Professional Documents

Culture Documents

Macroeconomics 24th Dec, 2021

Macroeconomics 24th Dec, 2021

Uploaded by

Kumail Ali KhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macroeconomics 24th Dec, 2021

Macroeconomics 24th Dec, 2021

Uploaded by

Kumail Ali KhanCopyright:

Available Formats

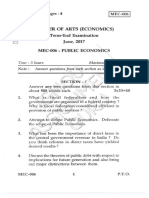

OBE: OPEN BOOK EXAMINATION

[This question paper contains 2 printed pages.]

Your Roll No: …………………..

Sr. No. of Question paper : XXXX

Unique Paper Code : 61011304

Name of the Paper : Macroeconomics

Name of the Course : Bachelor of Management Studies

Semester : III

Duration : 3 Hours

Maximum Marks : 75

Instructions for candidates:

1. This paper contains 6 questions. Attempt ANY FOUR questions.

2. All questions carry equal marks.

Q1. Classical economists believe that freely flexible prices and money wages keep

changes in aggregate demand from affecting output. How will an increase in aggregate

demand affect prices, wages and rate of interest. Explain with diagrams Will increase

in supply of labour have the same impact ?

Q2. “The more open the economy, the smaller is the response of income to aggregate

demand shocks such as changes government spending or autonomous changes in

investment demand.” Do you agree ? Give reasons for your answer. Describe the

process by which changes in government spending impact income in an open

economy.

Q3. C = 100 + 0.8Yd

I = 50-25r

G = T = 50

Ms = 350

Md = Y – 100r

(i) Find the equation of IS and LM curve

(ii) Find the equilibrium and rate of interest

(iii) What is the effect of change in Government spending from 50 to 100.

(iv) What is the effect of change in Money supply from 350 to 280.

Q4. Explain the relationship between interest sensitivity of investment and effectiveness

of

monetary and fiscal policy. Why is fiscal policy ineffective in certain circumstances?

Q5. What is the meaning of liquidity in an economy? How can it be measured ? If an

economy has excess liquidity then how Aggregate Demand and Supply curve

changes its position? What is Non accelerating inflation rate of unemployment

(NAIRU)? What controls and policy measures can be implemented in order to

restore the equilibrium in the economy?

Q6. What does the Balance of Payment (BP) Curve depict? Discuss the properties of BP

curve? Explain the effect of an expansionary monetary policy under fixed exchange

rate and imperfect capital mobility.

You might also like

- Chapter 1Document26 pagesChapter 1Hamid UllahNo ratings yet

- Principles of Macroeconomics - FullDocument375 pagesPrinciples of Macroeconomics - FullHafsa YusifNo ratings yet

- PP Macro Review-17th EditionDocument109 pagesPP Macro Review-17th EditionGregory GreenNo ratings yet

- Intro To Macroeconomics Theory and Practice - SyllabusDocument4 pagesIntro To Macroeconomics Theory and Practice - SyllabusHoney Hon67% (3)

- Chapter 2: Thinking Like An Economist: The Role of AssumptionsDocument2 pagesChapter 2: Thinking Like An Economist: The Role of AssumptionsSavannah Simone PetrachenkoNo ratings yet

- Economics in Micro and Macro Consistency: Challenging Old Biases with New InsightsFrom EverandEconomics in Micro and Macro Consistency: Challenging Old Biases with New InsightsNo ratings yet

- Macroeconomics 07th Dec, 2021Document2 pagesMacroeconomics 07th Dec, 2021Kumail Ali KhanNo ratings yet

- Mec-002 EngDocument31 pagesMec-002 EngnitikanehiNo ratings yet

- Mac - IDocument1 pageMac - ILucifer ONENo ratings yet

- Becc 103 em 2023 24 KPDocument17 pagesBecc 103 em 2023 24 KPGourav SealNo ratings yet

- Output and IncomeDocument3 pagesOutput and IncomeAnonymous JOOQkGbwoRNo ratings yet

- Principles of Macroeconomics Topic 1Document15 pagesPrinciples of Macroeconomics Topic 1peterkiamaw492No ratings yet

- Preston University Library: Course Outline Fall Semester 2011Document5 pagesPreston University Library: Course Outline Fall Semester 2011Iffat ChaudhryNo ratings yet

- Advanced Macro EconomicsDocument151 pagesAdvanced Macro EconomicsAbirami EkambaramNo ratings yet

- Macro Exam 2018Document4 pagesMacro Exam 2018Vignesh BalachandarNo ratings yet

- Course Outline Macro 2Document6 pagesCourse Outline Macro 2Gunjan ChoudharyNo ratings yet

- The General Theory of Employment, Interest, and Money After 75 YearsDocument24 pagesThe General Theory of Employment, Interest, and Money After 75 YearsYadira AceroNo ratings yet

- 05 Bdek2203 T1Document10 pages05 Bdek2203 T1Frizal RahimNo ratings yet

- Chapter1Document55 pagesChapter1Duyên Nguyễn Huỳnh KhánhNo ratings yet

- Macro 03Document381 pagesMacro 03subroto36100% (1)

- T6 Pretutorial 2019Document2 pagesT6 Pretutorial 2019karl hemmingNo ratings yet

- Christ University, Bangalore-560029 II BA End Semester Examination March 2011Document1 pageChrist University, Bangalore-560029 II BA End Semester Examination March 2011Sanjana PrabhuNo ratings yet

- TW5 - Tutorial QuestionsDocument5 pagesTW5 - Tutorial QuestionsAzizah AbidinNo ratings yet

- Unit-1 Introduction To Macroeconomics and National Income AccountingDocument39 pagesUnit-1 Introduction To Macroeconomics and National Income AccountingDaniel ParkerNo ratings yet

- Difference BTW Micro & Macro EconDocument5 pagesDifference BTW Micro & Macro EconshyasirNo ratings yet

- Mec-006 EngDocument33 pagesMec-006 EngnitikanehiNo ratings yet

- Economic Applications 225 SP 20Document7 pagesEconomic Applications 225 SP 20Muhammad UmarNo ratings yet

- Chapter1 PDFDocument55 pagesChapter1 PDFHuy AnhNo ratings yet

- Introduction To Business: Powerpoint Image SlideshowDocument24 pagesIntroduction To Business: Powerpoint Image SlideshowYuria NakaoNo ratings yet

- Ch1 IntroductionDocument42 pagesCh1 IntroductionNguyễn Lê Minh AnhNo ratings yet

- Eco401AMegaFileofFinaltermSolvedSubjective2011to PDFDocument33 pagesEco401AMegaFileofFinaltermSolvedSubjective2011to PDFmuhammad jamilNo ratings yet

- ECO 372 EDU Teaching Effectively Eco372edudotcomDocument25 pagesECO 372 EDU Teaching Effectively Eco372edudotcomaadam456No ratings yet

- SYBCom Semster III Business Economics 2014-15Document56 pagesSYBCom Semster III Business Economics 2014-15ginga716No ratings yet

- Iepm Ques PaperDocument1 pageIepm Ques Papermukesh_sri432No ratings yet

- UNIT 7 - MACROECONOMIC MODELS - FinalDocument5 pagesUNIT 7 - MACROECONOMIC MODELS - FinalKatlego MonyaeNo ratings yet

- Introduction To MicroeconomicsDocument16 pagesIntroduction To MicroeconomicsDe Leon100% (1)

- Solutions Baumol Chs 1 13 PDFDocument59 pagesSolutions Baumol Chs 1 13 PDFTy-Shana MaximeaNo ratings yet

- Macroeconomics (From Greek Prefix "Makros-" Meaning "Large" + "Economics") Is A Branch ofDocument5 pagesMacroeconomics (From Greek Prefix "Makros-" Meaning "Large" + "Economics") Is A Branch ofNirav NagariyaNo ratings yet

- MSC MT 2023 Lecture1 Introduction To Development MacroeconomicsDocument14 pagesMSC MT 2023 Lecture1 Introduction To Development MacroeconomicstorinobrunnaNo ratings yet

- Introduction To MacroeconomicsDocument4 pagesIntroduction To MacroeconomicsPeris WanjikuNo ratings yet

- Chapter 1 GoalDocument1 pageChapter 1 GoaljackNo ratings yet

- Master Thesis Topics in MacroeconomicsDocument7 pagesMaster Thesis Topics in Macroeconomicsafbwrszxd100% (2)

- Understanding Macroeconomics: Inflation Economic Growth Gross Domestic Product (GDP) UnemploymentDocument2 pagesUnderstanding Macroeconomics: Inflation Economic Growth Gross Domestic Product (GDP) UnemploymentTommyYapNo ratings yet

- Distribution Led GrowthDocument27 pagesDistribution Led GrowthAdarsh Kumar GuptaNo ratings yet

- Problem Set 2 (Econtwo)Document1 pageProblem Set 2 (Econtwo)illustra7No ratings yet

- Economics Module 1Document6 pagesEconomics Module 1ManishNo ratings yet

- Chapter 1Document403 pagesChapter 1S M IftekharNo ratings yet

- ECO 372 Final ExamECO 372 Week 5 Final Exam Answers Free - UOP StudentsDocument11 pagesECO 372 Final ExamECO 372 Week 5 Final Exam Answers Free - UOP StudentsUOP Students100% (1)

- Macro Economics - Vaishali PadakeDocument1 pageMacro Economics - Vaishali PadakeAyush GoyalNo ratings yet

- Asgn 5 IMDocument2 pagesAsgn 5 IMjahansherwaniNo ratings yet

- Lecture 202-03 Solow ModelDocument4 pagesLecture 202-03 Solow ModeljaffinkNo ratings yet

- Framework of Economic Resilience Analysis: From Enigma To Solution Proposals by Musoko KayembeDocument10 pagesFramework of Economic Resilience Analysis: From Enigma To Solution Proposals by Musoko KayembeKayembeNo ratings yet

- Sample Exam QuestionsDocument8 pagesSample Exam QuestionsEmmanuel MbonaNo ratings yet

- 6QQMN972 Tutorial 5 QuestionsDocument4 pages6QQMN972 Tutorial 5 QuestionsyuvrajwilsonNo ratings yet

- PhotoDocument1 pagePhotoAnkur GuptaNo ratings yet

- Ekn214 S1 2021Document7 pagesEkn214 S1 2021HappinessNo ratings yet

- Dwnload Full Macroeconomics International 5th Edition Williamson Solutions Manual PDFDocument22 pagesDwnload Full Macroeconomics International 5th Edition Williamson Solutions Manual PDFAlexisSmithpomtx100% (12)

- HW1Document5 pagesHW1roshkanianNo ratings yet

- MacroeconomicsDocument4 pagesMacroeconomicsPrerna MakhijaniNo ratings yet

- Case Study 2Document4 pagesCase Study 2Kumail Ali KhanNo ratings yet

- Practical Exam Schedule Dec 2022 - Final StudentsDocument3 pagesPractical Exam Schedule Dec 2022 - Final StudentsKumail Ali KhanNo ratings yet

- Sdea ProjectDocument22 pagesSdea ProjectKumail Ali KhanNo ratings yet

- Principles of Marketing A South Asian PeDocument6 pagesPrinciples of Marketing A South Asian PeKumail Ali KhanNo ratings yet

- Set 1 Fdas 2020Document3 pagesSet 1 Fdas 2020Kumail Ali KhanNo ratings yet

- R Practical File (Gautam-21074)Document22 pagesR Practical File (Gautam-21074)Kumail Ali KhanNo ratings yet

- Q Paper FdasDocument3 pagesQ Paper FdasKumail Ali KhanNo ratings yet

- R QueDocument4 pagesR QueKumail Ali KhanNo ratings yet