Professional Documents

Culture Documents

Social Demographic Forces

Uploaded by

Nuriel AguilarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Social Demographic Forces

Uploaded by

Nuriel AguilarCopyright:

Available Formats

4.

5 Social-Demographic Forces

4.5.1 Demographics of the population

In research from Statista (2022) approximately 51 percent of the female and 46

percent of the male respondents paid their transactions with an e-payment method often

a month as of February 2020. In contrary, six percent of the male respondents rarely

paid their transactions using an e-payment method. As stated by Massally, et al. (2019)

Women are more likely than males to engage in transactional activities such as

remittances, bill payments, and purchases. When it comes to age, In the Philippines,

83 percent of respondents aged 35 to 44 said they used online e-payment methods to

pay bills. The most popular e-payment transactions among Filipino respondents were

money transfers to friends and family and online shopping (Statista 2023).

4.5.2 Education level of the society

According to the 2017 Financial Inclusion Survey conducted by the Bangko

Sentral ng Pilipinas (BSP), the majority of Filipinos still do not have a bank account

owing to failure to maintain the balance needed for the account. According to BSP, just

15.8 million people, or 22.6 percent of the overall population, have a bank account, due

to a perceived lack of need, a lack of required documentation, and the high cost.

According to BSP data, in 2018, more Filipinos used e-wallets or e-payment systems

than credit cards. Platforms like GCash and PayMaya allow Filipinos to perform digital

financial transactions without the use of actual money or credit cards (Zoleta, 2022).

Industry Attractiveness: HIGH

Maya has shown great promise in emerging into the Philippines' mobile payments

market despite challenges. While it has yet to reach the level of services, functionality,

and penetration of global and regional mobile platforms and wallets, Maya has taken a

step forward to reach the "unbanked" and "uncarded" Filipinos and contribute to the

growth of the country's e-payments system. As said by Mr. Orlando B. Vea, PayMaya

CEO-Founder, "Our strong record of execution and innovation is a testament to our

world-class team's hard work and talent. With this milestone, we are excited to leap

forward and bring the best of PayMaya and Maya Bank to help unlock the digital

economy for the underserved and unbanked Filipinos.” Moreover, as of the end of

March 2022, two-thirds of the adult population in the Philippines - over 47 million

people, were Maya Bank customers (Businesswire, 2022).

References

Bangko Sentral ng Pilipinas, Inclusive Finance Advocacy Office. (2017).

Financial inclusion survey: Moving towards digital financial inclusion.

http://www.bsp.gov.ph/downloads/Publications/2017/2017FISToplineReport.pdf

Businesswire. (2022, April 11). Voyager Innovations Raises US$210M to Expand

the Financial Services Ecosystem of PayMaya and Maya Bank.

https://www.businesswire.com/news/home/20220411005585/en/Voyager-Innovations-

Raises-US210M-to-Expand-the-Financial-Services-Ecosystem-of-PayMaya-and-Maya-

Bank

Massally, K. N., Ricart, R. M., Bambawale, M., Totapally, S., & Bhandari, V.

(2019). The State of Digital Payments in the Philippines. Better Than Cash Alliance.

https://www.betterthancash.org/

Statista. (2022, January 18). Frequency of using e-payment methods Philippines

2020, by gender. https://www.statista.com/statistics/1105579/philippines-frequency-of-

using-e-payment-by-gender/

Statista. (2023, January 6). Transactions using e-payment methods Philippines

2022, by age group. https://www.statista.com/statistics/1105586/philippines-usage-e-

payment-method-by-age/

Zoleta, V. (2022, April 28). [Battle of the Brands] PayMaya vs GCash: Which

Mobile Wallet App is Right for You?

https://www.moneymax.ph/personal-finance/articles/paymaya-vs-gcash

You might also like

- Think Out Loud - 22Document2 pagesThink Out Loud - 22gregbaccayNo ratings yet

- Electronic Banking Final RequirementDocument12 pagesElectronic Banking Final RequirementBiens IIINo ratings yet

- Jacob Dy - Task 4 - Journal Article (Draft 2)Document8 pagesJacob Dy - Task 4 - Journal Article (Draft 2)Jacob DyNo ratings yet

- Financial Inclusion - BSP (CNN REPORT)Document3 pagesFinancial Inclusion - BSP (CNN REPORT)Jan CracoNo ratings yet

