Professional Documents

Culture Documents

UNEP FI Guidelines For Climate Change Target Setting

Uploaded by

CJ MurphyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UNEP FI Guidelines For Climate Change Target Setting

Uploaded by

CJ MurphyCopyright:

Available Formats

Guidelines for

Climate Target

Setting for

Banks

April

2021

Guidelines for Climate Target Setting for Banks 1

Summary

Achieving the objectives agreed in the Paris Agreement to limit global temperature

increases to well below 2°C from pre-industrial levels and striving for 1.5°C will require

ambitious actions from all strands of the economy: alongside governmental policy

commitments and corporate action, financial institutions will need to adjust their busi-

ness models in the short and long term and develop realistic strategies underpinned

by robust, science-based targets and action plans.

The window for action is small. To achieve the goals of the Paris Agreement, emissions

must now halve every decade.

The role of the banking industry in tackling this challenge is key. Banks will need to

support the transition to a net-zero economy through their lending and financing deci-

sions and through facilitating their clients’ transition.

To this end, the UNEP FI’s Collective Commitment to Climate Action (CCCA) group of 38

signatories has developed these Guidelines for Climate Target Setting, which outline

key principles to underpin the setting of credible, robust, impactful and ambitious

targets in line with achieving the objectives of the Paris Agreement.

For signatories to the CCCA, the implementation, monitoring and reporting against

these guidelines fits into wider UNEP FI Principles for Responsible Banking governance

processes.

The Guidelines will be reviewed at least every three years, and sooner when required.

Guidelines for Climate Target Setting for Banks 2

Summary

Key Principles

The Guidelines are based on the following key principles:

◾ Ambition: targets shall at least align with the temperature goals of the Paris Agree-

ment and support the transition towards a net-zero economy by 2050.

◾ Scope: the Guidelines apply to the bank’s lending and investment activities (Scope

3, Category 15).1 Banks’ targets shall include their clients’ Scope 1, Scope 2 and

Scope 3 emissions, where significant, and where data allows. Scope coverage is

expected to increase between each review period.

◾ Targets: banks shall set, at a minimum, a 2030 (or sooner) and 2050 target. Further

intermediary targets shall be set every five years after the initial interim target. As

each subsequent interim target year is approached, the next interim five-year target

shall be set. An overview of planned actions to meet the targets shall be provided.

◾ Impact in the real economy: targets shall focus on achieving an impact in the real

economy.

◾ Governance: targets shall be approved by the highest executive level within the bank.

◾ Implementation:

◽ Signatories to the Net-Zero Banking Alliance, and banks signing the CCCA after 21

April 2021, will apply these Guidelines, including setting their first round of targets

within 18 months, and within a further 18 months, set targets for all or a substan-

tial majority of the carbon-intensive sectors detailed in Guideline 1.

◽ Existing CCCA signatories (at 21 April 2021) have three years from the time of

joining the CCCA to apply these Guidelines, including setting their first round of

targets, and then a further 18 months to set the targets for all or a substantial

majority of the carbon-intensive sectors detailed in Guideline 1.

◾ Review dates: the targets shall be reviewed at a minimum every five years.

◾ Reporting: banks shall publicly disclose their targets and report annually on progress.

◾ Application: these Guidelines are to be applied on a comply-or-explain basis.

1 Banks’ own Scope 1, Scope 2 and non-category 15 Scope 3 (e.g. from business travel) emissions are not

addressed in this document; it is taken as given that banks shall target carbon neutrality in their own opera-

tions well before 2050.

Guidelines for Climate Target Setting for Banks 3

Key Principles

Guidelines

One Two

Banks shall set and publicly Banks shall establish an

disclose long-term and emissions baseline and annually

intermediate targets to support measure and report the

meeting the temperature goals emissions profile of their lending

of the Paris Agreement. portfolios and investment

activities.

Three Four

Banks shall use widely accepted Banks shall regularly review

science-based decarbonisation targets to ensure consistency

scenarios to set both long-term with current climate science.

and intermediate targets that

are aligned with the temperature

goals of the Paris Agreement.

Note to readers:

In the Guidelines, the following terminology is used:

◾ Shall means that a process is mandatory, on a comply-or-explain basis.

◾ Should means that a process is optional, but strongly recommended.

◾ May means that a process is optional.

Guidelines for Climate Target Setting for Banks 4

Guidelines

Guideline One

Banks shall set and publicly disclose long-term and intermediate targets

to support meeting the temperature goals of the Paris Agreement.

◾ The long-term targets shall at least align with the temperature goals of the Paris

Agreement and include a 2050 target.

◾ Intermediate targets shall include a target for 2030 or sooner.

◾ Banks’ targets shall include their clients’ Scope 1, Scope 2 and Scope 3 emissions,

where significant and data allows.

◾ The targets shall cover a significant majority of a bank’s Scope 3 emissions,2 includ-

ing those from a set list of carbon-intensive sectors (detailed below).

◾ The target base-year shall be no more than two full reporting years prior to the

setting of the target.

◾ Banks shall be transparent about timeframes for targets by disclosing the base-year

and target years, selected scenarios, intermediate targets and milestones.

◾ Target-setting shall be supported within 12 months of setting the targets by the

disclosure of planned actions and milestones to meet these targets, including

investment and lending guidelines, transition plans and climate-related sectoral poli-

cies, such as for fossil fuel and other high-emitting sectors.

◾ Banks shall measure and report annual progress against targets, using metrics that

are the basis of the long-term and intermediate targets.

◾ UNEP FI Principles for Responsible Banking (PRB) signatory banks shall obtain

third-party independent verification or assurance within four years of signing the

Principles, while non-PRB banks are encouraged to obtain third-party independent

verification or assurance.

◾ Banks shall be diligent in applying evolving leading practice on the use of offsets,

including the latest version of the GHG Protocol.

2 Scope 3 Financed Emission – Category 15 emissions as defined in the GHG Protocol, Chapter 4.

Guidelines for Climate Target Setting for Banks 5

Guideline One

Additional Guidance

◾ Banks shall set a 2050 target to support meeting the temperature goals of the Paris

Agreement.3

◾ Banks shall set an interim target for 2030 or sooner and may set further interim

targets prior to that date.

◾ Targets shall be set based on:

◽ Absolute emissions; and/or

◽ Sector-specific4 emissions intensity (e.g. CO2e/ metric5).

◾ While a bank’s targets may be supported by other approaches (e.g. production volume

trajectories, technology mix) or measurements (e.g. financing targets), the targets

shall nonetheless be set in absolute and/or intensity terms.

◾ As an interim target year is approached, the next interim five-year target shall be set.

◾ Long-term and interim targets shall be based on scenarios as defined in Guideline

Three. Banks are encouraged, where appropriate and where scenarios exist, to inte-

grate sector-specific scenarios in their analysis for their targets.

◾ The base year for the above targets shall be set to be no more than two full reporting

years prior to the year when the target is set, and should be disclosed. However, in

cases of exceptional current economic circumstances and/or where there are data

quality lags beyond the banks’ own control, it is possible to go beyond two full report-

ing years if the base year would otherwise be atypical. In these circumstances, banks

should explain and justify their approach.

◾ Banks’ targets shall include their clients’ Scope 1, Scope 2 and Scope 3 emissions,

where significant6 and where data allow. Scope coverage is expected to increase

between each review period.7

◾ Targets shall cover lending activities and should cover investment activities as

explained below. Banks should be clear about which parts of the balance sheet the

targets encompass.8

3 Banks who have set a net-zero target before 2050 do not need to set an additional 2050 target.

4 Sectors are defined according to internationally recognised sector classification codes, such as the NACE, SIC,

GICS or NAICS codes.

5 These metrics should be physical metrics (e.g. kWh, m2, tonne of product), but may be financial metrics if the

rationale for not using a physical metric is provided.

6 The approach to significance shall be explained and may refer to a recognised methodology.

7 Where data allows, Scope 3 emissions for the oil, gas, and mining sectors will be included from 2021 onward.

From 2024 additional sectors will be added (at least transportation, construction, buildings, materials, and indus-

trial activities, as data and guidance permit). From 2026, Scope 3 emissions should be included for all sectors

where targets are set, where significant and where data allows.

8 Where entities within the group structure carry out other types of business such as insurance, pensions funds,

or asset management, it may be appropriate for those entities to follow alternative frameworks.

Guidelines for Climate Target Setting for Banks 6

Guideline One

◽ At present this refers to on-balance sheet investment and lending activities.

However, on-balance sheet securities held for client facilitation and market-mak-

ing purposes (as opposed to held for investment) are excluded. Over time, banks

should increase the volume of investment activities covered by the targets in line

with methodological developments. For example, off-balance sheet activities,

including facilitated capital markets activities, will be considered in the next version

of the Guidelines.

◽ Banks shall justify the exclusion of relevant asset classes for materiality, method-

ological or other appropriate reasons.

◾ The scope and boundary of the targets should account for a significant majority of

the bank’s portfolio emissions where data and methodologies allow. Banks should

explain significant exclusions.

◽ Sector-level targets shall be set for all, or a substantial majority of, the carbon-in-

tensive sectors, where data and methodologies allow. These sectors include:

agriculture; aluminium; cement; coal; commercial and residential real estate; iron

and steel; oil and gas; power generation; and transport. Signatories should priori-

tise sectors based on GHG emissions, GHG intensities and/or financial exposure

in their portfolio in their first round of target setting (within 18 months of sign-

ing). Notwithstanding methodological limitations, the remaining carbon-intensive

sectors from this list shall be included in subsequent rounds of target setting

(within 36 months of signing). Within the agriculture and transport sectors, banks

may prioritise sub-sectors based on GHG emissions and financial exposure and/or

data and methodology availability. Banks shall justify their approach.

◽ Any client with more than 5% of their revenues coming directly from thermal9

coal mining, and electricity generation activities shall be included in the scope of

targets.10

◽ Banks should explain any exclusions for the above sectors, for instance if such

sectors are financially and/or environmentally (in terms of CO2e emissions) imma-

terial to their portfolios.

◾ Within 12 months of setting the targets, banks shall publish, at a minimum, a high-

level transition plan providing an overview of the categories of actions expected to

be undertaken to meet the targets and an approximate timeline.

◽ Categories of actions may include but are not limited to: client engagement; exclu-

sion policies; divestment; capacity building; development of new tools and prod-

ucts; assessment of portfolio alignment; assessment of portfolio exposure/risks;

development of policies; public policy positions and advocacy for government/

regulatory action; and strategy to grow customer base.

◽ Banks are encouraged to provide an overview of how they will meet their first

interim target with milestones or, at a minimum, provide a planned order of imple-

mentation (recognising actions may be implemented concurrently).

9 Metallurgical coal is considered within the value chain of the iron and steel sector.

10 Project finance to a mixed-generation utility for a specific renewables project would not require reporting on

Scope 3 emissions of the corporate as a whole.

Guidelines for Climate Target Setting for Banks 7

Guideline One

◽ Banks are encouraged to provide asset class-specific or sector-specific informa-

tion on planned actions.

◾ Banks are encouraged to obtain independent limited assurance over the reporting

on performance against targets, including the establishment of a baseline, from their

first progress report onwards.

◽ Principles for Responsible Banking (PRB) signatories are required to have this limited

assurance over their targets in place within four years of signing the Principles.

◾ Banks are encouraged to work with their risk and internal audit functions in managing

the risks and ensuring good controls and governance regarding climate-related targets.

◾ A summary of targets, relevant findings and key metrics should be increasingly

reported in banks’ mainstream annual financial filings over time, as per the Task-

force on Climate-related Financial Disclosures (TCFD) recommendations,11 other

market-place initiatives and growing international supervisory expectations. In the

case of privately held banks, where public financial filings are not required, targets

and relevant findings should be publicly reported through other appropriate reports.

◾ In implementing and reaching targets for all Scopes of emissions, offsets can play

a role to supplement decarbonisation in line with climate science. The reliance on

carbon offsetting for achieving end-state net-zero should be restricted to carbon

removals to balance residual emissions where there are limited technologically or

financially viable alternatives to eliminate emissions. Offsets should always be addi-

tional and certified.

◽ Banks should conduct appropriate due diligence on client offset claims in line with

other internal processes

11 The TCFD has a number of conditional guidance recommendations companies should consider when determin-

ing the appropriate location of disclosure. See Recommendations of the Task Force on Climate-related Financial

Disclosure, page 25.

Guidelines for Climate Target Setting for Banks 8

Guideline One

Guideline Two

Banks shall establish an emissions baseline and annually measure

and report the emissions profile of their lending portfolios and

investment activities.

In doing so, banks shall:

◾ Annually measure and report current emissions (absolute emissions and emissions

intensity) following relevant international and national GHG emissions reporting

protocols and guidelines.

◽ This shall cover a significant majority of a bank’s Scope 3 emissions,12 including

the set list of carbon-intensive sectors.

◾ Each bank shall disclose the:

◽ scope13 and boundary14 of the asset classes and sectors included (provide rationale);

◽ asset class and sector coverage15 of the emissions (provide rationale); and

◽ measurement method(s) and metric(s) used at portfolio, asset class or sector level.

12 Scope 3 Financed Emissions – Category 15 emissions as defined in the GHG Protocol, Chapter 4.

13 Scope defines the operational boundaries in relation to indirect and direct GHG emissions. [source: GHG Proto-

col, Chapters 3 and 4]

14 GHG accounting and reporting boundaries can have several dimensions, i.e. organisational, operational,

geographic, business unit, and target boundaries. The inventory boundary determines which emissions are

accounted and reported by the company. [source: GHG Protocol, Chapters 3 and 4]

15 Coverage defines what proportion of the selected portfolios are included in the analysis.

Guidelines for Climate Target Setting for Banks 9

Guideline Two

Additional Guidance

◾ The financed emissions profile of the bank’s portfolio shall be calculated and

disclosed annually. This shall include, where targets have been set:

◽ Absolute emissions; and

◽ Portfolio-wide emissions intensity (e.g. CO2e/$ lent or invested); and

◽ Sector16-specific emissions intensity (e.g. CO2e/metric17).

