Professional Documents

Culture Documents

Maf 603-T2-PF Mgmt-Exercise 1

Uploaded by

hazlamimalekOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maf 603-T2-PF Mgmt-Exercise 1

Uploaded by

hazlamimalekCopyright:

Available Formats

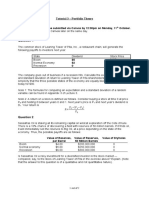

MAF 603

PORTFOLIO MGMT & APT (RISK & RETURN)

EXERCISE 1

1. You are considering two securities in the market, Tweety and Deedee. The following table shows

their possible payoffs.

Estimated returns

State of economy Probability Tweety Deedee

Optimistic 0.2 0.2 0.35

Normal 0.7 0.3 0.3

Pessimistic 0.1 0.4 0.2

Required:

a. Determine the expected return and standard deviation of each security.

b. Calculate the covariance and correlation between the two securities.

c. Calculate the expected return and standard deviation of a portfolio that invests half of its

funds in Tweety and half in Deedee.

2. You are considering investing your money in Bursa Malaysia and decide to consider two stocks; A

and B. The table below shows relevant information related to the two stocks:

Estimated returns (%)

State of economy Probability Stock A Stock B

Recession 0.1 5 -2

Normal 0.3 12 8

Boom 0.6 18 25

Required:

a. Determine the expected return and standard deviation of each stock.

b. Calculate the covariance and correlation between the two stocks.

c. Calculate the expected return and standard deviation of a portfolio with 60% of its funds

invested in Stock A and 40% in Stock B.

d. If you could invest your money in Stock A only, or Stock B only, or the portfolio in (c) above,

which alternative would you choose? Explain your decision.

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Study Questions Risk and ReturnDocument4 pagesStudy Questions Risk and ReturnAlif SultanliNo ratings yet

- HW5 S10Document6 pagesHW5 S10danbrownda0% (1)

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- CHPT 8Document16 pagesCHPT 8hazlamimalek0% (1)

- Chap 5-Pages-45-46,63-119Document59 pagesChap 5-Pages-45-46,63-119RITZ BROWNNo ratings yet

- Strategic Risk Management: Designing Portfolios and Managing RiskFrom EverandStrategic Risk Management: Designing Portfolios and Managing RiskNo ratings yet

- Chapter 10 Questions V2Document7 pagesChapter 10 Questions V2Lavanya KosuriNo ratings yet

- IU - Fm.lecture5 Handouts 2021NCTDocument5 pagesIU - Fm.lecture5 Handouts 2021NCTmai anh NguyễnNo ratings yet

- Practice Questions Set 1Document3 pagesPractice Questions Set 1ALBRIGHT PHANUELLA GLOVERNo ratings yet

- EXERCISE MEETING 1 - MAF603 Oct 2020Document3 pagesEXERCISE MEETING 1 - MAF603 Oct 2020nurul syakirinNo ratings yet

- Assignment 2Document3 pagesAssignment 2Gabriel PodolskyNo ratings yet

- Investement AssDocument2 pagesInvestement Assbona birra0% (1)

- Part II Workout Question: - Possible Rate of Return ProbabilityDocument4 pagesPart II Workout Question: - Possible Rate of Return ProbabilitySamuel Debebe100% (4)

- The Ex-Ante Estimate of Expected Return From A Stock A Is Given BelowDocument2 pagesThe Ex-Ante Estimate of Expected Return From A Stock A Is Given BelowShaoli MofazzalNo ratings yet

- Optimal Risky Portfolios Chapter 7 PracticeDocument2 pagesOptimal Risky Portfolios Chapter 7 PracticeRehabUddinNo ratings yet

- Tutorials 6 - Risk ReturnDocument2 pagesTutorials 6 - Risk ReturnDEVINA GURRIAHNo ratings yet

- Tutorial Chapter: Risk and Return: (Answer 12.5%, 20%) (Answer 5.12%, 20.49%) (Answer 0.4, 1.02)Document19 pagesTutorial Chapter: Risk and Return: (Answer 12.5%, 20%) (Answer 5.12%, 20.49%) (Answer 0.4, 1.02)FISH JELLYNo ratings yet

- Chapter 4 Risk and Return ExerciseDocument2 pagesChapter 4 Risk and Return ExerciseLy PhanNo ratings yet

- Chapter 4 Exercises: Date Stock PriceDocument2 pagesChapter 4 Exercises: Date Stock PriceLy PhanNo ratings yet

- FIN MGT 2 Quiz 1Document3 pagesFIN MGT 2 Quiz 1Alelie dela CruzNo ratings yet

- Portfolio TheoryDocument9 pagesPortfolio TheorytoabhishekpalNo ratings yet

- Af 212 - Review Questions 2022 2Document3 pagesAf 212 - Review Questions 2022 2Mwamba HarunaNo ratings yet

- 03 PS8 CapmDocument2 pages03 PS8 Capmahsan13790% (1)

- Risk Return Sharpe QsDocument2 pagesRisk Return Sharpe QsKshitij TyagiNo ratings yet

- Assignment1 2020 PDFDocument8 pagesAssignment1 2020 PDFmonalNo ratings yet

- UntitledDocument3 pagesUntitledAobakwe Rose TshupeloNo ratings yet

- Tutorial 4Document3 pagesTutorial 4sera porotakiNo ratings yet

- Screenshot 2022-10-11 at 6.54.55 PMDocument4 pagesScreenshot 2022-10-11 at 6.54.55 PMdesi mundaNo ratings yet

- Prob Set#4-Risk - Return - ProblemsDocument4 pagesProb Set#4-Risk - Return - ProblemsKenya Levy0% (1)

- Tutorial 3 - Risk Return (Part 1) PDFDocument2 pagesTutorial 3 - Risk Return (Part 1) PDFChamNo ratings yet

- A151 Tutorial Topic 6 - QuestionDocument3 pagesA151 Tutorial Topic 6 - QuestionNadirah Mohamad Sarif100% (1)

- Assignment 1Document2 pagesAssignment 1chanus19No ratings yet

- Chapter 6assignmentDocument6 pagesChapter 6assignmentUnni KuttanNo ratings yet

- Meeting 1 - Maf603Document2 pagesMeeting 1 - Maf603Liyana IzyanNo ratings yet

- IPMDocument6 pagesIPMPOOJAN DANIDHARIYANo ratings yet

- SV - Problems - Chapter 3Document2 pagesSV - Problems - Chapter 3Hiền VyNo ratings yet

- Tutorial-2 2013 Mba 6801Document4 pagesTutorial-2 2013 Mba 6801ANDREY BROTCHELLY AVILA FEIJOONo ratings yet

- Portfolio ManagementDocument4 pagesPortfolio ManagementMahedi HasanNo ratings yet

- Tutorial Questions On Fundamrntal of Investment Analysis 2024Document10 pagesTutorial Questions On Fundamrntal of Investment Analysis 2024Blaise KrisNo ratings yet

- Financial Management - Theory & Practice by Brigham-266-273Document8 pagesFinancial Management - Theory & Practice by Brigham-266-273Muhammad AzeemNo ratings yet

- Sample Ques MidsDocument8 pagesSample Ques MidsWaasfaNo ratings yet

- Chapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BDocument4 pagesChapters 12 & 13 Practice Problems: Economy Probability Return On Stock A Return On Stock BAnsleyNo ratings yet

- FIN 3331 Risk and Return AssignmentDocument2 pagesFIN 3331 Risk and Return AssignmentHelen Joan BuiNo ratings yet

- Inventment in Security and Portfolio TheoryDocument10 pagesInventment in Security and Portfolio Theorytmpvd6gw8fNo ratings yet

- Tutorial Chapter 4Document13 pagesTutorial Chapter 4Amirul ZikrieyNo ratings yet

- Investment Assign 2 - QuestionsDocument7 pagesInvestment Assign 2 - QuestionsYuhan KENo ratings yet

- Tutorial 5 PDFDocument2 pagesTutorial 5 PDFBarakaNo ratings yet

- Assignment 2Document2 pagesAssignment 2fiza akhterNo ratings yet

- Risk and Return A - Practice ExercisesDocument3 pagesRisk and Return A - Practice ExercisesmilotikyuNo ratings yet

- Portfolio TheoryDocument3 pagesPortfolio TheoryALBRIGHT PHANUELLA GLOVERNo ratings yet

- FINM7008 Applied Investments: Workshop 2Document2 pagesFINM7008 Applied Investments: Workshop 2Natalie OngNo ratings yet

- Portfolio Theory - Additional Problems 1Document3 pagesPortfolio Theory - Additional Problems 1Hambeca PHNo ratings yet

- FINM7008 Applied Investments: Workshop 2 SolutionsDocument4 pagesFINM7008 Applied Investments: Workshop 2 SolutionsNatalie OngNo ratings yet

- FIN300 Homework 3Document4 pagesFIN300 Homework 3JohnNo ratings yet

- Risk and Return Hand OutDocument4 pagesRisk and Return Hand OutAsad ur rahmanNo ratings yet

- Economics Model QP & Ms Xii 2022-23Document14 pagesEconomics Model QP & Ms Xii 2022-23HarshitNo ratings yet

- Question Bank Topic 6 - Foundations of Portfolio TheoryDocument8 pagesQuestion Bank Topic 6 - Foundations of Portfolio TheorymileNo ratings yet

- 5 - Portfolio Management - Assignment (14-05-19)Document6 pages5 - Portfolio Management - Assignment (14-05-19)AakashNo ratings yet

- Investment Analysis and Portfolio ManagementDocument1 pageInvestment Analysis and Portfolio ManagementUsama RajaNo ratings yet

- Tutorial 3 - Portfolio Theory: The Problem Sets Must Be Submitted Via Canvas by 12:30pm On Monday, 11 OctoberDocument2 pagesTutorial 3 - Portfolio Theory: The Problem Sets Must Be Submitted Via Canvas by 12:30pm On Monday, 11 OctoberVivienLamNo ratings yet

- Maf 603-T2-PF Mgmt-Exercise 2Document2 pagesMaf 603-T2-PF Mgmt-Exercise 2hazlamimalekNo ratings yet

- Ais 651 CHAPTERDocument25 pagesAis 651 CHAPTERhazlamimalekNo ratings yet

- CHPT 9Document18 pagesCHPT 9hazlamimalekNo ratings yet