Professional Documents

Culture Documents

Module 7-Lessee Accounting - (OTHER ACCTG ISSUES)

Uploaded by

Jeanivyle CarmonaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 7-Lessee Accounting - (OTHER ACCTG ISSUES)

Uploaded by

Jeanivyle CarmonaCopyright:

Available Formats

NEW BRIGHTON SCHOOL OF THE PHILIPPINES, Inx`C.

Module No. 7

Subject: Intermediate Accounting 2 Date of Submission: ____________

Name of Student: __________________________________________________

Course and Year: __________________________________________________

Semester and School Year: __________________________________________

EXTENSION OPTION

An entity entered into a lease of building on January 1, 2020 with the following information:

Annual rental payable at the end of each year 500,000

Lease term 5 years

Useful life 20 years

Implicit interest rate 10%

PV of an ordinary annuity of 1 at 10% for 5 periods 3.791

The lease contained an option for the lessee to extend for a further 5 years. At the commencement date, the exercise of

the extension option is not reasonably certain. After 3 years on January 1, 2023, the lessee decided to extend the lease

for a further 5 years.

New annual rental payable at the end of each year 600,000

New implicit interest rate 8%

PV of an ordinary annuity of 1 at 8% for 5 periods 3.993

PV of 1 at 8% for 2 periods 0.857

PV of an ordinary annuity of 1 at 8% for 2 periods 1.783

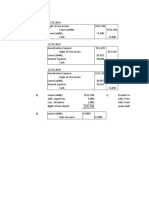

Table of amortization

Date Payment Interest Principal Present value

1/1/2020 1,895,500

12/31/2020 500,000 189,550 310,450 1,585,050

12/31/2021 500,000 158,505 341,495 1,243,555

12/31/2022 500,000 124,355 375,645 867,910

December 31, 2020

Payment on December 31, 2020 500,000

Interest expense for 2020 (1% x 1,895,500) (189,550)

Applicable to principal 310,450

Present value – January 1, 2020 (500,000 x 3.791) 1,895,500

Principal payment on December 31, 2020 (310,450)

Lease liability – December 31, 2020 1,585,050

Journal entries for 2020

Jan. 1 Right of use asset 1,895,500

Lease liability 1,895,500

Dec. 31 Interest expense 189,550

Lease liability 310,450

Cash 500,000

31 Depreciation (1,895,500 / 5 years) 379,100

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 1

Accumulated depreciation 379,100

Remeasurement of lease liability

On January 1, 2023, the lease liability is remeasured using the new implicit interest rate of 8%.

Annual rental for remaining 2 years of old lease term 500,000

Multiply by PV of an ordinary annuity of 1 at 8% for 2 periods 1.783

Present value – January 1, 2023 891,500

Annual rental for 5 years starting January 1, 2025 600,000

Multiply by PV of an ordinary annuity of 1 at 8% for 5 periods 3.993

Present value – January 1, 2025 2,395,800

Multiply by PV of 1 at 8% for 2 periods 0.857

Present value – January 1, 2023 2,053,200

The present value of the new rentals on January 1, 2025 is rediscounted for 2 periods on the date of extension on

January 1, 2023.

Present value of remaining rentals of old lease term 891,500

Present value of rentals of extended lease term 2,053,200

Total present value – January 1, 2023 2,944,700

Present value – December 31, 2002 (867,910)

Increase in lease liability on January 1, 2023 2,076,790

Right of use asset – January 1,2020 1,895,500

Accumulated depreciation – December 31, 2020

(379,100 x 3 years) (1,137,300)

Carrying amount – December 31, 2022 758,200

Increase in liability on January 1, 2023 2,076,790

New carrying amount – January 1, 2023 2,834,990

IFRS 16, paragraph 39, provides that the measurement of the lease liability is an adjustment of carrying amount of the

right of use asset.

Table of amortization

(8%)

Date Payment Interest Principal Present value

1/1/2023 2,944,700

12/31/2023 6,000,000 235,576 264,424 2,680,276

12/31/2024 6,000,000 214,422 285,578 2,394,698

12/31/2025 6,000,000 191,576 408,424 1,986,274

12/31/2026 6,000,000 158,902 441,098 1,545,176

12/31/2027 6,000,000 123,614 476,386 1,068,790

12/31/2028 6,000,000 85,503 514,497 554,293

12/31/2029 6,000,000 45,707 55,293

8% x P554,293 equals P44,343

There is a different of P1,364 due to rounding of present value factor.

Journal entries for 2023

1. To remeasure the lease liability on January 1, 2023

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 2

Right of use asset 2,076,790

Lease liability 2,076,790

To increase in lease liability is an adjustment of the carrying amount of the right of use asset.

2. To record the annual rent on December 31, 2023

Interest expense 235,576

Lease liability 264,424

Cash 500,000

3. To record the annual depreciation based on the new carrying amount:

Depreciation 404,999

Accumulated depreciation 404,999

The total lease term is 10 years minus 3 years expired equals remaining term of 7 years.

VARIABLE PAYMENTS

On January 1, 2020, an entity entered into an 8 years lease of a floor of a building with the following terms:

Annual rental for the first three years payable at the end of each years 300.000

Annual rental for the next five years payable at the end of each years 400,000

Implicit interest rate 10%

PV of an ordinary annuity of 1 at 10% for three periods 2.487

PV of an ordinary annuity of 1 at 10% for five periods 3.791

PV of 1 at 10% for three periods 0.751

The lease provides for neither a transfer of title to the lessee nor a purchase option.

Computation

Annual rental for first three years 300,000

Multiply by PV of an ordinary annuity of 1 at 10% for three periods 2.487

Present value – January 1,2020 746,100

Annual rental for next five periods 400,000

Multiply by PV of an ordinary annuity of 1 at 10% for five years. 3.791

Present value – January 1. 2023 1,516,400

Multiply by PV of 1 at 10% for three years periods. 0.751

Present value – January 1, 2020 1,138,816

The present value of the annual rental for the next five years starting January 1, 2023 is rediscount for three periods at

the beginning of the lease on January 1,2020

Present value of annual rentals for three years 746,100

Present value of annual rentals for next five years 1.138,816

Lease liability- January 1, 2020 1,884,916

Table of amortization

(10%)

Date Payment Interest Principal Present

value

1/1/2020 1,884,916

12/31/2020 300,000 188,492 111,508 1,773,408

12/31/2021 300,000 177,341 122,659 1,650,749

12/31/2022 300,000 165,075 134,925 1,515,824

12/31/2023 400,000 151,582 2248,418 1,267,406

12/31/2024 400,000 126,741 273,259 994,147

12/31/2025 400,000 99,415 300,585 693,562

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 3

12/31/2026 400,000 69,356 300,644 362,918

12/31/2027 400,000 37,082* 362,918 -

*10% x P362,918 equals P36,292.

There is a difference of P790 due to rounding of present value factor.

Journal entries for 2020

1. Right of use asset 1,884,916

Lease liability 1,884,916

2. Interest expense 188,492

Lease liability 111,508

Cash 300,000

3. Depreciation 235,615

Accumulated depreciation 235,615

(1,884,916 / 8 years)

The depreciation is based on the lease term of 8 years because there is neither a transfer of title nor purchase option.

Lease Modification

IFRS 16, paragraph 44, provides that the lessee shall account for the lease modification as a separate lease under the

following conditions:

a. The modification increases the scope of the lease by adding the right to use an additional underlying asset.

b. The rental for the lease modification increase by an amount commensurate with the increase in scope and

equivalent to the current market rental.

Illustration

On January 1, 2020, an entity entered into lease agreement with the following information:

Floor space 3,000 square meters

Annual rental payable at the end of each year 100,000

Implicit rate in the lease 10%

Lease term 8 years

Present value of an ordinary annuity of 1 at 10% for 8 periods 5.3349

On January 1, 2022, the entity and the lessor agreed to amend the original terms of the lease with the following

information:

Additional floor space 4,500 square meters

Increase in rental payable at the end of each year 200,000

Implicit rate in the lease 8%

Present value of an ordinary annuity of 1 at 8% for 6 periods 4.6229

The increase in the rental for additional 4,500 square meters is equivalent to the current market rent.

Journal entries for 2020

Present value of the lease payments – January 1, 2020

(100,000 x 5.3349) 533,490

Jan. 1 Right of use asset 533,490

Lease liability 533,490

Dec. 31 Interest expense 53,349

Lease liability 46,651

Cash 100,000

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 4

31 Depreciation 66,686

Accumulated depreciation 66,686

On January 1, 2022, the entity shall account for the modification as a separate lease.

The entity shall recognize the right of use asset and lease liability for the additional 4,500 square-meter lease space on

January 1, 2022.

No adjustment is made to the 3,000 square meter lease because of the modification.

Present value of the additional lease payment

on January 1, 2022 (200,000 x 4.6229) 924,580

Journal entries for 2022 – new separate lease

Jan. 1 Right of use asset 924,580

Lease liability 924,580

Dec. 31 Interest expense (924,580 x 8%) 73,966

Lease liability 126,034

Cash 200,000

31 Depreciation 154,097

Accumulated depreciation

(924,580 / 6 years) 154,097

Lease modification – extension of lease term

On January 1, 2020, an entity entered into lease for office space with the following information:

Annual rental payable at the end of each year

beginning December 31, 2020 200,000

Lease term 5 years

Implicit rate in the lease 9%

Present value of an ordinary annuity of 1 for 5 period at 9% 3.89

On January 1, 2022, the entity and the lessor to amend the original lease by extending the lease term by 3 more years

with the following information:

Annual rental payable at end of each

year beginning December 31, 2022 200,000

Implicit rate in the lease at 9% 11%

Present value of an ordinary annuity of 1 at 11% for 6 periods. 4.231

Amortization schedule for 2020 and 2021

Present value of the lease liability on

January 1,2020 (200,000 x 3.89) 778,000

Date Payment 9% Interest Principal Lease Liability

Jan. 1, 2020 778,000

Dec. 31, 2020 200,000 70,020 129,980 648,020

Dec. 31, 2021 200,000 58,322 141,678 506,342

Journal entries for 2020

Jan. 1 Right of use asset 778,000

Lease liability 778,000

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 5

Dec. 31 Interest expense 70,020

Lease liability 129,980

Cash 200,000

31 Depreciation 155.600

Accumulated depreciation 155.600

(778,000 x 5)

New lease liability due to extension

Present value of lease payment on January 1, 2022

as a result of the extension (200,000 x 4.231) 846,200

Carrying amount on January 1, 2022

before the extension – see schedule (506,342)

Increase in lease liability 339,858

Revised amortization schedule

Date Payment 11% Interest Principal Lease Liability

Jan. 1, 2022 846,200

Dec. 31, 2022 200,000 93,082 106,918 739,282

Dec. 31, 2023 200,000 81,321 118,679 620,603

Dec. 31, 2024 200,000 68,226 131,734 488,869

Dec. 31, 2025 200,000 53,776 146,224 342,645

Dec. 31, 2026 200,000 37,691 162,309 180,336

Dec. 31, 2027 200,000 19,664 180,336 -

Journal entries for 2022

Jan. 1 Right of use asset 339,858

Lease liability 339,858

Dec. 31 Interest expense 93,082

Lease Liability 106,918

Cash 200,000

31 Depreciation 134,443

Accumulated depreciation 134.443

Cost of right use asset 778,000

Accumulated depreciation – December 31, 2021

(155,600 x 2 years) (311,200)

Carrying amount – December 31, 2021 466,800

Increase of liability 339,858

Adjusted carrying amount – January 1, 2022 806,658

The increase in liability is an adjustment of the carrying amount of the right of use asset.

Old lease term 5 years

Expired 2020 and 2021 2

Remaining old lease term 3

Extension 3

Extended lease term 6 years

Depreciation for 2022 (806,658/6) 134,443

Lease modification - decrease in scope of lease

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 6

On January 1, 2020, an entity entered into a lease of office space with the following information:

Floor space 800 square meters

Annual rental payable at the end of each year 40,000

Lease term 10 years

Implicit rate in the lease 8%

Present value of an ordinary annuity of 1 for 8% for 10 periods 6.7101

Present value of lease payments – January 1, 2020 (40,000 x 6.7101) 268,404

Table of amortization for 2020 and 2021

Date Payment 8% Interest Principal Lease Liability

Jan. 1, 2020 268,404

Dec. 31, 2020 40,000 21,472 18,528 249,876

Dec. 31, 2021 40,000 19,990 20,010 229,866

Journal entries for 2020

Jan. 1 Right of use asset 268,404

Lease liability 268,404

Dec. 31 Interest expense 21,472

Lease Liability 18,528

Cash 40,000

31 Depreciation (268,404/10) 26,840

Accumulated depreciation 26,840

Amendment of the lease

On January 1, 2022, the lessee and the lessor agreed to amend the original term of the lease with the following

information:

Floor space 480 square meters

Annual rental payable at the end of each year 30,000

Implicit rate in the lease 10%

Present value of an ordinary annuity of 1 at 10% for 8 periods 5.3349

Decrease in scope

Since the floor space was reduced to 480 square meter, the scope of the lease was reduced by 40%.

IFRS 16, paragraph 46, states that a gain of loss should be recognized as a result of the partial termination of the lease.

If the decrease in carrying amount of lease liability is higher than the decrease in carrying amount of right of use asset,

the difference is a termination gain.

If the decrease in carrying amount of right of use asset is higher than the decrease in carrying amount of lease liability,

the difference is a termination loss.

Decrease in carrying amount of lease liability

(229,866 x 40%) 91,946

Decrease in carrying amount of right of use asset

(214,724 x 40%) ( 85,890)

Termination gain 6,056

Cost of right of use asset 268,404

Accumulated depreciation – December 31, 2021 (26,840 x 2) ( 53,680)

Carrying amount – December 31, 2021 214,724

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 7

Lease liability – January 1, 2022 (see table) 229,866

Reduction of old lease liability ( 91,946)

Remaining old lease liability – January 1, 2022 137,920

Present value of lease payments on January 1, 2022

as a result of the decrease in scope (30,000 x 5.3349) 160,047

Carrying amount of old lease liability on

January 1, 2022 (137,920)

Increase in liability 22,127

The increase in lease liability as a result of the lease modification is an adjustment to the carrying amount of right of

use asset.

Revised table of amortization

Date Payment 10% Interest Principal Lease Liability

Jan. 1, 2022 160,047

Dec. 31, 2022 30,000 16,005 13,995 146,052

Dec. 31, 2023 30,000 14,605 15,395 130,657

Dec. 31, 2024 30,000 13,066 16,934 113,723

Dec. 31, 2025 30,000 11,372 18,628 95,095

Dec. 31, 2026 30,000 9,512 20,490 74,605

Dec. 31, 2027 30,000 7,461 22,539 52,066

Dec. 31, 2028 30,000 5,207 24,793 27,273

Dec. 31, 2029 30,000 2,727 27,273 -

Accumulated Carrying

Cost depreciation amount

Right of use asset 268,404 53,680 214,724

Reduction by 40% (107,362) ( 21,472) (85,890)

Balance 161,042 32,208 128,834

Increase in lease liability 22,127 - 22,127

Adjusted balance 183,169 32,208 150,961

Journal entries for 2022

Jan. 1 Lease liability 91,946

Accumulated depreciation 21,472

Right of use asset 107,362

Termination gain 6,056

1 Right of use asset 22,127

Lease liability 22,127

Dec. 31 Interest expense 16,005

Lease liability 13,995

Cash 30,000

Depreciation 18,870

Accumulated depreciation

(150,961 / 8 years remaining) 18,870

Lease modification – change in rental

On January 1,2020, an entity leased equipment with the following information:

Annual rental payable at the end of each year 80,000

Lease term 6 years

Implicit rate in the lease 7%

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 8

Present value of an ordinary annuity of 1 at 7% for 6 periods 4.7665

Present value of lease payments – January 1, 2020 (80,000 x 4.7665) 381,320

Table of amortization

Date Payment 7% Interest Principal Lease Liability

Jan. 1, 2020 381,320

Dec. 31, 2020 80,000 26,692 53,308 328,012

Dec. 31, 2021 80,000 22,961 57,039 270,973

Dec. 31, 2022 80,000 18,968 61,032 209,941

Journal entries for 2020

Jan. 1 Right of use asset 381,320

Lease liability 381,320

Dec. 31 Interest expense 26,692

Lease liability 53,308

Cash 80,000

31 Depreciation (381,320/6) 63,553

Accumulated depreciation 63,553

Amendment of the lease

On January 1, 2023, the entity and the lessor agreed to amend the original term of the lease by reducing the lease

payment at P70,000 and increasing the implicit rate to 9%.

The present value of an ordinary annuity of 1 at 9% of 3 period is 2.5313.

Computation

Modified lease liability – January 1, 2023

(70,000 x 2.5313) 177,191

Carrying amount of lease liability - January 1, 2023 (209,941)

Decrease in lease liability (32,750)

The decrease in liability is a reduction in the carrying amount of the right of use asset.

Cost of the right of use asset 381,320

Accumulated depreciation (63,553 x 3) (190,659)

Carrying amount – January 1, 2023 190,661

Decrease in lease liability (32,750)

Adjusted carrying amount – January 1, 2023 157,911

Revised amortization schedule

Date Payment 9% Interest Principal Lease Liability

Jan. 1, 2023 177,191

Dec. 31, 2023 70,000 15,947 54,053 123,138

Dec. 31, 2024 70,000 11,082 58,918 64,220

Dec. 31, 2024 70,000 5,780 64,220 -

Journal entries for 2023

Jan. 1 Right of use asset 32,750

Lease liability 32,750

Dec. 31 Interest expense 15,947

Lease liability 54,053

Cash 70,000

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 9

31 Depreciation 52,637

Accumulated depreciation 52,637

(157,911/3 years remaining)

References

Valix, C. & Valix, C.A. (2018). Practical Accounting 1 vol 2. GIC Enterprises and Co., Inc. Manila, Philippines

Valix, C. & Valix, C.A. (2013). Theory of Accounts 2013 edition. GIC Enterprises and Co., Inc. Manila, Philippines

Valix, C. Valix, C.A. (2019). Financial Accounting and Reporting vol 2. GIC Enterprises and Co., Inc. Manila,

Philippines

Robles, N. & Empleo P. (2016). The Intermediate Accounting Series Vol 2. Millenium Books, Inc., Mandaluyong City

Uberita, C. (2012). Practical Accounting 1 2013 Edition. GIC Enterprises and Co, Inc. Manila, Philippines

Testbanks and CPA Examination Reviewers

Module for Intermediate Accounting 2, Jonard S. Baloyo, CPA Page 10

You might also like

- CH 21Document143 pagesCH 21Aqua Botol25% (4)

- Develop and Use Complex Spreadsheets Study Notes BSBITU402Document38 pagesDevelop and Use Complex Spreadsheets Study Notes BSBITU402raj100% (3)

- The Enhancement Program Handouts - Far PDFDocument36 pagesThe Enhancement Program Handouts - Far PDFRica Jane Lloren0% (1)

- Lease Modules ContinuedDocument8 pagesLease Modules ContinuedKenneth Marcial Ege0% (1)

- Tutorial Solution Lease LessessDocument13 pagesTutorial Solution Lease LessessOm PrakashNo ratings yet

- Example Exercise Lease Acctg With AnsDocument28 pagesExample Exercise Lease Acctg With AnsPrince Avena AquinoNo ratings yet

- Noncurrent Liabilities - PROBLEMS: B. A DiscountDocument12 pagesNoncurrent Liabilities - PROBLEMS: B. A DiscountIra Grace De Castro67% (3)

- 1 Agreed Upon Procedures GuideDocument27 pages1 Agreed Upon Procedures GuideiamnumberfourNo ratings yet

- Structured Credit and Equity Product PDFDocument480 pagesStructured Credit and Equity Product PDFRach3ch100% (1)

- BBMP Contact PointsDocument6 pagesBBMP Contact PointsUttam Hoode100% (1)

- Chapter Two: Determinants of Interest RatesDocument41 pagesChapter Two: Determinants of Interest Ratesmonica ongNo ratings yet

- December 9 Complete LectureDocument15 pagesDecember 9 Complete LectureToni100% (2)

- Personal Finance Canadian 4th Edition Madura Solutions ManualDocument25 pagesPersonal Finance Canadian 4th Edition Madura Solutions ManualDianaMartinpgtb100% (48)

- CEL 1 TOA Answer Key 1Document12 pagesCEL 1 TOA Answer Key 1Joel Matthew MozarNo ratings yet

- Seatwork 11.1 TaliteDocument10 pagesSeatwork 11.1 Taliteandrea taliteNo ratings yet

- Lease Modules ContinuedDocument8 pagesLease Modules ContinuedMariz RapadaNo ratings yet

- Problem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDocument2 pagesProblem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDominic RomeroNo ratings yet

- Date Payment Interest Principal Present Value: Table of AmortizationDocument6 pagesDate Payment Interest Principal Present Value: Table of AmortizationJekoeNo ratings yet

- Security DepositsDocument3 pagesSecurity DepositsQueen ValleNo ratings yet

- Reassessment of Lease LiabilityDocument6 pagesReassessment of Lease LiabilityJULIA CHRIS ROMERONo ratings yet

- De Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-ModificationsDocument3 pagesDe Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-ModificationsNita Costillas De MattaNo ratings yet

- IntAcc 2 - CHAPTER 11 NotesDocument5 pagesIntAcc 2 - CHAPTER 11 NotesikiNo ratings yet

- Problem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDocument2 pagesProblem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDominic RomeroNo ratings yet

- Ia PPT 6Document20 pagesIa PPT 6lorriejaneNo ratings yet

- Reviewer - Bonds PayableDocument16 pagesReviewer - Bonds PayableKrisha Joselle MilloNo ratings yet

- Loan ImpairmentDocument8 pagesLoan ImpairmentPaolo Immanuel OlanoNo ratings yet

- Paranoid Company Journal Entries: Date Account Title and ExplanationDocument8 pagesParanoid Company Journal Entries: Date Account Title and ExplanationKristel FieldsNo ratings yet

- IA2Document9 pagesIA2Claire BarbaNo ratings yet

- Intacc2-Quiz ExamDocument10 pagesIntacc2-Quiz ExamCmNo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- Mary Joy Otic Test 1Document10 pagesMary Joy Otic Test 1norman mandoNo ratings yet

- Lobrigas Unit5 Topic1 AssessmentDocument3 pagesLobrigas Unit5 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Acctg Lab 7Document8 pagesAcctg Lab 7AngieNo ratings yet

- Module - IA Chapter 6Document10 pagesModule - IA Chapter 6Kathleen EbuenNo ratings yet

- Asset For A Period of Time in Exchange For Consideration (IFRS #16)Document6 pagesAsset For A Period of Time in Exchange For Consideration (IFRS #16)Its meh SushiNo ratings yet

- Date of Bonds Date of Issue Interest Payment Dates Marurity Face Value Nominal Rate Effective Interest RateDocument5 pagesDate of Bonds Date of Issue Interest Payment Dates Marurity Face Value Nominal Rate Effective Interest RateJa RedNo ratings yet

- Accounting For Leases-5Document5 pagesAccounting For Leases-5drywinterNo ratings yet

- AE 16 Effective Interest MethodDocument14 pagesAE 16 Effective Interest MethodMiles CastilloNo ratings yet

- Lease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestDocument4 pagesLease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestQueen ValleNo ratings yet

- Right-of-Use Assets Lease LiabilityDocument10 pagesRight-of-Use Assets Lease LiabilityMoe ChurappiNo ratings yet

- Accounts Payable and Notes PayableDocument3 pagesAccounts Payable and Notes PayablenjsrzaNo ratings yet

- Assignment 02 Leases-SolutionDocument10 pagesAssignment 02 Leases-SolutionJaziel SestosoNo ratings yet

- Tutorial 6 SolutionsDocument5 pagesTutorial 6 SolutionsVanshika TilakNo ratings yet

- Problem 7-1 Requirement 1: Date Payment Interest PrincipalDocument9 pagesProblem 7-1 Requirement 1: Date Payment Interest PrincipalMarya GonzalesNo ratings yet

- AP-LIABS-3 (With Answers)Document4 pagesAP-LIABS-3 (With Answers)Kendrew SujideNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- 2-4-2-8-Answers (Empleo Book)Document5 pages2-4-2-8-Answers (Empleo Book)lcNo ratings yet

- Problem 1: ComputationsDocument6 pagesProblem 1: ComputationsClarissa BorbonNo ratings yet

- Leases Problems Solution GuideDocument11 pagesLeases Problems Solution Guidedane f.100% (1)

- Intacc2-Quiz ExamDocument5 pagesIntacc2-Quiz ExamCmNo ratings yet

- FAR 1 Chapter - 6Document13 pagesFAR 1 Chapter - 6Klaus DoNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Problem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueDocument11 pagesProblem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueJane Carla GarbidaNo ratings yet

- Interm 3 Quizzes Answer KeyDocument9 pagesInterm 3 Quizzes Answer KeyDanna VargasNo ratings yet

- Bonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ADocument8 pagesBonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ACamille BacaresNo ratings yet

- ACAE 15 Activity - Investment in Bonds: Problem 1Document5 pagesACAE 15 Activity - Investment in Bonds: Problem 1Nick ivan AlvaresNo ratings yet

- Case 1Document10 pagesCase 1Shawn VerzalesNo ratings yet

- Leases Robles Empleo Solution Manual - CompressDocument18 pagesLeases Robles Empleo Solution Manual - Compresschnxxi iiNo ratings yet

- Assessment Task 3Document5 pagesAssessment Task 3Christian N MagsinoNo ratings yet

- Acquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Document3 pagesAcquisition & Interest Date Interest Earned (NR X Face) A Interest Income (ER X BV) B Discount Amortization A-B Book Value 07/01/14 12/31/14 12/31/15Gray JavierNo ratings yet

- Chapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Document66 pagesChapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Never Letting GoNo ratings yet

- FINANCE LEASE-lecture and ExercisesDocument10 pagesFINANCE LEASE-lecture and ExercisesJamie CantubaNo ratings yet

- A. On April 1, 2015, Ben Ten Company Leased Equipment To Ironman Corporation. TheDocument2 pagesA. On April 1, 2015, Ben Ten Company Leased Equipment To Ironman Corporation. TheAvox EverdeenNo ratings yet

- Finance Lease Exercise 1Document13 pagesFinance Lease Exercise 1Jenyl Mae NobleNo ratings yet

- Financial Liabilities ProblemsDocument20 pagesFinancial Liabilities ProblemsEvelyn LabhananNo ratings yet

- Quiz #4 - Printed VersionDocument2 pagesQuiz #4 - Printed VersionPanda ErarNo ratings yet

- Assignment #3Document3 pagesAssignment #3Tricia Mae LuceroNo ratings yet

- Lagrimas - Leases Multiple ChoicesDocument4 pagesLagrimas - Leases Multiple ChoicesSarah Nicole S. LagrimasNo ratings yet

- Asia in the Global Transition to Net Zero: Asian Development Outlook 2023 Thematic ReportFrom EverandAsia in the Global Transition to Net Zero: Asian Development Outlook 2023 Thematic ReportNo ratings yet

- Module 11-SALE AND LEASEBACKDocument9 pagesModule 11-SALE AND LEASEBACKJeanivyle CarmonaNo ratings yet

- Module 9-DIRECT FINANCING LEASE - LESSORDocument10 pagesModule 9-DIRECT FINANCING LEASE - LESSORJeanivyle CarmonaNo ratings yet

- Module 10-SALES TYPE LEASE - LESSORDocument8 pagesModule 10-SALES TYPE LEASE - LESSORJeanivyle CarmonaNo ratings yet

- Module 8-OPERATING LESSEE-LESSORDocument5 pagesModule 8-OPERATING LESSEE-LESSORJeanivyle CarmonaNo ratings yet

- Module 2-WARRANTY LIABILITY and PROVISION AND CONTINGENT LIABILITYDocument12 pagesModule 2-WARRANTY LIABILITY and PROVISION AND CONTINGENT LIABILITYJeanivyle CarmonaNo ratings yet

- Module 5-NOTE PAYABLE AND DEBT RESTRUCTUREDocument13 pagesModule 5-NOTE PAYABLE AND DEBT RESTRUCTUREJeanivyle Carmona100% (1)

- Module 3-BONDS PAYABLEDocument24 pagesModule 3-BONDS PAYABLEJeanivyle CarmonaNo ratings yet

- Compound Financial Instrument ActivityDocument2 pagesCompound Financial Instrument ActivityJeanivyle CarmonaNo ratings yet

- Module 6-Lessee Accounting - (BASIC PRINCIPLES)Document14 pagesModule 6-Lessee Accounting - (BASIC PRINCIPLES)Jeanivyle CarmonaNo ratings yet

- Prof: John Bo S.Cayetano, Cpa, Mba Assessment For BONDS #01Document2 pagesProf: John Bo S.Cayetano, Cpa, Mba Assessment For BONDS #01John FloresNo ratings yet

- Problem Set #2-Solutions PDFDocument4 pagesProblem Set #2-Solutions PDFLhorene Hope DueñasNo ratings yet

- Module in General Mathematics Grade 11 Second Quarter, Week 3 To Week 4Document39 pagesModule in General Mathematics Grade 11 Second Quarter, Week 3 To Week 4Hanseuuu100% (1)

- A Primer On Whole Business SecuritizationDocument13 pagesA Primer On Whole Business SecuritizationSam TickerNo ratings yet

- Lesson 2 Simple Annuities Part 2 - STEM 1Document23 pagesLesson 2 Simple Annuities Part 2 - STEM 1aileeNo ratings yet

- CH 12 HWDocument45 pagesCH 12 HWHannah Fuller100% (1)

- Valuing BondsDocument26 pagesValuing BondsMohammad Taqiyuddin RahmanNo ratings yet

- Chap 3 Fixed Income SecuritiesDocument45 pagesChap 3 Fixed Income SecuritiesHABTAMU TULU0% (1)

- Ch06 Discounted Cash Flow ValuationDocument45 pagesCh06 Discounted Cash Flow Valuation마늘빵파스타No ratings yet

- 3) A 20 Year Mortgage Set Up For Uniform Monthly Payments With 6 Percent Interest Compounded MonthlyDocument4 pages3) A 20 Year Mortgage Set Up For Uniform Monthly Payments With 6 Percent Interest Compounded MonthlyAhmad AbdNo ratings yet

- Chapter7 The Time Value of MoneyDocument27 pagesChapter7 The Time Value of MoneyShikhar KumarNo ratings yet

- Cecchetti 6e Chapter 06updatedDocument53 pagesCecchetti 6e Chapter 06updatedmithatfurkananlarNo ratings yet

- HW 2Document4 pagesHW 2Marino NhokNo ratings yet

- NET PRESENT VALUE AND OTHER INVESTMENT CRITERIA - Chapter 08Document16 pagesNET PRESENT VALUE AND OTHER INVESTMENT CRITERIA - Chapter 08zordan100% (1)

- Time Value of MoneyDocument20 pagesTime Value of MoneymarianNo ratings yet

- Time Value of Money - TheoryDocument7 pagesTime Value of Money - TheoryNahidul Islam IUNo ratings yet

- Chapter Iv - Data Analysis and Interpretation: Property #1Document32 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- Lesson 27: Finding Interest Rate and Time in Compound InterestDocument15 pagesLesson 27: Finding Interest Rate and Time in Compound InterestDonna Angela Zafra BalbuenaNo ratings yet

- 2023 Time Value of MoneyDocument81 pages2023 Time Value of Moneylynthehunkyapple205No ratings yet

- CH 3Document13 pagesCH 3tamirat tadeseNo ratings yet