Professional Documents

Culture Documents

Lesson 3. Consolidated Financial Statements

Uploaded by

KsUnlockerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 3. Consolidated Financial Statements

Uploaded by

KsUnlockerCopyright:

Available Formats

St. Vincent de Ferrer College of Camarin Prof.

Adrigado

BUSINESS COMBINATION – IFRS 3

Non-Controlling Interest - NCI is the equity in a subsidiary not

attributable, directly or indirectly to a parent. Also known as “ minority

interest”

The acquirer measures any NCI in the acquiree either at

a. Fair value

b. NCI proportionate share in the acquiree’s net identifiable assets.

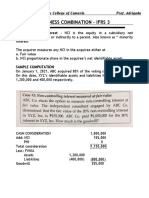

SAMPLE COMPUTATION

On January 1, 2021, ABC acquired 80% of the voting shares of XYZ, Inc.

On this date, XYZ’s identifiable assets and liabilities have fair values of

1,200,000 and 400,000 respectively.

CASH CONSIDERATION 1,000,000

Add: NCI 155,000

PHI 0

Total consideration 1,155,000

Less: FVNIA

Assets 1,200,000

Liabilities (400,000) (800,000)

Goodwill 355,000

31 Practical Accounting 2

CASH CONSIDERATION 1,000,000

Add: NCI 250,000

Total consideration 1,250,000

Less: FVNIA

Assets 1,200,000

Liabilities (400,000) (800,000)

Goodwill 450,000

CASH CONSIDERATION 1,000,000

Add: NCI 160,000 (800,000*20%)

Total consideration 1,160,000

Less: FVNIA

Assets 1,200,000

Liabilities (400,000) (800,000)

Goodwill 360,000

Chapter 2- Business Combination 32

33 Practical Accounting 2

1. PURCHASE PRICE 1,200,000

LESS: FVNIA

TOTAL ASSETS 1,650,000

TOTAL LIABILITIES (390,000) (1,260,000)

GAIN ON BARGAIN PURCHASE 60,000

Entries:

Identifiable Assets Acquired 1,260,000

Bonds Payable 1,200,000

Gain on BP 60,000

Bond issue cost 30,000

Cash 30,000

Legal Fees 10,000

Cash 10,000

2. Purchase Price 1,200,000

Non controlling Interest 260,000

Total Purchase Price 1,460,000

Less: FVNIA

Total assets 1,700,000

Total liabilities (400,000) 1,300,000

Goodwill 160,000

Identifiable Assets Acquired 1,300,000

Goodwill 160,000

Cash 1,200,000

Non controlling Interest 260,000

Chapter 2- Business Combination 34

3. Purchase Price 1,200,000

Non controlling Interest 300,000

Total purchase price 1,500,000

Less: FVNIA

Assets 1,700,000

Liabilities (400,000) 1,300,000

Goodwill 200,000

Entries:

Identifiable Assets Acquired 1,300,000

Goodwill 200,000

Cash 1,200,000

NCI 300,000

4. Purchase price 1,000,000 (10,000*100)

Less: FVNIA

Assets 1,800,000

Liabilities (900,000) (900,000)

Goodwill 100,000

Identifiable Assets Acquired 900,000

Goodwill 100,000

Share capital 200,000 (10,000*20)

Share Premium 800,000 (10,000*80)

Share Premium 40,000

Cash 40,000

Professional Fees 60,000

Cash 60,000

35 Practical Accounting 2

Date of business combination

Computation for total assets

1. Total Assets of Parent @ BV xxx

2. Total Assets of the subsidiary@FV xxx

3. Purchase Price(Cash or non-cash) (xx)

4. Goodwill xxx

5. Direct Cost (xx) (if paid)

6. Indirect Cost (xx) (if paid)

7. CTIR (xx) (if paid)

Consolidated Assets xxx

Computation Liabilities

1. Liability of parent @ BV xxx

2. Liability of Subs @ FV xxx

3. Purchase Price (Bonds or Note Payable) xxx

4. Contingent Consideration (CCP) xxx

5. DC xxx (if unpaid)

6. IDC xxx (if unpaid)

7. CTIR xxx (if unpaid)

Consolidated liabilities xxx

Computation of SHE

1. SHE of Parent xxx

2. Non controlling Interest xxx

3. Purchase Price (stock issuance@FV) xxx

4. Gain -BPO, PHI xxx

5. Direct Cost (xx) whether paid or not

6. Indirect Cost (xx) whether paid or not

7. CTIR (xx) whether paid or not

Consolidated SHE xxx

You might also like

- Sol. Man. Chapter 4 Consol. Fs Part 1Document37 pagesSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Business Combi Quiz (Part1)Document9 pagesBusiness Combi Quiz (Part1)Rica Joy RuzgalNo ratings yet

- Intacc SolmanDocument104 pagesIntacc Solmanpam92% (36)

- Accounting For Business Combinations Second Grading ExaminationDocument21 pagesAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- Internal Audit Reporting SPDocument45 pagesInternal Audit Reporting SPRajesh Mahesh Bohra100% (1)

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Corporate Liquidation & Reorganization: Problem 1: True or FalseDocument20 pagesCorporate Liquidation & Reorganization: Problem 1: True or FalseRicalyn Bugarin0% (2)

- BUSCOM Test Bank 2Document22 pagesBUSCOM Test Bank 2Liberty NovaNo ratings yet

- Reliance by Internal Audit On Other Assurance ProvidersDocument29 pagesReliance by Internal Audit On Other Assurance Providersmembership2915100% (1)

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Chapter 4 - Consolidated Financial Statements (Part 1)Document32 pagesChapter 4 - Consolidated Financial Statements (Part 1)Philip RososNo ratings yet

- 4 Chart of AccountsDocument115 pages4 Chart of Accountsresti rahmawatiNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Army Local Audit Manual (Part I & II)Document561 pagesArmy Local Audit Manual (Part I & II)Varma Mks83% (6)

- Sol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 EditionDocument22 pagesSol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 Editiondianel villarico100% (1)

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Volume 3 AnswersDocument105 pagesVolume 3 Answerskean leigh felicano50% (2)

- Primo Corporation and Sonia Company Consolidated Financial StatementsDocument2 pagesPrimo Corporation and Sonia Company Consolidated Financial StatementsLabLab ChattoNo ratings yet

- Strategic Management Accounting PDFDocument3 pagesStrategic Management Accounting PDFMohamed IrshaNo ratings yet

- Accounting For Business Combinations ExaminationDocument20 pagesAccounting For Business Combinations ExaminationJanella Umieh De UngriaNo ratings yet

- Calculating Goodwill in Business CombinationsDocument4 pagesCalculating Goodwill in Business Combinationslatte aeriNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- Chapter 4Document36 pagesChapter 4MARRIETTE JOY ABADNo ratings yet

- Quiz 1 AnswersDocument6 pagesQuiz 1 AnswersAlyssa CasimiroNo ratings yet

- Lesson 3. CONSOLIDATED FINANCIAL STATEMENTSDocument5 pagesLesson 3. CONSOLIDATED FINANCIAL STATEMENTSangelinelucastoquero548No ratings yet

- Business Combinations ExplainedDocument8 pagesBusiness Combinations ExplainedLabLab ChattoNo ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- Midterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerDocument9 pagesMidterm Exam 1 Sem 21-22 (Auditing Theory) MULTIPLE CHOICE. Select The Best AnswerJoanne RomaNo ratings yet

- Lesson 2. Business Combination Part 2Document3 pagesLesson 2. Business Combination Part 2KsUnlockerNo ratings yet

- Use The Following Information For The Next Two Items:: 1. Prepare The Consolidated Statement of Financial PositionDocument15 pagesUse The Following Information For The Next Two Items:: 1. Prepare The Consolidated Statement of Financial PositionJacqueline OrtegaNo ratings yet

- Acc For Business CombinationDocument4 pagesAcc For Business CombinationBabyann BallaNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionAnnabeth BrionNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- Mid Term ExamDocument6 pagesMid Term Examaika9maikaNo ratings yet

- Abc ProbsDocument12 pagesAbc ProbsZNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- BusCom Exercises AnswerDocument4 pagesBusCom Exercises AnswerVidgezxc LoriaNo ratings yet

- Class 2 HomeworkDocument7 pagesClass 2 HomeworkAngel MéndezNo ratings yet

- Ia 3 Answer KeyDocument104 pagesIa 3 Answer KeyAdrienne TarrayoNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Corporate Liquidation RecoveryDocument5 pagesCorporate Liquidation RecoveryArtisanNo ratings yet

- Business Combination Asset Acquisition: Third YearDocument6 pagesBusiness Combination Asset Acquisition: Third YearRosalie Colarte LangbayNo ratings yet

- Business Combination - ExercisesDocument36 pagesBusiness Combination - ExercisesJessalyn CilotNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Accounting For Business Combi SolutionDocument4 pagesAccounting For Business Combi SolutionSophia Anne Margarette NicolasNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Accounting For Business CombinationDocument11 pagesAccounting For Business CombinationMaika CrayNo ratings yet

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- Special Transaction ACtivityDocument4 pagesSpecial Transaction ACtivityPrincessNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- Unit I VDocument15 pagesUnit I VLeslie Mae Vargas ZafeNo ratings yet

- Consolidation Sample ProblemDocument3 pagesConsolidation Sample ProblemLeila Nicole FulgencioNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- On January 1Document4 pagesOn January 1Kryzzel Anne JonNo ratings yet

- Chapter 2 Hyperinflation LectureDocument4 pagesChapter 2 Hyperinflation LectureChristine SondonNo ratings yet

- Activity Part 1 Prepartion of Financial StatementsDocument4 pagesActivity Part 1 Prepartion of Financial Statementsjrmsu-3No ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- Quiz - Financial Statements With SolutionDocument6 pagesQuiz - Financial Statements With SolutionMary Yvonne AresNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Ia Vol 3 Valix 2019 Solman 2 PDF FreeDocument105 pagesIa Vol 3 Valix 2019 Solman 2 PDF FreeLJNo ratings yet

- Extreme Value Hedging: How Activist Hedge Fund Managers Are Taking on the WorldFrom EverandExtreme Value Hedging: How Activist Hedge Fund Managers Are Taking on the WorldRating: 2.5 out of 5 stars2.5/5 (1)

- Auditing Inventory ProblemsDocument43 pagesAuditing Inventory ProblemsKsUnlockerNo ratings yet

- Lesson 2. Business Combination Part 2Document3 pagesLesson 2. Business Combination Part 2KsUnlockerNo ratings yet

- Accounting for Special Transactions QuizDocument3 pagesAccounting for Special Transactions QuizKsUnlockerNo ratings yet

- Buscom Final Term ExamDocument8 pagesBuscom Final Term ExamKsUnlockerNo ratings yet

- Session 3Document55 pagesSession 3ahmedNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument8 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionMary Grace Errabo FloridoNo ratings yet

- Laporan Keuangan Auditan 2020Document219 pagesLaporan Keuangan Auditan 2020Muhammad Hasan SafariNo ratings yet

- Accounting Compress PDFDocument9 pagesAccounting Compress PDFJade jade jadeNo ratings yet

- Mind Map 5Document1 pageMind Map 5darylle roblesNo ratings yet

- Example 1 Illustration of 5-Step Model (Telecom Contract) Example 2 Contract Modification Example 3 Explicit vs. Implicit Performance Obligations Example 5 Variable Consideration With ContingencyDocument13 pagesExample 1 Illustration of 5-Step Model (Telecom Contract) Example 2 Contract Modification Example 3 Explicit vs. Implicit Performance Obligations Example 5 Variable Consideration With ContingencyHồ Đan ThụcNo ratings yet

- 5 - Change ManagementDocument26 pages5 - Change ManagementjoyteferaNo ratings yet

- Argenti PDFDocument216 pagesArgenti PDFAngel V. EstradaNo ratings yet

- Management Advisory Services NotesDocument2 pagesManagement Advisory Services NotesKyla RoxasNo ratings yet

- CHAPTER 1 Managerial Accounting: True or FalseDocument4 pagesCHAPTER 1 Managerial Accounting: True or FalseJinky P. RefurzadoNo ratings yet

- Lecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceDocument16 pagesLecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceGarp BarrocaNo ratings yet

- AC1101 Syllabus StudentDocument3 pagesAC1101 Syllabus StudentJerson AmbalNo ratings yet

- Accounting Cycle For Service Business - Part 1Document35 pagesAccounting Cycle For Service Business - Part 1Michael MagdaogNo ratings yet

- Accounts Assignment For Lone Pine CafeDocument2 pagesAccounts Assignment For Lone Pine CafeAmar BhattNo ratings yet

- Audtheo Part 1Document2 pagesAudtheo Part 1MichNo ratings yet

- AUDCLASS Midterm-ExamDocument7 pagesAUDCLASS Midterm-ExamBeverly MindoroNo ratings yet

- Chapter 12 (Kelas Z)Document9 pagesChapter 12 (Kelas Z)RIZAL EFENDINo ratings yet

- Invitation at SDM UjireDocument2 pagesInvitation at SDM UjireMahesh BendigeriNo ratings yet

- Subject Position and DecolonizationDocument2 pagesSubject Position and DecolonizationMian Muhammad AtifNo ratings yet

- CA Intermediate Auditing & Assurance November 2022 Suggested AnswersDocument8 pagesCA Intermediate Auditing & Assurance November 2022 Suggested AnswersLegends CreationNo ratings yet

- Managerial Accounting CASE Solves Missing Data Income StatementDocument3 pagesManagerial Accounting CASE Solves Missing Data Income StatementAlphaNo ratings yet

- 369-Article Text-822-1-10-20200805Document10 pages369-Article Text-822-1-10-20200805Alifia GaneshiNo ratings yet

- Small Company AuditDocument38 pagesSmall Company AuditShardulWaikarNo ratings yet

- QR Target Term-2 Ultimate Accountany XIIDocument193 pagesQR Target Term-2 Ultimate Accountany XIISatinder SandhuNo ratings yet

- Auditing Banks and Financial InstitutionsDocument8 pagesAuditing Banks and Financial InstitutionsziahnepostreliNo ratings yet