0% found this document useful (0 votes)

453 views4 pagesCosting Strategies for Managers

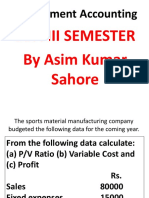

The document discusses various problems related to marginal costing. It includes problems about accepting special orders, profit planning, make or buy decisions, best sales mix, effect of changes in sales price, alternative methods of production, determination of optimum level of activity, evaluation of performance, and discontinuing a production line.

Uploaded by

Shyla PascalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

453 views4 pagesCosting Strategies for Managers

The document discusses various problems related to marginal costing. It includes problems about accepting special orders, profit planning, make or buy decisions, best sales mix, effect of changes in sales price, alternative methods of production, determination of optimum level of activity, evaluation of performance, and discontinuing a production line.

Uploaded by

Shyla PascalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 4