Professional Documents

Culture Documents

1 Fefe

Uploaded by

iiyousefgame YT0 ratings0% found this document useful (0 votes)

7 views2 pagesfdfd

Original Title

1fefe

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfdfd

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pages1 Fefe

Uploaded by

iiyousefgame YTfdfd

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

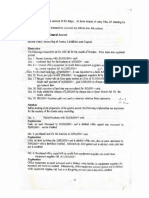

Problem for Illustration:

On September 2007, Tom Cruise organized a business called

“Friend With A Truck” for the purpose of operating an equipment

rental yard. The new business was able to begin operations

immediately. Therefore, the following transactions have occurred

during September 2007:

Sept. 1: Tom Cruise deposited $100,000 cash in a bank account in

the name of the business, Friend With A Truck.

Sept. 1: Paid $9,000 to Shapiro Realty as three months’ advance

rent on the rental yard and office, on the basis of $3,000 a month

starting from September 2007.

Sept. 1: Purchased equipment of $180,000 from Royal Machinery

Company. Paid $70,000 cash and issued a one-year note payable

for the rest.

Sept. 4: Purchased office supplies on account from Modern Office

Co. of $1,630.

Sept. 8: Received $10,000 cash from McBryan Construction Co.

as advance payment on rental equipment.

Sept. 14: Paid salaries for the first two weeks in September of

$3,600.

Sept. 15: Excluding the McBryan advance payment, equipment

rental fees earned during the first 15 days of September amounted

to $6,100, of which $5,300 was received in cash.

Sept. 17: Purchased on account from Earth Movers, Inc., parts

needed to repair a rental tractor of $340, payment is due in 10

days.

Sept. 23: Collected $210 of the accounts receivable recorded on

September 15.

Sept. 25: Paid the account payable to Earth Movers, Inc., $340.

Sept. 30: Equipment rental fees earned from the advance payment

made on September 8 from McBryan Construction Co. was equal

to $5,500.

Required:

1. Journalize the above transactions.

2. Post to ledger accounts (show the ending balances).

3. Prepare the unadjusted trial balance.

You might also like

- Week6 AComprehensiveIllustrationDocument86 pagesWeek6 AComprehensiveIllustrationyow jing pei89% (28)

- Week 3. Assignment 2 - Journat Entries and Adjustments and Preparing StatmentsDocument3 pagesWeek 3. Assignment 2 - Journat Entries and Adjustments and Preparing Statmentsayush guptaNo ratings yet

- Accounting Cycle Problem Question No.1.1Document2 pagesAccounting Cycle Problem Question No.1.1kmillat33% (3)

- Accounting Cycle Comprehensive ProblemDocument3 pagesAccounting Cycle Comprehensive Problemtamzid8179100% (1)

- Test (BBA)Document5 pagesTest (BBA)Ab Wahab100% (4)

- Questions For Practice - Transaction AnalysisDocument2 pagesQuestions For Practice - Transaction AnalysisAsvag Onda100% (2)

- Comprehensive Problem Project ManagementDocument3 pagesComprehensive Problem Project ManagementAmir ParwarishNo ratings yet

- Mgt101 PApers With SolutionDocument13 pagesMgt101 PApers With Solutioncs619finalproject.com100% (7)

- Questions Question 6. Journal Entries, T-Accounts, and Balance Sheet PreparationDocument2 pagesQuestions Question 6. Journal Entries, T-Accounts, and Balance Sheet PreparationЭниЭ.No ratings yet

- Exercises Before Mid-TermDocument6 pagesExercises Before Mid-TermSalmo AbdallaNo ratings yet

- Analyzing and Journalizing TransactionDocument3 pagesAnalyzing and Journalizing TransactionAmna PervaizNo ratings yet

- Individual Assignment For Chapter OneDocument2 pagesIndividual Assignment For Chapter OneTalu LigabaNo ratings yet

