Professional Documents

Culture Documents

Itr 2020-2021

Itr 2020-2021

Uploaded by

advisewise associates0 ratings0% found this document useful (0 votes)

15 views16 pagesOriginal Title

ITR 2020-2021

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views16 pagesItr 2020-2021

Itr 2020-2021

Uploaded by

advisewise associatesCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 16

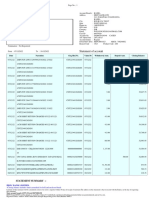

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT

“Assessment Year

[Where the data of the Return Iconic In Fora FTRGA (SAMA ATH, 1163, 2020-21

ITRA(SUGAM), FERS 16, ERT id and veri

(ease ee Role 12 of the Inome-tax Roles, 1962)

PAN AAKEPK1539N

Name MD SAHANAWAS KHAN

RAIBALLAVPUR, RAJBALLAVPUR, MASLANDAPUR, HAGRA, NORTH 24 PARGANAS, WEST BENGAL, 743289

Aduress

Status Individual Form Number mes

Fited ws | 139(1)-On or before due date ing Acknowledgement Number | 656505621171020

«| earrsnt Year business loss ifany 1 0

3 [ates 1669940

% [Book Pron under MAT, where applicable 2 0

[Adjusted Total income under ANT, where applicable 3 1669940

Z| Net tax payable 4 326021

[Interest and Fee Payable 5 0

S| Tovat tax interest and Fee payatie 6 326021

[Taxes Pata 7 756981

1 F |G yrax payable (epRetundabte (6-7) 8 #30960

[Dividend Tax Payable 9 0

-e & , [foorese rayane 10 0

3 S| Tora dividend tox and intrest payable i 0

B= *lracsraa 2 0

| Gran Payable (Refundable (11-12) B 0

E__ | Acereted tncome as per section 1151 4 0

% | Additional Tax payable wis 157 18 0

B= | ncerest payable wis STE 16 0

E [raxand interop 18 °

Jncome Tax Return submitted electronically on 17-10-2020 20:20:36 _ from IP address 103.76.211.176 and verified by

MD SAHANAWAS KIIAN

AKEPKISI9N on 17-10-2020 20: from IP address 103.76211.176, ee

paving PAN

Digital Signature Certificate (DSC).

DSC details:

17995782CN-e-Mudhra Sub CA for Class 2 Individual 2014,0U=Certfying Authorliy,O=eMuulhra Consumer Services Limited,C-IN

Do NOT SEND THIS ACKNOWLEDGEMENT T

‘0 CPC, BENGALURU

FORM NO.3CB

[See rule 6G(1)(b)]

Audit report under section 44AB of the Income-tax Act, 1961 in the ease of a person referred to in

clause (b) of sub-rule (1) of rule 6G

1.1 have examined the balance sheet as at 31st March 2020 and the Profitand/Joss account for the period beginning from O1/

042019 to ending on 31/03/2020 attached herewith, of MD _SAHANAWAS KHAN RAJIBALLAVPUR, HABRA,, NORTH.

24 PARGANAS, WEST BENGAL, 743289 AKEPKISi9N,

2.1 certify that the balance shect and the Profit and toss account are in agreement with the books of account maintained atthe

head office at RAJIBALLAVPUR, HAIRA, NORTH 24 PARGANAS, 743289, and @ branches,

3. (@) Lrepor the following observations/comments/discrepancieslinconsistencies; if any:

CASILIN HAND & CLOSING STOCK AS ON 31/03/2019 ARE VALUED AND CERTIFIED BY THE PROPRIETOR

(b) Subject to above,

(AVI have obtained all the information and explanations which, to the best of My knowledge and belief, were necessary

for the purposes ofthe audit.

(BylaMy opinion, proper books of account have been kept by the head office and branches of the assessee so far as appears

from My knowledge and belief, were necessary for the examination ofthe books.

(Coady opinion and tothe best of My information and according tothe explanations given to Me the said accounts, read

‘with notes thereon, ifany, give a true and fair

(i) in the case of the balance sheet, of the state of the affairs ‘of the assessee as at 31st March, 2020 and

(pin the case ofthe Profit and toss account of te: Profit ofthe assesee forthe year ended on that date,

4, The statement of particulars required to be furnished under section 44AB is annexed herewith in Form No. 3CD.

‘.Jn My opinion and tothe best of My information and according to explanations given to Me the particulars given in the said

Form No. 3CD and the Annexure thereto are true and correct subject to following observations/qualifications, iFany:~

ST] Qualification Type [Observations/ Qualifications

IN

Place HABRA ‘Name: ‘SUDIP__GHOsH

Date 7102020 Membership Number 301505,

FRN (Firm Registration Numbér) 0327806E

‘Adideess JOYGACHL HABRA, NORTH 24 PARG.

‘ANAS, WEST BENGAL, 743263

& on behalf of

SOpit GHOSH & CO.

amare

Bi tos)

‘ ty SOF peel

Mampersipne-sotets

UDIN: 20301505 AAAAOP4 of

SIALLAVPUI, HARA,

ENGAL, TAM

AKEPKISSON

ver

=F

the assessee is Tile 10 pa

duty, sles tax, goods nnd services tx

ldutyrcte.if'yes, please furnish the registeation m

number oF any other identifi

St [Type Reqiatralion Number

No.

1 | Gooiand Services Tax WEST TENG FIRTSIONTZS 4

[5 [Sa ii

(6 [Previous year fom OVO I019 we STRUT —

7” [Assessment Year 7020-21 |

ite the relevant clause of section 44AD under which the audit has been conducted

[SI] Relevant chuse of section 441 under which the audit has been conducted

No.

T [Clause 44A1(9)-Total salositurnover/gross receipts of business exceeding specified limi |

Ja [léfirm or Association of Persons, indicate names of parinersimembers and their profit sharing ratoa: Ta Gaz

lof AOP, whether shares of members are indeterminate oF unknown’?

fame Profit Sharing Fat]

le)

[9 / [it there is any change in the partners or members oF in their profit sharing rallo since The Tast date OF Whe)

preceding year, the particulars of such change.

Date ofchange [Name of Partner/Member_ [Type lO promt|New | Remark

Jehange sharing {profit

ratio, |Sharing

Rati

Toa [Nature of business or profession (iT more than one business or profession 1s carried on during the previous year, nature

of every business or profession).

Sector Sub Sector (Code

CONSTRUCTION Building of eanaplete constructions or party chit” [O00

contractors

TO[b— [ifthere is any change inthe nalure of business oF profession, the particulars of such Grange [Ro

[Business Sector SubSector [Code

Tifa [Whether books of accounts are proscribed under section 44AA, if ye, Mist of books so proseribad [ees

[Books prescribed

[CASH BOOK, GENERAL LEDGER, SALES REGISTER, PURCIIASE REGISTERC

Ti]b [List of books of account maintained and the address at which the books of accounts are Kept. (In case books oF account

are maintained in a computer system, mention the books of account generated by such computer system, Ifthe books of|

accounts are not kept at one location, please furnish the addresses of locations along withthe details of books of accounts

|maintained at each location.) Same as 11(a) above

[Books maintained [Address Line T [Address Line2 [City _or Town or] State PinCode

District

(CASH BOOK, GENERAL L | RANBALLAVPUR, Tr NORTITZ4 PARGAN [WEST BE [T3287

EDGER, SALES REGISTE |ABRA jas NGAL

IR, PURCHASE REGISTER |

Ti]e [List oF books of account and nature of relevant documents examined. Same as TI(b)above

[Books Examined

[CASH BOOK, GENERAL LEDGER, SALES REGISTER, PURCIIASE REGISTER

172 | Whether the profit and loss account includes any profits and gains assessable on presumpiive basis, yes, indicate he] No

amount and the relevant section (44D, 44AE, 44AF, 44B, 44BB, 44BBA, 440BB, Chapter XI-G, Fist Schedule

lor any other relevant section).

[Section

i

T3]a__[Metiod of accounting employed in the previous year _ [Mercantile system

T3]b | Whether there has been any change in the method of accounting employed Vist-vis the method employed in] No

tie immediately preceding previous year.

T3)e [IF answer to (b) above is inthe affirmative, give details of such chang

de

[Amana

7nd th effect thereof on the profit or Toss.

iGMNCaY[Vhxveave to pro Y |

nplylng with the provision sla

ee) |

| The sccossting policies edopied tw meavaring inventors: cou,

lor net realisable valae, whichever It lower =

| - - nt of inventoriet Ri 0.09,

fen - bet applicable

isi 7

| fase =

Acos vi

ACDS LN = Herrowieg

ICDS - Provisions, Cont

JIg]s | NSnsToT alison af cloning wok eplayed nthe Reon Fea oor NIV weber Te Tow

‘Contingent labilties exist on 31.03.2030

Ta]b Tin case of deviation from the micthod of valuation prescribed under secon TASAy and the elfect thereat on[No

_the peofit or toss, please furnish

[C]Paricatans increase in profil(its,) [Decrease in profitiits,)

[Give the following particulars of the capital assed comveed into WoeksTa rade

(e) Description of capital asset (Date ot] Con of] Amount at

acquisition acquisition fwhich the asset

Si

Te] Amount not ered To the prot an Tos aun BNE

[fea — [The ems falling within te scope of section 38

[ [Description y [Amount

| fk

[To]B Me potormna credits, drawbacks, refund AF Gly of Customs oF EXIs r seViGe aN Flan aT IX or alas wded

tau. where such credits, drawbacks of refund are smite as due bythe aulhries concerned

[senton Tamioaat

[IGE Essastion clam aeeepied dang he RIO

[PDessantion Amman

Nil

[Tee Any cihertem of meome

| [Dscinaon Amount

Tele |Capnal receipe any

if Desenption Amount

| NI

7] Where aby Lind or balding of both is wansfewred daring the previous year for a considetaton Tess Wan value alopial of

|__jsssessod of assessable by any authority ofa State Government referred tain section 43CA or SUC, please furnish

[Dewiis of] Adiiess. Line]Address Line|City/Town [State (Pincode | Consideration | Value adopted]

property |! 2 ree

accrued

1S) PRATSTas of dpeciion swale wpa he Time tax A, TUT Ta FART OT Gh ant oa GT mt ste ae

b 2 =

Desc [hae oT OpaRE Ration DaTactons| Dapeesiat Wriicn

ion of deprecia: WDV (A) | Purchase [MOD> [Change [Subsidy] Total © JAllowable [Dawn Value

Block ofjtion (In) Value (1) |-WAT Value off (D) [at the cad off

Assets! Percent | Q) Purchases ithe year

class of (Asthc-b)

Assets

= Vor Addition ved Deduction Detals refer Addiiva and Did

Ty]Amounis admissible under sections

SNe [Section [Amount debit To] Amounts admisible as per Whe provisions ofthe Tncomevax Aa, T5GT and]

