Professional Documents

Culture Documents

Practice Questions 1 Key

Practice Questions 1 Key

Uploaded by

Hamza Farooq Korai0 ratings0% found this document useful (0 votes)

49 views1 pageOriginal Title

Practice Questions 1 Key (2)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

49 views1 pagePractice Questions 1 Key

Practice Questions 1 Key

Uploaded by

Hamza Farooq KoraiCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

© Question 1 q® --

Company XYZ issues bonds seying that it will use the proceeds for a safe investment. Instead, it uses the proceeds for a risky

investment. Whase interest will be compromised, stockhalders or debtholders?

Answer

debtholders

© ouestion 2 an

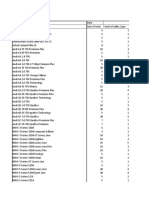

David Rose Inc. forecasts a capital budget of $500.000 next year with forecasted net income of $400.00. The company wants

to maintain a target capital structure of 30% debt and 70% equity. Ifthe company follows the residual dividend policy, how

much in dividends, if any, will it pay?

Hide answer choices «

Correct answer

Show feedback »

© Question 3 qeep --

If investors prefer firms that retain most of their earnings, then a firm that wants to maximize its stock price should set a low

payout ratio.

© Question 4 qe --

Which of the following statements is correct?

Hide answer choices «

Oe ems

‘Very often, a company’s stock price will decline when it announces that it plans to commence a share repurchase program

‘because a repurchase announcement usually is seen as a negative signal from management.

© teacompany ns ar skp ts sock prie shuld usp double

© Me ate eters wetestesphaaton or vy companles tad wo vary hl head paymens rm quarter‘ quarte

© None of the above.

© auestion 5 an

‘Which one of the following corporate board characteristics usually Improves corporate governance?

Hide answer choices «

@ Mobos tsa majority ofeies wh hv experience and arc

© croissornc caiman tte bard a

© Mrerosisasingeas spose

© Beard menbersare pi ata rate bie tna hi pers andthe payet is most ash

The board has a majority of insiders from company management on it who bring first-hand knowledge of how the company

© commen

© Question 6 an oe

Which of the following statements is correct?

Hide answer choices «

@ Firms with a lot of good investment opportunities and a relatively small amount of cash tend to have above average payout

ratios.

An increase in the stock price when a company decreases its dividend is consistent with signaling theory:

income will probably maximize the stock price.

‘Stock repurchases make the most sense at times when a company believes its stock is undervalued. Correct answer

© Mites corer a company hw ering Bacto ofpsng constant prceniagofe

© None of the above.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Aziz Ullah Assign 12Document70 pagesAziz Ullah Assign 12Hamza Farooq KoraiNo ratings yet

- 14th August Event Poster (Dropbox)Document1 page14th August Event Poster (Dropbox)Hamza Farooq KoraiNo ratings yet

- Sources:: Turnitin Originality ReportDocument13 pagesSources:: Turnitin Originality ReportHamza Farooq KoraiNo ratings yet

- Impact of Climate Change On Cotton Production in Pakistan: An ARDL Bound Testing ApproachDocument10 pagesImpact of Climate Change On Cotton Production in Pakistan: An ARDL Bound Testing ApproachHamza Farooq KoraiNo ratings yet

- Chapter 5Document16 pagesChapter 5Hamza Farooq KoraiNo ratings yet

- Assignment 11Document2 pagesAssignment 11Hamza Farooq KoraiNo ratings yet

- CamScanner 02-16-2022 22.08Document5 pagesCamScanner 02-16-2022 22.08Hamza Farooq KoraiNo ratings yet

- Ass Gnment 14Document73 pagesAss Gnment 14Hamza Farooq KoraiNo ratings yet

- 17,872 21,664 27,300 5,698 32,998 Residence Total Rural 1 3 A e A Ss o Oca No Res Ence Es o O Rban A TDocument1 page17,872 21,664 27,300 5,698 32,998 Residence Total Rural 1 3 A e A Ss o Oca No Res Ence Es o O Rban A THamza Farooq KoraiNo ratings yet

- Ch3 - 5 - Franchises (1) SolutionDocument1 pageCh3 - 5 - Franchises (1) SolutionHamza Farooq KoraiNo ratings yet

- Ch1 - An Overview of Statistical ConceptsDocument58 pagesCh1 - An Overview of Statistical ConceptsHamza Farooq KoraiNo ratings yet

- Chapter 05 ProblemsDocument6 pagesChapter 05 ProblemsHamza Farooq KoraiNo ratings yet

- Car SalesDocument836 pagesCar SalesHamza Farooq KoraiNo ratings yet

- Ch3 5 FranchisesDocument1 pageCh3 5 FranchisesHamza Farooq KoraiNo ratings yet

- Capture B (4 Files Merged)Document6 pagesCapture B (4 Files Merged)Hamza Farooq KoraiNo ratings yet

- Chapter 01Document29 pagesChapter 01Hamza Farooq KoraiNo ratings yet

- Introduction To Technology and Innovation Week-1Document27 pagesIntroduction To Technology and Innovation Week-1Hamza Farooq KoraiNo ratings yet

- FA2 CaseDocument3 pagesFA2 CaseHamza Farooq KoraiNo ratings yet

- Venkata Duggisetty: Business Forecasting & VisualDocument1 pageVenkata Duggisetty: Business Forecasting & VisualHamza Farooq KoraiNo ratings yet

- Chapter 4Document6 pagesChapter 4Hamza Farooq KoraiNo ratings yet

- Qaisar Hussain-Assignment 3 - SoilDocument3 pagesQaisar Hussain-Assignment 3 - SoilHamza Farooq KoraiNo ratings yet

- Food FutureDocument21 pagesFood FutureHamza Farooq KoraiNo ratings yet

- Week 2 AssignmentDocument4 pagesWeek 2 AssignmentHamza Farooq KoraiNo ratings yet

- Final Project ElementsDocument1 pageFinal Project ElementsHamza Farooq KoraiNo ratings yet

- BSAN67900 Activity2Document1 pageBSAN67900 Activity2Hamza Farooq KoraiNo ratings yet

- Assgnment 17Document29 pagesAssgnment 17Hamza Farooq KoraiNo ratings yet

- Application Form - Internship.Document2 pagesApplication Form - Internship.Hamza Farooq KoraiNo ratings yet

- Hamza Farooq A17Document30 pagesHamza Farooq A17Hamza Farooq KoraiNo ratings yet

- 6348 F 1 C 9489 B 6 Assgnment 3Document13 pages6348 F 1 C 9489 B 6 Assgnment 3Hamza Farooq KoraiNo ratings yet

- BSAN67900 Activity1Document1 pageBSAN67900 Activity1Hamza Farooq KoraiNo ratings yet