Professional Documents

Culture Documents

Acctg Final Notes

Uploaded by

Leena0 ratings0% found this document useful (0 votes)

9 views3 pagesOriginal Title

Acctg Final Notes Copy

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesAcctg Final Notes

Uploaded by

LeenaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Chapter 1: The purpose of financial statements

- records economic events, tells the information to users

o Internal users- need to be hired by the company, managers, employees etc

o External users- investors, creditors, CRA, customers

- Financial vs Managerial Accounting:

o Financial:

External users

Rigid rules

Historical perspective (last year, month etc.)

Aggregate information (summarized)

Quantitative (numerical) information

o Managerial:

Internal users

Flexible format

Future perspective

Detailed information

Quantitative and qualitative information

- Legal forms of business

o Sole proprietorship- owned by one person (personal tax return)

o Partnership- owned by more than one person but not incorporated (personal tax

return

o Corporation- separate legal entity (separate tax) held by shareholders, can be

public or private, profit or not-for-profit

Advantages:

Corporate management

Separate legal existence

Limited liability of shareholders

Differed or reduced taxes

Transferable ownership rights (sell or buy shares)

Ability to get capital (issue bonds or sell shares

Continuous life

Disadvantages:

Increased cost and complexity to adhere to regulation by the

government

Additional taxes

Difficulty in borrowing funds (because of limited liability)

- Types of business activities

o Operating

Main day-to-day activites of a business

Includes current assets/ liabilities (cash, AR, AP etc.)

o Investing (what businesses have invested in)

Getting the resources and assets needed to operate the business in the

long term

Includes long term assets (investments, property, land, equipment)

o Financing

Getting and repaying funds to finance operations of the business, usually

long-term liabilities, or shareholders’ equity

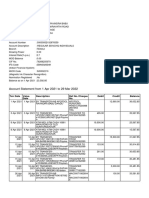

- Financial statements

o Balance sheet

AKA statement of financial position

Owned and owed

Assets- resources owned by a business (bank account, vehicle, land,

building)

Liabilities- obligations of the business (bank loans, bonds, money)

Shareholder’s equity- share capital and retained earnings (when

shareholders get shares to give money to the company)

Assets=liabilities + shareholders’ equity

At a point in time “as at” or “as of”

o Income statement

AKA statement of earnings

Revenues- obtained from the sale of a product or service

Expenses- costs of assets consumed or services used to generate revenue

Net income (loss)= revenues – expenses

For a period of time “for the year ended”

Measures gains and losses

o Statement of cash flows

Details on all cash inflows and outflows

Operating, investing and financing activities

For a period of time

Shows net increase or decrease in cash for the period

o Statement of retained earnings

For ASPE (private)

Shows the changes in retained earnings for the period

Net income for a period of time

Dividends paid to shareholders

o Retained earnings opening balance + net earnings –

dividends = retained earnings closing

Retained earnings (the account) is the cumulative net income (less losses)

that is retained in the business (not given to shareholders)

For a period of time

o Statement of changes in equity

for public businesses using IFRS

Shares and retained earnings

Shows the changes in each component of shareholders equity for the

period

Share capital:

Amounts contributed by shareholders

Each class of shares is shown in a separate column (common or

preferred)

Retained earnings/ deficit

For a period of time

o Other financial components

Notes/ footnotes- gives more detail on the information in the statements

Publicly traded companies would include management discussion and

analysis, and independent auditors report

o Generally accepted accounting principles (GAAP)

Rules and practices for the preparation of financial statements

Different for public and private corporations (IFRS vs ASPE)

Proprietorships and partnerships don’t need to use either if their

statements are for internal users only. If prepared for CRA or any other

external user, they will need to use ASPE

You might also like

- 01 Accounting Study NotesDocument8 pages01 Accounting Study NotesJonas ScheckNo ratings yet

- 3 4 Final AccountsDocument6 pages3 4 Final AccountsKANAK KOKARENo ratings yet

- Key Points For Week 3 TopicDocument4 pagesKey Points For Week 3 TopicKyaw Thwe TunNo ratings yet

- Accounting Term Alternatives DescriptionDocument1 pageAccounting Term Alternatives DescriptionstefpanNo ratings yet

- Chapter OneDocument35 pagesChapter OnesasaNo ratings yet

- Accounting..... All Questions & Answer.Document13 pagesAccounting..... All Questions & Answer.MehediNo ratings yet

- Chapter 1Document28 pagesChapter 1soujanyaNo ratings yet

- Chap 4 - 7 KTTCDocument14 pagesChap 4 - 7 KTTCQuyên NguyễnNo ratings yet

- Accounting:: Recording, Analysing and SummarisingDocument37 pagesAccounting:: Recording, Analysing and SummarisingNguyen Ngoc MaiNo ratings yet

- Income StatementDocument21 pagesIncome StatementAdil Khan LodhiNo ratings yet

- Finance For Non Finance Professionals Statements and RatiosDocument32 pagesFinance For Non Finance Professionals Statements and Ratioskrithika1288No ratings yet

- Statement of Financial PositionDocument8 pagesStatement of Financial PositionKaye LiwagNo ratings yet

- Statement of Financial Position: Zena Bituin F. Gardoce BSA 2101Document3 pagesStatement of Financial Position: Zena Bituin F. Gardoce BSA 2101Christine Marie RamirezNo ratings yet

- ACCT 101 Chapter 1 HandoutDocument3 pagesACCT 101 Chapter 1 HandoutLlana RoxanneNo ratings yet

- Chapter 1 MBA 560Document47 pagesChapter 1 MBA 560CendorlyNo ratings yet

- Topic 2Document48 pagesTopic 2Marie JulienNo ratings yet

- Chapters 1 and 2Document36 pagesChapters 1 and 2Qing ShiNo ratings yet

- Def of Assets and LiabilitiesDocument6 pagesDef of Assets and LiabilitieslancealcarazNo ratings yet

- Financial StatementsDocument25 pagesFinancial StatementsRaquel Sibal RodriguezNo ratings yet

- Module #03 - Financial Statements, Cash Flow, and TaxesDocument19 pagesModule #03 - Financial Statements, Cash Flow, and TaxesRhesus UrbanoNo ratings yet

- III Business Plan - Elements - Elements 3th PartDocument30 pagesIII Business Plan - Elements - Elements 3th PartefrenNo ratings yet

- Engineering Economics Reviewer Part 1 PDFDocument88 pagesEngineering Economics Reviewer Part 1 PDFagricultural and biosystems engineeringNo ratings yet

- Advance Financial Management - Financial Tools - Written ReportDocument36 pagesAdvance Financial Management - Financial Tools - Written Reportgilbertson tinioNo ratings yet

- Summary Pointer Chapter 2 Advanced AccountingDocument6 pagesSummary Pointer Chapter 2 Advanced Accountingahmed arfanNo ratings yet

- Additional Reading 2Document32 pagesAdditional Reading 2Htain Lin MaungNo ratings yet

- Accounting Notes (Week 1)Document9 pagesAccounting Notes (Week 1)junkmail4akhNo ratings yet

- Rules of Debits and CreditsDocument6 pagesRules of Debits and CreditsJubelle Tacusalme Punzalan100% (1)

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisAbinash MishraNo ratings yet

- Part Two: Financial Accounting: An IntroductionDocument139 pagesPart Two: Financial Accounting: An IntroductionRobel Habtamu100% (1)

- DPB2012 - T6Document26 pagesDPB2012 - T6suhanaNo ratings yet

- Chapter 2 Financial AnalysisDocument76 pagesChapter 2 Financial AnalysisAhmad Ridhuwan Abdullah100% (1)

- Midterm Notes Midterm Notes: Financial Accounting (University of Ottawa) Financial Accounting (University of Ottawa)Document38 pagesMidterm Notes Midterm Notes: Financial Accounting (University of Ottawa) Financial Accounting (University of Ottawa)Khải Hưng NguyễnNo ratings yet

- Trading Basics: AccountingDocument10 pagesTrading Basics: AccountingNonameforeverNo ratings yet

- 7.2 Financial Ratio AnalysisDocument31 pages7.2 Financial Ratio AnalysisteeeNo ratings yet

- Accounting For Non Accountants 2019Document39 pagesAccounting For Non Accountants 2019gina100% (1)

- FDNACCT - Accounting Equation PDFDocument33 pagesFDNACCT - Accounting Equation PDFChyle SamuelNo ratings yet

- Reading Comprehension Activity "Introduction To The Financial Statements"Document4 pagesReading Comprehension Activity "Introduction To The Financial Statements"LAURA TELLEZNo ratings yet

- MBAB 5P01 - Chapter 1Document3 pagesMBAB 5P01 - Chapter 1Priya MehtaNo ratings yet

- Review SessionDocument25 pagesReview SessionK60 Bùi Phương AnhNo ratings yet

- Chapter 1 Notes: Created Tags UpdatedDocument6 pagesChapter 1 Notes: Created Tags UpdatedTristan RamosNo ratings yet

- Basic Financial StatementsDocument11 pagesBasic Financial StatementsOmaYr RatherNo ratings yet

- Notes CanniiDocument53 pagesNotes Canniicaro.colcerasaNo ratings yet

- Financial Accounting, Lecture 1: Users of Accounting InformationDocument3 pagesFinancial Accounting, Lecture 1: Users of Accounting InformationNederlands LiteratuurNo ratings yet

- 1.0 CFI - FS Primer PDFDocument10 pages1.0 CFI - FS Primer PDFSarthak NautiyalNo ratings yet

- Intro To Economics Lecture 1 - Elements of FSDocument28 pagesIntro To Economics Lecture 1 - Elements of FSАлихан МажитовNo ratings yet

- Management: Principles, Processes & Practices © Oxford University Press 2008 All Rights ReservedDocument19 pagesManagement: Principles, Processes & Practices © Oxford University Press 2008 All Rights ReservedyeshaNo ratings yet

- Introduction To AccountingDocument39 pagesIntroduction To AccountingRazib KhanNo ratings yet

- Part 1 Ag Eng Revised 2011Document95 pagesPart 1 Ag Eng Revised 2011Zrrah Changitan0% (1)

- T 32fd6f43 3cd3 4d19 b62d 111e849211bfincome StatementDocument45 pagesT 32fd6f43 3cd3 4d19 b62d 111e849211bfincome StatementthukrishivNo ratings yet

- Statement of Financial PositionDocument64 pagesStatement of Financial PositionDaphne Gesto SiaresNo ratings yet

- Chapter 5 - Financial Position and Cash FlowsDocument8 pagesChapter 5 - Financial Position and Cash FlowsCait PostNo ratings yet

- Understanding Financial Statements: Creditor (Banks, Suppliers)Document14 pagesUnderstanding Financial Statements: Creditor (Banks, Suppliers)Raven Macaraig100% (1)

- Lesson 1Document20 pagesLesson 1Charlyn VasquezNo ratings yet

- Management Accounting: DR Hla Hla MonDocument77 pagesManagement Accounting: DR Hla Hla MonAnonymous jrIMYSz9No ratings yet

- Accounting Cycle GuideDocument12 pagesAccounting Cycle GuideChelay EscarezNo ratings yet

- Acct CH4Document10 pagesAcct CH4Aseel Al NajraniNo ratings yet

- Financial StatementsDocument24 pagesFinancial StatementsJemarse GumpalNo ratings yet

- Assets Liabilities and Stockholder's EquityDocument4 pagesAssets Liabilities and Stockholder's EquityalycarrinoNo ratings yet

- Chapter 1 - Introduction To Financial AccountingDocument60 pagesChapter 1 - Introduction To Financial Accountingnew rhondaldNo ratings yet

- FireinsuranceDocument9 pagesFireinsurancesmit9993No ratings yet

- 2Document12 pages2NAVAS IIANo ratings yet

- FM 02 Central Banking and Monetary PolicyDocument10 pagesFM 02 Central Banking and Monetary PolicyIvy ObligadoNo ratings yet

- NAFA Money Market FundsDocument2 pagesNAFA Money Market FundschqaiserNo ratings yet

- Cross Currency Basis - RBS PDFDocument7 pagesCross Currency Basis - RBS PDFJaz MNo ratings yet

- RDInstallmentReport13 11 2019Document1 pageRDInstallmentReport13 11 2019Archana AwasthiNo ratings yet

- TRAINING REPORT (Pankaj Bhardwaj)Document48 pagesTRAINING REPORT (Pankaj Bhardwaj)Pankaj BhardwajNo ratings yet

- Up To 2020-02-18 - HSBC Business Direct Portfolio Summary 02 - StatementDocument3 pagesUp To 2020-02-18 - HSBC Business Direct Portfolio Summary 02 - StatementLevi dos SantosNo ratings yet

- Chapter 08 AnswersDocument25 pagesChapter 08 AnswersMissy Rose LegaraNo ratings yet

- AE 18 Financial Market Prelim ExamDocument3 pagesAE 18 Financial Market Prelim ExamWenjunNo ratings yet

- Metabank Bank StatementDocument3 pagesMetabank Bank Statementevaristus221No ratings yet

- Demand LetterDocument2 pagesDemand Letter056 DIBYENDU MEHTANo ratings yet

- Cost Accounting System: TopicDocument2 pagesCost Accounting System: Topicsamartha umbareNo ratings yet

- ADJUSTING ENTRIES PPT Examples and ActivityDocument14 pagesADJUSTING ENTRIES PPT Examples and Activitytamorromeo908No ratings yet

- Tesco PLC Annual Report 2022 EXTRACT FINANCIAL RESULTSDocument6 pagesTesco PLC Annual Report 2022 EXTRACT FINANCIAL RESULTSkamunkiriNo ratings yet

- Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesAssets Liabilities Owner'S Equity Income ExpensesRalph Christer Maderazo0% (1)

- School of Business & Management: Course Outline & Accompanying Teaching & Learning PlanDocument6 pagesSchool of Business & Management: Course Outline & Accompanying Teaching & Learning PlanGurmanjot KaurNo ratings yet

- FAR PreBoard (1) CPAR BATCH90Document18 pagesFAR PreBoard (1) CPAR BATCH90Bella ChoiNo ratings yet

- S Ep JFX 3 Wa El Al GS2Document8 pagesS Ep JFX 3 Wa El Al GS2Danda RavindraNo ratings yet

- (Kotak) Vedanta, October 02, 2023Document9 pages(Kotak) Vedanta, October 02, 2023PrakashNo ratings yet

- Apr 30 23:59:59 IST 2023 Revanth Naik VankudothDocument2 pagesApr 30 23:59:59 IST 2023 Revanth Naik VankudothJagadish LavdyaNo ratings yet

- Gousia - A Study On Loans and Advances - Axis BankDocument25 pagesGousia - A Study On Loans and Advances - Axis BankMOHAMMED KHAYYUMNo ratings yet

- Edelweiss Financial Services LTDDocument7 pagesEdelweiss Financial Services LTDMukesh SharmaNo ratings yet

- Metro Pacific Investments Corporation SEC Form 17 Q 14august2023Document141 pagesMetro Pacific Investments Corporation SEC Form 17 Q 14august2023francisjhamesluzadasNo ratings yet

- Mergers and Acquisitions (M&as) in The Nigerian BankingDocument10 pagesMergers and Acquisitions (M&as) in The Nigerian BankingRitji DimkaNo ratings yet

- Advanced Accounting 11th Edition Hoyle Schaefer Doupnik 0078025400 9780078025402 Solution ManualDocument36 pagesAdvanced Accounting 11th Edition Hoyle Schaefer Doupnik 0078025400 9780078025402 Solution Manualfrednunezqatpikzxen100% (23)

- Silo - Tips Problems and SolutionsDocument14 pagesSilo - Tips Problems and SolutionsSasi chNo ratings yet

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryDocument18 pagesColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryFeelingerang MAYoraNo ratings yet

- Merchant Banking 2Document68 pagesMerchant Banking 2city cyberNo ratings yet

- DAYA 2019 Annual ReportDocument192 pagesDAYA 2019 Annual Reportanggita nur kNo ratings yet