Professional Documents

Culture Documents

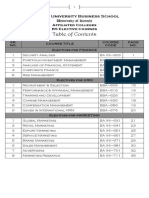

Inhoudstabel SFM

Uploaded by

Elke Liwerski0 ratings0% found this document useful (0 votes)

8 views5 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views5 pagesInhoudstabel SFM

Uploaded by

Elke LiwerskiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

LECTURE 1 (88)

1. BACKGROUND AND HISTORICAL TRENDS

1.1. TYPES OF MERGERS

1.1.1. By organizational structure

1.1.2. By method of payment

1.2. CASH DEALS

1.3. STOCK DEALS

1.4. DEBT DEALS

2. MARKET REACTION TO A TAKEOVER

3. REASONS TO ACQUIRE

3.1. COMMONLY LISTED REASONS TO ACQUIRE

3.1.1. Economies of scale and scope

3.1.2. Vertical integration

3.1.3. Expertise

3.1.4. Monopoly gains

3.1.5. Efficiency gains

3.1.6. Tax savings from operating losses

3.1.7. Diversification

3.1.8. Earnings growth

3.1.9. Managerial motives to merge

4. VALUATION AND THE TAKEOVER PROCESS

4.1. THE OFFER

4.2. MERGER ARBITRAGE

4.3. TAX AND ACCOUNTING ISSUES

4.4. BOARD AND SHAREHOLDER APPROVAL

5. TAKEOVER DEFENSES

5.1. POSION PILLS

5.2. STAGGERED BOARDS

5.3. WHITE KNIGHTS

5.4. GOLDEN PARACHUTES

5.5. RECAPITALIZATION

5.6. OTHER DEFENSIVE STRATEGIES

5.7. REGULATORY APPROVAL

6. WHO GETS THE VALUE ADDED FROM A TAKEOVER?

6.1. THE FREE RIDER PROBLEM

6.1.1. Overcoming the free-riding problem: toeholds

6.1.1.1. Overcoming the free-riding problem: toeholds: the leveraged buyout

6.1.1.2. Overcoming the free-riding problem: toeholds: the freezeout merger

6.2. COMPETITION

LECTURE 2: VALUATION TECHNIQUES FOR M&AS (39)

1. THE COMPARABLES APPROACHES

1.1. COMPARABLE COMPANIES ANALYSIS: A SIMPLE EXAMPLE

1.2. COMPARABLE TRANSACTIONS ANALYSIS

1.2.1. Case study: valuing Mobil for the Exxon-Mobil merger in 1998

1.2.2. Premium paid to the target and combined

1.3. ISSUES WITH COMPARABLES APPROACHES

2. THE DISCOUNTED FREE CASH FLOW VALUATION MODEL

2.1. THE DFCF MODEL: ENTERPRISE VALUATION

2.1.1. Enterprise valuation: what is a free cash flow?

2.1.2. What is the appropriate discount rate?

2.2. THE DFCF MODEL: EQUITY VALUE

2.2.1. Examples

2.3. ISSUE WITH THE DFCF APPROACH

3. CASE STUDY

LECTURE 3: THEORIES OF M&A’S (28)

1. MERGERS AS VALUE-INCREASING DECISIONS

2. MERGERS AS VALUE-REDUCING DECISIONS

3. MANAGERIAL HUBRIS

4. THE THEORIES OF TAKEOVERS

4.1. WHAT IS THE IMPACT OF TAKEOVER PROSPECT ON MANAGERIAL INCENTIVES TO INCREASE

SHAREHOLDER VALUE?

4.2. POSITIVE THEORY OF TAKEOVERS

4.2.1. Grossman and Hart (1980)

4.2.1.1. Value-enhancing raider: the Grossman and Hart Analysis

4.2.1.1.1. Positive raider surplus despite free riding

4.2.1.1.2. Discussion of Grossman and Hart’s analysis

4.3. THE ROLE OF TOEHOLDS IN ENCOURAGING TAKEOVERS

4.4. THE ROLE OF DILUTION IN ENCOURAGING TAKEOVERS

4.4.1. Müller and Panunzi (2004) on the dilution

4.4.1.1. Multiple bidders

5. MANAGERIAL RESISTANCE

LECTURE 4: EVENT STUDY ANALYSIS (45)

1. EVENT-STUDY: THE EMPIRICAL METHOD

2. ORDINARY LEAST SQUARES (OLS)

3. AN EVENT STUDY

3.1. PROCEDURE OF AN EVENT STUDY

3.2. HOW DO WE CONSTRUCT ABNORMAL RETURNS?

3.3. MODELS FOR MEASURING NORMAL RETURNS

3.3.1. Constant mean return model (CMR)

3.3.1.1. Are the abnormal returns under the CMR model statistically from zero?

3.3.2. A market model for normal returns

3.3.2.1. Are the abnormal returns under the market model statistically different from zero?

3.3.2.2. Other specifications for market model

3.3.3 Aggregation of the abnormal returns

3.3.3.1. Aggregation through time: cumulative abnormal returns (CARs)

3.3.3.1.1. Are cumulative abnormal returns (CAR) statistically different from zero?

3.3.3.1.2. Variance for CARs

3.3.3.1.3. Aggregation across firms is required

3.3.3.1.4. Aggregation across firms and time

3.3.4. An alternative (equivalent) approach

3.3.4.1. What about CAR standard errors?

LECTURE 5: EMPIRICAL EVIDENCE ON M&A’S (51)

1. MAIN THEORIES

1.1. MERGERS AS VALUE-INCREASING DECISIONS

1.2. MERGERS AS VALUE-REDUCING DECISIONS

1.3. MERGERS AS VALUE-NEUTRAL DECISIONS: MANAGERIAL HUBRIS AND ZERO-VALUE M&AS

2. THE COMBINED RETURNS IN M&AS

2.1. EVIDENCE ON COMBINED RETURNS

2.1.1. Bradley, Desai and Kim (1988)

2.1.2. More evidence

2.1.3. General conclusions

2.2. EXTENDED ANALYSIS

2.3. BANKING INDUSTRY

2.4. CONCLUSION

3. FACTORS RELATED TO TARGET RETURNS

3.1. TYPE OF MERGER AND METHOD OF PAYMENT

3.2. SINGLE VS MULTIPLE BIDDERS

3.3. TARGET RUN-UP

3.4. TAKEOVER BIDDING AND TAKEOVER PREMIUMS

4. FACTORS RELATED TO BIDDER RETURN

4.1. METHOD OF PAYMENT

4.1.1. Digression: Myers and Majluf (1984): Pecking order hypothesis

4.2. SINGLE VS MULTIPLE BIDDERS

4.3. DO BAD BIDDERS BECOME GOOD TARGETS?

5. TAKEOVER REGULATION AND TAKEOVER HOSTILITY

5.1. THE EFFECT OF THE WILLIAM ACT

5.2. TAKEOVER IMPEDIMENTS IN THE 1980S

5.3. TAKEOVER HOSTILITY

6. POSTMERGER OPERATING PERFORMANCE

7. LONG-TERM STOCK PRICE PERFORMANCE FOLLOWING MERGERS

8. EFFICIENCY VS MARKET POWER

9. EFFECTS OF CONCENTRATION

LECTURE 6: INITIAL PUBLIC OFFERINGS (IPOS) (44)