- Going Cashless in The PhilippinesDocument2 pagesGoing Cashless in The PhilippinesSky OcampoNo ratings yet

- Satisfaction On Digitalization of The Remittance CenterDocument25 pagesSatisfaction On Digitalization of The Remittance CenterEdgardo S. Ochondra Jr.No ratings yet

- Position Paper ExampleDocument3 pagesPosition Paper ExampleRamy Joy MorquianosNo ratings yet

- Trust, Acceptance, and Use of Online Banking Services in The PhilippinesDocument15 pagesTrust, Acceptance, and Use of Online Banking Services in The Philippinesrafael oviedoNo ratings yet

- Current Event Paper #1Document4 pagesCurrent Event Paper #1SophiaNo ratings yet

- A Literature Review Factors Affecting The Adoption of Mobile Payment in The PhilippinesDocument10 pagesA Literature Review Factors Affecting The Adoption of Mobile Payment in The PhilippinesGian Carlo LajarcaNo ratings yet

- Modal TextDocument6 pagesModal TextdungptpNo ratings yet

- The Impact of Fintech On Financial InclusionDocument7 pagesThe Impact of Fintech On Financial InclusionMariane CanorioNo ratings yet

- E-Commerce in PeruDocument5 pagesE-Commerce in PeruMilagros LártigaNo ratings yet

- III. Evidence A. Evidence For Business Proposition 1: With The Changing Consumer Behavior, BusinessesDocument3 pagesIII. Evidence A. Evidence For Business Proposition 1: With The Changing Consumer Behavior, BusinessesKherstineNo ratings yet

- Background of The Study: of The Digital Payment System On Financial Inclusion in The PhilippinesDocument44 pagesBackground of The Study: of The Digital Payment System On Financial Inclusion in The PhilippinesRandae Kazy LacanariaNo ratings yet

- RESEARCH - April LibaoDocument30 pagesRESEARCH - April LibaoEstrada, Jemuel A.No ratings yet

- Case Study Driving Ecomerse in The PhilippinesDocument16 pagesCase Study Driving Ecomerse in The PhilippinesQueen mary magtalasNo ratings yet

- Financial InclusionDocument6 pagesFinancial InclusionsignNo ratings yet

- SSL05 - A Study On Problems of A Cashless Society inDocument10 pagesSSL05 - A Study On Problems of A Cashless Society inAditya BandagaleNo ratings yet

- 2021 Financial Inclusion ReportDocument101 pages2021 Financial Inclusion ReportQoudifoNo ratings yet

- CII Report Digital IndiaDocument11 pagesCII Report Digital IndiaRenuka SharmaNo ratings yet

- Ecommerce MRTDocument43 pagesEcommerce MRTDominador De GuzmanNo ratings yet

- Feature ArticleDocument4 pagesFeature Articlechan DesignsNo ratings yet

- 11475-Article Text-32922-1-10-20181129Document29 pages11475-Article Text-32922-1-10-20181129Natinael AbebeNo ratings yet

- BSP Speeches 993Document5 pagesBSP Speeches 993Hassan AdamNo ratings yet

- Zoleta Aranez Bongalos Final 1Document120 pagesZoleta Aranez Bongalos Final 1lairadianaramosNo ratings yet

- Financial Inclusion 4Document6 pagesFinancial Inclusion 445satishNo ratings yet

- Baby Boomers and The Online Payment System: Why A BurdenDocument2 pagesBaby Boomers and The Online Payment System: Why A BurdenJoyce VilaNo ratings yet

- Level of Fondness of Filipino's in Online ShoppingDocument6 pagesLevel of Fondness of Filipino's in Online ShoppingKrishel GabucoNo ratings yet

- Analysis of FII Data 2013 & 2018 - MA EconomicsDocument27 pagesAnalysis of FII Data 2013 & 2018 - MA EconomicsSaloni SomNo ratings yet

- Financial Inclusion in The Digital AgeDocument5 pagesFinancial Inclusion in The Digital AgeramNo ratings yet

- Financial Inclusion 4Document6 pagesFinancial Inclusion 4simran simieNo ratings yet

- Leng 12Document3 pagesLeng 12Kceey CruzNo ratings yet

- PerfectDocument3 pagesPerfectNicole Faith DupitasNo ratings yet

- Factors That Influence Adoption of Cashless Payment Method Among Youth in MalaysiaDocument12 pagesFactors That Influence Adoption of Cashless Payment Method Among Youth in MalaysiaZarazarith lovettNo ratings yet

- 3 - APJARBA - 2021 - 021 With Cover Page v2Document10 pages3 - APJARBA - 2021 - 021 With Cover Page v2nicollette claireNo ratings yet

- Abm ApDocument9 pagesAbm ApMark OtocNo ratings yet

- Mobile Banking in The Government-To-Person Payment Sector For Financial Inclusion in PakistanDocument29 pagesMobile Banking in The Government-To-Person Payment Sector For Financial Inclusion in PakistanLakshanaNo ratings yet

- Tommorow 10pmDocument3 pagesTommorow 10pmJENILINE MIZALNo ratings yet

- Vietnam's E-Commerce Market To Exceed $17 Billion in 2023 - Vietnam Trade Office in SingaporeDocument2 pagesVietnam's E-Commerce Market To Exceed $17 Billion in 2023 - Vietnam Trade Office in Singaporethunguyen.89223020063No ratings yet

- Measuring Progress on Women's Financial Inclusion and Entrepreneurship in the Philippines: Results from Micro, Small, and Medium-Sized Enterprise SurveyFrom EverandMeasuring Progress on Women's Financial Inclusion and Entrepreneurship in the Philippines: Results from Micro, Small, and Medium-Sized Enterprise SurveyNo ratings yet

- Digital Payments Transformation Roadmap ReportDocument44 pagesDigital Payments Transformation Roadmap ReportChris aribasNo ratings yet

- Effect of Mobile Banking On Financial Inclusion Among Comercial Bank in KenyaDocument14 pagesEffect of Mobile Banking On Financial Inclusion Among Comercial Bank in KenyaAl FahmyNo ratings yet

- SecurityBank - Strategic PlanDocument19 pagesSecurityBank - Strategic PlanJhon Ray Ganton Rabara0% (1)

- Leng 10Document5 pagesLeng 10Kceey CruzNo ratings yet

- Innovation: Integration Into A Cashless SocietyDocument3 pagesInnovation: Integration Into A Cashless SocietyZechNo ratings yet

- Chapter 1 JL AngelsDocument21 pagesChapter 1 JL AngelsJayar DimaculanganNo ratings yet

- Paper 5Document15 pagesPaper 5Ahmed A. M. Al-AfifiNo ratings yet

- Muni InvestmentMemo Sep2022Document17 pagesMuni InvestmentMemo Sep2022MANUELNo ratings yet

- Domination of Online Shopping PlatformsDocument12 pagesDomination of Online Shopping PlatformsMelvin ZafraNo ratings yet

- India's Demonetization: Time For A Digital EconomyDocument12 pagesIndia's Demonetization: Time For A Digital EconomyRenuka SharmaNo ratings yet

- Draft 1Document3 pagesDraft 1Jessa Rodene FranciscoNo ratings yet

- Customer Satisfaction Towards Online ShoppingDocument28 pagesCustomer Satisfaction Towards Online ShoppingSadia Hassan100% (3)

- Related StudiesDocument6 pagesRelated StudiescyralizmalaluanNo ratings yet

- E-Finance in The PhilippinesDocument33 pagesE-Finance in The PhilippinesWynona Kim MaticNo ratings yet

- Accresm Research Chap 1 & 2Document24 pagesAccresm Research Chap 1 & 2Eijoj MaeNo ratings yet

- Digital Finance and Poverty ReductionDocument6 pagesDigital Finance and Poverty ReductionTanakaNo ratings yet

- Google Temasek e Conomy Sea 2019Document65 pagesGoogle Temasek e Conomy Sea 2019Sofian HadiwijayaNo ratings yet

- An Analysis of E-Commerce Development in Vietnam and Policy Implications For Business After COVID-19Document14 pagesAn Analysis of E-Commerce Development in Vietnam and Policy Implications For Business After COVID-19khunglonghoathachNo ratings yet

- Leveraging Fintech to Expand Digital Health in Indonesia, the Philippines, and Singapore: Lessons for Asia and the PacificFrom EverandLeveraging Fintech to Expand Digital Health in Indonesia, the Philippines, and Singapore: Lessons for Asia and the PacificNo ratings yet

- Research Final Paper 1 PDFDocument101 pagesResearch Final Paper 1 PDFNuriel AguilarNo ratings yet

- Confidentiality Undertaking StudentDocument1 pageConfidentiality Undertaking Studentandrei tumbokonNo ratings yet

- E BankingDocument93 pagesE BankingNuriel AguilarNo ratings yet

- Confidentiality Undertaking Student (It0093)Document2 pagesConfidentiality Undertaking Student (It0093)Nuriel AguilarNo ratings yet

- E-Banking Survey Questionnaire FinalDocument6 pagesE-Banking Survey Questionnaire FinalNuriel AguilarNo ratings yet

- DANICA PaperDocument4 pagesDANICA PaperNuriel AguilarNo ratings yet

- E-Banking Survey Questionnaire FinalDocument6 pagesE-Banking Survey Questionnaire FinalNuriel AguilarNo ratings yet

- Paymaya Philippines Manager Business Analysis Strategy November 12 2021Document2 pagesPaymaya Philippines Manager Business Analysis Strategy November 12 2021Nuriel AguilarNo ratings yet

- FINAL2 AWOS Caths Angels No BorderDocument185 pagesFINAL2 AWOS Caths Angels No BorderNuriel AguilarNo ratings yet

- FINAL2 AWOS Caths Angels No BorderDocument185 pagesFINAL2 AWOS Caths Angels No BorderNuriel AguilarNo ratings yet

- Preprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesDocument10 pagesPreprint Not Peer Reviewed: Impact of Covid-19 On Digital Payment Services at Towns and VillagesShameerNo ratings yet

- E-Banking Survey QuestionnaireDocument5 pagesE-Banking Survey QuestionnaireNuriel AguilarNo ratings yet

- Par QDocument2 pagesPar QNuriel AguilarNo ratings yet

- Ijfs 10 00082Document15 pagesIjfs 10 00082Nuriel AguilarNo ratings yet

- Buemia - Introduction, Mission, VisionDocument3 pagesBuemia - Introduction, Mission, VisionNuriel AguilarNo ratings yet

- Systems Integration and Architecture 1: ExerciseDocument3 pagesSystems Integration and Architecture 1: ExerciseCheese BurgerNo ratings yet

- Adoption of E-Payment Systems in The Philippines: Camille Jeremy B. Raon, Myra V. de Leon, Rayan DuiDocument12 pagesAdoption of E-Payment Systems in The Philippines: Camille Jeremy B. Raon, Myra V. de Leon, Rayan DuiLanze Micheal LadrillonoNo ratings yet

- Market Market 201 Market Research SurveyDocument5 pagesMarket Market 201 Market Research SurveyNuriel AguilarNo ratings yet

- 6026-Article Text-16886-1-10-20201201Document12 pages6026-Article Text-16886-1-10-20201201Nuriel AguilarNo ratings yet

- Sustainability 13 00831 v2Document18 pagesSustainability 13 00831 v2Patricia Jean DigoNo ratings yet

- Paymaya Philippines Manager Business Analysis Strategy November 12 2021Document2 pagesPaymaya Philippines Manager Business Analysis Strategy November 12 2021Nuriel AguilarNo ratings yet

- Global Information Systems: Hossein BIDGOLIDocument37 pagesGlobal Information Systems: Hossein BIDGOLIMat Retarep EtocamNo ratings yet

- Module 1 TSA - AguilarDocument4 pagesModule 1 TSA - AguilarNuriel AguilarNo ratings yet

- Networking Reviewer For Summative 1Document17 pagesNetworking Reviewer For Summative 1Nuriel AguilarNo ratings yet

- Networking Reviewer For Summative 1Document17 pagesNetworking Reviewer For Summative 1Nuriel AguilarNo ratings yet

- Adoption of E-Payment Systems in The Philippines: Camille Jeremy B. Raon, Myra V. de Leon, Rayan DuiDocument12 pagesAdoption of E-Payment Systems in The Philippines: Camille Jeremy B. Raon, Myra V. de Leon, Rayan DuiLanze Micheal LadrillonoNo ratings yet

- Code 3Document6 pagesCode 3Nuriel AguilarNo ratings yet

- Kotlin Code FinalsDocument17 pagesKotlin Code FinalsNuriel AguilarNo ratings yet

- SA1 - Variable, Operators and Control StructuresDocument9 pagesSA1 - Variable, Operators and Control StructuresNuriel AguilarNo ratings yet

- Cinema 4D Beginners GuideDocument10 pagesCinema 4D Beginners Guidetharnax75% (4)

- SL AI Mixer Bro A4Document11 pagesSL AI Mixer Bro A4Claudio PortelaNo ratings yet

- 2013 Joseph A. Luxbacher - Soccer-4th Edition - Steps To Success-Human Kinetics PublishersDocument272 pages2013 Joseph A. Luxbacher - Soccer-4th Edition - Steps To Success-Human Kinetics PublishersagusmulyaNo ratings yet

- Tavener John PDFDocument124 pagesTavener John PDFOlga67% (3)

- Module 1 SFDC Getting StartedDocument18 pagesModule 1 SFDC Getting StartedSonal RnNo ratings yet

- History of The Manufacture of Explosives PDFDocument106 pagesHistory of The Manufacture of Explosives PDFrecon506No ratings yet

- The - Thomas.crown - Affair (1999) DvDrip (Eng) (Multi Sub) VexDocument80 pagesThe - Thomas.crown - Affair (1999) DvDrip (Eng) (Multi Sub) Vexdream_pianist272100% (1)

- Dallas Cowboys 2014 Media GuideDocument452 pagesDallas Cowboys 2014 Media GuideDerrick WhiteNo ratings yet

- Great Gatsby EssayDocument4 pagesGreat Gatsby Essayapi-332142656No ratings yet

- Contoh Teks Daily Activities (Kegiatan Sehari-Hari Di Rumah)Document6 pagesContoh Teks Daily Activities (Kegiatan Sehari-Hari Di Rumah)aina maryamNo ratings yet

- UntitledDocument88 pagesUntitledFrancisco Rojas100% (2)

- Spelling Worksheet - Words With EyDocument1 pageSpelling Worksheet - Words With EyPrimary Leap.co.uk100% (1)

- Test For Unit 1,2,3 I Find The Word Which Has A Different Sound in The Part UnderlinedDocument5 pagesTest For Unit 1,2,3 I Find The Word Which Has A Different Sound in The Part UnderlinedPhương Trần MinhNo ratings yet

- SEVENTEENDocument6 pagesSEVENTEENJennie KimNo ratings yet

- High Rise Construction ReferencesDocument28 pagesHigh Rise Construction ReferenceswilliamsaminNo ratings yet

- IBM Total Storage DS6000 Series Performance Monitoring and TuningDocument536 pagesIBM Total Storage DS6000 Series Performance Monitoring and Tuningrussell_buttsNo ratings yet

- Redemption Form CoreDocument1 pageRedemption Form CoreJan Marie SingcaNo ratings yet

- Usted Abusó (Trumpet 2)Document2 pagesUsted Abusó (Trumpet 2)Manuel Botero MesaNo ratings yet

- RFT Program: Reg - FitnessDocument2 pagesRFT Program: Reg - FitnessTaboka MarobelaNo ratings yet

- MM Ise 2002 Solns PDFDocument16 pagesMM Ise 2002 Solns PDFAHMED ALANINo ratings yet

- Climate Zones: Janvi JithinDocument7 pagesClimate Zones: Janvi JithinJITHIN JAYARAMNo ratings yet

- Ufintipanta PDFDocument128 pagesUfintipanta PDFddgdmrlNo ratings yet

- DK Eyewitness Travel Guide - Chicago (2017) PDFDocument214 pagesDK Eyewitness Travel Guide - Chicago (2017) PDFValentin ZecheruNo ratings yet

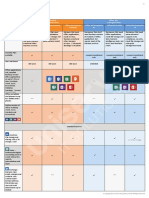

- Uniserve Office365 Comparsion PDFDocument3 pagesUniserve Office365 Comparsion PDFforum4userNo ratings yet

- Artist Spotlight Claude Monet1Document29 pagesArtist Spotlight Claude Monet1Sanda IonescuNo ratings yet

- 49 Dangerous Occurrences at B.C. MinesDocument8 pages49 Dangerous Occurrences at B.C. MinesThe Vancouver SunNo ratings yet

- Catalogue Exact ToolDocument11 pagesCatalogue Exact ToolRahul MandeliaNo ratings yet

- WeekendDocument1 pageWeekendJuliaNo ratings yet

- Mozart 1Document4 pagesMozart 1api-200402960No ratings yet

- 1 - Computer Network NotesDocument2 pages1 - Computer Network NotesSirupyEwe GamerNo ratings yet