Professional Documents

Culture Documents

Bac 101 Fundamentals of Accounting Ii

Uploaded by

Shadddie SnrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bac 101 Fundamentals of Accounting Ii

Uploaded by

Shadddie SnrCopyright:

Available Formats

MACHAKOS UNIVERSITY

University Examinations for 2016/2017 Academic Year

SCHOOL OF BUSINESS AND ECONOMICS

DEPARTMENT OF BUSINESS ENTREPRENEURSHIP AND MANAGEMENT

SCIENCES

FIRST YEAR SECOND SEMESTER EXAMINATION FOR DEGREE IN

BACHELOR OF ECONOMICS AND FINANCE

BACHELOR OF EDUCATION

BACHELOR OF COMMERCE

BAC 101: FUNDAMENTALS OF ACCOUNTING II

DATE: 6/6/2017 TIME: 8:30 – 10:30 AM

INSTRUCTIONS:

Answer Question One and Any Other Two Questions

QUESTION ONE (COMPULSORY) (30 MARKS)

a) As an accountant of Bei zuri company, you have decided to compute the following

accounting ratios after the end of a trading period:

i) Earnings per share ii) Inventory turnover

iii) Return on assets iv)Dividend yield.

Briefly describe the meaning and the purpose of calculating each of the above

ratios (6 marks)

b) An entity prepares a statement of cashflows to show the sources of cash inflows and

application of the cash for a specified financial year. Identify any two cash inflows

specific to each of the following categories.

i) financing activities

ii) Operating activities

iii) investing activities (6 marks)

Examination Irregularity is punishable by expulsion Page 1 of 8

c) Explain the meaning of the following terms as used when accounting for limited liability

companies.

i) Preference share capital ii)ordinary share capital

iii) corporation tax iv) General reserve (6 marks)

d) The following information relates to Akili Rotary club for the year ended 31 December

2016.

1st January 2016 31st December 2016

shs. shs.

Subscriptions in advance 10 000 37 000

Subscriptions in arrears 65 000 85 000

Subscription received during the year sh. 1 987 000.

Prepare the club’s subscription account for the year ended 31 December, 2016 (6 marks)

e) Explain the meaning of the following terms as used in financial accounting.

i) Manufacturing overheads

ii) Allotment of shares

iii) Goodwill

iv) Rights issue of shares (6 marks)

QUESTION TWO (20 MARKS)

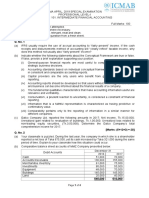

a) The following information relates to the books of Ngonda limited for the year just ended

31/12/2014

Shs

Profits after tax at 50% 1,084,000

Ordinary dividend paid 20%

The market price of ordinary shares sh. 8.00

Total capital commitments sh. 480,000

Issued share capital

7% preference shares @ sh2.00 each 1,200,000

Examination Irregularity is punishable by expulsion Page 2 of 8

Ordinary shares of sh. 2.00 each 3,200,000

Required

i. Calculate the dividend yield (2 marks)

ii. Calculate the earnings yield (2 marks)

iii. The price earnings ratio (2 marks)

iv. Dividend cover (4 marks)

b) The following financial statements relates to ABC limited

ABC LIMITED

Statement of financial position

as at 31.3.2013

Shs Shs

Assets Liabilities and networth

Net fixed assets 285,750 Net worth 663,000

Current assets Long-term debt (10%) 300,000

Stock 649,500 Other current liabilities 100,500

Debtors 270,000 Notes payable (9%) 54,000

Cash 28 500 Trade creditors 116,250

1,233,750 1,233,750

Income statement for the year ended 31/03/2013

Shs

Sales 1,972,500

Less: cost of goods sold 1,368,000

Gross profit 604,500

Less: selling and administration expenses 498,750

Earnings before interest and tax 105,750

Examination Irregularity is punishable by expulsion Page 3 of 8

Less: interest expense 34,500

Earnings before tax 71,250

Less taxation @ 40% 28,500

Earnings after tax 42,750

From the above information, calculate

i) Inventory turnover ratio (2 marks)

ii) Total assets turnover ratio (2 marks)

iii) Times interest earned ratio (2 marks)

iv) Net profit margin (2 marks)

v) Quick ratio (2 marks)

QUESTION THREE (20 MARKS)

The following list of balances at 31/03/2010 was extracted from the books of Excel limited

Shs

Ordinary share capital –ordinary shares of sh 1.00

Each fully paid 200,000

Share premium A/C 20,000

Retained earnings as at 31/03/2009 15,000

Cost of goods sold 350,000

Rates, light and heat 11,400

Telephone and postages 5,600

Salaries 21,000

Directors emoluments 12,000

Motor vehicle expenses 24,100

Sales 500,000

Debtors 21,700

Stock in trade at cost 38,000

Freehold property at cost 140,000

Fixtures and fittings at cost 120,000

Provision for depreciation 72,000

Motor vehicles at cost 80,000

Provision for depreciation 16,000

Examination Irregularity is punishable by expulsion Page 4 of 8

Balance at bank 7,000

Creditors 7,800

Additional information

a) The authorized capital is sh.250,000

b) The company’s freehold property was valued at sh. 190,000 on 31/03/2010 and the

company’s Board of directors has decided that this valuation should be reflected in the

accounts.

c) i) Rates, light and heat charges prepaid at 31/03/2010 amounted to sh. 2,300.

ii) Accrued charges at 31/03/2010 were.

Sh

Telephone and postages 900

Motor vehicle expenses 300

d) depreciation is provided annually on the cost of fixed assets held at the end of the

accounting year as follows:- Fixtures and fittings 5%

Motor vehicles 20%

e) In February 2010, the company sold a motor vehicle which had been bought for sh. 8,000

in January 2007. The only entry in the company’s books of account relating to the sale

concerns the receipt of the sale proceeds of sh. 1,500 which have been credited to motor

vehicle expenses.

f) The directors are recommending that a dividend of 15% be paid on the ordinary shares

for the year ended 31/03/2010.

Required

i) A comprehensive income statement for the year ended 31/03/2010. (12 marks)

ii) A statement of financial position as at that date. (8 marks)

Examination Irregularity is punishable by expulsion Page 5 of 8

QUESTION FOUR (20 MARKS)

The treasurer of Ronda social club had prepared the following Receipt and payment accounts for

the year ended 31st December 2016

Receipts sh Payments sh

Cash and bank (1.1.2016) 11 410 Wages 30, 870

Deposit 36 400 Rent and rates 7, 000

31st December Repair to pavilion 4, 900

Member subscriptions 31 370 Games and equipment 23, 450

Bar receipt 142 240 ( New lawn mower less proceeds

Of sales of old mower sh 3,150) 10,850

Surplus on dance 13 510 Bar purchase 106,680

Interest on deposit 1 960 Secretarial charges 3,290

Donation 980 Miscelenous expenses 3,500

Competition fee 1 260 Prizes 1,540

Cash and bank 8,450

Deposit 38,850

239 470 239 470

The following additional information is provided

i) The other current asset and liabilities were as follows:

1.1.2016 31.12.2016

Value of bar stocks at cost 9 170 7 700

Subscription due but not received 3 990 3 010

Creditor for bar supplies 2 800 2 310

Amount due for secretarial services 1 400 1 610

Miscellaneous expenses paid in advance 840 560

(ii) In January 2016 the book values of non- current assets were :

Pavilion sh101 500 (cost sh. 224,000) and lawn mower sh. 1050 (cost sh. 9,450)

(iii) The club provided depreciation on non-current asset on straight line basis at the rate of 10%

per annum on pavilion and 20% per annum on new lawn mower and games equipment.

