Professional Documents

Culture Documents

Documentary Requirement and Clearance Procedure in The Exportation of Articles

Uploaded by

Mark Abinan0 ratings0% found this document useful (0 votes)

26 views8 pagesnotes

Original Title

Documentary requirement and clearance procedure in the exportation of articles

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnotes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views8 pagesDocumentary Requirement and Clearance Procedure in The Exportation of Articles

Uploaded by

Mark Abinannotes

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

- Documentary requirement and clearance procedure in

the exportation of articles

General export procedure

Classification of exports

- As to physical movement of goods

Ø Actual or outright exportation- refers to the customs procedure applicable to goods

which, being in free circulation, leave the Philippine territory and are intended to remain

permanently outside it.

Ø Constructive exportation- refers to customs procedures applicable to goods which

are subject of sale from free zone to the customs territory or vice versa, bonded

manufacturing warehouse to free zone or vice versa

- As to Documentation and customs procedures to be undertaken at the time of

exportation

Ø Temporary exports- Which sent abroad for repair, processing, conditioning, public

exhibition etc. and intention to re import is express at the time of exportation.

Ø Exports claiming drawbacks

Ø Exports from CBW

Ø Exports from free zone

Ø Regulated or restricted exports

PD 930: simplifying export procedure and documentation

Authority to load- refers to the approval or permission granted by the BOC for each

deputies agencies for the loading of export goods on board the carriers specified in the

expert declaration.

Certificate if shipment- issued by the BOC (export division) Upon request of an exporter

certifying to the nature of the shipment of export goods which can either be full

shipment effected, shut off or non shipment.

Certificate of origin- Refers to the declaration of the exporter certified by the BOC that

his export complies with the origin requirements he specified under bilateral, regional

our multilateral trading agreements to which the Philippines or ASEAN is a party

Export clearance- Refers to all pre exportation requirements other than those of the BOC

to authorize loading

Periodic export clearance- Refers to export clearance that is valid for a specific period but

not exceeding one year and issued by the concerned government agency of products

regularly exported by an exporter.

Original export clearance- Refers to the export clearance issued for export products

upon the request of the exporter.

Expert declaration- refers to the statement made in the manner prescribed by the BOC

and other appropriate agencies by which the person concerned indicated procedure to

be observed for taking out or causing to be taken out in exported goods and the

particulars that may be required by customs.

Prohibited export products- products which are not allowed for exportation except for

scientific or testing purposes which needs export clearance from government agencies

concerned.

Regulated export- Products exportation of which is not prohibited but which need export

clearance from concerned government agency.

Export declaration shall be accomplished in 4 copies

(1) BOC (original);

(2) exporters copy

(3) NSO

(4) DTI (not applicable under automated system)

Where to file Export declaration:

Metro Manila (POM, MICP, NAIA or OSEDC)

Provincial (Export Coordinating Division and Export Division at port of loading and

OSEDC at the port of loading)

Inspectors report of loading- After loading the Customs Inspector on board a vessel or

Customs Container Control Division (CCCD) representative for containerized cargo shall

submit to the Export Division which processed the export declaration the original copy

of inspector’s report uploading together with the copy of export declaration included in

the report.

- If the shipment is subject to duty draw back a copy of the completely process

export declaration shall be submitted to the tax credit and duty drawbacks center of the

Department of Finance.

Special permit to load shall be granted on.

- for authority to load local transship goods to foreign vessels

- for shipments word export declaration is not a requirement for loading

- for partial shipments covered by monthly general export declaration

Exporter Accreditation

Accrediting agencies

- Accrediting agencies for investment promotion-oriented exporters are the BOI,

PEZA, CDC, SBMA, AFAB, CEZA and ZEZA, provided that garment exporters under

GITIDO, except those located inside the PEZA/Freeport’s shall be accredited by BOI.

- Accrediting agency for export promotion-oriented exporters, as well as coffee

exporters operating under the export development act and the International Coffee

Organization Certifying Agency is the BETP.

- The accredit ing authority for exporters not falling within any of the foregoing,

except Customs Bonded Warehouse (CBW) operators, shall be the PHILEXPORT.

Validity and renewal

- The validity of the CPRS registration of an exporter accredited by the government

agencies shall be determined agency.

- The validity of CPRS of exporters accredited by PHILEXPORT shall be valid for one

year. The exporters shall renew their accreditation with their respective government

agencies or with PHILEXPORT not later than 30 days-prior to the expiration of the

accreditation and/or CPRS.

- Transfer of accreditation of exporters from one agency to another after end of

registration period should be accompanied by clearance from the original accrediting

agency.

Causes for suspension or termination

- Expiration and failure of the accrediting agency that the exporter’s accreditation has

been suspended or terminated.

- Upon notice from the accrediting agency that the exporter’s accreditation has been

suspended or terminated.

- Upon orders from the commissioner of Customs for violation of the Customs law its

rules and regulation.

Bank Reference Number

- Exporter submits a copy pf the CoR to its bank for a BRN for purposes of paying

the Documentary Stamp Fee and other charges in the processing of ED. Importers who

are issued BRN’s cannot use the same BRN for their exports.

- Upon issuance if the BRN to the exporter, the AAB shall transmit to e2m the

corresponding information through PASS5

- Export oriented enterprise registered either with the BOI or PEZA are exempted

from payment of BOC/BIR DSF.

o CDS 100

o BIR stamp 15

o Exporters registered with freeport zone authority are required to pay 115 stamps

Export declaration

Automated Export Declaration processing under e2m

- Accredited CPRS registered exporters or through an accredited customs broker

lodges export declaration though VASP.

- Export Declaration lodge may be routed to the Green lane, Yellow lane or Red lane.

- For ED routed to Green lane, exporter, his authorized representative or customs

broker prints the ED and proceeds to the Customs Container Control Division (CCCD)

which ensures that the container number in the ED lodge matches with the container

number to be loaded.

- For ED routed to the Yellow lane, exporter his authorized representative or customs

broker prints the ED and proceeds to Export Division. The Trade Control Examiner at the

Export Div. conducts document check and re rout to green lane.

- For ED routed to RED lane, the exporter, his authorized representative or customs

broker prints the ED and proceeds to the Export Division. The TCE at the export division

conducts the physical examination and re-rout the ED to green

Export Declaration- Single Administrative Document Cancellation

- A procedure to be followed when there are changes/amendments in the shipping

details after lodgment of

- ED-SAD

-

Registration of Exporters Authorized Representative (EAR)

- EAR is a CPRS-registered broker (meaning: registered in CPRS as a Broker) who is

not PRC-licensed broker, authorized by an exporter to sign and process for his export

declaration pursuant to RA 9853.

o RA 9853 IRR: the EAR must be a fulltime employee of the exporter,

- The EAR who lodges the ED-SAD will also be the declarant for the ED-SAD lodged.

Procedures in EAR registration

- The EAR encodes his CPRS Broker’s Profile in the VASP

- VASP system shall send the EAR’s encoded profile on the BOC’s e2m

- EAR prints stored CPRS and submits with all required documents to the accrediting

agency

- Accrediting agency endorses to AMO list of all EAR applicants together with:

o Duly notarized SPA in favor of the EAR where the exporter is a natural person or a

single proprietorship

o Corporate secretary’s certificate designating the EAR as its representative where the

exporter is a registered corporation or partnership

- Based on the list endorsed by the accrediting agency AMO shall approve within 7

working days from the date of indorsement.

- MISTG shall activate the EAR profile in the e2m

- Appropriate sanctions and /or penalties such as but not limited to cancellation of

CPRS registration may be imposed on the EAR if found to be using the CPRS broker

registration for import related transactions.

One-time exporters

- An individual company, corporation or partnership who has a single export

shipment covered by one BL and ED

- The registration of an exporter as one-time exporter shall be limited only one

exportation within 365 days from date of approval either by the BOC or by the

accrediting agency concerned

- A one-time exporter may apply for CPRS registration through any of the accrediting

agency he belongs to or with the PHILEXPORT

o A one time exporter shall accomplish the form for CPRS registration for Once a year

exporter

o The one time exporter shall submit the notarized application for once a year exporter

in the CPRS thru any VASP which shall be stored in the e2m CPRS for once a year

exporter. Endorsed to AMO by the accrediting agency.

ED-SAD cancellation

- A procedure to be followed when there are changes/amendments in the shipping

details after lodgment of ED-SAD or when shipping details were encoded only after

lodgment of the ED-SAD

- Exporter shall file a written request with the collector of the port of loading for

authority to cancel a previously filed ED-SAD lodge covering the same shipment

Attach dude request is the print out of the verified true copy of the original ED-SAD

sought to be cancelled issued by the MISTG and the accompanied e2m SAD

Cancellation form, accompanied by a BL or AWB.

Upon receipt of the application, Chief ED shall cancel the ED-SAD by printing cancelled

and the date of cancellation.

DepCom, MISTG shall be furnished certified true copy of the cancelled ED-SAD for

purpose of adjusting the electronic record.

- In case of provincial loading where the ED-SAD was filed with the Export

Coordinating Division (ECD), the cancellation of the application shall be addressed to

the Chief, ECD.

- A new ED-SAD shall be lodged by the exporter for the same export shipment even

without first cancelling the previous ED-SAD lodge for the same shipment.

Open Account ED-SAD

- “Open account” is an ED-SAD where no report of loading has been furnished

against the shipment or ED-SAD does not have the status of “Export Release”.

- If upon generation of the report to the e2m a particular ED-SAD is an open

account, the exporter or EAR shall be given 15 days from date the ED-SAD lodge to

cancel the same.

Failure to do so shall be ground for temporary suspension of CPRS registration

Cancellation of the previous ED-SAD is not automatic by mere lodging of a new ED-SAD

- Upon cancellation of the overdue open account ED-SAD, the exporter shall request

the commissioner for the lifting of the suspension supported by the approved ED-SAD

cancellation form. Upon verification of the cancellation MISTG shall immediately

reactivate the CPRS registration.

Payment of Documentary Stamp Fee

- Payment of the Documentary Stamp Fee of 115 pesos shall be done thru the auto-

debit scheme of PASS5 or thru the tillering module via the inhouse bank or the

designated BOC cashier, for payments made beyond office hours.

Manual Processing of ED

- Manual processing of ED shall be allowed in the following instances.

o Computer system breakdown

o Power failure which renders the computer system non-operational

o The AAB is off-line

o Upon authorization by the BOC deputy Commissioner for MISTG

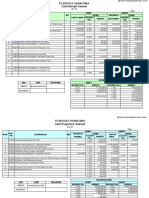

Documentary requirement for processing

Requirements for ED Processing

- Regular export

o Export declaration

o Proforma invoice

o Packing list

- Export under warehousing

o Export Declaration

o Proforma invoice

o Packing List

o Certificate of Identification

o Certificate of Inspection and Loading

o Boatnote

- Export under drawback

o Export declaration

o Proforma invoice

o Packing list

o Shipment information slip issued by CIIS

- Export under bond for repair

o Export declaration

o Proforma Invoice

o Packing list

o Certificate of Identification

- Export of regulated article

o Export declaration Proforma invoice

o Packing list

o Commodity clearance/ export clearance

- Transshipment

o Special permit to load

o Proforma invoice/packing list

o Copy of cargo manifest

o Copy of domestic BL

Issuance of certificate of shipment

- Documentary requirements

o Copy of processed ED

o Copy of commercial invoice

o Inspectors certificate of loading (CCCD) for containerized shipment

§ PID for conventional cargoes

- Office where for request be made for issuance of certificate of shipment

o Export division

Withdrawal of Shut-out containerized cargo

- Requirements

o A copy of the pre advance notice issued by the shipping line 2 depart of showing the

date of booking and container numbers for the relevant containers.

o a certification from the port operator showing the date the container arrived and

certifying to the fact that the container arrived from within the Philippine customs

territory and not from abroad as a transshipment from another port.

Control system to ensure only containers with authority to load are loaded to exporting

vessels

- The export division shall provide the customs container control division with a

running list of all containers for which it has issued an authority to load. This list must be

kept current at all times it shall be the responsibility of the loading inspector to ensure

that no loaded containers for which an authority to load has not been issued or allowed

to be loaded into any vessel. It shall be the responsibility of the export division to ensure

that authority to load is issued for the containers forming part of an export declaration

only after compliance with all the requirements for the issuance of such authority to

load, including the requirement to subject any containers or entries which are tagged

red by the risk management office, and any containers or entries which are the subject

of an alert order, or either X-ray or physical inspection, and even then, only if there are

no derogatory findings after such inspection.

Export entries are not required to be filed prior to the entry of containers

- the Bureau of customs shall not require that export entries must be filed prior to

the entry of containers into any port. However, no cargo whether in containers or not

can be loaded into a vessel without an authority to load.

Pre exportation evaluation of products to be exported for CO purposes

- Documentary requirements

o written request for evaluation to be submitted at least five days prior to exportation

o complete list of all materials used in the production both local and imported

o breakdown of cost element

o import and export declarations

o production flow chart

o company profile

o other documents to support originating status of the product

o photo of production process

Issuance of certificate of origin

- copy of approved export declaration

- copy of bill of lading anyway bill of lading

- commercial invoice

- copy of export permit for regulated products

Obligations of a certified exporter

- allow BOC access to records and premises to monitor the use of the authorization

and of the verification of the correctness of the declarations made. the records and

accounts must allow for identification and verification off the originating status of the

goods for which an invoice declaration must made during at least three days from the

date of the declaration.

- undertake to make invoice declaration only for goods that such exporter produces

and for which he has all appropriate documents proving the originating status of the

goods concerned at the time of the declaration.

- undertake to ensure that the persons responsible for making invoice declaration

know and understand the rules of origin

- assumes full responsibility for all invoice declarations made out on behalf of the

company including any misuse

- these certified exporter shall submit a quarterly report of all invoice declarations

made during the same. Using the prescribed form and shall submit the said report to

the port operations services within seven days after the end of each quarter.

You might also like

- Export Import ProcedureDocument193 pagesExport Import Procedureprasantkumar8783% (6)

- EXIM InfoDocument193 pagesEXIM Infonshahani03100% (1)

- Export Import DocumentationDocument21 pagesExport Import DocumentationSabir ShaikhNo ratings yet

- Kyg 2 - Royal Wings 1Document24 pagesKyg 2 - Royal Wings 1Shoaib ShaikhNo ratings yet

- Export ProcedureDocument13 pagesExport Procedurejayparekh280% (1)

- Export Incentives in IndiaDocument12 pagesExport Incentives in IndiaFasee NunuNo ratings yet

- Export ManagementDocument36 pagesExport ManagementprasadtharwalNo ratings yet

- Export Documentation Procedure Are As Follows: Export ProcedureDocument19 pagesExport Documentation Procedure Are As Follows: Export ProcedurePawan KeswaniNo ratings yet

- Ignou AED-01 Export Procedures and Documenntation Important Questions and Answers (Note:Attempt All Questions in Exam)Document77 pagesIgnou AED-01 Export Procedures and Documenntation Important Questions and Answers (Note:Attempt All Questions in Exam)Hazel Grace100% (2)

- Processing An Export Order: I. Confirmation of OrderDocument4 pagesProcessing An Export Order: I. Confirmation of Orderkaran singhNo ratings yet

- Export Procedure in IndiaDocument16 pagesExport Procedure in IndiaRohan AroraNo ratings yet

- Air Export CustomsDocument7 pagesAir Export CustomsDivyabhan SinghNo ratings yet

- Export Incentive AbhishekDocument7 pagesExport Incentive Abhishekpramodbms1369No ratings yet

- Export Procedure and DocumentationDocument18 pagesExport Procedure and DocumentationElegant EmeraldNo ratings yet

- Procedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41Document23 pagesProcedure For Clearance of Imported and Export Goods.: Roduct - Development - Process - International - Marketing&b 37&c 41niharaNo ratings yet

- Export ProcedureDocument21 pagesExport ProcedurekanikaNo ratings yet

- Export Documentation and ProceduresDocument180 pagesExport Documentation and ProceduresTUSHER14767% (3)

- Draft BOC Order On Export Cargo Clearance Formalities and Issuance of Proof of OriginDocument9 pagesDraft BOC Order On Export Cargo Clearance Formalities and Issuance of Proof of OriginPortCallsNo ratings yet

- Procedural & Documentary Formalities (As Per Import Policy) FORDocument21 pagesProcedural & Documentary Formalities (As Per Import Policy) FORSamrita SinghNo ratings yet

- Export OrderDocument3 pagesExport OrderJia MakhijaNo ratings yet

- How To Export: 1) Establishing An OrganisationDocument5 pagesHow To Export: 1) Establishing An Organisationarpit85No ratings yet

- Export ProcedureDocument3 pagesExport Procedurethyvivek91% (11)

- Indian Customs Manual - Procedure For Clearance of Imported and Export Goods PDFDocument5 pagesIndian Customs Manual - Procedure For Clearance of Imported and Export Goods PDFshivam_dubey4004No ratings yet

- Process of Export of New or Used Vehicles From RSADocument7 pagesProcess of Export of New or Used Vehicles From RSAmarshy bindaNo ratings yet

- Custom ClearanceDocument24 pagesCustom ClearanceManasi BundeNo ratings yet

- CMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mDocument9 pagesCMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mMichael Joseph IgnacioNo ratings yet

- Import Export DocumentsDocument32 pagesImport Export DocumentsPriya Shah100% (1)

- Stage 1: Preliminary StageDocument8 pagesStage 1: Preliminary StageIshaan JaveriNo ratings yet

- Presidential Decree NO.930Document9 pagesPresidential Decree NO.930Lj CadeNo ratings yet

- Clearance of Export GoodsDocument10 pagesClearance of Export GoodsPromila ChetriNo ratings yet

- Import & Export Procedures - EACDocument15 pagesImport & Export Procedures - EACrodgerlutaloNo ratings yet

- Coffee Importers in KoreaDocument22 pagesCoffee Importers in KoreazmahfudzNo ratings yet

- Procedures For Export and ImportDocument3 pagesProcedures For Export and ImportSriram MuraleedharanNo ratings yet

- Exchange Control Regulations - ExportsDocument52 pagesExchange Control Regulations - ExportsAkanksha Singh100% (1)

- Import and Export ProceduresDocument27 pagesImport and Export Proceduressubbu2raj3372No ratings yet

- GCC Unified Guide For Customs ProceduresDocument75 pagesGCC Unified Guide For Customs Proceduresyahya Her,manson100% (1)

- 1) Establishing An Organisation: Click HereDocument6 pages1) Establishing An Organisation: Click HerePraWin KharateNo ratings yet

- Procedure For Clearance of Export GoodsDocument11 pagesProcedure For Clearance of Export GoodssahuanNo ratings yet

- Procedure For Import and ExportDocument3 pagesProcedure For Import and ExportPooja GujarathiNo ratings yet

- Docs For Claiming Exp AssistanceDocument5 pagesDocs For Claiming Exp Assistancejuzerali007No ratings yet

- MC MC MC MC MC MC MC MCDocument13 pagesMC MC MC MC MC MC MC MCRep Wale MayankNo ratings yet

- Border ManagementDocument48 pagesBorder ManagementRoebie Marie DimacaliNo ratings yet

- Pre-Shipment Inspection (PSI) Guide: For ExportersDocument8 pagesPre-Shipment Inspection (PSI) Guide: For Exportersابوالحروف العربي ابوالحروفNo ratings yet

- Goods Subject For Consumption Under Formal Entry ProcessDocument13 pagesGoods Subject For Consumption Under Formal Entry ProcessElaine Antonette RositaNo ratings yet

- Procedure For Clearance of Imported & Export GoodsDocument9 pagesProcedure For Clearance of Imported & Export Goodsprachi_rane_4No ratings yet

- Export Procedure of Agricultural Products: Registration As A Business EntityDocument5 pagesExport Procedure of Agricultural Products: Registration As A Business Entityvinnie10No ratings yet

- 22 Excise Procedure For Factory StuffingDocument21 pages22 Excise Procedure For Factory StuffingGanesh SingareNo ratings yet

- Export ProceduresDocument12 pagesExport ProceduressreenivasakirankumarNo ratings yet

- Procedure For Clearance of Imported and Export GoodsDocument14 pagesProcedure For Clearance of Imported and Export GoodstodkarvijayNo ratings yet

- Custom Clerarance: Area of Operations and AuthorityDocument4 pagesCustom Clerarance: Area of Operations and AuthorityRajeev VyasNo ratings yet

- Lms Module On Export - Import of JewelleryDocument45 pagesLms Module On Export - Import of JewelleryRaghu.GNo ratings yet

- EXIM ProcedureDocument5 pagesEXIM ProcedureSandeep GoleNo ratings yet

- Presentation Custom ProcedureDocument30 pagesPresentation Custom ProcedureSohail Saahil0% (1)

- Customs Law Review 9 QuizDocument5 pagesCustoms Law Review 9 Quizjanna.barbasaNo ratings yet

- Custom Clearance Procedures For Imported and Exported GoodsDocument54 pagesCustom Clearance Procedures For Imported and Exported GoodsntamakheNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- TruckingDocument2 pagesTruckingMark AbinanNo ratings yet

- Transportation Management ActivitiesDocument4 pagesTransportation Management ActivitiesMark AbinanNo ratings yet

- Piolo NavaDocument25 pagesPiolo NavaMark AbinanNo ratings yet

- Nihonggo Midterm ExamDocument2 pagesNihonggo Midterm ExamMark AbinanNo ratings yet

- Chapter 5 Competitive Rivalry and Competitive DynamicsDocument4 pagesChapter 5 Competitive Rivalry and Competitive DynamicsMark AbinanNo ratings yet

- Week 6 Self AssessmentDocument13 pagesWeek 6 Self AssessmentDaniel NikiemaNo ratings yet

- To Indian Financial System: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Document12 pagesTo Indian Financial System: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Aishwarya SharmaNo ratings yet

- Adjustment Operational Costs Flat Rate / Anpassung BetriebskostenpauschaleDocument1 pageAdjustment Operational Costs Flat Rate / Anpassung BetriebskostenpauschaleMario David Gordillo BenavidesNo ratings yet

- m1 Bank ReconDocument2 pagesm1 Bank ReconRedmond Abalos TejadaNo ratings yet

- Rules of OriginDocument14 pagesRules of OriginRasul0% (1)

- Module 9 - Cash and Marketable Securities ManagementDocument26 pagesModule 9 - Cash and Marketable Securities ManagementemmanvillafuerteNo ratings yet

- Power TradingDocument5 pagesPower TradingCpgeorge JohnNo ratings yet

- Simple Interest Principal × Rate × Time: ExamplesDocument17 pagesSimple Interest Principal × Rate × Time: ExamplesAliya IqbalNo ratings yet

- Amarylis Putri - KERTAS KERJA JURNAL - Sent2Document6 pagesAmarylis Putri - KERTAS KERJA JURNAL - Sent2SatriaArdya10No ratings yet

- Tutorial 7Document6 pagesTutorial 7KÃLÅÏ SMÎLĒYNo ratings yet

- Pakistan Balance of PaymentsDocument94 pagesPakistan Balance of PaymentsHamzaNo ratings yet

- MNLU Aurangabad LLM 2021Document6 pagesMNLU Aurangabad LLM 2021CLAT LLM 2021No ratings yet

- Skin Care in China - Datagraphics: Country Report - Apr 2021Document4 pagesSkin Care in China - Datagraphics: Country Report - Apr 2021Long Trần HoàngNo ratings yet

- Yen To Trade Full Curriculum UnitDocument148 pagesYen To Trade Full Curriculum UnitAlbert Kirby TardeoNo ratings yet

- International Trade: of ChinaDocument3 pagesInternational Trade: of ChinaCrina-Elena CostacheNo ratings yet

- ExportingDocument30 pagesExportingArshad AnsariNo ratings yet

- Book 2 Discussion ProblemsDocument22 pagesBook 2 Discussion ProblemsElsie GenovaNo ratings yet

- TB CHDocument77 pagesTB CHg202301230No ratings yet

- Interest Rates SummaryDocument28 pagesInterest Rates SummaryMichael ArevaloNo ratings yet

- Social Studies Sample Scope and Sequence Updated - Grade 6 PDFDocument287 pagesSocial Studies Sample Scope and Sequence Updated - Grade 6 PDFJC Zapata67% (3)

- Catfish Demand AnalysisDocument30 pagesCatfish Demand AnalysisWolfie WufNo ratings yet

- 1.1 Audit of Cash and Cash EquivalentsDocument2 pages1.1 Audit of Cash and Cash EquivalentsANGELU RANE BAGARES INTOLNo ratings yet

- Bir Ruling No. Vat-424-2022 - Philippine Vending To Peza Subject To VatDocument5 pagesBir Ruling No. Vat-424-2022 - Philippine Vending To Peza Subject To VatJohnallen MarillaNo ratings yet

- Wade Timmerson, Suzanne Caplan, - Building Big Profit in REDocument273 pagesWade Timmerson, Suzanne Caplan, - Building Big Profit in REkafes51427No ratings yet

- SCM & LogisticsDocument27 pagesSCM & LogisticsPratik Awari100% (1)

- Ratio Analysis ParticipantsDocument17 pagesRatio Analysis ParticipantsDeepu MannatilNo ratings yet

- Economics Project: Role of Rbi in Control of CreditDocument35 pagesEconomics Project: Role of Rbi in Control of CreditDhairya Tamta82% (11)

- Andria TempleDocument1 pageAndria TempleAndri MatsangouNo ratings yet

- Solved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25Document1 pageSolved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25M Bilal SaleemNo ratings yet

- Jurnal Privasi KeamanaanDocument19 pagesJurnal Privasi KeamanaanSekar AyuNo ratings yet