Professional Documents

Culture Documents

Accounting For Employee Benefits

Uploaded by

nuggsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Employee Benefits

Uploaded by

nuggsCopyright:

Available Formats

Accounting for Employee

Benefits

Created @April 17, 2021 1:27 PM

Class ACYFAR4

Type Class Lecture

Materials

Reviewed

URL

Topic

Accounting for Employee Benefits

Employee Benefits

All forms of consideration given by an entity in exchange for service rendered by

employees or for the termination of employment

Categories of Employee Benefits

Short-term Employee Benefits

As an employee renders services to a company, the company recognizes an

Expense and a Liability for services that have not yet been paid

In some cases, the employees render services to generate an Asset and

employee benefits can be included in the Cost of an Asset in accordance

with the Accounting Standards such as

IAS16 PPE

Accounting for Employee Benefits 1

IAS2 Inventory

Because the Liability is settled within 12 months from the end of the

reporting period, there is no need to discount future cash payments

Using the Undiscounted Cash Flows as a basis for measuring Liability is

a fundamental difference between Accounting for Short-term Benefits

and Accounting for Long-term Employee Benefits

Examples:

Wages, Salaries, and Social Security Contributions

SSS, PhilHealth, PAG-IBIG

Paid Annual Leave and Paid Sick Leave

Profit-sharing and Bonuses

Non-monetary Benefits

Medical Care, Housing, Cars, and free subsidised goods or services for

current employees (Rice Subsidy)

Short-term Paid Absences could be:

Accumulating Paid Absences: Unused leave carried forward to future

period

An employer recognizes an Expense during the period when employees

are entitled to accumulating leave

Can be:

Vesting: Unused leave at the end of the future period is paid off on

resignation

Company has an obligation to pay the employee the peso

amount of the unpaid leave on resignation, whether the leave is

taken or not

Liability is recorded at the end of the current reporting period

Non-Vesting: Unused leave expires at the end of the future period

Accounting for Employee Benefits 2

We have to measure the expected cost to the company arising

from the unused leave at the end of the reporting period

The expected cost requires an estimate of the amount of

leave days that will be used by the employees in the future

period

Liability is recorded at the end of the current reporting period

Non-Accumulating Paid Absences: Unused leave expires at the end of

the current reporting period

An employer recognizes an Expense during the period when Non-

Accumulating Leave is taken

Forfeited at the end of the current accounting period if the employee

did not take the leave

No Liability at the end of the current reporting period

Accounting for Employee Benefits 3

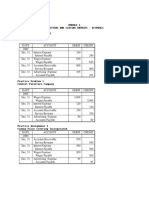

Computation:

Salary per Day (Annual Salary/365 Days) xxx

Multiplied by: Unused Leave (Given) xxx

Liability for Unused Leave xxx

Journal Entry Computation 1:

Liability for Unused Leave xxx

Multiplied by: Expected Utilization Rate xx%

Journal Entry Computation 2:

Total Liability of the Previous Year xxx

Less: Liability for Unused Leave (Current) xxx

Accounting for Employee Benefits 4

Annual Salary: 300,000 + 250,000 + 110,000 (Semi-annual salary since stated in the

problem joined during the half of the year) = 660,000

Accumulating Vested Paid Leave (Calculated a while ago): Sum of all Liability for

Unused Leave

Accounting for Employee Benefits 5

Computation:

Salary per Day (Annual Salary/365 Days) xxx

Multiplied by: Unused Leave (Given) xxx

Multiplied by: Rate of Utilization xx%

Liability for Unused Leave xxx

Accounting for Employee Benefits 6

Annual Salary: 300,000 + 250,000 + 110,000 (Semi-annual salary since stated in the

problem joined during the half of the year) = 660,000

Accumulating Vested Paid Leave (Calculated a while ago): Sum of Liability for

Unused Leave x Expected Utilization Rate

Post-employment Benefits

Retirement Benefits

Examples: Pensions and Lump-sum Payments on Retirement

Pension Plans: Provide Income to individuals during their retirement

years

Accomplished by setting aside funds during an employee's working

years so that at retirement, the accumulated funds plus earnings

from investing those funds are available to replace wages

Accounting for Employee Benefits 7

Basic Nature: Company and/or the employees make contributions

to a fund manager

Fund Manager invests the fund and makes payment to retired

employees

Amount contributed to the Fund Manager is often determined

by an actuary

Reasons why companies establish Pension Plans:

Sponsorship of Pension Plans provide employees with a degree

of Retirement Security

Fulfills a moral obligation by many employers

Can induce a degree of Job Satisfaction and Loyalty that may

enhance productivity and reduce turnover

Motivation to sponsor a plan sometimes comes from Union

Demands

If a company has Employee Unions and often to be

competitive in the labor market

2 Types of Pension Plans:

Defined Contribution Plan: Promise fixed annual contribution

to a pension fund

Employees choose where funds are invested

Usually in Stock or Fixed Income Securities (Bonds)

Retirement Pay depends on the size of the fund at

retirement

Characteristics:

Contributions are defined by agreement

Agreement between the employee and the

employer

Employer deposits an agreed-upon amount into an

employee-directed investment fund

Accounting for Employee Benefits 8

Employee bears all risk of pension fund performance

No further commitment is made by the employer

regarding the benefit amounts at retirement

Defined Benefit Plan: Promise fixed Retirement Benefits

defined by a designated formula

Typically, the Pension Formula bases retirement pay on the

employee's years of service, annual compensation, the

compensation can be based on the final pay of the

employee, or could be average for the last few years

Sometime the formula also considers the age of the

employee

Employers are responsible for ensuring that sufficient funds

are available to provide the promised benefits

Characteristics:

Employer is committed to specified retirement benefits

Retirement Benefits are based on a formula that

considers years of service, compensation level, and

age

Employer bears all risk of pension fund performance

Unlike the Defined Contribution Plan wherein the

employee bears all the risk of pension fund

performance

An Actuary assesses the various uncertainties (employee

turnover, salary levels, mortality, etc.) and estimates the

company's obligation with its pension plan

Key Elements:

Employer's obligation to pay retirement benefits in the

future

Plan Assets set aside by the employer from which to

pay the retirement benefits in the future

Accounting for Employee Benefits 9

Periodic Expense of having a pension plan

NOTE: Neither the Defined Benefit Obligation nor the Plan

Assets are reported individually in the Statement of Financial

Position

Even though they are not reported separately, it is

critical that you understand the compensation of both

the Defined Benefit Obligation and the Plan Assets

because they are reported as a Net Amount in the

Statement of Financial Position and their balances are

reported in the disclosure notes

Defined Benefit Cost reported in the Statement of

Comprehensive Income is a direct composite of periodic

changes that occur in both the Defined Benefit

Obligation and Plan Assets

Defined Benefit Cost: Reflect changes in both the Defined

Benefit Obligation and the Plan Assets

Ways to Measure the Defined Benefit Obligation:

Accumulated Benefit Obligation

Vested Benefit Obligation

Projected Benefit Obligation: The Actuary's estimate

of the total retirement benefit (at their discounted

Present Value) earned so far by employees, applying

Accounting for Employee Benefits 10

the pension formula using estimated future

compensation levels

NOTE: Should be at discounted amount (Present

Value)

Under the Projected Credit Unit Approach: Units

of Benefits increase with each year of service

Only this Approach is permitted by IAS19

Service Cost: The primary component of annual

Defined Benefit Expense

Remeasurement Gain or Loss

NOTE: Estimates are necessary to derive the Defined

Benefit Obligation

Accounting for Employee Benefits 11

When one ore more of these estimates require

revision the estimate of Defined Benefit

Obligation also will require revisions

The resulting increase or decrease in

Defined Benefit Obligation: Referred to as

Actuarial Gain or Loss respectively

Example: An increase in the final salary

estimate increase the Defined Benefit Obligation

and represent a Loss on the Defined Benefit

Obligation because the obligation turned out to

be higher than previously expected

But, however, an increase in the assumed

discount rate used in the Present Value

calculation for the Defined Benefit Obligation

would result in a decrease of the estimate of the

Defined Benefit Obligation

Would result in a Gain on the Defined

Benefit Obligation because the obligation

turned out to be less than the previously

expected

Not reported as Expense in the Income

Statement but reported as OCI in the

Statement of Financial Position

(Shareholders' Equity account)

Accounting for Employee Benefits 12

Report Gain or Losses in an accumulative

basis as a Net Loss Accumulated OCI or as

a Net Gain Accumulated OCI depending on

whether we have greater losses or gains

over time

Plan Assets: Not reported separately in the Statement of

Financial Position but are netted together with the Defined

Benefit Obligation to report either a Net Defined Benefit

Asset (debit balance) or a Net Defined Benefit Liability

(credit balance)

Its separate balance must be reported as a disclosure

note in the Notes to the Financial Statements

Return on Plan Assets is included in the calculation of

the Periodic Expense

Plan Assets of a Defined Benefit Plan must be held by

a Trustee to manage the fund

Trustee accepts employer contributtion

Invests the contribution

Stocks

Bonds

Other Income Producing Assets

Accumulates the earnings on the investments

Accumulated Balance of the annual employee

contributions plus the Return on Investment

(Dividends, Interest, or Market Price

Appreciation) must be sufficient to pay benefits

as they come due

NOTE: When an employer estimates how much

must be set aside every year to accumulate

sufficient funds to pay retirement benefits as they

Accounting for Employee Benefits 13

come due, it is necessary to estimate the Return

those investment will produce

The higher the expected return on Plan Assets,

the lesser the employer must actually

contribute

A relatively low expected return means the

difference must be made up by higher

contribution

Pays benefit from the Plan Asset to retired

employees or their beneficiaries

Funded Status of a Pension Plan:

Overfunded: Fair Value of Plan Assets exceeds the

Actuarial Present Value of all Benefits earned by

participants

Underfunded: Fair Value of Plan Assets is below the

Actuarial Present Value of all Benefits earned by

participants

Reporting the Funded Status of Defined Benefit Plan

A company's Defined Benefit Obligation is not reported

separately from the company's Liabilities

Accounting for Employee Benefits 14

A company's Plan Assets set aside to pay those Benefits

are not reported separately from the company's Assets

BUT, firms do report the Net Difference between these 2

amounts and referred to as the Funded Status or Statues of the

Plan

The amount of Overfunding or Underfunding is reported in

the current period of the Statement of Financial Position as

either a Defined Benefit Liability (Underfunding) or Defined

Benefit Asset (Overfunding)

Relationship between Defined Benefit Cost and Changes in

the Defined Benefit Obligation and Plan Assets

Accounting Objective: Achieve a matching of the Cost of

providing these forms of compensation with the Benefits of

the services performed

Other Post-employment Benefits

Examples: Post-employment Life Insurance and Post-

employment Medical Care

Accounting for Employee Benefits 15

Post-employment Benefit Obligation:

Expected Post-employment Benefit Obligation (EPBO):

The Actuary's estimate of the total Post-employment

Benefits (at their discounted Present Value) expected to be

received by Plan Participants

Defined Benefit Obligation (DBO): The portion of the

EPBO attributed to employee service to date

Most Common so far is Health Care Benefits

Illustrative Problems (Retirement Benefits)

Accounting for Employee Benefits 16

330,000 x 3% = 9,900

Accounting for Employee Benefits 17

Accounting for Employee Benefits 18

Accounting for Employee Benefits 19

Accounting for Employee Benefits 20

Service Cost increases Defined Benefit Expense

Accounting for Employee Benefits 21

Interest Cost increase Defined Benefit Cost

Accounting for Employee Benefits 22

Return on Plan Assets decreases the Defined Benefit Cost

Accounting for Employee Benefits 23

Past Service Cost is the Present Value of the retroactive Benefit from Modification of the Plan

Formula or Amendment to the Plan and increases the Defined Benefit Obligation and is included in

the Net Income as part of Expense

Accounting for Employee Benefits 24

Accounting for Employee Benefits 25

Service Cost and Interest Cost: Add to Defined Benefit Obligation

Return on Plan Assets: Adds to the Plan Assets

Accounting for Employee Benefits 26

Illustrative Problems (Other Post-employment Benefits)

Accounting for Employee Benefits 27

Other Long-term Employee Benefits

Long-term paid absences

Examples: Long-service Leave or Sabbatical Leave, Jubilee or Other Long-

service Benefits (Longevity Pay), and Long-term Disability Benefits

Termination Benefits

Benefit given to a terminated employee

Could be:

Prior to retirement of employee

Retirement Package given by the company

Accounting for Employee Benefits 28

Accounting for Employee Benefits 29

You might also like

- Chap 001 Spiceland 6e SolutionsDocument28 pagesChap 001 Spiceland 6e Solutionsmondew99No ratings yet

- Psychology: Example B: Extended Essay 1Document21 pagesPsychology: Example B: Extended Essay 1KritviiiNo ratings yet

- DSIMGTS Syllabus - RCRRDocument6 pagesDSIMGTS Syllabus - RCRRGabrielle Beatrice TroncoNo ratings yet

- Answers To Problem Sets: Financial AnalysisDocument13 pagesAnswers To Problem Sets: Financial Analysismandy YiuNo ratings yet

- Monitoring and Evaluation Guidelines for IAEA Technical Cooperation ProjectsDocument61 pagesMonitoring and Evaluation Guidelines for IAEA Technical Cooperation Projectsmp dcNo ratings yet

- The Responsibilities of a Good ShepherdDocument8 pagesThe Responsibilities of a Good ShepherdMae Hazel Esteban AlanoNo ratings yet

- Manufacturing BusinessDocument25 pagesManufacturing BusinessCristian Marlon De GuzmanNo ratings yet

- IAS 19 Employee Benefits OverviewDocument8 pagesIAS 19 Employee Benefits OverviewAANo ratings yet

- IAS 19 Employee BenefitsDocument14 pagesIAS 19 Employee BenefitsShiza ArifNo ratings yet

- Unit 03Document9 pagesUnit 03bobo tangaNo ratings yet

- IAS 19 Employee BenefitDocument20 pagesIAS 19 Employee BenefitAklilNo ratings yet

- Ias 19 Employee BeneftDocument24 pagesIas 19 Employee Beneftesulawyer2001No ratings yet

- Notes On Employee BenefitsDocument26 pagesNotes On Employee BenefitsSarannyaRajendraNo ratings yet

- Employee Benefits: PAS 19 Corpuz, Mary Lorie Anne ODocument38 pagesEmployee Benefits: PAS 19 Corpuz, Mary Lorie Anne OMarylorieanne CorpuzNo ratings yet

- Chapter 21 - Employee Benefits IFRS (IAS 19) and Then ASPE (Section 3462), Minor Difference Flashcards - QuizletDocument1 pageChapter 21 - Employee Benefits IFRS (IAS 19) and Then ASPE (Section 3462), Minor Difference Flashcards - QuizletcathNo ratings yet

- Employee BenefitDocument32 pagesEmployee BenefitnatiNo ratings yet

- Employee Benefit (Ias 19) FinalDocument36 pagesEmployee Benefit (Ias 19) FinalKanbiro OrkaidoNo ratings yet

- Accounting for Employee BenefitsDocument6 pagesAccounting for Employee BenefitsHannah Jane Arevalo LafuenteNo ratings yet

- IA2 10 01 Employee Benefits PDFDocument17 pagesIA2 10 01 Employee Benefits PDFAzaria MatiasNo ratings yet

- Practical Accounting 2: BSA51E1 &BSA51E2Document68 pagesPractical Accounting 2: BSA51E1 &BSA51E2Carmelyn GonzalesNo ratings yet

- Ias 19Document43 pagesIas 19Reever RiverNo ratings yet

- Lecture # 11: Employee Benefits IAS-19Document3 pagesLecture # 11: Employee Benefits IAS-19ali hassnainNo ratings yet

- EmployeebenefitsreportDocument172 pagesEmployeebenefitsreportMikaela LacabaNo ratings yet

- Pension Plans ExplainedDocument21 pagesPension Plans ExplainedMichael NguyenNo ratings yet

- IAS 19 - Employee BenefitDocument33 pagesIAS 19 - Employee BenefitlaaybaNo ratings yet

- Handout 3.0 ACC 226 Sample Problems Employee BenefitsDocument12 pagesHandout 3.0 ACC 226 Sample Problems Employee BenefitsLyncee BallescasNo ratings yet

- Employee Compensation - Study Session 5, Reading 15Document12 pagesEmployee Compensation - Study Session 5, Reading 15Analyst832No ratings yet

- Employee Benefit 2020Document18 pagesEmployee Benefit 2020harman singhNo ratings yet

- Far28 Employee BenefitsDocument26 pagesFar28 Employee BenefitsCzar John JaudNo ratings yet

- Acivity Module 4Document2 pagesAcivity Module 4Honey TolentinoNo ratings yet

- Employee Benefits Chapter SummaryDocument29 pagesEmployee Benefits Chapter SummaryDudz MatienzoNo ratings yet

- Employee Benefits AccountingDocument83 pagesEmployee Benefits AccountingArlene Rose GonzaloNo ratings yet

- PAS 19 Employee BenefitsDocument62 pagesPAS 19 Employee BenefitsBenj FloresNo ratings yet

- Ias 19 Employee BenefitsDocument43 pagesIas 19 Employee BenefitsHasan Ali BokhariNo ratings yet

- IAS 19 Employee Benefits ExplainedDocument40 pagesIAS 19 Employee Benefits ExplainedYI WEI CHANGNo ratings yet

- Employee Benefits P201Document18 pagesEmployee Benefits P201krisha milloNo ratings yet

- Chapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsDocument50 pagesChapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsLovely AbadianoNo ratings yet

- Lesson Six: Accounting For Employee BenefitsDocument27 pagesLesson Six: Accounting For Employee BenefitssamclerryNo ratings yet

- PAT P13 Notes - Ias 19, 10, Ifrs 11 & Ifrs 12Document14 pagesPAT P13 Notes - Ias 19, 10, Ifrs 11 & Ifrs 12HSFXHFHXNo ratings yet

- Employee Benefits P201Document17 pagesEmployee Benefits P201krisha milloNo ratings yet

- IAS-19 Employee BenefitsDocument49 pagesIAS-19 Employee BenefitsmalikjawadNo ratings yet

- CH20 PDFDocument81 pagesCH20 PDFelaine aureliaNo ratings yet

- PAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenDocument5 pagesPAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenKaila Clarisse CortezNo ratings yet

- Unit 7 E-Tutor PresentationDocument18 pagesUnit 7 E-Tutor PresentationKatrina EustaceNo ratings yet

- Employee Benefits Part 1 PDFDocument21 pagesEmployee Benefits Part 1 PDFHerald JoshuaNo ratings yet

- IAS 19 SummaryDocument6 pagesIAS 19 SummaryMuchaa VlogNo ratings yet

- Chapter 2 Lecture Notes.2021Document15 pagesChapter 2 Lecture Notes.2021Hoyin SinNo ratings yet

- Chapter 8 Employee BenefitsDocument40 pagesChapter 8 Employee BenefitsjammuuuNo ratings yet

- Module 3 Packet: College of CommerceDocument21 pagesModule 3 Packet: College of CommerceDexie Jane MayoNo ratings yet

- Accounting For Pensions and Postretirement BenefitsDocument3 pagesAccounting For Pensions and Postretirement BenefitsDhivena JeonNo ratings yet

- Chapter 17 Ia2 No ProblemsDocument23 pagesChapter 17 Ia2 No ProblemsJM Valonda Villena, CPA, MBANo ratings yet

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- Pay For Performance UCPDocument27 pagesPay For Performance UCPDarfishan TanveerNo ratings yet

- Ias 19 - Employee Benefits QUESTION 57-17Document9 pagesIas 19 - Employee Benefits QUESTION 57-17Janella Gail ArenasNo ratings yet

- Csfas Pas19Document30 pagesCsfas Pas19Jack GriffoNo ratings yet

- Employee Benefits Quiz and ExplanationsDocument2 pagesEmployee Benefits Quiz and ExplanationsJan JanNo ratings yet

- Employee Benefit - Vol.1Document1 pageEmployee Benefit - Vol.1Edzel Dwight GumiranNo ratings yet

- Chapter 20: Accounting For Pensions: Tujuan PensiunDocument7 pagesChapter 20: Accounting For Pensions: Tujuan PensiunMagnalia RestuNo ratings yet

- Module 1 - Employee BenefitsDocument38 pagesModule 1 - Employee BenefitsMitchie Faustino100% (1)

- Pas 19Document2 pagesPas 19MMBRIMBAPNo ratings yet

- Application Summary 1Document2 pagesApplication Summary 1nuggsNo ratings yet

- ACTBFAR Work Text - Chapter 13. - 2T1920 - FormattedDocument7 pagesACTBFAR Work Text - Chapter 13. - 2T1920 - FormattednuggsNo ratings yet

- Corporation Accounting Proforma EntriesDocument21 pagesCorporation Accounting Proforma EntriesnuggsNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsnuggsNo ratings yet

- ACTBFAR Work Text - Chapter 12 - 2T1920 - FormattedDocument18 pagesACTBFAR Work Text - Chapter 12 - 2T1920 - FormattednuggsNo ratings yet

- LFC001-2002 (Real Property Tax Unit 2)Document3 pagesLFC001-2002 (Real Property Tax Unit 2)nuggsNo ratings yet

- 03.2 Handbook of The International Code of Ethics For Professional AccountantsDocument92 pages03.2 Handbook of The International Code of Ethics For Professional AccountantsnuggsNo ratings yet

- ACTBFAR Work Text Chapter 11 2T1920 FormattedDocument11 pagesACTBFAR Work Text Chapter 11 2T1920 FormattednuggsNo ratings yet

- CPA firm considerations accepting new clientsDocument19 pagesCPA firm considerations accepting new clientsNathalie PadillaNo ratings yet

- Actreg1 Notes 3Document33 pagesActreg1 Notes 3nuggsNo ratings yet

- 04 Pre-Engagement ActivitiesDocument26 pages04 Pre-Engagement ActivitiesnuggsNo ratings yet

- Katherine Uy Sobremonte: Income TaxDocument1 pageKatherine Uy Sobremonte: Income TaxnuggsNo ratings yet

- BP22 Worthless Checks Law SummaryDocument16 pagesBP22 Worthless Checks Law SummarynuggsNo ratings yet

- Bank Secrecy LawDocument9 pagesBank Secrecy LawnuggsNo ratings yet

- AMLADocument9 pagesAMLAnuggsNo ratings yet

- Pdic Law I. Philippine Deposit Insurance Corporation Law (RA 3591 As Amended by RA 10846) A. Description of Philippine Deposit Insurance CorporationDocument7 pagesPdic Law I. Philippine Deposit Insurance Corporation Law (RA 3591 As Amended by RA 10846) A. Description of Philippine Deposit Insurance CorporationnuggsNo ratings yet

- Actreg1 Notes 4Document33 pagesActreg1 Notes 4nuggsNo ratings yet

- Competitiveness, Strategy, and Productivity: or Distribution Without The Prior Written Consent of Mcgraw-Hill EducationDocument39 pagesCompetitiveness, Strategy, and Productivity: or Distribution Without The Prior Written Consent of Mcgraw-Hill EducationnuggsNo ratings yet

- Actreg1 Notes 2Document17 pagesActreg1 Notes 2nuggsNo ratings yet

- Learning Curves: Distribution Without The Prior Written Consent of Mcgraw-Hill EducationDocument18 pagesLearning Curves: Distribution Without The Prior Written Consent of Mcgraw-Hill EducationnuggsNo ratings yet

- Stevenson 13e Chapter 7 SupplementDocument18 pagesStevenson 13e Chapter 7 SupplementnuggsNo ratings yet

- Actreg1 Notes 1Document33 pagesActreg1 Notes 1nuggsNo ratings yet

- Forecasting: Distribution Without The Prior Written Consent of Mcgraw-Hill EducationDocument40 pagesForecasting: Distribution Without The Prior Written Consent of Mcgraw-Hill EducationnuggsNo ratings yet

- Process Selection and Facility LayoutDocument40 pagesProcess Selection and Facility LayoutnuggsNo ratings yet

- Stevenson 13e Chapter 1Document40 pagesStevenson 13e Chapter 1nuggsNo ratings yet

- Stevenson 13e Chapter 4Document59 pagesStevenson 13e Chapter 4nuggsNo ratings yet

- Notes On Economics of InformationDocument11 pagesNotes On Economics of InformationnuggsNo ratings yet

- Pryce Corp. - Revised Manual On Corporate Governance - July 27,2020Document27 pagesPryce Corp. - Revised Manual On Corporate Governance - July 27,2020nuggsNo ratings yet

- SEC Form 17-A Annual Report of Pryce CorporationDocument198 pagesSEC Form 17-A Annual Report of Pryce CorporationnuggsNo ratings yet

- CH 9Document82 pagesCH 9Michael Fine100% (2)

- Exercises On Financial StatementDocument10 pagesExercises On Financial Statementzuraidiroslan game100% (1)

- Chap 17Document34 pagesChap 17ridaNo ratings yet

- Quarter 2 - Module 4 Performing Bookkeeping Tasks: EntrepreneurshipDocument15 pagesQuarter 2 - Module 4 Performing Bookkeeping Tasks: EntrepreneurshipLeynard Collado100% (1)

- Cash Receipt JournalDocument39 pagesCash Receipt JournalAlma SiwiNo ratings yet

- Part One: Multiple Choice (1.5 Pts Each)Document4 pagesPart One: Multiple Choice (1.5 Pts Each)Samuel DebebeNo ratings yet

- Formation Burgos RefozarDocument10 pagesFormation Burgos RefozarJasmine ActaNo ratings yet

- Commercial Bank of Ethiopia: Account StatementDocument9 pagesCommercial Bank of Ethiopia: Account StatementSamuel Abebe100% (1)

- Salsse Roofing Services Was Formed On December 01, 2016. The Following Transactions TookDocument7 pagesSalsse Roofing Services Was Formed On December 01, 2016. The Following Transactions TookDipika tasfannum salamNo ratings yet

- ACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8Document28 pagesACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8rodell pabloNo ratings yet

- Full Download Accounting Volume 1 Canadian 9th Edition Horngren Solutions ManualDocument12 pagesFull Download Accounting Volume 1 Canadian 9th Edition Horngren Solutions Manualkotelamalbec6100% (19)

- CH 14 - Translation SolutionDocument3 pagesCH 14 - Translation SolutionJosua PranataNo ratings yet

- Apr 2016 PDFDocument2 pagesApr 2016 PDFBALWINDER SINGHNo ratings yet

- Accounting Practice Test ANSWERSDocument10 pagesAccounting Practice Test ANSWERSMargarete DelvalleNo ratings yet

- Preparing FinancialDocument18 pagesPreparing FinancialAbhishek VermaNo ratings yet

- Origin and Evolution of Double Entry Bookkeeping A Study of Italian Practice From The Fourteenth Century by Edward Peragallo PDFDocument161 pagesOrigin and Evolution of Double Entry Bookkeeping A Study of Italian Practice From The Fourteenth Century by Edward Peragallo PDFDan PolakovicNo ratings yet

- Chap 10 PartnershipDocument24 pagesChap 10 PartnershipIvhy Cruz Estrella100% (2)

- EBAY Audit ReportDocument26 pagesEBAY Audit ReportHaywire UmarNo ratings yet

- Ifrs All About Debit and Credit: CS. Rajkumar S AdukiaDocument40 pagesIfrs All About Debit and Credit: CS. Rajkumar S AdukiaAbhiraj ShuklaNo ratings yet

- Solution Manual For Accounting Information Systems 13th Edition Romney, SteinbartDocument10 pagesSolution Manual For Accounting Information Systems 13th Edition Romney, Steinbarta672546400100% (1)

- DeKalb County Commissioners Chief of Staff Morris Williams P-Card ActivityDocument37 pagesDeKalb County Commissioners Chief of Staff Morris Williams P-Card ActivityViola DavisNo ratings yet

- Csidc Bhilai M/s Sai Creation RaipurDocument1 pageCsidc Bhilai M/s Sai Creation Raipursc BhagatNo ratings yet

- Bop Internship ReportDocument70 pagesBop Internship Reportiqarah100% (4)

- SQLAcc UserManual PDFDocument120 pagesSQLAcc UserManual PDFNiKki LoVaNo ratings yet

- Class 11 AccountsDocument3 pagesClass 11 Accountssamarthj.9390No ratings yet

- Cash Disbursement JournalDocument21 pagesCash Disbursement JournalJanine PigaoNo ratings yet

- Create Nonlabor CostsDocument13 pagesCreate Nonlabor CostsSohailMunawarNo ratings yet

- Tally ERP9 PDFDocument8 pagesTally ERP9 PDFRizwan AhmedNo ratings yet

- Marking Scheme Sample Question Paper Accountancy, Class XII Board Examination, March, 2015Document13 pagesMarking Scheme Sample Question Paper Accountancy, Class XII Board Examination, March, 2015kamalNo ratings yet

- Auditing Problems v1 2018 CompressDocument36 pagesAuditing Problems v1 2018 CompressMr. CopernicusNo ratings yet