Professional Documents

Culture Documents

Risalah SPS English10Jan2020

Uploaded by

TeohKXOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risalah SPS English10Jan2020

Uploaded by

TeohKXCopyright:

Available Formats

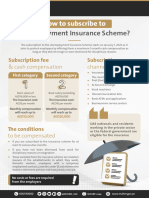

PROTECTION OF SELF-EMPLOYMENT SCHEDULE OF CONTRIBUTION

SOCIAL SECURITY SCHEME The contribution is based on options of insurable earnings:

Selected Contribution Contribution

This Scheme provides protection for self-employed insured Plan Insured Monthly Payment Per Payment Per

persons against self-employment injury including Earnings Month Year

occupational diseases and accidents during work-related 1 RM1,050 RM13.10 RM157.20

SELF-EMPLOYMENT activities.

2 RM1,550 RM19.40 RM232.80

SOCIAL SECURITY

“Self-employment injury” means personal injury to 3 RM2,950 RM36.90 RM442.80

self-employed insured person caused by an accident or 4 RM3,950 RM49.40 RM592.80

an occupational disease arising out of and in the course

SCHEME of his or her self-employment activity including while

travelling for the purpose of his or her self-employment

activity.

BACKGROUND

The Self-Employment Social Security Scheme was introduced Occupational disease is a disease caused by or arising

to provide protection for individuals who are self-employed out of any occupation specified in the Fifth Schedule of

under the provisions of the Self-Employment Social Security the Employees’ Social Security Act 1969.

Act 2017.

This Scheme provides cash benefits to the self-employed

In the beginning, this scheme is compulsory for the and their beneficiaries besides providing medical care,

self-employed in the Passenger Transportation Sector physical rehabilitation and vocational training.

which are taxi, e-hailing and bus drivers under the provisions

of the Self-Employment Social Security Act 2017, which ELIGIBILITY

took effect on 1 June 2017.

• Malaysian citizen / permanent resident without age

limit

Effective from 1 January 2020, the scheme is extended to

19 other sectors as follows: • Individuals who work for themselves to earn a living

• Good and Food Transport • Online Business

DOCUMENTS NEEDED Protecting you

• Agriculture

• Livestock

• Information Technology

• Data processing

•

•

Photocopy of Identity Card (IC)

Copy of PSV Card / E-hailing Profile / Permit /

and your family...

• Forestry • Agents Licence / Certificate or Letter of Confirmation from For more information, please visit or contact us online

• Fisheries • Professional Services the relevant association or agency subject to the

• Food • Support Services type of sector. www.perkeso.gov.my | 1 300 22 8000

• Manufacturing • Household Services https://matrix.perkeso.gov.my

• Construction • Arts PAYMENT OF CONTRIBUTION

• Hawkers • Beauty and Healthcare

• Contribution can be paid on a monthly or yearly

• Accommodation Premises

basis

• Cash payment can be made at all SOCSO offices

The coverage for self-employed individual contributing to

• Online payment can be made via

the scheme starts from the date and time the contribution

https://matrix.perkeso.gov.my

is paid and recognised on the contribution payment receipt.

(on-screen instructions are available by clicking the

‘Help’ button)

PERMANENT DISABLEMENT BENEFIT • Examples of Dependant’s Benefit calculation for wife

• Self-employed insured persons who suffer from and child are shown below:

permanent disability due to self-employment injury PLAN

SELECTED INSURED MONTHLY

can apply for this benefit. MONTHLY EARNING PENSION

• The rate of Permanent Disablement Benefit is 90% RM 1,050 X 90%

1 RM 1,050

SELF-EMPLOYMENT of the selected insured monthly earning. = RM 945.00

• Example of calculation of Permanent Disablement RM 1,550 X 90%

2 RM 1,550

SOCIAL SECURITY Benefit (lump sum payment) - if the assessment is

20%, the age factor is 8873 (below 20 years of age)

= RM 1,395.00

RM 2,950 X 90%

SCHEME BENEFITS and the contribution is RM592.80.

3 RM 2,950

= RM 2,655.00

RM 3,950 X 90%

= (RM 3,950 × 90% ÷ 30 Days)× 20% × 8873 4 RM 3,950

BENEFITS UNDER THE SCHEME : = RM 210,290.10 = RM 3,555.00

• Medical Benefit

• Temporary Disablement Benefit CONSTANT ATTENDANCE ALLOWANCE FACILITIES FOR PHYSICAL OR VOCATIONAL

• Permanent Disablement Benefit • This allowance is paid to self-employed insured person REHABILITATION

• Constant Attendance Allowance who is suffering from total permanent disablement as

• Physical rehabilitation and vocational rehabilitation

• Dependants’ Benefit a result of self-employment injury and is so severely

are provided free of charge.

• Funeral Benefit incapacitated as to constantly require the personal

attendance of another person, certified by Medical • Physical rehabilitation that includes physiotherapy,

• Education Benefit occupational therapy, reconstructive surgery, supply

Assessor or the Appellate Medical Board.

• Facilities for Physical or Vocational Rehabilitation of prosthetics, orthotics and other appliances, supply of

• The allowance is fixed at RM500 per month.

orthopaedics apparatus such as wheelchair, crutches,

hearing aids, spectacles, special shoes and others.

MEDICAL BENEFIT DEPENDANTS’ BENEFIT • Vocational rehabilitation such as courses in sewing,

• Self-employed insured persons suffering from • If a self-employed insured person dies as a result of radio repair and others.

self-employment injury or occupational diseases self-employment injury, his dependant shall be entitled

may receive free medical treatment at SOCSO’s to Dependants’ Benefit.

FUNERAL BENEFIT

panel clinics / government hospitals; or • A payment of 90% from selected insured monthly

• Funeral Benefit will be paid to the eligible person if

• Self-employed insured persons can claim for earning.

the self-employed insured person dies as a result of

reimbursement of expenses incurred in getting • Eligible dependants: self-employment injury or while receiving Permanent

medical treatment at SOCSO’s non-panel clinics. Widow or widower and child under 21 years old. If Disablement Benefit. The amount paid will be the

Application can be made to SOCSO and the there are no widow, widower or child: actual amount incurred or RM2,000 whichever is

reimbursement is subject to such conditions as a) Parents; or lower.

determined by the Organisation or according to b) Brothers or sisters below 21 years old; or

Fees Act 1951. c) Grandparents

EDUCATION BENEFIT

• Widow / widower, parents, grandparents receive

• This benefit is in the form of loans that may be provided

TEMPORARY DISABLEMENT BENEFIT lifetime benefits.

to a dependant child of self-employed insured person

• Temporary Disablement Benefit is paid for the period the • Child eligible to receive the benefit up to age 21 or who dies as a result of self-employment injury or

self-employed insured person is on medical leave until he/ she gets married (whichever occurs earlier). If is receiving periodical payments of Permanent

certified by a doctor for not less than (4) days including the child is studying in an institution of higher learning, Disablement Benefit.

the day of accident. he/she will receive the benefit until the completion of

• Need to submit medical certificate (mc) the first degree or he/she gets married (whichever

occurs earlier).

• The minimum rate is RM30.00 per day while the

maximum rate is RM105.33 per day.

You might also like

- IC 78 Miscellaneous InsuranceDocument306 pagesIC 78 Miscellaneous InsuranceKrishna GowdaNo ratings yet

- Health Insurance in INDIADocument36 pagesHealth Insurance in INDIAheema25No ratings yet

- Wic Guide For Employers SingaporeDocument40 pagesWic Guide For Employers Singaporem_saminathanNo ratings yet

- PCIL Study Material English PDFDocument123 pagesPCIL Study Material English PDFIsaac Wong100% (1)

- CEILLI Slides (English)Document148 pagesCEILLI Slides (English)Arvin Kovan100% (1)

- Mission and VissionDocument11 pagesMission and VissionPradeep Kumar V PradiNo ratings yet

- On Group InsuranceDocument14 pagesOn Group Insuranceyuviuv8867% (3)

- Risalah SPS English-1Document2 pagesRisalah SPS English-1ZANDER AKIRA MoeNo ratings yet

- Workers CompensationDocument36 pagesWorkers CompensationKaviyarasiiNo ratings yet

- SBI General InsuranceDocument21 pagesSBI General InsuranceSusanta Dey /Assistant Manager /Capacity Building /KolkataNo ratings yet

- SampoornSuraksha SchemeDetails14102022190Document1 pageSampoornSuraksha SchemeDetails14102022190Murthy NandulaNo ratings yet

- Insurance PPDocument12 pagesInsurance PPSanchit ArtNo ratings yet

- Micro InsuranceDocument15 pagesMicro Insurancesujithsnair100% (2)

- Health - Wellness - EngagementDocument27 pagesHealth - Wellness - EngagementNSCC ViganNo ratings yet

- Micro InsuranceDocument18 pagesMicro InsurancePrateek AgarwalNo ratings yet

- Sozialversicherung SkriptDocument9 pagesSozialversicherung SkriptJan ISTENIČNo ratings yet

- Wica Guide 2020Document40 pagesWica Guide 2020Arthur LimNo ratings yet

- Pension Topic One and TwoDocument7 pagesPension Topic One and Twonogarap767No ratings yet

- Etiqa BerhadDocument20 pagesEtiqa Berhadanisathirah07No ratings yet

- Lecture 12 - Introduction To Insurances - ClaimsDocument26 pagesLecture 12 - Introduction To Insurances - ClaimsSITI NURHASLINDA ZAKARIANo ratings yet

- Information-Benefits: Services Information Announcement What's NewDocument3 pagesInformation-Benefits: Services Information Announcement What's NewYash ChoudharyNo ratings yet

- ERP ID:-0191PGM057 PGDM Sap: Submitted By: - Sunny AnandDocument30 pagesERP ID:-0191PGM057 PGDM Sap: Submitted By: - Sunny AnandSunny AnandNo ratings yet

- Employees' State Insurance Scheme: Citizen'S CharterDocument21 pagesEmployees' State Insurance Scheme: Citizen'S CharterBhawzNo ratings yet

- Cocoa Farmers Pension Scheme: Education Program - 2023Document29 pagesCocoa Farmers Pension Scheme: Education Program - 2023Erinaldina MclaughlinNo ratings yet

- My Insurance FinallllllllllllllllDocument64 pagesMy Insurance Finallllllllllllllllstarshines2128No ratings yet

- Guideassure CF Fr801eDocument32 pagesGuideassure CF Fr801esabinahbugNo ratings yet

- 1-2 Personal Accident InsuranceDocument33 pages1-2 Personal Accident InsuranceReemaNo ratings yet

- Union Smart HealthDocument2 pagesUnion Smart HealthakanagesNo ratings yet

- Presentation 27Document12 pagesPresentation 27Rohith BidadiNo ratings yet

- Compensation Proposal (iHRM) GROUPDocument4 pagesCompensation Proposal (iHRM) GROUPAjar NairNo ratings yet

- Community Based Insurance-MicroinsuranceDocument33 pagesCommunity Based Insurance-MicroinsuranceRanjusha AshokNo ratings yet

- UNIT1, Point D Micro & Mass Insurance SchemesDocument15 pagesUNIT1, Point D Micro & Mass Insurance SchemesHarsh SharmaNo ratings yet

- AIA Future Builder PrimerDocument24 pagesAIA Future Builder PrimerjulianraphaelrazonNo ratings yet

- New Microsoft Office Power Point PresentationDocument8 pagesNew Microsoft Office Power Point PresentationsunillsNo ratings yet

- THINK SAFE-Online SO1 - Part 2Document139 pagesTHINK SAFE-Online SO1 - Part 2tracert_atanNo ratings yet

- How To Subscribe To Unemployment Insurance SchemeDocument1 pageHow To Subscribe To Unemployment Insurance SchemeSaad BashouriNo ratings yet

- CHAPTER 4 - InsuranceDocument134 pagesCHAPTER 4 - InsuranceMuneera Zakaria75% (8)

- Group Insurance ProductsDocument8 pagesGroup Insurance Productshamza omarNo ratings yet

- Veh Insur With PVT CosDocument1 pageVeh Insur With PVT CostsrajanNo ratings yet

- Proposal - Humano EnergyDocument14 pagesProposal - Humano EnergymsewornooNo ratings yet

- Citizens' Charter: Employees' Provident Fund OrganisationDocument12 pagesCitizens' Charter: Employees' Provident Fund OrganisationkumarajaNo ratings yet

- Thy Name Is LIC: About UsDocument63 pagesThy Name Is LIC: About UsMahendraNo ratings yet

- Coop MGT - COOP - INSDocument14 pagesCoop MGT - COOP - INSJames ChuaNo ratings yet

- WWW Icicilombard Com Cashless HospitalsDocument2 pagesWWW Icicilombard Com Cashless Hospitalsnithin.vNo ratings yet

- Rural Insurance Ashutosh Srivastava Premnath Residency, ph-9920196847, 9320482828 Flat - 301, Plot-74, Sector - 44, Nerul, Navi-Mumbai - 400706Document16 pagesRural Insurance Ashutosh Srivastava Premnath Residency, ph-9920196847, 9320482828 Flat - 301, Plot-74, Sector - 44, Nerul, Navi-Mumbai - 400706pankaj_subhedarNo ratings yet

- Literature Review On Insurance Management SystemDocument5 pagesLiterature Review On Insurance Management SystemAncy KalungaNo ratings yet

- Report On Motor InsuranceDocument59 pagesReport On Motor InsuranceMangesh SarjeNo ratings yet

- MOFS MIni ProjectDocument9 pagesMOFS MIni ProjectArijit TewaryNo ratings yet

- MGFP BrochureDocument14 pagesMGFP BrochuresarthakNo ratings yet

- PNB MetLife Accidental Death Benefit RiderDocument3 pagesPNB MetLife Accidental Death Benefit RiderParul GuleriaNo ratings yet

- 7Ps of Insurance Service Marketing by Mayak Pareek and Shikhar KantDocument14 pages7Ps of Insurance Service Marketing by Mayak Pareek and Shikhar KantMAYANK PAREEKNo ratings yet

- Recruitment and Team Building of Life Advisors in Bharti Axa Life InsuranceDocument86 pagesRecruitment and Team Building of Life Advisors in Bharti Axa Life Insurancesukanta meher100% (1)

- Medical Repricing RevisionDocument6 pagesMedical Repricing RevisionSarveshrau SarveshNo ratings yet

- Ashu 4Document13 pagesAshu 4Ashutosh SengarNo ratings yet

- Taka Ful Product DisclosureDocument4 pagesTaka Ful Product DisclosureNurul NatashaNo ratings yet

- Employee Benefits and ServicesDocument31 pagesEmployee Benefits and ServicesEva Barrios LaweyanNo ratings yet

- Final Year Project For MCom in Manufacturing PencilDocument73 pagesFinal Year Project For MCom in Manufacturing PencilPadmaja MenonNo ratings yet

- ABSLI Wealth Infinia BrochureDocument16 pagesABSLI Wealth Infinia BrochureijarNo ratings yet

- Sharp Fan Brochure FA - 4Document6 pagesSharp Fan Brochure FA - 4TeohKXNo ratings yet

- Curiosity+Stream+VPAT®+2 4+-+WCAG+EditionDocument15 pagesCuriosity+Stream+VPAT®+2 4+-+WCAG+EditionTeohKXNo ratings yet

- Exception To Hearsay RuleDocument1 pageException To Hearsay RuleTeohKXNo ratings yet

- Intoxication CaseDocument3 pagesIntoxication CaseTeohKX100% (1)

- Studocu Cidb ConstructionDocument35 pagesStudocu Cidb ConstructionTeohKXNo ratings yet

- 2019 Amej 1430Document24 pages2019 Amej 1430TeohKXNo ratings yet