Professional Documents

Culture Documents

FRM-CNB-02-00 Business Trip Expenses Report - 01 Juni 2022

Uploaded by

Yanthi Sepriana SiagianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FRM-CNB-02-00 Business Trip Expenses Report - 01 Juni 2022

Uploaded by

Yanthi Sepriana SiagianCopyright:

Available Formats

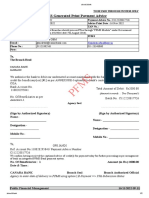

Document number FRM-CNB-02-00

BUSINESS TRIP EXPENSES REPORT Created date 01 June 2022

(LPPD) Revision to 00

Number of page 1

No. /PETS-SITE/SPPD/IX/2019

Name/ID :

Position/Grade : Bank :

Department : Branch :

Departure date : Time: Account number :

Return date : Time: Total : Rp.

Charges by PT :

Cash Advance Amount (if

: Spelled:

any)

(cash advance nominal is filled in by cash advance user)

NO EXPENDITURE DETAILS TOTAL (Rp) COST CODE NOTE

TOTAL

CASH ADVANCE (IF ANY)

*BALANCE or Difference of Less/More*

Prepared by: Acknowledge by: Checked by: Approved by:

Employee Related Supervisor HR Supervisor Head of Finance Department

Note :

* Cross the unnecessary ones

This form must be accompanied by an Business Trip Order & a copy of the cash advance application (if any)

Employees LPPD must be acknowledged by their supervisors at least Dept Manager

Especially for overseas business trip, the Business Trip Expenses Report must be signed by the relevant Board of Directors

The Business Trip declaration must be made a maximum of 14 (fourteen) working days after the Business Trip, by submitting the LPPD to the Dept. Finance

This publication may not be reproduced, stored in the system, transferred in any form by any means, electronic, mechanical, photocopying,

recorded or otherwise without the permission of PT PUNCAK EMAS TANI SEJAHTERA.

You might also like

- Mutants and Masterminds - Hero HighDocument129 pagesMutants and Masterminds - Hero HighAnarchangel84% (19)

- Marriage Breaking Demons With Dr. Pat HolidayDocument11 pagesMarriage Breaking Demons With Dr. Pat Holidaygeorgewatts100% (3)

- Commercial Law ReviewDocument256 pagesCommercial Law ReviewRobert Kane Malcampo ReyesNo ratings yet

- Vladimir Moss - New Zion in Babylon - Part 6Document156 pagesVladimir Moss - New Zion in Babylon - Part 6VäterchenNo ratings yet

- TRF FormatDocument76 pagesTRF FormatKarun DasNo ratings yet

- Investment Philosophies, DamodaranDocument113 pagesInvestment Philosophies, DamodaranMalarkey Snollygoster100% (1)

- IPC Rape Laws Research PaperDocument25 pagesIPC Rape Laws Research PaperSwati KishoreNo ratings yet

- Form VendorDocument4 pagesForm VendorEko HarnoNo ratings yet

- People v. SoriaDocument16 pagesPeople v. SoriaerforNo ratings yet

- PMP Audit ChecklistDocument6 pagesPMP Audit ChecklistSyerifaizal Hj. MustaphaNo ratings yet

- Contract Franciza Model 1 - en PDFDocument5 pagesContract Franciza Model 1 - en PDFCatalin BaltagNo ratings yet

- FRM-CNB-02-00 Business Trip Expenses Report - 01 Juni 2022Document1 pageFRM-CNB-02-00 Business Trip Expenses Report - 01 Juni 2022Yanthi Sepriana SiagianNo ratings yet

- Bonk Has Revised A Single Combined Form For Remittance Through RTGS and NEFTDocument3 pagesBonk Has Revised A Single Combined Form For Remittance Through RTGS and NEFTSteve WozniakNo ratings yet

- CA Pak Ronald - Nov 2021Document2 pagesCA Pak Ronald - Nov 2021Octovianus tandi arruNo ratings yet

- (Template) Formulir Manual-Kas Kecil Rev.01 - FinalDocument7 pages(Template) Formulir Manual-Kas Kecil Rev.01 - FinalAnggun GuelNo ratings yet

- Jurnal Prisma KONCIDocument9 pagesJurnal Prisma KONCIRas MuammarNo ratings yet

- Payment Order: Komatsu India PTV LTD Pvno: DateDocument2 pagesPayment Order: Komatsu India PTV LTD Pvno: DateHari NarayananNo ratings yet

- Rfa For Transfer - Laptop - Sr. CG Supervisor of Butuan BC - Bennajer E. BaridjiDocument43 pagesRfa For Transfer - Laptop - Sr. CG Supervisor of Butuan BC - Bennajer E. BaridjiAldwin Roy H. EsperNo ratings yet

- Purchase Request: PT. Destinasi Maritim IndonesiaDocument1 pagePurchase Request: PT. Destinasi Maritim IndonesiaMuhammad Taufiq FathurrahmanNo ratings yet

- Acctstmt HDocument3 pagesAcctstmt HNew Age InvestmentsNo ratings yet

- Simulasi Angsuran ErtigaDocument9 pagesSimulasi Angsuran ErtigaYudiDiansyahPutraYudiNo ratings yet

- EPDA Keagenan Di Maloy (Revisi) - 1Document1 pageEPDA Keagenan Di Maloy (Revisi) - 1Tirto SumaryantoNo ratings yet

- Uco Rtgs FormDocument2 pagesUco Rtgs FormdevchandvirjiNo ratings yet

- Acctstmt HDocument3 pagesAcctstmt Hrekha nairNo ratings yet

- AU Small Finance RTGS NEFT DD FT FORMDocument1 pageAU Small Finance RTGS NEFT DD FT FORMPRINCE KUMAR100% (1)

- PFMS Generated Print Payment Advice: To, The Branch HeadDocument2 pagesPFMS Generated Print Payment Advice: To, The Branch HeadPunjabi JindNo ratings yet

- Bussines Case - Gudang Container Bantul - (Rev 2)Document99 pagesBussines Case - Gudang Container Bantul - (Rev 2)Bangun SaranaNo ratings yet

- BvA - Budget Versus Actuals PDFDocument1 pageBvA - Budget Versus Actuals PDFAssad CamajeNo ratings yet

- Contoh Perdin Dan Realisasi - AndiDocument2 pagesContoh Perdin Dan Realisasi - AndiChrisa ThianNo ratings yet

- RFP Sewa Gudang Adib Feb 2021Document3 pagesRFP Sewa Gudang Adib Feb 2021Sulis SetioriniNo ratings yet

- DHBVNDocument1 pageDHBVNsumannavfinNo ratings yet

- PFMS Generated Print Payment Advice: To, The Branch HeadDocument2 pagesPFMS Generated Print Payment Advice: To, The Branch HeadPunjabi JindNo ratings yet

- Application Form STP / SWP: Distributor InformationDocument1 pageApplication Form STP / SWP: Distributor InformationSatya Prakash TrivediNo ratings yet

- New FolderDocument1 pageNew FolderRahul AhirNo ratings yet

- Amith Boi 1Document3 pagesAmith Boi 1Law DepotNo ratings yet

- PT Trakindo UtamaDocument4 pagesPT Trakindo UtamaJOHAN SIAHAANNo ratings yet

- New CRFDocument44 pagesNew CRFabhipawar376No ratings yet

- Wiretransoutp BlankDocument1 pageWiretransoutp BlankAdv Kunal KapoorNo ratings yet

- R FAIZAL FITROHNY - Katering KaryawanDocument1 pageR FAIZAL FITROHNY - Katering Karyawanhcmms2020No ratings yet

- Transaction Form For Existing InvestorsDocument4 pagesTransaction Form For Existing InvestorsRRKNo ratings yet

- Ibs Mont Kiara 1 31/10/22Document1 pageIbs Mont Kiara 1 31/10/22jonfalconNo ratings yet

- Payment Request Non&PO Based (Form. FIN-006) - RevisedDocument1 pagePayment Request Non&PO Based (Form. FIN-006) - RevisedSuryanto KimNo ratings yet

- BPI Telegraphic Transfer FormDocument2 pagesBPI Telegraphic Transfer FormYasmine AquinoNo ratings yet

- Expenses Report FormDocument2 pagesExpenses Report FormMarno S100% (1)

- Angel Broking Limited.: Daily Margin Statement For The Day: 18/08/2020Document1 pageAngel Broking Limited.: Daily Margin Statement For The Day: 18/08/2020vinodNo ratings yet

- Payment Request Form Templates - J&T CARGODocument19 pagesPayment Request Form Templates - J&T CARGOBernanda Cenank ClaluNo ratings yet

- CM V132190 18082020 PDFDocument1 pageCM V132190 18082020 PDFvinodNo ratings yet

- Expense Report: Date Project / Material Air Ticket Hotel Meals Other Expenses Curr Total Details (To Be Specify)Document1 pageExpense Report: Date Project / Material Air Ticket Hotel Meals Other Expenses Curr Total Details (To Be Specify)AgungNo ratings yet

- INDIA Expense ReimbursementDocument3 pagesINDIA Expense ReimbursementVicky RajputNo ratings yet

- CM D59707 10042018 CombmarginDocument1 pageCM D59707 10042018 CombmarginDarshil DilipbhaiNo ratings yet

- A Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingDocument2 pagesA Simple Way To Invest-Common Transaction Slip: ISC's Signature & Time StampingProfessional positiveNo ratings yet

- Lampiran Alat Bukti Tergugat - T-4Document12 pagesLampiran Alat Bukti Tergugat - T-4Arya PermanaNo ratings yet

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- Form TR 59 (C)Document1 pageForm TR 59 (C)bcemailidNo ratings yet

- Income Tax Payment Challan: PSID #: 165866486Document1 pageIncome Tax Payment Challan: PSID #: 165866486Ashok KumarNo ratings yet

- Income Tax Payment Challan: PSID #: 165866345Document1 pageIncome Tax Payment Challan: PSID #: 165866345Ashok KumarNo ratings yet

- Account Opening FormDocument23 pagesAccount Opening Formabhishek shawNo ratings yet

- 4 Remuneration FormDocument2 pages4 Remuneration FormRDC SPUNo ratings yet

- It-000147630388-2022-00 123Document1 pageIt-000147630388-2022-00 123cofini2389No ratings yet

- Investor Account Opening Form For Individual: Day Month YearDocument4 pagesInvestor Account Opening Form For Individual: Day Month YearEngr. Nadeem AhmadNo ratings yet

- Account-Opening-Individual - Saving Plans - Final EditDocument10 pagesAccount-Opening-Individual - Saving Plans - Final EditSalman ArshadNo ratings yet

- PFMS Generated Print Payment Advice: To, The Branch HeadDocument2 pagesPFMS Generated Print Payment Advice: To, The Branch HeadPunjabi JindNo ratings yet

- Cash VoucherDocument2 pagesCash VouchernehaadnankNo ratings yet

- Ibs Mont Kiara 1 30/11/22Document1 pageIbs Mont Kiara 1 30/11/22jonfalconNo ratings yet

- FormDocument6 pagesFormwawiNo ratings yet

- App Nri 15-01-08Document4 pagesApp Nri 15-01-08sarvathaqaryNo ratings yet

- FM-ACC-001 Request For Payment Form - DPI Rev. 02Document1 pageFM-ACC-001 Request For Payment Form - DPI Rev. 02Aristeo GarzonNo ratings yet

- Advance ReturnDocument1 pageAdvance ReturnMaria DanialNo ratings yet

- Resources and CapabilitiesDocument13 pagesResources and CapabilitieslokeshNo ratings yet

- 1 PBDocument6 pages1 PBAkanksha SinghNo ratings yet

- Export Import Moserbaer1Document90 pagesExport Import Moserbaer1junedzia21No ratings yet

- Bsbmgt517 Manage Operational PlanDocument6 pagesBsbmgt517 Manage Operational PlanRahul MalikNo ratings yet

- Determining The Benefits of Using Profanity in Expressing Emotions of Grade 12 Students in FCICDocument5 pagesDetermining The Benefits of Using Profanity in Expressing Emotions of Grade 12 Students in FCICPaola CalunsagNo ratings yet

- Modal Verbs: Bill Likes To Show Off. Form Sentences Using The Present PerfectDocument2 pagesModal Verbs: Bill Likes To Show Off. Form Sentences Using The Present PerfectEvaNo ratings yet

- Buffin and Patterson Et Al. v. San Francisco and CaliforniaDocument36 pagesBuffin and Patterson Et Al. v. San Francisco and CaliforniaKQED NewsNo ratings yet

- Case Information: Go Back NowDocument3 pagesCase Information: Go Back Nowghj6680No ratings yet

- Word OrderDocument6 pagesWord OrderEditura Sf MinaNo ratings yet

- Getzel M. Cohen - KATOIKIAI, KATOIKOI AND MACEDONIANS IN ASIA MINORDocument11 pagesGetzel M. Cohen - KATOIKIAI, KATOIKOI AND MACEDONIANS IN ASIA MINORUmut CansevenNo ratings yet

- External Whistleblowing ProceduresDocument9 pagesExternal Whistleblowing Proceduresgautham kannanNo ratings yet

- Strategy Evaluation and ChoiceDocument3 pagesStrategy Evaluation and ChoicePrabakaran PrabhaNo ratings yet

- The Income Statement Items For CIBDocument2 pagesThe Income Statement Items For CIBKhalid Al SanabaniNo ratings yet

- Orion Shop DattaDocument5 pagesOrion Shop Dattablr.visheshNo ratings yet

- Sir M. Visvesvaraya Institution of Technology Bangalore: Name: Ranjitha O Usn: 1Mz19Mba17Document12 pagesSir M. Visvesvaraya Institution of Technology Bangalore: Name: Ranjitha O Usn: 1Mz19Mba17Nithya RajNo ratings yet

- MaintMaster Maintenance Manual 6.0 ENGDocument92 pagesMaintMaster Maintenance Manual 6.0 ENGmanoj tyagiNo ratings yet

- Industry Insights The D2C Brands Guide To Fashion WholesaleDocument15 pagesIndustry Insights The D2C Brands Guide To Fashion WholesaleLalithusfNo ratings yet

- Ds Web Gateway Reverse ProxyDocument3 pagesDs Web Gateway Reverse ProxyKuncen Server (Yurielle's M-Chan)No ratings yet

- Accounting For Overheads by DR Kamlesh KhoslaDocument16 pagesAccounting For Overheads by DR Kamlesh KhoslaKrati SinghalNo ratings yet

- 64-Kenya Citizenship Regulations 2012Document81 pages64-Kenya Citizenship Regulations 2012aleemtharaniNo ratings yet

- RR Forms of BSW, B - A, B - SC 2nd and 3rd YearDocument13 pagesRR Forms of BSW, B - A, B - SC 2nd and 3rd YearRoHit SiNghNo ratings yet