Professional Documents

Culture Documents

Alpha Limited

Alpha Limited

Uploaded by

Van Anh Au0 ratings0% found this document useful (0 votes)

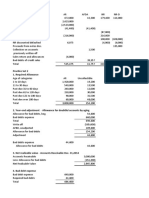

9 views2 pagesThe document contains budgets for sales revenues, receipts from debtors, production of finished goods, purchase of raw materials, and payment of purchases for the months of January, February and March. It provides figures for quantities sold and revenues for sales, expected receipts and timing for debtors, opening and ending finished good inventory and production needs, raw material consumption and purchase needs, and payment schedules that include a one month delay for 60% of the next month's purchases.

Original Description:

alpha limited case study

Original Title

alpha limited

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains budgets for sales revenues, receipts from debtors, production of finished goods, purchase of raw materials, and payment of purchases for the months of January, February and March. It provides figures for quantities sold and revenues for sales, expected receipts and timing for debtors, opening and ending finished good inventory and production needs, raw material consumption and purchase needs, and payment schedules that include a one month delay for 60% of the next month's purchases.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesAlpha Limited

Alpha Limited

Uploaded by

Van Anh AuThe document contains budgets for sales revenues, receipts from debtors, production of finished goods, purchase of raw materials, and payment of purchases for the months of January, February and March. It provides figures for quantities sold and revenues for sales, expected receipts and timing for debtors, opening and ending finished good inventory and production needs, raw material consumption and purchase needs, and payment schedules that include a one month delay for 60% of the next month's purchases.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

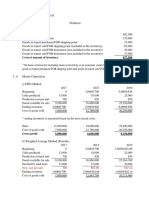

1) Sales revenues budget

January February March

Qty 8,000 15,500 11,000

4 4 4

Sales revenues 32,000 62,000 44,000

2) Schedule for the receipts from debtors

20% 6,400 12,400 8,800

40% 12,800 24,800

40% 12,800

Receipts expected from former sales 50,000 25,000

Total receipts from debtors 56,400 50,200 46,400

3) A Production budget of Finished goods

Initial opening position 7,000 10,850 7,700

sales 8,000 15,500 11,000

Ending position 10,850 7,700 9,800

Production of FP 11,850 12,350 13,100

4) Purchase budget of Raw materials

Initial opening position of RM $ 8,000 8,000 8,000

Consumption of RM for PN $ 22,515 23,465 24,890

Ending position $ 8,000 8,000 8,000

Purchase of RM $ 22,515 23,465 24,890

5) Schedule of payment of purchase

Payment with one month delay (60% of N+1) 5,300 13,509 14,079

Payment the same month (40% of N) 9,006 9,386 9,956

Total payment of purchase 14,306 22,895 24,035

Production = Sales (volume) + Ending

stock of FP - Beginning stock FP

BOM : the bill of material

RM = $1,9 / bottle

Purchase = Consumption + Ending

inventory - Beginning inventory

14,934

Payment = Purchase + Beginning AP -

Ending AP

You might also like

- Budgeting Activity - Annamarisse Parungao - BSA 2BDocument6 pagesBudgeting Activity - Annamarisse Parungao - BSA 2BAnnamarisse parungaoNo ratings yet

- Budget Assignment Norma GDocument5 pagesBudget Assignment Norma Gapi-242614310No ratings yet

- RCA Solutions Mod4 PDFDocument13 pagesRCA Solutions Mod4 PDFdiane camansagNo ratings yet

- Comprehensive BudgetDocument5 pagesComprehensive Budgetapi-317125310No ratings yet

- Marjon M. Lucero Bsais-4 Strategic Cost ManagementDocument4 pagesMarjon M. Lucero Bsais-4 Strategic Cost ManagementMarjon Maurillo LuceroNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- 4 5845855793034823827Document4 pages4 5845855793034823827Gena HamdaNo ratings yet

- Sol. Man. - Chapter 7 - Inventories - Ia Part 1aDocument19 pagesSol. Man. - Chapter 7 - Inventories - Ia Part 1aRezzan Joy Camara MejiaNo ratings yet

- ACC 102 - QuizDocument11 pagesACC 102 - QuizSarah Mae EscutonNo ratings yet

- Question 2 CashFlowDocument6 pagesQuestion 2 CashFlowsuraj lamaNo ratings yet

- Financial Control-1-Master Budgeting CS-Gordon Com. - SolutionDocument3 pagesFinancial Control-1-Master Budgeting CS-Gordon Com. - SolutionQuang NhựtNo ratings yet

- Auditing Problem 2 To 6Document5 pagesAuditing Problem 2 To 6April Rose CercadoNo ratings yet

- ACCT103 Supplementary Notes Cash and Cash EquivalentsDocument1 pageACCT103 Supplementary Notes Cash and Cash EquivalentsChrislyn Janna BeljeraNo ratings yet

- Excel Budget Problem TemplateDocument2 pagesExcel Budget Problem Templateapi-324651338No ratings yet

- Post Test - Answer KeyDocument6 pagesPost Test - Answer KeyLynn A. NuestroNo ratings yet

- COMM1170 Tutorial 10Document10 pagesCOMM1170 Tutorial 10Lia LeNo ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- Central College Multan Name: - Paper: Accounting Total Marks:50 Roll No: - Class: BSC 4 YearDocument2 pagesCentral College Multan Name: - Paper: Accounting Total Marks:50 Roll No: - Class: BSC 4 YearWaqar AmjadNo ratings yet

- AUDPROB CHPT 5 and 61Document30 pagesAUDPROB CHPT 5 and 61Jem ValmonteNo ratings yet

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- Master Budget SolutionDocument2 pagesMaster Budget SolutionAra FloresNo ratings yet

- Pembahasan Genap ACT Genap 2020 19 MarDocument12 pagesPembahasan Genap ACT Genap 2020 19 MarSoca NarendraNo ratings yet

- Practice Set 1Document6 pagesPractice Set 1moreNo ratings yet

- APC Ch11solDocument5 pagesAPC Ch11solDessa Dianna MadridNo ratings yet

- Financial Reporting and AnalysisDocument5 pagesFinancial Reporting and AnalysisJeanette Bayona CumayasNo ratings yet

- Mas ReviewerDocument14 pagesMas ReviewerMichelle AvilesNo ratings yet

- Class 4 QuestionsDocument24 pagesClass 4 QuestionsKeylia SeniorkklooNo ratings yet

- Sol. Man. - Chapter 7 - Inventories - Ia Part 1a - P 2,3,5,6 PDFDocument18 pagesSol. Man. - Chapter 7 - Inventories - Ia Part 1a - P 2,3,5,6 PDFLalaland Acads100% (2)

- Qualifying Exam Review Financial Accounting & ReportingDocument21 pagesQualifying Exam Review Financial Accounting & ReportingClene DoconteNo ratings yet

- Fra PGP13173 D S10Document9 pagesFra PGP13173 D S10Prateek WritesNo ratings yet

- Chap14 The Calculation & Interpretation of Accounting RatiosDocument6 pagesChap14 The Calculation & Interpretation of Accounting RatiosSaiful AliNo ratings yet

- Sales BudgetDocument12 pagesSales BudgetMai YếnNo ratings yet

- Cma Budget ExcelDocument6 pagesCma Budget ExcelDristi SinghNo ratings yet

- The Answer For The Exercise of Trading Company The ABC StoreDocument6 pagesThe Answer For The Exercise of Trading Company The ABC StoreSajakul SornNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- ASYNCHRONOUS ACTIVITY 4 WorksheetsDocument12 pagesASYNCHRONOUS ACTIVITY 4 WorksheetsAbejero Trisha Nicole A.No ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- Accounting Case 1Document3 pagesAccounting Case 1aidanNo ratings yet

- 20201015012755Document57 pages20201015012755hasharawanNo ratings yet

- FR 2018 Paper PrelimDocument12 pagesFR 2018 Paper PrelimshashalalaxiangNo ratings yet

- Cost Management 2Document5 pagesCost Management 2melesemelaku1234No ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- 4.2 Answers and Solutions - Assignment On Materials and LaborDocument8 pages4.2 Answers and Solutions - Assignment On Materials and LaborRoselyn LumbaoNo ratings yet

- APC Ch11sol.2014Document5 pagesAPC Ch11sol.2014Anonymous LusWvyNo ratings yet

- Depreciation Expense For First Year ofDocument6 pagesDepreciation Expense For First Year ofDanara Ann MeanaNo ratings yet

- AP 5904Q InvestmentsDocument6 pagesAP 5904Q InvestmentsRhea NograNo ratings yet

- SS 2 Fin. Accounting First Term ExamDocument10 pagesSS 2 Fin. Accounting First Term ExamMadu Cecilia chiomaNo ratings yet

- Midterms I Answer KeyDocument5 pagesMidterms I Answer Keyaldric taclanNo ratings yet

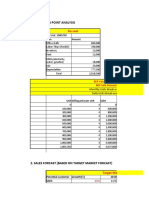

- Breakeven Point Analysis: Fix CostDocument7 pagesBreakeven Point Analysis: Fix CostKankanNguyenNo ratings yet

- Excel Budget ProjectDocument6 pagesExcel Budget Projectapi-314303195No ratings yet

- WOODDocument12 pagesWOODJayson ReyesNo ratings yet

- Homework Submission Point For Lecture Date 15 - 8Document8 pagesHomework Submission Point For Lecture Date 15 - 8Hạ Phạm NhậtNo ratings yet

- MadindigwaDocument7 pagesMadindigwaRay MondNo ratings yet

- Multiple ChoiceDocument5 pagesMultiple ChoicejaneNo ratings yet

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Chapter-2 Profit & Loss - Balance SheetDocument2 pagesChapter-2 Profit & Loss - Balance Sheetvihanjangid223No ratings yet

- Chapter 14 Mas Agamata Answer KeyDocument21 pagesChapter 14 Mas Agamata Answer Keytae ah kimNo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet