Professional Documents

Culture Documents

Grade 10 Worksheet 2 and 3

Uploaded by

Girish SinghalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Grade 10 Worksheet 2 and 3

Uploaded by

Girish SinghalCopyright:

Available Formats

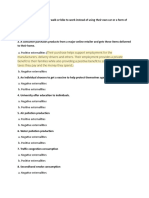

Define followings: (One statement supported by suitable example)

A. Proportional Tax

B. Multiplier Effect

C. Budget Deficit

D. Market Failure

E. Direct Tax

F. Inheritance tax

Differentiate between – (At least two points for each)

A. Progressive and regressive tax

B. Expansionary and Contractionary fiscal policy

C. Income Tax and Corporation tax

D. Budget surplus and Budget deficit

E. Tax base and tax burden

F. Fiscal Policy and Monetary policy

Answer following questions:

A. What is meant by automatic stabilizer?

B. List out impact of Increase and decrease of tax on Consumers, Producer and the government.

C. What is meant by informal economy?

D. List out various causes for change in money supply.

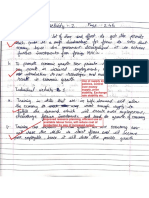

Answer following questions :

A. Analyse why trade unions are likely to welcome an increase in the money supply? [6]

Hint: Use DEED concept

Ans:

B. Discuss whether or not an increase in the rate of interest will reduce consumer expenditure? [8]

Hint: Use DEED and also provide conclusion

Ans:

C. Analyse the reasons why government impose taxes? [6]

Hint: Use DEED concept

Ans:

D. Discuss whether or not an increase in income tax will improve economic performance. [8]

Hint: Use DEED and also provide conclusion

Ans:

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- AP Macroeconomics TestDocument10 pagesAP Macroeconomics TestTomMusic100% (1)

- AP Macro Practice TestDocument12 pagesAP Macro Practice TestNathan WongNo ratings yet

- Econ 203 Tt2Document7 pagesEcon 203 Tt2examkillerNo ratings yet

- Chapter 6 AnswerDocument29 pagesChapter 6 AnswerKathy WongNo ratings yet

- Questions and Problems Week 4Document18 pagesQuestions and Problems Week 4Ruby HordijkNo ratings yet

- Chap 011Document26 pagesChap 011Himanshu DhamijaNo ratings yet

- Economics Mock ExamDocument7 pagesEconomics Mock ExamfarahNo ratings yet

- Screenshot 2022-04-04 at 16.20.59Document5 pagesScreenshot 2022-04-04 at 16.20.59niallNo ratings yet

- Quiz BUSN 225 Section DDocument4 pagesQuiz BUSN 225 Section DAMNA SHARIF BAJWANo ratings yet

- Olympiad QuestionsDocument7 pagesOlympiad QuestionsAsilbek AshurovNo ratings yet

- Mid Term RevisionDocument68 pagesMid Term Revisionfairouzali398No ratings yet

- 04Document9 pages04Thuỳ DươngNo ratings yet

- 2 Term Mock Exam: Paper 1 Name: - Total Mark: - /30Document8 pages2 Term Mock Exam: Paper 1 Name: - Total Mark: - /30Training & Development GWCNo ratings yet

- Test Resueltos MAcroDocument50 pagesTest Resueltos MAcroAlvaro MerayoNo ratings yet

- ECO 372 Final ExamDocument9 pagesECO 372 Final ExamHeightlyNo ratings yet

- Final Exam Paper of MacroDocument7 pagesFinal Exam Paper of MacroABDUL AHADNo ratings yet

- Microeconomics Australia in The Global Environment Australian 1st Edition Parkin Test BankDocument62 pagesMicroeconomics Australia in The Global Environment Australian 1st Edition Parkin Test Bankelfledalayla5900x100% (32)

- Microeconomics Australia in The Global Environment Australian 1St Edition Parkin Test Bank Full Chapter PDFDocument68 pagesMicroeconomics Australia in The Global Environment Australian 1St Edition Parkin Test Bank Full Chapter PDFSherryElliottpgys100% (9)

- Public Finance and Tax AccountingDocument6 pagesPublic Finance and Tax AccountingSentayehu GebeyehuNo ratings yet

- Macsg09: The Government and Fiscal PolicyDocument24 pagesMacsg09: The Government and Fiscal PolicyJudith100% (1)

- Sample Exam Questions Chapter7Document9 pagesSample Exam Questions Chapter7Patricia Kim LeeNo ratings yet

- C04-Fundamentals of Business Economics: Sample Exam PaperDocument26 pagesC04-Fundamentals of Business Economics: Sample Exam PaperLegogie Moses Anoghena100% (1)

- C04-Fundamentals of Business Economics: Sample Exam PaperDocument17 pagesC04-Fundamentals of Business Economics: Sample Exam Paperhkanuradha100% (1)

- IGCSE - Mock 2 Econ Paper 1 MCQDocument7 pagesIGCSE - Mock 2 Econ Paper 1 MCQTOMY PERIKOROTTE CHACKONo ratings yet

- Worksheet On Fiscal PolicyDocument4 pagesWorksheet On Fiscal Policysubham chakrabortyNo ratings yet

- FECB - PaperNEW 01Document5 pagesFECB - PaperNEW 01daerangagmlNo ratings yet

- Macroeconomics Principles Applications and Tools 8th Edition Osullivan Test BankDocument40 pagesMacroeconomics Principles Applications and Tools 8th Edition Osullivan Test Banknhanselinak9wr16100% (21)

- Economic Assessment Test - Free Enterprise SystemDocument5 pagesEconomic Assessment Test - Free Enterprise SystemNaaz SikandarNo ratings yet

- QUIZtpmikhsan 11312288Document10 pagesQUIZtpmikhsan 11312288Hanindya PrajakusumaNo ratings yet

- 2281 s12 QP 12Document12 pages2281 s12 QP 12mstudy123456No ratings yet

- Econ Summer Homework 2Document16 pagesEcon Summer Homework 2Nikole Ornstein0% (1)

- Macro Econ CH 10Document42 pagesMacro Econ CH 10maria37066100% (1)

- 1.2 Eco Method-1-1Document9 pages1.2 Eco Method-1-1Khadija MasoodNo ratings yet

- CBA Model Question Paper - C04Document21 pagesCBA Model Question Paper - C04Mir Fida NadeemNo ratings yet

- Y9 Econs Sem 2 ExamDocument16 pagesY9 Econs Sem 2 ExamJIE MIN CHANNo ratings yet

- FEcB Revision 3Document5 pagesFEcB Revision 3Sadeep MadhushanNo ratings yet

- Y9 Econs Sem 2 ExamDocument16 pagesY9 Econs Sem 2 ExamJIE MIN CHANNo ratings yet

- Building Your Dream Canadian 10th Edition Good Test BankDocument13 pagesBuilding Your Dream Canadian 10th Edition Good Test Bankdariusadele6ncs100% (30)

- Building Your Dream Canadian 10th Edition Good Test BankDocument38 pagesBuilding Your Dream Canadian 10th Edition Good Test Bankstockeadishureejw100% (17)

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument4 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionTrúc LinhNo ratings yet

- Continue: Kinh tế vĩ mô pdf uehDocument2 pagesContinue: Kinh tế vĩ mô pdf uehDT6541No ratings yet

- May 2024 Chaptr 7 Unit 4 Fiscal Policy PDFDocument12 pagesMay 2024 Chaptr 7 Unit 4 Fiscal Policy PDFsathyashreekadhamNo ratings yet

- AFM 131 Midterm 1 Prof. Bob Sproule Unknown YearDocument6 pagesAFM 131 Midterm 1 Prof. Bob Sproule Unknown YearGqn GanNo ratings yet

- 2281 w05 QP 1Document12 pages2281 w05 QP 1mstudy123456No ratings yet

- Formative AssessmentDocument5 pagesFormative AssessmentanusuyaNo ratings yet

- Instruction: Write The Letter of The Correct AnswerDocument4 pagesInstruction: Write The Letter of The Correct Answerzanderhero30No ratings yet

- BS 1Document12 pagesBS 1Wajeeha KhanNo ratings yet

- 6. Bài tập môn F1Document16 pages6. Bài tập môn F1Thu TrangNo ratings yet

- CE2 - Eco - Trial Exam - 2018 - Paper 1 - QDocument8 pagesCE2 - Eco - Trial Exam - 2018 - Paper 1 - QnadineNo ratings yet

- Monetary and Fiscal PolicyDocument5 pagesMonetary and Fiscal Policyakm.mhs20No ratings yet

- Public Finance PaperDocument10 pagesPublic Finance PaperDaniyal AbbasNo ratings yet

- Multiple Choice Questions: GRADE - 11Document4 pagesMultiple Choice Questions: GRADE - 11Babu BalaramanNo ratings yet

- Chapter9 QuizDocument3 pagesChapter9 QuizJoey YUNo ratings yet

- Foundations of Economics 7Th Edition Bade Test Bank Full Chapter PDFDocument68 pagesFoundations of Economics 7Th Edition Bade Test Bank Full Chapter PDFhieuorlarofjq100% (11)

- 2020-DEC-2021-JUNE-CYCLES - NetDocument32 pages2020-DEC-2021-JUNE-CYCLES - NetAbhinav PalNo ratings yet

- ECO EXAM 100 MARKS XI Term 1Document9 pagesECO EXAM 100 MARKS XI Term 1Sutapa DeNo ratings yet

- 2281 s11 QP 11Document12 pages2281 s11 QP 11mstudy123456No ratings yet

- Unilag Past QuestionDocument12 pagesUnilag Past QuestionTemitayoNo ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- Cycle Test - 1 Grade 11 05-04-2023Document10 pagesCycle Test - 1 Grade 11 05-04-2023Girish SinghalNo ratings yet

- Class Test - 1 - Grade 11 - Economics - 02-05-2023Document11 pagesClass Test - 1 - Grade 11 - Economics - 02-05-2023Girish SinghalNo ratings yet

- Walk Through Observation CommentsDocument3 pagesWalk Through Observation CommentsGirish SinghalNo ratings yet

- Newspaper Report AnalysisDocument2 pagesNewspaper Report AnalysisGirish SinghalNo ratings yet

- Cycle Test - 1 Grade 11 05-04-2023Document10 pagesCycle Test - 1 Grade 11 05-04-2023Girish SinghalNo ratings yet

- Rubrics For Intra Class Activity - Grade 11-12-12!04!2023Document1 pageRubrics For Intra Class Activity - Grade 11-12-12!04!2023Girish SinghalNo ratings yet

- Home Work Grade 10 27th Sept - 1st Oct 2021Document2 pagesHome Work Grade 10 27th Sept - 1st Oct 2021Girish SinghalNo ratings yet

- Rubrics For Intra Class Activity - Grade 11-12-12!04!2023Document1 pageRubrics For Intra Class Activity - Grade 11-12-12!04!2023Girish SinghalNo ratings yet

- Newspaper Report AnalysisDocument2 pagesNewspaper Report AnalysisGirish SinghalNo ratings yet

- New Doc 02-Aug-2021 11.19 AmDocument2 pagesNew Doc 02-Aug-2021 11.19 AmGirish SinghalNo ratings yet

- Economics IA Commentary Planning Sheet (Microeconomics)Document4 pagesEconomics IA Commentary Planning Sheet (Microeconomics)Girish SinghalNo ratings yet

- Demand and Elasticity of DemandDocument11 pagesDemand and Elasticity of DemandGirish SinghalNo ratings yet

- Question Framing 11-12Document2 pagesQuestion Framing 11-12Girish SinghalNo ratings yet

- Multiple Choice QuestionsDocument5 pagesMultiple Choice QuestionsGirish SinghalNo ratings yet

- XII 90 MCQs For PracticeDocument12 pagesXII 90 MCQs For PracticeGirish SinghalNo ratings yet