Professional Documents

Culture Documents

0.1 GST On Supplies To Merchant Exporter 0.1 GS

Uploaded by

Monu KhilwaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0.1 GST On Supplies To Merchant Exporter 0.1 GS

Uploaded by

Monu KhilwaniCopyright:

Available Formats

)

* +

Supplies to Merchant Exporter

Type of Goods Exporter

1. Manufacture Exporter

2. Merchant Exporter

Merchant Exporter means a person engaged in

trading activity for exporting of goods. Merchant

Exporter procures goods from the manufacture

and export same in his firm name. Merchant

Exporters buy goods from the Indian

manufacturers and sell them into international

market. They may not have their own

manufacturing unit or processing facility.

0.1% GST on Supplies to

Merchant Exporter

With recent changes of indirect tax

GST introductions , the Council noticed

the major difficulties for the export

sector are on account of delays in

refunds of IGST and input taxes on

exports. Due to delay of taxes which

ideally resulting into blockage of

working capital to export business

To prevent cash blockage of exporters

due to upfront payment of GST on

inputs etc. the Council approved new

scheme. Merchant exporters will now

have to pay nominal GST of 0.1% for

procuring goods from domestic

suppliers for export. Merchant exporter

can buy goods at 0.1% for export of

goods. In article we talk about GST On

Supplies to Merchant Exporter.

Conditions for buying of

goods at 0.1% for

Merchant Export

1. Supplier shall supply goods

to Merchant Exporter on tax

invoice.

2. Merchant export shall

export goods with 90 days

from date of tax invoice.

3. Merchant Exporter shall

mention supplier GST

number & tax invoice

number on shipping bill ,

bill of export etc

4. Merchant Export shall get

registration with an Export

Promotion Council or a

Commodity Board

recognised by the

Department of Commerce.

5. Place PO on Supplier : – the

registered recipient shall

place an order on

registered supplier for

procuring goods at

concessional rate and a

copy of the same shall also

be provided to the

jurisdictional tax officer of

the registered supplier

9. the registered merchant

exporter shall move the

said goods from place of

registered supplier – (a)

directly to the Port, Inland

Container Deport, Airport or

Land Customs Station from

where the said goods are to

be exported; or (b) directly

to a registered warehouse

from where the said goods

shall be move to the Port,

Inland Container Deport,

Airport or Land Customs

Station from where the said

goods are to be exported;

7. when goods have been

exported, the registered

recipient shall provide copy

of shipping bill or bill of

export containing details of

Goods and Services Tax

Identification Number

(GSTIN) and tax invoice of

the registered supplier

along with proof of export

general manifest or export

report having been filed to

the registered supplier as

well as jurisdictional tax

officer of such supplier.

Important Documentation

for Merchant Exporter

1. Buy Goods from registered supplier

under GST

2. Place Purchase order on supplier

for export of goods at concessional

rate

3. Submit Purchase order copy to the

jurisdictional tax officer of the

registered supplier

4. Merchant exporter shall mention

suppliers tax invoice number &

GST Registration number On

Export invoice, Shipping bill etc.

5. Merchant Exporter shall provide

copy of shipping bill or bill of

export containing details of Goods

and Services Tax Identification

Number (GSTIN) and tax invoice of

the registered supplier along with

proof of export general manifest or

export report

What if Export is not done

in90 days from date of Tax

Invoice?

The merchant exporter shall not be

eligible for the above mentioned

exemption if the registered recipient

fails to export the said goods within a

period of ninety days from the date of

issue of tax invoice.

Download Notification

Notification No. 41/2017–Integrated Tax

(Rate) – Click

Notification No. 40/2017-Central Tax- Click

FAQ on Application of GST

for Merchant Exporter

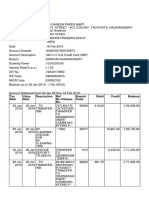

Example for Calculation of GST

Amount for Merchant Exporter

?

Mr. Ravi exporting inverter of $ 1000 to USA ,

RBI Rate of exchange on that day is Rs. 65 then

taxable value shall be Rs. 65000/- ( $ 1000 x

Rs. 65 ) GST amount is 1 % that is Rs. 6500 (

Rs. 65000 x 1 % ). This amount need to be

paid for merchant exporter.

Time line to receive GST

Refund for exporter ?

Exporter need to submit online

acknowledgement with other supporting

documents at GST department / customs.

Refund of 90% value shall be transferred

immediately and balance 10 % will be paid after

verification of documents of document. Interest

at 6 % shall be payable for delayed GST

Refund.

GST Refund for Export on

payment of duty for exporter

of goods ?

Exporter not required to submit documents at

department. Shipping bill is a documents for

taking refund amount. Customs shall verify the

information with GSTR3 B filed by person. After

verification customs shall refund to persons

bank statement.

Mr. Ravi is registered in

Maharashtra and outsourcing

inverter from Chennai and

export post is Chennai. Does

Mr. Ravi need to take

registration in Chennai ?

For outsourcing inverter form Chnnai, Mr. Ravi

need not to take registration in Chennai. He

need to take care of below points

In shipping bill mention state code of

Maharashtra ( that is 27 )

At item level mention state of origin at

Tamilnadu.

Gst send to Job work , GST

need to pay ?

No. the goods sent by an exporter to a job

worker is not a supply, as there is no transfer of

title and no consideration for the goods is

involved. In terms of section 143 of the CGST

Act, 2017 a registered taxable person (the

principal) may send any inputs or capital goods,

without payment of GST, to a job worker for job

work.

visit us at www.anbca.com

Share ! " # $ %2

ANBCA

Related posts

GST on real Estate agent

April 27, 2020

GST On Rate and SAC Code on Real Estate Commission

& Read more

March 16, 2020

Know Your Supplier Scheme Under GST

& Read more

GST On Rate and SAC Code on Painting Work

December 26, 2019

GST On Rate and SAC Code on Painting Work

& Read more

4 Comments

Amr says: Reply

December 7, 2021 at 7:21 am

please guide..on below senario

IF A is a manufacturer, B is a Trader, and C

is the Merchant Exporter,

Then C raises a Purchase order on B of

0.1% GST.

How will B deal with A?

Shobia says: Reply

February 5, 2022 at 5:59 pm

Hi

The business between A and B is normal,

merchant exporter dePnition will only be

applicable to C.

jitendra says: Reply

February 19, 2022 at 5:30 am

overall; B will raise the invoice to C at the

rate of 0.1%;

ghanshyam says: Reply

February 19, 2022 at 6:55 am

i am merchant exporter , we bought goods

@0.1% GST . we have exported the goods

and now we have to send Shipping Bill to

supplier , but their is issue . if my suppliers

comes to know my customer or rate he

may contact him directly in future . how

can we save our details and send my

supplier

Leave a Reply

Your email address will not be published. Required

Pelds are marked *

Comment

Name *

Email *

Website

Post Comment

A. N. Bhutada & Co. is trusted and versatile Chartered

Accountant In Pune India. The Prm have been providing

various services under one roof in the Peld of Company

Registration, Accounts outsourcing, Auditing, GST Audit,

Filing in India.

Recent Posts

Caught Error Description as null ?

( November 27, 2021

Can employee become Director of

Private Limited company ?

( September 19, 2021

Minimum Capital required for

Partnership Firm

( September 19, 2021

Links

Online GST Registration

Private Limited Company

Proprietorship Registration

GST Return Filing

Tax Audit

Income Tax Filing

Newsletter

Enter your e-mail and subscribe to our newsletter

SUBSCRIBE

' Contact us

© 2022 Betheme by Mucn group | All Rights Reserved |

Powered by WordPress

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Commission Sales AgreementDocument3 pagesCommission Sales AgreementMonu Khilwani100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- BIR Form 2316 and 1700 TemplateDocument16 pagesBIR Form 2316 and 1700 Templatepogiman_0167% (3)

- Account Statement PDFDocument12 pagesAccount Statement PDFBull's EyeNo ratings yet

- Payslip TemplateDocument1 pagePayslip Templatersingh2022No ratings yet

- MixDocument32 pagesMixUnnecessary BuyingNo ratings yet

- Orders ManagementDocument2 pagesOrders ManagementAnonymous GOPegWrg100% (1)

- Statement of Account: No 63 Jalan Seroja 12 Taman Seroja Bandar Baru Salak Tinggi 43900 Sepang, SelangorDocument2 pagesStatement of Account: No 63 Jalan Seroja 12 Taman Seroja Bandar Baru Salak Tinggi 43900 Sepang, Selangorroro cocoNo ratings yet

- Department of Micro, Small & Medium Enterprises1Document2 pagesDepartment of Micro, Small & Medium Enterprises1Monu KhilwaniNo ratings yet

- Department of Micro, Small & Medium EnterprisesDocument6 pagesDepartment of Micro, Small & Medium EnterprisesMonu KhilwaniNo ratings yet

- Track Shipment Status Consignment Status - DTDCDocument1 pageTrack Shipment Status Consignment Status - DTDCarjun9567No ratings yet

- Approval of SRN M26936792 Dated 30-May-22Document3 pagesApproval of SRN M26936792 Dated 30-May-22Monu KhilwaniNo ratings yet

- Department of Micro, Small & Medium Enterprises2Document1 pageDepartment of Micro, Small & Medium Enterprises2Monu KhilwaniNo ratings yet

- Save Electricity: N1802000393 PRS1 - 7 - 1802000393Document1 pageSave Electricity: N1802000393 PRS1 - 7 - 1802000393nikhil parasiaNo ratings yet

- Faq MiningDocument10 pagesFaq MiningSneha AgarwalNo ratings yet

- Tax Audit ChecklistDocument19 pagesTax Audit ChecklistMonu KhilwaniNo ratings yet

- Form DPT 3 - What Is It, Who Should File It and Due Date of FilingDocument10 pagesForm DPT 3 - What Is It, Who Should File It and Due Date of FilingMonu KhilwaniNo ratings yet

- GST On Education Services: (Goods and Services Tax)Document5 pagesGST On Education Services: (Goods and Services Tax)Prashant KumarNo ratings yet

- Indian Stamp Act English Under Indian Stamp Act-1899Document52 pagesIndian Stamp Act English Under Indian Stamp Act-1899Monu KhilwaniNo ratings yet

- Taxguru - in-GST On Food Soft Drink Amp ITC On Movie Distributor Revenue Share BillDocument10 pagesTaxguru - in-GST On Food Soft Drink Amp ITC On Movie Distributor Revenue Share BillMonu KhilwaniNo ratings yet

- In Re Jabalpur Entertainment Complexes Pvt. Ltd. Authority For Advance RulingDocument11 pagesIn Re Jabalpur Entertainment Complexes Pvt. Ltd. Authority For Advance RulingMonu KhilwaniNo ratings yet

- Boat 20000 Mah Power Bank (20 W, Quick Charge 3.0, Power Delivery 2.0)Document1 pageBoat 20000 Mah Power Bank (20 W, Quick Charge 3.0, Power Delivery 2.0)entertainment kingNo ratings yet

- rc151 Fill 17eDocument4 pagesrc151 Fill 17eKewkew AzilearNo ratings yet

- Chapter 5 FINANCING FOREIGN TRADE SHIPMENTDocument10 pagesChapter 5 FINANCING FOREIGN TRADE SHIPMENTkateangel ellesoNo ratings yet

- Commissioner of Internal Revenue vs. Burmeister and Wain Scandinavian Contractor Mindanao, Inc.Document22 pagesCommissioner of Internal Revenue vs. Burmeister and Wain Scandinavian Contractor Mindanao, Inc.Jayson FranciscoNo ratings yet

- iCare-Special-Lecture-VAT by Andrew Gil AmbrayDocument73 pagesiCare-Special-Lecture-VAT by Andrew Gil AmbrayMark Gelo WinchesterNo ratings yet

- Tax Invoice: Zoho Technologies Pvt. LTDDocument3 pagesTax Invoice: Zoho Technologies Pvt. LTDAakash GangwaniNo ratings yet

- Canara - Epassbook - 2024-01-04 104102.809851Document40 pagesCanara - Epassbook - 2024-01-04 104102.809851pankajprajapati000078666No ratings yet

- Arthakranti BTT Budget Proposal - Advertorial PDFDocument1 pageArthakranti BTT Budget Proposal - Advertorial PDFAryann GuptaNo ratings yet

- Fe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityDocument2 pagesFe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityJoanna PaulaNo ratings yet

- s6 Econ (Public Finance and Fiscal Policy)Document50 pagess6 Econ (Public Finance and Fiscal Policy)juniormugarura5No ratings yet

- Final Examintation - TaxationDocument5 pagesFinal Examintation - TaxationMPCINo ratings yet

- Bill No. 1422 STI College - PasayDocument1 pageBill No. 1422 STI College - PasayKristel BelenNo ratings yet

- Paper F6 Taxation: Revision Mock Examination September 2016 Question PaperDocument22 pagesPaper F6 Taxation: Revision Mock Examination September 2016 Question PaperAhmed SabryNo ratings yet

- AKSINDO (Mr. Ferlian), 11 - 13 Mar 2016 (NY)Document2 pagesAKSINDO (Mr. Ferlian), 11 - 13 Mar 2016 (NY)Sunarto HadiatmajaNo ratings yet

- CC PDFDocument6 pagesCC PDFJaya JayavardhanNo ratings yet

- Excise, Taxation and Narcotics - Government of SindhDocument1 pageExcise, Taxation and Narcotics - Government of SindhqqqNo ratings yet

- Phone - June 22 PDFDocument1 pagePhone - June 22 PDFMihir BaggaNo ratings yet

- MayoDocument6 pagesMayodakpi479No ratings yet

- Kelompok 1 - CVP Analysis - Akmen (A4)Document20 pagesKelompok 1 - CVP Analysis - Akmen (A4)Yuliana RiskaNo ratings yet

- Morth Delegation April InvoiceDocument1 pageMorth Delegation April InvoiceAshu SinghNo ratings yet

- Od 126044903266212000Document1 pageOd 126044903266212000ABHINAV VELAGANo ratings yet

- Form 1707 PDFDocument2 pagesForm 1707 PDFNetweightNo ratings yet

- Taxation Law ProjectDocument9 pagesTaxation Law ProjectPrince RajNo ratings yet

- Chapter 1 - Basic Concepts of Income Tax - AY - 20-21 PDFDocument16 pagesChapter 1 - Basic Concepts of Income Tax - AY - 20-21 PDFAbhishek VermaNo ratings yet