Professional Documents

Culture Documents

Income Tax Payment Challan

Uploaded by

Muhammad Asif BashirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Payment Challan

Uploaded by

Muhammad Asif BashirCopyright:

Available Formats

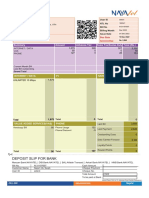

INCOME TAX PAYMENT CHALLAN

PSID # : 162397225

CTO Islamabad 7 6 2022

Name of LTU/MTU/RTO LTU/MTU/RTO Code Tax Year

Nature of Tax Admitted Income Tax Misc. CVT Month/Year

Payment

Demanded Income Tax Advance Income Tax Withheld Income Tax (Final) (only for payment u/s 149)

Withheld Income Tax (Adjustible) WPPF/WWF

Payment Section 137 Admitted Income Tax Payment Section Code 9203

(Section) (Description of Payment Section) Account Head (NAM) B01131

Taxpayer's Particulars (To be filled for payments other than Withholding Taxes) (To be filled in by the bank)

NTN 4380477-2 CNIC/Reg./Inc. No. 0092712

Taxpayer's Name WORDSMITH (PRIVATE) LIMITED Status

Business Name

Address HOUSE # 01 STREET # 46 FECHS KORANG TOWN

FOR WITHHOLDING TAXES ONLY

NTN/FTN of Withholding agent CNIC/Reg./Inc. No.

Name of withholding agent

Total no. of Taxpayers Total Tax Deducted

Amount of tax in words: One Hundred Sixty Seven Thousand Four Hundred Ninety Three Rs. 167,493

Rupees And No Paisas Only

Modes & particulars of payment

Sr. Type No. Amount Date Bank City Branch Name & Address

1 ADC (e- 167,493 No Branch

payment)

DECLARATION

I hereby declare that the particulars mentioned in this challan are correct.

CNIC of Depositor

Name of Depositor WORDSMITH (PRIVATE) LIMITED

Date

Stamp & Signature

PSID-IT-000131006552-002022

Prepared By : guest_user - Guest_User Date: 27-Dec-2022 01:27 PM

Note: This is an input form and should not be signed/stamped by the Bank. However, a CPR should be issued after receipt of payment by

the Bank.

You might also like

- Income Tax Payment Challan: PSID #: 145879823Document1 pageIncome Tax Payment Challan: PSID #: 145879823farhan aliNo ratings yet

- TAX - Quiz 1Document14 pagesTAX - Quiz 1Mojan VianaNo ratings yet

- International Tax OutlineDocument126 pagesInternational Tax OutlineMa Fajardo50% (2)

- 03 Chap 03 05 Mamalateo 2019 Tax BookDocument151 pages03 Chap 03 05 Mamalateo 2019 Tax BookZachary Siayngco100% (1)

- Corporate Income Tax Computations Over 3 YearsDocument61 pagesCorporate Income Tax Computations Over 3 YearsMay Grethel Joy Perante100% (1)

- Taxation PreweekDocument26 pagesTaxation PreweekMo Mindalano Mandangan100% (1)

- Cir Vs Procter and Gamble Philippine Manufacturing CorporationDocument4 pagesCir Vs Procter and Gamble Philippine Manufacturing CorporationRemson OrasNo ratings yet

- 2 Madrigal Vs Rafferty, G.R. No. L-12287 August 7, 1918Document4 pages2 Madrigal Vs Rafferty, G.R. No. L-12287 August 7, 1918Perry YapNo ratings yet

- Taxation ProblemsDocument6 pagesTaxation ProblemsanggandakonohNo ratings yet

- Revenue Audit Memorandum Order 1-95Document6 pagesRevenue Audit Memorandum Order 1-95azzy_km100% (1)

- Zamora vs. Collector of Internal Revenue: Summary: Mariano Zamora Owner of The Bay View HotelDocument26 pagesZamora vs. Collector of Internal Revenue: Summary: Mariano Zamora Owner of The Bay View HotelthethebigblackbookNo ratings yet

- It 000145577881 2023 00Document1 pageIt 000145577881 2023 00Hazrat BilalNo ratings yet

- It 000139444749 2022 00Document1 pageIt 000139444749 2022 00WajehNo ratings yet

- It 000147296140 2022 00Document1 pageIt 000147296140 2022 00MUHAMMAD TABRAIZNo ratings yet

- It 000137673641 2022 00Document1 pageIt 000137673641 2022 00ayanNo ratings yet

- It 000130629196 2021 00Document1 pageIt 000130629196 2021 00muhammad faiqNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanQazi zubairNo ratings yet

- It 000133212268 2023 01Document1 pageIt 000133212268 2023 01omer akhterNo ratings yet

- It 000144391613 2022 00Document1 pageIt 000144391613 2022 00Muhammad Aamir AbbasNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanWaris Corp.No ratings yet

- Income Tax Payment Challan: PSID #: 162486635Document1 pageIncome Tax Payment Challan: PSID #: 162486635samNo ratings yet

- Income Tax Payment Challan: PSID #: 171894732Document1 pageIncome Tax Payment Challan: PSID #: 171894732moxykho109No ratings yet

- It 000144586598 2022 00Document1 pageIt 000144586598 2022 00hizbullahjantankNo ratings yet

- It 000141516198 2022 00Document1 pageIt 000141516198 2022 00Abdul Basit KtkNo ratings yet

- It 000151339382 2023 00Document1 pageIt 000151339382 2023 00shaheenmagamartNo ratings yet

- It 000144271793 2022 00Document1 pageIt 000144271793 2022 00online69979No ratings yet

- It 000130389542 2023 11Document1 pageIt 000130389542 2023 11Muneeb ChaudhryNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- It 000136606018 2022 00Document1 pageIt 000136606018 2022 00Amazon wall streetNo ratings yet

- It 000146384671 2022 00Document1 pageIt 000146384671 2022 00zohaib hassan ShahNo ratings yet

- Income Tax Payment Challan: PSID #: 50631682Document1 pageIncome Tax Payment Challan: PSID #: 50631682ZeeshanNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- Income Tax Payment Challan: PSID #: 173203210Document1 pageIncome Tax Payment Challan: PSID #: 173203210Muhammad QayyumNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanSyed Tahir ImamNo ratings yet

- It 000144747898 2022 00Document1 pageIt 000144747898 2022 00hizbullahjantankNo ratings yet

- It 000141511985 2022 00Document1 pageIt 000141511985 2022 00Abdul Basit KtkNo ratings yet

- It 000152818667 2023 00Document1 pageIt 000152818667 2023 00b3024345No ratings yet

- Income Tax Payment Challan DetailsDocument1 pageIncome Tax Payment Challan DetailsSyed Tahir ImamNo ratings yet

- Income Tax Payment Challan: PSID #: 175921882Document1 pageIncome Tax Payment Challan: PSID #: 175921882taxhouse.kasur786No ratings yet

- Saeed KhanDocument1 pageSaeed Khanattock jadeedNo ratings yet

- Nawaz Challan Tax Year 2022 It-000146079994-2022-00Document1 pageNawaz Challan Tax Year 2022 It-000146079994-2022-00Shahid AminNo ratings yet

- Income Tax Payment Challan: PSID #: 165866486Document1 pageIncome Tax Payment Challan: PSID #: 165866486Ashok KumarNo ratings yet

- It 000141614736 2022 00Document1 pageIt 000141614736 2022 00Shahbaz MuhammadNo ratings yet

- It 000144628237 2024 10Document1 pageIt 000144628237 2024 10hizbullahjantankNo ratings yet

- Income Tax Payment Challan: PSID #: 148473407Document1 pageIncome Tax Payment Challan: PSID #: 148473407Haseeb RazaNo ratings yet

- Income Tax Payment Challan: PSID #: 144740076Document1 pageIncome Tax Payment Challan: PSID #: 144740076usama ameenNo ratings yet

- It 000144564836 2024 10Document1 pageIt 000144564836 2024 10MUHAMMAD TABRAIZNo ratings yet

- It 000136721186 2022 00Document1 pageIt 000136721186 2022 00wali khelNo ratings yet

- It 000145493451 2022 00Document1 pageIt 000145493451 2022 00Salman AhmedNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challangandapur khanNo ratings yet

- IT-000132223866-2023-01Document1 pageIT-000132223866-2023-01mazharehsan08No ratings yet

- It 000133172232 2023 01Document1 pageIt 000133172232 2023 01omer akhterNo ratings yet

- Income Tax Payment Challan: PSID #: 165120097Document1 pageIncome Tax Payment Challan: PSID #: 165120097FBR GujranwalaNo ratings yet

- Income Tax Payment Challan: PSID #: 148473028Document1 pageIncome Tax Payment Challan: PSID #: 148473028Haseeb RazaNo ratings yet

- It 000144378527 2022 00Document1 pageIt 000144378527 2022 00حنفیت اور شیعت مقلدNo ratings yet

- It 000142649015 2022 00Document1 pageIt 000142649015 2022 00MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 150493633Document1 pageIncome Tax Payment Challan: PSID #: 150493633Shehla FarooqNo ratings yet

- Income Tax Payment Challan: PSID #: 161602500Document1 pageIncome Tax Payment Challan: PSID #: 161602500Muhammad Asif BashirNo ratings yet

- Goga 2.5Document1 pageGoga 2.5advocateyaqootNo ratings yet

- Income Tax Payment Challan DetailsDocument1 pageIncome Tax Payment Challan DetailsHaseeb RazaNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- It 000144418085 2024 10Document1 pageIt 000144418085 2024 10Sheeraz AhmedNo ratings yet

- Income Tax Payment Challan: PSID #: 48977809Document1 pageIncome Tax Payment Challan: PSID #: 48977809Abdul SattarNo ratings yet

- TAHIR HUSSAIN SHAH 236 K 12000Document1 pageTAHIR HUSSAIN SHAH 236 K 12000mazharehsan08No ratings yet

- Income Tax Payment Challan: PSID #: 165866345Document1 pageIncome Tax Payment Challan: PSID #: 165866345Ashok KumarNo ratings yet

- Income Tax Payment Challan: PSID #: 43320237Document1 pageIncome Tax Payment Challan: PSID #: 43320237gandapur khanNo ratings yet

- Income Tax Payment Challan: PSID #: 148643587Document1 pageIncome Tax Payment Challan: PSID #: 148643587Ehtsham AliNo ratings yet

- Income Tax Payment Challan: PSID #: 42719670Document1 pageIncome Tax Payment Challan: PSID #: 42719670Muhammad Qaisar LatifNo ratings yet

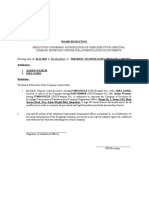

- Hearing of Appeal - 21-11-2022Document2 pagesHearing of Appeal - 21-11-2022Muhammad Asif BashirNo ratings yet

- Invoice for Hard HatsDocument1 pageInvoice for Hard HatsMuhammad Asif BashirNo ratings yet

- Form 45Document1 pageForm 45Muhammad Asif BashirNo ratings yet

- MOADocument4 pagesMOAMuhammad Asif BashirNo ratings yet

- House of Lakhani Invoice for Social Media Marketing ServicesDocument1 pageHouse of Lakhani Invoice for Social Media Marketing ServicesMuhammad Asif BashirNo ratings yet

- Deposit Slip For Bank: Amount Advance Tax Sales Tax/Excise Duty Total (RS.)Document2 pagesDeposit Slip For Bank: Amount Advance Tax Sales Tax/Excise Duty Total (RS.)Muhammad Asif BashirNo ratings yet

- Aident NTNDocument1 pageAident NTNMuhammad Asif BashirNo ratings yet

- Income Tax Payment Challan: PSID #: 161602500Document1 pageIncome Tax Payment Challan: PSID #: 161602500Muhammad Asif BashirNo ratings yet

- Instruction No.4 2017Document1 pageInstruction No.4 2017Muhammad Asif BashirNo ratings yet

- Payment Details: Email: Investor - Relations@pidilite - Co.inDocument2 pagesPayment Details: Email: Investor - Relations@pidilite - Co.inOpenText DataNo ratings yet

- P&A - Local Taxation of PEZADocument2 pagesP&A - Local Taxation of PEZACkey ArNo ratings yet

- ENTREPRENEURSHIP QUARTER 2 MODULE 10 Computation-of-Gross-ProfitDocument11 pagesENTREPRENEURSHIP QUARTER 2 MODULE 10 Computation-of-Gross-Profitrichard reyesNo ratings yet

- Tax 1 Valencia Solman For Chap 2Document12 pagesTax 1 Valencia Solman For Chap 2Yeovil Pansacala100% (1)

- Form No. 15G: (See Rule 29C)Document1 pageForm No. 15G: (See Rule 29C)MKNo ratings yet

- BIR Form 1700 filing guideDocument72 pagesBIR Form 1700 filing guidemiles1280No ratings yet

- 2018 Greece Prooptiki SaDocument33 pages2018 Greece Prooptiki SaMoroie MariaNo ratings yet

- Assessment of Charitable Institution-A Comprehensive Case StudyDocument22 pagesAssessment of Charitable Institution-A Comprehensive Case StudyRachana P NNo ratings yet

- CIT Vs Shree Meenakshi Mills LTDDocument6 pagesCIT Vs Shree Meenakshi Mills LTDKomalpreet KaurNo ratings yet

- 10 Da-596-06Document3 pages10 Da-596-06Cheska VergaraNo ratings yet

- Tan vs. Del Rosario, JRDocument5 pagesTan vs. Del Rosario, JRAnonymous KgOu1VfNyBNo ratings yet

- Tax Finals Angel PDFDocument20 pagesTax Finals Angel PDFJosh RoaNo ratings yet

- Budget1 Taxation Upto GSTDocument37 pagesBudget1 Taxation Upto GSTbhavyaNo ratings yet

- Tax II Chapter IDocument49 pagesTax II Chapter IsejalNo ratings yet

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Document2 pagesIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNo ratings yet

- Elements of Taxation Elements of Taxatio PDFDocument24 pagesElements of Taxation Elements of Taxatio PDFTuryamureeba JuliusNo ratings yet

- Cir v. ST Luke's Medical Center Inc. GR No. 195909Document11 pagesCir v. ST Luke's Medical Center Inc. GR No. 195909Joshua RodriguezNo ratings yet

- ACC 311 Sample Problem General Instructions:: ST ND RD THDocument1 pageACC 311 Sample Problem General Instructions:: ST ND RD THexquisiteNo ratings yet

- TaxDocument11 pagesTaxWilsonNo ratings yet

- BIR Ruling 359-17Document5 pagesBIR Ruling 359-17Bobby Olavides SebastianNo ratings yet