0% found this document useful (0 votes)

196 views25 pagesRice Credit for Farmers & Co-ops

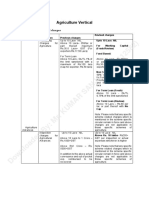

The ERCA-RCEF program provides simplified lending to individual rice farmers and cooperatives for rice-related projects. Eligible purposes include farm inputs, equipment, and facilities. Individual farmers can borrow up to 1 million pesos, while cooperatives can borrow up to 90% of project costs. Loans have interest rates of 2% for individuals and 0% for on-lending cooperatives. The program aims to improve food security, farm viability and competitiveness through access to formal credit.

Uploaded by

Vivian Mabasa CezarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

196 views25 pagesRice Credit for Farmers & Co-ops

The ERCA-RCEF program provides simplified lending to individual rice farmers and cooperatives for rice-related projects. Eligible purposes include farm inputs, equipment, and facilities. Individual farmers can borrow up to 1 million pesos, while cooperatives can borrow up to 90% of project costs. Loans have interest rates of 2% for individuals and 0% for on-lending cooperatives. The program aims to improve food security, farm viability and competitiveness through access to formal credit.

Uploaded by

Vivian Mabasa CezarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd