Professional Documents

Culture Documents

30.fuzzy J.Nagi

Uploaded by

Vikas0 ratings0% found this document useful (0 votes)

16 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pages30.fuzzy J.Nagi

Uploaded by

VikasCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

1284 IEEE TRANSACTIONS ON POWER DELIVERY, VOL. 26, NO.

2, APRIL 2011

Improving SVM-Based Nontechnical Loss Detection in Power Utility Using

the Fuzzy Inference System

Jawad Nagi, Keem Siah Yap, Sieh Kiong Tiong, Member, IEEE, Syed Khaleel Ahmed, Member, IEEE, and

Farrukh Nagi

Abstract—This letter extends previous research work in mod-

eling a nontechnical loss (NTL) framework for the detection of

fraud and electricity theft in power distribution utilities. Pre-

vious work was carried out by using a support vector machine

(SVM)-based NTL detection framework resulting in a detection

hitrate of 60%. This letter presents the inclusion of human knowl-

edge and expertise into the SVM-based fraud detection model

(FDM) with the introduction of a fuzzy inference system (FIS), in

the form of fuzzy IF-THEN rules. The FIS acts as a postprocessing

scheme for short-listing customer suspects with higher probabili-

ties of fraud activities. With the implementation of this improved

SVM-FIS computational intelligence FDM, Tenaga Nasional

Berhad Distribution’s detection hitrate has increased from 60%

to 72%, thus proving to be cost effective.

Index Terms—Computational intelligence system, fuzzy logic,

nontechnical loss, pattern classification.

I. INTRODUCTION

ISTRIBUTON losses in power utilities originating from

D electricity theft and other customer malfeasances are

called nontechnical (NTLs). These losses mainly occur due

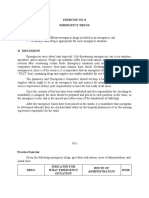

Fig. 1. Flowchart of the improved data postprocessing NTL framework for im-

to meter tampering, meter malfunction, illegal connections, plementation and integration of the FIS into the FDM.

billing irregularities, and unpaid bills [1].

The problem with NTLs is not only faced by the least developed

countries in the Asian and African regions, but also by developed FDM in [2] achieved a detection hitrate of 60%. The approach

countries, such as the U.S. and the U.K. Specifically, high rates proposed in this letter extends the research work of [2] by inte-

of NTL activities have been reported in the majority of devel- grating human intelligence and knowledge into the SVM-based

oping countries in the Association of South East Asian Nations FDM with the introduction of a fuzzy inference system (FIS) [4]

(ASEAN) group, which includes Malaysia, Indonesia, Thailand, as a postprocessing scheme. The FIS acts as an intelligent de-

and Vietnam [1]. As an example, in developing countries, such as cision-making system together with the SVM-based detection

Bangladesh, India, Pakistan, and Lebanon, an average between model in [2] to shortlist customer suspects with high probabilities

20% to 30% of NTLs have been observed [2], [3]. of fraud activities and abnormalities.

In [2], the authors proposed a fraud detection model (FDM) to

detect NTLs using support vector machines (SVMs) by utilizing II. IMPLEMENTATION OF THE FIS

load patterns of customers derived from the customer database.

Based on the feedback from Tenaga Nasional Berhad Distribution The data postprocessing scheme in [2] employs a decision-

(TNBD) Sdn. Bhd. for onsite customer inspection, the proposed making system using structured query language (SQL) to short-

list potential fraud customers from the correlated data. In con-

text to [2, Fig. 6], Fig. 1 in this letter illustrates the flowchart of

Manuscript received October 06, 2009; revised March 22, 2010 and June 11,

2010; accepted June 21, 2010. Date of current version March 25, 2011. This

the improved data postprocessing NTL framework for the im-

work was supported in part by Tenaga Nasional Berhad Distribution (TNBD) plementation and integration of the FIS into the current SVM-

Sdn. Bhd. and in part by Tenaga Nasional Berhad Research (TNBR) Sdn. Bhd. based FDM in [2].

under Grant RJO 10061948. Paper no. PESL-00108-2009.

J. Nagi and S. K. Tiong are with the Power Engineering Centre (PEC) and De-

partment of Electronics and Communication Engineering of Universiti Tenaga A. Parameter Selection

Nasional, Kajang 43009, Selangor, Malaysia (e-mail: jawad@uniten.edu.my;

siehkiong@uniten.edu.my).

In order to select customers with higher probabilities of fraud

K. S. Yap and S. K. Ahmed are with the Department of Electronics and Com- from the correlated data in Fig. 1, useful parameters for the cre-

munication Engineering, Universiti Tenaga Nasional, Kajang 43009, Selangor, ation of a customer selection rule are determined by inspecting

Malaysia (e-mail: yapkeem@uniten.edu.my; syedkhaleel@uniten.edu.my). load profiles of customers confirmed as fraud by TNBD onsite

F. Nagi is with the Department of Mechanical Engineering, Universiti Tenaga

Nasional, Kajang 43009, Selangor, Malaysia (e-mail: farrukh@uniten.edu.my). inspection teams. From the correlated data, ten parameters are

Digital Object Identifier 10.1109/TPWRD.2010.2055670 selected to construct a rule for the selection of customers with

0885-8977/$26.00 © 2011 IEEE

NAGI et al.: IMPROVING SVM-BASED NONTECHNICAL LOSS DETECTION IN POWER UTILITY 1285

TABLE I TABLE III

PARAMETERS SELECTED FOR FORMATION OF THE CUSTOMER SELECTION RULE COMPARISON OF THE DETECTION HITRATE

FOR SVM AND SVM-FIS FRAMEWORK

E. Evaluation of the FIS

The FIS [4] is implemented by evaluating the fuzzy rule in

Table II for all customers (FIS testing samples) shortlisted as

fraud by the SVM in [2]. The FIS produces a fuzzified output

TABLE II value in between 0 to 1 for each testing sample (customer).

FORMATION OF ORDINARY AND FUZZY RULE FOR CUSTOMER SELECTION

Testing samples with a fuzzy output value of greater than 0.5

(default threshold in between 0 to 1) are considered as customers

with higher probabilities of fraud activities and abnormalities.

III. EXPERIMENTAL RESULTS

Pilot testing results obtained from TNBD Sdn. Bhd. for

onsite customer inspection by using the SVM-based FDM in

[2] and the SVM-FIS FDM are indicated in Table III. The

obtained results indicate that the computational intelligence

scheme of SVM-FIS outperforms the SVM-based FDM in [2]

by contributing a 12% increase in the average detection hitrate.

high probabilities of fraud and abnormalities, as indicated in IV. CONCLUSION

Table I. The approach proposed in this letter extends the research

work conducted in [2] by integrating human knowledge and

B. Formation of the Customer Selection Rule expertise into the SVM-based FDM with the implementation

The parameters selected in Table I are analyzed in order to de- of an FIS. The FIS first introduced in [4] can be used as a

velop an ordinary rule for the selection of customers with high decision-making system for various applications. To the best

probabilities of fraud activities and abnormalities. The customer of our knowledge, the work presented here is the first to use

selection rule is established by using discriminative features in the FIS for detection of fraud and electricity theft in power

order to classify (identify) consumption patterns of good cus- distribution utilities.

tomers [2, Fig. 4] against consumption patterns fraud customers In this letter, the FIS acts as a postprocessing scheme to short-

[2, Fig. 3], as shown in Table II. The customer selection rule fil- list customer suspects with high probabilities of fraud and ab-

ters (removes) customers with low probabilities of fraud activi- normalities. The FIS emulates the reasoning process that human

ties from the shortlisted suspects. experts (TNBD NTL Engineers) undertake in detecting fraud

activities. The higher detection hitrate of the SVM-FIS proves

C. Transformation of the Ordinary Rule Into Fuzzy Rule it to be more cost effective than the FDM in [2]. With the im-

plementation of the SVM-FIS-based FDM, TNBD’s detection

In order to implement fuzzy reasoning, the ordinary rule in

hitrate will increase 12% from 60% to 72%.

Table II is transformed into a fuzzy IF-THEN rule, using defini-

tions for combining fuzzy sets. For union operations (OR), the

REFERENCES

fuzzy set “ ” operation is used and for intersection opera-

[1] A. H. Nizar and Z. Y. Dong, “Identification and detection of elec-

tions (AND), the “ ” operation is used. tricity customer behaviour irregularities,” in Proc. IEEE/Power Eng.

Soc. Power Systems Conf. Expo., Seattle, WA, Mar. 15–18, 2009, pp.

D. Fuzzy Membership Function Formulation and Tuning 1–10.

[2] J. Nagi, K. S. Yap, S. K. Tiong, S. K. Ahmed, and M. Mohamad, “Non-

Triangular and trapezoid membership functions (MFs) using technical loss detection for metered customers in power utility using

the ten parameter values defined in the ordinary rule in Table II support vector machines,” IEEE Trans. Power Del., vol. 25, no. 2, pp.

1162–1171, Apr. 2010.

are used to implement the fuzzy rule in Table II. The values of [3] A. H. Nizar, Z. Y. Dong, and Y. Wang, “Power utility nontechnical loss

the MFs are determined by inspecting load profiles of customers analysis with extreme learning machine model,” IEEE Trans. Power

confirmed as fraud by TNBD onsite inspection teams. The MFs Syst., vol. 23, no. 3, pp. 946–955, Aug. 2008.

[4] J.-S. R. Jang, “ANFIS: Adaptive-network-based fuzzy inference

are fine tuned by using knowledge and expertise from engineers system,” IEEE Trans. Syst., Man, Cybern., vol. 23, no. 3, pp. 665–685,

in TNBD’s NTL Group. May/Jun. 1993.

You might also like

- An Optimal Genetic Algorithm With Support Vector Machine For Cloud Based Customer Churn PredictionDocument7 pagesAn Optimal Genetic Algorithm With Support Vector Machine For Cloud Based Customer Churn PredictionHridoy IshrakNo ratings yet

- Churn PredictionITNACCDocument7 pagesChurn PredictionITNACCKakashi HatakeNo ratings yet

- Classification of Customer Churn Prediction Model For Telecommunication Industry Using Analysis of VarianceDocument7 pagesClassification of Customer Churn Prediction Model For Telecommunication Industry Using Analysis of VarianceIAES IJAINo ratings yet

- Customer Churn Analysis in Telecom IndustryDocument6 pagesCustomer Churn Analysis in Telecom Industryrahuly5340No ratings yet

- Churn Prediction in Mobile Telecom Syste PDFDocument5 pagesChurn Prediction in Mobile Telecom Syste PDFMahmoud Al-EwiwiNo ratings yet

- Subudhi-Panigrahi2018 Article AHybridMobileCallFraudDetectioDocument13 pagesSubudhi-Panigrahi2018 Article AHybridMobileCallFraudDetectioYassine LASRINo ratings yet

- Customers Churn Prediction in Financial Institution Using Artificial Neural NetworkDocument9 pagesCustomers Churn Prediction in Financial Institution Using Artificial Neural Networkgarikai masawiNo ratings yet

- Big Data Analytics ProjectDocument21 pagesBig Data Analytics ProjectKoushal SinghNo ratings yet

- Minority Report in Fraud Detection: Classification of Skewed DataDocument10 pagesMinority Report in Fraud Detection: Classification of Skewed DataJesús Alcalá GarcíaNo ratings yet

- Analysis and Modelling of Fraud and Revenue Assurance Threats in Future Telecommunications Network and Service EnvironmentsDocument4 pagesAnalysis and Modelling of Fraud and Revenue Assurance Threats in Future Telecommunications Network and Service EnvironmentsPhilippe LangloisNo ratings yet

- Tencon NTL DetectionDocument6 pagesTencon NTL DetectionAjit KumarNo ratings yet

- Customer Churn Prediction Using Machine Learning AlgorithmsDocument5 pagesCustomer Churn Prediction Using Machine Learning AlgorithmsIJRASETPublicationsNo ratings yet

- GC 3310851089Document5 pagesGC 3310851089Shakeel RanaNo ratings yet

- Customer Churn Prediction in TelecommunicationDocument13 pagesCustomer Churn Prediction in TelecommunicationnimaNo ratings yet

- A Feature Selection Based On The Farmland Fertility Algorithm For Improved Intrusion Detection SystemsDocument27 pagesA Feature Selection Based On The Farmland Fertility Algorithm For Improved Intrusion Detection SystemsRashed ShakirNo ratings yet

- (IJCST-V11I3P15) :auti Divya.S, Deshmukh Rajeshwari.B, Dumbre Komal.G, Dr.A.A.KhatriDocument5 pages(IJCST-V11I3P15) :auti Divya.S, Deshmukh Rajeshwari.B, Dumbre Komal.G, Dr.A.A.KhatriEighthSenseGroupNo ratings yet

- Vig SPS-5382-Telecom Customer Churn Prediction Using Watson Auto AIDocument51 pagesVig SPS-5382-Telecom Customer Churn Prediction Using Watson Auto AIVigneshNo ratings yet

- SPS-5382-Telecom Customer Churn Prediction Using Watson Auto AIDocument51 pagesSPS-5382-Telecom Customer Churn Prediction Using Watson Auto AIVigneshNo ratings yet

- Conf Chunk Predict IeeeDocument5 pagesConf Chunk Predict IeeeRACHANA GUPTANo ratings yet

- Performance Evaluation of Various Classification Techniques For CustomerDocument19 pagesPerformance Evaluation of Various Classification Techniques For CustomerTú Nguyễn Hà TrọngNo ratings yet

- Churn Analysis Using Fuzzy Hybrid K-Mean Clustering With SVM Classifier TechniquesDocument10 pagesChurn Analysis Using Fuzzy Hybrid K-Mean Clustering With SVM Classifier Techniquesthirumuru jithesh kumarNo ratings yet

- Detecting SIM Box Fraud by Using Support Vector Machine and Artificial Neural NetworkDocument14 pagesDetecting SIM Box Fraud by Using Support Vector Machine and Artificial Neural NetworkAmitNo ratings yet

- 2paper (SCI)Document10 pages2paper (SCI)lavanya penumudiNo ratings yet

- Machine Learning-Based Network Status Detection and Fault LocalizationDocument10 pagesMachine Learning-Based Network Status Detection and Fault LocalizationJohnNo ratings yet

- 2588 Software Development and Modelling For Churn Prediction Using Logistic Regression in Telecommunication IndustryDocument5 pages2588 Software Development and Modelling For Churn Prediction Using Logistic Regression in Telecommunication IndustryWARSE JournalsNo ratings yet

- Comparison of Learning Techniques For Prediction of Customer Churn in TelecommunicationDocument36 pagesComparison of Learning Techniques For Prediction of Customer Churn in TelecommunicationHsu Let Yee HninNo ratings yet

- Intrusion Awareness Based On D-SA: Prashant Shakya, Prof. Rahul ShuklaDocument3 pagesIntrusion Awareness Based On D-SA: Prashant Shakya, Prof. Rahul ShuklaInternational Journal of computational Engineering research (IJCER)No ratings yet

- IspanyakonferansiDocument5 pagesIspanyakonferansiabdelkader daghfousNo ratings yet

- Computer Science Self Management: Fundamentals and ApplicationsFrom EverandComputer Science Self Management: Fundamentals and ApplicationsNo ratings yet

- Churn Prediction2Document16 pagesChurn Prediction2simon linnertNo ratings yet

- Piyush DmbiDocument9 pagesPiyush DmbiRahul PandyaNo ratings yet

- Research ArticleDocument7 pagesResearch ArticlemainakroniNo ratings yet

- A Comparative Study of Hidden Markov Model and SupDocument10 pagesA Comparative Study of Hidden Markov Model and Supasdigistore101No ratings yet

- Available Online Through Research ArticleDocument16 pagesAvailable Online Through Research ArticleAndres Esteban AreasNo ratings yet

- NRC Publications Archive (Nparc) Archives Des Publications Du CNRC (Nparc)Document7 pagesNRC Publications Archive (Nparc) Archives Des Publications Du CNRC (Nparc)Kleber Magno VieiraNo ratings yet

- Intrusion Detection System IDS DevelopmeDocument17 pagesIntrusion Detection System IDS DevelopmeFabio Carciofi JuniorNo ratings yet

- Intrusion Detection System (Ids) Development Using Tree - Based Machine Learning AlgorithmsDocument17 pagesIntrusion Detection System (Ids) Development Using Tree - Based Machine Learning AlgorithmsAIRCC - IJCNCNo ratings yet

- Intrusion Detection System (IDS) Development Using Tree-Based Machine Learning AlgorithmsDocument17 pagesIntrusion Detection System (IDS) Development Using Tree-Based Machine Learning AlgorithmsAIRCC - IJCNCNo ratings yet

- Purnamasari 2020 J. Phys. Conf. Ser. 1641 012010Document9 pagesPurnamasari 2020 J. Phys. Conf. Ser. 1641 012010Abdullah ArifinNo ratings yet

- Analysis of Imbalanced Data Set Problem The Case oDocument7 pagesAnalysis of Imbalanced Data Set Problem The Case oSheikh Tanjurur Rahaman MinarNo ratings yet

- A Combined Mining Based Framework For Predicting Telecommunications Customer Payment BehaviorsDocument9 pagesA Combined Mining Based Framework For Predicting Telecommunications Customer Payment Behaviorsputri gustaNo ratings yet

- A Review of Machine Learning Methodologies For Network Intrusion DetectionDocument4 pagesA Review of Machine Learning Methodologies For Network Intrusion Detectiondinesh nNo ratings yet

- Analysis of Customer Churn Prediction in Telecom Industry Using Decision Trees and Logistic RegressionDocument4 pagesAnalysis of Customer Churn Prediction in Telecom Industry Using Decision Trees and Logistic RegressionD DNo ratings yet

- Churn Analysis ReportDocument28 pagesChurn Analysis ReportRohit BhangaleNo ratings yet

- An Efficient Intrusion Detection System With Custom Features Using FPA-Gradient Boost Machine Learning AlgorithmDocument17 pagesAn Efficient Intrusion Detection System With Custom Features Using FPA-Gradient Boost Machine Learning AlgorithmAIRCC - IJCNCNo ratings yet

- SSRN Id4080303Document3 pagesSSRN Id4080303Juan Lautaro LopezNo ratings yet

- Semi-Supervised Bearing Fault Diagnosis and Classification Using Variational Autoencoder-Based Deep Generative ModelsDocument11 pagesSemi-Supervised Bearing Fault Diagnosis and Classification Using Variational Autoencoder-Based Deep Generative ModelsRaouf BenabdesselamNo ratings yet

- A Novel Statistical Analysis and Autoencoder Driven (CB)Document29 pagesA Novel Statistical Analysis and Autoencoder Driven (CB)Elanor ElNo ratings yet

- Vol 11 3Document5 pagesVol 11 3bhuvanesh.cse23No ratings yet

- Customer Churn Prediction in The Telecommunication Sector Using A Rough Set ApproachDocument13 pagesCustomer Churn Prediction in The Telecommunication Sector Using A Rough Set Approach김기영No ratings yet

- Citation 52 - An In-Depth Analysis On Traffic Flooding Attacks Detection and System Using Data Mining Techniques - Yu2013 - DT - DDOS - IDSDocument8 pagesCitation 52 - An In-Depth Analysis On Traffic Flooding Attacks Detection and System Using Data Mining Techniques - Yu2013 - DT - DDOS - IDSZahedi AzamNo ratings yet

- Deepvcm: A Deep Learning Based Intrusion: Detection Method in VanetDocument6 pagesDeepvcm: A Deep Learning Based Intrusion: Detection Method in VanetSamsam87No ratings yet

- Paper 3 PDFDocument5 pagesPaper 3 PDFindiraNo ratings yet

- Daily Activity Recognition Based Principal Component ClassificationDocument7 pagesDaily Activity Recognition Based Principal Component ClassificationM'hamed Bilal ABIDINENo ratings yet

- Fault Detection and Classification in Industrial IoT in Case of Missing Sensor DataDocument8 pagesFault Detection and Classification in Industrial IoT in Case of Missing Sensor Datasamuel yigaNo ratings yet

- A Comparative Study of Classification Techniques For Fraud DetectionDocument5 pagesA Comparative Study of Classification Techniques For Fraud DetectionAnonymous Tg2ypWjlNMNo ratings yet

- SN ArticleDocument18 pagesSN ArticlemihirNo ratings yet

- Iccse 2009 5228542Document4 pagesIccse 2009 5228542zhaobingNo ratings yet

- Customer Profitability Analysis of AutomobileDocument7 pagesCustomer Profitability Analysis of AutomobileRadia AbbasNo ratings yet

- Research On A Customer Churn Combination Prediction Model Based On Decision Tree and Neural NetworkDocument4 pagesResearch On A Customer Churn Combination Prediction Model Based On Decision Tree and Neural Networkdanty.dmcNo ratings yet

- Statistical FrameworkDocument13 pagesStatistical FrameworkVikasNo ratings yet

- Critical Information Infrastructures Security: Erich Rome Marianthi Theocharidou Stephen WolthusenDocument269 pagesCritical Information Infrastructures Security: Erich Rome Marianthi Theocharidou Stephen WolthusenVikasNo ratings yet

- Electrical Power and Energy Systems: Josif V. Spiric, Miroslav B. Doc Ic, Slobodan S. StankovicDocument9 pagesElectrical Power and Energy Systems: Josif V. Spiric, Miroslav B. Doc Ic, Slobodan S. StankovicVikasNo ratings yet

- Cyberthreat Analysis and Detection For Energy Theft in Social Networking of Smart HomesDocument11 pagesCyberthreat Analysis and Detection For Energy Theft in Social Networking of Smart HomesVikasNo ratings yet

- Old Titles of Me ThesisDocument245 pagesOld Titles of Me ThesisVikasNo ratings yet

- Your Excel Cheatsheet - Tiger Spreadsheet SolutionsDocument1 pageYour Excel Cheatsheet - Tiger Spreadsheet Solutionskev_170No ratings yet

- Short History Og LNG VesselDocument32 pagesShort History Og LNG VesseljwsommermannNo ratings yet

- Subsea Ngee Ann Primer CourseDocument6 pagesSubsea Ngee Ann Primer CoursescribdmingNo ratings yet

- Avtar Singh Brar, Chandigarh Vs Assessee On 23 February, 2011Document97 pagesAvtar Singh Brar, Chandigarh Vs Assessee On 23 February, 2011CacptCoachingNo ratings yet

- Detection and Control Components: FCM-1 Control Module (IQ-318/IQ-636X-2)Document98 pagesDetection and Control Components: FCM-1 Control Module (IQ-318/IQ-636X-2)Eduardo Diaz PichardoNo ratings yet

- Captain Door Lock and GlassDocument2 pagesCaptain Door Lock and GlassNiten GuptaNo ratings yet

- Quawan Charles LawsuitDocument17 pagesQuawan Charles LawsuitLeigh EganNo ratings yet

- PTS Genap Bahasa Inggris Grade 4Document2 pagesPTS Genap Bahasa Inggris Grade 4smart edufunNo ratings yet

- Whs Project Proposal TawilaDocument19 pagesWhs Project Proposal TawilaLawrence WatssonNo ratings yet

- Nokia 220 Dual Sim - Schematic Diagarm PDFDocument23 pagesNokia 220 Dual Sim - Schematic Diagarm PDFShaktidhan KumarNo ratings yet

- Tally Erp 9 Shortcuts in PDFDocument5 pagesTally Erp 9 Shortcuts in PDFAmit Baviskar100% (1)

- Exercise No. 8 Emergency Drugs I. ObjectivesDocument5 pagesExercise No. 8 Emergency Drugs I. ObjectivesUn knownnnNo ratings yet

- Government College University, Faisalabad: Examination Form (Annual System)Document1 pageGovernment College University, Faisalabad: Examination Form (Annual System)Ghulam MurtazaNo ratings yet

- The Uralla Post Issue #4Document4 pagesThe Uralla Post Issue #4TheUrallaPostEditorNo ratings yet

- Summer Internship Project Report The Outlook Group: Ramaiah Institute of ManagementDocument36 pagesSummer Internship Project Report The Outlook Group: Ramaiah Institute of Managementshashank kumarNo ratings yet

- M53 Lec4.4 Area and ArclengthDocument141 pagesM53 Lec4.4 Area and Arclengthcriscab12345100% (1)

- Finished Goods Inventories XX Work in Progress XX To Record The Completed JobDocument6 pagesFinished Goods Inventories XX Work in Progress XX To Record The Completed JobClarissa TeodoroNo ratings yet

- EAG Haufler - BACKSTROKE T P PDFDocument23 pagesEAG Haufler - BACKSTROKE T P PDFKylaMayAndrade100% (1)

- Biotech Companies in IndiaDocument4 pagesBiotech Companies in IndiaBusinessNo ratings yet

- Rationale Self AssessmentDocument5 pagesRationale Self Assessmentapi-267446628No ratings yet

- LP VI Bi Lab ManualDocument28 pagesLP VI Bi Lab Manualgpay94348No ratings yet

- SHELTER FOR COMPOSITE CLIMATES 3rd SEMDocument19 pagesSHELTER FOR COMPOSITE CLIMATES 3rd SEMflower lilyNo ratings yet

- Aotr 2.9 Hotfix 3 Patch NotesDocument12 pagesAotr 2.9 Hotfix 3 Patch NotesflamesofwarNo ratings yet

- Charities (Institutions of A Public Character) RegulationsDocument14 pagesCharities (Institutions of A Public Character) RegulationsTravis SimNo ratings yet

- Apple Company AnalysisDocument10 pagesApple Company AnalysisEvansNo ratings yet

- SipDocument16 pagesSipAlison LewisNo ratings yet

- SA 560 CA Inter Updated NotesDocument4 pagesSA 560 CA Inter Updated Notesnathsuprakash93No ratings yet

- English P1 Mark SchemeDocument14 pagesEnglish P1 Mark SchemeGeeta Aswani100% (3)

- Wiles Cbup Lesson PlansDocument37 pagesWiles Cbup Lesson Plansapi-302146942No ratings yet

- G-Series Lua APIDocument46 pagesG-Series Lua APIGabriel FaureNo ratings yet