0% found this document useful (0 votes)

196 views10 pagesHypothesis Testing and Sales Prediction for Cars

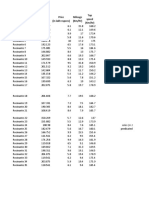

The document contains the responses to questions about analyzing sales data and predicting profits for two new car models, Rocinante36 and Marengo32. Key details include:

- Hypothesis tests are conducted on mileage and top speed data and fail to reject the null hypotheses for both models.

- A type 2 error of claiming a car meets specifications when it does not would be more expensive for the company than a type 1 error.

- Regression equations are developed to predict unit sales, with Rocinante36 predicted to sell over 22 lakh units for a profit of Rs. 227897 lacs, more profitable than Marengo32.

- Increasing price by Rs. 1 lakh would

Uploaded by

Nishant AroraCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

196 views10 pagesHypothesis Testing and Sales Prediction for Cars

The document contains the responses to questions about analyzing sales data and predicting profits for two new car models, Rocinante36 and Marengo32. Key details include:

- Hypothesis tests are conducted on mileage and top speed data and fail to reject the null hypotheses for both models.

- A type 2 error of claiming a car meets specifications when it does not would be more expensive for the company than a type 1 error.

- Regression equations are developed to predict unit sales, with Rocinante36 predicted to sell over 22 lakh units for a profit of Rs. 227897 lacs, more profitable than Marengo32.

- Increasing price by Rs. 1 lakh would

Uploaded by

Nishant AroraCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd