Professional Documents

Culture Documents

Glossary

Uploaded by

Aila Fatima MiguelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Glossary

Uploaded by

Aila Fatima MiguelCopyright:

Available Formats

TAX -

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an

individual or legal entity) by a governmental organization in order to fund government spending and

various public expenditures (regional, local, or national)

- A tax is a governmental organization's mandatory financial charge or other sort of levy

placed on a taxpayer to fund government spending and various public expenses.

TAXES IN THE PHILIPPINES

Philippines Capital Gains Tax

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the

seller from a sale, exchange, or other disposition of capital assets located in the

Philippines, including pacto de retro sales and other forms of conditional sale in the

Philippines.

Capital Gains Tax is a tax imposed on gains considered to have been realized by the seller as a

result of a sale, exchange, or other disposition of capital assets located in the Philippines,

including pacto de retro sales and other types of conditional sales in the Philippines.

Philippines Documentary Stamp Tax

Documentary Stamp Tax is a tax on documents, instruments, loan agreements, and

papers pertaining to the acceptance, assignment, sale, or transfer of an obligation,

rights, or property incident thereto in the Philippines.

Documentary Stamp Tax is a tax imposed in the Philippines on documents, instruments, loan

agreements, and papers related to the acceptance, assignment, sale, or transfer of an obligation,

rights, or property concomitant to it.

Philippines Donor’s Tax

Donor’s Tax is a tax on a donation or gift, and is imposed on the gratuitous transfer of

property between two or more persons who are living in the Philippines at the time of

transfer.

The Donor's Tax is a tax levied on the gratuitous transfer of property between two or more

people who are resident in the Philippines at the time of the transfer.

Philippines Estate Tax

Estate Tax is a tax on the rights of a deceased person to transmit his/her estate to

his/her lawful heirs and beneficiaries at the time of death and on certain transfers which

are made by law as equivalent to testamentary disposition in the Philippines.

Estate tax is a tax on a deceased person's right to transfer his or her estate to his or her rightful

heirs and beneficiaries at the time of death, as well as on some transfers made by law as equal to

testamentary disposition.

Philippines Income Tax

Income Tax is a tax on all annual profits arising from property, profession, trades or

offices, or a tax on a person’s income, emoluments, profits, and the like in the

Philippines.

Income tax is a tax on all annual gains derived from property, profession, trades, or offices, as

well as a tax on a person's earnings, emoluments, profits, and the like.

Philippines Percentage Tax

Percentage Tax is a business tax imposed on persons or entities who sell or lease

goods, properties, or services in the course of trade or business whose gross annual

sales or receipts do not exceed P550,000 and are not VAT-registered in the Philippines.

Percentage Tax is a business tax levied on persons or corporations who sell or lease goods,

properties, or services in the conduct of trade or commerce and are not VAT-registered in the

Philippines, and whose gross yearly sales or revenues do not exceed P550,000.

Philippines Value Added Tax (VAT)

Value Added Tax (VAT) is a business tax imposed and collected from the seller or

vendor of services in the course of trade or business on every importation, sale of

properties (real or personal), or lease of goods and other properties (real or personal). It

is an indirect tax, thus, it can be passed on to the buyer in the Philippines.

VAT is a commercial tax that is levied and collected from the seller or vendor of services in the

course of trade or business on every importation, sale of real or personal property, or lease of

products and other properties (real or personal). Because it is an indirect tax, it can be passed on

to buyers in the Philippines.

Philippines Withholding Tax on Compensation

Withholding Tax on Compensation is the final tax withheld from individuals receiving

compensation income in the Philippines. It is the employer’s responsibility to withhold

and pay these taxes on a monthly basis.

The final tax deducted from individuals receiving compensation income in the Philippines is the

Withholding Tax on Compensation. Employers are responsible for withholding and paying these

taxes on a monthly basis.

Philippines Expanded Withholding Tax

Expanded Withholding Tax is a kind of withholding tax which is prescribed only for

certain payors and is creditable against the income tax due of the payee for the taxable

quarter year in the Philippines.

Expanded Withholding Tax is a type of withholding tax that is only applied to select payors and

is deducted from the payee's income tax liability for the taxable quarter year in the Philippines.

Philippines Final Withholding Tax

Final Withholding Tax is a kind of withholding tax which is prescribed only for certain

payors and is not creditable against the income tax due of the payee for the taxable

year. Income Tax withheld constitutes the full and final payment of the Income Tax due

from the payee on the said income in the Philippines.

Final Withholding Tax is a type of withholding tax that is only imposed on select payors and is

not deducted from the payee's income tax liability for the taxable year. The entire and final

payment of the Income Tax due from the payee on the aforementioned income in the Philippines

is Income Tax withheld.

Philippines Withholding Tax on Government Money Payments

Withholding Tax on Government Money Payments is the withholding tax withheld by

government offices and instrumentalities, including government-owned or -controlled

corporations and local government units, before making any payments to private

individuals, corporations, partnerships, and/or associations in the Philippines.

Government offices and instrumentalities, including government-owned or -controlled

enterprises and local government units, withhold withholding tax on government money

payments before making payments to private people, corporations, partnerships, and/or

associations in the Philippines.

LOAN - A loan is the money you receive from a bank or financial institution in exchange

for a commitment to repay the principal amount with interest.

Since lenders take the risk of a possible default, they charge a fee to offset this risk –

and this fee is known as the interest.

A loan is money given to you by a bank or financial organization in exchange for a promise to

repay the principal plus interest. Because lenders assume the risk of a prospective default, they

charge a fee to compensate for it, which is known as interest.

Types of Loan Repayment Methods

(The loan repayment option available to you may depend upon your lender and the type

of loan that’s issued.)

Your loan repayment options may be determined by your lender and the sort of loan you received.

1. EMIs –Equated Monthly Installments or EMIs, are the most popular loan repayment

option. Every installment involves a part of the principal and a part of the interest,

which is scheduled to be paid every month over a fixed tenure.

The most common loan repayment option is Equated Monthly Installments, or EMIs. Every

installment includes a portion of the principal as well as a portion of the interest, and it is

scheduled to be paid every month over a set period of time.

2. Bullet Repayment – Some loan products may allow you to repay the loan through

bullet loan repayment method. In this option, you need to pay only the interest

component every month. When the loan tenure

You may be able to repay your loan using the bullet loan repayment method with some loan

products. You only have to pay the interest component each month if you choose this option.

When the borrowing period ends

You might also like

- Strategically M-WPS OfficeDocument3 pagesStrategically M-WPS OfficeBALISORO, Ylaizza B.No ratings yet

- Capital Gains TaxDocument2 pagesCapital Gains TaxShiena Lou B. Amodia-RabacalNo ratings yet

- Different Kinds of Taxes in The PhilippinesDocument4 pagesDifferent Kinds of Taxes in The PhilippinesJUDADRIEL MADRIDANONo ratings yet

- Kinds of TaxDocument1 pageKinds of TaxMaricar Corina CanayaNo ratings yet

- Types of TaxesDocument27 pagesTypes of TaxesJosh DumalagNo ratings yet

- TaxationDocument25 pagesTaxationkherbalcapsulNo ratings yet

- Determine Taxpayer Status for Income TaxDocument4 pagesDetermine Taxpayer Status for Income TaxMel Loise DelmoroNo ratings yet

- Alana - Self-Assessment Module 3Document3 pagesAlana - Self-Assessment Module 3kate trishaNo ratings yet

- TaxxxxDocument3 pagesTaxxxxfaye gNo ratings yet

- National Taxation SystemDocument11 pagesNational Taxation SystemJeanelle PaduaNo ratings yet

- Different Kinds of Taxes in The PhilippinesDocument5 pagesDifferent Kinds of Taxes in The PhilippinesJosephine Berces100% (1)

- Tax InformationDocument2 pagesTax InformationAlvin WatinNo ratings yet

- I. Basic Concepts in Income TaxationDocument79 pagesI. Basic Concepts in Income Taxationcmv mendoza100% (1)

- Summary of You Tube VideoDocument2 pagesSummary of You Tube VideoErylle Jeen VivasNo ratings yet

- EC1B1 - Intro TaxationDocument38 pagesEC1B1 - Intro TaxationZen Marcus RodasNo ratings yet

- Taxation: Paula R. Morota BS Midwifery IDocument37 pagesTaxation: Paula R. Morota BS Midwifery INano KaNo ratings yet

- Taxes ExplainedDocument56 pagesTaxes ExplainedJosh DumalagNo ratings yet

- Situs of Taxation Literally Means Place of TaxationDocument19 pagesSitus of Taxation Literally Means Place of TaxationRowie Ann Arista SiribanNo ratings yet

- TAXATIONDocument21 pagesTAXATIONRichelle Ann CarinoNo ratings yet

- Notes On Income TaxationDocument21 pagesNotes On Income TaxationBen Dela Cruz100% (2)

- Readingd in Philippine History Fabro, Lesly Ann A. DEC. 15, 2020Document3 pagesReadingd in Philippine History Fabro, Lesly Ann A. DEC. 15, 2020Agyao Yam Faith100% (1)

- Philippine Government Taxation and Agrarian Reform ExplainedDocument34 pagesPhilippine Government Taxation and Agrarian Reform ExplainedStarilazation KDNo ratings yet

- Understanding Taxation Through Business and Non-Business ActivitiesDocument9 pagesUnderstanding Taxation Through Business and Non-Business ActivitiesPewdsNo ratings yet

- Kinds of Tax - Tax Information BirDocument3 pagesKinds of Tax - Tax Information BirLiwanag, NikkoNo ratings yet

- Financial Statements ConceptsDocument6 pagesFinancial Statements ConceptsAlberto NicholsNo ratings yet

- TaxesDocument4 pagesTaxesFelicity BondocNo ratings yet

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesJustin Laraño RabagoNo ratings yet

- TaxationDocument3 pagesTaxationErwin MacaspacNo ratings yet

- Business TaxationDocument10 pagesBusiness TaxationImman AgdonNo ratings yet

- IrsDocument64 pagesIrsYogesh KumarNo ratings yet

- RIPH - MODULE 6Document7 pagesRIPH - MODULE 6Reigne Yzabelle T. PALOMONo ratings yet

- System of Taxation in The PhilippinesDocument7 pagesSystem of Taxation in The PhilippinesdendenliberoNo ratings yet

- Income TaxationDocument32 pagesIncome Taxationblackphoenix303No ratings yet

- Unit 3 - Concepts of Income & Income TaxationDocument10 pagesUnit 3 - Concepts of Income & Income TaxationJoseph Anthony RomeroNo ratings yet

- Kinds of Taxes in The PhilippinesDocument11 pagesKinds of Taxes in The PhilippinesARCHIE AJIASNo ratings yet

- Philippine Tax SystemDocument11 pagesPhilippine Tax SystemHyacinth Eiram AmahanCarumba LagahidNo ratings yet

- Module 4 Lesson 10 Taxation Read... in Phil. His.Document5 pagesModule 4 Lesson 10 Taxation Read... in Phil. His.John Mark Candeluna EreniaNo ratings yet

- Anti-Terrorism Act of 2020Document1 pageAnti-Terrorism Act of 2020Bithey BolivarNo ratings yet

- Answer-Tax-Concepts-RehashDocument2 pagesAnswer-Tax-Concepts-RehashAnice YumulNo ratings yet

- MidTerm Lesson Part 1Document34 pagesMidTerm Lesson Part 1ARMAN WAYNE ANGELESNo ratings yet

- Bureau of Internal RevenueDocument3 pagesBureau of Internal RevenueAngeline LlamasNo ratings yet

- TAX1 ReviewerDocument97 pagesTAX1 ReviewerAbdulwahid MadumNo ratings yet

- Types of Taxes and Their ClassificationsDocument3 pagesTypes of Taxes and Their Classificationstere_aquinoluna828No ratings yet

- Income Taxation ReviewerDocument65 pagesIncome Taxation ReviewerShiela100% (10)

- Review of Financial Statements, Tax Returns & Business IncomeDocument29 pagesReview of Financial Statements, Tax Returns & Business IncomeLia Nicole BungabongNo ratings yet

- Tax 1 ReviewerDocument7 pagesTax 1 ReviewerRaymond SangalangNo ratings yet

- TAXATIONDocument2 pagesTAXATIONsarahjanemontalban26No ratings yet

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Income Taxation Mamalateo NotesDocument19 pagesIncome Taxation Mamalateo Notesclandestine2684100% (1)

- TAXIATION GROUP 8Document15 pagesTAXIATION GROUP 8rheamae2bernalesNo ratings yet

- TaxationDocument5 pagesTaxationHyuga NejiNo ratings yet

- Income TaxationDocument2 pagesIncome TaxationAntonioGloriaComiqueNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Taxation 2 : Introduction Transfer Taxes and Estate TaxDocument22 pagesTaxation 2 : Introduction Transfer Taxes and Estate TaxCharles John Palabrica CubarNo ratings yet

