Professional Documents

Culture Documents

Chapter 1 Review of The Accounting Cycle

Uploaded by

Louriel MartinezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 Review of The Accounting Cycle

Uploaded by

Louriel MartinezCopyright:

Available Formats

Chapter 1

Review of the Accounting

Cycle of a Service and

Merchandising Business

Overview

Accounting performs important tasks of recording daily

transactions, classifying recorded data, summarizing recorded

and classified data in order to prepare financial reports and

providing interpretation of the summarized facts in informing

interested people about business operation and financial

condition. Accounting information is summarized in at least four

basic financial reports, namely, (1) Statement of Comprehensive

Income (SCI); (2) Statement of Changes in Equity (SCE); (3)

Statement of Financial Position (SFP); and (4) Cash Flows

Statement (CFS) together with its accompanying notes to the

financial statements.

The work for each accounting period follows a cycle, which is

called the accounting cycle. This refers to a series of sequential

steps or procedures performed to accomplish the accounting

process.

The accounting cycle starts with Step 1, the analysis of various

business transactions through the different business documents

and journalizing or recording these transactions in the general

and special journals. Step 2 is the posting to the general ledger

of the business transactions recorded in Step 1. The trial balance

is prepared in Step 3 followed by the worksheet preparation in

Step 4 which is an optional step in the accounting cycle. Step 5

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 1

requires the journalizing and posting of adjusting entries in order

to prepare fairly valued financial statements which is Step 6. The

last three steps namely, Step 7 Closing the books, Step 8

Preparing post-closing trial balance, and Step 9 recording and

posting reversing entries are accomplished to prepare the books

for the next reporting/accounting period. Recording and posting

reversing entries is also an optional step similar worksheet

preparation.

Learning Objectives

After studying this chapter, the student should be able to acquire

the following competencies:

1. Practice the use of general journal by recording

business transactions and applying the rules of

debits and credits

2. Do the step posting in the general ledger using T-

accounts.

3. Prepare and understand the importance of different

trial balance.

4. Prepare the Statement of Financial Position of a

single proprietorship.

5. Prepare the functional Income Statement for a

single proprietorship.

6. Prepare Cash Flows Statement using the direct

method.

7. Perform the rest of the steps in completing the

accounting cycle.

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 2

Business Case to Understand the Accounting Cycle of a

Service and Merchandising Business

Joseph Landscaping and Plants Store

How time flies so fast! It seems just like yesterday when Joseph

started a small store selling various plants out of his hobby of

gardening in the backyard of his house after his retirement as a

professional electrical engineer. He also made use of his spare

time when business is not so busy in his small store accepting

landscaping of gardens of clients in the neighborhood and

nearby towns. Look where his favorite pastime brought him! He

is now considered by many to be a successful entrepreneur after

putting his landscaping and plant store two years ago!

Joseph more than ever is really so concerned with the progress

of his business operations on its third year of operation. He never

forgets that the business to operate successfully must embody

the principles of earning profits with outmost concern for the

welfare of people and planet!

He reviewed the lessons on the different steps of the accounting

cycle which he tried to learn when he was starting his small

business. He started with the chart of accounts of the business as

follows.

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 3

CHART OF ACCOUNTS

Account Account

No. Account Title No. Account Title

ASSETS OWNER'S EQUITY

101 Cash in Bank 401 Joseph de Jesus, Capital

102 Petty Cash Fund 401-A Joseph de Jesus, Drawing

Financial Assets at Fair

Value

103 Through Profit or Loss REVENUES

104 Accounts Receivable 501 Service Income

Allowance for Doubtful

104-A Accounts 502 Sales

105 Notes Receivable 502-A Sales Discounts

Sales Returns and

106 Interest Receivable 502-B Allowances

107 Merchandise Inventory 503 Interest Income

108 Office Supplies on Hand EXPENSES

109 Store Supplies on Hand 601 Purchases

201 Land 601-A Purchases Discounts

Purchases Returns and

202 Buildings 601-B Allowances

Accumulated Depreciation-

202-A Building 602 Freight in

203 Equipment 610 Freight out

Accumulated Depreciation- Salaries and Wages

203-A Equipment 611 Expense

204 Furniture and Fixture 612 Depreciation Expense

Accumulated Depreciation –

204-A Furniture 613 Utilities Expense

LIABILITIES 614 Insurance Expense

301 Accounts Payable 615 Office Supplies Expense

302 Notes Payable 616 Store Supplies Expense

Repairs and Maintenance

303 Withholding Taxes Payable 617 Expense

SSS, Philhealth, and

304 Utilities Payable 618 Pag-ibig Expense

Doubtful Accounts

305 Interest Payable 619 Expense

310 Mortgage Payable 620 Miscellaneous Expense

630 Interest Expense

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 4

The following is the trial balance prepared for Joseph

Landscaping and Plant Store as of November 30, 2023.

Joseph Landscaping and Plants Store

Trial Balance

November 30, 2023

Account Title Debit Credit

Cash in Bank P 95,000

Petty Cash Fund 10,000

Financial Assets at Fair Value Through

Profit or Loss 100,000

Accounts Receivable 95,000

Allowance for Doubtful Accounts P 7,000

Merchandise Inventory, January 1 17,800

Office Supplies on Hand 10,500

Store Supplies on Hand 15,000

Land 400,000

Buildings 440,000

Accumulated Depreciation-Building 57,600

Equipment 220,000

Accumulated Depreciation-Equipment 50,000

Furniture and Fixture 120,000

Accumulated Depreciation – Furniture 44,000

Accounts Payable 37,000

Notes Payable 12,000

Withholding Taxes Payable 5,600

Mortgage Payable 200,000

Joseph de Jesus, Capital 842,950

Joseph de Jesus, Drawing 10,000

Service Income 140,000

Sales 776,850

Sales Discounts 15,000

Sales Returns and Allowances 12,500

Purchases 325,000

Purchases Discounts 10,000

Purchases Returns and Allowances 14,700

Freight in 6,850

Freight out 9,500

Salaries and Wages Expense 194,000

Insurance Expense 28,450

Utilities Expense 26,000

Repairs and Maintenance Expense 16,750

SSS, Philhealth, and Pag-ibig Expense 11,550

Miscellaneous Expense 12,400

Interest Expense 6,400

Total P 2,197,700 P 2,197,700

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 5

Step 1: Analyzing Business Transactions and Journalizing in

the General Journal

Joseph reviews the first step which is journalizing business

transaction, now that all the business documents of his business

for the month of December were properly sorted and filed. He

recalled the definition that journalizing is the chronological

recording of the business transactions in the book called the

general journal. A journal is a daily record of business

transactions that shows in one place the complete debit and

credit effect of each transaction on the accounts of the business

in chronological order.

Journalizing transactions of service and merchandising business

requires knowledge as to the difference between the two

activities undertaken by Joseph Landscaping and Plants Store.

Merchandising or trading means the company is engaged in the

buying and selling of merchandise such us soil, flower pots,

plants, fertilizers, decorative rocks and stones among others.

Service activity on the other hand is rendering service, e.g.,

landscaping and garden maintenance.

A business firm selling a product like Joseph Landscaping and

Plant Store must use an inventory record system to value the

merchandise on hand at the end of an accounting period. Two

different inventory systems may be used to record trading

transactions in the accounting records. These systems are the

periodic and perpetual inventory system. In a perpetual

inventory system a continual, or perpetual, record of the

inventory activity is maintained. Consequently, any items that

are sold or otherwise physically removed from inventory must

be removed from the Merchandise Inventory account, and items

that are purchased are added to the Merchandise Inventory

account. This may result in significant extra record keeping as

compared to a periodic system. However, a perpetual inventory

system does have advantages, and businesses with a relatively

low number of high-value transactions often find the extra effort

to be worthwhile. Computers are also making it practical for

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 6

businesses to use perpetual systems than would have been not

feasible in the past.

In the periodic inventory system, the ending inventory is

determined by a physical count of the merchandise on hand at

the end of an accounting period. The periodic inventory system

receives its name because the balance in the inventory account

is known only at the beginning and at the end of the accounting

period. The periodic inventory is the simpler system commonly

used in practice and was the only practical alternative for most

businesses with large number of transactions before the advent

of computers. The periodic inventory system will be used in the

Joseph Landscaping and Plants Store review business case.

Exercise 1-1: Journalizing business transactions

• The following is the list summarizing the various

transactions of Joseph Landscaping and Plants Store for the

month of December 2023 which you are asked to record in

a worksheet using the periodic inventory system.

Dec. 1 Sold merchandise to Argem Day Care Center for

P20,000 and received a 3-month, 12% note.

