Professional Documents

Culture Documents

Forex Facility To NRO

Uploaded by

GahininathJagannathGadeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forex Facility To NRO

Uploaded by

GahininathJagannathGadeCopyright:

Available Formats

Home About Us Notifications Press Releases Speeches & Interviews Publications Memorial Lectures Statistics Regulatory Reporting

Banking

FREQUENTLY ASKED QUESTIONS

Currency

Do You Know ??????

Foreign Exchange

Government Securities Market

FOREX FACILITIES FOR NRIS/PIOS

NBFCs If you are a Non-Resident Indian (NRI) or a Person of Indian Origin (PIO), you can avail of the following facilities without permission from

the Reserve Bank :

Others

Deposits

Payment Systems

You can open, hold and maintain following types of accounts with an authorised dealer in India i.e. a bank authorised to deal in

foreign exchange.

Non-Resident (Ordinary) Rupee Account – NRO Account

Non-Resident (External) Rupee Account – NRE Account

Foreign Currency Non Resident (Bank) Account – FCNR (B) Account

Salient features of the above accounts are as under :

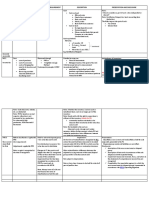

Particulars FCNR (B) Account NRE Account NRO Account

Joint account of two Permitted Permitted Permitted

or more NRIs

Joint account with Not permitted Not permitted Permitted

another person

resident in India

Currency in which Pound Sterling/ US Indian Rupees Indian Rupees

account is Dollar/Jap.Yen/Euro

denominated

Repatriability –

Principal Freely repatriable Freely repatriable Not repatriable

(except current

income like rent,

dividend, pension

etc. and

remittances

indicated under

"Repatriation of

NRO Funds")

Interest Freely repatriable Freely repatriable Freely repatriable

Foreign currency risk Account holder is Account holder is Account holder is

protected against exposed to the exposed to the

changes in INR fluctuations in the fluctuations, in the

value vis-à-vis the value of INR. value of INR to the

currency in which extent of interest

the account is amount.

denominated.

Type of accounts Term deposits only. Current, Savings, Current, Savings,

Recurring, Fixed Recurring, Fixed

Deposits. Deposits.

Period of fixed For terms not less For the periods as For the periods as

deposits than 1 year and not announced by the announced by the

exceeding 3 years deposit taking deposit taking bank.

bank.

Rate of interest Banks are free to Banks are free to Banks are free to

determine interest determine interest determine interest

rates within the rates. rates.

ceiling, if any,

prescribed by the

Reserve Bank

Rupee Loans in India

against Security of

the funds held in the

account to :

Permitted Permitted Permitted

Account holder

Permitted Permitted Permitted

Third Party

Foreign currency

loans outside India

against security of

the funds held in the

Permitted Permitted Not permitted

account to :

Permitted Permitted Not permitted

Account holder

Third Party

Only account holders can avail of foreign currency loans in India against the security held in FCNR(B) Deposit Account.

Repatriation of NRO funds

Authorised Dealers can allow remittance/s upto USD 1 million, of balances in NRO accounts/of sale proceeds of assets on

production of an undertaking by the remitter togetherwith a certificate issued by a Chartered Accountant in Annexure A and B as

prescribed by the Central Board of Direct axes (CBDT). In the case of repatriation of sale proceeds of immovable property by

NRIs/PIOs, ADs can allow repatriation thereof even if the immovable property was held by the NRIs/PIOs for less than 10 years

provided the cumulative period of holding of the immovable property in India and retention of the sale proceeds of the property in

the NRO Account is not less than 10 years.

Investment in India :

You can invest in :

Government Securities/Units with repatriation rights.

Company shares/Debentures with repatriation rights.

Shares/debentures of Indian companies through stock exchange under port-folio investment scheme with repatriation rights.

Indian companies without any limit on non-repatriation basis, freely.

For details please refer to Reserve Bank’s Notifications No.FEMA.20/RB-2000 and No.FEMA.24/RB-2000 dated May 3, 2000 as amended

from time to time.