Examination Irregularity is punishable by expulsion Page 6 of 8

Required

(a) Statement showing the accumulated fund at 1st January 2016 (5 marks)

(b) An income and expenditure account for the year ended 31st December 2016. (8 marks)

(c) Statement of financial position as at that date (7 marks)

QUESTION FIVE (20 MARKS)

The following figures relates to the accounts YZ manufacturing for the year ended 31st

December 2016.

Invenrory 1st January 2016

Raw materials 3,186

Work in progress 2,745

Finished goods 4,264

Inventory at 31st December 2016

Raw materials 4,479

Work in progress 3,621

Finished goods 9,651

Purchase of raw materials 23,766

Purchase of finished goods 2,431

Sales of finished goods 102,695

Rent and rates 3,292

Manufacturing wages 33,463

Factory power 1,765

Factory heating and lighting 1,237

Factory expenses and maintenance 1,819

Salaries and wages 22,870

Advertising 4,217

Office expenses 1,786

Depreciation of plant and equipment 2,450

Depreciation of office equipment 750

Examination Irregularity is punishable by expulsion Page 7 of 8

One half of salaries and wages and three quarters of rent and rate are to be treated as

manufacturing charge

Required:

a) i) Manufacturing account for the year ended 31 December 2016. (9 marks)

ii) Income statement for the year ended 31 December 2016. (5 marks)

b) Discuss the importance of cash flow statement to an organization (6 marks)

Examination Irregularity is punishable by expulsion Page 8 of 8

You might also like

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Daf1301 Fundamentals of Accounting Ii - Digital AssignmentDocument6 pagesDaf1301 Fundamentals of Accounting Ii - Digital AssignmentcyrusNo ratings yet

- ADVANCED ACCOUNTING 2CDocument5 pagesADVANCED ACCOUNTING 2CHarusiNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- ADVANCED ACCOUNTING 2DDocument5 pagesADVANCED ACCOUNTING 2DHarusiNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Alliance Ascent College: Master of Business Administration: Financial Reporting and Cost Control (MGT 521)Document5 pagesAlliance Ascent College: Master of Business Administration: Financial Reporting and Cost Control (MGT 521)Rahul RavindranathanNo ratings yet

- B.B.A., Sem.-IV CC-213: Corporate Financial StatementsDocument4 pagesB.B.A., Sem.-IV CC-213: Corporate Financial StatementsJJ NayakNo ratings yet

- Section C - BOTH Questions Are Compulsory and MUST Be AttemptedDocument6 pagesSection C - BOTH Questions Are Compulsory and MUST Be AttemptedAliNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementROHIT SHANo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- College Business Exam Covers Key Accounting ConceptsDocument9 pagesCollege Business Exam Covers Key Accounting ConceptsNicole TaylorNo ratings yet

- Accounts Important Questions by Rajat Jain SirDocument31 pagesAccounts Important Questions by Rajat Jain SirRajiv JhaNo ratings yet

- SPCC Accounts Term 2 HomeworkDocument2 pagesSPCC Accounts Term 2 HomeworkHarsh MishraNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- MBA731 Class Activity Question 2 CashflowDocument5 pagesMBA731 Class Activity Question 2 CashflowWisdom MandazaNo ratings yet

- Accounting for Managers: Cash Budget and Financial StatementsDocument4 pagesAccounting for Managers: Cash Budget and Financial StatementsyogeshgharpureNo ratings yet

- MBA Managerial Accounting TestDocument3 pagesMBA Managerial Accounting TestasdeNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Financial Statement Anaysis-Cat1 - 2Document16 pagesFinancial Statement Anaysis-Cat1 - 2cyrusNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- Question CMA April 2019 SP Exam.Document4 pagesQuestion CMA April 2019 SP Exam.F A Saffat RahmanNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- Acs 303Document4 pagesAcs 303Amos kundaNo ratings yet

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet

- EXERCISE Cashflow of The CompanyDocument41 pagesEXERCISE Cashflow of The CompanyDev lakhaniNo ratings yet