◾ Signatories may select additional alternative methodological approaches, such as

an implied temperature rise or forward-looking technological profile, as expressed in

production capacity.

◽ In selecting additional metrics, signatories shall:

justify their rationale;

ensure that they meet commonly accepted methodological expectations and

data requirements; and

provide an explanation of the methodology as well as references to external

public sources of information.

◽ In selecting additional metrics for guiding their alignment, banks shall nonetheless

disclose their current absolute emissions and emissions intensity on an annual basis.

◾ No specific methodology is mandated in these Guidelines to calculate values for the

above metrics. However, banks should strive to use credible sources and explain the

methodologies used for calculating their emissions profile. Where methodologies are

not publicly available and there are data challenges, banks should explain the allo-

cation approach used, data sources and their limitations, approaches to estimation,

proxies used if data are not available and key assumptions. Banks should provide an

assessment of the data quality used in their calculations. If several data sources are

available, data with the highest quality are expected to be used, unless justified.

◾ Banks shall assess the emissions profile for lending and investment activities as

explained in Guideline 1.

◾ The scope and boundary of the emissions profile should account for a significant

majority of the bank’s emissions, including the sectoral approach, as explained in

Guideline 1.

◽ As the current state of methodological development and data availability means it

is not yet possible to measure the totality of a bank’s financed emissions, it is not

possible to calculate the precise proportion of a bank’s financed emissions that

have been measured. Nevertheless, banks should take reasonable steps to ensure

that the assessment covers a “significant majority of their emissions”.18

16 Sectors are defined according to internationally recognised sector classification codes, such as the NACE, SIC,

GICS or NAICS codes.

17 These metrics should be physical metrics (e.g. kWh, m2, tonne of product), but may be financial metrics if the

rationale for not using a physical metric is provided.

18 Banks should look to disclose the percentage of their investment and lending activities covered by portfolio

targets in a metric representative of the magnitude of FIs’ main business activities.

Guidelines for Climate Target Setting for Banks 10

Guideline Two

Guideline Three

Banks shall use widely accepted science-based decarbonisation

scenarios to set both long-term and intermediate targets that are

aligned with the temperature goals of the Paris Agreement.

Guidelines for Climate Target Setting for Banks 11

Guideline Three

Additional Guidance

◾ The scenarios used by banks shall come from credible and well-recognised sources

and banks should provide rationale for the scenario(s) chosen.

◽ IPCC scenarios and scenarios derived from IPCC-qualifying models that meet the

criteria outlined below are strongly recommended.19

◽ Scenarios such as the IEA scenarios (e.g. SDS or NZE2050 scenarios) or

sector-specific scenarios (such as the shipping decarbonisation trajectories devel-

oped under the Poseidon Principles) may be used, if the individual scenarios are

expected to be aligned with the temperature goals of the Paris Agreement.

◾ The scenarios selected shall be “no-overshoot” or “low-overshoot” scenarios (e.g.

scenarios P1 and P2 of the IPCC).

◾ The scenarios selected shall rely conservatively on negative emissions technologies.

◾ The scenarios selected shall have reasonable assumptions on carbon sequestration

achieved through nature-based solutions and land use change.

◾ Banks shall disclose which scenario their climate targets are based upon (scenario

name, date and provider). Banks should disclose key assumptions used in these

scenarios.

◾ The scenarios selected shall, where possible, minimise misalignment with other

Sustainable Development Goals (SDGs).

19 The One Earth Climate Model (OECM) is included under the IPCC exercise. The Network for Greening the Finan-

cial System (NGFS) scenarios are based on models that are included in the IPCC exercise.

Guidelines for Climate Target Setting for Banks 12

Guideline Three

Guideline Four

Banks shall regularly review targets to ensure consistency with current

climate science.

◾ Targets shall be reviewed, and if necessary revised, at least every five years, to

ensure consistency with the latest science (as detailed in IPCC assessment reports).

◾ Targets shall be recalculated and revised as needed to reflect significant changes

that might compromise the relevance and consistency of the existing targets, e.g.

material portfolio changes, methodological developments.

◾ Targets shall be approved by the highest executive level and reviewed by the high-

est-level governance body in the bank.

Guidelines for Climate Target Setting for Banks 13

Guideline Four

Additional Guidance

◾ Targets shall be reviewed periodically, for instance in line with business strategic

planning.

