Professional Documents

Culture Documents

Itdf 2

Itdf 2

Uploaded by

Rajan KMR0 ratings0% found this document useful (0 votes)

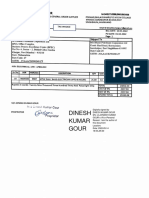

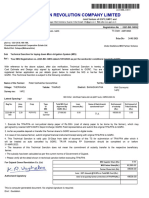

10 views3 pagesThe document is an investment declaration for an employee named M Kundru Malai Rajan for the month of September 2021 under the old tax regime. It details the employee's HRA exemption of Rs. 21,000 per month from May 2021 to March 2022 paid to landlord Geetha M. It also lists deductions of Rs. 79,000 under section 80D for medical insurance and Rs. 300,000 under section 80E for education loan interest. Total deductions under sections 80C and 80CCC are Rs. 207,729 which include EPF, life insurance, and NPS contributions.

Original Description:

Original Title

ITDF-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is an investment declaration for an employee named M Kundru Malai Rajan for the month of September 2021 under the old tax regime. It details the employee's HRA exemption of Rs. 21,000 per month from May 2021 to March 2022 paid to landlord Geetha M. It also lists deductions of Rs. 79,000 under section 80D for medical insurance and Rs. 300,000 under section 80E for education loan interest. Total deductions under sections 80C and 80CCC are Rs. 207,729 which include EPF, life insurance, and NPS contributions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesItdf 2

Itdf 2

Uploaded by

Rajan KMRThe document is an investment declaration for an employee named M Kundru Malai Rajan for the month of September 2021 under the old tax regime. It details the employee's HRA exemption of Rs. 21,000 per month from May 2021 to March 2022 paid to landlord Geetha M. It also lists deductions of Rs. 79,000 under section 80D for medical insurance and Rs. 300,000 under section 80E for education loan interest. Total deductions under sections 80C and 80CCC are Rs. 207,729 which include EPF, life insurance, and NPS contributions.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

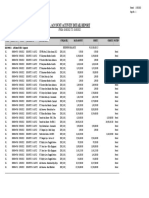

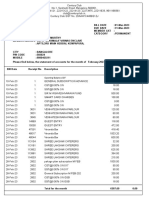

Details of Investment Declaration for the Month of September

Old Tax Regime

2021

Employee Details

Employee Code 300058471 Name M Kundru Malai Rajan

PAN No BURPK0719A Date of Joining 03/05/2021

Information for HRA Exemption

Landlord Landlord Address of rented

Month City Amount Declared

Name PAN accommodation

Apr-21 0.00

May-21 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Jun-21 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Jul-21 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Aug-21 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Sep-21 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Oct-21 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Nov-21 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Dec-21 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Jan-22 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Feb-22 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

Mar-22 GEETHA M BSDPG7341E 210/1, 1st Cross, 2nd A Others 21000.00

Cross Main Road,

Nagappareddy Layout,

Kaggadesapura,

Bangalore

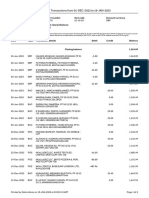

Housing Loan/House Property/Other Income Amount Declared

House Property Income/(Loss) - Let Out Property (Sec 24(b)) 0.00

Interest on Housing Loan-Self Occupied Property (Sec 24(b)) 0.00

Other Income (Bank Interest, etc.) 0.00

Previous Employment Income Amount Declared

Income received from previous employer salary 0.00

Professional Tax recovered by previous employer 0.00

Provident Fund contributed with Previous employer 0.00

Tax paid outside salary / Tax recovered by previous employer 0.00

Other Permitted Exemptions (Section 80D to 80U) Amount Declared

Medical Insurance Premium (Sec 80D) 26000.00

Medical Insurance Premium for parents (Sec 80D) 0.00

Medical Insurance Premium paid for senior Citizen (Parents) 53000.00

Medical for Handicapped Dependents (Sec 80DD) 0.00

Medical for Handicapped Dependents (severe disability) (Sec 80 DD) 0.00

Medical for Specified Diseases (Sec 80DDB) 0.00

Medical for Specified Diseases for Senior Citizen (Sec 80DDB) 0.00

Interest Paid on Higher Education Loan (Sec 80E) 300000.00

Deduction for Permanent Disability (Sec 80U) 0.00

Interest on House Property (Sec 80EE) 0.00

Interest on Housing Loan - Additional Deduction (Sec 80EEA) 450000.00

Tax Exemption on Loan for Purchase of Electric Vehicles (Sec 80EEB) 0.00

Total Deductibles 829000.00

Total Investments U/s 80C & 80CCC limited up to Rs.1.5 Lakhs +

Amount Declared

Rs.50000 for additional NPS

Employees Provident Fund (Auto populated through payroll) 93729.00

Voluntary Provident Fund (Auto populated through payroll) 0.00

Deduction under Life Insurance Pension Scheme (Sec 80CCC) 0.00

Public Provident Fund 0.00

Children Education Expenses 0.00

National Savings Certificate (NSC) 0.00

Life Insurance Premium 114000.00

Housing Loan Principal Repayment 0.00

Others - Post Office Savings Schemes , Tax Saver Term Deposit - 5 years 0.00

Sukanya Samriddhi Scheme 0.00

Long term Infrastructure Bonds ( 80CCF) 0.00

Accrued NSC Interest 0.00

Mutual Funds / ULIP 0.00

Employee's contribution towards NPS 0.00

Total Investments U/s 80C & 80CCC limited up to Rs.1.5 Lakhs + Rs.50000 for

207729.00

additional NPS

You might also like

- Stuckenbruck, Loren T. (Editor) and Daniel M. Gurtner (Editor) T&T Clark Encyclopedia of Second Temple Judaism. Vol. 1. T&T Clark (2020)Document649 pagesStuckenbruck, Loren T. (Editor) and Daniel M. Gurtner (Editor) T&T Clark Encyclopedia of Second Temple Judaism. Vol. 1. T&T Clark (2020)Nestor Petruk100% (3)

- Conceptual Contours of ArrestDocument17 pagesConceptual Contours of Arrestgargi sharma100% (3)

- Star GazingDocument30 pagesStar GazingCarmen Lu Páez100% (2)

- Wedding Checklist - MishDocument3 pagesWedding Checklist - MishHannah PayasNo ratings yet

- Reconstructing Caste HistoryDocument5 pagesReconstructing Caste HistoryRamesha Jayaneththi0% (1)

- Vignesh CochinDocument1 pageVignesh CochinRajan KMRNo ratings yet

- Intellectual PropertyDocument41 pagesIntellectual PropertyDiana WangamatiNo ratings yet

- Consolidated Unpaid Dividend List As On 30.07.2015Document393 pagesConsolidated Unpaid Dividend List As On 30.07.2015JamesNo ratings yet

- Statement de Aprail - 20-Mar 2021Document175 pagesStatement de Aprail - 20-Mar 2021Balachander RNo ratings yet

- Statement de Aprail - 20-Mar 2021Document175 pagesStatement de Aprail - 20-Mar 2021Balachander RNo ratings yet

- Cause ListDocument13 pagesCause ListVishnu PrasadNo ratings yet

- Tenderers' Info November 2021Document7,044 pagesTenderers' Info November 2021Shohel RanaNo ratings yet

- ABJ - InD As 116 - Disclosure Final Update 1Document38 pagesABJ - InD As 116 - Disclosure Final Update 1APS PlacementsNo ratings yet

- AY 2021 Admission - DetailsDocument25 pagesAY 2021 Admission - DetailsRohith KumarNo ratings yet

- SQ - Notice AllDocument1 pageSQ - Notice AllSanzay DahalNo ratings yet

- PT Geoservices LTD.: FROM 01/08/2022 TO 31/08/2022Document6 pagesPT Geoservices LTD.: FROM 01/08/2022 TO 31/08/2022heruNo ratings yet

- Kh521, Bicano Colony Surajpur Greater Noida, Gautam Budh Nagar 201306Document2 pagesKh521, Bicano Colony Surajpur Greater Noida, Gautam Budh Nagar 201306crackresultsNo ratings yet

- February 2023 PayslipDocument1 pageFebruary 2023 Payslipisaaclevey536No ratings yet

- Wellhead Gas Prices Period July To December 2020Document3 pagesWellhead Gas Prices Period July To December 2020Saad AliNo ratings yet

- Kashipur CompaniesDocument3 pagesKashipur Companiestecbatch1No ratings yet

- Nandigama: SachivalayamDocument4 pagesNandigama: Sachivalayamkunkalaguntagp2No ratings yet

- Dr. Agarwals Eye Hospital: No. 2, Ludhiana Road, Opposite S.G.G School, Raikot, Punjab-141109Document1 pageDr. Agarwals Eye Hospital: No. 2, Ludhiana Road, Opposite S.G.G School, Raikot, Punjab-141109Hardeepsingh DhaliwalNo ratings yet

- Materials Sample Details: National Highway Authority of India (PIU Ahmedabad)Document4 pagesMaterials Sample Details: National Highway Authority of India (PIU Ahmedabad)ali akbar lokhandwalaNo ratings yet

- Cataloc Online - Purchase RequititionDocument2 pagesCataloc Online - Purchase RequititionEdy AntoNo ratings yet

- 10 Jan 2023 10-05-15 Account Statement Transaction HistoryDocument3 pages10 Jan 2023 10-05-15 Account Statement Transaction HistoryHalima AdnanNo ratings yet

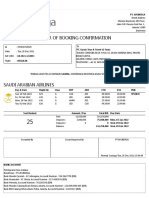

- W92BJX 25paxDocument1 pageW92BJX 25paxRhendy CaniagoyNo ratings yet

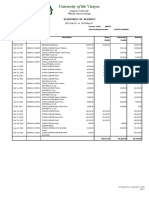

- University of The Visayas: Bohol, Mark Joseph BDocument1 pageUniversity of The Visayas: Bohol, Mark Joseph BMary joy BoholNo ratings yet

- Bharat Sanchar Nigam Limited: A.C.E.-2 A/C NoDocument9 pagesBharat Sanchar Nigam Limited: A.C.E.-2 A/C NoSDE BSNLNo ratings yet

- PDK 03Document1 pagePDK 03anuragv.paawanNo ratings yet

- Data Penjualan Victoria AsriDocument1 pageData Penjualan Victoria AsriMuhammad IsaNo ratings yet

- Wa0049.Document9 pagesWa0049.Shree EntertainmentNo ratings yet

- Opening Balance B/F 0.00Document2 pagesOpening Balance B/F 0.00Ram MurthyNo ratings yet

- The Honourable Sri Justice B.Vijaysen Reddy To Be Heard On Tuesday The 28th Day of June 2022 (AT 12:00 NOON) (Motion List)Document10 pagesThe Honourable Sri Justice B.Vijaysen Reddy To Be Heard On Tuesday The 28th Day of June 2022 (AT 12:00 NOON) (Motion List)Q TubeNo ratings yet

- CY 2020 Admission DetailsDocument12 pagesCY 2020 Admission Detailsammu kannanNo ratings yet

- Outstanding 21-22Document3 pagesOutstanding 21-22Achena BoipokaNo ratings yet

- Grab HelpCenter 18082022Document5 pagesGrab HelpCenter 18082022Siriepathi SeetharamanNo ratings yet

- Cost Extra JointDocument3 pagesCost Extra JointCitra KitabisaNo ratings yet

- 546604050000007Document29 pages546604050000007PriyankaNo ratings yet

- Order 1695504741830Document1 pageOrder 1695504741830JaiNo ratings yet

- Job CardDocument4 pagesJob Cardtechnosumit18230No ratings yet

- Ocrv Report ViewerDocument5 pagesOcrv Report ViewerDanirose JalaoNo ratings yet