Immovable property

You can acquire –

immovable property in India other than agricultural/plantation property or a farm house, if you are an NRI.

immovable property other than agricultural land/farm house/plantation property in India out of repatriable funds, if you are a PIO.

You can repatriate –

sale proceeds of immovable property acquired in India out of your repatriable funds, without any lock-in period.

refund of application/earnest money/purchase consideration made by house-building agencies/seller on account of non-

allotment of flats/plots/cancellation of booking/deals for purchase of residential/commercial properties, togetherwith interest,

net of taxes, provided original payment is made out of NRE/FCNR(B) account/inward remittances.

N.B. - All persons, whether resident in India or outside India, who are citizens of Pakistan, Bangladesh, Sri Lanka,

Afghanistan, China, Iran, Nepal, or Bhutan, require prior permission of Reserve Bank for acquiring or transferring any

immovable property in India.

On return to India

If you decide to return to India :

You may continue to hold, own, transfer or invest in foreign currency, foreign security or any immovable property situated outside

India, if such currency, security or property was acquired, held or owned when you were resident outside India.

You may open, hold and maintain with an authorised dealer in India a Resident Foreign Currency (RFC) Account to keep your

foreign currency assets. Assets held outside India at the time of return can be credited to RFC account. The funds in RFC

accounts are free from all restrictions regarding utilisation of foreign currency balances including any restriction on investment

outside India.

N.B. All the above facilities are available under general permission, i.e., foreign exchange can be availed of from authorised dealers and

does not require Reserve Bank’s approval.

Top

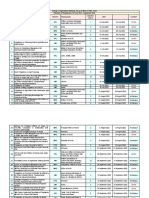

You might also like

- 3 Months Statement. SAUDA 18Document2 pages3 Months Statement. SAUDA 18Fikile Eem100% (1)

- Hexaware Letter of Offer PDFDocument68 pagesHexaware Letter of Offer PDFJohnsonNo ratings yet

- Tally ERP AssignmentDocument42 pagesTally ERP Assignmentdisha_200983% (93)

- Chapter 8Document11 pagesChapter 8nimnimNo ratings yet

- Foreign Currency Transactions and TranslationsDocument5 pagesForeign Currency Transactions and TranslationsKenneth PimentelNo ratings yet

- Types of Bank AccountDocument5 pagesTypes of Bank AccountS K MahapatraNo ratings yet

- AFAR 12 Foreign Currency TransactionsDocument6 pagesAFAR 12 Foreign Currency TransactionsLouie RobitshekNo ratings yet

- Cruz Vs Serrano DigestDocument2 pagesCruz Vs Serrano DigestCarol Jacinto50% (2)

- Nmims Sec A Test No 1Document6 pagesNmims Sec A Test No 1ROHAN DESAI100% (1)

- Your College NameDocument22 pagesYour College NamegihanNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Frequently Asked Questions Forex Facilities For Nris PiosDocument3 pagesFrequently Asked Questions Forex Facilities For Nris Piosmaniraj sharmaNo ratings yet

- NRE - NRO A - CFDocument4 pagesNRE - NRO A - CFRahulNo ratings yet

- Accounts and Features NRO NRE FCNR (B)Document3 pagesAccounts and Features NRO NRE FCNR (B)Abhishek JadhavNo ratings yet

- Nri BankingDocument36 pagesNri Bankingabin 2003No ratings yet

- Retail Banking - Class of 2022Document49 pagesRetail Banking - Class of 2022Aditya RajNo ratings yet

- Non-Resident Indian (NRI) - Different Type of Bank Accounts: Defined Under FEMADocument5 pagesNon-Resident Indian (NRI) - Different Type of Bank Accounts: Defined Under FEMAChitsimran SinghNo ratings yet

- Difference Between NRE & NRO Account: 4 Mins April 15, 2017Document4 pagesDifference Between NRE & NRO Account: 4 Mins April 15, 2017Bhavik MehtaNo ratings yet

- Types of Bank Accounts: Explained in DetailsDocument2 pagesTypes of Bank Accounts: Explained in DetailsRamachandran RamNo ratings yet

- Foreign Exchange Management Act, 1999Document39 pagesForeign Exchange Management Act, 1999Taxpert mukeshNo ratings yet

- Balance of PaymentsDocument44 pagesBalance of PaymentsHusain IraniNo ratings yet

- Types of Nri Acc in BanksDocument6 pagesTypes of Nri Acc in BanksshradddhaNo ratings yet

- Who Can Open A NRE Account?Document6 pagesWho Can Open A NRE Account?Ravishankar PrasadNo ratings yet

- FOREX OPERATIONS - PPTX FINALDocument29 pagesFOREX OPERATIONS - PPTX FINALLikhitha annapuraNo ratings yet

- Treasury & Risk Management: Post Graduate Diploma in Management (ePGDM)Document13 pagesTreasury & Risk Management: Post Graduate Diploma in Management (ePGDM)Jitendra YadavNo ratings yet

- NRI TaxationDocument9 pagesNRI TaxationTekumani Naveen KumarNo ratings yet

- HDCFDocument1 pageHDCFkr_dandekarNo ratings yet

- Forex Nre Nro NriDocument5 pagesForex Nre Nro NriManu MaheshwariNo ratings yet

- Key Features of NRE (Non Resident External) AccountsDocument3 pagesKey Features of NRE (Non Resident External) AccountsVijay KumarNo ratings yet

- Summary of NRO AccountDocument2 pagesSummary of NRO AccountKIRAN REDDYNo ratings yet

- Balance of PaymentDocument9 pagesBalance of PaymentMuskanNo ratings yet

- Foreign Exchange RegulationsDocument58 pagesForeign Exchange RegulationsSanket SinghNo ratings yet

- NRE (Non Resident (External) Rupee) Account: NRE Is A Term Assigned To Bank Accounts Available ToDocument2 pagesNRE (Non Resident (External) Rupee) Account: NRE Is A Term Assigned To Bank Accounts Available ToPriyaneet BhatiaNo ratings yet

- THOUFIKA SUMMER INTERNSHIP REPORT SDocument4 pagesTHOUFIKA SUMMER INTERNSHIP REPORT SKUMARAGURU PONRAJNo ratings yet

- Forex NRE NRO NRIDocument5 pagesForex NRE NRO NRIadifaahNo ratings yet

- Retail Banking: by Prof Santosh KumarDocument30 pagesRetail Banking: by Prof Santosh KumarSuraj KumarNo ratings yet

- UNIT-II - International Parity Conditions, TheoriesDocument34 pagesUNIT-II - International Parity Conditions, TheoriesSarath kumar CNo ratings yet

- Current A/c: MeaningDocument4 pagesCurrent A/c: MeaningNOOB CAMPER GAMINGNo ratings yet

- Current A/c: MeaningDocument4 pagesCurrent A/c: MeaningNOOB CAMPER GAMINGNo ratings yet

- Non-Resident Indian Deposits in India: Trend and DeterminantsDocument35 pagesNon-Resident Indian Deposits in India: Trend and DeterminantsPRAVEEN RADHAKRISHNANNo ratings yet

- FCNR Swap Deal: What It Means For NrisDocument5 pagesFCNR Swap Deal: What It Means For NrisPrateek MohapatraNo ratings yet

- External Commercial BorrowingsDocument37 pagesExternal Commercial BorrowingsTrisha Agarwala100% (1)

- Or Selling Or: TorceDocument3 pagesOr Selling Or: TorceD.SANJANA 2011050No ratings yet

- Xam Idea Economics Chapter 5Document1 pageXam Idea Economics Chapter 5Kajal RanaNo ratings yet

- PWC News Alert 19 January 2019 Changes To The Ecb FrameworkDocument4 pagesPWC News Alert 19 January 2019 Changes To The Ecb FrameworkShweta AgarwalNo ratings yet

- Foreign ExchangeDocument27 pagesForeign ExchangeNitish YadavNo ratings yet

- Nri BankingDocument24 pagesNri BankingmissionwarNo ratings yet

- IND AS 21 RevisionDocument11 pagesIND AS 21 RevisionPrakashal shahNo ratings yet

- Website Notice Revision in Tariff Effective April 2023 - Non MSFDocument3 pagesWebsite Notice Revision in Tariff Effective April 2023 - Non MSFbackupvipul2304No ratings yet

- FC Accounts by ResidentsDocument2 pagesFC Accounts by Residentsmithilesh tabhaneNo ratings yet

- NRIFAQ2014 ModDocument43 pagesNRIFAQ2014 ModHappylifeNo ratings yet

- Foreign Currency ConversionDocument10 pagesForeign Currency ConversionTejas NimaseNo ratings yet

- We Make Our Own Path and World Follow UsDocument47 pagesWe Make Our Own Path and World Follow UssushantgawaliNo ratings yet

- Resident Indians AccountsDocument7 pagesResident Indians Accountsshaunak goswamiNo ratings yet

- Summary of Measurement, Presentation and DisclosureDocument17 pagesSummary of Measurement, Presentation and DisclosureMelrose Eugenio ErasgaNo ratings yet

- NRI BankingDocument4 pagesNRI Bankingjayanti kappalNo ratings yet

- RCBC Atp 55 328Document2 pagesRCBC Atp 55 328Rhogen Aubrey GarciaNo ratings yet

- Role of Banks in Financial MarketsDocument18 pagesRole of Banks in Financial MarketsSabbir SaiyedNo ratings yet

- Hedging of Fixed Income Securities Using Interest Rate Swap: Presented byDocument43 pagesHedging of Fixed Income Securities Using Interest Rate Swap: Presented byAbhijeet SinghNo ratings yet

- Foreign Exchange Management - An Overview of Current Account TransactionsDocument26 pagesForeign Exchange Management - An Overview of Current Account TransactionsAmrita KaurNo ratings yet

- List of Major Differences Between The Old and The New Schedule VIDocument7 pagesList of Major Differences Between The Old and The New Schedule VInikhilmandlecha6142100% (1)

- Export ImportDocument17 pagesExport ImportNirmalNo ratings yet

- Foreign Currency TransactionsDocument24 pagesForeign Currency TransactionsCAPSNo ratings yet

- Financial Markets - Money MarketsDocument10 pagesFinancial Markets - Money MarketsHarshit AgrawalNo ratings yet

- Foreign Exchange Market Foreign Exchange MarketDocument52 pagesForeign Exchange Market Foreign Exchange MarketCarol Santis CarvalhoNo ratings yet

- Week 1: Day 1: EnglishDocument12 pagesWeek 1: Day 1: EnglishGahininathJagannathGadeNo ratings yet

- Rbi Guidelines On NRODocument6 pagesRbi Guidelines On NROGahininathJagannathGadeNo ratings yet

- Week 1: Day 1: MathDocument12 pagesWeek 1: Day 1: MathGahininathJagannathGadeNo ratings yet

- Calendar Jul22-Sep22 EngDocument2 pagesCalendar Jul22-Sep22 EngGahininathJagannathGadeNo ratings yet

- RBI Guidelines On NRO NRI Account85341Document14 pagesRBI Guidelines On NRO NRI Account85341GahininathJagannathGadeNo ratings yet

- RBI Guidelines On Accounts in India by NIDocument4 pagesRBI Guidelines On Accounts in India by NIGahininathJagannathGadeNo ratings yet

- List of Exempted Goods Under GST With HSN Code - Taxguru - inDocument8 pagesList of Exempted Goods Under GST With HSN Code - Taxguru - inGahininathJagannathGadeNo ratings yet

- Annex 4 - Product - Specifications - Technical Requirements - GHSC-PSM-TO1-2017-MCO-LUB-IDIQ - FINALDocument18 pagesAnnex 4 - Product - Specifications - Technical Requirements - GHSC-PSM-TO1-2017-MCO-LUB-IDIQ - FINALGahininathJagannathGadeNo ratings yet

