Professional Documents

Culture Documents

Soriano Vs BSP

Soriano Vs BSP

Uploaded by

PAC0 ratings0% found this document useful (0 votes)

15 views1 page1) Petitioner was accused of facilitating an unauthorized P8 million loan from the Rural Bank of San Miguel, Inc. to spouses Enrico and Amalia Carlos, despite them never applying for or receiving the loan.

2) Petitioner argued he did not violate the law since it requires the offender to obtain a loan directly from their bank.

3) The court ruled the prohibition in the law is broad and also covers indirect loans where the director or officer has a stake, like petitioner benefitting from the unauthorized loan.

Original Description:

Banking Law

Original Title

Soriano vs BSP

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Petitioner was accused of facilitating an unauthorized P8 million loan from the Rural Bank of San Miguel, Inc. to spouses Enrico and Amalia Carlos, despite them never applying for or receiving the loan.

2) Petitioner argued he did not violate the law since it requires the offender to obtain a loan directly from their bank.

3) The court ruled the prohibition in the law is broad and also covers indirect loans where the director or officer has a stake, like petitioner benefitting from the unauthorized loan.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageSoriano Vs BSP

Soriano Vs BSP

Uploaded by

PAC1) Petitioner was accused of facilitating an unauthorized P8 million loan from the Rural Bank of San Miguel, Inc. to spouses Enrico and Amalia Carlos, despite them never applying for or receiving the loan.

2) Petitioner argued he did not violate the law since it requires the offender to obtain a loan directly from their bank.

3) The court ruled the prohibition in the law is broad and also covers indirect loans where the director or officer has a stake, like petitioner benefitting from the unauthorized loan.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

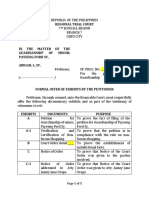

Soriano vs BSP

FACTS:

The Office of Special Investigation of the Bangko Sentral ng Pilipinas, through

its officers, transmitted a letter to Jovencito Zuño, Chief State Prosecutor of the

Department of Justice. The letter attached five affidavits, which would allegedly

serve as bases for filing criminal charges for Estafa thru Falsification of Commercial

Documents, and for Violation of Section 83 of RA 337, against, Hilario P. Soriano.

These five affidavits, stated that spouses Enrico and Amalia Carlos appeared to

have an outstanding loan of P8 million with the Rural Bank of San Miguel, Inc., but

had never applied for nor received such loan; that it was petitioner, who was then

president of RBSM, who had ordered, facilitated, and received the proceeds of the

loan; and that the P8 million loan had never been authorized by RBSM's Board of

Directors and no report thereof had ever been submitted to the Department of

Rural Banks, Supervision and Examination Sector of the BSP.

Petitioner moved to quash the information stating that it does not constitute

to an offense. He argued that a violation of DOSRI law requires the offender

to obtain a loan from his bank, without complying with procedural, reportorial, or

ceiling requirements.

ISSUE:

Whether or not the contention of petitioner is correct

RULING:

No. The prohibition in Section 83 is broad enough to cover various modes of

borrowing. It covers loans by a bank director or officer (like herein petitioner) which

are made either: (1) directly, (2) indirectly, (3) for himself, (4) or as the

representative or agent of others. It applies even if the director or officer is a mere

guarantor, indorser or surety for someone else's loan or is in any manner an obligor

for money borrowed from the bank or loaned by it. The covered transactions are

prohibited unless the approval, reportorial and ceiling requirements under Section

83 are complied with.

A direct borrowing is obviously one that is made in the name of the DOSRI

himself or where the DOSRI is a named party, while an indirect borrowing includes

one that is made by a third party, but the DOSRI has a stake in the transaction. The

latter type - indirect borrowing - applies in this case.

The information describes the manner of securing the loan as indirect; names

petitioner as the benefactor of the indirect loan; and states that the requirements of

the law were not complied with. It contains all the required elements for a violation

of Section 83, even if petitioner did not secure the loan in his own name.

You might also like

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- Virginia Marie Spencer Complaint & SofDocument9 pagesVirginia Marie Spencer Complaint & SofLaw&CrimeNo ratings yet

- Legal Opinion Qualified Theft 1Document6 pagesLegal Opinion Qualified Theft 1Francisco Braganza100% (3)

- Notes in Criminal Procedure Class of Atty. Plaridel Bohol II (UE & San Beda)Document33 pagesNotes in Criminal Procedure Class of Atty. Plaridel Bohol II (UE & San Beda)Lex Talionis Fraternitas100% (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Banking DigestsDocument9 pagesBanking DigestsEm DavidNo ratings yet

- Central Bank of The Phils. Vs - Citytrust BankDocument3 pagesCentral Bank of The Phils. Vs - Citytrust Bankazzy_km67% (3)

- Formal Offer of ExhibitsDocument5 pagesFormal Offer of ExhibitsKitel YbañezNo ratings yet

- Mims v. State of North Carolina Et Al - Document No. 4Document3 pagesMims v. State of North Carolina Et Al - Document No. 4Justia.comNo ratings yet

- False Imprisonment by ShananiDocument6 pagesFalse Imprisonment by ShananiSADATI MKINGANo ratings yet

- 2019-b Negotiable Instruments Case DigestDocument33 pages2019-b Negotiable Instruments Case DigestEstrellita GlodoNo ratings yet

- Go V BSPDocument1 pageGo V BSPtrish bernardoNo ratings yet

- Soriano Vs PeopleDocument2 pagesSoriano Vs PeopleMichelle Dulce Mariano CandelariaNo ratings yet

- Commercial Law Review - Banking Laws (Incomplete)Document75 pagesCommercial Law Review - Banking Laws (Incomplete)Ann SCNo ratings yet

- Nedlloyd vs. Glow LaksDocument2 pagesNedlloyd vs. Glow LaksPACNo ratings yet

- Soriano vs. People and BSP GR NO. 162336, FEB. 1, 2010Document2 pagesSoriano vs. People and BSP GR NO. 162336, FEB. 1, 2010Julio100% (1)

- People vs. CastanedaDocument2 pagesPeople vs. CastanedaPACNo ratings yet

- PBCOM Vs CADocument3 pagesPBCOM Vs CAfreak20No ratings yet

- I. SHORT TITLE: Ching v. Secretary of Justice Ii. Full Title: Alfredo Ching, Petitioner, vs. The Secretary of JusticeDocument3 pagesI. SHORT TITLE: Ching v. Secretary of Justice Ii. Full Title: Alfredo Ching, Petitioner, vs. The Secretary of JusticenilesrevillaNo ratings yet

- Banking Soriano v. PeopleDocument7 pagesBanking Soriano v. PeopleJessa PuerinNo ratings yet

- Estate of Edward Miller Grimm vs. Estate of Charles Parsons and Patrick C. ParsonsDocument2 pagesEstate of Edward Miller Grimm vs. Estate of Charles Parsons and Patrick C. ParsonsPACNo ratings yet

- BSB GROUP V GODocument4 pagesBSB GROUP V GOALEXA100% (2)

- Obligations and Contracts CasesDocument9 pagesObligations and Contracts CaseslazylawstudentNo ratings yet

- 05 The Metropolitan Bank and Trust Company vs. Rosales and Yo Yuk ToDocument15 pages05 The Metropolitan Bank and Trust Company vs. Rosales and Yo Yuk ToStacy WheelerNo ratings yet

- Ejercito V SandiganbayanDocument3 pagesEjercito V SandiganbayanMickey RodentNo ratings yet

- 2019 Negotiable Instruments Case DigestDocument33 pages2019 Negotiable Instruments Case DigestEstrellita GlodoNo ratings yet

- Davao Integrated Port Stevedoring Services vs. AbarquezDocument3 pagesDavao Integrated Port Stevedoring Services vs. AbarquezPACNo ratings yet

- CLJ Intro To Cjs 2 Atty JMFDocument118 pagesCLJ Intro To Cjs 2 Atty JMFJed DizonNo ratings yet

- Go vs. BSP G.R. No. 178429, Oct. 23, 2009 (604 SCRA 322)Document5 pagesGo vs. BSP G.R. No. 178429, Oct. 23, 2009 (604 SCRA 322)Carlos JamesNo ratings yet

- Central Bank v. CitytrustDocument2 pagesCentral Bank v. CitytrustAnjNo ratings yet

- Soriano V. People G.R. NO. 162336 FEBRUARY 1, 2010 DoctrineDocument3 pagesSoriano V. People G.R. NO. 162336 FEBRUARY 1, 2010 DoctrineTricia CornelioNo ratings yet

- Metropolitan Bank and Trust Company, The vs. Rosales DigestDocument2 pagesMetropolitan Bank and Trust Company, The vs. Rosales DigestCher100% (1)

- Caballes Vs CA (GR No. 136292. Jan 15, 2002)Document1 pageCaballes Vs CA (GR No. 136292. Jan 15, 2002)Ei BinNo ratings yet

- Lack of Authority From Corporation in Filing Criminal ComplaintsDocument3 pagesLack of Authority From Corporation in Filing Criminal ComplaintsBobby Olavides SebastianNo ratings yet

- Hilario Soriano CaseDocument2 pagesHilario Soriano CaseDarlene GanubNo ratings yet

- Villanueva Vs PeopleDocument14 pagesVillanueva Vs PeopleMarianne Hope VillasNo ratings yet

- 02 Garcia v. FloridoDocument3 pages02 Garcia v. FloridoKarina Garcia100% (2)

- Banking Soriano Vs PeopleDocument1 pageBanking Soriano Vs PeopleCamille GrandeNo ratings yet

- Lozano vs. de Los Santos: 274 SCRA 452 - Business Organization - Corporation Law - Jurisdiction of The SECDocument16 pagesLozano vs. de Los Santos: 274 SCRA 452 - Business Organization - Corporation Law - Jurisdiction of The SECGrace Lacia Delos Reyes100% (1)

- Central Bank of The Philippines v. Citytrust Banking Corporation, G.R. No. 141835Document1 pageCentral Bank of The Philippines v. Citytrust Banking Corporation, G.R. No. 141835xxxaaxxxNo ratings yet

- Soriano vs. People, G.R. No. 162336, Feb. 1, 2010, (611 SCRA 191)Document5 pagesSoriano vs. People, G.R. No. 162336, Feb. 1, 2010, (611 SCRA 191)Carlos James100% (1)

- RPC RA 337 PD 1795: Obtain A LoanDocument3 pagesRPC RA 337 PD 1795: Obtain A LoanKatherine GutierrezNo ratings yet

- Banking Case Digest PDFDocument18 pagesBanking Case Digest PDFNFA TARLACNo ratings yet

- Banking Lapulapu B1Document8 pagesBanking Lapulapu B1Jennica Gyrl DelfinNo ratings yet

- (Soriano v. BSP)Document2 pages(Soriano v. BSP)Patrick ManaloNo ratings yet

- JOSE C. GO, Petitioner, Vs - BANGKO SENTRAL NG PILIPINAS, RespondentDocument7 pagesJOSE C. GO, Petitioner, Vs - BANGKO SENTRAL NG PILIPINAS, RespondentJorela TipanNo ratings yet

- Hilario PDocument12 pagesHilario PAnjo AldeneseNo ratings yet

- Soriano V PeopleDocument21 pagesSoriano V PeopleptbattungNo ratings yet

- Compiled Cases Soriano vs. People Up To Alan Limso vs. PNBDocument7 pagesCompiled Cases Soriano vs. People Up To Alan Limso vs. PNBKylie GavinneNo ratings yet

- Soriano vs. PPDocument6 pagesSoriano vs. PPMichelle Ann LunaNo ratings yet

- Soriano Vs People and BSP 1Document7 pagesSoriano Vs People and BSP 1Samantha GuevaraNo ratings yet

- The Letter Attached As Annexes Five Affidavits,: Factual AntecedentsDocument13 pagesThe Letter Attached As Annexes Five Affidavits,: Factual AntecedentsJun Bill CercadoNo ratings yet

- Soriano V People GR162336Document13 pagesSoriano V People GR162336Jesus Angelo DiosanaNo ratings yet

- Rule 117 Soriano V PeopleDocument2 pagesRule 117 Soriano V PeopleGyelamagne EstradaNo ratings yet

- Jose P. Go vs. Bangko Sentral NG PilipinasDocument6 pagesJose P. Go vs. Bangko Sentral NG PilipinasJohn Ludwig Bardoquillo PormentoNo ratings yet

- Soriano V PeopleDocument15 pagesSoriano V PeopleanailabucaNo ratings yet

- 17 Soriano v. BSPDocument6 pages17 Soriano v. BSPChester BryanNo ratings yet

- Metropolitan Bank and Trust Company, The vs. Rosales, 713 SCRA 75, G.R. No. 183204 January 13, 2014Document8 pagesMetropolitan Bank and Trust Company, The vs. Rosales, 713 SCRA 75, G.R. No. 183204 January 13, 2014CherNo ratings yet

- Linsangan Vs TolentinoDocument2 pagesLinsangan Vs TolentinoDaniela Erika Beredo InandanNo ratings yet

- Obligations and Contracts Case SummaryDocument2 pagesObligations and Contracts Case SummaryPat TrickNo ratings yet

- BS Case CompleteDocument14 pagesBS Case CompleteYanz RamsNo ratings yet

- Petitioner Vs Vs Respondents Barbers Molina & Tamargo: First DivisionDocument13 pagesPetitioner Vs Vs Respondents Barbers Molina & Tamargo: First DivisionCamille CruzNo ratings yet

- Facts:: People of The Philippines, Vs Capt. Florencio O. GasacaoDocument4 pagesFacts:: People of The Philippines, Vs Capt. Florencio O. GasacaoEis Pattad MallongaNo ratings yet

- Republic v. CuadernoDocument2 pagesRepublic v. CuadernoMaria Olivia Repulda AtilloNo ratings yet

- Memorandum (Finished Na)Document5 pagesMemorandum (Finished Na)Raymund Joseph CamarilloNo ratings yet

- Banking Law Cases Go Vs BSPDocument10 pagesBanking Law Cases Go Vs BSPMarion JossetteNo ratings yet

- Bank of The Philippine Islands Vs LaingoDocument2 pagesBank of The Philippine Islands Vs LaingoBeverlyn Jamison50% (2)

- Far East Bank vs. TentmakersDocument2 pagesFar East Bank vs. Tentmakersxx_stripped52No ratings yet

- 9 BSB Group Inc. Vs Sally GoDocument3 pages9 BSB Group Inc. Vs Sally GoBOEN YATORNo ratings yet

- Cases 5Document4 pagesCases 5Thoughts and More ThoughtsNo ratings yet

- 08 - A.C. No. 6672Document4 pages08 - A.C. No. 6672Basem ManardasNo ratings yet

- (Batulanon v. People) (Serapio) c2021Document2 pages(Batulanon v. People) (Serapio) c2021itsmestephNo ratings yet

- Ancog vs. Court of AppealsDocument2 pagesAncog vs. Court of AppealsPACNo ratings yet

- United States Vs Santiago Palma - Article No 195Document1 pageUnited States Vs Santiago Palma - Article No 195PACNo ratings yet

- Brito, Sr. vs. DianalaDocument4 pagesBrito, Sr. vs. DianalaPACNo ratings yet

- JV Ejercito Vs SandiganbayanDocument15 pagesJV Ejercito Vs SandiganbayanPACNo ratings yet

- People of The Philippines Vs Feliciano EmbalidoDocument1 pagePeople of The Philippines Vs Feliciano EmbalidoPACNo ratings yet

- Employees Within The Appropriate Bargaining Unit Shall Be Entitled To A Basic Monthly Compensation Plus Commission Based On Their Respective SalesDocument1 pageEmployees Within The Appropriate Bargaining Unit Shall Be Entitled To A Basic Monthly Compensation Plus Commission Based On Their Respective SalesPACNo ratings yet

- Heirs of Maximo Labanon vs. Heirs of Constancio LabanonDocument3 pagesHeirs of Maximo Labanon vs. Heirs of Constancio LabanonPACNo ratings yet

- People of The Philippines Vs Marivic GenosaDocument1 pagePeople of The Philippines Vs Marivic GenosaPACNo ratings yet

- Heirs of Gregorio Tengco Vs Heirs of AliwalasDocument2 pagesHeirs of Gregorio Tengco Vs Heirs of AliwalasPACNo ratings yet

- Jimenez vs. National Labor Relations Commission, 256 SCRA 84, G.R. No. 116960 April 2, 1996Document2 pagesJimenez vs. National Labor Relations Commission, 256 SCRA 84, G.R. No. 116960 April 2, 1996PACNo ratings yet

- Catan vs. National Labor Relations Commission, 160 SCRA 691, No. L-77279 April 15, 1988Document2 pagesCatan vs. National Labor Relations Commission, 160 SCRA 691, No. L-77279 April 15, 1988PACNo ratings yet

- TAN LIM TE vs. Workmen's Compensation CommissionDocument2 pagesTAN LIM TE vs. Workmen's Compensation CommissionPACNo ratings yet

- People Vs Quidato Jr.Document2 pagesPeople Vs Quidato Jr.PACNo ratings yet

- People Vs Ilagan - COLMENARESDocument2 pagesPeople Vs Ilagan - COLMENARESPACNo ratings yet

- Josefina Cruz-Arevalo vs. Judge Lydia-LayosaDocument2 pagesJosefina Cruz-Arevalo vs. Judge Lydia-LayosaPACNo ratings yet

- Tai Tong Chuache VS Insurance CommisionDocument1 pageTai Tong Chuache VS Insurance CommisionPACNo ratings yet

- Delos Reyes Vs Lukban and BorjaDocument1 pageDelos Reyes Vs Lukban and BorjaPACNo ratings yet

- Emnace Vs CADocument2 pagesEmnace Vs CAPACNo ratings yet

- Ortega Vs CADocument2 pagesOrtega Vs CAPACNo ratings yet

- Munasque Vs CADocument2 pagesMunasque Vs CAPACNo ratings yet

- CIR Vs SuterDocument1 pageCIR Vs SuterPACNo ratings yet

- Santiago Inc Vs CADocument2 pagesSantiago Inc Vs CAPACNo ratings yet

- People of The Philippines Vs Marciano GonzalesDocument1 pagePeople of The Philippines Vs Marciano GonzalesPACNo ratings yet

- Jo Chung Cang Vs Pacific ComDocument1 pageJo Chung Cang Vs Pacific ComPACNo ratings yet

- SANCHO Vs LIZArragaDocument5 pagesSANCHO Vs LIZArragaPACNo ratings yet

- Arnel Colinares Vs People of The PhilippinesDocument1 pageArnel Colinares Vs People of The PhilippinesPACNo ratings yet

- CDS6 and CDS7 Billing CodesDocument9 pagesCDS6 and CDS7 Billing CodesMatthew BellusciNo ratings yet

- Death PenaltyDocument10 pagesDeath PenaltyRon Jovaneil JimenezNo ratings yet

- San Miguel vs. MacedaDocument5 pagesSan Miguel vs. MacedaRocky MagcamitNo ratings yet

- September 3, 2014Document12 pagesSeptember 3, 2014Maple Lake MessengerNo ratings yet

- Example of Deposition of WitnessDocument2 pagesExample of Deposition of WitnessIris Lianne BonifacioNo ratings yet

- Nacnac V PDocument6 pagesNacnac V PExistentialist5aldayNo ratings yet

- CommercialDocument157 pagesCommercialBuddy FlorendoNo ratings yet

- IN THE COURT OF ADDITIONAL SENIOR CIVIL JUDGE Chief Examination Affidvit Gayatri AuntyDocument5 pagesIN THE COURT OF ADDITIONAL SENIOR CIVIL JUDGE Chief Examination Affidvit Gayatri AuntyHemeswarareddy KarimireddyNo ratings yet

- Puspavathy A/p Thaveethu V Majlis Perbandaran Klang & Ors and Other AppealsDocument14 pagesPuspavathy A/p Thaveethu V Majlis Perbandaran Klang & Ors and Other AppealsFadzila SaidNo ratings yet

- People vs. RelovaDocument23 pagesPeople vs. RelovaJayco-Joni CruzNo ratings yet

- People vs. Abdul MacalabaDocument1 pagePeople vs. Abdul MacalabaConnie BebNo ratings yet

- Toaz - Info Robbery Complaint Ate Gina PRDocument6 pagesToaz - Info Robbery Complaint Ate Gina PRSANTOS, Jan Jewel J.No ratings yet

- Dala F. Sibay v. Mounzer F. Sibay Magda Sibay Johnston & Roche Counselor Field United States President of America Clinton Jack Quinn, Counsel or the United States Attorney General United States Department of Justice Jeffrey Axelrad Eric H. Holder, United States Attorney Federal Deposit National Corporation Nations Title Life Insurance of New York Federal Home Loan Mortgage National Corporation All States Insurance National Corporation Crestar Mortgage Corporation Richard T. Cregger, Trustee Forclosure Jessie B. Wilson, Iii, Commissioner of the Act Fairfax County Atlas Assurance of America--Dean, Homer Homer W. Smith John M. Deutch Central Intelligence Agency (Ciaoprt) United States State Department Emp Marilyn MacAfee Dala F. Sibay v. Mounzer F. Sibay Magda Sibay Johnston & Roche Counselor Field United States President of America Clinton Jack Quinn, Counselor the United States Attorney General United States Department of Justice Jeffrey Axelrad Eric H. Holder, United States Attorney FeDocument3 pagesDala F. Sibay v. Mounzer F. Sibay Magda Sibay Johnston & