Professional Documents

Culture Documents

Note Topic 2

Uploaded by

ModraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Note Topic 2

Uploaded by

ModraCopyright:

Available Formats

Financial Management: Investment Companies: Private Equity

Principles & Applications Non—Bank Financial Intermediaries Firms

Thirteenth Edition • These include: Private equity firms is a financial intermediary

Chapter 2: Firms and the – financial services corporations, such invests in equities that are not traded on the publi

Financial Market as GE Capital Division; capital markets. Two types of private equity firm

– insurance companies, such as Prudential; dominate this group:

Learning Objectives – investment banks, such as Goldman Sachs; Venture capital (VC) firms; and

1. Describe the structure and – investment companies, including mutual Leveraged buyout (LBO) firms.

functions of financial markets. funds, hedge funds, and private equity firms.

2. Distinguish between commercial Private Equity Firms: Venture Capital Firms

banks and other financial Venture capital firms raise money from investo

institutions in the financial Financial Services Corporations

• Financial services corporation are in the (wealthy people and other financial institutions),

marketplace. which they then use to provide the initial financin

3. Describe the different securities lending or financing business, but they are

not commercial banks. for private start-up companies. For example, initi

markets for bonds and stocks. financing of Google was provided by a venture

– For example: GE capital – it provides

commercial loans, financing programs, capital firm called Kleiner Perkins Caufield & By

Principles Applied in this Chapter commercial insurance, equipment leasing, and (KPCB).

• Principle 2: There is a Risk-Return Tradeoff other services in over 35 countries. It also

• Principle 4: Market Prices Reflect Information provides credit services to more than 130 Private Equity Firms: Leveraged Buyout

• Principle 5: Individual Respond to Incentives million customers. In 2015, GE announced that Leveraged buyout (LBO) firms acquire establis

it will be selling off most of GE capital over the firms that typically have not been

2.1 THE BASIC STRUCTURE OF THE following two years. performing well with the objective of making the

U.S. FINANCIAL MARKETS profitable again and then selling them. An LBO

Insurance Companies typically uses debt to fund the purchase of a firm

Three Sets of Players in the Financial • Insurance companies sell insurance to

Markets individuals and businesses to protect their

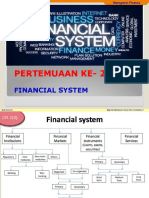

Within the financial markets, there are three investments. They collect premium and hold 2.3 THE FINANCIAL MARKETPLACE:

principal sets of players that interact: the premium in reserves until there is an SECURITIES MARKETS

– Borrowers (individuals and businesses) insured loss and then pay out claims to the

– Savers (mostly individual investors) holders of the insurance contracts. Security

– Financial Institutions (Intermediaries) • The reserves are deployed in various types of • A security is a negotiable instrument that

(ex. Commercial banks) investments, including loans to individuals and represents a financial claim. It can take the form

businesses. ownership (stock) or a debt agreement (bond).

• The public securities markets allow businesses

Investment Banks and individual investors to trade the securities

2.2 THE FINANCIAL MARKETPLACE: issued by public corporations.

FINANCIAL INSTITUTIONS Investment banks are specialized financial

intermediaries that help companies and

governments raise money and that provide advisory Primary versus Secondary Market

services to client firms when they enter into major • Primary market – a market in which securities

transactions such as buying or merging with other are bought and sold for the first time. The firm

firms. selling securities receives the money raised that

they can then use to finance their businesses.

Investment Companies: Mutual Funds • Secondary market – a market for subsequent

• Mutual funds are professionally managed trading of previously issued securities. The issuin

according to a stated investment objective. firm does not receive any new money, as the

Through mutual funds individuals can invest in securities are simply being transferred from one

virtually all of the securities offered in the investor to another.

financial market.

Figure 2-1 Financial Markets, Institutions, and the • Individuals can invest in mutual funds by

Circle of Money buying shares in the mutual fund at the net

Financial Intermediaries asset value (NAV). Mutual funds can either be

Financial institutions like commercial banks, finance load or noload funds. Load refers to sales

companies, insurance companies, investment commission.

banks, and investment companies are called

financial intermediaries as they help bring

together those who have money (savers) and those

who need money (borrowers). Investment Companies: Exchange Traded

Funds (ETFs)

• An exchange-traded fund (ETF) is similar to a

Money Market versus Capital Market mutual fund except that the ownership shares in

• Money market - markets for short-term debt the ETF can be bought and sold on the stock Figure 2.2 Security Markets Provide a Link betw

instruments, with maturities of one year or less exchange throughout the day. Most ETFs track an the Corporation and Investors

(such as Treasury bills, Commercial paper). index, such as S&P 500.

• Capital market - markets for long-term debt and • Mutual funds and ETFs provide a cost-effective Types of Securities: Debt Securities

equity instruments (such as Common stock, way to diversify, which reduces risk – a great Debt Securities: Firms borrow money by selling

Preferred stock, Corporate bond, U.S. Treasury benefit for the small investor. debt securities in the debt market.

bond). Debt is classified based on maturity period: Less

than one year (issued in money market), one to te

Commercial Banks: Everyone’s Financial years (called Note, issued in capital market), mor

Marketplace Investment Companies: Hedge Funds

10 years (called bond, issued in capital

• Commercial banks collect the savings of Hedge funds are similar to mutual funds but are

market)

individuals as well as businesses and then lend less regulated, take more risk, and are generally

those pooled savings to other individuals and open only to high net worth investors (typically $1

million and above). Management fees are higher for Types of Securities: Equity Securities

businesses. They earn money by charging a rate Equity securities represent ownership of the

hedge funds; they typically run at about 2 percent of

of interest to borrowers that exceeds the rate they the assets and include an incentive fee (typically 20% corporation. There are two major types of equity

pay to savers. of profits) based on the fund’s overall performance. securities: common stock and preferred stock.

• The 4 largest commercial banks in the US are When you buy equity securities, you are making

JPMorgan Chase & Co., Bank of America Corp., investment that you expect will generate a return

Wells Fargo Bank, and Citigroup, Inc.

Types of Securities: Common Stock Table 2.2 Characteristics of Different Financial

• Common stock is a security that represents Instruments (1 of 11)

equity ownership in a corporation, provides voting Money Market Debt For the Borrower:

rights, and entitles the holder to a share of the • Good way of inexpensively raising money for short

company’s success in the form of dividends and periods of time.

any capital appreciation in the value of the • Rates tend to be lower than long-term rates.

security. • Can borrow money to match short-term needs.

• Investors who purchase common stock are the • If interest rates rise, the cost of borrowing will

residual owners of the firm. immediately rise accordingly.

For the Investor:

Types of Securities: Preferred Stock • Very liquid—investors have access to their

Preferred Stock For the Issuer:

• Preferred stock is an equity security. It gives money when they need it.

• Dividends can be omitted without the risk of

preference, relative to common stockholders, with • Safe—generally invested in high-quality

bankruptcy.

regard to dividends and claim on assets. Thus investments for brief periods.

• Has the disadvantage that dividends are not tax

preferred shareholders receive their dividends • Low returns—rates tend to be close to the rate

deductible for the issuer, whereas interest payments

before any dividends are distributed to the of inflation.

from debt are tax deductible.

common stockholders. For the Investor:

• For corporate investors, it has a tax advantage

Stock Markets because at a minimum

A stock market is a public market in which the stock of 70 percent of dividends received are tax-free.

companies is traded. Stock markets are classified as either

organized security exchanges or the overthe-counter

(OTC) market.

Stock Markets: Organized Securities Exchange

• Organized security exchanges occupy physical

space and financial instruments are traded on their

premises. For example, the New York Stock Common Stock For the Issuer:

Exchange (NYSE) located in New York. The common • The issuing firm is not legally obligated to make

stocks of nearly 3,000 listed companies is traded on this payments.

exchange. • Does not have a maturity date.

• Today, the NYSE is a hybrid market, allowing for face • Issuance of common stock increases creditworthiness

to-face trading on the floor of the stock exchange in because the firm

addition to automated electronic trading. About 80 to 90 has more investor money to cushion the firm in the

percent of all trades are done electronically. case of a loss.

• Has a tax disadvantage relative to debt; whereas debt

Stock Markets: Over—The—Counter Market interest payments are deductible for tax purposes,

• NASDAQ (National Association of Securities common stock dividends are not.

Dealers Automated Quotations) is an over-thecounter Table 2.2 Characteristics of Different Financial For the Investor:

market and describes itself as a Instruments (4 of 11) • Over the long run, common stock has outperformed

“screen-based, floorless market”. In 2013, Long-Term Debt and Fixed-Income Securities For debt-based financial assets.

nearly 3,100 companies were listed on NASDAQ the • Along with the increased expected return comes

exchange, including Starbucks, Alphabet, Intel Borrower: increased risk.

and Whole Foods. • Interest rates are locked in over the entire life of the

• Figure 2.3 illustrates how to read stock price debt.

quotes from www.google.com/finance. • Has a tax advantage over common stock in that

interest payments are tax deductible, whereas dividend

payments are not.

For the Investor:

• Can be used to generate dependable current income.