Profit and toss also fils the conditions, f any specified under the relevant 14provsions

account ofincome-tax Ac, 1961 or Incomestax Rules,1962 or anyother guidelines, |

iccula, et, issued inthis behalf

Ni

20} Any sim paid o an employee as onus or commision Tor ferTees rendered, where sh sum War aihervise payable

to him as profits or dividend (Section 36(1))}

Deserpi Amount

2O[b [Details of eonrbaons received Tom employees Tor varius Tanda refered Wo SeaIon TOUT}

Rare oF Fund Sum Due date for] The actual) The ecu dae

received payment [amount paid fof payment

from the "concer

employees authorities

Please fammish the details of amounts debited to the profit and Toss account,

advertisement expenditure ete

ing in the nature of capital, personal,

(Capital expenditure

Pariculars [Amount in Rs

Personal expenditure 1

Particulars (Amount in Rs,

‘Advertisement expenditure in any souvenir, brochure, act, pamphlet or the ike published by a political pany

[Lo [Particulars [Amount in Rs.

[Expenditure incurred af clubs being entrance fees and subscriptions

[Particulars ‘Amount i Rs,

[Expenditure incurred af clubs being cost for elub services and Taciiies used.

Particulars (Amount a RS,

[Expenditure by way of penaliy of fine for violation oF any Taw forthe time being force

Particulars (Amount in Re.

Expenditure by way of any other penally or fine not covered above’

Particulars r [Amountin Rs.

[Expenditure incurred for any purpose which is an offence or which is prohibited by law

Particulars [Amount in Rs.

[() Amounts inadmissible under section 4000)

(Gas

‘payment to non-resident referred to in sub-clause (i)

(A) Details of payment on which tax isnot deducted:

Date off Amount _ of Nature. of|Name of the|PAN™ of Address, Address City or] Pincode

payment [payment ~|payment payee” the payee, Line2 | Town or|

avaliable District

|(B) Details of payment on which tax has been deducted but has not been paid during the previous year or inthe subsequent year]

before the expiry of time prescribed under section200(1),

Date offAmount offNature of)Name _ of]PAN_of]Address [Address [City or Pincode [Amount

payment [payment [payment ihe payee |the —|Line! —|Line2 [Town or lor tax

payee District |deducted|

avaliable}

(Gi) as payment referred 19 im sub-clause (i)

(A) Details of payment on which tax snot deducted:

[Date ofAmount) Nature of Name of the [PAN — of] Address Line 1]Address ]Cityor Town] Pincode

Jpayment Jot |payment [payee the lLine2 Jor District

payment payec,it

avaliable

[(B) Details of payment on which Tax has been deducted but has not been paid on oF before the due date specified in

sub-section (1) of section 139,

Date offAmount [Nature of]Name of]PAN of Address [Address [City or|Pincode [Amount [Amouat ou

Jpsyment Jot payment |the payer |the [Line1 |Linc2 |Town or of taxlof (VD

payment payee District deducted | deposited, it

avaliable any

(i) as payment referred to i sub-clause (1D)

[(A) Details oF payment on which levy isnot deducted:

[Date of[Amount] Nature of]Name of tie]PAN of Address Line I]Address [City or Town Pincode

lpayment Jof payment —|payee the Line2 or District

payment pay

avaliable

dy

[(B) Details of payment on which Te

vy has been deducted but has not been pad on or before the due date specified in

sub- section (1) of section 139.

Date “ofAmount [Nature of Name of] PAN of[Address [Address [Cily —or]Pincode [Amount [Amount om

payment Jof payment |the payer|the —|Line1 |Line2 [Town ot lor tevylof (Vi

[payment payee,it Di [deducted |deposited, i

avaliable any

(Gv) Hinge Deneit ox under sub-clause (ig)

(wealth ax under sub-clause Gia)

(vi) royalty, license fee, service fee ele. under sub-clause (1D).

(vi) salary payable ouside Tndvto a non resident without TDS ete. under sub-clause (iN,

Date ofJAmountof]Name of the[PAN of Address Line 1 [Address [Ciiy Pincode

payment — payment — payee the payee,i} Line 2

avaliable

(Vii payment fo PF Tother fund ete- under sub-clause (ivy

(ix) tax paid by employer for perquisites under sub-clause (w)

(©) Amounts debited to profit and Toss account being, interest, salary, bonus, commission oF remuneration inadmissible under

section 40(b)/40(ba) and computation thereof;

Particulars Section [Amount debited] Amount [Amount [Remarks

to PLAC | Admissible Inadmissible

(.

Disallowanceldcemed income under section 40AG):

[(A) On the basis of the examination of books of account and olher relevant documentsevidence, whether the] Ves

expenditure covered under section 40(3) read with rule GDD were made by account payee cheque drawn on a bank|

Jor account payee bank draft If not, please furnish the details:

[Date Of Payment [Nature O!]Amount ia Rs,

[Name of the payee Permanent ‘Recount

Payment

Number of the payee,

available

[(B) On he basis ofthe examination of books of account and other relevant documenisTevidence, whether the payment] Yes

referee to in section 40A(3A) read with rule GD were maue by account payee cheque drawn on a bank or account

payee bank draft If not, please furnish the detils of amount deemed to be the profits and gains of business or

[profession under section 40A(3A)

[Date OF Payment [Nature Of]Amount im Ra Name ofthe payee [Permanent Recount

Payment wy [Number of the payee, if]

z available

e

Provision for payment of gratuity not allowable under section 4UA(T)

(®) Any sum paid by the assessce as an employer not allowable under section 4A)

(e)

Particulars of any lability ofa contingent nature

[Rature OF Liability [Amount ia Rs

o

does not form part of the total income

‘Amount of deduction inadmissible ih terms of section 4A Tn Fespect of the expenditure incurred in relation fo income which

[Nature OF Liability [Amount in Rs.

[G) Amount inadmissible under the proviso to section 36I)Gi)

22]

[Amount of interest inadmissible under section 23 of the Micro, Small und Medium Enterprises Development Act,

12006

25 [Particulars oF any payment made to persons specified under section 4UA@2N).

[Name of Related Person [PAN of Related Person [Relation [Nature of] Payment Made(Amount)

trasaction

[2 [Amounts deemed to be profits and gains under section 3ZAC of S2AD of 33AB or 33AC or S3ABA.

[Section [Description ‘Amount

IN :

[25| Any amount of profit chargeable To tax under section 41 and computation thereof. ;

[Name of Person [Amount ofincome [Section Description of Transaction [Computation any

[2G] [lm respect of any sum referred Yo in clause (@)(C(.E)A0 oF (B) of section 43B the Hablity for which

'26|(i)A |pre-existed on the frst day of the previous year but was not allowed inthe assessment of any preceding previous yea

and was

P2o[COCANe) [Paid during the previous year

Section [Nature of Tabiliy [Amount

IN

ZETA NG) [Not pat daring the previous year

Om [Ratare of Tabiliy [Amount

ni

[26](0)H [was incurred inthe previous year and was 5 -

Fe ay Fad ono er We dr ne Tor ming Ta RS OTE RV ea we TNT)

a

ance ee nnEnInSenEIESNNDESSEENEEEESEUEEIOTNEENE ECC

[Section

[TassDuty.Cess Fee ete

[Ta Duty, Cess.Fee ete

26[({G)(b)___Jnot paid on oF before the aforesaid date

Sesion __ [Nan

(State whether sales tax, pods & service Tax, customs]No |

uty, excise duty or any other indirect tax, levy,

MPOSL, eC, i

account.)

27]a [Amount of Central Value Added Tax Credits Input Tax Credi(ITC) ava

year and its treatment in profit and loss a

Input Tax Credit(ITC) in accounts

Amount]

2800]

Ta016|

passed through the profit and los

led of or utilised during the previous] No

‘count and treatment of outstanding Central Value Added Tax Credit|

iCENVATITTC ‘Amount [Treatment ta Profit andj

LossiAccounts

(Opening Balance

[Credit Availed

[Credit Utized

[Closing/Outstanding

Balance

27[b [Particulars of income oF expenditure of prior period crediied or debited tote profitand Toss accoum

Type Particulars [Amount [Prior period 10 whieh

itcelates(Year in yyyy-

yyformat)

In

[38] When

ther during the previous year the assessce has received any propery, being share of @ company not being a

‘company in which the public are substantially interested, without consideration or for inadequate consideration as|

referred to in section 56(2)(viia)

[Name “of the]PAN” of the|Name_ of the]CIN ofthe company [No. of Shares[Amount of]Fair Market]

lperson ——from|person,_if|company from| Received consideration |value of the

which shares|available | which » shares { paid shares

received received

i

[29| Whether daring the previous year the assessee received any consideration for issue Of shares which exceeds the far]

market value of the shares as referred to in section $6(2)(viib. If yes, please furnish the details of the same

[Name oF the person from whom]PAN of the person, if[No. of Shares |Amount ‘of]Fair — Markel

consideration received for issue of] available ‘consideration value of the|

shares received shares

[Ala) _ | Whether any amount is to be included as income chargeable under the head Income from olher sourees as/No

referred to in clause (ix) of sub-section (2) of section 56? (b) If yes, please Furnish te following details:

ISIN. [Rature of Income rAmount

IN

[B(a) | Whether any amount ito be Included as income chargeable under the head Income from ler sourees 3]No

refereedto in clause (x) of sub-section (2) of section 562(YesINo) (b) Ifyes, please furnish the following details:

STN. [Nature of Income [Amount

Iki

30] Deiails of any amount borrowed on hundi oF any amount due thereon (including interest on the amount bowowed) [No

repaid otherwise than through an account payee cheque, Section 69D)

[Name off PAN of[Address] Address|City or] State |FincoddAmount [Date of|Amount [Amount [Date —of]

the the fine 1 |Line 2. }Town or| lborrowed|Borrowingdue _|repaid | Repayment

lperson _|person, if District including

from available interest

whom

amount

borrowed

or repaid

jon hun

IN

FA(ay | Whether primary adjustment to trans price, as referred fo in sub-section (I) of wection SCE, has been made]

during the previous year.

(6) tyes, please furnish the Tolfowing details

L

[ST _]Under which [Amount (in] Whether the excess]IT yes, whether]it no, the amount (in[Expected

No, Jelause of sub-|Rs.) —of/money available|the excess.) of imputed interest of repati

section (1) offprimary with the associated|money ns] income on such exeess}of money

section 92CEJadjustment fenterprise is{been repatited| money which has, not

primary required wo be the| been repatriated within |

adjustment is repaiiated 40 India} prescribed time, |the prescribed time

made? 38 per the provisions

of sub-scetion (2) of

section 92CE,

Ix

[B(ay —] Whether the assessee has incurred expenditure daring the previous year by way of interest or of similar nature

lexcceding one erore rupees as referred to in sub-section (I) of section 94B,

ib) Iryes, please furnish the Tollowing details

SINo, [Amount (in Rs)]Eamings —before]Amount (im Rs) of] Deas of nteres] Details of

ofexpenditureby|interet, taxexpenditure by way offexpenditure brought) expenditure

|way of interest or| depreciation and|interest or of similar|forward as per sub-|forward as per sub-

jnature as per (i) above|section (4) of section|section (4) of section

(EBITDA) during| which exceeds 30% of] 94B, sa:

the previous year|EBITDA as per (i)|Assessment] Amount [Assessment] Amount

(in Rs.) jabove. Year (in Rs.) [Year (in Rs.)

IN

ICla) | Wher he assessee has entered into an impenmissible avoNdance arrangement, as Feerred To n section 96,

| duing the previous year (This Clause is kept in abeyance till 31st March, 2021)

(b) If yes, please furnish the following details

SIN6. [Nature of the impermissible avoidance arrangement Amount (in Rs) of tax benefit ithe

previous year arising, in agercente, to

al the parties tothe arrangement

IN

‘3T]a— |Pariculars of each loan or deposit in an amount exceeding the limit specified in section 2698S taken or accepted during|

the previous year :-

S.No [Name of the]Address of]Permanent |Amoun| Whethe} Maximum [Whether theyin case the

lender or|the tender or}Account.: of loan the amount oan or deposit|loan or deposit

depositor depositor |Number(if or |loan orloutstanding in|was taken|was taken or}

lavailable. |deposit|deposit|the account atlor acceptedlaccepted —_by|

lwith the|taken |was” anytime during|by .-cheque|cheque or bank|

lassessee)-lor -|squared|the _previous|or bank draft| draft, whether the

lof~~-the|acceptetup | year Jor use of|same was taken|

Tender or| during Jelectronic Jor accepted by

the the clearing _Jan account payee|

depositor previout system Jcheque or an]

lyear through aaccount _payee|

bank account. bank draft.

IN

[SID _ [Particulars of each spe

the previous year:

ied sam in an amount exceeding the limit specified in section 2698S taken or accepted during|

ISINo. [Name of the] Address of the person from] enmanent Amount [Whether —the]In case the

person from|whom specified sum is|Account of specified sum|specfied sum was

whom specified| received [Number (f}specified |was taken or|taken or accepted|

sum is received available |sum taken] accepted —_by|by cheque or bank|

fwith — the|or cheque or bank{ draft, whether the

assessee)oflaccepted draft or use|same was taken|

the person| lof electroniclor accepted by|

from whom| clearing system|an account payee|

specified through a bank|eheque or an

lsum is account account payee

received bank daft.

[sir

(Particulars at @) and (b) need not be given in the ease of @ Government company, a banking company ora corporation established|

by a Central, State or Provincial Act.)

'31]b(@) [Particulars of each receipt in an amount exceeding the Timi specified in section 269ST, in aggregate from a person in|

a day or in respect of a single transaction or in respect of transactions relating to one event or occasion from a person,

during the previous year, where such receipt is otherwise than by a cheque or bank draft or use of electronic clearing]

system through a bank account

ISNo. ne oF the] Address ofthe Payer Fenmanent [Nature of Amount of Date OT ex

[Account _ |transaetior receipt

[Number (

available

with the|

assessee) of

the Payer

Nt

31/50)

Particulars of each reocip it specified in section 260ST, In aggregate from a person Tn)

a day oF in respect of a single transaction or in respect of transactions relating to one event or occasion from a person,

eae “ pe ng an account payee cheque or an account payee bank draft, during the|

S.No, [Name ofthe Payer [Adivess of the Payer Permanent Aecounl Armount of receipt

Number (if available with

the assessee) of the Payer

Ne

ST) be

Pariiculars of each payment made in an amount exceeding the limit specified in Section 2OUST, In aggregate to a person

ina day or in respect ofa single transaction or in respect of transactions relating to one event or occasion toa person,

otherwise than by a cheque or bank draft or use of electronic clearing system through a bank account during the previous

year

ISNo. [Name of the]Address of te Payer [Permanent [Nature ofAmount of] Date Of Payment

Payer Account —_|transaction| Payment

INumber (if

available

with. the|

assessee) of|

the Payer

IN

31/5)

[Particutars of each payment in an amount exceeding the limit specified in section 269ST, in aggregate to a person in |

day or in respect of a single transaction or in respect of transactions relating to one event or occasion to a person, made|

by a cheque or bank draft, not being an account payee cheque or an account payee bank draft, during the previous year

S.No. [Name of the Payee. [Address ofthe Payee [Permanent “Account ]Amount of Payment

Number (if available with

the assessce) of the Payee

i

|(Particulars at (ba), (bb), (be) and (bd) need not be given in the cate of receipt by or payment to a Government company, a

lbanking Company, a post office savings bank, a cooperative bank or inthe case of transactions referred to in section 269SS|

lor in the ease of persons referred to in Notification No. S.O. 2065(E) dated 3d July, 2017)”

IST ]e [Particulars of each repayment of loan or depositor any specified advance in an amount exceeding the limit specified

in section 269T made during the previous year =

S.No. [Name of the|Address of the|PermanenAmounj Maximum __|Whether the]in ease the repayment

payee payee JAccount lof the|amount repayment — |was made by cheque or|

INumber(ifrepaymfoutstanding in|was — made|bank draft, whether the

available the account at|by cheque|same was repaid by an]

with the] any time during|or bank account payee cheque ot|

assessee)o| the previous|draft or use|an account payee bank|

the payee lyear lof electronic| draft

clearing

system

through |

bank account.