◽ At a minimum, banks shall review their targets every five years.

◽ Banks should strive to align their ambition with any major changes in international

agreements or national goals.

◽ Banks shall change or restate baseline data in line with revisions made to the

targets or boundaries if required.

◽ As climate science evolves, banks should review their methodologies and targets at

the earliest practical opportunity (e.g. following the publication of new IPCC reports).

◾ It is important that climate targets should be part of broader organisational strategic

plans. Climate targets should be appropriately governed and approved by the CEO

or executive committee. They should be reviewed by the board, or the highest-level

governance body that normally oversees and approves the strategic plan.

Guidelines for Climate Target Setting for Banks 14

Guideline Four

About the CCCA

The Collective Commitment to Climate Action (CCCA) is an ambitious global banking

sector initiative supporting the transition to a net-zero economy by 2050.

It brings together a leadership group of 38 banks, all signatories of the Principles for

Repsonsible Banking, from across all six continents who have committed to align their

portfolios with the global climate goal to limit warming to well-below two degrees, striv-

ing for 1.5-degrees Celsius.

The CCCA banks, representing more than USD 15 trillion in assets, are fast-tracking the

commitment all Principles for Responsible Banking signatories have made to align

their business strategy with the temperature goals of the Paris Agreement.

Signatories to the Collective Commitment

to Climate Action are required to:

◾ Take decisive action from the moment of signing, focusing on the most carbon-inten-

sive and climate-vulnerable sectors within their portfolios;

◾ Set and publish sector-specific intermediary and long-term targets for aligning their

portfolios with a well-below 2°C and striving for 1.5°C trajectory, based on scientific

climate scenarios; and

◾ Drive and facilitate the necessary transition in the real economy through their client

relationships, products and services.

Each bank is required to report annually on its progress in implementing the Commit-

ment and achieving set targets. Every two years, the signatories will report on their

collective progress.

The collective work of the CCCA banks will also provide leadership, guidance, tools and

frameworks for the 200+ signatories to the Principles for Responsible Banking, helping

all signatories to strategically align their business with the temperature goals of the

Paris Agreement. This leadership group drafted the Guidelines for Climate Target Setting,

a seminal piece of work which provides guidance on setting robust, credible, science-

based targets. All banks are encouraged to apply these Guidelines, which also underpin

the Net-Zero Banking Alliance (NZBA). In the coming years, signatories to the CCCA and

NZBA will jointly review the Guidelines at least every 3 years, and sooner when required.

The full text of the Collective Commitment to Climate Action can be found on the CCCA’s

official website.20

For further information about the CCCA and how to join, go to:

unepfi.org/climate-pledge

20 The CCCA is advised by a Civil Society Advisory Body (CSAB). These guidelines were agreed before the CSAB

was put in place, therefore members of the Body were not consulted on this inaugural edition.

Guidelines for Climate Target Setting for Banks 15

About the CCCA

Guidelines for Climate Target Setting for Banks 16

About the CCCA

United Nations Environment Programme Finance Initiative

(UNEP FI) is a partnership between UNEP and the global

financial sector to mobilize private sector finance for

sustainable development. UNEP FI works with more than

350 members—banks, insurers, and investors—and over

100 supporting institutions– to help create a financial

sector that serves people and planet while delivering posi-

tive impacts. We aim to inspire, inform and enable finan-

cial institutions to improve people’s quality of life without

compromising that of future generations. By leveraging

the UN’s role, UNEP FI accelerates sustainable finance.

unepfi.org

unepfi.org

info@unepfi.org

/UNEPFinanceInitiative

United Nations Environment Finance Initiative

@UNEP_FI

Guidelines for Climate Target Setting for Banks 17

UntiedNato

i nsEnvrionmenPtrogrammeFn

ianceInta

i tvie(UNEPFsa

ipI)artnershp

ibetweenUNEPandthego

l ba

fn

ilanca

sie

lctotormobzileprviatesectofn

irancefosrustan

iabeldeveo

l pmenUt.NEPFw

Iorkswtihmorethan350members—bankn

iss,urera

sn

,d

n

ivestors—andove1r00supportn

ig

n

istiuto

i ns–tohep

lcreateafn

ianca

sie

lctothrastervespeopelandp

You might also like

- Decoding Article 6 of the Paris Agreement—Version IIFrom EverandDecoding Article 6 of the Paris Agreement—Version IINo ratings yet

- Starbucks StoryDocument27 pagesStarbucks Storymushi_ak4u100% (15)

- VALUE IFRS PLC Interim June 2022 Final 26 MarchDocument45 pagesVALUE IFRS PLC Interim June 2022 Final 26 MarchKatarina GojkovicNo ratings yet

- Lecture 6 Project Green Bonds. How Green Is Your AssetDocument26 pagesLecture 6 Project Green Bonds. How Green Is Your AssetLouis LagierNo ratings yet

- Corporate Governance Complete ProjectDocument21 pagesCorporate Governance Complete ProjectEswar Stark100% (1)

- 21 - Procure 2 Pay Cycle in Oracle Apps R12Document22 pages21 - Procure 2 Pay Cycle in Oracle Apps R12Bala SubramanyamNo ratings yet

- Asset Management Strategy FrameworkDocument15 pagesAsset Management Strategy FrameworkDoirNo ratings yet

- Science Based TargetsDocument18 pagesScience Based Targetsapi-540302051No ratings yet

- Article 6 of the Paris Agreement: Piloting for Enhanced ReadinessFrom EverandArticle 6 of the Paris Agreement: Piloting for Enhanced ReadinessNo ratings yet

- Greenhouse Gas ProtocolDocument4 pagesGreenhouse Gas ProtocolJan Aldrin AfosNo ratings yet

- H430TTM Sofitel Case Study PaperDocument16 pagesH430TTM Sofitel Case Study PaperMark XiarwilleNo ratings yet

- Climate Transition Finance Handbook Related Questions: 9 December 2020Document4 pagesClimate Transition Finance Handbook Related Questions: 9 December 2020glenlcyNo ratings yet

- World Bank Paris Alignment Method For Program For ResultsDocument17 pagesWorld Bank Paris Alignment Method For Program For ResultsshintiyaNo ratings yet

- IFI - Framework - For - Harmonized - Approach To - Greenhouse - Gas - AccountingDocument4 pagesIFI - Framework - For - Harmonized - Approach To - Greenhouse - Gas - Accountingdiqyst33251No ratings yet

- MDB Idfc Mitigation Common Principles enDocument64 pagesMDB Idfc Mitigation Common Principles enKicki AnderssonNo ratings yet

- Climate Impact Measurement: Urgency, Methodologies and A Way Forward With Dutch BanksDocument16 pagesClimate Impact Measurement: Urgency, Methodologies and A Way Forward With Dutch BanksgrobbebolNo ratings yet

- Sbti Criteria and Recommendations: Twg-Inf-002 - Version 4.2 April 2021Document21 pagesSbti Criteria and Recommendations: Twg-Inf-002 - Version 4.2 April 2021Three KenNo ratings yet

- EBRD Paris Alignment Methodology FinalDocument84 pagesEBRD Paris Alignment Methodology FinalYacoub Bani TahaNo ratings yet

- Katowice Banks 2020 Credit Portfolio AlignmentDocument52 pagesKatowice Banks 2020 Credit Portfolio AlignmentComunicarSe-Archivo100% (1)

- 2021 Summary of Annex ChangesDocument5 pages2021 Summary of Annex ChangesGabi MusatNo ratings yet

- En ANGELINI 15 Novembre 2022Document16 pagesEn ANGELINI 15 Novembre 2022MicheleNo ratings yet

- COP28 Net Zero Transition CharterDocument7 pagesCOP28 Net Zero Transition Charterglenn.cmuNo ratings yet

- Addressing Financial Risks From Climate Change 1689415144Document40 pagesAddressing Financial Risks From Climate Change 1689415144yvfrdn5mv9No ratings yet

- Tor 77680Document7 pagesTor 77680Wakarusa CoNo ratings yet

- Grant-Scheme-Rules Nicfi 01012020Document10 pagesGrant-Scheme-Rules Nicfi 01012020Antonio Mauricio MeloNo ratings yet

- Uk Pact FaqDocument16 pagesUk Pact FaqAlejandro León CelisNo ratings yet

- Sustainable Financial System 2021 - FINALDocument26 pagesSustainable Financial System 2021 - FINALSustainably MeNo ratings yet

- Glen 2018 Annual Report Climate ChangeDocument2 pagesGlen 2018 Annual Report Climate ChangeETOUNDI ESSIMI AlainNo ratings yet

- 2133 - Rapport Perriersynthese ENGDocument15 pages2133 - Rapport Perriersynthese ENGJeanNo ratings yet

- Fashion Industry Carter For Climate Action - 2021Document4 pagesFashion Industry Carter For Climate Action - 2021azzahraNo ratings yet

- Roadmap For The Development of A Functional National Greenhouse Gas Emissions Inventory System and MRV System For MoldovaDocument22 pagesRoadmap For The Development of A Functional National Greenhouse Gas Emissions Inventory System and MRV System For MoldovaYitzhak dextreNo ratings yet

- Cop12 Dial SaDocument11 pagesCop12 Dial SaRehan HassanNo ratings yet

- NZIA Target Setting Protocol Version 1.0Document39 pagesNZIA Target Setting Protocol Version 1.0ComunicarSe-ArchivoNo ratings yet

- Netzero PrinciplesDocument15 pagesNetzero PrinciplesComunicarSe-ArchivoNo ratings yet

- 01.introductory Materia... 03-07-2020 7.32 PMDocument20 pages01.introductory Materia... 03-07-2020 7.32 PMوليد محمد فكري عبيدNo ratings yet

- CDP Technical Note Science Based TargetsDocument16 pagesCDP Technical Note Science Based TargetsRoshan KhanNo ratings yet

- NZ en Accounting Alertdec 2020Document15 pagesNZ en Accounting Alertdec 2020Ike FinchNo ratings yet

- Climate-Related Reporting Standards Including The TCFD Framework and Their Impact On The Aviation Industry - Global Law Firm - Norton Rose FulbrightDocument9 pagesClimate-Related Reporting Standards Including The TCFD Framework and Their Impact On The Aviation Industry - Global Law Firm - Norton Rose Fulbrightpranav771vermaNo ratings yet

- Joint Statement Claims Recommendations On The VCM (Final)Document6 pagesJoint Statement Claims Recommendations On The VCM (Final)Michael WallNo ratings yet

- G20 Sustainable Finance RoadmapDocument37 pagesG20 Sustainable Finance RoadmapServina VarisyaNo ratings yet

- TCFD Scenario Analysis Methodology Outcome - Borregaard GroupDocument20 pagesTCFD Scenario Analysis Methodology Outcome - Borregaard GroupThanh Thủy PhạmNo ratings yet

- CDP Technical Note Science Based TargetsDocument19 pagesCDP Technical Note Science Based TargetsHerdhiska Pradhiarta AjiprayogaNo ratings yet

- Module 9: What You Will LearnDocument13 pagesModule 9: What You Will Learn刘宝英No ratings yet

- RBV2013 Conceptual FrameworkDocument32 pagesRBV2013 Conceptual FrameworkhemantbaidNo ratings yet

- SWISSCO Guidance Document SBTi StandardsDocument31 pagesSWISSCO Guidance Document SBTi StandardsJoaquin MunozNo ratings yet

- 33 11042 Fact SheetDocument3 pages33 11042 Fact SheetAlkaNo ratings yet

- Letter To ISSB On ED IFRS S1-S2Document30 pagesLetter To ISSB On ED IFRS S1-S2ahahahahahNo ratings yet

- Policy Brief Climate Finance in BrazilDocument11 pagesPolicy Brief Climate Finance in BrazilRafaella BarrosNo ratings yet

- Tubiana GCEP 110216Document15 pagesTubiana GCEP 110216younes BaylouxNo ratings yet

- The Copenhagen CommuniqueDocument3 pagesThe Copenhagen CommuniqueANDI Agencia de Noticias do Direito da InfanciaNo ratings yet

- Net Zero Standard CriteriaDocument16 pagesNet Zero Standard CriteriaQ LauNo ratings yet

- Issb Exposure Draft 2022 2 Climate Related DisclosuresDocument60 pagesIssb Exposure Draft 2022 2 Climate Related DisclosuresRiny AgustinNo ratings yet

- International Climate Change InitiativeDocument22 pagesInternational Climate Change InitiativeJameel AlzabidiNo ratings yet

- International Auditing and Assurance Standards Board Draft Action Plan 2005 - 2006Document10 pagesInternational Auditing and Assurance Standards Board Draft Action Plan 2005 - 2006gold.2000.dzNo ratings yet

- Joint Statement On Fossil Fuel SubsidiesDocument2 pagesJoint Statement On Fossil Fuel SubsidiesL'EchoNo ratings yet

- Aligning Portfolios With The Paris Agreement Product InsightDocument10 pagesAligning Portfolios With The Paris Agreement Product InsightFjbatisNo ratings yet

- Basel Committee On Banking SupervisionDocument14 pagesBasel Committee On Banking SupervisionRijesh RNNo ratings yet

- Sustainability - Overall ReviewDocument3 pagesSustainability - Overall ReviewThảo Phương AnhNo ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesSatesh Kumar KonduruNo ratings yet

- Working Towards A Harmonized Framework For Impact Reporting For Social BondsDocument11 pagesWorking Towards A Harmonized Framework For Impact Reporting For Social BondsbodnartiNo ratings yet

- Basel Committee On Banking SupervisionDocument21 pagesBasel Committee On Banking SupervisionMirko MaidaNo ratings yet

- Preface To IFRS Preface To International Financial Reporting Standards Purpose of Issuing PrefaceDocument4 pagesPreface To IFRS Preface To International Financial Reporting Standards Purpose of Issuing PrefaceJere Mae Bertuso TaganasNo ratings yet

- The Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesFrom EverandThe Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesNo ratings yet

- Green Design: An Introduction To Issues and Challenges: Werner JDocument6 pagesGreen Design: An Introduction To Issues and Challenges: Werner Jjulio perezNo ratings yet

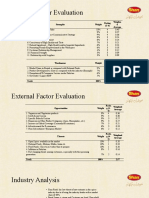

- Internal Factor Evaluation: Strengths Weight Rating (3-4) Weighte D AverageDocument3 pagesInternal Factor Evaluation: Strengths Weight Rating (3-4) Weighte D AverageHira NazNo ratings yet

- Wallstreetjournaleurope 20160819 The Wall Street Journal EuropeDocument36 pagesWallstreetjournaleurope 20160819 The Wall Street Journal EuropestefanoNo ratings yet

- Amena Akter Mim 1620741630 - SCM 320 Individual Assignment 1Document10 pagesAmena Akter Mim 1620741630 - SCM 320 Individual Assignment 1amena aktar MimNo ratings yet

- From (Nikita Nehriya (Nikita - Nehriya@gmail - Com) ) - ID (128) - ProjectDocument17 pagesFrom (Nikita Nehriya (Nikita - Nehriya@gmail - Com) ) - ID (128) - ProjectNikhil AradheNo ratings yet

- Price List Grand I10 Nios DT 01.05.2022Document1 pagePrice List Grand I10 Nios DT 01.05.2022VijayNo ratings yet

- E-Business Assignment AnswersDocument50 pagesE-Business Assignment AnswersAmeer HumzaNo ratings yet

- Theories, Development and Its Types Qualities of Negotiator and Process For NegotiationDocument20 pagesTheories, Development and Its Types Qualities of Negotiator and Process For NegotiationOjasvi AroraNo ratings yet

- Manage Security Agency Within Legal Framework - Rev.1Document44 pagesManage Security Agency Within Legal Framework - Rev.1Vksathiamoorthy KrishnanNo ratings yet

- Iffco at A GlanceDocument74 pagesIffco at A Glancelokesharya1No ratings yet

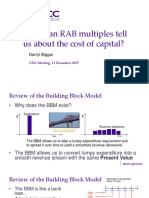

- AER Presentation On RAB MultiplesDocument18 pagesAER Presentation On RAB MultiplesKGNo ratings yet

- AML KYC Booklet 3rd Dec 2020Document12 pagesAML KYC Booklet 3rd Dec 2020Sawansolanki7167gmail.com Sawansam7167No ratings yet

- Career Planning NotesDocument5 pagesCareer Planning NotessreeyaNo ratings yet

- The Box MethodDocument9 pagesThe Box MethodDiyonata KortezNo ratings yet

- Cotton Cultivation &ginningDocument3 pagesCotton Cultivation &ginningJack PhelpsNo ratings yet

- Audit EvidenceDocument27 pagesAudit EvidenceMhmd HabboshNo ratings yet

- Ah! Capital Facilitation Agreement v17.10Document9 pagesAh! Capital Facilitation Agreement v17.10Mamidi Raja ManikantaNo ratings yet

- Automobile Corporation of Goa LTD: Federal-Mogul Goetze (India) LTDDocument4 pagesAutomobile Corporation of Goa LTD: Federal-Mogul Goetze (India) LTDShashikant VaidyanathanNo ratings yet

- MGP ApplicationDocument6 pagesMGP Application21f1006509No ratings yet

- ThePowerMBA GLOBALDocument6 pagesThePowerMBA GLOBALrosadomingobernausNo ratings yet

- R3 PT Canggu International-1 PDFDocument2 pagesR3 PT Canggu International-1 PDFkarina MEPNo ratings yet

- Aggregations of Manufacturing Based On NACE Rev. 2Document3 pagesAggregations of Manufacturing Based On NACE Rev. 2xdjqjfrxhiivnpNo ratings yet

- Economic Planning For OrganizationsDocument3 pagesEconomic Planning For Organizationszionne hiladoNo ratings yet

- Sadat Individal Assement. (Land)Document14 pagesSadat Individal Assement. (Land)nyamutoka rukiaNo ratings yet

- Homework Assignment 1 PDFDocument2 pagesHomework Assignment 1 PDFDavid RoblesNo ratings yet

- Introduction To Strategic ManagementDocument16 pagesIntroduction To Strategic ManagementNelsie PinedaNo ratings yet