• Some bonds produce tax-free income.

• Long-term debt tends to produce higher returns than Financial Markets and the Financial Crisis

short-term debt. • Beginning in 2007, US experienced its most severe

• Less risky than common stock. financial crisis since the Great Depression of the

• Investors can lock in an interest rate and know the 1930s. As a result, some financial institutions

future returns (assuming the issuer does not default on collapsed, while the government bailed others out;

its payments). unemployment skyrocketed; the stock market

plummeted, the country entered into a recession, and it

spread world wide.

• Although many factors contributed to the financial

crisis, the most immediate cause has been found to be

the collapse of the real estate market and the resulting

Figure 2-3 Common Stock Price Quotes real estate loan (mortgage) defaults.

Securitization Process (1 of 2)

Other Financial Instruments Securitization Process

Table 2.2 provides a list of different financial 1. Homebuyers borrow money by taking out a

instruments used by firms to raise money, beginning mortgage loan

with the shortest-maturity instruments (U.S. 2. Lender sells the mortgage to another firm or

Treasury bills) that are traded in the money market financial institution.

and moving through to the longest-maturity 3. That financial institution pools together and creates

instruments (common stock) that are traded in the a portfolio of mortgages. The purchase of that portfolio

capital market. is financed through sale of MBS.

You might also like

- Chapter 20 - IPO, Investment Bank, Financial RestructionDocument20 pagesChapter 20 - IPO, Investment Bank, Financial RestructionFariza SiswantiNo ratings yet

- Financial Markets - ReviewerDocument11 pagesFinancial Markets - ReviewerOne DozenNo ratings yet

- FINANCIAL-MARKETS Prelims RevDocument13 pagesFINANCIAL-MARKETS Prelims RevJasmine TamayoNo ratings yet

- Introduction to investment banking divisions and capital marketsDocument31 pagesIntroduction to investment banking divisions and capital marketssanjayNo ratings yet

- BUSINESS FINANCE 3rd ReviewerDocument5 pagesBUSINESS FINANCE 3rd ReviewerFelicity BondocNo ratings yet

- Financial Markets and Institutions GuideDocument48 pagesFinancial Markets and Institutions GuideJun AdajarNo ratings yet

- Chapter 1 - An Overview of Financial Managemen: ReviewerDocument3 pagesChapter 1 - An Overview of Financial Managemen: ReviewerChristian Mozo Oliva67% (3)

- 001 FMI Mod1 Investment Industry V09!20!01 22 RTDocument69 pages001 FMI Mod1 Investment Industry V09!20!01 22 RTFumani ShipalanaNo ratings yet

- Finance PointersDocument8 pagesFinance PointersMgrace arendaknNo ratings yet

- Capital MarketDocument31 pagesCapital Marketmarycris miraNo ratings yet

- Chapter 1 - Introduction To Financial ManagementDocument28 pagesChapter 1 - Introduction To Financial ManagementArminda Villamin100% (1)

- Participation in The Market: A Portion ofDocument5 pagesParticipation in The Market: A Portion ofRonah Abigail BejocNo ratings yet

- MAS2 - Group 1Document6 pagesMAS2 - Group 1Cheese ButterNo ratings yet

- Finance Part 2 PDFDocument5 pagesFinance Part 2 PDFJustine PascualNo ratings yet

- Finance Research Paper2Document11 pagesFinance Research Paper2NITYA JHANWARNo ratings yet

- Debt Market: - Presented by - Akshit-5042 - Shivam-5022 - Alex-5067Document15 pagesDebt Market: - Presented by - Akshit-5042 - Shivam-5022 - Alex-5067Shivam NirwanaNo ratings yet

- M&A Investment BankingDocument21 pagesM&A Investment Bankingisaure badreNo ratings yet

- Chapter - OneDocument30 pagesChapter - OneMagix SmithNo ratings yet

- Business Finance Hand Outs 02Document4 pagesBusiness Finance Hand Outs 02Shane VeiraNo ratings yet

- the capital market intermediate and long term financingDocument55 pagesthe capital market intermediate and long term financingLina AlamiNo ratings yet

- Asummary For Sources of FinanceDocument11 pagesAsummary For Sources of FinanceMostafa SakrNo ratings yet

- Financial MarketsDocument4 pagesFinancial MarketsFlorina LuminitaNo ratings yet

- CAPITAL MARKET MANAGEMENTDocument28 pagesCAPITAL MARKET MANAGEMENTJenina Rose SalvadorNo ratings yet

- Slide 1 Slide 2: I FinancDocument7 pagesSlide 1 Slide 2: I FinancAnalyza PallagoNo ratings yet

- Financial Sector Neel PatelDocument19 pagesFinancial Sector Neel PatelNEEL PATELNo ratings yet

- Role of financial markets and institutions lectureDocument13 pagesRole of financial markets and institutions lectureJohanna Nina UyNo ratings yet

- Financial Markets and Institutions OverviewDocument31 pagesFinancial Markets and Institutions OverviewBUBOYNo ratings yet

- Fin 12 Notes (Ch2 Updated)Document4 pagesFin 12 Notes (Ch2 Updated)Kaycee StylesNo ratings yet

- BSF 1 STQDocument3 pagesBSF 1 STQPretty BaljonNo ratings yet

- Topic 2 - Firms and Financial MarketDocument50 pagesTopic 2 - Firms and Financial Market谢彩玲No ratings yet

- MNGT M2Document3 pagesMNGT M2Melody MadarraNo ratings yet

- AlmiraDocument4 pagesAlmiraAlmira GregorioNo ratings yet

- Group 4-Treasury Management-MWF 10-11 AMDocument13 pagesGroup 4-Treasury Management-MWF 10-11 AMAshley Garcia100% (1)

- GEC Elect 2 Module 4Document10 pagesGEC Elect 2 Module 4Aira Mae Quinones OrendainNo ratings yet

- 098 Fmbo-1Document9 pages098 Fmbo-1KetakiNo ratings yet

- 02 - Handout - 1 (FINANCIAL MARKETS AND INSTITUTIONS)Document6 pages02 - Handout - 1 (FINANCIAL MARKETS AND INSTITUTIONS)Janrey RomanNo ratings yet

- Mbfs With 16 MarkDocument16 pagesMbfs With 16 MarkPadmavathiNo ratings yet

- Chapter # 7Document35 pagesChapter # 7BappyNo ratings yet

- Private Placement & Venture CapitalDocument18 pagesPrivate Placement & Venture Capitalshraddha mehtaNo ratings yet

- Hints To Essay Questions - Revised 2-28-2020-2Document4 pagesHints To Essay Questions - Revised 2-28-2020-2DavidNo ratings yet

- Finance Impt Topics For PlacementDocument3 pagesFinance Impt Topics For PlacementMRIDUL GOELNo ratings yet

- CJ (.FT - : SP, 3J Jl:NID (PQ (I:M.Jl Ry (PJ ( ('JL :M.JLDocument61 pagesCJ (.FT - : SP, 3J Jl:NID (PQ (I:M.Jl Ry (PJ ( ('JL :M.JLISHAAN MUNDEJANo ratings yet

- Banking Chapter 1Document7 pagesBanking Chapter 1Shasharu Fei-fei LimNo ratings yet

- Role of financial marketsDocument12 pagesRole of financial marketsGabrielle VizcarraNo ratings yet

- Capital Market & Institutional Finacing - Sajal JanaDocument23 pagesCapital Market & Institutional Finacing - Sajal JanasajalecoNo ratings yet

- KMB204Document8 pagesKMB204Poorani PNo ratings yet

- IPO Word Doc-ParadkarDocument95 pagesIPO Word Doc-Paradkarkiran rokadeNo ratings yet

- primary market ppt (1)Document15 pagesprimary market ppt (1)Kapil KumarNo ratings yet

- Managerial Finance: An Overview of Financial Systems and MarketsDocument116 pagesManagerial Finance: An Overview of Financial Systems and MarketsJaja SutejaNo ratings yet

- MBFS Question Bank & AnswersDocument17 pagesMBFS Question Bank & AnswersArunkumar JwNo ratings yet

- Financial Markets and InstitutionsDocument11 pagesFinancial Markets and InstitutionsEarl Daniel RemorozaNo ratings yet

- Financial Market & Banking OperationsDocument38 pagesFinancial Market & Banking Operationsamit chavariaNo ratings yet

- Intro CMDocument6 pagesIntro CMFreddierick JuntillaNo ratings yet

- Financial Markets and InstitutionsDocument28 pagesFinancial Markets and Institutionsmomindkhan100% (4)

- Financial Institutions and Markets - Answers (Sem-IV)Document8 pagesFinancial Institutions and Markets - Answers (Sem-IV)Udit JoshiNo ratings yet

- Web Chapter: Financial Markets and InstitutionsDocument28 pagesWeb Chapter: Financial Markets and InstitutionsnjcumartinNo ratings yet

- Capital Markets Overview: Market Participants and Financial InnovationDocument52 pagesCapital Markets Overview: Market Participants and Financial Innovationlinda zyongweNo ratings yet

- Mutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingFrom EverandMutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingNo ratings yet

