Professional Documents

Culture Documents

Far460 Group Project 1

Uploaded by

NURAMIRA AQILAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Far460 Group Project 1

Uploaded by

NURAMIRA AQILACopyright:

Available Formats

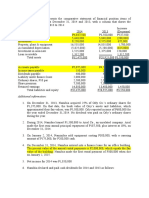

d)Property,Plant & Equipment

Old building Land A Land B Total

Cost / evaluation RM RM RM RM

1 January 2015 4,000,000.00 4,000,000.00 3,000,000.00

Elimination - - -

Revaluation 1,000,000.00 500,000.00 -

31 December 2015 5,000,000.00 4,500,000.00 3,000,000.00

Accumulated Depriciation

1 January 2015 (720,000.00) - -

Elimination - - -

Charge for the year (80,000.00) - (60,000.00)

31 December 2015 800,000.00 -

Carrying amount 4,200,000.00 4,500,000.00 2,940,000.00 11,640,000.00

Workings on Investment Property :-

Factory A Factory B Office A Land B Land c Total

RM RM RM RM RM RM

At Fair Value

1 January 2015 1,500,000.00 9,000,000.00 7,000,000.00 1,000,000.00 2,000,000.00

Disposal - (9,000,000.00) -

Acquisition - - - 10,500,000.00

Changes in fair value 200,000.00 - 500,000.00 50,000.00 1,000,000.00

Transfer to inventory - - - (1,050,000.00)

Balance as at 31/12/2015 1,700,000.00 - 7,500,000.00 - 13,500,000.00 22,700,000.00

a) Melawati Corporation Bhd

Extract Statement of Financial Position as at 31/12/2015

RM RM

Non-current Asset

Property, Plant & Equipment 11,640,000.00

Investment property 22,700,000.00

34,340,000.00

b) Melawati Corporation Bhd

Extract Statement of Profit & Loss and other Comprehensive Income for the year ended 31/12/2015

RM RM

Income

Rental (240,000 + 480,000 + 420,000) 1,140,000.00

Gain on fair value changes in IP 1,750,000.00

Gain on deposit 100,000.00

2,990,000.00

Expenses

Depriciation expenses (140,000.00)

Total Operating Profit 2,850,000.00

Total Operating Profit 5,700,000.00

Other Comprehensive Income:

Surplus on revaluation 1,500,000.00

Total Comprehensive Income 10,050,000.00

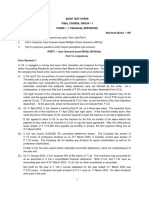

c) Investment property is held to earn rental or capital apprieciation or both. Investment property can be measured

by using cost model and fair value model. Based on above situation, the significant policies adopted by the

company for investment property is fair value model. By using fair value model, the investment property

must be measured at fair value (markrt value) at measurement date.

Meanwhile, Property,plant and equipment are asset held by enterprise to generate income or to carry out its

operations which is not for resale in the ordinary course of business. Property plant and equipment can be

measured at cost model and revaluation model. The significant policies adopted by company for PPE is revaluation

model.Revaluation model is an item of PPE whose fair value can be measured shall be carried at its revalued

amount less any subsequent accumulated depreciation and subsequent impairment loss.

Besides that, there is transfer of asset from IP to inventory on 1 st October 2015. Accounting policies for this

change is the property (inventory) deemed cost shall be its fair value at the date of change and the different

between carrying value and fair value recognized in statement of profit or loss.

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Statement - I Cost of Project Particulars Sl. No. Ref. Annex Total CostDocument15 pagesStatement - I Cost of Project Particulars Sl. No. Ref. Annex Total Costsohalsingh1No ratings yet

- SS1 - Tenang Bhd Financial Statements AnalysisDocument9 pagesSS1 - Tenang Bhd Financial Statements AnalysisAFIZA JASMANNo ratings yet

- Chapter 14 AssociatesDocument15 pagesChapter 14 AssociatesChristian James RiveraNo ratings yet

- Purchase Price AllocationDocument8 pagesPurchase Price AllocationTharnn KshatriyaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Statement of Profit and Loss, Balance Sheet and Cash Flow Analysis for 1999Document4 pagesStatement of Profit and Loss, Balance Sheet and Cash Flow Analysis for 1999Jayash KaushalNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- FARAP 4406A Investment in Equity SecuritiesDocument8 pagesFARAP 4406A Investment in Equity SecuritiesLei PangilinanNo ratings yet

- Financial Statement Analysis Ratios and CalculationsDocument6 pagesFinancial Statement Analysis Ratios and CalculationsHannah Mae VestilNo ratings yet

- Far460 Group Project 2Document4 pagesFar460 Group Project 2NURAMIRA AQILANo ratings yet

- COMPARATIVE INCOME STATEMENTDocument12 pagesCOMPARATIVE INCOME STATEMENTBISHAL ROYNo ratings yet

- CH 14 - Translation SolutionDocument3 pagesCH 14 - Translation SolutionJosua PranataNo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- Balance Sheet and Cash Flow Statement AnalysisDocument3 pagesBalance Sheet and Cash Flow Statement AnalysisAmit GodaraNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- BA 118.3 Module 2 Post and Sage AnswersDocument18 pagesBA 118.3 Module 2 Post and Sage AnswersRed Ashley De LeonNo ratings yet

- Income Statement and Financial Position for Multinational CompanyDocument3 pagesIncome Statement and Financial Position for Multinational CompanyAway To PonderNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Akuntansi Keuangan 1Document15 pagesAkuntansi Keuangan 1Vincenttio le CloudNo ratings yet

- Vertical BfsDocument4 pagesVertical BfsKrüpãl MãñgrùlêNo ratings yet

- BADVAC1XDocument8 pagesBADVAC1Xfaye pantiNo ratings yet

- Accounting Fundamentals PracticeDocument9 pagesAccounting Fundamentals PracticealitohdezsalNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- Project Report On Grocery Shop: Mrs Atsü PhomDocument5 pagesProject Report On Grocery Shop: Mrs Atsü PhomShyamal DuttaNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- Answer Far270 Feb2021Document8 pagesAnswer Far270 Feb2021Nur Fatin AmirahNo ratings yet

- MGT AC - Prob-NewDocument276 pagesMGT AC - Prob-Newrandom122No ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Working Notes Profit and Loss Adjustment AccountDocument11 pagesWorking Notes Profit and Loss Adjustment Accountkvrajan6No ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Tutorial 11 QsDocument3 pagesTutorial 11 QsDylan Rabin PereiraNo ratings yet

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellNo ratings yet

- Jawaban Soal Quiz No 2 Dan 3Document4 pagesJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- Parch and Sag Corp ConsolidationDocument5 pagesParch and Sag Corp ConsolidationJeth MahusayNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Cash Flow Statement ProblemsDocument19 pagesCash Flow Statement ProblemsSubbu ..No ratings yet

- 12 Accounts Imp ch10 PDFDocument14 pages12 Accounts Imp ch10 PDFmukesh kumarNo ratings yet

- Accounts Important Questions by Rajat Jain SirDocument31 pagesAccounts Important Questions by Rajat Jain SirRajiv JhaNo ratings yet

- Hifa NurafwaDocument8 pagesHifa Nurafwa20197 Elisa Nurhayati AhmadNo ratings yet

- Imp QuesDocument2 pagesImp QueskaveriNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Expansion Project Example: Dr. C. Bulent AybarDocument10 pagesExpansion Project Example: Dr. C. Bulent AybarTricia Mae PetalverNo ratings yet

- Case 3.7Document7 pagesCase 3.7Thái SơnNo ratings yet

- Financing Daycare CenterDocument3 pagesFinancing Daycare CenterAngel CastilloNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- Tutorial 7 - IntangibleDocument2 pagesTutorial 7 - IntangibleABABNo ratings yet

- Ratio Analysis (Divya Jadi Booti)Document85 pagesRatio Analysis (Divya Jadi Booti)Michael AdhikariNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- Icma.: PakistanDocument3 pagesIcma.: Pakistangfxexpert36No ratings yet

- SoS MidTerm ReportDocument17 pagesSoS MidTerm ReportDheeraj Kumar ReddyNo ratings yet

- Torrent Company Updt Sep22Document6 pagesTorrent Company Updt Sep22Aa BaNo ratings yet

- AA153501 1427378053 BookDocument193 pagesAA153501 1427378053 BooklentinieNo ratings yet

- NorQuant Multi-Asset Fund White Paper 2023Document24 pagesNorQuant Multi-Asset Fund White Paper 2023oscar.haukvikNo ratings yet

- MonmouthDocument28 pagesMonmouthAndrew SumirNo ratings yet

- Multiple Choices - Computational Answer KeyDocument4 pagesMultiple Choices - Computational Answer KeyAleah kay BalontongNo ratings yet

- Nippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Document29 pagesNippon India Growth Fund: (Mid Cap Fund-An Open Ended Equity Scheme Predominantly Investing in Mid Cap Stocks)Saif MansooriNo ratings yet

- Financial PlanningDocument8 pagesFinancial PlanningMohamed EzzatNo ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- Errors and Questionable Judgments in Analysts' DCF ModelsDocument37 pagesErrors and Questionable Judgments in Analysts' DCF ModelsSergiu CrisanNo ratings yet

- Fundamentals of Corporate Finance Canadian 9th Edition Brealey Test BankDocument45 pagesFundamentals of Corporate Finance Canadian 9th Edition Brealey Test Bankanselmthangxu5eo0100% (26)

- T RoweDocument1 pageT RoweKevin ParkerNo ratings yet

- Depreciation DBM DDBM SYDDocument16 pagesDepreciation DBM DDBM SYDTayam Prince RussellNo ratings yet

- Investment & Portfolio Management - Assignment Four - Smart 3BDocument6 pagesInvestment & Portfolio Management - Assignment Four - Smart 3BAhmed AzazyNo ratings yet

- ProblemDocument2 pagesProblemchandra K. SapkotaNo ratings yet

- Tugas Akuntansi Keuangan LanjutanDocument8 pagesTugas Akuntansi Keuangan LanjutanMin DaeguNo ratings yet

- LSE Financial Management II Corporate Valuation Assignment SolutionDocument2 pagesLSE Financial Management II Corporate Valuation Assignment SolutionFarah ImamiNo ratings yet

- Essentials of Investments 10th Edition Bodie Solutions Manual DownloadDocument14 pagesEssentials of Investments 10th Edition Bodie Solutions Manual DownloadJennifer Walker100% (21)

- Telchi Litel Ltda Eeff 2021Document3 pagesTelchi Litel Ltda Eeff 2021Info Riskma SolutionsNo ratings yet

- Class 12 Accountancy CBSE Cash Flow StatementDocument7 pagesClass 12 Accountancy CBSE Cash Flow StatementSarvesh SreedharNo ratings yet

- Individual Assignment 2Document15 pagesIndividual Assignment 2MingxNo ratings yet

- Unit 2 Objectives VipulDocument7 pagesUnit 2 Objectives Vipulamrutapillai06No ratings yet

- Fund Flow Statement ExplainedDocument11 pagesFund Flow Statement ExplainedSANTHIYA KNo ratings yet

- ExamDocument3 pagesExamMIN THANTNo ratings yet

- DAF30Document2 pagesDAF30axaagency.deveyraNo ratings yet

- Ôn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Document48 pagesÔn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Thương TrầnNo ratings yet

- FEIA ImportantDocument14 pagesFEIA Importantguru1barkiNo ratings yet