Professional Documents

Culture Documents

Understanding CIR

Uploaded by

gkp0 ratings0% found this document useful (0 votes)

20 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views3 pagesUnderstanding CIR

Uploaded by

gkpCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

Credit Information Bureau (India) Limited

IN ASSOCIATION WITH DUN & BRADSTREET AND TRANSUNION

[EMPOWERING YOU

UNDERSTANDING YOUR CIBIL TRANSUNION SCORE

What is the CIBIL TransUnion Score?

The CIBIL TransUnion Score is a 3 digit numeric summary of your credit history. The Score is derived by using the details found in the

“Accounts” and “Enquiries” sections on your Credit Information Report {CIR} and ranges from 300 to 900. The closer your Score is to 900,

the more favourably your loan application will be viewed by a credit institution, The Score plays a critical rale in the loan approval process,

What does my Score mean?

{An individual's Credit Score provides a credit institution with an indication of the “probability of default” of the individual based on their

credit history. What this means in simple English is that the Score tells a credit institution how likely you are to pay back a loan (should

the credit institution choose to sanction your (oan) based on your past pattern of credit usage and loan repayment behaviour. The closer

you are to 900, the more confidence the credit institution will have in your ability to repay the loan and hence, the better the chances of

your application getting approved.

What are the major factors that affect my Score?

There are 4 major factors that affect your Score. These are described below:

Late payments or defaults in the recent past: Your payment history has @ significant impact en your Score. Hence, if you have

missed payments on any of your existing loans, over the last couple of years, your Score is likely to be negatively affected because it

indicates that you are having trouble servicing your existing obligations.

igh utilization of Credit Limits: While the balances on your toans will only reduce over time as payments are made, you must be

diligent about making timely payments on your credit cards. While increased spending on your credit cards may not necessarily negatively

affect your Score, an increase in the current balance on the card over time is an indication of an increased repayment burden and may

negatively impact your Score. I's always prudent to not use too much credit

Higher percentage of Credit Cards or Personal Loans (commonly known as Unsecured Loans] on your CIR: A higher

‘Concentration of home loans or auto loans {commonly known as Secured Loans is likely to be more favourable for your Score than a large

number of unsecured loans. Although unsecured loans offer easy access to finance, it's also by far the most expensive form of credit.

More the number of unsecured loans with high utilization, larger are the payments resulting from its high rate of interest.

Seeking Excessive Credit: f you have made many applications for loans in a short period of time or have recently been sanctioned

new credit facilities, a credit institution is likely to view your application with caution. This behavior of seeking excessive credit indicates

that your debt burden is likely to, or has increased and you are less capable of honoring any additional debt, leading to @ marginal impact

‘on your Credit Score

‘What does it mean when my Score is “NA” or “NH

‘A Score of “NA” or "NH" is nat a bad thing at all. These Scores mean 1 of 3 things:

a). Youdo not have a credit history or you donot have enough ofa credit history tobe scored, ie. you are new tothe credit system

b)_ You have had no credit activity in the last couple of years

cl You have all add-on credit cards and have no credit exposure

It is important to note that while these Scores are not viewed negatively by a credit institution, some credit institutions’ credit policy

prevents them from providing loans to an applicant with Scores of "NA" or “NH” [applicants with no credit track record]. Hence, you may

have better chances applying for a loan elsewhere.

Regi. Office: Hoechst House, 6th Floor, 193, Backbay Reclamation, Nariman Point, Mumbai 400 021. In

(© COPYRIGHT 2011 CREDIT INFORMATION BUREAU INDIA) LIMITED. ALL RIGHTS RESERVED.

How to read your Credit Report

Your CIBIL Credit Information Report [CIR s a record of your credit payment history complied from information received from banks and financial institutions. The purpose i to help loan

providers make informed lending decisions basi your erelt history, quickly and objectively. healthy Credit Report can get your loan approve faster and often at better terms.

strat ue i CIBIL TransUnion Score:

This section relets your credit score, EMPOWERING YOU

sch ic wiely wsed by loan provers to

alate (oan applications. An indidua’s

CIBIL TransUnion Score ranges between

| intermatonintheAccouns'andEnqury | ores ese +

| secon of the rei report. The clesertne | = pone on Employment Information: i

"Ioan ana hence, the Bter the chances ot AUTORUN ccupation and income [A the time of |

your appeaon geting aprrove pening ere ai) as reported by he

a lender fora parte ered account, |

| igresindeat the percentage lancom

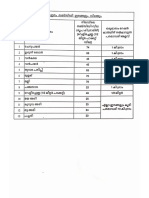

eee to | 1 year an falling in particular score band | Account Information:

cover woman | atthe tie tons apptiestin = i

5 |The most imporant secon of your ER

Se SG SE em For example 57.0% of lan applications | tis sector comaine the dele of your

sam | spprovedintne aI yearnerefrcansur | ened ere are ers he ne

Ee 4 | srewta nada crest scora00 i | ofthe angel, ype fea faites

" : “theme an, ast lance cart, the

ae. Des = | Personal Information, | scruninumterla usin sing arjeiny

== ppecezeatinformations | feldahen each acount was opened, date |

Gam | Thssectonhasyour Nome Date ot ith and | teste parent len oncutcoel

vase, | Ganderasreporedto CB ythemembars, | | balance, amount overdue i ay) and most

ss Memieaton ts your temicton eet “une | ieee aed gee

ame gee | | Meerindbrhe rember, Yorncome Tes | | ode monte eyour payments i

2 eee “eau” | IDIPAN Passport rversLeerce ane eer I

2S “| Bytatnave een repre he lenders wl —— = =

2 indestes that he section is under eepte |

Data received through an Enquiry: a [and il be removed when the dispute |

The symbol nex to any of he dete in

Yourrapartincates that heals eprosoe

bylendernen yu spp ora ered ey,

Enquiry Information:

Contact Information:

‘our asteses teeprene, mone rues ander esses a resus lenders appearereTeaditess ceca expats tater

| theastesisa elena aes fal adress poranen| aes orteperayaoiress 3 raped he lnde Uplotaairessesand |

| eats repre

This sein proves yt deta repardng the anqurymace ye lender yur sect

apoleaton uch as name fthelener, eet apa he pe ocan an se

Visit us at www.cibil.com for more information.

ioneirkincueent heme

KEYTERM: EXPLANATION

"AC [ASSET CLASSIFICATION Ts imporant orate Thal Same ban report DBD [env othe DPD description Yor more arnVon] a pat the Asal CasaMcaion Rare

detined by RE, which areas flows

‘DP Denotes Explanation

STD Standard Payments ae being made within 90 dys. Any accoun: verde by moe than 90 days i lass ed a Non-Perlarming set

INPA by banks

‘SMA Special Menton Aetount Special scaunt crened fr reporting Standard actoun, noving towards Sub-Standard

SUB. Sub-Standard An account which has rained an NPA or up to 12 months

DBT Beustl The econ has remained a Substandard secount fra pri of 12 months

[AMOUNT OVERDUE esd the tal clin Ut Fat beet bal lnce a rwo ac Deis bncpa and iret

ASH LIMIT ln i cr rN ET at of anh Gola pete Wah roma Yo eT,

{EN [CONTROL NUMBER) This Your apart number ans esental yu el you needa rive a Dapute Rogue

COLLATERAL Te prose ta lendor seri fo potent he ender inthe een you are unable to apap your ean, The may be proper saver ge Ae

CREDIT LMT ples ead earde and ovedra eie,Kreflets he eal amount of ereai yeu have secon lo with regard tat eed eare or nero OU

(CURRENT BALANCE Te the sun you si owe ona garirar ced iy, Lenders pial ake 30-65 eye alle your payment ie reeves i upeate fs infrration wih OL

‘DPD DAYS PAST DUET DPD o- Days Past Due appear n the Account Inormation section of your CIR, Th DPO nscale how many yea payment an at account ie that month

Anything ater than O00" ar "STD" [lear refer athe ASSET CLASSIFICATION sesription for mara nlrmatio) ie canesered negative ys lander Up 096

rant ofthis aymen history lh the moet recent month sepiayed frst ae provider,

Sn oeeasionyou may see 200 roperas or your DPD ans ertsin secant wich mp hatinarmaton fortes months has ne ean rare o CII y the bank

EWI AMOUNT Te the EMI Enusted Morty salient] at you pay onthe an

ENQUIRY Enquiries ae ase to your report when yu appl ora lan or cred card and the lender Gecices a access your CIR, Delale such ae he rare othe lan provider

Size ang type of oan ar captured in his Section. Please nte iat he dae of he enquiry may ie rom your actual aalcation dat because the

lender may access your Ca day o mare ater you have ale

TH CREDIT Ra ret re Sd Tes ral he Ngee ornOur eT De UncoGng STEAL nd el or pare crea cor oT

‘OWNERSHI “Ths elle the lender who responsible or payments on tat lean or cred car. There are 4 ype cf neeaors hat cn appear on your CIR

1. Sing: You ar slay resgonsibe fr making payments onthe account.

2 Join You and someone ese ear joint responsi for payments on these accounts. Ths il also retect onthe othr iniidua's CR

5. hutnoraed User: This is used for ‘adicon creat cards that you may have, While ths rtects on yur CIR, enders knw tht you ae not responsible fr paying

dues on that particular account

44 GuaratarAguarantar pledges to repay loan on behalf of thir party who hes tskan a loan, Hence, he provides a guarantee tothe ender hat he wil honour

the aga nin case the principal apcants unable ta so

‘REPAYMENT TENURE Te the fer of your lan This fil Tobe rad wih the PAYMENT FREDUENO ldo ort accurately understand the Term he an For xarple, 10st

monthly payment frequency would mean the term athe aan is 10 year

‘SANCTIONED ANOUNT “Ths the ean amount disband oyu: Applies to aezaunt pes other Wan Tet cas aha wea

SETTLEMENT AMOUNT When an moun ones on lean aezaunt puted, the ivaal nd ender sella at same amount in Between Wo whale ander believes is ond ora wnat he

indvual eoieveshe should pa. Ths she amount the nda has aged pa. Te rest a he amar hah lander Beetes is ewes wren the ene

'SUTF- FILED WILFUL DEFAULT

Tr case he lender has eda sal agains you, heres spesieaporng prescnbadoy the Revere Banka Wai RBM, This a [olons

No Sut Fie lar the ld wil be Blank! 2. Sui fed! 3, ila Default Suit ed Will Default

WAITTEN-OFF AMOUNT [PRINCIPAL]

WAUTTEN-OFF AMOUNT [TOTAL]

WRITTEN-OFF ANO SETTLED STATUS

Thi action populated the lense ae ether esrutared your lan by olen you afferent ferme [extended he loan tenure or reduces he Irene Sl

“Tha possible values ar as flows

1. Restructured Loan 2. Resiructuted Loan [Dot Mandated] 3. Writen-t [WO] 4 Settled, Post NOI Sete

‘tPoweRING YOU

You might also like

- AquariusDocument2 pagesAquariusgkpNo ratings yet

- Kakuro - Volume 1&3 MergedDocument100 pagesKakuro - Volume 1&3 MergedgkpNo ratings yet

- PriceList Jan2018Document3 pagesPriceList Jan2018gkpNo ratings yet

- October 2022 MalayalamDocument1 pageOctober 2022 MalayalamgkpNo ratings yet

- Bath Fittings - Price List - 01.05.19Document56 pagesBath Fittings - Price List - 01.05.19gkpNo ratings yet

- Energen Heat PumpDocument2 pagesEnergen Heat PumpgkpNo ratings yet

- Experian Credit Report - Dispute Guide - 2022Document15 pagesExperian Credit Report - Dispute Guide - 2022gkpNo ratings yet

- Nama RamayanamDocument3 pagesNama RamayanamgkpNo ratings yet

- Wellmate Classic International CatalogueDocument2 pagesWellmate Classic International CataloguegkpNo ratings yet

- Scrurulating of CIBILDocument4 pagesScrurulating of CIBILgkpNo ratings yet

- Vathayasave Vathayasave PDFDocument1 pageVathayasave Vathayasave PDFgkpNo ratings yet

- Kakuro - Volume 1 - 11-20 PDFDocument80 pagesKakuro - Volume 1 - 11-20 PDFgkp0% (1)

- Fire Zoning Zone 1 Zone 2 Zone 3 Zone 4Document1 pageFire Zoning Zone 1 Zone 2 Zone 3 Zone 4gkpNo ratings yet

- Kind Enough For The Being of Individual Development in The Organizationzal Approach For The Being Plant in Made Out DateDocument1 pageKind Enough For The Being of Individual Development in The Organizationzal Approach For The Being Plant in Made Out DategkpNo ratings yet

- Vathayasave VathayasaveDocument1 pageVathayasave VathayasavegkpNo ratings yet

- Kind ApproachDocument1 pageKind ApproachgkpNo ratings yet

- Kind ApproachDocument1 pageKind ApproachgkpNo ratings yet

- Kind Enough For The Being of Individual Development in The Organizationzal Approach For The Being Plant in Made Out DateDocument1 pageKind Enough For The Being of Individual Development in The Organizationzal Approach For The Being Plant in Made Out DategkpNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)