2 Purchased merchandise from Stephen Trading

amounting to P25,000 on terms P10,000 down payment

and the balance 2/10,n/30. FOB Shipping Point,

Collect, P800.

3 Rendered landscaping services to Guadalupe's Garden,

P30,000. Terms: 50% down payment balance on

account.

4 Sold merchandise to Emmanuel Merchandising

amounting to P70,000. Terms: P20,000 down payment

and the balance 2/10,1/15,n/30. FOB Destination Point,

Prepaid, P1,200.

5 Issued a debit memorandum to Stephen Trading for

P500 worth of defective goods.

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 7

6 Joseph made additional investment in the form of

merchandise for P20,000.

7 Issued a credit memorandum to Emmanuel

Merchandising amounting to P1,000 for goods sold not

in accordance to specifications.

8 Sold merchandise to Rafael Novelty Shop P50,000,

C.O.D.

9 Made partial payment amounting to P5,000 to Stephen

Trading.

10 Purchased additional store supplies worth P5,000 and

office supplies amounting to P10,000 from Gabriel

Supermart. Terms: P5,000 down payment and the

balance 2/10, n/30.

12 Paid account with Stephen Trading in full.

15 Joseph withdrew in anticipation of future profits

merchandise which was originally purchased for

P8,000 but is being sold for P12,000.

17 Returned P500 worth of store supplies to Gabriel

Supermart.

19 Collected in full the receivable from Emmanuel

Merchandising.

20 Paid account with Gabriel Supermart in full.

26 Rafael Novelty Shop returned P1,000 worth of

defective merchandise.

28 Rendered landscaping services to Shalom House of

Prayer P50,000 on account.

31 Collected in full the receivable from Guadalupe's

Garden.

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 8

Step 2: Posting to the General Ledger

After recording the above transactions, let us recall the lessons

in posting to the general ledger. Posting is the process of

transferring journal entries to the ledger accounts. The ledger is

also called the book of final entry. It is in this book where all

the accounts listed in the company’s chart of accounts are

maintained. This book keeps all the information about the

changes in every account balance and often very useful for

management. An account is used as an accounting tool to record

increases and decreases to individual accounting record in a

specific asset, liability, or owner's equity item. An open account

in the general ledger means that there is an amount posted in the

ledger and has an existing balance. There are two possible forms

of general ledger, namely: (1) running balance form and (2)

standard form.

In lieu of the actual general ledger accounts, accountants use T-

accounts to analyze business transactions. As the term implies,

a T-account really looks like a capital letter T which consists of

a horizontal and a vertical line. To make use of this tool of

analysis for accounting, the account title is written just above the

horizontal line. The vertical line provides an imaginary left and

right side of the account where increases or decreases will be

recorded similar to the standard form of general ledger.

Exercise 1-2: Analyzing Business Transactions Using T-

accounts

• Using a second worksheet, draw T-accounts and post the

journal entries recorded for the December transactions of

Joseph Landscaping and Plants Store. The first transaction

was posted for your sample.

• After posting the journal entries, compute for the December

31 balance of all the accounts that were affected by the

December business transactions of Joseph Landscaping and

Plants Store.

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 9

EXAMPLE of posting using T-accounts

December 1- Sold merchandise to Argem Day Care Center for

P20,000 and received a 3-month, 10% note.

Notes Receivable Sales

12/1 20,000 11/30 776,850

12/1 20,000

Step 3: Trial Balance preparation

The trial balance is a list of schedule of open accounts in the

general ledger with their corresponding account balances, i.e.,

the difference between the total debits and total credits of an

account in the ledger. It is prepared to verify the equality of

debits and credits in the ledger at the end of each accounting

period or at any time the postings are updated.

The previous section has shown journalizing and posting

business transactions, at this point in the sequence, it is advisable

to check the work for arithmetic accuracy. Preparing the trial

balance does this. The trial balance summarizes all the accounts

in the general ledger and thus, provides a check on the equality

of the debits and credit entries in the ledger. This schedule has

the following characteristics:

1. It is a list of accounts.

2. The list of accounts is unclassified; it does not attempt to

state whether accounts listed are assets or liabilities,

current or long term.

3. The accounts listed are normally those with open

balances, that is, they have peso amount balances.

4. The accounts are listed in ledger orders.

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 10

If the accounts have been debited and credited with equal

amounts for each transaction during the accounting period, and

if the balances of all accounts have been accurately calculated,

the sum of the debit balance accounts (the assets and the

expenses) will equal the sum of the credit balance accounts

(contra asset accounts, the liabilities, proprietor’s capital and

revenues).

It is important to note that the trial balance is a list prepared for

all accounts with open (debit or credit) balances. Accounts with

zero balances are excluded. The trial balance is not a complete

proof of the correctness of the accounting entries recorded.

Exercise 1-3: Preparing trial balance

• Using the provided trial balance, complete the amounts to

prepare the trial balance of Joseph Landscaping and Plants

Store as of December 31, 2023.

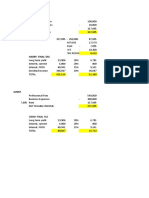

Joseph Landscaping and Plants Store

Trial Balance

December 31, 2023

Account Title Debit Credit

Cash in Bank P

Petty Cash Fund 10,000

Financial Assets at Fair Value Though

Profit or Loss 100,000

Accounts Receivable

Allowance for Doubtful Accounts P 7,000

Notes Receivable

Merchandise Inventory, January 1 17,800

Office Supplies on Hand

Store Supplies on Hand

Land 400,000

Buildings 440,000

Accumulated Depreciation-Building 57,600

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 11

Equipment 220,000

Accumulated Depreciation-Equipment 50,000

Furniture and Fixture 120,000

Accumulated Depreciation – Furniture 44,000

Accounts Payable

Notes Payable 12,000

Withholding Taxes Payable 5,600

Mortgage Payable 200,000

Joseph de Jesus, Capital

Joseph de Jesus, Drawing

Service Income

Sales

Sales Discounts

Sales Returns and Allowances

Purchases

Purchases Discounts

Purchases Returns and Allowances

Freight in

Freight out

Salaries and Wages Expense 194,000

Insurance Expense 28,450

Utilities Expense 26,000

Repairs and Maintenance Expense 16,750

SSS, Philhealth, and Pag-ibig Expense 11,550

Miscellaneous Expense 12,400

Interest Expense 6,400

Total P P

Step 4: Worksheet Preparation

The worksheet is a multicolumn devised used to systematically

assemble the accounting data used in the adjustment process,

financial statements preparation and closing entries. A

worksheet is just a temporary accounting record. It is not a

journal or a part of the general ledger. The worksheet is

commonly known as the “working paper” of accountants which

makes it easier for them to record adjusting entries, determines

the result of the firm’s operation (whether net income or net loss)

and is used as a tool in preparing financial statements and closing

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 12

Reference:

Manalo, M., and Rapatan, M. (2016). Learning to Succeed in

Business with Accounting. Volume 1 and 2. Phoenix

Publishing House, Inc.

REVIEW OF ACCOUNTING CYCLE OF A SERVICE AND MERCHANDISING BUSINESS 13

You might also like

- CH 6 (WWW - Jamaa Bzu - Com)Document8 pagesCH 6 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (2)

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- Zabala Auto Supply General JournalDocument3 pagesZabala Auto Supply General JournalDavid Bermudez0% (1)

- Inventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2ADocument18 pagesInventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2AOJERA, Allyna Rose V. BSA-1BNo ratings yet

- Chapter6 Matematika BusinessDocument17 pagesChapter6 Matematika BusinessKarlina DewiNo ratings yet

- 401 Chap13 Flashcards - QuizletDocument8 pages401 Chap13 Flashcards - QuizletJaceNo ratings yet

- 1st Year ExamDocument9 pages1st Year ExamMark Domingo MendozaNo ratings yet

- Partnership ReviewDocument5 pagesPartnership ReviewAirille CarlosNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- Sol Man Chapter 11 She Part 2 2021 - CompressDocument27 pagesSol Man Chapter 11 She Part 2 2021 - CompressDump DumpNo ratings yet

- Week 4 5 ULOc Lets Analyze Activities SolutionDocument3 pagesWeek 4 5 ULOc Lets Analyze Activities Solutionemem resuentoNo ratings yet

- Accounts Receivable: QuizDocument4 pagesAccounts Receivable: QuizRisa Castillo MiguelNo ratings yet

- Quiz On Partnership LiquidationDocument4 pagesQuiz On Partnership LiquidationTrisha Mae AlburoNo ratings yet

- Afar 2901 Diy PDFDocument1 pageAfar 2901 Diy PDFkngnhngNo ratings yet

- AssignmentDocument9 pagesAssignmentBaekhunnie ByunNo ratings yet

- Accounting For Partnership DissolutionDocument19 pagesAccounting For Partnership DissolutionMelanie kaye ApostolNo ratings yet

- Multiple Choice Answers and Solutions: PAR Boogie BirdieDocument19 pagesMultiple Choice Answers and Solutions: PAR Boogie BirdieNelia Mae S. VillenaNo ratings yet

- Partnership Operations ProblemsDocument2 pagesPartnership Operations ProblemsAilene MendozaNo ratings yet

- Acc 211B Job Order Costing - ActivityDocument5 pagesAcc 211B Job Order Costing - Activityjr centenoNo ratings yet

- SolutionDocument8 pagesSolutionIts meh SushiNo ratings yet

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFDocument4 pagesFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhNo ratings yet

- Partnership FormationDocument3 pagesPartnership FormationJules AguilarNo ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- Intermediate Accounting FormulasDocument2 pagesIntermediate Accounting FormulasBlee13No ratings yet

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNo ratings yet

- TFA 1 Chapter 33 - Financial Assets at Fair ValueDocument1 pageTFA 1 Chapter 33 - Financial Assets at Fair ValueIanna ManieboNo ratings yet

- Chapt 4 Partnership Dissolution - Asset Revaluation & BonusDocument8 pagesChapt 4 Partnership Dissolution - Asset Revaluation & BonusDaenaNo ratings yet

- PrelimsDocument24 pagesPrelimsRhea BadanaNo ratings yet

- Cash and Cash Equivalents QuizDocument2 pagesCash and Cash Equivalents QuizMarkJoven Bergantin100% (1)

- Prelim ExamDocument7 pagesPrelim ExamHoney Grace TangarurangNo ratings yet

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- Receivable FinancingDocument15 pagesReceivable FinancingshaneNo ratings yet

- Bonds PayableDocument39 pagesBonds PayableRuiz, CherryjaneNo ratings yet

- For The Year Ended December 31Document2 pagesFor The Year Ended December 31elsana philipNo ratings yet

- AC 3 - Intermediate Acctg' 1 (Ate Jan Ver)Document119 pagesAC 3 - Intermediate Acctg' 1 (Ate Jan Ver)John Renier Bernardo100% (1)

- SimexDocument3 pagesSimexRoland Ron BantilanNo ratings yet

- BS ACCOUNTANCY TRUE OR FALSE STATEMENTSDocument1 pageBS ACCOUNTANCY TRUE OR FALSE STATEMENTSSheena ClataNo ratings yet

- Ellen Company Cash Bank ReconciliationDocument8 pagesEllen Company Cash Bank ReconciliationShaine PacsonNo ratings yet

- Chapter 2 - Shareholder's Equity MCDocument19 pagesChapter 2 - Shareholder's Equity MCJoshua AbanalesNo ratings yet

- Q and A PartnershipDocument9 pagesQ and A PartnershipFaker MejiaNo ratings yet

- Gavarra-Marie Joy-Bsais-2b-Problem3-No.3Document2 pagesGavarra-Marie Joy-Bsais-2b-Problem3-No.3Nikki Jean Hona50% (2)

- 02 - Cash & Cash EquivalentDocument5 pages02 - Cash & Cash EquivalentEmmanuelNo ratings yet

- Module 7 Loans Receivable and Impairment of ReceivablesDocument10 pagesModule 7 Loans Receivable and Impairment of Receivablesshaira doctorNo ratings yet

- PRELIM Quiz 1 Cash, CE, PCF, Bank ReconDocument8 pagesPRELIM Quiz 1 Cash, CE, PCF, Bank ReconApril Faye de la CruzNo ratings yet

- Partnership Dissolution: QuizDocument5 pagesPartnership Dissolution: QuizLee SuarezNo ratings yet

- Home Office & Branch Accounting Problems SolvedDocument3 pagesHome Office & Branch Accounting Problems SolvedChristianAquinoNo ratings yet

- Accounting for Special Partnership TransactionsDocument15 pagesAccounting for Special Partnership TransactionsJessaNo ratings yet

- Donor's Tax Guide for Self-StudyDocument13 pagesDonor's Tax Guide for Self-StudyEmmanuel PenullarNo ratings yet

- FAR2 CHAPTER 1 (PG 1-13)Document13 pagesFAR2 CHAPTER 1 (PG 1-13)Layla MainNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- Prelim Learning Task 1 PDFDocument5 pagesPrelim Learning Task 1 PDFAdrian FaminianoNo ratings yet

- Exam Questionaire in IntermediateDocument5 pagesExam Questionaire in IntermediateJester IlaganNo ratings yet

- Ia FifoDocument5 pagesIa FifoNadine SofiaNo ratings yet

- Pre FinactDocument6 pagesPre FinactMenardNo ratings yet

- Accounting - Inventory Test BankDocument3 pagesAccounting - Inventory Test BankAyesha RGNo ratings yet

- Chapter 1 Review of The Accounting Cycle of A Service and Merchandising BusinessDocument17 pagesChapter 1 Review of The Accounting Cycle of A Service and Merchandising Businesstim c0% (1)

- Module 1 Review of The Accounting Cycle For A Service Business by Marivic ManaloDocument28 pagesModule 1 Review of The Accounting Cycle For A Service Business by Marivic ManaloChing ChongNo ratings yet

- Audit Module 1 - Trial Balance Account MappingDocument6 pagesAudit Module 1 - Trial Balance Account MappingGaurav KumarNo ratings yet

- Statement of Cash FlowsDocument40 pagesStatement of Cash FlowsGaluh Boga KuswaraNo ratings yet

- Audit Module 1 - Variance Analysis TemplateDocument8 pagesAudit Module 1 - Variance Analysis TemplateKawtar BensalahNo ratings yet

- Compilation of Measuring DevicesDocument4 pagesCompilation of Measuring DevicesLouriel MartinezNo ratings yet

- Pwede Na Ba YanDocument5 pagesPwede Na Ba YanLouriel MartinezNo ratings yet

- The White ManDocument3 pagesThe White ManLouriel MartinezNo ratings yet

- Cleaning AgentsxDocument1 pageCleaning AgentsxLouriel MartinezNo ratings yet

- Tribute To TeachersDocument1 pageTribute To TeachersLouriel Martinez100% (1)

- Cleaning AgentsxDocument1 pageCleaning AgentsxLouriel MartinezNo ratings yet

- OpticsDocument5 pagesOpticsLouriel MartinezNo ratings yet

- HttpsDocument10 pagesHttpsLouriel MartinezNo ratings yet

- OpticsDocument5 pagesOpticsLouriel MartinezNo ratings yet

- Introduction To Stem Cell Theraphy Week 8Document10 pagesIntroduction To Stem Cell Theraphy Week 8HappyNo ratings yet

- How Google Is Changing Our Brains PDFDocument4 pagesHow Google Is Changing Our Brains PDFHappyNo ratings yet

- Impact of GoogleDocument3 pagesImpact of GoogleHappyNo ratings yet

- Tugas BACA-ITP500-Bias in ResearchDocument4 pagesTugas BACA-ITP500-Bias in ResearchLinda Trivana HavanaNo ratings yet

- Reducing Carbon - A Bacterial Approach - Bio 2.0 - Learn Science at Scitable PDFDocument2 pagesReducing Carbon - A Bacterial Approach - Bio 2.0 - Learn Science at Scitable PDFdncNo ratings yet

- Playing God?: Scientists Must Let Society Decide On The Ethics of Reproductive TechnologiesDocument1 pagePlaying God?: Scientists Must Let Society Decide On The Ethics of Reproductive TechnologiesHappyNo ratings yet

- Human Subjects and Diagnostic Genetic Testing - Learn Science at ScitableDocument3 pagesHuman Subjects and Diagnostic Genetic Testing - Learn Science at ScitableGhellMagaleMolinaNo ratings yet

- OpticsDocument5 pagesOpticsLouriel MartinezNo ratings yet

- LM - CHSDocument76 pagesLM - CHSRyan Rojas RicablancaNo ratings yet

- Digmaang Puniko (Group 4)Document23 pagesDigmaang Puniko (Group 4)Louriel Martinez100% (3)

- Accounting 1 (SHS) - Week 5 - Accounting Concepts and PrinciplesDocument18 pagesAccounting 1 (SHS) - Week 5 - Accounting Concepts and PrinciplesAustin Capal Dela CruzNo ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th EditionDocument30 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 4th Editiongabrielthuym96j100% (16)

- Statutory Audit ReportDocument11 pagesStatutory Audit ReportShivaniNo ratings yet

- Worksheet FABM2 Q1 M2 2 SCI Multi-StepDocument3 pagesWorksheet FABM2 Q1 M2 2 SCI Multi-StepMarjun AbogNo ratings yet

- 02 Activity 1 - AuditingDocument2 pages02 Activity 1 - AuditingMillania ThanaNo ratings yet

- Accounts Question Bank From Unit 1 To 5Document23 pagesAccounts Question Bank From Unit 1 To 5Haripriya VNo ratings yet

- AIS, CPA Material, Revenue CycleDocument29 pagesAIS, CPA Material, Revenue CycleDamien LeeNo ratings yet

- A212 Far 1 - AssessmentDocument2 pagesA212 Far 1 - AssessmentCarylChooNo ratings yet

- A.K.A Brands HoldingDocument298 pagesA.K.A Brands HoldingGustavo MoreiraNo ratings yet

- BorrowingsDocument8 pagesBorrowingsStephen Paul EscañoNo ratings yet

- Compileeee Business CombiDocument14 pagesCompileeee Business CombiEddie Mar JagunapNo ratings yet

- GROUP PROJECT ASSIGNMENT HTH587 (HM2404Aa)Document34 pagesGROUP PROJECT ASSIGNMENT HTH587 (HM2404Aa)NurulSyafiqah Syafiqah67% (3)

- Auditing: The Art and Science of Assurance Engagements: Fifteenth Canadian EditionDocument51 pagesAuditing: The Art and Science of Assurance Engagements: Fifteenth Canadian EditionManav PatelNo ratings yet

- Faseela Nadir Cv-1Document1 pageFaseela Nadir Cv-1faseelanadirNo ratings yet

- Accounting Theories and ProblemsDocument9 pagesAccounting Theories and ProblemsDonnelly Keith MumarNo ratings yet

- Audit Report SampleDocument9 pagesAudit Report SampleKielRinonNo ratings yet

- Fourth Year - Bsa: University of Makati Set BDocument11 pagesFourth Year - Bsa: University of Makati Set BYedam BangNo ratings yet

- Special Purpose Audit Procedures and ReportsDocument6 pagesSpecial Purpose Audit Procedures and ReportsPaupauNo ratings yet

- Chap. 1 Principles of Assurance ServicesDocument22 pagesChap. 1 Principles of Assurance ServiceskripsNo ratings yet

- Polangui Executive Summary 2012Document4 pagesPolangui Executive Summary 2012Retis, Thirdy SamanthaNo ratings yet

- HCA&S Commerce Dept Lesson Plan for Principles of AuditingDocument6 pagesHCA&S Commerce Dept Lesson Plan for Principles of AuditingDR.GUNAVELAN.G COMMERCENo ratings yet

- Interim and Final Audit ProceduresDocument10 pagesInterim and Final Audit ProceduresClyton MusipaNo ratings yet

- Horngrens Accounting 11th Edition Miller Nobles Solutions ManualDocument26 pagesHorngrens Accounting 11th Edition Miller Nobles Solutions ManualColleenWeberkgsq100% (52)

- A 1 The Statement Is Entitled Consolidated Balance SheetsDocument1 pageA 1 The Statement Is Entitled Consolidated Balance SheetsM Bilal SaleemNo ratings yet

- Witness Fitness Module1Document14 pagesWitness Fitness Module1saggusimran318No ratings yet

- Spiceland-9th Edition-Chapter-03-Solution ManualDocument5 pagesSpiceland-9th Edition-Chapter-03-Solution ManualStephen Andrei VillanuevaNo ratings yet

- Workbook 1 Introduction To IPSAS Accruals AccountingDocument40 pagesWorkbook 1 Introduction To IPSAS Accruals AccountingBig-Brain MuzunguNo ratings yet

- FinancialAccounting Sample 20-07-2022Document32 pagesFinancialAccounting Sample 20-07-2022Vibrant Publishers100% (1)

- Department of Education: Gigaquit National School of Home Industries Entrepreneurship 10Document6 pagesDepartment of Education: Gigaquit National School of Home Industries Entrepreneurship 10Liza BanoNo ratings yet

- Chapter 3 - Financial Statement Analysis - Exercises - Sv4.0Document2 pagesChapter 3 - Financial Statement Analysis - Exercises - Sv4.0Kieu DangNo ratings yet