned Property ActbazyrkyrNo ratings yet

- Ra 9243 DSTDocument6 pagesRa 9243 DSTapi-247793055100% (1)

- Ground Lease SampleDocument25 pagesGround Lease Samplenguyenhm16No ratings yet

- Tridel Holdings-DRAFT Contract of Lease-Grand Champ PackagingDocument14 pagesTridel Holdings-DRAFT Contract of Lease-Grand Champ PackagingAileen Love ReyesNo ratings yet

- 47-17.1. Documents Registered or Ordered To Be Registered in Certain Counties To Designate Draftsman ExceptionsDocument33 pages47-17.1. Documents Registered or Ordered To Be Registered in Certain Counties To Designate Draftsman ExceptionsDanielNo ratings yet

- The Chit Funds ActDocument5 pagesThe Chit Funds ActGuru RamanathanNo ratings yet

- LGT - CollectionDocument3 pagesLGT - CollectionKezNo ratings yet

- RA 3765 Truth in Lending ActDocument3 pagesRA 3765 Truth in Lending ActljolivaNo ratings yet

- Title III Estate TaxDocument10 pagesTitle III Estate TaxJonathan UyNo ratings yet

- Bir Ruling - Exemption of Donation From DSTDocument10 pagesBir Ruling - Exemption of Donation From DSTDenise Capacio LirioNo ratings yet

- Chattel Mortgage To Judicial ForeclosureDocument46 pagesChattel Mortgage To Judicial ForeclosureChedeng KumaNo ratings yet

- Majority Action-Sb 1638 BillDocument6 pagesMajority Action-Sb 1638 BillBONDCK88507No ratings yet

- Bankruptcy NoticesDocument5 pagesBankruptcy NoticesYogeswaranKuppanNo ratings yet

- Commrev (De Guia2)Document22 pagesCommrev (De Guia2)patrixiaNo ratings yet

- Indian Stamp Act, 1899: ( (47A. Instruments of Conveyance Etc., Under-Valued How To Be Dealt WithDocument3 pagesIndian Stamp Act, 1899: ( (47A. Instruments of Conveyance Etc., Under-Valued How To Be Dealt WithArpit AgarwalNo ratings yet

- Revenue Regulations No. 2-2003Document22 pagesRevenue Regulations No. 2-2003Kiko RoxasNo ratings yet

- Promissory NoteDocument3 pagesPromissory NoteCHRIS OGAMBANo ratings yet

- The Revenue Recovery Act, 1890 - Arrangement of SectionsDocument5 pagesThe Revenue Recovery Act, 1890 - Arrangement of SectionsSadhvi SinghNo ratings yet

- Estate and Donors TaxDocument10 pagesEstate and Donors Taxybbob_11No ratings yet

- Trust Fund Agreement: Section 1. Definitions. As Used in This AgreementDocument9 pagesTrust Fund Agreement: Section 1. Definitions. As Used in This AgreementAriannaNo ratings yet

- Republic Act No. 3765Document1 pageRepublic Act No. 3765Josef PeñasNo ratings yet

- California Government Code Section 27279-27297.7Document6 pagesCalifornia Government Code Section 27279-27297.7Freeman LawyerNo ratings yet

- Auction Arrangement of SectionsDocument8 pagesAuction Arrangement of SectionsyogastioNo ratings yet

- Dizon Vs CIRDocument3 pagesDizon Vs CIRRay John Uy-Maldecer AgregadoNo ratings yet

- Appraisal and Assessment of Real PropertyDocument2 pagesAppraisal and Assessment of Real Propertynoemi melaya100% (1)

- Absolute Community of PropertyDocument19 pagesAbsolute Community of Propertyjeremiah100% (1)

- Tax January 20 2021Document36 pagesTax January 20 2021Rae ManarNo ratings yet

- Title Iii Estate and Donor'S Taxes Estate Tax SEC. 84. Rates of Estate TaxDocument15 pagesTitle Iii Estate and Donor'S Taxes Estate Tax SEC. 84. Rates of Estate Taxmiss independentNo ratings yet

- Opdr RulesDocument40 pagesOpdr Rulesprithvirajmeher99No ratings yet

- Laws On CorporationDocument16 pagesLaws On CorporationBam SeñeresNo ratings yet

- SB 1890Document28 pagesSB 1890Foreclosure Fraud100% (1)

- The Cash Price or Delivered Price of The Property or Service To Be Acquired (2) The Amounts, If Any, To Be Credited As Down Payment And/or Trade-InDocument2 pagesThe Cash Price or Delivered Price of The Property or Service To Be Acquired (2) The Amounts, If Any, To Be Credited As Down Payment And/or Trade-InJaneth NavalesNo ratings yet

- TRAIN LAW - Estate TAX - SUMMARY OF CHANGESDocument10 pagesTRAIN LAW - Estate TAX - SUMMARY OF CHANGESBon BonsNo ratings yet

- Master Gilt Edged Stock Lending (1996)Document30 pagesMaster Gilt Edged Stock Lending (1996)Mark Xavier OyalesNo ratings yet

- SEC. 84. Rates of Estate Tax. - There Shall Be Levied, Assessed, Collected and Paid UponDocument10 pagesSEC. 84. Rates of Estate Tax. - There Shall Be Levied, Assessed, Collected and Paid UponJoy Navaja DominguezNo ratings yet

- Missouri Cemetery Laws, Revisions Chapter 214Document22 pagesMissouri Cemetery Laws, Revisions Chapter 214enewsonly100% (1)

- Transfer Taxes: SEC. 84 Rates of Estate Tax. - There Shall Be Levied, AssessedDocument16 pagesTransfer Taxes: SEC. 84 Rates of Estate Tax. - There Shall Be Levied, AssessedAster Beane AranetaNo ratings yet

- Estate and Donor's TaxDocument6 pagesEstate and Donor's TaxKimberly SendinNo ratings yet

- Batas Pambansa Blg. 22Document13 pagesBatas Pambansa Blg. 22DjatTanNo ratings yet

- @ 1 42-1983 NOTES ShortDocument5 pages@ 1 42-1983 NOTES ShortBlaiberteNo ratings yet

- @ 1 42-1983 NOTES MainDocument60 pages@ 1 42-1983 NOTES MainBlaiberteNo ratings yet

- Pa Taxpayers - GREATDocument20 pagesPa Taxpayers - GREATBlaiberteNo ratings yet

- Common Law RemedyDocument79 pagesCommon Law RemedyBlaiberte100% (1)

- 50-State Chart of Small Claims Court Dollar LimitsDocument4 pages50-State Chart of Small Claims Court Dollar LimitsBlaiberteNo ratings yet

- Kontakt Factory Library Manual EnglishDocument116 pagesKontakt Factory Library Manual EnglishBlaiberteNo ratings yet

- Reconciliation HR 4872 Full TextDocument2,310 pagesReconciliation HR 4872 Full TextSpandan ChakrabartiNo ratings yet

- Audio Plug-Ins Guide PDFDocument398 pagesAudio Plug-Ins Guide PDFtwentysixtwoNo ratings yet

- Pro Tools ShortcutsDocument65 pagesPro Tools ShortcutsmodemayoNo ratings yet

- Rudiment Study SheetDocument3 pagesRudiment Study SheetBlaiberteNo ratings yet

- BUS13401n14099 10 09Document2 pagesBUS13401n14099 10 09jc199707No ratings yet

- Invoice IXITRN4712391663216796Document1 pageInvoice IXITRN4712391663216796rahul swainNo ratings yet

- Weekly Tax Table: Pay As You Go (PAYG) WithholdingDocument12 pagesWeekly Tax Table: Pay As You Go (PAYG) Withholdingwawen03No ratings yet

- III. Problem 1 - 122601Document1 pageIII. Problem 1 - 122601Everly Mae ElondoNo ratings yet

- T4 Ans. (Export Incentives R&D)Document4 pagesT4 Ans. (Export Incentives R&D)KY LawNo ratings yet

- SW05Document7 pagesSW05Nadi HoodNo ratings yet

- P Narendra Pay SlipDocument2 pagesP Narendra Pay SlipBADI APPALARAJUNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- Final MCQ GST Question BAnk Mumbai UnivDocument27 pagesFinal MCQ GST Question BAnk Mumbai UnivMayuri MhatreNo ratings yet

- Revenue Memorandum Circular No. 028-19Document2 pagesRevenue Memorandum Circular No. 028-19Alvin AgullanaNo ratings yet

- Instructions For Schedule B (Form 941) : (Rev. January 2017)Document3 pagesInstructions For Schedule B (Form 941) : (Rev. January 2017)gopaljiiNo ratings yet

- Depreciation: Section 32 Income Tax Act, 1961Document11 pagesDepreciation: Section 32 Income Tax Act, 1961varunh9No ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- Rnlic Pay Slip 70648381 Oct 2023Document1 pageRnlic Pay Slip 70648381 Oct 2023Neeraj BhardwajNo ratings yet

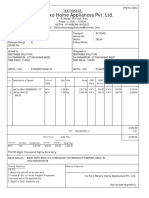

- INR One Thousand Eight Hundred and Thirty Four Rupees and Zero Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR One Thousand Eight Hundred and Thirty Four Rupees and Zero Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EAshish MishraNo ratings yet

- 3 Sales Invoice RelaxoDocument3 pages3 Sales Invoice RelaxoSantosh OjhaNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- Drill Problems - Community Tax:: Mr. Lafa Mrs. LafaDocument2 pagesDrill Problems - Community Tax:: Mr. Lafa Mrs. LafaRealEXcellenceNo ratings yet

- GST Debit Note & Credit Note FormatDocument2 pagesGST Debit Note & Credit Note Formatstar pandiNo ratings yet

- RMC 39-14Document2 pagesRMC 39-14racheltanuy6557No ratings yet

- Sales Invoice: Invoice From Shipping FromDocument1 pageSales Invoice: Invoice From Shipping FromGiancarlos SanchezNo ratings yet

- Offer DriveDocument1 pageOffer DriveAman DeepNo ratings yet

- Tds ProvisionsDocument38 pagesTds Provisionsglobalfreedom4No ratings yet

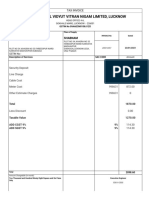

- Madhyanchal Vidyut Vitran Nigam Limited, Lucknow: Shabnam ShabnamDocument2 pagesMadhyanchal Vidyut Vitran Nigam Limited, Lucknow: Shabnam ShabnamYadav Manish KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRAMBABU KURUVANo ratings yet

- Noa-Iit Ob2420230619070707preDocument1 pageNoa-Iit Ob2420230619070707prehvikashNo ratings yet

- Si - No. Invoice Date Invoice No. Cleint NameDocument8 pagesSi - No. Invoice Date Invoice No. Cleint NameKishnsNo ratings yet

- Solved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFDocument1 pageSolved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFAnbu jaromiaNo ratings yet

- JunDocument1 pageJunkallinath nrNo ratings yet

- Monthly Budget WorksheetDocument24 pagesMonthly Budget WorksheetMichaela PortsNo ratings yet

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadFrom EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadNo ratings yet

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)