Professional Documents

Culture Documents

PPE Part 2

Uploaded by

Jester Lim0 ratings0% found this document useful (0 votes)

38 views24 pagesAUDIT OF PPE

Original Title

PPE-Part-2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAUDIT OF PPE

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views24 pagesPPE Part 2

Uploaded by

Jester LimAUDIT OF PPE

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 24

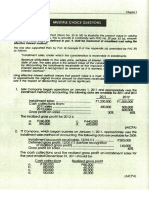

Ppt eit Ewing Panta), Oe

Chapter 16

Property, Plant and Equipment (Part 2)

Learning Objectives

1. State the subsequent measurement of PPE.

2, Define depreciation and state when depreciation commences

and when it ceases.

3, Account for the revaluation of PPE,

| Account for the derecognition of PPE.

‘Subsequent Measurement

‘After initial recognition, an entity chooses either the (a) cost model

or the (b) revaluation model’as its accounting policy and applies

that policy to an entire class of PPE! ‘

Cost model

Under the ‘cost model, a PPE is carried at its cost less any

accumulated depreciation and any accumulated impairment losses.

Depreciation

> Depreciation is “the systematic allocation of the depreciable

amount of arvasset over its useful life.” (PAS 16.6)

> Depreciable amount is “the ‘cost of an/asset, or other amount

substituted for cost, less its residual value.” (pass)

> Residual value is “the estimated amount that an entity would

currently obtain from disposal of the asset, after deducting the

estimated costs of disposal, if the asset were already of the age

and in the condition expected at the end of its useful life.” (pas

166)

> Useful lifes: “(a) the ppetiod over which arvasset is expected to

be available for/use by an! entity; or (b) the number of

production or similar Units expected to be obtainéd from the

asset by aflentity.” (PAs 166)

The following are factors considered in determining

the useful life of an asset:

220. (a wa

peste

& Expected usage ofthe asot

Expected physical wear and tea eciation separately

© Obsolescence Ta ns of PE erected

4 a ieame

Legal and similar limitation

lation on the use

‘he government places an age limit for

Public ut

Kinds of depreciation

1. Physical depreciation — This relat to an

oe ies 2

ple, the oss)

cam ly. (profit To

epi a recoizd 28 epee

in| ring ater ass For

—— sn the cont of Prosar nll in the

2g et fi en heat avaiable or ws i

'unctional or economic depreciation vy jan starts wt

mae promi hehe HE,

> Chetan mnt pene catnip

a ming no . der PERS: oF ,

outa The olowingaretype of een oe ef ads ae ERTS hen is

Functional > Occurs when an iasset las ally epee pu ts residual tale. However,

duets outdated design, bane a ya dese bow te carying amount. he

> Kacational or Ezmomic”obiclscense — occurs whe fdas ogee as an aditiona depreciation,

Prpberty loses value because of negative tall recog

cause ive in

Src, yams" amattvichan ast mn

thence chan SPOT oF allway tack and Weller sor edie any acum” depres

< epesby ae, {curt impale oes (8166)

rn ~ occurs when new predat becomes lle

iets MBE Rane, abacus epoca when he at cme)

calculator, “ cated maine se

4. Physic beled - and and bung are acount for separately ever

in hy ae acquired together. Land is not deprecated because

chs an anata si (wth certain exceptions, such as.

‘us and andl ste), Buildings are deprecated because they

ve SEAN. te Bd aug gd

q

DeecatonMatods | i» fishin med

Thee ue varius dpration methods, PAS 16 mentions thee

mos amy staghine met dng blac mea

‘eds of podton maid. However, PAS. 16. does. Mot

ay peiiemetod The cote of depreciation method

management's june.

ory fe

vk te mae | sgt a

fie mre medbodl'iewie date, Sure

|

|

|

— tea

IE.

When: et

rt

Sela of 72000

oes oo

nro ofeasipment

Although PAs

ePreciation method, it preg

Ina is cd an POMS he a

isto

280

feast 1600 we 5000

ei 200

Pr rd ca

Dosim 1600 S40 eon

als 10 00 eee

0

ee

rare ih mcd

crear I dated fom the

inating ama

+ Tel dca over th ie he eulpent equa the

rece an of FD, This cus theresa ale

‘ce am e decile anata 0 el ae the

‘ld egal het et

~ ath shal abe eying in wl be Rothe

Asin wh it te ly dei as i he stron

‘Sep nat as ial ah, syn wl be

(em went cn filly de

Straight tine metnog

Under this methods depreciating

ME ones Me Serta eee ee

ee SS

a

ry

Journal entries Cn the fist tv years):

se 5D denominator may aso Be

sage sts J

syD = life * [ _

decor

‘+ Accurate depreciation om Dee, 31, 2012: (80,000 x 2/5. eernrare

‘edges annt the ped pr and Sty

aig aout on De, 20080038 + 200 = 6.000; Wh

‘he dpe mea the nee ped: 3 tee a

gal

esumotyeas gis mene’ ment (OF

seer pe

cnt

0" i ad ack ole, ‘The equipment is estins

a a Prelate PND =

Accelerated depreciation methods al

‘Under accelerated depreciation methods (d isa ot srl ot of epment am

‘methods), depreciation charges decrease over the useful lied) Rest valve am

Asset, meaning depreciation is higher in the early years of dp Deprecsheomoun!

‘ets and erin he era Tas eb talons

Poop tt the capacy of an af TSO ue)

declines ‘Thus, ‘i +1)* 2),

tmp ely yr a rs ot cap» Saree, SH!

‘higher revenues are generated. The following are application ariek

accelerated deprecation: ~ ‘The depreciat + = cumulated — Carrying

& Sum-of-the-years’ digits (SYD) Togitt) 2 %

'. Double delning balance

Pr er

‘Sumt.the years digits (SYD)

i000

Sumftheyens' digits (SYD) depreciation — depreciation 4 viii

‘imputed by applying a series of fractions to the iit mommy sn5 2606718867 7303

mount of thease, aoe gm is 7130 so SD

A faction is derived by dividing the asset's namo mao 3n3 16000

‘eft fey te samo igs retire coe foot wom 2s 106877467 53H

Foreample anasset witha 3yearnacfalife would MONS som 15 53 and 2.000

4 sumotyean’ digits of 6 @ 2-1). The sees of fraction? oan

then be 3/6, 2/6, and 1/6, with 3/6 asthe fraction used in

Yar of thease’ usefl life, 216 in the 2 year, and 30 OF

creasing factions are multiplied 1 the deretable amon!

‘he amet determine the accelerated depectae

Nett epnsedpresin charges are decreasing:

~ .

Journal entries (in the firs to

sehen

| Depreciation

5 oe S

si ease Ss Must 1; Double declining balance met eer

a < ea "eed a piece of eguiPmen

eo int aime ste

Accumulated dey 1 a

om tc

= ype dob dings computed follows:

Pout declining ate=2* Lie

> Poubledetningsate=2*5~ AU

oni

a a

“wire epee mca on

_ adam,

Splenicnc nmewaeret

mi re iqeat neni

Se ered ps: 15 te eden caesar oP SN cigs

40,000

resale

Yat

ian) aon

goa ino -40000 ;

Double dectining balance method am 0000-2400) 4400

the amount derived for

cm ‘Sra

ting balance method — ie

sts ge

cma ae eae

i ot ea

Peale aa te

sig Seat

‘evga dosnt il lw te ei oe

continuing the calculations above,

ante etd manana 400-1) 4-1 hls ARNG

‘he earn amount of the-emuipment. on Decs 31

woul fal Below the #200 residual wale: com «no

saa 4» 1280 caring amor o. 20000 real ie, ThE

imum earying amount ofan asst with a residual value 5

ul tote real vale, Accordingly, only the excess of the

‘tulpmens carving amount as of Dec. 31, 20x3.0ver the residual,

‘aloes recopnaed as depreciation in 20x. This is computed as

The double

ble dectining rate is computed as follows:

follows:

Double decining ate = [ . ]

=e Canina on 2018 0 -a- 24-1

; sie ase wm) 21460

‘Variation 1

Of the double decining i the 250% det Tine 2t —

balance met

ance method. The rate is computed as follows:

The ast

150% detinin 1s fly depreciated in 20x4; Therefore, no

es fy Aoatin rit 3 The depen be

Life

8

Date

Depreciation Accumulated

Teta

Dec 31.200 4000

Denia amy S00

Dre32m3— 14409 73,400

Desa y6t0 80,000

Dc 32,

2 80,000

000

ding

* Cee emo De, 22 m6 ct =

toca cat adi

Senay hrs tr i

is thre istration:

=PIOUONN Usa ie 5 yrs Re

Residual value= 720,000

query tuk we huge the deiceny of BY

as depreation 0 ma

552 000-1648)

“tl depresaton Sage

= Dec. 31, 20x5 equal

we do ht the deprecation for 20N5 would be P25, 920 ca

seus obs + 1550) which is igher than the

“pect of 1728 in 2d, This would violate the concept of

Se ch dole dein lance metho

“Sng or which he dol )

When Oe dob Snel pr Teer he engamout on De 31, 2063

sept pate spied oer he sto Yost and 205)

: tote ih ia eho.

carrying amt

a enya 5203

asm) 20

Iastration: 2

ne Sh ine dpe or 28 and 20S zo

out tte <5

Double dectning ate e-sramtttmy SY a? oo

Reigate ae oe es

131

a

cay,

‘Accumulated

per 21,2081 For PAO,000-

station

ine on Septem

an a useful ie of 4 YER" and a

oon 2-50

on 1-18.00

roo <2

tnx 902-7500

Wag

Correct

Paria

hen eagieition pase aloes

Year deprecatig tet © disposed of during the yea, hei

in 'spronated

race, the ted in order to achieve proper

see a 800 i normally done ee | ane

s month, ‘on the basis 9 [ses | =o

srsonama=28i250 sm x9ii2= 1895

sip 22s afte ant, Acconingy 6

seam a

‘treated

+ a5 ifit has been

of

rattan 1 individual 368 in a Flatively Homogeneous group are

lsposed of during the lst #44) aly sured and disposed of, one of ihe folowing

cmap

Ted flyers eptnin hyenas on

4, Haeineyeot dsp or

nee in the year of acquisition

ition inthe year of @spos

‘known as half-year convention). booms ok

tr

a

SS Sy 2 Se st ree

Seen on

gon March 1,

=

hws ~~ ‘ei

we

133

ocd)

tid Conse om is PO amated total wis

a cn tn eet Go rte cena

ecg. This ig Aung the period, no Depreciation rate =(80.000* 200

asoperumit ofontpit

Ctr depreiton methods

acho PEs epee separately an for ante of PE

tht fas giant pan, each of those pats is depreciated

Sunt. Howee, an tem-byitem depreciation may not be

‘oydin fr umerous items of FPE tht are low-raued and ae

play acute and disposed fn the inkrest of cost-benefit

Depreciation rate= Deprun

> Depreciation rate ~ 800003 syne *Etinated total oA

> Depreciation ate = 2perhowea

Po

> Composite rate~ xrreata 2280+ Annual depreciate

Depreciation is computed.

i Dividing the total depreag

P0Up by the compose mpgs the assets is

a

+ Total cost

asian: Compost method

Cot Residual value Use

Taam 70 200 (Syer

Mere 1000 1m Sys

Reintecenines 3000 2 year

‘The compote and compost rat are computed as follows:

& Composite life Depreciableamount+ Annual de

‘Composite life = 63,000 + 14,000 = 45 years 7

& "Composite rate = Anrwal deprecation +Total cost

Composite rate = 14,000 = 66,000 = 21.21%

Depreciation is computed as follows:

‘Subsequent replacement and addition

In 20%2, old returnable containers costing 5,000 were replay

new containers costing 6,000,

] Accumulated depredation

Returnable containers

| _ tdi cnt

se i ols wt nga sto

Seon

et ein ook cared

Se ac proceeds, only when the aset is

eel

‘Meee av a sn in heads When the

st is place, the cost of the replacement is charged as

‘expense net of any proceeds from disposal.

When anew asset is acquired but no existing asset is

‘piano expense is recogrized. On the other hand, when an

tig sis eted but not replaced, the cost ofthat asset is

dared expense, net of any proceeds from disposal

‘lasation: Retirement and Replacement methods

Islomation on an entity's acquisitions and disposals of tools

ing year isasfllows:

Tatainen wolsocqured 10,000

ont fd tok reid 6000

Panes fom le ofl tools 500

ase Retiement method

‘The depreciation expense is computed as follows:

guseletanmc menos :

peircaccane tenn ero ops ey ial

Depreciation ‘eample, an ent 000 or more and charge 25 €X}

Soe tn Fy = deo

su Te

Case 2: Replacement method —

‘Thedepecation expense is computed as follows:

Cos new ols acuied as replacements (1020 « 22000)

Cov ofall tired but not replaced

Freres fom sl fad tools 0 «9 +1200)

esta mprovemets ade by a tenant 18

epee ae tons me ig te

renova

Depreciation expense leet rs

oe re ar ace ise

Te meres ae test “

wees " 7 - cramnd fare necessarily transferred without charge to 1

moos, ee inn gen fe Improves a

thon eae wh Non

renal » are not leasehold improvements but rather

‘pon of the lease)

Depron s computed as the equipment,

2% the difference between the or

See iran rs edited to a “eased

‘etry nl end the improve

Period, juste for the cod are

hd any proceeds from assct disposal secant and deprecated over thes I of Ut

sii renry method

Prams, 2S Of an entity has a beginning’ balance

1 naltion of tools during the year totaled P60.

Hine lsporals of old tools were P25,000. The balance

Physical count at year-end was P10,000,

‘nec tpt,

Sin Inschold-improvernens- are transferred t0-the

Ladin dl vale nore

Some consider leasehold improvements a intangible assels

forthe run tht, because they are necessarily transferred to the

ldo! at le expiration, they are more of a “right” than

Piyseal ats. Others, however, eat leasehold improvements as

_PEtcase they have physical Substance - this is usually the ase

‘coved in prac. We will us the ater approach:

Te

Screiton expense is computed a ollows:*

eg bat G ae

Kiang BB)” TT Prods trom set depos

100 | 75,00. Depeiation queese)

© Lito end ta (per py coun)

—

0

‘Mlustration: Leaschold improvements

metnod, useful ie, 8

in depreciation useful life, oF

‘On January 1, 20x1, ABC Co. signed a in depresintion method fox prospectively:

oe tere 2 ten-year lease fa etna ts A ey the

Sveyear period. In the first half of Janus 7a? addin A cing mens he a et

incur the following costs: MATY 2022, Ane ero sar fur periods. peiods prior 10

oe ort ation charges made in Past

‘sera improvements to the leased, pat pes

‘improvement have an estima

“be

int of the asset as ofthe beginning °°

vith an etnies Te ant ve ma

tenyears ‘sal el of a on mcd, wef oF esi

+ F290000 for portale (movable) walls eg bem

‘ie five yeas, mae

we alo he allowing procedures when acount

, oe cargos acounting estimates:

ABC Co. reasonably certain to

tte eee ra

pe Gaing amount ofthe assat as at the

eyecare pe)

cay ps ei al teens and he

ting neue dufing 2 painter pe he

Si oan amped at he ening of tat

smtp fegs Apel be ange oes ing

freer

272 Depth ying amount computed in Sky 1 sing

she vad depreciation method, useful ie or esidual

‘he

sao: Changes in acounting estimates

‘Onn 120, amenity acquired a machine for ¥2,000,00. The

ache was eimated to have a useful Wf of 10 years and a

"ida valu of 2.000000.

Only the #500800 geen, =

2 leasehold improvement. The ther eens are recorri

red istures. Swe mppind as fr

‘Se Change eprection method (fom DDB to SLA

ec

=|

tine wat ial depretedwsng, he dsb |

tin med In 2b, th erly ange |

nti meio tothe stag ne ete

~, Sale|

"vin at cept

Step 1:

: amount 3s atthe

+ Double dangtatns sae of the

Carying anton Jens 20st

Ub)orawingre

vine

S162 Apply the change

(hey

Siming amount njan (se fom DDB to SL.np

Senge Bette eb ym 3

depreciation ye)

ation

al

eldeenyeate

‘Accateied depen,

Carrying amt. onan 1-5)

Step 2: Apply the change Ge,

Carrying amt. on Jan. 3,200” "5° 9 Dpp)

Multiply by: Double deciing ra,

Double declining depreciation neg uy

in:

Solution: 2047

Period ofc,

‘method Ghom SYD to DDB)

‘corte sing the me

entity changed its

Ray changed 3 depres

from austin date

sl ie

aN ent and te esd ae F200.)

yp ¥Cayng amount 2 ate beg. ofthe pri of

Seeing emt ono 1,2 aN-s).7000"2M

change

00000

2s apply the changes (ie, useful if residual value)

SE ofthe period of change

crys 14600000

nto, 20

sda wae 2200.00)

Depeitie amount 12,000000

Diet: Revd eainingwsfl Me 3). -29) 2

Red nal dpreiation tring in 204 0000

Jus ne

TEI | Depedatin expense Tm

ase] pcumulated depreciation 1000000

ie, enor tte ot fuse, ane abandoned properties

‘ass tai, emporrly ake outa se, feted rom

‘ive or sandr re conte to Be epee wl the

lof wel fe. PRS 5 defines abandoned ste 38)

1} Thesis dae a

© Tee fly depreciated

forsale" under PRS

‘tht ae tobe usd to the end of thei economic ie or (0)

‘el eto beloved rather than old,

saw ™ sig msn whe depen ay

‘Thess disposed of through slo permanent 7

7 (le ws

41 The ase nat used in production durin

re capable of operating in the

Aeprecatin meth weds selon actu us ale an item capable of Pea

usage SERIE cons inal et hase 1b Bh?

Ful epee atts = seta oS rss

assets considered fully depreciated when its tit operating ses cor all of the entity’s

‘ster alti residual val, SAyingamg lS Cas fling o worgaizing Pat

decrease in the residual value of a fully a pets PAS)

een sada depen expen, ne espn era when teri

PAS 16 the note disclosure A a

‘senest expend

se tant dition FP and

Near eco eis wil BW 1 he

We a eat canbe mes ry eta

al ata expen

Te ct at does nok ually under the

opis opel ey. Tis cost cls

purpose retin Eee i 3 (a) an extension inthe

The of (rather than the account Future benefits may ben the form ofa) ane

Tinietancatecat ioe he eect cam ger hm ee coe

Tn conjunction wih ae coun. tsk ria or ici

‘procedure called ‘set isting, an internal contd

‘Gt came to matin orto ring back an ast to ts

relly is recognized as expense

i lesan at aby t facto intend

Uiinagenes capacity of a building to provide adequate

‘pectpoapanisand capac of factory equipment to prodce a

‘getty of tpl witina cea nerame

fier tothe ably of «PPE to produce economic

‘eit teat cot and east ime, eg, gas consumption of a

cei ono mieage

74S I ends to dstvor the capitalization of subsequent

‘pests FAS I6peciicaly addresses ony the capitalization

‘a sabequent expenditures that relate to replacement costs and

‘eas of mar inspectims. Accordingly, other types of subsequent

eee, oe only if management can clearly

that the sq litures under the

—. ibsequent expenditures qualify under th

Costs subsequent to intiat

Capitalization of costs

ceases vine go

condition necessary fort tobe page NE the eatin a

intended by management The ys PR inthe a

‘on PPE are recognized as expenscy "Qi expenditute

2 Costs of day-to-day servicing ay

maintenance expense). Se, repairs a

> Nee

Rigi

oe

"Major types of subsequent expenditures,

ons

‘ins ew mai to an ase that ing

Bl acy ction, wh eats oul

‘enue anew ass mtd eg, the

a the adiion of » we

re pen ht ares in his aa isthe ac

‘See Rist obe cg secure a «see

cot lwn an eld wall to mat

tbe adtion or an expense

Seat saate

‘=siy hod not anticipated the

‘concrete for fort ose ft le

‘te ia Ayo the Se

wooden fa) eet wooden floor fort

Improvements

Example

‘Arent incur 10000 impor,

com

Case 1 The improvement ext PY EP

costar aptalizd a foley gg, TRE

a >

lopoven et te opments

paves gical reducd te ep

ee ‘such that the equipment is Baa my

on a say PS

isfllows aa]

ary eine 10.00,

sh

re tmaorpars 7

re ert ed 0 bela The es

Seen lo PE apa he respon

gi he epic pr (pa

cad Sarge st ors fetes at ld

‘Shen rn prt or

eee ep pr camot be determin the

ete pment uo par) used sa dono

metered uso te ie es ued

onan

aro:

(nf 2, an ety aquired an aireraft fr 6,000.00, The

sic ws depreciated over a useful life of 10 years using the

Sta ie math. On Jan. 1, 25, a major pat of the airrat

sl feral cost of PS, 000.

(et Tecate ol parts 500,00,

‘Teper seconded flows:

[53 Acute depesation gaa swioy | 200000

saxo

lominseplaeent es saan |

Deer equipment - aircraft pt)

Dale appear ew

as | ca

Case2 The cst ofthe ld part isnot determinable.

‘The rplcement recorded a follows:

Tat Acai depeation X40) | 320,000

25 | Lew oeplaenet ogee 480,000

Deine equipment arr pat) ‘sp

Fe) Daves equrment- rsa) | 800000

1s | Ca

rege eer pcre oe

7 Fhe all pr cane be cermin te cosa the ew at

sinduitectearl ad pr

hr pr nas dpe Separtely oF nok ie a

amount charged as loss = 7

Major inspections

Rearrangement and reinstallation

earangement refers to rearranging the lyoat of machinery i

Sey amine tn fay opt an pro

and reinstallation costs are normally”

Rearingeent

ape genes becane te apts oc ete onet

SSePPE is apable of operating in the mann ogalty tendo!

by management. Rearrangement 2nd ‘eingallation costs I

“ ~

ua

ye ti te es)

sn me th

se

— .

pain maenance costs inured’ to Keep assets in the

joao sol ation are expensed. “These are usually presented in

Sr Spin man

a ‘uamples include costs of regular replacement of me

siete pepo spi

wa it determining,

apenas

car ee mae

ne aoe or

ecapitalize.

=

we ct ame mnt mu

Se a

Se casa

z

> Faris “te price that would be received to sell an asset

trp ttranter ibility in an orderly transaction between

et prints atthe measurement dae" (PRS 13.AppE. A)

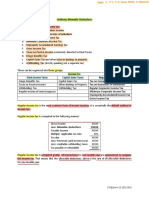

fasisoreauation

4 ety apples PFRS"13) Fur Value” Mensurement_ when

‘enn te fr value ofan asst that is being revalied. PERS.

‘isan nt:

cide the nonfinancal asses highest and est se,

een from the perspective of market participants:

sete fair alu hierarchy; a

sesnappoprite valuation technique.

Natest nd best use

Pole bat isthe US of a nani asset by market

sofas ht would maximize the value of the asset or the

FS

rap ol sets and niles (eg busi

pon caaaaad leg. business) within whe,

‘The highest and best use of a non-financial asset 7

scout he lloig, ‘ake

1 Phyl dnc ofthe no fnaclal as

(or sie of the property); oot (Ola

0. lap matic on the we of the none-financtal

‘toning regulations applicable to the proper ahaa

Fran asbty "wher thee OF he asset gen

adequate income or cash flow's. mee

set eg

fo ceelemcy

i oak gi

ee eee and comparability in fair vake

vale hierarchy that cea, EEESST® coat approaches he amount hat is carey need!

CS the service capacity of an asset (ie corer

replacement cost)

4. Income approach - converts future amounts (cash OWS

single current (discounted) amount,

income an expenses) 199

Teneting curent market expectations about those future

amounts.

In some cass, a single valuation technique would suffice

wheres in thers, multiple valuation techniques would be more

appropriate.

‘Accounting for revaluations of PPE

‘a inaease or decrease inthe carrying amount ofa PPE. cesulting

‘fom revaluation i recognized in other income and

‘ccumlated in eguity under the “ “surplus” account,

cet forthe folowing:

2 An ome tat represents a reversal ofa previous impairment

Isis ognized in profit ls as ipairment ain

1 Aderesein excess ofthe credit balance in the “Revaluation

in prot rls a impure

153

12 es

2 es ee co tere)

cannot be expected to possess the same lee of

‘The revaluation increase or decrease is com rant

= : “eho of @ profess

kare en el niyo provide the

= = fs et eaten

The ent valuation. The highly techie

“spent approach

Te tt nc ar vale measurement i based on he

ee are ey a, at

sis sir opr Tears cone ne

sete a timed Re FIOWNE

rene deer te Tcaton of he propetty being

+ te ation othe propery hat was ee

se aly tat the recent sale price elects the

ttn propery eng revaud ,

| ETD matin = eg accssbilty, panoramic views

Fae and oie, and proximity 10 business

Sto ie schools malls and he ike may alee the

‘Sra ofthe propery.

Sayre. tot aes and or area

Fst ties = eg. desig, con

hinge nde ie

PUted uy

“The trae deerme yep tan eo

SNPS Sear Manes a

iustraton:

‘On December 31, 20, an nyu with ahistorical.

with ahistorical cost

720000000 and cumulated deprecation of P5,000,000

Seem 1 hea a of POND Te og

‘remaining useful life is 20 years wie |

Requrements:

8. Compute fr the revautn:

. Compute forthe anal ome,

Assume straight ie after the revaluation

of the property,

Solutions:

«lr on the property ~ eg, deed restritons and

Requirement (a: coca

Fair value soma f Beste

ess: Carrying amount cam, 00 Uh eat ph fi vale measurement is based on the

‘evaluations an 15,000.00 J ear caren needed to replace the asset current replacement

‘The fsicpremise under this approach is that “an informed

‘oye wil nt pay more than the cost of constructing an equal,

‘hte propery minus the deprediation and assuming, 10

"sary ren

The eat approach is most applicable when there is

‘tice dation tecent market transactions for similar assets,

Fair value - 121/91

east beng revaled is relatively new or of special use, and

Divide by: Remaining use li

Annual depreciation afte N ss

25,0000

Ll

: . 155.

ppg tet) $$

there is adequate pricing information to value th enn srt

le the ceive age is 30 years

components. Property ut agi 40 years ae eects 2° i ee

tN estimates can

‘The cost approach involves the oe ‘market and applied with

steps:

So cn te :

Tees ope cd apa

2 Estimate the deprecation taking into account the

physical deterioration, functional obsolescence and i

ee

3. The ference between Ian (2) the ft:

value.

4 Faire ess caring mats the revaluation supa,

llusation Cost Approach

December 3,2) nents tulding with ahistorical ca

000,000 and accumulated depreciation of | P5,000010

"ind physical characteristics of the

anorg athe the outside the cope ofthis book)

pein vaed Ts ou

ota econo ife= Eee fe + Rernning comme

(03-40

> Reming

ofthe dat ofthe revaluation.

emo fe tne remaiing life of the Building 2s

reagent AC

5 yeare fir

ie Fo ; se or 1) ~ the number of

i“ _ eres > i ped ine censtcian of the BAIN was

eionet: Copter be relaton surplus

Sotuton

“The fair valu is measured

Replacement cost lis:

{Depreciation 05M x 06am

Fair value

‘Notice ht the ata if is gard inthe computation’ of

the derciten above. "The actual age 1s never used in the

‘gee mcd of estimating depreciation” 0a Soa. St

See, peor a

Replacement cost (current cost) is the amount of cash that

ould hae tobe paid ifthe same’or an equivalent asset was

tgquired currently. Replacement cost cannot be used as basis for

‘he ealuton ofan asset that is already partially depreciated.

Therefor, the replacement costs adjusted forthe depreciation to

came up ith alle the deprecated replacement

meth ef ae local he era pi

“is approach to fair value measurement is based on the

on of sun lu, Sou wae isthe equivalent of the cost of

‘pceentof the service potential ofthe asset, adjusted to rele.

excorasan ag i oe) ~ ix t88 on the oboe

stiective ile may be ile og yea has sustained: ™

The estimation o he gen a it

For example, “You are singe and are subject

know your date is $0 year

notice that your date aks gaat “Pou finally meet

‘he relative fos in is wiity due

faction 10 the passage o

a pede pty hat halen te

= penises GRUNER uae

assume that the propery beng Daler

Les: Carey

ing amount aosman-.

Revaluation surplus aon

Alternative solution:

tution: Using percentage depreciation

Replacment cot oxo

1 Depecon ha) a

ar oalae re

1s: Camying amount 26,2500

Revaluation supa ee

11,250.00

‘Pome prin ie Me Twa

Mesto 40-25%

pcr tt ss

omni ont

semen Yo inp deans np ee

five itd al carat n E

eg nce eg

rt wton ne ued sgn ht cost. We A

‘Traditional GAAP

‘method

Under traditional accounting. the

effective life is used when determining ath. tathersthan

the cat appro Te san es lac

2 sopiiaon: an

should ot be construed

propery valuations POE he rnp of at!

(Ea i

(nea as a useful life of 20 years

oper cost

137

punt Een a2

GAAP method

ip cguied a building for #2000000

and a residual value of

sy ae, the bing is sessed 1 *

wand a residual value of F800,000.

sitcoms ve evaluation sD

si

otc 22,000.00

amr deprecation 2M 008) 720 300.00)

fare 16,700000

ping anon [GON 50K) 5720) 45,125,000)

Aton sat 1575000

P~ Percentage of depreciation

astaton 2 Traditional GAA

mation follows

ney realoed its building. Relevant infor

Replacement cost

Historical Cost

Baking 12,000,000 15,000,000

Auman deprecation $0,000

Aepenn Compute forthe revaluation surplus.

Sse

hanes

15,000,000,

eee peo 000.000)

1000.00

eying amount (248) 9.00.

tinue 000,000

Thelncome approach

Under tis approach, the Valuation’ is based-on th,

‘neha the prety ca

ea, ED: Th

eee Seong pees cape

» pent dunt at

‘eal othe anount determined in a) abore

emt RG Din ne epi

‘Methods of recordir

era ene lad

‘teed ama following

Pept ae

th te

Grea SMB amount and the accumu

(esstin oe pevalued asset are increased either by:

Tren MPlcement ost and the red

.

Popa ads

Tet Sites based on the change in te

‘ ‘The silat

ane Paton is eiminatd against the gm

of the asset,

Bsn.

Dec. 3 an,

to hae y leprecation of 10,000,000 ¥

‘toms ng "ATO POIANA

Ute le

2

re years

Income weet myer

sox

ee A

Which

real i crying amount is ads

159

i rovide he entry 10 record the revaluation sop

areal he following methods:

A roportional method

4 Bimination method

ace «200200

en 2609) 1400000

pe cs "28,000,000

en (10,000,000)

ean 2180

orang f 730000

(eee (89 60000

npn fa 70000

ocean

rtm elie ie Renaiing cnc

Aeprenent a): Proportional method

yunts are determined as follows:

Tepbcoent oot Ie

Historical Cost

720,0,000 zoo 22000000,

Aas dest (10 qgonoony 00,000,

caypecrise _—_ saamn.000 ‘00000 180,000

[Bling neat

‘Accumulated depreciation ta)

evalatonsrpls

Daler iby ©

"AST rus then fered tity a0 ep

‘Gan aig tuto, cong er cme aes ise

te gerade Ang Pa 2

The biingseamyingramourt after posting the entry

‘Sovels anayzed a follows:

gaat iy so) «000.000

ulated depreciation (10M + 4M) (14,000,000) _

out fer evaluation plane) 2,000,000

pal

wo 161

tid

Requirement (b}: Elimination method pie i Propet the revaluation is recorded: BY

Te Piunicteamutmhlatn foe neg nto ele

Oy, | Accumulated deprecitonwimbation 10,000,005

‘Bullington ae 8,000,000 Sn roto

L_|_eteredtartsbiiy | b Z determined as follows:

7 Sawil Cou ——Firvalue ch

® buildings carrying amount ‘er Posting the amy 7

shove is analyzed a folows

a a“

Accumulated deprecation ga) ms

Camying amount fer rraation ae irae

ely based on the change inthe camry

KE

) |e

25000 Fs 2s flows

ree w Toa ange Reval maa

‘nin mi, tn evaluation samp :

th mite ete tay ae med a, aoe,

balance ofthe accumulated dere Besson (sna) _ter_aeese) —

recorded tothe asset scant The balancing figures Geegeae some

‘Mlustration 2: Market appro [alg 2) jco0.000

On Oe ny anit i etm ation 80 cord

Pano and aces Mg with historical costo f|™| arse aay an

Sar Me a no Ltt =

Ae ination method

Requirement: Provide the ety to wed deprecation imag | 500000

under each tealowing mange nt eatin spl Win scare somoa

Proportional method Deere ta ail a7

‘b. Elimination method 7" |

Solutions ‘etiingsanying mount fer he revaluation is analyzed

Pair value Stee ; na

tes Caring amount ag 2400000 I $$ —airaton—

cert tk OMS) qsam0 | Eaiiarancay sanyo — 2400000

Revaluation surplus net of a, mn, |e SS Oa

Ses

_ £20

ont

re

aoa doesnot cfr mater ofits is 30%

pn ce xa pple 1 Prot ST

soon core hk

: jane profs made on hese of POPE 5%

aed

eo chameetenes cae

ae, ee omen,

tan cane al

Revaluation lied to all assets in a class

Revaatiese appt an entire class of

ety ras ene of its bul

ted as Follows

spe vation surpass computed

iene

Cyingsonnt a

nation srl Before

PPE. For exam,

7

stat ne ne

— ‘amount, which is most likely through sale

semtrctg ae st

es

dapat and er

mate tt cs

don foregoing, te appropri tx rate thas

one zing for eauation surplus

%, 1 eda ‘accounted for as follows: ar

a 7 pie ‘transferr 66, land, thea i ‘Deferred tax liability (15M x 6%) 900,000,

Pa a yo oa Revaluation surplus (15M x 94%) 100,000

6 oe rvct eesti deecognized, +

a arg tl Parton of the revalti Fh aatin psi presented in he 2

1 Sant of prt or sted oter comprehensive ico — as

Cain on propery recauation,” a component of ther

comprehensive income; and

1. Stdonn of aca pation — as part of “Other component of

guy.” The related defered tax liability is presented Jn

scumenthabiiies

toe tered each year sequal 1%

Geri moun lepreciation based on the revalue!

concatenate

‘Subsequently, the revaluation surplus and deferred tax

Leann su sd pone aby, weet I

i {eg sold or disposed of

ee + cea e.

atin of

3 Dat ateeprecable asst

oF F200 hae pee’ AM ABC Co. witha historical cit

red to have a fir value

~

ee tax lability

evaluation sucplUS

{0 both the revaluation surplus and the related defer

liability

> On January 1, 2033, the land was sold for 30,000,000,

iodically transferred

The entries are a follows: = oun of revaluation surplus tat is pet

Ten] Cash, 30,000,000 Te amos ings computed 23 i

7 | Loss on sale 5,000,000 _ ti reed aialue (eed

Land Tepes sed on stoic ost

mee Dagon bse loli)

ten © Revaluation surplus 14,100,000 reece gross oft 1,050,000.

*9 | Deferred tax ibility 900,000 er jus - net of tax (1500000%70%) 1,050,000

Retained earnings ae 450,000

Income tax payable ity 1.500,000%30%)

"mond erro oan

sehen aden tee flows

stented an 500

: 3500,000

Ilustration 2: Revaluation of depreciable asset 4

On December 31, 201, the building of ABC Co, with a carrying 1,050,000

amount of ?20,000, Useful life of 10 years wis "450,000

determined to hav

735,000,000. Income tax rate 1,050.00)

ildings using the straight-lit

The revaluation su

Fair value

"plus is computed as follows;

ico — dom = of transfer and reversal may also be

sation 7 i am

Les: Defered tax laity (184x304) 4,500,000. Spud foo Revaluation surplus Deferred

Revaluation surplus after tax "70,500,00, ~ met of ta liability

December 31,201 seettows: 1 gins a 10

The entry on 20a 83s foows: — a a

: : . ‘al tneeseal —_ts0000 450,000

=

©

You might also like

- Vatable Transactions PDFDocument5 pagesVatable Transactions PDFJester LimNo ratings yet

- Intrams 2023 Waiver 1Document1 pageIntrams 2023 Waiver 1Jester LimNo ratings yet

- AUDIT OF Shareholder's EquityDocument5 pagesAUDIT OF Shareholder's EquityJester LimNo ratings yet

- Lim MT2Document2 pagesLim MT2Jester LimNo ratings yet

- Installment Sales QuestionsDocument29 pagesInstallment Sales QuestionsJester LimNo ratings yet

- Gross Income ActivityDocument2 pagesGross Income ActivityJester LimNo ratings yet

- Ordinary Allowable Deductions 1Document19 pagesOrdinary Allowable Deductions 1Jester LimNo ratings yet

- WP - Forex Practice SetDocument8 pagesWP - Forex Practice SetJester LimNo ratings yet

- AEC 54 Asynchronous Activity Accounts Payable and Purchases 102922Document4 pagesAEC 54 Asynchronous Activity Accounts Payable and Purchases 102922Jester LimNo ratings yet

- SWOT AnalysisDocument20 pagesSWOT AnalysisJester LimNo ratings yet

- Quiz 9 20Document2 pagesQuiz 9 20Jester LimNo ratings yet

- Solution Manual Special Transactions Millan 2021 Chapter 1Document14 pagesSolution Manual Special Transactions Millan 2021 Chapter 1Jester LimNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)