Professional Documents

Culture Documents

GST Question Paper

Uploaded by

ramaswamy dOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Question Paper

Uploaded by

ramaswamy dCopyright:

Available Formats

lOMoARcPSD|5376085

Goods and service tax previous year question paper

B.com finance and taxition (Mahatma Gandhi University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by ramaswamy d (rdramaswamy@gmail.com)

lOMoARcPSD|5376085

Downloaded by ramaswamy d (rdramaswamy@gmail.com)

lOMoARcPSD|5376085

Downloaded by ramaswamy d (rdramaswamy@gmail.com)

lOMoARcPSD|5376085

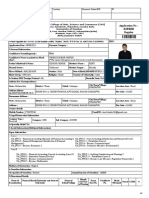

QP CODE: 21100522 21100522 Reg No : .....................

Name : .....................

B.Com DEGREE (CBCS)EXAMINATION, MARCH 2021

Third Semester

Optional Core - CO3OCT01 - GOODS AND SERVICES TAX

Common to B.Com Model I Finance & Taxation, B.Com Model II Finance & Taxation, B.Com Model

III Taxation

2017 Admission Onwards

FA7E3AC8

Time: 3 Hours Max. Marks : 80

Part A

Answer any ten questions.

Each question carries 2 marks.

1. What is tax cascading? Elucidate with an example.

2. What is UTGST? Explain with an example.

3. Write a short note on GST Council.

4. Define “Input tax” in relation to a registered person.

5. A new mobile handset is supplied for Rs. 25000 exchanging an old phone. Without

exchange offer the price of the handset is Rs.30000. Determine the value of supply with

explanation.

Corporate services firm A is engaged to handle the legal work pertaining to the

6.

incorporation of Company B. Other than its service fees, A also recovers from B,

registration fee and approval fee for the name of the company paid to the Registrar of

Companies. The fees charged by the Registrar of Companies for the registration and

approval of the name are compulsorily levied on B. Is the recovery of such expenses is

part of the value of supply made by A to B. Why?

7. How is input tax on goods sent for job works treated? Narrate with a practical case.

8. Who is an Input Service Distributor? Give example.

9. How will you determine the value of supply of goods between related persons?

10. Explain the rules regarding registration to persons required to deduct tax at source or

collect tax at source.

Page 1/3 Turn Over

Downloaded by ramaswamy d (rdramaswamy@gmail.com)

lOMoARcPSD|5376085

11. Mr. X, a registered dealer purchased goods of Rs. 1,00,000 plus tax 18% (9% SGST +

9% CGST). Later it was found that the transaction was actually inter-state supply on

which IGST was applicable. Explain the tax implication under GST.

12. How long the accounts and records are to be maintained under GST?

(10×2=20)

Part B

Answer any six questions.

Each question carries 5 marks.

13. What is GST? Explain the major features of GST.

14.

Mr. X, the owner of a printing press purchased printing paper for Rs. 4,48,000

(inclusive of tax 12%) during the month of October 2017. The paper has been used as

during the month itself, follows.

i) One third of the paper is used to publish academic books (not taxable)

ii) One third sold to a manufacturer in special economic zone (zero rated)

iii) Balance used to make envelope (tax rate 18%)

Assuming that Mr. X has collected output tax Rs. 45,000 during the month, compute

input tax credit and tax payable for the month.

15.

X Ltd. has four independent divisions of operation South, North, West and East. The

turnover of these four divisions during the relevant period was as follows.

South Rs. 40 crore, North Rs. 70 crore, West Rs. 50 crore and East Rs. 30 crore.

The company installed a common software at a cost of Rs. 23,60,000 (Rs.20,00,000

plus18%). How should X Ltd. distribute input tax among the four divisions.

16. Explain about Composition tax under GST. What is the tax impact when a composition

dealer become GST dealer?

17. How is input tax credit dealt with in the case of sale, merger and lease of business?

18. Explain the contents of electronic credit ledger.

19. What is TDS in GST? Explain the provisions related to TDS.

20. Explain the provisions related to Best Judgement Assessment.

21. Tax evasion is not possible under GST. Why?

(6×5=30)

Part C

Answer any two questions.

Each question carries 15 marks.

Page 2/3

Downloaded by ramaswamy d (rdramaswamy@gmail.com)

lOMoARcPSD|5376085

22. Explain the provisions relating to value of supply in different situations.

23. How will you determine place of supply of goods and place of supply of service?

24. Explain the important provisions relating to tax invoice.

25. What is an E- way bill? Explain its importance in GST system and summarise the

provisions relating to E-way bill.

(2×15=30)

Page 3/3

Downloaded by ramaswamy d (rdramaswamy@gmail.com)

You might also like

- Income Tax 1 - 20223Document3 pagesIncome Tax 1 - 20223nimalpes21No ratings yet

- Terminal Test March 2018Document6 pagesTerminal Test March 2018Laksh VermaniNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument17 pagesFinal Examination: Suggested Answers To QuestionsRohit KunduNo ratings yet

- Theory & Practice of GSTDocument3 pagesTheory & Practice of GSTnishatNo ratings yet

- Financial Accounting II MinDocument4 pagesFinancial Accounting II MinAsna Rachal ShibuNo ratings yet

- CT 1 - QP - Icse - X - GSTDocument2 pagesCT 1 - QP - Icse - X - GSTAnanya IyerNo ratings yet

- QB GSTDocument12 pagesQB GSTJeevitha ReddyNo ratings yet

- Practical Question Bank: Faculty of Commerce, Osmania UniversityDocument4 pagesPractical Question Bank: Faculty of Commerce, Osmania Universitymekala sailajaNo ratings yet

- Vision Classes: An Institute For IIT-JEE (Mains/ADV.) & NEETDocument4 pagesVision Classes: An Institute For IIT-JEE (Mains/ADV.) & NEETdick kumarNo ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument11 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- Idt Test - 3 (CH - 8,14,15,16,24)Document12 pagesIdt Test - 3 (CH - 8,14,15,16,24)amaan sheikhNo ratings yet

- P18 PDFDocument14 pagesP18 PDFsiva ramanNo ratings yet

- Mock Test Series 2 QuestionsDocument10 pagesMock Test Series 2 QuestionsSuzhana The WizardNo ratings yet

- Income Tax - I 2020Document3 pagesIncome Tax - I 2020nimalpes21No ratings yet

- FMDocument18 pagesFMPriyanka DashNo ratings yet

- Idt AacDocument177 pagesIdt AacVinay KumarNo ratings yet

- GSTDocument11 pagesGSTvamshi9686No ratings yet

- GST Assignments For B.com 6TH Sem PDFDocument4 pagesGST Assignments For B.com 6TH Sem PDFAnujyadav Monuyadav100% (1)

- MTP 2 Idt 2019Document10 pagesMTP 2 Idt 2019kartikNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationDocument6 pagesMTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationvijaykumartaxNo ratings yet

- Section: A MCQ 20X1 20 Marks: A. B. C. DDocument12 pagesSection: A MCQ 20X1 20 Marks: A. B. C. DSarath KumarNo ratings yet

- Telecom Sector - GST Project - Group M - Sec (C)Document37 pagesTelecom Sector - GST Project - Group M - Sec (C)0443GomathinayagamNo ratings yet

- Fac511s - Financial Accounting - 1st Opp - June 2019Document8 pagesFac511s - Financial Accounting - 1st Opp - June 2019FrancoNo ratings yet

- Frequently Asked Questions: Q. What Are The Common Exit Formalities After Resignation?Document12 pagesFrequently Asked Questions: Q. What Are The Common Exit Formalities After Resignation?anshumaan upadhyay100% (1)

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- 7th Sem BINEET SIR PROJECTDocument12 pages7th Sem BINEET SIR PROJECTAnamika VatsaNo ratings yet

- A This Question Paper Contains Three Pages.: Be Used Throughout The PaperDocument3 pagesA This Question Paper Contains Three Pages.: Be Used Throughout The PaperTushar KumarNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument9 pages© The Institute of Chartered Accountants of IndiaSuresh TamangNo ratings yet

- AFM 2021 BatchDocument4 pagesAFM 2021 BatchDhruv Shah0% (1)

- P11 QpmaDocument7 pagesP11 QpmaRehan RahmanNo ratings yet

- CA Final IDT RTP For May 2023Document19 pagesCA Final IDT RTP For May 2023Nick VincikNo ratings yet

- Paper18 - Set1 Rev AnsDocument15 pagesPaper18 - Set1 Rev AnsSanya GoelNo ratings yet

- ACCT103-23S2 L09 Bookkeeping3-StudentsDocument18 pagesACCT103-23S2 L09 Bookkeeping3-StudentsowmferrierNo ratings yet

- Handbook On Works Contract Under GSTDocument56 pagesHandbook On Works Contract Under GSTABC 123No ratings yet

- Cl10 Math Revision WS-GSTDocument2 pagesCl10 Math Revision WS-GSTpreetakaran12No ratings yet

- Group G E-Commerce IndustryDocument28 pagesGroup G E-Commerce IndustryNitinNo ratings yet

- Income Tax MCQs 2020-21 - Income Tax Laws and Practice MCQs - Objective Questions and AnswersDocument18 pagesIncome Tax MCQs 2020-21 - Income Tax Laws and Practice MCQs - Objective Questions and AnswersSomyaNo ratings yet

- Bcom 5 Sem Cost Accounting 1 20100106 Feb 2020Document4 pagesBcom 5 Sem Cost Accounting 1 20100106 Feb 2020sandrabiju7510No ratings yet

- 1idt PDFDocument19 pages1idt PDFShantanuNo ratings yet

- Question Bank GSTDocument6 pagesQuestion Bank GSThimanshuNo ratings yet

- GST & Charge of GST PaperDocument3 pagesGST & Charge of GST PaperDevendra AryaNo ratings yet

- 18 GSTDocument1,042 pages18 GSTSwetaNo ratings yet

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- Mighty - Top 50 QuestionsDocument79 pagesMighty - Top 50 QuestionsjvbsdNo ratings yet

- Cma RTP Dec 18Document34 pagesCma RTP Dec 18amit jangraNo ratings yet

- Test 1 SolutionsDocument20 pagesTest 1 SolutionssamanialenaNo ratings yet

- Theory and Precatice of GSTDocument3 pagesTheory and Precatice of GSTakking0146No ratings yet

- Idt MCQ - QuestionsDocument3 pagesIdt MCQ - QuestionsKhader MohammedNo ratings yet

- Constituent Assembly DebatesDocument93 pagesConstituent Assembly Debatesaridaman raghuvanshi100% (1)

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Bcom 2 Sem Financial Accounting 2 20101139 Nov 2020Document5 pagesBcom 2 Sem Financial Accounting 2 20101139 Nov 2020Akhil AbrahamNo ratings yet

- Bcom 4 Sem Entrepreneurship Development and Project Management 21100877 Mar 2021Document2 pagesBcom 4 Sem Entrepreneurship Development and Project Management 21100877 Mar 2021Vimal AnilkumarNo ratings yet

- Nitin 21015126033 GST Final Report.......Document50 pagesNitin 21015126033 GST Final Report.......ks841932No ratings yet

- Chapter 3 Charge Under GSTDocument10 pagesChapter 3 Charge Under GSTabhay javiyaNo ratings yet

- Complete GST Book PDFDocument351 pagesComplete GST Book PDFAGNIHOTRAM RAM NARAYANANo ratings yet

- I Got All These Questions Collected From Our MembersDocument15 pagesI Got All These Questions Collected From Our MembersvishalNo ratings yet

- Project Class Day 11Document6 pagesProject Class Day 11phogatNo ratings yet

- Simplified Goods & Services Tax (GST) For Hotels & RestaurantsDocument14 pagesSimplified Goods & Services Tax (GST) For Hotels & Restaurantsvishaljain_caNo ratings yet

- Dec 18 Cma SuggDocument13 pagesDec 18 Cma Suggamit jangraNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- NYPD 'Stop-And-Frisk' Policy Ruled UnconstitutionalDocument157 pagesNYPD 'Stop-And-Frisk' Policy Ruled UnconstitutionalFindLawNo ratings yet

- PP Vs Cesar Dela Cruz y Libonao Alias Sesi of Zone 3, Macanaya, Aparri, CagayanDocument2 pagesPP Vs Cesar Dela Cruz y Libonao Alias Sesi of Zone 3, Macanaya, Aparri, CagayanAnonymous aDY1FFGNo ratings yet

- Analog Circuit Design Discrete and Integrated 1st Edition Franco Solutions ManualDocument12 pagesAnalog Circuit Design Discrete and Integrated 1st Edition Franco Solutions Manualunshelvemarined.fe10y100% (45)

- Elaine Brown, A Taste of Power Pages 105 294Document1 pageElaine Brown, A Taste of Power Pages 105 294apmendez317No ratings yet

- Case Study#2Document1 pageCase Study#2Kyle100% (1)

- Cancellation of Title Vs Annulment of JudgmentDocument20 pagesCancellation of Title Vs Annulment of Judgmentromarcambri100% (1)

- Political GlobalizationDocument5 pagesPolitical GlobalizationAadhityaNo ratings yet

- BOC v. PDBDocument2 pagesBOC v. PDBRuab PlosNo ratings yet

- BirlaDocument2 pagesBirlaviresh shindeNo ratings yet

- Contracts Flowchart (Oshi)Document7 pagesContracts Flowchart (Oshi)JjjjmmmmNo ratings yet

- Contempt-Kinds and Constitutional ValidityDocument22 pagesContempt-Kinds and Constitutional ValidityShrutiNo ratings yet

- CCA Recommendation ReportDocument7 pagesCCA Recommendation ReportWVXU News100% (1)

- Texas Certificate of TitleDocument2 pagesTexas Certificate of TitleArq Isaac TriujequeNo ratings yet

- LBP Vs TapuladoDocument3 pagesLBP Vs Tapuladojun junNo ratings yet

- Icici Prudential Life InsuranceDocument19 pagesIcici Prudential Life InsuranceShubhanshu DubeyNo ratings yet

- Chap 5 Accounting For Merchandising OperationDocument71 pagesChap 5 Accounting For Merchandising OperationtamimNo ratings yet

- 15-Legarda v. CA G.R. No. 94457 March 18, 1991Document6 pages15-Legarda v. CA G.R. No. 94457 March 18, 1991Jopan SJNo ratings yet

- Environmental Impact Assessment Report On: Corrugated Galvanized Steel Sheet, Steel Profile and Insulated Panel Production ProjectDocument80 pagesEnvironmental Impact Assessment Report On: Corrugated Galvanized Steel Sheet, Steel Profile and Insulated Panel Production ProjectMekon-Engineering Mke100% (1)

- Antazo, Adrian - GOVERNMENT OF THE UNITED STATES OF AMERICA vs. PURGANANDocument2 pagesAntazo, Adrian - GOVERNMENT OF THE UNITED STATES OF AMERICA vs. PURGANANDenz Christian ResentesNo ratings yet

- United States v. Hadley, 10th Cir. (2003)Document3 pagesUnited States v. Hadley, 10th Cir. (2003)Scribd Government DocsNo ratings yet

- Corporate Governance in IndiaDocument29 pagesCorporate Governance in IndiaMH PHOTO CREATIVENo ratings yet

- Nature of CrimeDocument105 pagesNature of CrimeRajatNo ratings yet

- Acc501 Assignment Solution by Pin and MuhammadDocument2 pagesAcc501 Assignment Solution by Pin and MuhammadMohammadihsan NoorNo ratings yet

- (A41) LAW 121 - Segovia vs. The Climate Change Commission (G.R. No. 211010)Document5 pages(A41) LAW 121 - Segovia vs. The Climate Change Commission (G.R. No. 211010)mNo ratings yet

- International Trade LawDocument16 pagesInternational Trade LawAyush Pratap SinghNo ratings yet

- Indigo TicketDocument4 pagesIndigo TicketROhit MalikNo ratings yet

- Supreme Court: Republic of The Philippines ManilaDocument2 pagesSupreme Court: Republic of The Philippines ManilaJopan SJNo ratings yet

- Current Affairs 2019Document58 pagesCurrent Affairs 2019Muhammad HarisNo ratings yet

- 1 SMDocument16 pages1 SMHabiburrahman AlmansurNo ratings yet

- Web Etymology Class 4Document3 pagesWeb Etymology Class 4GETTO VOCAB100% (2)