100% found this document useful (1 vote)

4K views14 pagesSpecial Journals

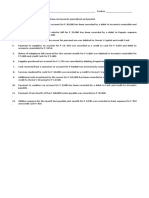

The document discusses special journals that are used in accounting to record specific transaction types more efficiently than the general journal. Special journals include the sales journal, cash receipts journal, purchases journal, and cash disbursements journal. Each special journal records one type of recurring transaction, like sales on account or cash receipts. The special journals save time in journalizing and posting transactions compared to the general journal. Control accounts in the general ledger summarize details from related subsidiary ledger accounts.

Uploaded by

Criziel Ann LealCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

4K views14 pagesSpecial Journals

The document discusses special journals that are used in accounting to record specific transaction types more efficiently than the general journal. Special journals include the sales journal, cash receipts journal, purchases journal, and cash disbursements journal. Each special journal records one type of recurring transaction, like sales on account or cash receipts. The special journals save time in journalizing and posting transactions compared to the general journal. Control accounts in the general ledger summarize details from related subsidiary ledger accounts.

Uploaded by

Criziel Ann LealCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd