Professional Documents

Culture Documents

Hospitals New Reforms Impact Edel 201806

Uploaded by

manish.wbsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hospitals New Reforms Impact Edel 201806

Uploaded by

manish.wbsCopyright:

Available Formats

SECTOR UPDATE

POLICY PULSE

Healthcare reforms – Big will become bigger

India Equity Research | Healthcare

Lately, there has been lot of noise in the media about heightened government

sensitivity towards healthcare and pharma practices, both at the centre and in

states. This implies an imminent risk of: i) price control or cap on medicines,

diagnostic tests and procedures in the short term; and ii) a shift from branded

to generic medicines over the long term. In our view, the government is trying

to impose regulatory controls to raise the quality of healthcare and bring

transparency in pricing to bring in affordability. Though the process will be a

challenging in the short term and can impact the earnings and valuations, in the

long term this will accelerate the shift from the unorganized to organized.

Healthcare providers, especially hospitals, will thus shift towards a service led

model, while pharma companies reduce their sales and marketing spends. We

believe these reforms will drive consolidation in long term. Analysis of recent

government proposals is part of the note.

Central govt.’s price control: Would make healthcare affordable

The government is planning to link the prices of scheduled and non-scheduled drugs to a

special pharma index. This index will likely form the basis for future price revisions. The

government also intends to control the prices of diagnostics and healthcare packages.

The average price increase of Indian Pharmaceutical Market was 1.3% over three years.

Delhi’s healthcare bill: Consumer and hospitals both to benefit

Here the endeavor is to improve the patient experience and lower their cost burden. We

have read the white paper and most of the provisions therein should improve the overall

healthcare services. It suggests every nursing home/ private hospital must have a tie-up

with a multi speciality hospital. It also allows 20% markup in cost of high-risk packages.

One of the controversial suggestions is to cap the gross margins on consumables at 50%.

The option to purchase drugs outside the hospital pharmacy and a mechanism to

eradicate commissions are other notable recommendations.

Clinical Establishment Act: To lift quality of healthcare

The Act prescribes minimum standards for facilities and services provided by healthcare

establishments registered with the states. Four states and all union territories except

Delhi have implemented this law, and six states have adopted the Act pending

implementation. The Act requires states to have a necessary regulatory machinery to Deepak Malik

verify documents, infrastructure, and qualifications of medical staff and availability of +91 22 6620 3147

medical equipment before establishing a nursing home. It also requires regular inspection deepak.malik@edelweissfin.com

by the regulator. The general apprehension is that the government may cap rates for

Ankit Hatalkar

various diagnostic tests, procedures, surgeries or treatments. +91 22 6623 3097

ankit.hatalkar@edelweissfin.com

Ayushman Bharat: Major hospitals may refrain from it

Videesha Mehta

Last month, the government released a model tender for the Pradhan Mantri Rashtriya videesha.mehta@edelweissfin.com

Swasthya Suraksha Mission (PMRSSM), which expected to start in October 2018. Charges

for the procedures listed in the scheme are extremely low and we believe corporate

hospitals like Apollo and Max are likely to refrain from empanelment with this scheme. June 08, 2018

Edelweiss Research is also available on www.edelresearch.com, Edelweiss Securities Limited

1

Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset.

Healthcare

Recommendations by Delhi Government

A few weeks ago, the Delhi government came up with its draft proposal to address patients’

issues at private hospitals (PH) and nursing homes (NH). The recommendations have been

elaborated below:

a) In order to ensure that the consumer is not forced to buy non-NLEM drugs, all hospitals

should preferably prescribe only National List of Essential Medicines (NLEM) drugs and

doctors while prescribing non-NLEM drugs should counsel the patient and provide

printed counsel material to the patient and their attendant.

b) Bill non-NLEM drugs/disposables/consumables at lower of maximum retail price (MRP)

or cost + up to a 50% markup and implants at lower of MRP or cost + up to a 35%

markup, to avoid profiteering by healthcare establishments. Furthermore, drugs can be

purchased from a hospital’s in-house pharmacy or outside.

c) Hospital shall waive off:

50% of total bill in case of death in an emergency room/casualty department within

6 hours of their arrival

20% of total bill if the death occurs between 6-24 hours of arrival

The hospital can levy extra charges for any complications expected to arise during the

surgery, subject to displaying undertaking of such practice at various places in the

premises especially at the admission counter.

d) In order to eradicate cuts & commissions, patients will be given the right to decide

whether any further consultation/ counseling is required during their course of indoor

admission in the hospital. For greater transparency, hospitals will to give an upfront

declaration on the bill that no cuts & commissions have been paid to any

person/organisation.

e) Under no circumstances should an NH refuse treatment to any injured/serious patients

and ensure immediate medical care is provided.

f) Every nursing home/ private hospital will be linked with a super/multispecialty hospital

and would provide ambulance for the shifting patient.

g) Others:

Under no circumstances, including non-payment of dues, can a PH/NH disrespect a

dead body

In order to avoid medical negligence and to ensure patient safety, development of

‘Standard Operating Procedures’ that need to be implemented mandatorily.

Bring an end to levying items like compulsory donation/ billing charges etc.

Pradhan Mantri Rashtriya Swasthya Suraksha Mission

In May 2018, the government released a model tender document to select insurance

companies for implementing the PMRSSM. The PMRSSM is part of the National Health

Protection Scheme (NHPS), which we covered in our post-budget note. The model tender

suggests the following:

2 Edelweiss Securities Limited

Sector Update

a) Package rates: The tender specifies rates for 1,394 procedures, out of which ~45% are

mandated for pre-authorization. If the treatment cost exceeds the available benefit

coverage, which is capped at INR500,000 per family per year, the remaining cost will be

borne by the beneficiary. In case of multiple treatments, the 2 nd highest treatment shall

be at 50% of the package rate and 3rd highest at 25%. During the first two years of the

policy cover period, the insurer shall not permit any change to the package rates.

b) Empanelment of providers: Private healthcare providers which comply with a set of

requirements can apply for empanelment either directly or online. After expiry of the

three year empanelment duration, the agreement can be renewed every three years till

expiry or validity of the National Accreditation Board for Hospitals & Healthcare

Providers (NABH) certificate.

c) Pre-authorization of procedures: Nearly 610 of the 1,354 packages required pre-

authorisation from the insurance provider. Of these, almost all treatments in cardiology,

ophthalmology, oncology and paediatric require pre-authorisation.

d) Claims management: Healthcare providers shall be obligated to submit claims within 24

hours of discharge. Insurer should be responsible for settling all claims within fifteen

days after receiving all the required documents.

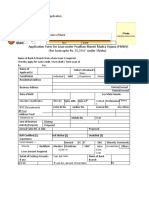

Table 1: Examples of prescribed rates given in PMRSSM

Rates provided in the Average Industry Rates

Procedure/ Surgery

tender (INR) (INR)

Caesarian Delivery 9,000 30,000 - 60,000

Total Hip Replacement 75000 - 90000 200,000 - 300,000

Total Knee Replacement 80,000 200,000 - 400,000

Coronary artery bypass 90,000 - 150,000 600,000 - 800,000

Cataract 5,000 -10,500 30,000-35,000

Fig.1: Summary of government regulations/policies

Snapshot

Price controls Proposal by Delhi govt. Clinical Establishment Act Affordable health scheme

• Link prices of all drugs – essential • Up to 50% margin for using non- • Act prescribes the minimum • Part of the National Health

and others to a special index for NLEM standards for facilities and Protection Scheme

medicines drugs/consumables/disposables services provided by

• Specifies guideline rates for 1,394

and up to 35% margin for using establishments registered with

• Index of medicines will form the procedures

implants states

basis for all price revisions

• In case of multiple treatments,

• Drugs can be purchased from • Regular inspection by regulator

• World Health Organisation has the 2 nd highest treatment shall be

either hospital’s in-house

recently announced its list of • Government may cap charges for at 50% of the package rate and

pharmacy or outside

essential diagnostic tests various diagnostic tests, the 3 rd highest at 25%

• 50% waiver on bill in case of procedures, surgeries and

• Private healthcare providers that

death within six hours of arrival treatments

comply with a set of requirements

and 20% waiver in case of death

can apply for empanelment either

between 6-24 hours of arrival

directly or online

• Eradication of cuts and

• Nearly 610 of the 1,354 packages

commissions

require pre-authorisation from

the insurance provider

Source: Edelweiss research

3 Edelweiss Securities Limited

Healthcare

Edelweiss Securities Limited, Edelweiss House, off C.S.T. Road, Kalina, Mumbai – 400 098.

Board: (91-22) 4009 4400, Email: research@edelweissfin.com

Digitally signed by ADITYA NARAIN

ADITYA

DN: c=IN, o=EDELWEISS SECURITIES

LIMITED, ou=HEAD RESEARCH,

Aditya Narain cn=ADITYA NARAIN,

serialNumber=e0576796072ad1a3266

c27990f20bf0213f69235fc3f1bcd0fa1c

NARAIN

Head of Research 30092792c20, postalCode=400005,

2.5.4.20=6b7d777d3c8c77e0e2c454e

91543f9f4d9b8311cf0678cd975097fc

aditya.narain@edelweissfin.com 645327865, st=Maharashtra

Date: 2018.06.08 18:47:55 +05'30'

Coverage group(s) of stocks by primary analyst(s): Healthcare

Apollo Hospitals Enterprise, Dr. Lal Pathlabs Ltd, FORTIS HEALTHCARE LTD, HealthCare Global Enterprises Limited, Max India Limited, Thyrocare

Technologies Ltd

Recent Research

Recent Research

Date Company Title Price (INR) Recos

Date Company Title Price (INR) Recos

02-Jan-14 IPCA The growth prescription; 729 Buy

31-May-18 Laboratories

Apollo VisitContinues

Note to deliver amid 950 Buy

Hospitals challenging environment;

23-Dec-13 Torrent Aggressive M&A valuations to

Result Update 480 Hold

Pharma strain ROCE; Event Update

30-May-18 Max India Disappointing performance 84 Hold

17-Dec-13 Ranbaxy Receives approval for generic

amidst regulatory 418 Hold

Laboratories Felodipine ;

uncertainties; Result Update

EdelFlash

24-May-18 Apollo All set to cruise in overdrive!; 964 Buy

Hospitals Visit Note

Distribution of Ratings / Market Cap

Edelweiss Research Coverage Universe Rating Interpretation

Buy Hold Reduce Total Rating Expected to

Rating Distribution* 161 67 11 240 Buy appreciate more than 15% over a 12-month period

* 1stocks under review

Hold appreciate up to 15% over a 12-month period

> 50bn Between 10bn and 50 bn < 10bn

Reduce depreciate more than 5% over a 12-month period

Market Cap (INR) 156 62 11

4 Edelweiss Securities Limited

Sector Update

DISCLAIMER

Edelweiss Securities Limited (“ESL” or “Research Entity”) is regulated by the Securities and Exchange Board of India (“SEBI”) and is

licensed to carry on the business of broking, depository services and related activities. The business of ESL and its Associates (list

available on www.edelweissfin.com) are organized around five broad business groups – Credit including Housing and SME

Finance, Commodities, Financial Markets, Asset Management and Life Insurance.

This Report has been prepared by Edelweiss Securities Limited in the capacity of a Research Analyst having SEBI Registration

No.INH200000121 and distributed as per SEBI (Research Analysts) Regulations 2014. This report does not constitute an offer or

solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Securities as

defined in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 includes Financial Instruments and Currency

Derivatives. The information contained herein is from publicly available data or other sources believed to be reliable. This report is

provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The

user assumes the entire risk of any use made of this information. Each recipient of this report should make such investigation as it

deems necessary to arrive at an independent evaluation of an investment in Securities referred to in this document (including the

merits and risks involved), and should consult his own advisors to determine the merits and risks of such investment. The

investment discussed or views expressed may not be suitable for all investors.

This information is strictly confidential and is being furnished to you solely for your information. This information should not be

reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in

part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or

resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use

would be contrary to law, regulation or which would subject ESL and associates / group companies to any registration or licensing

requirements within such jurisdiction. The distribution of this report in certain jurisdictions may be restricted by law, and persons

in whose possession this report comes, should observe, any such restrictions. The information given in this report is as of the date

of this report and there can be no assurance that future results or events will be consistent with this information. This information

is subject to change without any prior notice. ESL reserves the right to make modifications and alterations to this statement as

may be required from time to time. ESL or any of its associates / group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. ESL is committed

to providing independent and transparent recommendation to its clients. Neither ESL nor any of its associates, group companies,

directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential

including loss of revenue or lost profits that may arise from or in connection with the use of the information. Our proprietary

trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed

herein. Past performance is not necessarily a guide to future performance .The disclosures of interest statements incorporated in

this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in

the report. The information provided in these reports remains, unless otherwise stated, the copyright of ESL. All layout, design,

original artwork, concepts and other Intellectual Properties, remains the property and copyright of ESL and may not be used in

any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

ESL shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason including

network (Internet) reasons or snags in the system, break down of the system or any other equipment, server breakdown,

maintenance shutdown, breakdown of communication services or inability of the ESL to present the data. In no event shall ESL be

liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or

expenses arising in connection with the data presented by the ESL through this report.

We offer our research services to clients as well as our prospects. Though this report is disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. We will not treat recipients as customers by virtue of

their receiving this report.

ESL and its associates, officer, directors, and employees, research analyst (including relatives) worldwide may: (a) from time to

time, have long or short positions in, and buy or sell the Securities, mentioned herein or (b) be engaged in any other transaction

involving such Securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

subject company/company(ies) discussed herein or act as advisor or lender/borrower to such company(ies) or have other

potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of

publication of research report or at the time of public appearance. ESL may have proprietary long/short position in the above

mentioned scrip(s) and therefore should be considered as interested. The views provided herein are general in nature and do not

consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional

advice before investing. This should not be construed as invitation or solicitation to do business with ESL.

5 Edelweiss Securities Limited

Healthcare

ESL or its associates may have received compensation from the subject company in the past 12 months. ESL or its associates may

have managed or co-managed public offering of securities for the subject company in the past 12 months. ESL or its associates

may have received compensation for investment banking or merchant banking or brokerage services from the subject company in

the past 12 months. ESL or its associates may have received any compensation for products or services other than investment

banking or merchant banking or brokerage services from the subject company in the past 12 months. ESL or its associates have

not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

Research analyst or his/her relative or ESL’s associates may have financial interest in the subject company. ESL and/or its Group

Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise in the

Securities/Currencies and other investment products mentioned in this report. ESL, its associates, research analyst and his/her

relative may have other potential/material conflict of interest with respect to any recommendation and related information and

opinions at the time of publication of research report or at the time of public appearance.

Participants in foreign exchange transactions may incur risks arising from several factors, including the following: ( i) exchange

rates can be volatile and are subject to large fluctuations; ( ii) the value of currencies may be affected by numerous market

factors, including world and national economic, political and regulatory events, events in equity and debt markets and changes in

interest rates; and (iii) currencies may be subject to devaluation or government imposed exchange controls which could affect the

value of the currency. Investors in securities such as ADRs and Currency Derivatives, whose values are affected by the currency of

an underlying security, effectively assume currency risk.

Research analyst has served as an officer, director or employee of subject Company: No

ESL has financial interest in the subject companies: No

ESL’s Associates may have actual / beneficial ownership of 1% or more securities of the subject company at the end of the month

immediately preceding the date of publication of research report.

Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of

the month immediately preceding the date of publication of research report: No

ESL has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately

preceding the date of publication of research report: No

Subject company may have been client during twelve months preceding the date of distribution of the research report.

There were no instances of non-compliance by ESL on any matter related to the capital markets, resulting in significant and

material disciplinary action during the last three years except that ESL had submitted an offer of settlement with Securities and

Exchange commission, USA (SEC) and the same has been accepted by SEC without admitting or denying the findings in relation to

their charges of non registration as a broker dealer.

A graph of daily closing prices of the securities is also available at www.nseindia.com

Analyst Certification:

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about

the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or

indirectly related to specific recommendations or views expressed in this report.

Additional Disclaimers

Disclaimer for U.S. Persons

This research report is a product of Edelweiss Securities Limited, which is the employer of the research analyst(s) who has

prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States

(U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to

supervision by a U.S. broker-dealer, and is/are not required to satisfy the regulatory licensing requirements of FINRA or required

to otherwise comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public

appearances and trading securities held by a research analyst account.

This report is intended for distribution by Edelweiss Securities Limited only to "Major Institutional Investors" as defined by Rule

15a-6(b)(4) of the U.S. Securities and Exchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and

Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as

specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied,

duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional Investor.

6 Edelweiss Securities Limited

Sector Update

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC

in order to conduct certain business with Major Institutional Investors, Edelweiss Securities Limited has entered into an

agreement with a U.S. registered broker-dealer, Edelweiss Financial Services Inc. ("EFSI"). Transactions in securities discussed in

this research report should be effected through Edelweiss Financial Services Inc.

Disclaimer for U.K. Persons

The contents of this research report have not been approved by an authorised person within the meaning of the Financial

Services and Markets Act 2000 ("FSMA").

In the United Kingdom, this research report is being distributed only to and is directed only at (a) persons who have professional

experience in matters relating to investments falling within Article 19(5) of the FSMA (Financial Promotion) Order 2005 (the

“Order”); (b) persons falling within Article 49(2)(a) to (d) of the Order (including high net worth companies and unincorporated

associations); and (c) any other persons to whom it may otherwise lawfully be communicated (all such persons together being

referred to as “relevant persons”).

This research report must not be acted on or relied on by persons who are not relevant persons. Any investment or investment

activity to which this research report relates is available only to relevant persons and will be engaged in only with relevant

persons. Any person who is not a relevant person should not act or rely on this research report or any of its contents. This

research report must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other

person.

Disclaimer for Canadian Persons

This research report is a product of Edelweiss Securities Limited ("ESL"), which is the employer of the research analysts who have

prepared the research report. The research analysts preparing the research report are resident outside the Canada and are not

associated persons of any Canadian registered adviser and/or dealer and, therefore, the analysts are not subject to supervision by

a Canadian registered adviser and/or dealer, and are not required to satisfy the regulatory licensing requirements of the Ontario

Securities Commission, other Canadian provincial securities regulators, the Investment Industry Regulatory Organization of

Canada and are not required to otherwise comply with Canadian rules or regulations regarding, among other things, the research

analysts' business or relationship with a subject company or trading of securities by a research analyst.

This report is intended for distribution by ESL only to "Permitted Clients" (as defined in National Instrument 31-103 ("NI 31-103"))

who are resident in the Province of Ontario, Canada (an "Ontario Permitted Client"). If the recipient of this report is not an

Ontario Permitted Client, as specified above, then the recipient should not act upon this report and should return the report to

the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any Canadian person.

ESL is relying on an exemption from the adviser and/or dealer registration requirements under NI 31-103 available to certain

international advisers and/or dealers. Please be advised that (i) ESL is not registered in the Province of Ontario to trade in

securities nor is it registered in the Province of Ontario to provide advice with respect to securities; (ii) ESL's head office or

principal place of business is located in India; (iii) all or substantially all of ESL's assets may be situated outside of Canada; (iv)

there may be difficulty enforcing legal rights against ESL because of the above; and (v) the name and address of the ESL's agent for

service of process in the Province of Ontario is: Bamac Services Inc., 181 Bay Street, Suite 2100, Toronto, Ontario M5J 2T3 Canada.

Disclaimer for Singapore Persons

In Singapore, this report is being distributed by Edelweiss Investment Advisors Private Limited ("EIAPL") (Co. Reg. No.

201016306H) which is a holder of a capital markets services license and an exempt financial adviser in Singapore and (ii) solely to

persons who qualify as "institutional investors" or "accredited investors" as defined in section 4A(1) of the Securities and Futures

Act, Chapter 289 of Singapore ("the SFA"). Pursuant to regulations 33, 34, 35 and 36 of the Financial Advisers Regulations ("FAR"),

sections 25, 27 and 36 of the Financial Advisers Act, Chapter 110 of Singapore shall not apply to EIAPL when providing any

financial advisory services to an accredited investor (as defined in regulation 36 of the FAR. Persons in Singapore should contact

EIAPL in respect of any matter arising from, or in connection with this publication/communication. This report is not suitable for

private investors.

Copyright 2009 Edelweiss Research (Edelweiss Securities Ltd). All rights reserved

Access the entire repository of Edelweiss Research on www.edelresearch.com

7 Edelweiss Securities Limited

You might also like

- Control of Non-Conformity & Corrective ActionDocument5 pagesControl of Non-Conformity & Corrective ActionAli Kaya83% (6)

- Massif Capital Pitch DeckDocument18 pagesMassif Capital Pitch DecksidjhaNo ratings yet

- Health Insurance in KsaDocument9 pagesHealth Insurance in KsaserlinaNo ratings yet

- AHM 250 SummaryDocument116 pagesAHM 250 SummaryDinesh Anbumani100% (5)

- B2B The Element Value PDFDocument4 pagesB2B The Element Value PDFIfkar NaurNo ratings yet

- A Budget Is A Plan Expressed in QuantitativeDocument14 pagesA Budget Is A Plan Expressed in QuantitativeNidhi RanaNo ratings yet

- CCD COffee WarDocument5 pagesCCD COffee WarVikas Joshi100% (2)

- No Balance Billing PolicyDocument6 pagesNo Balance Billing PolicyRhyne Amante YpulongNo ratings yet

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDocument12 pagesMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- Discipline and Grievance ManagementDocument176 pagesDiscipline and Grievance ManagementTMTCS HR100% (1)

- Abigail Santos Boutique, Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Financial Statement For MerchandisingFeiya Liu100% (1)

- World Class ManufacturingDocument16 pagesWorld Class ManufacturingedercassettariNo ratings yet

- Strategic Outsourcing at Bharti Airtel: Should Network and IT Infrastructure be OutsourcedDocument9 pagesStrategic Outsourcing at Bharti Airtel: Should Network and IT Infrastructure be OutsourcedNIKHILA TUMMALANo ratings yet

- Ud. Surya Prabhu-3Document24 pagesUd. Surya Prabhu-3Iduy OutSiders100% (1)

- Family Medicare Policy-ProspectusDocument11 pagesFamily Medicare Policy-ProspectusRKNo ratings yet

- Tamil Nadu's CMCHIS provides free healthcare to 1.34 crore BPL familiesDocument12 pagesTamil Nadu's CMCHIS provides free healthcare to 1.34 crore BPL familiesDisha MorNo ratings yet

- Prospectus Yuva Bharat Health PolicyDocument28 pagesProspectus Yuva Bharat Health PolicyS PNo ratings yet

- Parivar Mediclaim Policy 17 B (I)Document11 pagesParivar Mediclaim Policy 17 B (I)RKNo ratings yet

- National Insurance ProspectusDocument8 pagesNational Insurance ProspectusSoumen PaulNo ratings yet

- Ayushman Bharat: Pradhan Mantri Jan Arogya YojanaDocument21 pagesAyushman Bharat: Pradhan Mantri Jan Arogya Yojana'Aakash Yadav'No ratings yet

- 763 - National Mediclnational Insurance - Aim Policy Wording For IndividualDocument3 pages763 - National Mediclnational Insurance - Aim Policy Wording For IndividualAvijit RoyNo ratings yet

- 15 Chapter 6Document35 pages15 Chapter 6Sairaj SankpalNo ratings yet

- Mediclaim policy summaryDocument3 pagesMediclaim policy summarySwarnendu MoitraNo ratings yet

- Rule No 10 - Medical Policy May 2020Document8 pagesRule No 10 - Medical Policy May 2020RaziAbbasNo ratings yet

- PolicyUsageGuide UPTO 40 LAKHS PDFDocument3 pagesPolicyUsageGuide UPTO 40 LAKHS PDFpizza nmorevikNo ratings yet

- Prospectus Yuva Bharat Health PolicyDocument29 pagesProspectus Yuva Bharat Health PolicyAlen KarbiaNo ratings yet

- Untitled Extract PagesDocument1 pageUntitled Extract PagesErika BrubakerNo ratings yet

- Media Statement: The Fpmpam Healthcare Wishlist - Budget 2015Document4 pagesMedia Statement: The Fpmpam Healthcare Wishlist - Budget 2015Nurul ShahirahNo ratings yet

- Prospectus: The New India Assurance Co. LTDDocument26 pagesProspectus: The New India Assurance Co. LTDShittyNo ratings yet

- Final TPADocument40 pagesFinal TPAkushal87100% (1)

- Reports Webdocs W0215 Vidal Mobileapp Terms and ConditionsDocument8 pagesReports Webdocs W0215 Vidal Mobileapp Terms and Conditionsakhil goneNo ratings yet

- Policies To Support SMES in VietnamDocument35 pagesPolicies To Support SMES in VietnamJung Kyu ChanNo ratings yet

- 1 DR.N.S.R Chandraprasad, Chairman & MD, National Insurance Company - Healthcare Insurance Past, Present & FutureDocument46 pages1 DR.N.S.R Chandraprasad, Chairman & MD, National Insurance Company - Healthcare Insurance Past, Present & FutureAkshayNo ratings yet

- Healthcare Reform: Enhancing Services On A Sustainable BasisDocument18 pagesHealthcare Reform: Enhancing Services On A Sustainable BasisextravaganzarNo ratings yet

- What Is Baroda Health Policy?Document6 pagesWhat Is Baroda Health Policy?Chhavi BhatnagarNo ratings yet

- Summer Training Report (CHL APOLLO)Document47 pagesSummer Training Report (CHL APOLLO)Ram BairwaNo ratings yet

- Extra Care Plus - A Super Top Up Plan for Higher Medical ExpensesDocument18 pagesExtra Care Plus - A Super Top Up Plan for Higher Medical ExpensesSushma SrivastavaNo ratings yet

- Extra Care Plus: Bajaj AllianzDocument18 pagesExtra Care Plus: Bajaj Allianzrock_on_rupz99No ratings yet

- VARISTHA Mediclaim For Senior Citizens Policy PDFDocument15 pagesVARISTHA Mediclaim For Senior Citizens Policy PDFSudhirNo ratings yet

- New HealthDocument5 pagesNew HealthRavi TejaNo ratings yet

- STU Policy WordingsDocument35 pagesSTU Policy WordingsSandeep NRNo ratings yet

- SIM Benefir ScheduleDocument12 pagesSIM Benefir ScheduleHihiNo ratings yet

- InsuranceDocument24 pagesInsurancekanikabagariaNo ratings yet

- Easy Health Renewal BenefitsDocument13 pagesEasy Health Renewal Benefitsraa96No ratings yet

- PAMDRAP COE - Rev1 PDFDocument14 pagesPAMDRAP COE - Rev1 PDFJohanna Gotera GulleNo ratings yet

- ReAssure - Policy - Document - PDF ... NEWDocument37 pagesReAssure - Policy - Document - PDF ... NEWPrasath NagendraNo ratings yet

- Smart Super Health Assure - Customer Information SheetDocument12 pagesSmart Super Health Assure - Customer Information SheetNiket RaikangorNo ratings yet

- Managed Care Explained: Cost Savings and Quality OversightDocument12 pagesManaged Care Explained: Cost Savings and Quality OversightFarian Tahrim VikiNo ratings yet

- Mutthoottu Mini HRD Corporate Office Knowledge Series Question Answers on Mediclaim Insurance PolicyDocument8 pagesMutthoottu Mini HRD Corporate Office Knowledge Series Question Answers on Mediclaim Insurance PolicyRahul Rao MKNo ratings yet

- Accenture Base Policy Coverages..Document3 pagesAccenture Base Policy Coverages..Mahesh M.No ratings yet

- Providing cashless medical care under govt schemesDocument13 pagesProviding cashless medical care under govt schemesPankaj HatwarNo ratings yet

- Mediclaim Policy (2007) : The New India Assurance Co. LTDDocument15 pagesMediclaim Policy (2007) : The New India Assurance Co. LTDAnil Kumar ChauhanNo ratings yet

- Blomqvist (1991) 'Doctor As Double Agent'Document3 pagesBlomqvist (1991) 'Doctor As Double Agent'sanjayb1008491No ratings yet

- Mediclaim Insurance Policy (Individual) - ProspectusDocument23 pagesMediclaim Insurance Policy (Individual) - ProspectusSatyaki DuttaNo ratings yet

- Individual Health Insurance Policy ProspectusDocument16 pagesIndividual Health Insurance Policy ProspectusPrasanthNo ratings yet

- Medi Care Plus Prospectus Cb8fdfbba9Document10 pagesMedi Care Plus Prospectus Cb8fdfbba9etyala maniNo ratings yet

- Easy Health Premium Plan SummaryDocument13 pagesEasy Health Premium Plan Summaryama2amalNo ratings yet

- STAR COMPREHENSIVE INSURANCE POLICY COVERAGEDocument20 pagesSTAR COMPREHENSIVE INSURANCE POLICY COVERAGEJanakiramaiah YarlagaddaNo ratings yet

- Bajhlip21127v032021 2020-2021Document26 pagesBajhlip21127v032021 2020-2021aakash.shandilya.cscNo ratings yet

- Arogya Sanjeevani Policy Reliance General-ProspectusDocument11 pagesArogya Sanjeevani Policy Reliance General-ProspectusRachna LalNo ratings yet

- Health - Individual Mediclaim Policy PDFDocument25 pagesHealth - Individual Mediclaim Policy PDFAlakh BhattNo ratings yet

- Project CATCH - Concept NoteDocument6 pagesProject CATCH - Concept Notepurnima gautamNo ratings yet

- NTUC Product SummaryDocument7 pagesNTUC Product SummaryHihiNo ratings yet

- Lifeline 2.0 Policy WordingDocument33 pagesLifeline 2.0 Policy WordingVijay Singh RathourNo ratings yet

- Health Insurance N TPA by Poonam N Neha BhakerDocument44 pagesHealth Insurance N TPA by Poonam N Neha Bhakerpoonam@imsNo ratings yet

- Prospectus National Mediclaim PolicyDocument8 pagesProspectus National Mediclaim PolicyJeemit MehtaNo ratings yet

- Rural Hospital VisitDocument12 pagesRural Hospital VisitMercy JacobNo ratings yet

- Register complaints about your insurance companyDocument10 pagesRegister complaints about your insurance companyDipsonNo ratings yet

- Group Mediclaim Scheme For RetireesDocument9 pagesGroup Mediclaim Scheme For RetireesAnal GuhaNo ratings yet

- Office Memorandum Dated 17.10Document21 pagesOffice Memorandum Dated 17.10Pradeep SaxenaNo ratings yet

- SEO Packages in DelhiDocument7 pagesSEO Packages in DelhiAffordable SEO Services in DelhiNo ratings yet

- MK Share Genius Back TestingDocument4 pagesMK Share Genius Back Testingyash MunotNo ratings yet

- MRP PpsDocument4 pagesMRP Ppsvadivel.km1527No ratings yet

- Application Form For Mudra Loan ShishuDocument2 pagesApplication Form For Mudra Loan ShishuSree DigitalNo ratings yet

- Understanding Corporate StrategyDocument12 pagesUnderstanding Corporate StrategylovenanuinNo ratings yet

- Finance Case StudyDocument4 pagesFinance Case StudyKelvin CharlesNo ratings yet

- PCI DSS v4 0 DESV FAQsDocument3 pagesPCI DSS v4 0 DESV FAQsjldtecnoNo ratings yet

- Xpress Point Staff Referral Scheme FAQsDocument2 pagesXpress Point Staff Referral Scheme FAQsMichael FaeNo ratings yet

- Exercise 12B-2 - Kelompok 1Document2 pagesExercise 12B-2 - Kelompok 1Lucky esteritaNo ratings yet

- Full Download Bcom Canadian 1st Edition Lehman Test BankDocument17 pagesFull Download Bcom Canadian 1st Edition Lehman Test Banksmallmanclaude100% (33)

- Info Sheet Assessing RiskDocument5 pagesInfo Sheet Assessing RiskalkalkiaNo ratings yet

- Charles R. Wood Theater Capital Campaign PlanDocument25 pagesCharles R. Wood Theater Capital Campaign PlanErin CoonNo ratings yet

- Financial Accounting and Accounting StandardsDocument31 pagesFinancial Accounting and Accounting StandardsAlbert Adi NugrohoNo ratings yet

- ACE Services Information Security Risk AssessmentDocument2 pagesACE Services Information Security Risk AssessmentKishor KumarNo ratings yet

- Internship CVDocument2 pagesInternship CVapi-347506265No ratings yet

- TRAVCRM India's Best Travel Management Software by DeBox GlobalDocument7 pagesTRAVCRM India's Best Travel Management Software by DeBox GlobalKm DeepaNo ratings yet

- CH 35Document5 pagesCH 35Vishal GoyalNo ratings yet

- BodyDocument83 pagesBodyarunantony100% (1)

- Quality Control ProcessDocument1 pageQuality Control ProcessHuseyinNo ratings yet