1. EXTERNAL FINANCING AND IPO

2. IPO AS A STRATEGIC DECISION

2.1. IPO = GOING PUBLIC

2.2. WHY GOING PUBLIC?

2.2.1. Going public and the cost of capital

2.2.2. Going public and cash-out by insiders

2.2.3. Going public and takeover activities

3. STRATEGIC REASONS FOR GOING PUBLIC

3.1. WHAT DO CFOS SAY ABOUT THE REASON TO GO PUBLIC?

3.2. OTHER ADVANTAGED OF IPO

3.3. DISADVANTAGES OF GOING PUBLIC

3.4. WHAT DO CFOS SAY ABOUT THE REASON TO NOT GOING PUBLIC?

4. TIMING OP IPOS: FACTORS THAT INFLUENCE IPO TIMING

4.1. BULL MARKET AND IPO ACTIVITIES

4.2. ATTRACTIVENESS OF THE IPO MARKET

4.3. WHAT DO CFOS SAY ABOUT IPO TIMING?

5. IPO PROCESS

5.1. UNDERWRITERS AND IPO

5.2. DUE DILIGENCE AND FILINGS

5.3. PRICING

5.4. STABILIZATION

5.5. TRANSITION TO MARKET COMPETITION

5.6. REVERSE MERGER: GOING PUBLIC WITHOUT AN IPO

6. IPO UNDERPRICING

6.1. WHY IPOS ARE UNDERPRICED

6.2. WHERE HAVE ALL THE IPOS GONE?

7. CURRENT TRENDS IN IPOS

8. CASE STUDY

LECTURE 7: CORPORATE RESTRUCTURING AND DIVESTITURES (33)

1. CORPORATE RESTRUCTURING STRATEGIES

2. CORPORATE RESTRUCTURING AND REORGANIZATION STRATEGIES

3. PRIMARY REASONS FOR DIVESTITURE

4. PRIMARY METHODS OF DIVESTITURES AND ITS VARIATIONS

4.1. EQUITY CARVE-OUTS (ECO)

4.1.1. Benefits of ECO and its end goal

4.1.2. Efficiency of ECOs

4.1.3. Example of an ECO

4.2. SPIN-OFFS

4.2.1. Why spin off?

4.2.2. What are the disadvantages of a spin-off?

4.2.3. Example of a spin-off: PayPal and eBay

4.3. VARIATION OF PRIMARY METHODS OF DIVESTITURES

4.3.1. Split-up

4.3.1.1. Why split up?

4.3.1.2. Split-up case study: Hawlett-Packard

4.3.1.3. Spin-off vs Split-up vs Carce-out

4.3.2. Tracking stock

4.3.2.1. Salient features of tracking stock

4.3.2.2. Pros and cons of tracking stock

4.3.2.3. Example of a tracking stock

4.3.3. Exchange offer

4.4. THEORY: WHY MIGHT DIVESTITURES CREATE WEALTH?

4.4.1. Empirical evidence: types of divestitures and parent returns

4.4.2. Empirical evidence: asset sales

4.4.3 Empirical evidence: related vs unrelated divestitures

LECTURE 8: FINANCIAL RESTRUCTURING (35)

1. WHAT IS FINANCIAL RESTRUCTURING

1.1. FINANCIAL VS OPERATIONAL RESTRUCTURING

1.1.1. Financial restructuring

2. WHY AND HOW TO UNDERGO FINANCIAL RESTRUCTURING?

3. LEVERAGE AND LEVERAGED RECAPITALIZATIONS

3.1. OPTIMAL LEVERAGE

3.1.1. Trade-off theory

3.1.2. Agency cost

3.1.3. Taxes, financial distress and agency cost

3.2. LEVERAGED RECAPITALIZATIONS

3.2.1. Characteristics

4. DEBT RESTRUCTURING AND BANKRUPTCY PROCEDURE

4.1. DEBT RESTRUCTURING

4.2. BANKRUPTCY

4.2.1. Liquidation

4.2.2. Reorganization

4.2.3. Strategic bankruptcy

4.2.4. Chapter 11 and efficiency

4.2.5. Chapter 11 and incentives

5. EQUITY RESTRUCTURING

5.1. DUAL-CLASS STOCK

5.1.1 Empirical evidence

5.1.2. Paradox of entrenchment

6. SIDE-NOTE: PRISONER’S DILEMMA

7. EXCHANGE OFFERS AND EQUITY-FOR-DEBT SWAPS

7.1. EMPIRICAL EVIDENCE

7.2. SIDE-NOTE: SWAPS VS EXCHANGE OFFER

LECTURE 9: GOING PRIVATE AND LEVERAGED BUYOUTS (41)

1. GOING PRIVATE AND LBO/MBO

1.1. WHY GOING PRIVATE?

1.2. PRIVATE EQUITY BUYOUT

1.3. MANAGEMENT BUYOUT

2. PRIVATE EQUITY

2.1. ADVANTAGE AND DISADVANTAGE OF PE FINANCING

2.2. PUBLIC VS PRIVATE EQUITY

2.3. TYPES OF PE

3. HISTORICAL OVERVIEW OF LBO MARKET

3.1. THE PROFILE OF LBO TARGETS

4. LBO DEAL STRUCTURE

4.1. GPS AND LPS

4.2. ROLE OF CLOS AND OTHER INVESTMENT VEHICLES

5. 4 STAGES OF LBO

6. EXIT STRATEGIES IN LBOS

7. EMPIRICAL EVIDENCE ON LBOS

8. LBO AND VALUE CREATION

8.1. POST BUYOUT

LECTURE 10: SHARE REPURCHASE (33)

1. SHARE REPURCHASE ACTIVITIES

2. REASONS FOR BUYBACKS

3. MAJOR TYPES OF SHARES REPURCHASE

3.1. FIXED-PRICE TENDER OFFERS (FPTS)

3.2. DUTCH AUCTION REPURCHASES (DARS)

3.3. TRANSFERABLE PUT RIGHTS (TPRS)

3.4. OPEN-MARKET REPURCHASES (OMRS)

4. Empirical evidence on share repurchase

5. Undervaluation and share repurchase

6. SHARE REPURCHASE VS DIVIDENDS

6.1. MOTIVES: EMPIRICAL EVIDENCE

You might also like

- Investment Banking Handbook for Comparable Company AnalysisDocument211 pagesInvestment Banking Handbook for Comparable Company Analysisraghavmitt100% (8)

- RCD-GillesaniaDocument468 pagesRCD-GillesaniaJomarie Alcano100% (2)

- EconomicsDocument204 pagesEconomicsandasempai100% (3)

- Value Vs Growth Stock in Emerging Market-SubmittedDocument72 pagesValue Vs Growth Stock in Emerging Market-Submitted0796105632No ratings yet

- The Professional Risk Managers Handbook A Comprehensive Guide To Current Theory and Best PracticesDocument16 pagesThe Professional Risk Managers Handbook A Comprehensive Guide To Current Theory and Best PracticesSyed Muhammad Hassan100% (1)

- 12 Orpic Safety Rules Managers May 17 RevDocument36 pages12 Orpic Safety Rules Managers May 17 RevGordon Longforgan100% (3)

- Qy130v633 Operation ManualDocument414 pagesQy130v633 Operation ManualumamNo ratings yet

- Private Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingFrom EverandPrivate Equity Fund Investments: New Insights on Alignment of Interests, Governance, Returns and ForecastingNo ratings yet

- Volatility RegimeDocument202 pagesVolatility RegimeDaniele Rubinetti100% (1)

- Stock Market's Greatest Winners: Picking The Stocks That Move The Soonest, Fastest and Farthest in Every Bull CycleDocument143 pagesStock Market's Greatest Winners: Picking The Stocks That Move The Soonest, Fastest and Farthest in Every Bull CycleGPNo ratings yet

- Valuation Methods and Shareholder Value CreationFrom EverandValuation Methods and Shareholder Value CreationRating: 4.5 out of 5 stars4.5/5 (3)

- Initial Public Offering: An Introduction to IPO on Wall StFrom EverandInitial Public Offering: An Introduction to IPO on Wall StRating: 5 out of 5 stars5/5 (1)

- (Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsDocument185 pages(Thesis) 2011 - The Technical Analysis Method of Moving Average Trading. Rules That Reduce The Number of Losing Trades - Marcus C. TomsFaridElAtracheNo ratings yet

- Risus License Information PDFDocument1 pageRisus License Information PDFSam CorbenNo ratings yet

- Arnica The Miracle Remedy - Case RecordsDocument4 pagesArnica The Miracle Remedy - Case Recordskaravi schiniasNo ratings yet

- Obstfeld & Rogoff - Foundations of International MacroeconomicsDocument814 pagesObstfeld & Rogoff - Foundations of International Macroeconomicsjuanherrr100% (35)

- James W. Marion-Project Management - A Common Sense Guide To The PMBOK, Part One-Framework and Schedule-Momentum Press (2018)Document242 pagesJames W. Marion-Project Management - A Common Sense Guide To The PMBOK, Part One-Framework and Schedule-Momentum Press (2018)Bogdan CorneaNo ratings yet

- International Financial Reporting Standards (IFRS) Workbook and Guide: Practical insights, Case studies, Multiple-choice questions, IllustrationsFrom EverandInternational Financial Reporting Standards (IFRS) Workbook and Guide: Practical insights, Case studies, Multiple-choice questions, IllustrationsNo ratings yet

- Putting Auction Theory To Work - 2004 - 1era Edición - Milgrom PDFDocument393 pagesPutting Auction Theory To Work - 2004 - 1era Edición - Milgrom PDFJose100% (2)

- Handbook of Financial Markets: Dynamics and EvolutionFrom EverandHandbook of Financial Markets: Dynamics and EvolutionNo ratings yet

- Auctions in Corporate Finance: A Review of Theory and ApplicationsDocument82 pagesAuctions in Corporate Finance: A Review of Theory and ApplicationsnencydhamejaNo ratings yet

- Auctions in Corporate Finance: Sudipto Dasgupta Robert G. Hansen March, 2006Document82 pagesAuctions in Corporate Finance: Sudipto Dasgupta Robert G. Hansen March, 2006nencydhamejaNo ratings yet

- Energy Risk: Valuing and Managing Energy DerivativesFrom EverandEnergy Risk: Valuing and Managing Energy DerivativesRating: 1 out of 5 stars1/5 (1)

- Study Material: For Capital Market Examination-3 (CME-3) of Broker-Dealer Qualification CertificateDocument235 pagesStudy Material: For Capital Market Examination-3 (CME-3) of Broker-Dealer Qualification CertificateLim Chan CheeNo ratings yet

- Recent Trends in Valuation: From Strategy to ValueFrom EverandRecent Trends in Valuation: From Strategy to ValueLuc KeuleneerNo ratings yet

- Nguyen Tuan VietDocument83 pagesNguyen Tuan VietsachinNo ratings yet

- Crowdfunding As A Tool For Startups To Raise Capital (PDFDrive)Document109 pagesCrowdfunding As A Tool For Startups To Raise Capital (PDFDrive)Abodi AtrashNo ratings yet

- Capital Market Research in Accounting: A Review of Empirical Studies on the Relationship Between Capital Markets and Financial ReportingDocument23 pagesCapital Market Research in Accounting: A Review of Empirical Studies on the Relationship Between Capital Markets and Financial ReportingAgung Gde AgungNo ratings yet

- Grant S. Foster, Chris J. Grannell - Essential Management Models - Tried and Tested Business Frameworks For Strategy, Customers and Growth-Routledge (2022)Document139 pagesGrant S. Foster, Chris J. Grannell - Essential Management Models - Tried and Tested Business Frameworks For Strategy, Customers and Growth-Routledge (2022)Harma KardonNo ratings yet

- Markusen Maskus TextbookDocument408 pagesMarkusen Maskus TextbookAradhana SahaNo ratings yet

- M.A (Economics)Document254 pagesM.A (Economics)anshulNo ratings yet

- Underpricing and the Long-run Performance of InitialDocument230 pagesUnderpricing and the Long-run Performance of Initialgogayin869No ratings yet

- How financial ratios can predict UK acquisition targets from 1980-1986Document362 pagesHow financial ratios can predict UK acquisition targets from 1980-1986smh9662No ratings yet

- Subject Title: Principles of Economics Code: 500/S02 Duration: 180 HoursDocument7 pagesSubject Title: Principles of Economics Code: 500/S02 Duration: 180 HoursCollymore MangwiroNo ratings yet

- PRM Handbook Introduction and ContentsDocument23 pagesPRM Handbook Introduction and ContentsMike Wong0% (1)

- 06 ContentDocument11 pages06 ContentDrx Mehazabeen KachchawalaNo ratings yet

- Knowledge As Strategic Asset in Choosing A Market Entry ModeDocument152 pagesKnowledge As Strategic Asset in Choosing A Market Entry ModeSantiago RobledoNo ratings yet

- Business Cycles - DPP 03 - (Sampurna 2.0 Dec 2023)Document3 pagesBusiness Cycles - DPP 03 - (Sampurna 2.0 Dec 2023)Maanav GuptaNo ratings yet

- Beeb2033 Sow (1) A161Document11 pagesBeeb2033 Sow (1) A161zikril94No ratings yet

- Performance of Mutual Funds and Investors Behavior: in The Partial Fulfilment of Degree of McomDocument47 pagesPerformance of Mutual Funds and Investors Behavior: in The Partial Fulfilment of Degree of McomSagar AdhavNo ratings yet

- Risk Managemaepnpltic Ationosf Swap StrategiesDocument2 pagesRisk Managemaepnpltic Ationosf Swap Strategiessufyanbutt007No ratings yet

- CME-1 Study Material for Securities OperationsDocument225 pagesCME-1 Study Material for Securities OperationsJ SarkarNo ratings yet

- Take Over Merger & AcquisitionDocument7 pagesTake Over Merger & AcquisitionChandra KalaNo ratings yet

- UNDERPRICING OF INITIAL PUBLIC OFFERINGSDocument82 pagesUNDERPRICING OF INITIAL PUBLIC OFFERINGSgogayin869No ratings yet

- Ir Qualification SyllabusDocument7 pagesIr Qualification Syllabussimone_reid_1No ratings yet

- MCOM 104 International Financial ManagementDocument184 pagesMCOM 104 International Financial ManagementAniruddha ChakrabortyNo ratings yet

- Download Principles Of Macroeconomics 5E 5E Edition Ben Bernanke Et Al all chapterDocument67 pagesDownload Principles Of Macroeconomics 5E 5E Edition Ben Bernanke Et Al all chapterroscoe.carbonaro447100% (3)

- SLM BCSD 19S2 Econpmics for businessDocument122 pagesSLM BCSD 19S2 Econpmics for businessaishwarkNo ratings yet

- Strategy, Value and Risk: A Guide to Advanced Financial ManagementFrom EverandStrategy, Value and Risk: A Guide to Advanced Financial ManagementNo ratings yet

- Strategic Business Management November 2018 Mark PlanDocument19 pagesStrategic Business Management November 2018 Mark PlanWongani KaundaNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)Sohail Liaqat AliNo ratings yet

- Instant Download Ebook PDF An Introduction To Derivative Securities Financial Markets and Risk Management 2nd Edition PDF ScribdDocument42 pagesInstant Download Ebook PDF An Introduction To Derivative Securities Financial Markets and Risk Management 2nd Edition PDF Scribdcharles.brookshire691100% (33)

- Download ebook Principles Of Macroeconomics 5E Pdf full chapter pdfDocument56 pagesDownload ebook Principles Of Macroeconomics 5E Pdf full chapter pdfkaren.shaw573100% (27)

- IAS 36 NokulungaDocument54 pagesIAS 36 NokulungaWebster GobvuNo ratings yet

- CourseOutline TAMDocument5 pagesCourseOutline TAMJyoti BudhiaNo ratings yet

- notesDocument103 pagesnotesGonzalo SaavedraNo ratings yet

- Effects of Analyst RecommendationsDocument60 pagesEffects of Analyst RecommendationsDebNo ratings yet

- Killer Merger AcquisitionDocument51 pagesKiller Merger AcquisitionBadrul Hisham ShafieNo ratings yet

- Bachelor Thesis (FEB13100X) : Accounting For Mineral Resources: A Literature ReviewDocument46 pagesBachelor Thesis (FEB13100X) : Accounting For Mineral Resources: A Literature ReviewShawn WalkerNo ratings yet

- Intro To EconomicsDocument9 pagesIntro To EconomicsMelat GetachewNo ratings yet

- Elective Courses SyllabusDocument37 pagesElective Courses SyllabusAsif WarsiNo ratings yet

- Slfi604 M&aDocument3 pagesSlfi604 M&aHARDIK1001No ratings yet

- NISM Series-XXI-A: Portfolio Management Services (PMS) Distributors CertificationDocument7 pagesNISM Series-XXI-A: Portfolio Management Services (PMS) Distributors CertificationAugustus PrimeNo ratings yet

- Al-Jahiz (781-869) : ZoologyDocument25 pagesAl-Jahiz (781-869) : ZoologyJA QuibzNo ratings yet

- PVC and CPVC Pipes - Schedule 40 & 80Document8 pagesPVC and CPVC Pipes - Schedule 40 & 80yarzar17No ratings yet

- Green Tree PythonDocument1 pageGreen Tree Pythonapi-379174072No ratings yet

- All About Bearing and Lubrication A Complete GuideDocument20 pagesAll About Bearing and Lubrication A Complete GuideJitu JenaNo ratings yet

- Synchronous Motor - InstruDocument12 pagesSynchronous Motor - InstruMohit IndurkarNo ratings yet

- Grammar Notes-February2017 - by Aslinda RahmanDocument41 pagesGrammar Notes-February2017 - by Aslinda RahmanNadia Anuar100% (1)

- LTC3108 EnergyHarvestDocument3 pagesLTC3108 EnergyHarvestliawyssbdNo ratings yet

- Anubis - Analysis ReportDocument17 pagesAnubis - Analysis ReportÁngelGarcíaJiménezNo ratings yet

- NasaDocument26 pagesNasaMatei BuneaNo ratings yet

- LQRDocument34 pagesLQRkemoNo ratings yet

- Electrical Experimenter 1915-08Document1 pageElectrical Experimenter 1915-08GNo ratings yet

- Nad C541iDocument37 pagesNad C541iapi-3837207No ratings yet

- Adafruit Color SensorDocument25 pagesAdafruit Color Sensorarijit_ghosh_18No ratings yet

- Q3 SolutionDocument5 pagesQ3 SolutionShaina0% (1)

- Main Application of Fans and BlowerDocument5 pagesMain Application of Fans and Blowermissy forlajeNo ratings yet

- Workbook. Unit 3. Exercises 5 To 9. RESPUESTASDocument3 pagesWorkbook. Unit 3. Exercises 5 To 9. RESPUESTASRosani GeraldoNo ratings yet

- Alicrite StringDocument4 pagesAlicrite Stringtias_marcoNo ratings yet

- Transportation Chapter 3Document17 pagesTransportation Chapter 3Tuan NguyenNo ratings yet

- Floor CraneDocument6 pagesFloor CranejillianixNo ratings yet

- SAC SINGLAS Accreditation Schedule 15 Apr 10Document5 pagesSAC SINGLAS Accreditation Schedule 15 Apr 10clintjtuckerNo ratings yet

- Topic 4a Presentation: Types of PatrolDocument4 pagesTopic 4a Presentation: Types of PatrolGesler Pilvan SainNo ratings yet

- Ndeb Bned Reference Texts 2019 PDFDocument11 pagesNdeb Bned Reference Texts 2019 PDFnavroop bajwaNo ratings yet

- FINANCIAL REPORTSDocument34 pagesFINANCIAL REPORTSToni111123No ratings yet

- Appendix A - Status Messages: Armed. Bad Snubber FuseDocument9 pagesAppendix A - Status Messages: Armed. Bad Snubber Fuse이민재No ratings yet

- A Review of High School Economics Textbooks: February 2003Document27 pagesA Review of High School Economics Textbooks: February 2003Adam NowickiNo ratings yet