- Preparing Accounts for Sinking Fund, Bank and InvestmentsDocument12 pagesPreparing Accounts for Sinking Fund, Bank and InvestmentsGanesh AgarwalNo ratings yet

- Finance For ProcurementDocument3 pagesFinance For ProcurementAlex MuhweziNo ratings yet

- ADVANCED ACCOUNTING 2EDocument3 pagesADVANCED ACCOUNTING 2EHarusiNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- 9706 m17 QP 32Document12 pages9706 m17 QP 32FarrukhsgNo ratings yet

- Important QuestionsDocument3 pagesImportant QuestionsNayan JainNo ratings yet

- Advanced AccountsDocument3 pagesAdvanced AccountsArun SankarNo ratings yet

- The Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceDocument3 pagesThe Institute of Certified General Accountants of Bangladesh Formation Level 2 F7 - Business FinanceAbdullah Tousif MajumderNo ratings yet

- 6167f0c20cf2c12cd8917628 OriginalDocument34 pages6167f0c20cf2c12cd8917628 OriginalTM GamingNo ratings yet

- Management Accounting QBDocument31 pagesManagement Accounting QBrising dragonNo ratings yet

- Cash Flow ENDDocument11 pagesCash Flow ENDinstant uploaderNo ratings yet

- Management Programme: TH STDocument3 pagesManagement Programme: TH ST19BAD007 Bendangsenla JamirNo ratings yet

- Financial Management Economics For Finance 2023 1671444516Document36 pagesFinancial Management Economics For Finance 2023 1671444516RADHIKANo ratings yet

- Advanced Financial Reporting Key HighlightsDocument8 pagesAdvanced Financial Reporting Key HighlightssmlingwaNo ratings yet

- Accounting concepts and statutory auditDocument4 pagesAccounting concepts and statutory auditNamrata RamgadeNo ratings yet

- Accountancy Board Practical Paper - 2020-2021 Class - Xii Time: 1 Hour Max. Marks: 12Document3 pagesAccountancy Board Practical Paper - 2020-2021 Class - Xii Time: 1 Hour Max. Marks: 12Kairav KhuranaNo ratings yet

- Financial Reporting and AnalysisDocument10 pagesFinancial Reporting and AnalysisSagarPirtheeNo ratings yet

- BAC 322 Advanced AccountingDocument9 pagesBAC 322 Advanced AccountingLawrence jnr MwapeNo ratings yet

- April 2020-2Document3 pagesApril 2020-2amjuamjath10No ratings yet

- Management Accounting (Acct 321) P2 PT 2ND Trimester 2017Document5 pagesManagement Accounting (Acct 321) P2 PT 2ND Trimester 2017Nodeh Deh SpartaNo ratings yet

- Mock Test - 2023Document3 pagesMock Test - 2023Phuoc TruongNo ratings yet

- Management Accounting Question BankDocument18 pagesManagement Accounting Question BankDharshanNo ratings yet

- CMA Exam Principles of AccountingDocument4 pagesCMA Exam Principles of AccountingMohammad ShahidNo ratings yet

- Advanced Financial Reporting 1.PDF Nov 2011 1Document12 pagesAdvanced Financial Reporting 1.PDF Nov 2011 1Prof. OBESENo ratings yet

- Exercise Problems SECTION-A (6 Marks) : Page - 1Document14 pagesExercise Problems SECTION-A (6 Marks) : Page - 1Saa RaaNo ratings yet

- Accountancy Practical Examination Class XII (2021-22) Practice SET ADocument4 pagesAccountancy Practical Examination Class XII (2021-22) Practice SET AAyush ChauhanNo ratings yet

- SEM 6 - 10 - BCom - HONS - COMMERCE - DSE 61A - FINANCIAL REPORTING AND FINANCIAL STATEMENT ANALYSIS - 10297Document5 pagesSEM 6 - 10 - BCom - HONS - COMMERCE - DSE 61A - FINANCIAL REPORTING AND FINANCIAL STATEMENT ANALYSIS - 10297Aaysha AgrawalNo ratings yet

- Acm 3Document2 pagesAcm 3Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument9 pagesNfjpia Nmbe Taxation 2017 AnsJeric RebandaNo ratings yet

- Pre-Feasibility Study on Calf Fattening BusinessDocument18 pagesPre-Feasibility Study on Calf Fattening BusinessOroj KhanNo ratings yet

- Quantity Survey EstimatesDocument24 pagesQuantity Survey EstimatesShahid KhanNo ratings yet

- Offer Lakshmi MoogDocument5 pagesOffer Lakshmi MoogKali RathNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- Q2'20 UpdateDocument26 pagesQ2'20 UpdateFred Lamert100% (2)

- Financial Statements, Cash Flow, and TaxesDocument30 pagesFinancial Statements, Cash Flow, and TaxesVincent BuyanNo ratings yet

- Tutorial Week 6Document7 pagesTutorial Week 6Mai Hoàng100% (1)

- PWC Basics of Mining Accounting UsDocument133 pagesPWC Basics of Mining Accounting Ussharanabasappa baliger100% (1)

- Financial Management Mcqs With AnswersDocument53 pagesFinancial Management Mcqs With Answersviveksharma51No ratings yet

- CATA-AL - Jolly's Java and Bakery Executive SummaryDocument9 pagesCATA-AL - Jolly's Java and Bakery Executive SummaryReynelle Cata-alNo ratings yet

- Case Study 2Document25 pagesCase Study 2Febie CarmonaNo ratings yet

- Shoppers Stop - Catchment Analysis and Customer Satisfaction Study of Shoppers StopDocument20 pagesShoppers Stop - Catchment Analysis and Customer Satisfaction Study of Shoppers StopRidhima SharmaNo ratings yet

- PRACTICAL ACCOUNTING II P2.1406-Long TermDocument4 pagesPRACTICAL ACCOUNTING II P2.1406-Long TermKristine DominiqueNo ratings yet

- (Saurashtra Cement Financial Report)Document108 pages(Saurashtra Cement Financial Report)HarshThanki100% (1)

- Transaction ExposureDocument419 pagesTransaction ExposureJelly Sunarli0% (1)

- Shabbir Ar 2012Document46 pagesShabbir Ar 2012Debbie JacobsonNo ratings yet

- PCNCDocument4 pagesPCNCHerzl Hali V. HermosaNo ratings yet

- Aqua Bounty - Case AnswersDocument6 pagesAqua Bounty - Case AnswersAblorh Mensah Abraham50% (4)

- Profit Center Split DeterminationDocument9 pagesProfit Center Split DeterminationRajab Ali JiwaniNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2015 SeriesDocument8 pages9706 Accounting: MARK SCHEME For The May/June 2015 Seriesasad HgdfjjNo ratings yet

- Chapter 4 Capital Structure PolicyDocument17 pagesChapter 4 Capital Structure PolicyAndualem ZenebeNo ratings yet

- Malandog Socioeconomic Baseline SurveyDocument7 pagesMalandog Socioeconomic Baseline SurveyDaniel ElemiaNo ratings yet

- Fatima Fertilizer CompanyDocument8 pagesFatima Fertilizer Companyalee irshadNo ratings yet

- 12.capital Budgeting Decisions - Answers PDFDocument3 pages12.capital Budgeting Decisions - Answers PDFRylleMatthanCorderoNo ratings yet

- TreetFinal2018 PDFDocument318 pagesTreetFinal2018 PDFImran ShoukatNo ratings yet

- ACCT224Document9 pagesACCT224thinkstarzNo ratings yet

- Public Finance Case Study on Market Failure in Sierra LeoneDocument8 pagesPublic Finance Case Study on Market Failure in Sierra LeoneShazana KhanNo ratings yet

- 2015 Financial ReturnDocument27 pages2015 Financial ReturnChad O'CarrollNo ratings yet