Professional Documents

Culture Documents

Info Graphic

Info Graphic

Uploaded by

Balint197Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Info Graphic

Info Graphic

Uploaded by

Balint197Copyright:

Available Formats

2022

APR

Implications of the War in Ukraine

Global financial conditions have tightened and downside risks to the economic outlook increased,

though no material systemic event affecting financial institutions or markets has materialized so far.

Transmission Channels of Foreign Banks and NBFIs’ Gross Claims Corporate Exodus from Russia

on Russia and Ukraine (Number of large firms, by type of exit)

the War in Ukraine (Billions of US dollars)

200

600 Foreign Domestic

528

160

450

120

312

300

80

Direct and indirect exposures 150 40

65 54

6 8

0 0

Banks - Russia Banks - Ukraine NBFIs - Russia Withdrawal Suspension Scaling No No change

back expansion

Commodity Price Volatility Surging Inflation Expectations Increasing

(Percent) (Inflation breakeven, percent)

15 Weekly percent change US 5 year Euro area 5 year

Post

10 4.0 Fed's hawkish turn invasion

+ virus concerns

5 3.0

Commodity price shock and 0

near-term inflation concerns 2.0

-5

1.0 Stabilization

-10 Sharp rise in H1

-15 0.0

Apr-21

Aug-21

Sep-21

Jan-21

Feb-21

Mar-21

May-21

Jun-21

Oct-21

Nov-21

Dec-21

Jan-22

Feb-22

Mar-22

Jul-21

Jan-62

Jan-67

Jan-72

Jan-77

Jan-82

Jan-92

Jan-97

Jan-07

Jan-17

Jan-22

Jan-87

Jan-02

Jan-12

Cross-Currency Basis Spreads Bid-Ask Spreads of High-Quality

Showing Some Strains Government Bonds the Widest since

(Three month, basis points) the Peak of the COVID-19 Crisis

(Basis points)

Euro Japanese yen British pound

20

0

US Treasury bonds German bunds

1.0

-20 Feb. 23

Funding and liquidity stress -40 0.8

-60

0.6

-80

-100 Feb. 23 0.4

-120

0.2

-140

-160 0.0

Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 Jan-20 Jul-20 Jan-21 Jul-21 Jan-22

Financial Conditions Tightening, Capital Outflows Increasing, with Risks

notably in Europe, the Middle East, and to the Downside

Asia (Standard deviations from the mean)

0.30 October 2021 GFSR

China

Asia ex. China Latest

Latin America 0.25

Risk-off scenario

Europe, Middle East, and Africa excl Russia and Ukraine

Probability of outflows

3 0.20

Financial conditions tightening Tightening Probability of

outflows

2 20%

and spillovers to emerging markets 1

0.15 30%

50%

0 0.10

Capital flows at risk

-1 1.7%

October 2021 0.05 2.3%

-2 2.5%

GFSR

-3 -

20 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 -4 -3 -2 -1 0 1 2 3 4 5

Percent of GDP

Russia’s Share in Global Production Limited Investment in Renewable Energy

(Percent) May Put the Transition at Risk

18 Net zero by 2050 (additional capacity)

Energy security 15 7,000

Accelerated case (additional capacity)

Actual

Total capacity in gigawatts

vs 12

6,000 Main case

5,000

energy transition 9 4,000

6

3,000

2,000

3 1,000

0 0

2010

11

12

13

14

15

16

17

18

19

20

21

26

Aluminum Copper Nickel Coal Oil Gas

Sources: Bank for International Settlements; Bloomberg Finance L.P.; BP, Statistical Review of World Energy, July 2021; Haver Analytics; JPMorgan Chase & Co.;

Morningstar; UN Comtrade; US Geological Survey; and IMF staff calculations.

Note: GFSR = Global Financial Stability Report; NBFIs = Nonbank financial intermediaries.

Challenging Trade-Offs amid Uncertain Geopolitics

❑ Central banks should act decisively to prevent inflation pressure from becoming entrenched and avoid

an unmooring of inflation expectations, while avoiding a disorderly tightening of financial conditions that

would jeopardize the post-pandemic economic recovery.

❑ Policy normalization in emerging markets should continue based on country-specific assessments of

inflation, economic outlook.

❑ Regulators should assess the implications of the elevated volatility in commodity markets on market

functioning and risk management.

❑ Policymakers should intensify their efforts to implement the 2021 United Nations Climate Change

Conference (COP26) road map while taking appropriate steps to address energy security concerns.

You might also like

- CPPDSM4008A Manual Part 2.v1.1Document114 pagesCPPDSM4008A Manual Part 2.v1.1grace rodriguez50% (2)

- Bloc PDFDocument1 pageBloc PDFcalestru.vladimirNo ratings yet

- Bloc Social Administrativ PDFDocument1 pageBloc Social Administrativ PDFcalestru.vladimirNo ratings yet

- Account Relationships: Federal Reserve Banks Operating Circular 1Document18 pagesAccount Relationships: Federal Reserve Banks Operating Circular 1Wesley Davis100% (3)

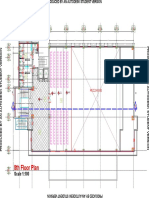

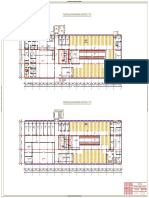

- 1st Floor Plan: Scale 1:100Document1 page1st Floor Plan: Scale 1:100AlulaNo ratings yet

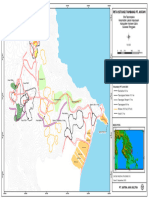

- Tohai Topographic PDFDocument1 pageTohai Topographic PDFBignet Crew MaturanNo ratings yet

- Sdre14-15 TFM 1-2-1dec17Document3 pagesSdre14-15 TFM 1-2-1dec17lwin_oo2435No ratings yet

- First Floor-1Document1 pageFirst Floor-1Lyton TamanyiirwaNo ratings yet

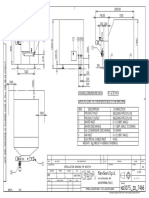

- ASC-6P-72-3BB SeriesDocument2 pagesASC-6P-72-3BB Serieslorens moraNo ratings yet

- 4 5915739562390326418-1Document1 page4 5915739562390326418-1dere ameleNo ratings yet

- 1.1.1 TUGAS 2 JEMBATAN PALING BARU-ModelDocument1 page1.1.1 TUGAS 2 JEMBATAN PALING BARU-ModelMUHAMMAD ALFAN NAJIBNo ratings yet

- RC - DRAWING WITH LEVEL-ModelDocument1 pageRC - DRAWING WITH LEVEL-Modeldigvijay singhNo ratings yet

- A B C D E F: Ground Floor Lighting PlanDocument1 pageA B C D E F: Ground Floor Lighting PlanAmos KormeNo ratings yet

- Cafterial Lighting Electrical PLan PDFDocument1 pageCafterial Lighting Electrical PLan PDFAmos KormeNo ratings yet

- Section CDocument1 pageSection CDawitNo ratings yet

- Section CDocument1 pageSection CDawitNo ratings yet

- Petty Cash Expenses of Chilkalguda For The Month of March 2010Document4 pagesPetty Cash Expenses of Chilkalguda For The Month of March 2010porapandhiNo ratings yet

- Bangkok Noi: Jmi Pacific Limited Ch. KarnchangDocument1 pageBangkok Noi: Jmi Pacific Limited Ch. KarnchangkeaoreNo ratings yet

- Floor Plan 1Document1 pageFloor Plan 1Baye SeyoumNo ratings yet

- Med 001 040418 Novair (Julie)Document1 pageMed 001 040418 Novair (Julie)Chiến nguyễnNo ratings yet

- Upper Floor ElectricalDocument1 pageUpper Floor Electricalkiran yadavNo ratings yet

- Parc National Du Canada ForillonDocument1 pageParc National Du Canada ForillonAntoine GagnéNo ratings yet

- Mapa de Comunidades NativasDocument1 pageMapa de Comunidades NativasLizeth Licas camposNo ratings yet

- World Trade Organisation International Trade Statistics 2009Document262 pagesWorld Trade Organisation International Trade Statistics 2009http://besthedgefund.blogspot.com100% (1)

- Weekly Report 41: Preparation and LaboratoriumDocument8 pagesWeekly Report 41: Preparation and LaboratoriumArthur Paul M SNo ratings yet

- Drafting Portfolio 2 - AfrindaDocument15 pagesDrafting Portfolio 2 - AfrindaafrindaistighfarinnNo ratings yet

- CZ LOKO Catalogue of Locomotives and Special Vehicles1Document32 pagesCZ LOKO Catalogue of Locomotives and Special Vehicles1frtanay12No ratings yet

- Plano NS3075 - ID - 7466Document1 pagePlano NS3075 - ID - 7466Christian CastilleroNo ratings yet

- Tilos AnalysisDocument1 pageTilos AnalysisEthan DiazNo ratings yet

- ERA Mono PERC 325W 60cDocument1 pageERA Mono PERC 325W 60cAngel M Granados EscalonaNo ratings yet

- May 2023 S&P Credit DataDocument26 pagesMay 2023 S&P Credit Datafalistor2No ratings yet

- Two Storey House Plan 1Document1 pageTwo Storey House Plan 1Edmar InietoNo ratings yet

- Return Sludge PumpDocument2 pagesReturn Sludge PumpAbu SuraisyNo ratings yet

- Joinery DrawingsDocument5 pagesJoinery Drawingsdesignerdxb786No ratings yet

- Cabsanro Arq Ap R00 Fa1 P01Document1 pageCabsanro Arq Ap R00 Fa1 P01Thiago CamposNo ratings yet

- BP Foundation 2 PDFDocument1 pageBP Foundation 2 PDFSatria PinanditaNo ratings yet

- Peta Situasi OB Removal BDH-TGS Antam TPK 2023Document1 pagePeta Situasi OB Removal BDH-TGS Antam TPK 2023zgv2bmp2zgNo ratings yet

- Interland: A-TypeDocument1 pageInterland: A-TypeDuy Giáp NguyễnNo ratings yet

- Horizontal End Suction Pump Din 24255: GU, GUM Series 50Hz/60HzDocument8 pagesHorizontal End Suction Pump Din 24255: GU, GUM Series 50Hz/60HzAwwalin Bocah IlangNo ratings yet

- 8th Floor Plan: Scale 1:100Document1 page8th Floor Plan: Scale 1:100AlulaNo ratings yet

- 8th Floor Plan: Scale 1:100Document1 page8th Floor Plan: Scale 1:100AlulaNo ratings yet

- Active Glass MediaDocument2 pagesActive Glass Mediaehden.emadNo ratings yet

- Electrical Plumbing Layout PlanDocument1 pageElectrical Plumbing Layout PlanChetna JoshiNo ratings yet

- Viktec Catalog 2023 v8Document234 pagesViktec Catalog 2023 v8lilymighty8No ratings yet

- Down Town Sitting Out Block 14-Layout2Document1 pageDown Town Sitting Out Block 14-Layout2Abdelrahman ShamsNo ratings yet

- Bloc PDFDocument1 pageBloc PDFcalestru.vladimirNo ratings yet

- Bloc PDFDocument1 pageBloc PDFcalestru.vladimirNo ratings yet

- Bloc Social Administrativ SC 1 100Document1 pageBloc Social Administrativ SC 1 100calestru.vladimirNo ratings yet

- San Clemente Ar 09 PDFDocument1 pageSan Clemente Ar 09 PDFMel Frederick MadriagaNo ratings yet

- Osnova Krova Osnova Stubova: RHS80x3Document1 pageOsnova Krova Osnova Stubova: RHS80x3TomoNo ratings yet

- R4 Plan Armare Grinda de Fundare PDFDocument1 pageR4 Plan Armare Grinda de Fundare PDFVictor RîndunicaNo ratings yet

- Pantry HS Tampak DepanDocument6 pagesPantry HS Tampak DepanAndi Cahyo EnelisNo ratings yet

- Basaoda TBD Plan LayoutDocument1 pageBasaoda TBD Plan LayoutANKESH SHRIVASTAVANo ratings yet

- Reinforcing Diagram: Note! Refer Brandon & Associated Engineering Drawings For Any Additional Technical InformationDocument1 pageReinforcing Diagram: Note! Refer Brandon & Associated Engineering Drawings For Any Additional Technical InformationAndyNo ratings yet

- D Dev p001 Sheet1Document2 pagesD Dev p001 Sheet1Sanjeewa HerathNo ratings yet

- Check Structure Layout2Document1 pageCheck Structure Layout2Elaine Joyce GarciaNo ratings yet

- Check Structure Layout2Document1 pageCheck Structure Layout2WesNo ratings yet

- Microeconomics Production TheoryDocument29 pagesMicroeconomics Production Theorysagar dhakalNo ratings yet

- Gambar Kerja Kursi REOG Ver.bDocument1 pageGambar Kerja Kursi REOG Ver.b41721010012No ratings yet

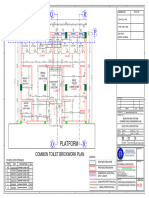

- Bbs Toilet - Brick Work - Seoni StationDocument1 pageBbs Toilet - Brick Work - Seoni Stationojasprajapati6No ratings yet

- Database Management Systems: Understanding and Applying Database TechnologyFrom EverandDatabase Management Systems: Understanding and Applying Database TechnologyRating: 4 out of 5 stars4/5 (8)

- Economic Indicators for Southeast Asia and the Pacific: Input–Output TablesFrom EverandEconomic Indicators for Southeast Asia and the Pacific: Input–Output TablesNo ratings yet

- BSBFIA402 Assessment 1Document2 pagesBSBFIA402 Assessment 1YingsriManaweepNo ratings yet

- Project Work Mining and FinanceDocument8 pagesProject Work Mining and FinanceJhon Jairo CiezaNo ratings yet

- University of Waterloo School of Accountancy Accounting 451 - Audit Strategy Midterm ExaminationDocument6 pagesUniversity of Waterloo School of Accountancy Accounting 451 - Audit Strategy Midterm ExaminationgladsNo ratings yet

- General Power of AttorneyDocument1 pageGeneral Power of AttorneyCools CreationNo ratings yet

- Sardha Scam Company Law Project Case StudyDocument11 pagesSardha Scam Company Law Project Case StudyShantnuNo ratings yet

- Chapter 6Document20 pagesChapter 6Federico MagistrelliNo ratings yet

- Valuation in A World of CVA and DVADocument226 pagesValuation in A World of CVA and DVAdislorthNo ratings yet

- Bee Gee Loan DetailsDocument3 pagesBee Gee Loan Detailsnarendar kumar kNo ratings yet

- DTC PARTICIPANTS Listing DRS Direct Resgistration Services Limited ListDocument2 pagesDTC PARTICIPANTS Listing DRS Direct Resgistration Services Limited Listjacque zidaneNo ratings yet

- FM Unit 3Document9 pagesFM Unit 3ashraf hussainNo ratings yet

- Alco Sec 17Q Q3 2021 - Fin - PseDocument69 pagesAlco Sec 17Q Q3 2021 - Fin - PseOIdjnawoifhaoifNo ratings yet

- Registration Document and Full-Year Financial ReportDocument532 pagesRegistration Document and Full-Year Financial ReportAwais ShoaibNo ratings yet

- Viewbilltr 59 eDocument2 pagesViewbilltr 59 eShabeerMuhammadNo ratings yet

- Intregration Project ManagementDocument3 pagesIntregration Project ManagementMukesh RaiyaNo ratings yet

- Life Insurance Background Paper 29Document128 pagesLife Insurance Background Paper 29violeta1972100% (1)

- Combined 3 Bank Senior Officer Question 2018 AUSTDocument28 pagesCombined 3 Bank Senior Officer Question 2018 AUSTRanaNo ratings yet

- Company DirectorsDocument52 pagesCompany DirectorsLuqman HakeemNo ratings yet

- CasesDocument30 pagesCasesthe humansNo ratings yet

- Solution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionDocument24 pagesSolution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionJenniferLeonyowc100% (33)

- Ailet 2017 LLMDocument43 pagesAilet 2017 LLMArchit Virendra SharmaNo ratings yet

- New Directions For Monetary Policy: MARCH 2023Document72 pagesNew Directions For Monetary Policy: MARCH 2023Electra EVNo ratings yet

- Beach Resort FisibilityDocument18 pagesBeach Resort FisibilityJahan Zeb Amar Ghowl WalaNo ratings yet

- Opening Saving Account in HDFC BankDocument31 pagesOpening Saving Account in HDFC BankSukhchain AggarwalNo ratings yet

- FAC1501 GlossaryDocument13 pagesFAC1501 GlossaryVhukhudo SikhwivhiluNo ratings yet

- Comparing Quantities Assignment Class 8 Maths CBSEDocument3 pagesComparing Quantities Assignment Class 8 Maths CBSEgurdeepsarora8738100% (1)

- Market Index: Measure of The Investment Performance of The Overall MarketDocument13 pagesMarket Index: Measure of The Investment Performance of The Overall MarketVadim TNNo ratings yet

- Pas 40 1Document1 pagePas 40 1nericuevas1030No ratings yet

- Amalgmation, Absorbtion, External ReconstructionDocument12 pagesAmalgmation, Absorbtion, External Reconstructionpijiyo78No ratings yet