- AMC AprilDocument9 pagesAMC AprilDineshkumar GourNo ratings yet

- 12 Eletricity BillDocument4 pages12 Eletricity BillMostafizur Rahman KallolNo ratings yet

- Notice No 2 FinalDocument1 pageNotice No 2 Finalnitish JhaNo ratings yet

- ITDFDocument2 pagesITDFdepakmunirajNo ratings yet

- BRAC Bank Statement 31072023Document17 pagesBRAC Bank Statement 31072023freelancer.siddikNo ratings yet

- 93f3ca8 5002smartDocument3 pages93f3ca8 5002smartsamiul azadNo ratings yet

- L IQUIDATIONDocument8 pagesL IQUIDATIONRinalyn RazNo ratings yet

- CY 2022 Admission DetailsDocument18 pagesCY 2022 Admission DetailsroxNo ratings yet

- BoqcomparativechartDocument3 pagesBoqcomparativechartSNS INFRACONNo ratings yet

- Crop 14-03-2023 15223699 SignedDocument15 pagesCrop 14-03-2023 15223699 SignedNagendra Singh PariharNo ratings yet

- 19 Amc TataDocument9 pages19 Amc TataDineshkumar GourNo ratings yet

- Tier 2 Contribution 94.5 and Ytd Contribution 754.4300Document1 pageTier 2 Contribution 94.5 and Ytd Contribution 754.4300Benedict OppongNo ratings yet

- Invoice 30 OctDocument1 pageInvoice 30 OctDea HerawatiNo ratings yet

- February 2021 PayslipDocument1 pageFebruary 2021 PayslipMohammed Iddrisu AntwiNo ratings yet

- February 2021 PayslipDocument1 pageFebruary 2021 PayslipMohammed Iddrisu AntwiNo ratings yet

- Ilovepdf MergedDocument12 pagesIlovepdf Mergedvinesh reddyNo ratings yet

- Rekap HSM Ke 4Document4 pagesRekap HSM Ke 4Andris AndrianNo ratings yet

- Nomor Po Project ShaktiDocument1 pageNomor Po Project Shaktidudu sadullohNo ratings yet

- 2223-BK-14855 WoDocument4 pages2223-BK-14855 WoVinod Kumar DubeyNo ratings yet

- AYZODocument1 pageAYZOJay Kishor (AYZO)No ratings yet

- Balister Electricity BillDocument1 pageBalister Electricity BillFarman KhanNo ratings yet

- Account STMTDocument7 pagesAccount STMTanujabairagi1877No ratings yet

- Laporan Data Reduksi CO2 Proyek Green Building Sucofindo (Edge-Greenship) - 17082023 (For Pak TITO GBCI)Document1 pageLaporan Data Reduksi CO2 Proyek Green Building Sucofindo (Edge-Greenship) - 17082023 (For Pak TITO GBCI)Ecoframework Cabang JakartaNo ratings yet

- RUMS - Mutasi Petty Cash IDR - 27-311223Document2 pagesRUMS - Mutasi Petty Cash IDR - 27-311223ronni gunadi sNo ratings yet

- 2017-18 Guidance Value For The Immovable Properties Coming Under The Jurisdiction of BTM-Layout Sub-Register OfficeDocument9 pages2017-18 Guidance Value For The Immovable Properties Coming Under The Jurisdiction of BTM-Layout Sub-Register OfficeShiva KumarNo ratings yet

- Water Tax 2021-22 IVDocument1 pageWater Tax 2021-22 IVRajan KMRNo ratings yet

- Goodies Tracker - 2021Document24 pagesGoodies Tracker - 2021Rajan KMRNo ratings yet

- InvoiceDocument1 pageInvoiceRajan KMRNo ratings yet

- Invoice 1Document1 pageInvoice 1Rajan KMRNo ratings yet

- Train TicketDocument1 pageTrain TicketRajan KMRNo ratings yet

- PropertiesDocument35 pagesPropertiesYANIshaNo ratings yet

- Metaphor-Spatiality-Discourse - 10-11 July 2020 - Programme - FINALDocument6 pagesMetaphor-Spatiality-Discourse - 10-11 July 2020 - Programme - FINALkostyelNo ratings yet

- Dkfezd Fohkkx) Fcykliqj Eamy NF (K.K Iwoz E/ JsyosDocument7 pagesDkfezd Fohkkx) Fcykliqj Eamy NF (K.K Iwoz E/ Jsyosdadan vishwakarmaNo ratings yet

- Channel DynamicsDocument14 pagesChannel DynamicsNeha GoyalNo ratings yet

- Important Links and Information For Speaking EnglishDocument4 pagesImportant Links and Information For Speaking EnglishTa FanNo ratings yet

- FO51 - Student Performance Contract (SPC) PDFDocument1 pageFO51 - Student Performance Contract (SPC) PDFTrisha Mae AbocNo ratings yet

- Succession 3.0: Nortel NetworksDocument0 pagesSuccession 3.0: Nortel NetworksencotronicNo ratings yet

- SYNOPSIS HDFC BankDocument4 pagesSYNOPSIS HDFC BanksargunkaurNo ratings yet

- Shailaja Stalin, PMP: Work HistoryDocument2 pagesShailaja Stalin, PMP: Work HistoryAshwin Jaya KumarNo ratings yet

- Levels of Popularity of Greeting Customs in VietnaDocument9 pagesLevels of Popularity of Greeting Customs in VietnaThanh NguyenNo ratings yet

- Migrants and Their Health Issues: (Document Subtitle)Document9 pagesMigrants and Their Health Issues: (Document Subtitle)IkramNo ratings yet

- OU COM Social Determinants of HealthDocument43 pagesOU COM Social Determinants of HealthSharon DenhamNo ratings yet

- A Nun's TestimonyDocument39 pagesA Nun's TestimonyLois Maillet LynnNo ratings yet

- Shaykh Muqbil Bin Haadee Al-Waadi'Ee: His Life, Creed and ManhajDocument10 pagesShaykh Muqbil Bin Haadee Al-Waadi'Ee: His Life, Creed and ManhajmohammadhasanNo ratings yet

- (PM Pamphlet) Peter Linebaugh - Ned Ludd & Queen Mab - Machine-Breaking, Romanticism, and The Several Commons of 1811-12-PM Press (2012)Document52 pages(PM Pamphlet) Peter Linebaugh - Ned Ludd & Queen Mab - Machine-Breaking, Romanticism, and The Several Commons of 1811-12-PM Press (2012)JuanPabloMontoyaPepinosaNo ratings yet

- Gerunds and Infinitives and The EnvironmentDocument1 pageGerunds and Infinitives and The EnvironmentJasleydi100% (1)

- The Internet Is A Global System of Interconnected Computer Networks That Use The Standardized Internet Protocol SuiteDocument7 pagesThe Internet Is A Global System of Interconnected Computer Networks That Use The Standardized Internet Protocol SuiteakhilsunilkumarNo ratings yet

- Answer Sheet: Quarter 4 - Week 4Document2 pagesAnswer Sheet: Quarter 4 - Week 4Bonifacio LeddaNo ratings yet

- Growth Hacking 22-23 Course ManualDocument11 pagesGrowth Hacking 22-23 Course ManualFrancisco HurtadoNo ratings yet

- Learning Task 18Document2 pagesLearning Task 18Marlhen Euge SanicoNo ratings yet

- CDB Vol I No. 77 (02.18.2014)Document16 pagesCDB Vol I No. 77 (02.18.2014)Christian Ian LimNo ratings yet

- Worldwide Address ListDocument40 pagesWorldwide Address Listmusaismail8863No ratings yet

- CSR PRINT REPORT-KalyaniDocument52 pagesCSR PRINT REPORT-KalyaniAmruta MuradeNo ratings yet

- Ready To Drink Report (Vietnam Market)Document8 pagesReady To Drink Report (Vietnam Market)silver2appleNo ratings yet