- Note Topic 4Document4 pagesNote Topic 4ModraNo ratings yet

- Analyze firm profitability and financial statementsDocument4 pagesAnalyze firm profitability and financial statementsModraNo ratings yet

- Note Topic 3Document8 pagesNote Topic 3ModraNo ratings yet

- Note Topic 1Document2 pagesNote Topic 1ModraNo ratings yet

- 2.the Structural Analysis of IndustriesDocument27 pages2.the Structural Analysis of IndustriesEric Parilla0% (1)

- Industrial Environment: Chapter OutlineDocument13 pagesIndustrial Environment: Chapter OutlineRevti sainNo ratings yet

- Marketing MixDocument84 pagesMarketing MixVijay GaneshNo ratings yet

- Relationship Marketing Defined? An Examination of Current Relationship Marketing DefinitionsDocument9 pagesRelationship Marketing Defined? An Examination of Current Relationship Marketing DefinitionsОльга ИNo ratings yet

- A19 Hedge SystemDocument2 pagesA19 Hedge SystemRavi SinghNo ratings yet

- How To Write A Winning Business PlanDocument17 pagesHow To Write A Winning Business PlanBastian de JongNo ratings yet

- Technical Analysis Introduction: Key Concepts and Tools ExplainedDocument65 pagesTechnical Analysis Introduction: Key Concepts and Tools Explainedmr25000No ratings yet

- Chapter 2 Asset Based ValuationDocument44 pagesChapter 2 Asset Based ValuationMs. VelNo ratings yet

- BOM Unit 4 - Consumer BehaviourDocument27 pagesBOM Unit 4 - Consumer BehaviourKaushal SabalNo ratings yet

- Retail Management Assignment No#1Document6 pagesRetail Management Assignment No#1Rehab ShaikhNo ratings yet

- SMU Cournot Competition and Collusion AnalysisDocument11 pagesSMU Cournot Competition and Collusion AnalysisChin Yee LooNo ratings yet

- Business Idea GenerationDocument25 pagesBusiness Idea GenerationVictor BarnabasNo ratings yet

- VAT and OPTDocument10 pagesVAT and OPTSharon CarilloNo ratings yet

- Digital Marketing Scope and Career OpportunitiesDocument15 pagesDigital Marketing Scope and Career Opportunitiesarunmittal1985No ratings yet

- Explore Warren Buffett's Investment StrategiesDocument24 pagesExplore Warren Buffett's Investment StrategiesAnika Tabassum100% (1)

- Economics Course Summary Module 1-3Document23 pagesEconomics Course Summary Module 1-3monkaratNo ratings yet

- Retail Management Unit4Document53 pagesRetail Management Unit4Gautam DongaNo ratings yet

- Narrative Report - Raymond VernonDocument3 pagesNarrative Report - Raymond VernonNicki Lyn Dela CruzNo ratings yet

- 1079-Article Text-3539-3-10-20210315Document11 pages1079-Article Text-3539-3-10-20210315Muhammad lan Muhammad lanNo ratings yet

- LOFGREN, Markets With Asymmetric Information - The Contributions of George Akerlof, Michael Spence and Joseph StiglitzDocument18 pagesLOFGREN, Markets With Asymmetric Information - The Contributions of George Akerlof, Michael Spence and Joseph StiglitzAnonymous ykRTOE100% (1)

- Chapter 2 Promotion MixDocument2 pagesChapter 2 Promotion MixJe LazanaNo ratings yet

- An Analysis of The Takeover of The Bank of Melbourne by Westpac Banking CorporationDocument28 pagesAn Analysis of The Takeover of The Bank of Melbourne by Westpac Banking CorporationMRASSASINNo ratings yet

- Business TaxationDocument5 pagesBusiness TaxationMajoy BantocNo ratings yet

- ICE Trade Vault White PaperDocument16 pagesICE Trade Vault White PapersenapatiabhijitNo ratings yet

- Project ReportDocument3 pagesProject ReportKNo ratings yet

- CHAPTER III Business PlanDocument13 pagesCHAPTER III Business PlanGizelle Joy Paningbatan MercurioNo ratings yet

- Regional Manager Resume with 18+ Years Agro Sales ExperienceDocument4 pagesRegional Manager Resume with 18+ Years Agro Sales Experiencesatya sanjib PatraNo ratings yet

- Tarjeta de Credito y DebitoDocument19 pagesTarjeta de Credito y DebitoviaraNo ratings yet

- Insider Trading Policy (04.03.2018)Document10 pagesInsider Trading Policy (04.03.2018)Heidi Haws Payne100% (4)