Professional Documents

Culture Documents

Bank

Uploaded by

sanuj singh0 ratings0% found this document useful (0 votes)

9 views11 pagesThis document discusses different types of banks, including public sector banks and private sector banks. Public sector banks are banks where the government owns over 50% shares. They offer services nationwide and have large customer bases due to perceptions of security. However, they also have disadvantages like bureaucratic management and inability to make quick decisions. Private sector banks are majority owned by private entities. They offer customized services and quick decisions but charge more fees and don't serve rural areas as extensively.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses different types of banks, including public sector banks and private sector banks. Public sector banks are banks where the government owns over 50% shares. They offer services nationwide and have large customer bases due to perceptions of security. However, they also have disadvantages like bureaucratic management and inability to make quick decisions. Private sector banks are majority owned by private entities. They offer customized services and quick decisions but charge more fees and don't serve rural areas as extensively.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views11 pagesBank

Uploaded by

sanuj singhThis document discusses different types of banks, including public sector banks and private sector banks. Public sector banks are banks where the government owns over 50% shares. They offer services nationwide and have large customer bases due to perceptions of security. However, they also have disadvantages like bureaucratic management and inability to make quick decisions. Private sector banks are majority owned by private entities. They offer customized services and quick decisions but charge more fees and don't serve rural areas as extensively.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

A bank is a financial institution

licensed to receive deposits and make

loans. Banks may also provide

financial services such as wealth

management

Types of Bank

Central Bank.

Cooperative Banks.

Commercial Banks.

Regional Rural Banks (RRB)

Local Area Banks (LAB)

Specialized Banks.

Small Finance Banks.

Payments Banks.

Banking Product

Fixed Deposit

Recuring Deposit

Debit Card

Credit Card

Savings Account

Current Account

What is Public Sector Bank ?

Public sector banks are those banks where the

government holds more than 50% ownership. With

these banks, the government regulates the financial

guidelines. Because of government ownership, most

depositors believe that their money is more secured in

public sector banks. As a result, most public sector

banks have a large customer base.

Advantages of Public Sector Bank

Here are some advantages customers get from

public sector banks.

High-interest rate on deposits

Low-interest charge on loans

Employees get full job security

These employees also get a pension after retirement

Offer service to a large customer base

Offer their service to the rural part of the nation

Offer financial service through multiple branches

Disadvantages of Public Sector

Bank.

Here are some disadvantages associated with public

sector banks.

The big bureaucratic system at the management level

Inability to a big financial decision quickly

Offer less customized service to the customers

Too many complaints against the employees for their poor

service

Most public sector banks are suffering from big corruption

scandals

High defaulter rate from the customer

Public sector banks spend lots of money on financial

operation

What is Private Sector Bank ?

Private Sector Banks: In these banks,

most of the equity is owned by private

bodies, corporations, institutions or

individuals rather than government.

These banks are managed and

controlled by private promoters.

Advantages of Private Sector Bank

Here are some advantages that are associated with

private sector banks.

Private Sector Banks offer quick service to the

customers.

These banks also offer customized services according

to the customer’s financial needs.

Private Sector Banks has a streamlined management

system.

Quick financial decision making is possible in private

sector banks

Here are some common disadvantages of private sector

banks.

Private Sector Banks charge extra on every financial service.

These banks only operate in cities and out of reach for the

rural population.

Private Sector Banks offer no job security to the employees.

Thank you

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- Introduction To BankingDocument59 pagesIntroduction To Bankingshahyashr100% (1)

- Sample Trust Deed - PDFDocument18 pagesSample Trust Deed - PDFJayarma Parlikad100% (3)

- CM1 Specimen Questions and SolutionsDocument5 pagesCM1 Specimen Questions and SolutionsBakari HamisiNo ratings yet

- Commercial BanksDocument25 pagesCommercial BanksAe AsisNo ratings yet

- Branch Banking SystemDocument16 pagesBranch Banking SystemPrathyusha ReddyNo ratings yet

- DPDP by KPMGDocument19 pagesDPDP by KPMGnidelel214No ratings yet

- Theories of International BusinessDocument6 pagesTheories of International Businessrgayathri16100% (2)

- Core Banking Solution For US Community Banks, Credit Unioins - BankingDocument15 pagesCore Banking Solution For US Community Banks, Credit Unioins - BankingAnil Kumar100% (1)

- The Functional Microfinance Bank: Strategies for SurvivalFrom EverandThe Functional Microfinance Bank: Strategies for SurvivalNo ratings yet

- Business Model of A Bank Through Business Canvas ModelDocument3 pagesBusiness Model of A Bank Through Business Canvas ModelAyush Jaiswal50% (2)

- New Non Banking Financial InstitutionsDocument18 pagesNew Non Banking Financial InstitutionsGarima SinghNo ratings yet

- Chapter 3 PDFDocument27 pagesChapter 3 PDFMaritoni MedallaNo ratings yet

- Media ResearchDocument53 pagesMedia Researchdeepak kumarNo ratings yet

- Banking Untuk Presentation.Document6 pagesBanking Untuk Presentation.qyrahcrusNo ratings yet

- Organizational Structures of Bank - Chapter-2Document4 pagesOrganizational Structures of Bank - Chapter-2KRZ. Arpon Root HackerNo ratings yet

- Banking Explained - TechnofunkDocument14 pagesBanking Explained - TechnofunkFawaaz KhurwolahNo ratings yet

- About Vietnamese FiannceDocument13 pagesAbout Vietnamese FiannceAnNo ratings yet

- Internship ReportDocument34 pagesInternship ReportSanthoshi DuraiNo ratings yet

- Assignment Principes of BankingDocument6 pagesAssignment Principes of BankingRabiul Karim ShipluNo ratings yet

- Retail and Wholesale BankingDocument8 pagesRetail and Wholesale Bankingpradeep3673No ratings yet

- What Are The Different Types of Indian BanksDocument3 pagesWhat Are The Different Types of Indian BanksMarcel Sylvester0% (1)

- What Is Commercial Bank?: (A) Primary FunctionsDocument17 pagesWhat Is Commercial Bank?: (A) Primary Functions20E0218 VETRIVELNo ratings yet

- Overview of Banking IndustryDocument12 pagesOverview of Banking Industrybeena antuNo ratings yet

- RB NotesDocument35 pagesRB NotesmyokhinewinNo ratings yet

- Retail BanksDocument10 pagesRetail BanksAnn RoseNo ratings yet

- Branch Banking SystemDocument6 pagesBranch Banking SystemNabhonil Basu ChoudhuryNo ratings yet

- Saving Plan and PaymentsDocument45 pagesSaving Plan and PaymentsJan Francine AbanteNo ratings yet

- SudhaDocument12 pagesSudhaRAJ GAUTAMNo ratings yet

- Commercial and Cooperative BanksDocument18 pagesCommercial and Cooperative BanksDODONo ratings yet

- Banking and Insurance Anuj AssingmentDocument4 pagesBanking and Insurance Anuj AssingmentNabin AdNo ratings yet

- COMMERCIALDocument15 pagesCOMMERCIALBadbitchNo ratings yet

- Retail BankingDocument19 pagesRetail BankingRajesh JyothiNo ratings yet

- Banking ServicesDocument24 pagesBanking Services004. Amlikar ChaitaliNo ratings yet

- Commercial BanksDocument28 pagesCommercial BanksHarshita MarmatNo ratings yet

- Overview of Banking IndustryDocument18 pagesOverview of Banking IndustryNekta PinchaNo ratings yet

- Fm1 Categories of BanksDocument31 pagesFm1 Categories of BanksJane Carla BorromeoNo ratings yet

- Unit III: Introduction To Financial InstitutionDocument11 pagesUnit III: Introduction To Financial Institutionshourya rastogiNo ratings yet

- What Is Differential BankingDocument8 pagesWhat Is Differential BankingSakshiNo ratings yet

- Cooperative Bank: Finance FunctionDocument2 pagesCooperative Bank: Finance FunctionKaranPatilNo ratings yet

- Non Banking InstitutionsDocument42 pagesNon Banking Institutionsramesh.kNo ratings yet

- Banking Products & Operations: Session 7Document34 pagesBanking Products & Operations: Session 7Vaidyanathan RavichandranNo ratings yet

- Introduction To Co OpsDocument5 pagesIntroduction To Co Opssapanamadas4540No ratings yet

- Branch BankingDocument22 pagesBranch BankingSakthiNo ratings yet

- Banking Awareness: Unit BankingDocument2 pagesBanking Awareness: Unit Bankingparam_pasrichaNo ratings yet

- Banking & Finanacial Institution ChotaDocument20 pagesBanking & Finanacial Institution Chotaavinashpandey10102001No ratings yet

- Standard Chartered BankDocument28 pagesStandard Chartered BankRajni YadavNo ratings yet

- Final ProjectDocument73 pagesFinal ProjectShilpa NikamNo ratings yet

- Services of Private and Public BankDocument1 pageServices of Private and Public BankDipak K. SahNo ratings yet

- Assignment 2: Submitted By, Team 4 & Team 5 Ii Bcom (A&F)Document10 pagesAssignment 2: Submitted By, Team 4 & Team 5 Ii Bcom (A&F)Gadha S UdayanNo ratings yet

- Assignment Banking-1Document8 pagesAssignment Banking-1Al RafiNo ratings yet

- Basharat Adil COMPLETEDocument66 pagesBasharat Adil COMPLETEBasharat AdilNo ratings yet

- Banking OmbudsmanDocument73 pagesBanking OmbudsmanmoregauravNo ratings yet

- Introduction and Design of The StudyDocument37 pagesIntroduction and Design of The StudySathya SelvanNo ratings yet

- Vietnam Has A Robust Banking System With Several Commercial Banks Operating in The CountryDocument5 pagesVietnam Has A Robust Banking System With Several Commercial Banks Operating in The Countrynguyenphuongly04No ratings yet

- Unit 2-3Document12 pagesUnit 2-3Yuvashree GNo ratings yet

- Module 2 2020Document87 pagesModule 2 2020Hariprasad bhatNo ratings yet

- Types of Banks: BankingDocument11 pagesTypes of Banks: BankingKaviya KaviNo ratings yet

- Disadvantages of Branch BankingDocument12 pagesDisadvantages of Branch Bankingsirjoel100% (2)

- Retail Banking in IndiaDocument3 pagesRetail Banking in Indiabeena antuNo ratings yet

- Module 1Document15 pagesModule 1Prajakta GokhaleNo ratings yet

- Du Banking 1Document25 pagesDu Banking 114.104.royNo ratings yet

- Name Regestration No Program Cource Title Assighment No Cource Instructor UniversityDocument8 pagesName Regestration No Program Cource Title Assighment No Cource Instructor UniversityIzzah CurlNo ratings yet

- Economics FinalDocument36 pagesEconomics FinalPratham PrahaladkaNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- V Vii Time Table Jan. 2023Document8 pagesV Vii Time Table Jan. 2023sanuj singhNo ratings yet

- CBCS Paper Time TableDocument1 pageCBCS Paper Time Tablesanuj singhNo ratings yet

- Iii Sem Time Table Jan. 2023Document12 pagesIii Sem Time Table Jan. 2023sanuj singhNo ratings yet

- How Should They Segment Their Customers?Document2 pagesHow Should They Segment Their Customers?sanuj singhNo ratings yet

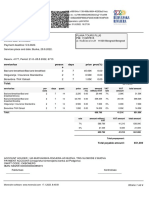

- Invoice 2260, 2261, 2262Document4 pagesInvoice 2260, 2261, 2262miroljubNo ratings yet

- World Current Affairs Mcqs For NTS TEST, FPSC TEST and PMS CSSDocument3 pagesWorld Current Affairs Mcqs For NTS TEST, FPSC TEST and PMS CSSYasin CNo ratings yet

- Encrypt SignedfinalDocument2 pagesEncrypt SignedfinalRamNo ratings yet

- List of HDWOsDocument16 pagesList of HDWOsrohanagarwalNo ratings yet

- Centre State RelationsDocument7 pagesCentre State RelationsSubscriptions NikhilNo ratings yet

- 2018LLB003 - DPC - Sem Vii - Research PaperDocument16 pages2018LLB003 - DPC - Sem Vii - Research PaperAishwarya BuddharajuNo ratings yet

- IRI Report Understand Me Dont Define MeDocument25 pagesIRI Report Understand Me Dont Define Međạt QuốcNo ratings yet

- Question-and-Answer PRISAP PreparationDocument17 pagesQuestion-and-Answer PRISAP PreparationAdrianne John EmperadorNo ratings yet

- Risk Management Approach For Testing and Calibration Laboratories - SpringerLinkDocument8 pagesRisk Management Approach For Testing and Calibration Laboratories - SpringerLinkrobert borgNo ratings yet

- M/S Best Sellers Retail (I) P.Ltdvs M/S Aditya Birla Nuvo Ltd.&Ors (2012) 6 SCC 792Document4 pagesM/S Best Sellers Retail (I) P.Ltdvs M/S Aditya Birla Nuvo Ltd.&Ors (2012) 6 SCC 792sai kiran gudisevaNo ratings yet

- Newcase MNLdraftDocument2 pagesNewcase MNLdraftHari DasNo ratings yet

- Introduction To Open InnovationDocument7 pagesIntroduction To Open InnovationShivam PatelNo ratings yet

- Vietnam War Notes With TimelineDocument27 pagesVietnam War Notes With TimelineLuNo ratings yet

- Roscorla V ThomasDocument1 pageRoscorla V ThomasIrwanshah100% (4)

- Fixed Asset 31122022Document1,406 pagesFixed Asset 31122022kelsykalokiNo ratings yet

- Syariah Subordinate CourtDocument1 pageSyariah Subordinate CourtIrah ZinirahNo ratings yet

- Sample - Syllabus - ICL 860 Refugee Protection F21Document9 pagesSample - Syllabus - ICL 860 Refugee Protection F21offsite.orgNo ratings yet

- Hostel Allotment Circular - II III IV V Years of All Other Programmes-V2Document4 pagesHostel Allotment Circular - II III IV V Years of All Other Programmes-V2Saiei eiNo ratings yet

- Abello vs. CIRDocument2 pagesAbello vs. CIRluis capulongNo ratings yet

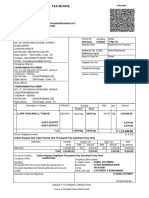

- Tax InvoiceDocument2 pagesTax InvoiceTechnetNo ratings yet

- E-Auction Spec SDSTPS - UploadDocument21 pagesE-Auction Spec SDSTPS - Uploadvsakr1No ratings yet

- Ucsp - ReviewerDocument2 pagesUcsp - ReviewerLucille Maye ArceNo ratings yet

- Punjabi Hits LegalDocument12 pagesPunjabi Hits LegaldivanshuNo ratings yet

- Family Law ProjectDocument20 pagesFamily Law Projectsomya100% (1)