- Financial Accounting Practice ProblemsDocument15 pagesFinancial Accounting Practice ProblemsFaryal Mughal100% (1)

- Kohat University of Science & Technology: (KUST) Institute of Business StudiesDocument2 pagesKohat University of Science & Technology: (KUST) Institute of Business Studiesilyas muhammadNo ratings yet

- Common Stock Cash Note Payable Cash Cash Services Cash Note Payable Services A/P Services A/R A/P A/R Cash CashDocument3 pagesCommon Stock Cash Note Payable Cash Cash Services Cash Note Payable Services A/P Services A/R A/P A/R Cash CashĐàm Quang Thanh TúNo ratings yet

- Acc 31: Quiz 2Document1 pageAcc 31: Quiz 2Felimar CalaNo ratings yet

- Financial AccountingDocument4 pagesFinancial Accountingkashifaslam022No ratings yet

- DisposalDocument1 pageDisposalFatima KifayatNo ratings yet

- EXERCISE 3.11 Journalizing, Posting, and Preparing A Trial: Balance Page 123Document24 pagesEXERCISE 3.11 Journalizing, Posting, and Preparing A Trial: Balance Page 123Ifrah BashirNo ratings yet

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- Chapter 2 Practice ExercisesDocument2 pagesChapter 2 Practice ExercisesSokrit SoeurNo ratings yet

- Fdocuments - in Test BbaDocument5 pagesFdocuments - in Test Bbatop 10 infoNo ratings yet

- Chapter 1Document2 pagesChapter 1Ngọc LinhNo ratings yet

- ACC 101 Practice Set RequirementDocument104 pagesACC 101 Practice Set RequirementClarissa Jane Alcazar100% (1)

- Trial BalanceDocument1 pageTrial BalanceRaeha Tul Jannat BuzdarNo ratings yet

- Quiz 2Nd: Saleem Consulting: Saleem Consulting. Saleem Consulting Entered Into The Following Transactions During OctoberDocument1 pageQuiz 2Nd: Saleem Consulting: Saleem Consulting. Saleem Consulting Entered Into The Following Transactions During OctoberharissonNo ratings yet

- HSHDocument3 pagesHSHMonny MOMNo ratings yet

- Assighment IDocument3 pagesAssighment IMujib Abdlhadi100% (1)

- Assignment OneDocument6 pagesAssignment OneUser50% (2)

- Value of The Building Was $300,000. The Company Paid $200,000 Cash and Issued A Note Payable For The BalanceDocument4 pagesValue of The Building Was $300,000. The Company Paid $200,000 Cash and Issued A Note Payable For The BalanceBushra NazNo ratings yet

- Pirates Incorporated Had The Following Balances at The Beginning ofDocument1 pagePirates Incorporated Had The Following Balances at The Beginning oftrilocksp SinghNo ratings yet

- Tutorial Before UTS Peng Akun 1Document11 pagesTutorial Before UTS Peng Akun 1Fanji AriefNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Soal Akuntansi Perusahaan JasaDocument2 pagesSoal Akuntansi Perusahaan JasasaharaoaoaNo ratings yet

- Practice Set I AcctgDocument14 pagesPractice Set I AcctgJan Pearl Hinampas100% (1)

- On November 1, 2016 Mr. Iqbal Organized Continental Moving Company. The Transactions Occurring During The First Month of Operations Were As FollowsDocument1 pageOn November 1, 2016 Mr. Iqbal Organized Continental Moving Company. The Transactions Occurring During The First Month of Operations Were As FollowsnfiiuiNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument5 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsNoorNo ratings yet

- ACC 205 Complete Class HomeworkDocument40 pagesACC 205 Complete Class HomeworkSwadesh BangladeshNo ratings yet

- Preparation of The General: JournalDocument3 pagesPreparation of The General: JournalWamema joshuaNo ratings yet

- ACC 205 Complete Class AssignmentsDocument39 pagesACC 205 Complete Class AssignmentsDecemberjaan0% (1)

- AccountingDocument3 pagesAccountingRahat Islam50% (4)

- FA Week 2Document14 pagesFA Week 2Khánh AnNo ratings yet

- ACC 205 Complete Class HomeworkDocument41 pagesACC 205 Complete Class HomeworkAvicciNo ratings yet

- AssignmentDocument3 pagesAssignmentoblazer shadowNo ratings yet

- InstructionsDocument2 pagesInstructionsGabriel SNo ratings yet

- Assignment. 1Document1 pageAssignment. 1NT VIDEOSNo ratings yet

- Basic Accounting-3Document2 pagesBasic Accounting-3Zubair JuttNo ratings yet

- Jesse Taylor Comprehensive Accounting ProblemDocument9 pagesJesse Taylor Comprehensive Accounting Problemapi-311367219No ratings yet

- Illustrations ch02Document3 pagesIllustrations ch02FantayNo ratings yet

- ACCOUNTING TRANSACTION ENTRIES - SoalDocument1 pageACCOUNTING TRANSACTION ENTRIES - SoalNaufal AthallahNo ratings yet

- On September 1 2010 The Following Were The Account BalancesDocument1 pageOn September 1 2010 The Following Were The Account BalancesM Bilal SaleemNo ratings yet

- ACC101 Exercise Chap2Document4 pagesACC101 Exercise Chap2Pham Thi Que (K17 DN)No ratings yet

- Questions For Practice - Transaction AnalysisDocument2 pagesQuestions For Practice - Transaction Analysispranay raj rathoreNo ratings yet

- Question For AccountsDocument1 pageQuestion For AccountsPrabhleen KaurNo ratings yet

- In April J Rodriguez Established An Apartment Rental Service TheDocument1 pageIn April J Rodriguez Established An Apartment Rental Service Thetrilocksp SinghNo ratings yet

- Truro Excavating Co Owned by Raul Truro Began Operations In: Unlock Answers Here Solutiondone - OnlineDocument1 pageTruro Excavating Co Owned by Raul Truro Began Operations In: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Iemanac Problem Set Problem 1: May CorporationDocument1 pageIemanac Problem Set Problem 1: May Corporationvicencio39No ratings yet

- SW 1Document1 pageSW 1calvinjohnvaldez010No ratings yet

- Normal DistributionDocument29 pagesNormal Distributioniiyousefgame YTNo ratings yet

- Introduction To ProbabilityDocument20 pagesIntroduction To Probabilityiiyousefgame YTNo ratings yet

- Applied Statistics: Testing of HypothesesDocument21 pagesApplied Statistics: Testing of Hypothesesiiyousefgame YTNo ratings yet

- Correlation & RegressionDocument17 pagesCorrelation & Regressioniiyousefgame YTNo ratings yet

- Applied Statistics: Confidence IntervalsDocument8 pagesApplied Statistics: Confidence Intervalsiiyousefgame YTNo ratings yet

- Applied Statistics: Normal DistributionDocument13 pagesApplied Statistics: Normal Distributioniiyousefgame YTNo ratings yet

- Descriptive StatisticsDocument23 pagesDescriptive Statisticsiiyousefgame YTNo ratings yet

- Applied Statistics: Correlation & Regression Analysis Correlation AnalysisDocument16 pagesApplied Statistics: Correlation & Regression Analysis Correlation Analysisiiyousefgame YTNo ratings yet

- Inferential StatisticsDocument19 pagesInferential Statisticsiiyousefgame YTNo ratings yet

- Applied Statistics: ProbabilityDocument14 pagesApplied Statistics: Probabilityiiyousefgame YTNo ratings yet

- Applied Statistics: Normal DistributionDocument11 pagesApplied Statistics: Normal Distributioniiyousefgame YTNo ratings yet

- Applied StatisticsDocument12 pagesApplied Statisticsiiyousefgame YTNo ratings yet

- 3Document1 page3iiyousefgame YTNo ratings yet