Professional Documents

Culture Documents

PCS ICDR Compliance Certificate 04

PCS ICDR Compliance Certificate 04

Uploaded by

Tejas Sarvaiya0 ratings0% found this document useful (0 votes)

2 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views3 pagesPCS ICDR Compliance Certificate 04

PCS ICDR Compliance Certificate 04

Uploaded by

Tejas SarvaiyaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

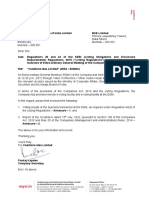

Anish Gupta & Associates

(COMPANY SECRETARIES & INSOVENCY PROFESSIONAL

Anish Gupta 413 Autumn Grove, Lokhandwala, Kandivali(E), Mumbai -400101

FCS, IP, LLBBeom __ India, Call: +91 022 29659720 email: anish@rsanishaupta.com

COMPLIANCE CERTIFICATE

[Pursuant to Regulation 163(2) of the Securities Exchange Board of India (Issue ofCapital and

Disclosure Requirements) Regulations, 2018]

To,

Board of Directors,

Vodafone Idea Limited

Birla Centurion, 10% Floor,

Century Mills Compound,

P.B. Marg, Worli,

Mumbai - 400 030

In connection with the proposed preferential issue of upto 42,76,56,421 Equity Shares of

Rs. 10/- each OR upto 42,76,56,421 Warrants (each convertible into one fully paid-up equity

share) of Vodafone Idea Limited (hereinafter referred to as “Company”), to Euro Pacific

Securities Ltd ("Proposed Allottee”), aggregating to upto Rs. 436.21 crore (“Preferential

Issue"), the Company is required to obtain a certificate from Practicing Company Secretary

confirming that the proposed preferential issue is being made in terms of Securities and

Exchange Board of India(Issue of Capital and Disclosure Requirements) Regulations, 2018,

as amended (the “ICDR Regulations’).

Accordingly, this Certificate is being issued under the ICDR Regulations.

Management Responsibility:

‘The Management of the Company is responsible for ensuring the compliance of the

requirements of the ICDR Regulations detailed as under:

() Determination of the relevant date, being the date thirty days prior to the date on

which the meeting of shareholders is proposed to consider the proposed preferential

issue;

(i) Determination of the minimum price of Equity Share / Warrant in terms of Regulation

164 of the ICDR Regulations;

(ii) Compliance with the conditions/ requirements of the ICDR Regulations.

Verification:

For the purpose of confirming that the proposed preferential issue is in compliance of the

applicable provisions of the ICDR Regulations, we have examined the following limited

documents as provided by the Company and available on the date of this certificate:

(a) Certified copy of Board Resolution dated 22 June 2022, approving Preferential Issue of

upto 42,76,56,421 Equity Shares of Rs. 10/- each at an issue price of Rs. 10.20 per

equity share (including premium of Re. 0.20) OR upto 42,76,56,421 Warrants each

convertible into one fully paid-up equity share of the Company of face value of Rs. 10/- each

(‘Warrants’) at an issue price of Rs. 10.20 each payable in cash, aggregating upto Rs.

436.21 crore to the Proposed Allottee;

(>) Confirmation from the Company that:

() The Board of Directors of the Company have decided 15 June 2022, as the

“Relevant Date” being the date thirty days prior to the date on which the meeting

of shareholders is expected to be held i.e. 15 July 2022, to consider and approve the

Preferential Issue;

The Company has determined the minimum price of equity shares in terms of

Regulation 164 of the ICDR Regulations;

The Board of Directors of the Company has at its meeting held on 22 June 2022,

approved Notice convening the Extra-ordinary General Meeting of the Company for

the Preferential Issue on 15 July 2022;

‘The proposed Preferential Issue is being made to Promoter of the Company;

(¥) None of the Proposed Allottee belonging to Promoter(s) / Promoter Group are

{ineligible for allotment in terms of Regulation 159 of the ICDR Regulations;

(vi) The equity shares held by the Proposed Allottee are already in dematerialized

form;

(vii) The equity shares held by the Proposed Allottee have already been placed under

lock-in;

(vil) The Proposed Allottee have not sold or transferred any equity shares of the

Company during the ninety trading days preceding the Relevant Date;

(ix)_None of the entities in the Promoter / Promoter Group have sold any equity shares

of the Company during the ninety trading days preceding the Relevant Date;

()_ The Company is in compliance with the conditions for continuous listing of equity

shares as specified in the listing agreement with the stock exchange where the

equity shares of the Company are listed and the Securities and Exchange Board of

India (Listing Obligations and Disclosure Requirements), 2015, as amended, and

any circular or notification issued by the Securities and Exchange Board of India

thereunder;

(x) The Company will file an application seeking in-principle approval for the proposed

Preferential Issue on 23 June 2022, ie, on the same day when the notice is being

sent in respect of the general meeting seeking shareholders’ approval for the

proposed Preferential Issue;

(xii) The Company has no outstanding dues to the Securities and Exchange Board of India,

Stock Exchanges where the securities of the Company are listed (ie. BSE Ltd. and

National Stock Exchange of India Ltd.) and the Depositories (i.e NSDL/ CDSL).

Certification:

In our opinion and to the best of our knowledge and according to the verifications as

considered necessary and explanations furnished to us by the Company and its Officers, we

certify that the proposed Preferential Issue is being made in compliance with the

conditions/ requirements of ICDR Regulations stated above under the heading of

verification.

Assumption & Limitation of Scope and Review:

1. Ensuring the authenticity of documents and information furnished is the responsibilityof

the Board of Directors of the Company.

2. Our responsibility is to give certificate based upon our examination of relevant

documents and information. It is neither an audit nor an investigation.

3. This certificate is neither an assurance as to the future viability of the Company nor ofthe

efficiency or effectiveness with which the management has conducted the affairsof the

Company.

4. our scope of work did not include verification of compliance with other requirements of

the ICDR Regulations, Companies Act, 2013, Rules and Regulations framed thereunder,

other circulars, notifications, etc., as issued by relevant regulatory authorities from time

to time, and any other laws and regulations applicable to the Company.

5. This certificate is addressed to and provided to the Board of Directors of the Company

solely for the purpose of further submission in the general meeting of the shareholders

considering the proposed preferential issue and should not be used by any other person

or for any other purpose.

Place : Mumbai FRN:12001MH236100

Date : 22 June 2022 FCS: 5733, CP No. 4092

UDIN: F005733D000520555

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2signed 07Document4 pages2signed 07Tejas SarvaiyaNo ratings yet

- SEIntimationEGMVotingResults 01Document5 pagesSEIntimationEGMVotingResults 01Tejas SarvaiyaNo ratings yet

- EGM - Newspaper - Advertisement 03Document4 pagesEGM - Newspaper - Advertisement 03Tejas SarvaiyaNo ratings yet

- EGM - Newspaper - Dispatch 05Document4 pagesEGM - Newspaper - Dispatch 05Tejas SarvaiyaNo ratings yet

- Vodafone - Idea - LTD - EGM - Notice - DTD - 22 - June - 2022 02Document20 pagesVodafone - Idea - LTD - EGM - Notice - DTD - 22 - June - 2022 02Tejas SarvaiyaNo ratings yet

- Tejas Final Black Book 19-20Document72 pagesTejas Final Black Book 19-20Tejas SarvaiyaNo ratings yet