- Indian CurrencyDocument6 pagesIndian CurrencyGahininathJagannathGadeNo ratings yet

- London Condom Manufacturing in AfricaDocument2 pagesLondon Condom Manufacturing in AfricaGahininathJagannathGadeNo ratings yet

- Mah Act No VIII of 2022Document2 pagesMah Act No VIII of 2022GahininathJagannathGadeNo ratings yet

- Print CAExam CertificateDocument1 pagePrint CAExam CertificateGahininathJagannathGadeNo ratings yet

- BoB Vs Joel Joy Education Loan 215700267322017 - 1Document8 pagesBoB Vs Joel Joy Education Loan 215700267322017 - 1GahininathJagannathGadeNo ratings yet

- Annual Report 2014Document257 pagesAnnual Report 2014Bilal AhmadNo ratings yet

- Case Digest Week 2 - Civ Rev 2Document9 pagesCase Digest Week 2 - Civ Rev 2JD BuhanginNo ratings yet

- India: AMB Country Risk ReportDocument4 pagesIndia: AMB Country Risk ReportaakashblueNo ratings yet

- MIS HBL BANK ProjectDocument52 pagesMIS HBL BANK ProjectSyedFahad50% (10)

- 45Document9 pages45Anonymous yMOMM9bsNo ratings yet

- Punjab National Bank Ratio AnalysisDocument62 pagesPunjab National Bank Ratio AnalysiskodalipragathiNo ratings yet

- 14th Century Banking CrisisDocument4 pages14th Century Banking CrisisAman SinglaNo ratings yet

- Proposal of Nabil BankDocument13 pagesProposal of Nabil BankBadri maurya50% (2)

- Udyamimitra MSME Loan FlyerDocument4 pagesUdyamimitra MSME Loan FlyerMohit TiwariNo ratings yet

- Revision - PLPDocument61 pagesRevision - PLPedward scottNo ratings yet

- Origin, History and Types of Banking SystemDocument44 pagesOrigin, History and Types of Banking Systemriajul islam jamiNo ratings yet

- Lease Subordination AgreementDocument2 pagesLease Subordination AgreementRocketLawyer100% (1)

- Vendor MasterDocument35 pagesVendor Mastersameer987No ratings yet

- Assessing The Impact of Mobile Money Services On The Profitability of Banks in Ghana: A Case Study of GCB BankDocument35 pagesAssessing The Impact of Mobile Money Services On The Profitability of Banks in Ghana: A Case Study of GCB Bankindex PubNo ratings yet

- Om Exam AnswersDocument2 pagesOm Exam AnswersShaun FernandezNo ratings yet

- Monopoly - Universal Banks Enjoy A Monopoly in The Market As TheseDocument3 pagesMonopoly - Universal Banks Enjoy A Monopoly in The Market As TheseAIDAN FRANK MILLORANo ratings yet

- Status of Microfinance in Rajasthan 1. Background: Jai Pal Singh Programmes Director, Centre For Microfinance, JaipurDocument4 pagesStatus of Microfinance in Rajasthan 1. Background: Jai Pal Singh Programmes Director, Centre For Microfinance, JaipurpantgauravNo ratings yet

- Daring DerivativesDocument3 pagesDaring DerivativesSakha SabkaNo ratings yet

- Synopsis-BBA Project - KIRAN NAINWAR 1Document10 pagesSynopsis-BBA Project - KIRAN NAINWAR 1Kiran NainwarNo ratings yet

- Reflection UTSDocument1 pageReflection UTSManingas John PaulNo ratings yet

- 1.1 Background of The StudyDocument6 pages1.1 Background of The StudySocialist GopalNo ratings yet

- Financial CrisisDocument14 pagesFinancial CrisisDanGel WongNo ratings yet

- Gateway of Tally-Accounts Info-Ledger-CreateDocument6 pagesGateway of Tally-Accounts Info-Ledger-CreatebhagathnagarNo ratings yet

- REFUND RULES Wef 12-Nov-15 PDFDocument12 pagesREFUND RULES Wef 12-Nov-15 PDFcontenteeeNo ratings yet