- Asianbank Corp. vs. CIRDocument1 pageAsianbank Corp. vs. CIRenzymadam2631No ratings yet

- Hotel Invoice TemplateDocument2 pagesHotel Invoice TemplateNik RajputNo ratings yet

- Payment-Options Rev2 PDFDocument6 pagesPayment-Options Rev2 PDFriannaNo ratings yet

- Save Electricity: N3968017241 MMZ50 - 3 - 3968017241Document1 pageSave Electricity: N3968017241 MMZ50 - 3 - 3968017241FREE BUSINESS INTELLIGENCENo ratings yet

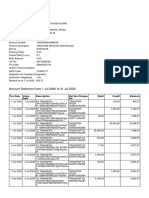

- Account Statement From 1 Jul 2020 To 31 Jul 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Jul 2020 To 31 Jul 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancepavans25No ratings yet

- Managing Director Street Oven LTD.: Address: House 38, 1 Floor, Road-9/A, Dhanmondi R/A, Dhaka - 1209Document5 pagesManaging Director Street Oven LTD.: Address: House 38, 1 Floor, Road-9/A, Dhanmondi R/A, Dhaka - 1209Hasan Ibrahim MiaNo ratings yet

- Auction CatalogDocument128 pagesAuction CatalogSanjay100% (1)

- Gmail - FWD - Booking Confirmation On IRCTC, Train - 16603, 02-Apr-2019, 2A, MAQ - ERS PDFDocument4 pagesGmail - FWD - Booking Confirmation On IRCTC, Train - 16603, 02-Apr-2019, 2A, MAQ - ERS PDFNikita Rathish0% (1)

- Skrill Quick Checkout GuideDocument110 pagesSkrill Quick Checkout GuidesubcribedNo ratings yet

- Dahab Tower Apartments Payment PlanDocument3 pagesDahab Tower Apartments Payment PlanLexico InternationalNo ratings yet

- Enroll UgDocument10 pagesEnroll UgJohn Henry EscotoNo ratings yet

- Noting and ProtestDocument16 pagesNoting and ProtestJiaNo ratings yet

- NEFT - RTGS - IMPS Transaction Timings, Limits and Charges - ICICI BankDocument4 pagesNEFT - RTGS - IMPS Transaction Timings, Limits and Charges - ICICI BankktsnlNo ratings yet

- OIEP00608369000000985748 : Electricity BillDocument1 pageOIEP00608369000000985748 : Electricity BillMohamed AarifNo ratings yet

- Chime Direct DepositDocument1 pageChime Direct Deposityusufosoba51No ratings yet

- The Inspiring Journey of Mobikwik Founder Upasana TakuDocument5 pagesThe Inspiring Journey of Mobikwik Founder Upasana TakukarthikNo ratings yet

- Cheque Submission FormDocument1 pageCheque Submission FormSAKSHINo ratings yet

- Cir v. SekisuiDocument1 pageCir v. SekisuiFrancis Xavier SinonNo ratings yet

- Batch Sap TGL 5-12-21Document1 pageBatch Sap TGL 5-12-21Bastian SNo ratings yet

- Deutsche Bank €2 Billion Payment to Standard CharteredDocument1 pageDeutsche Bank €2 Billion Payment to Standard Charteredpejman mashhadianNo ratings yet

- Chapter - 2.2 Compound InterestDocument18 pagesChapter - 2.2 Compound InterestsaudzulfiquarNo ratings yet

- InvoiceDocument1 pageInvoiceKameenNo ratings yet

- Unit-I Taxation by Prof. Anbalagan ChinniahDocument23 pagesUnit-I Taxation by Prof. Anbalagan ChinniahProf. Dr. Anbalagan ChinniahNo ratings yet

- Taxation 2 Project - UG18-54Document12 pagesTaxation 2 Project - UG18-54ManasiNo ratings yet

- 0902Document15 pages0902hemrajkNo ratings yet

- High Risk Merchant Accoun 8970351Document7 pagesHigh Risk Merchant Accoun 8970351roxan cruzNo ratings yet

- Virgin PDFDocument22 pagesVirgin PDFtarunNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020MaayaBimbamNo ratings yet

- Achieve Financial Freedom with Crypto Family's Wealth Generating SystemDocument18 pagesAchieve Financial Freedom with Crypto Family's Wealth Generating SystemVojkan MilosavljevicNo ratings yet