Init

5T]a-— ]Pantculars of repayment of Toon or depositor any specified advance in an amount exceeding the limit specified in section

I269T received otherwise than by a cheque or bank draft or use of electronic clearing system through a bank account

[during the previous year:-—

ISNqName of the lender [Address of the lender, or]Permanent Account Number (f[Amount of repayment

Jor depositor or person depositor or person from|available with the assessce)of theJof loan or deposit or|

from whom specified| whom specified advance|tender, or depositor or person|any specified advance]

is received from whom specified advance is|reccived otherwise than

received by a cheque or bank

draft of use of electronic

clearing system through a]

Jpank account during the|

previous year

advance is received

a

aitspeciied in section|

GJe [Particulars of repayment of loan or deposit or any speeified advance tn anvamount exceeding the lim

‘bank draft during the

pe Fees by a cheque or bank draft which is not an account payee cheque oF account payee

ISNqName of the Tender [Address of the Tender, or[Femmanent Act

or depositor or person depositor or person from} available with the assessee)oF the

from whom specified|whom specified advance|lender, oF depositor or person

ladvance is received {is received From whom specified advance is

received

{Number (i]Amount of repayment

lof foan or deposit of

any specified advance]

received otherwive than|

lby a cheque or bank|

draft or use of electroni|

clearing system through al

bank account during the|

Iprevious year

Tor any specified advance|

ne (Petco), and] mest Hat be Given The eave oF a repayment oF ay Toa oF depos

lished by a Central, State

aan eae a om Government, Covernnent company, banking company o corporation

oePrvinist Ac) ae eaan ana

are as TORO TORT To Or Tapa aowanc, Ue Tlawing antes

Pe oe Rascartcnt Yeo] Nau of lssfallowanes Amount [Amount [Ors+ U7

fe fas |S and

ezued assessed [Date

To extent avaiable

‘Remarks

sa

S3]b | Whether change in shareholding of the company has taken place

Pear pcuted prior to the provious year cannot be allowed to be eared forward in terms of

Tre previous year due to which]Not Applicable

section 79.

fs Wistar ie assess as incurred any speculation Tos refered foi section 73 during the previews YX. [Ne

ye, please furnish the

tails below

IS2]a | Whether the aseenseo has incurred any Toss refered to in sect

during the previous year

tyes, please furnish detals

ofthe same i

STs cama pease sate at wheter Te companys deried to Be caring on epecTation Dusinss

as refered in explanation to section 73

rye please furnib he deals of specaton oss any

Incurred during the previows year

153|Sestion-wise details of deductions, ifany a

[S.No_[Section [Amount

TS0000

Tan T3A tn respect Of any specified business] No

—aisibre under Chapier VIA oF Chapter (Section 10A, Section TONA)] Yes

fr __[s0e

sata] Wheiher the asvessoe 1 required to deduct or collect tak as per the [provisions of Chapter XVIT-B or Chapter] No

XVIL-BB, ifyes please furnish

Se eT cecion [Revue of[Tout [Teal —Total [Amount [Tost [mou TAmountof|

deduction rameat amount of|amount Jamount-[of | taxjamount fof | taxi

snd [payment lon which/on’which|deducted Jon which}deducted |éeducted

collection Jor receipt tax was|tax was|or lax waslor or

|Account or ree falrequired [deducted collected |deducted |collected |collected

Number nature to belor lout of (6) jor jon(8) not

(TAN) specified \deducted collected collected deposited

in columa|or st at less tothe

1G) collected |specified than credit of]

out of (4) [rate out of specified the Central

(5) rate out o |Governmert

@) out of (6)

and (8)

i

a] Wie es equ o Tara ie Sateen of ox dedueted of BX coTeced Tr yes please furnish] No

the details:

Dae Ga Tor] Bate of] Whether the statement of] IF not, please

No [Tax deduction] Type

land collection|of

| Account Number] Form

\(rAN)

ffunishing (furnishing, \tax deducted or collected}furnish list of

if furnished contains information about details!

all details/tansactions| transactions

[which are requiced to be|which are not

reported. reported.

IN

"Saye | Whether the assessee is

Table pay Tevet under setion ZOICTA) oF sation 2OGC(TP IT yes, please Turis Pot

|Applicatfie

(EE renner

: man ‘of[Amount ates of payment

Jcallection — Account st under} " ca

mir ran)

Ssianyauc

35]a__|In the eave of a wading eoncem,

re quantitative details of prinielpal items of woods waded

No [item Name [Unit

[Opening — [Parehas-|Sales [Closing stock Shortage}

stock les during, excess,

lduring |the if any

the [previous

previous |year

year

iN

[35]b]In the case ofa manufacturing concem, give quanti

rea 7 give quantitative details ofthe prinsipal ems of raw materials, finished products

3S[BA_| Raw material

No [ltem Name Unit —[OpeninfPurchases ——]Consumpir[Sales —CTosing /*Vield ]-Pereent]Shorage

stock [during thelon during|during stock of age offexcess,

previous year |the the finished] yield |ifany

previous |previow product

= year __|year

[35]BB_| Finished products:

ENO fem Name [Unit [Opening PachasefQuantiy—]Sales_during the[Closing stock [Shoraee}

stock [during [manufactur [previous year excess,

line Jed during itany

previous |ihe previous

7 year. _|year

35|BC [By products =

Ear Nane [Unt — [Opening Purchasefuantiy _]Seles daring thejCTosing stock Shores

stock [during |manufactur- [previous year excess,

jed_ daring ifany

the previous

year

Ni

chia es Fa ToT Company, Gta Tax on dabted profs under secon 175-0 ne foowing Fos =

er aT amount[@) Amourl of] Amount of/@) Total tax] (@) Tota x paid Hereon

@) Foereibuted|feduclion | as|reduction ~~ as|paid thereon "Amount Dates of]

profits \referred.to._in|referred...to™ in} payment

[section 115-O(1A)]section 115-O(1A)

a «i 4

Ni

“Alay | Whether the assessee fas received any

amount ia the nature of dividend as referred to in sub-clause (@) of]No

clause (22) of section 2. yes, please furnish the folowing details:~

ISIN. [Amouat received (in RS.)

IN

[37] Whether any cost audit was carried out Not

|Applicalfte

‘of diaqualification or disagreement on any]

reported/identified by the cost auditor

der the Central Excise Act, 1944

I yes, give the details, any,

matter/item/value/quantity as may be

[36] Whether any audit was conducted un [Not

|Applicatite

I ye give The details, Fany, of disqualification or disagreement on any

rcttevitem/value/quantity as may be reportedsidentified by the auditor

So asic any aut was Conducted under setion 724 ofthe Finance Act 1994 Tn felation 10 valuation of taxable] Not

services as may be reported/identified by the auditor |Applicalfie

Ii jes> give the details, any, of disqualification or disagreement 0” 20)

ee Atem/valuefquantity as may be feportei/identified by the auditor

Leading Turnover, eros profit te Tr the previous yeor and preceding PrEVOHS YESS

ST]Particulars [Previous Year Preceding previous Year

Ng

We nr

raat anova ;

ofthe asses 7 919048 45653288

[Gross proit SIS] Tp VOR Ia

{Turnover 298% 1635411] 45653288]5.58%

Ie [Net profit 7| 1819937 07

lTumover rete e) 1265523 ASGSSIEB|Z.ITI

4 i 2649983 | “45653288 | 5.80%

LTurover

je | Material me

Jconsumed! \%

Finished

eoods

produced

atts quedo Be ois or papal Weis of ood ated oman ‘or services rendered)

fe a el eee eaageaeg

Finnsayeario[Name of elie Type (Dera Dat of dmandT Aout Remas

which demand! Tax law rsisedRefund |risedrefund

refund eats 0 received) received

Nl

laa Naps acted To Tain sats Fos NOT of For No. 6TH or Fors No GIB? TNO

yes plese furnish z

rsi|income-tax [Iypeot Form [Due date Tor/Date Siiwhather the Form ifnot, please furnish

INqDepartment fumishing > {funishing, _if|conains fist of the detail

Reporting Entity| furnished, information about transactions | which

Identification jal details’ are not reported.

Number feansactions which

ae required to be

report.

i I it

Lg epee The ss oF pare ely oralenateepORE FH SBT To Trish report a FeETEGINO

, Ito in sub-section (2) of section. 286

in or fas Name of PSH ET, ot Farnishing

No. been, furnished. by HY MTpontng entity, Gffofreport

ine assessee oF is applicable),

parent entity or 28

ltematereporting|

entity

Ri 3

ft Node pease ever enpened dnt of TSN Tepar as

Fe aa expendi oF ens ose of 8 pe wer Ws ST Clase Hap Tn aA

i 31st March, 2021)

ae out] Expendre in reper of ents ered ante OST Expendie

dat Expenditure| Relating 0 go0us| Relating rer relating 10 other Total payment torelating to enties

jincurred during|or services| entities falling| registered entities registered entities Pe under}

Nic year exempt fom /undes cs

lest composition

scheme

. MABRA Name supie_cuostt

Dae Taio Nenbesip Number suis

MEN tei Registration Number) 275065

‘Addeoss GACIL,MABRA, NORTIL24 PAR

ANAS, WEST IST BENGAL, 743263,

orm Filing Details

tevisioa/Original

iiion Detaierom Polat No. 18)

Description of]SINo]Date of] Date put tofAmount ‘Adjustment on account of [Total Amount

Block of Assets Purchase juse IMODVAT [Exchange Subsidy

Rate Grant

Change

[Deduction Detail rom Porat No. 8)

[Deseription of Block of Assels [SiNo Date of Sate ete: [Amount

“This Torm has been digialy signed by SUDIE_GHOSH faving PAN BBRPGEAGZS from IP Address)

103.76.211.176 on 2020-10-17 19:44:04.0

sc SI No and issuer 2 ee

|Authority, =eMudhra Consumer Services Limited,C=IN

For & on behalf of

SUDII? GOSH & Co.

Chaticred Agppustants

1 ad

be ome thay

opt

Momberehi. No.-301505 7

FRN: 3275086

MD SAHANAWAS KHAN

Se ae

PROPRIETOR OF -"M/$ MD SAIIANAWAS KHAN & CO*

STATUS - INDIVIDUAL (MALE)

ADDRESS - RAJIBALLAVPUR, HABRA, NORTH 24 PARGANAS, WEST DENGAL-743209

PAN AKEPK1S39N

poe 08/10/1967

Assessment Year: 2020-21

Finaneal Year: 2019-20

BALANCE SHEET AS ON 31ST MARCI 2020

crapiuiries

[carrat accouN

lasperlast Year)

[abo: NET PROFIT

Less: prawins

1 Personal & Family perpose

2 Life Insurance Premium

a. Mediciaim

Loan uiapuuiry:

Jecuoan

|staTe BANK OF INDIA.

[a/cNo- 30300082258

‘ANOUNT] ——TOTAT]

i (5) (5)

53,3543

1619937

71.55,780|

500,000

150,000

650000

6505,700

1965,186

ASSETS ‘aNOUNT] —TOTAT]

FIRED ASSETS

1. FURNITURE @ FUcTURES

(As Pertast Year Bal) 39599

Addition his year 39599

2 tletrical Equipments

|(as er tase Year Bal) 32030

ladaitionthis year 32,038

[Loose roots

(As PerLast Year Bal) 9989]

[addition eis year : 9.959

[s.Lanp ano BUILDING

as er Last Year Bal)

Addition his year

176500

435.000] 22,00,000

lnwvestateNT

lsecuniry DEPostrs

| Ambuja cements)

1,40,000

|cunreNr assers:

1. SUNDRY DEBTORS 1496140| 14,9640

[2 crosine stock. 5

[s.cast1n HAND

&

js cas aT BANK

IBANDHIAN BANK, MASLANDAPUR BR,

irsc- BDBLooO1649

[a/c No-10170004280287 1573

assis] 15.018,

luco BANK, MASLANDAPUR BR.

lrsc- uceaoooases

lac No- 0668021000038

3772856] 37,80431

ls. oTHER CURRENT ASSETS

Irps FoR THE Av-2020-21 1756981

756981

(Tora

BETO RE

[TOTAL

e709.

4)

For & on behalf of

SUDIP GHOSH & CO,

SRIn GHOSH &

eecer ae

UDIP GHOSH)

Proptotor

‘Mombership No 301803,

RN: S27605E

MD SAHANAWAS KHAN

PROPRIETOR OF - "M/S MD SAHANAWAS KIIAN & CO™

STATUS- INDIVIDUAL (MALE)

ADDRESS RAJIBALLAVPUR, HADRA, NORTH 24 PARGANAS, WEST DENGAL-743209

PAN- AKEPKIS39N ‘Assessment Year: 2020-21,

08-08/10/1967 Financial Year: 2019-20

TRADING AND PROFIT & LOSS A/C FOR TIE YEAR ENDED 31/03/2020

fn (85)

pane —-

comer

ieee

Pee 2 EE some

rome 7

eee ater ae

|TO, NET PROFIT 18,19,937

For & on behalf of

SUDIR GHOSH & CO.

Chartered Apeountans

~ Sb

SP Hos

Proprietor

‘Membership No-301505

FRN : $27508E

MD SAHANAWAS KHAN

PROPRIETOR OF -"M/S MD Santas

STATUS - INDIVIDUAL (MALE)

‘ADRESS AIBALLAVPUR, HARA NORTH 24 PARGANAS West BENGAL-743209

PAN AKEPK1539N

08-08/10/1967

WAWAS KHAN & co*

‘Assessment Year: 2020-24,

Finaneal Year: 2019-20

ind Tax Ora

TNCONE FROM BUSINESS 3619937)

ADD: INCOME FROM House PROPERTY °

ADD: INTEREST iicoME (8),

‘ADD: ACCRUED INTEREST INCOME (FD) ;

‘ADD: OTHR SOURSE OF INCOME

(a) GnossToTALINcome: 819,937,

LESS: DEDUCTION UNDER CHAPTER VI-A

{LUNDERSECTION 80(¢) coe

SUNDER SECTION 80 (TTA) :

(®) Torat pepucriow: 150/000

‘**NET TAXADLE INCOME AFTER DEDUCTION (AB) a

BASIC EXEMPTION LIMIT (Fr Individual Men) ae

INCOME TAKON ae

TTAKATSPSCIAL RATE ome

LESS: REBATE UNDER SECTION 7 (4) 2

TAKAFTER REDATE onus

‘ADD: EDUCATION CESS (4%) a

‘GROSS TAX LIABILETY 526.020

‘ADD: INTEREST UNDER SECTION 234 (4) 7

NET TAXLIABILITY $26000

usss.tos 7.56,900

LESS: ADVANCE TAX / SELF ASSESSMENT TAX PAID 5

NET TAX REFUNDABLE. Soa

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CamScanner 05-12-2022 21.20.32Document11 pagesCamScanner 05-12-2022 21.20.32advisewise associatesNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceadvisewise associatesNo ratings yet

- Adobe Scan 20 Dec 2022Document2 pagesAdobe Scan 20 Dec 2022advisewise associatesNo ratings yet

- Ashraf Khan Prior DeedDocument23 pagesAshraf Khan Prior Deedadvisewise associatesNo ratings yet

- Form PDF 656505621171020Document59 pagesForm PDF 656505621171020advisewise associatesNo ratings yet

- Kaagaz 20221221 16121289445Document11 pagesKaagaz 20221221 16121289445advisewise associatesNo ratings yet

- Form PDF 232337771301019Document55 pagesForm PDF 232337771301019advisewise associatesNo ratings yet

- Ack Nowledgem Ent Num Ber:270384470280222Document25 pagesAck Nowledgem Ent Num Ber:270384470280222advisewise associatesNo ratings yet

- Syed Wasim Anam: Professional SummaryDocument1 pageSyed Wasim Anam: Professional Summaryadvisewise associatesNo ratings yet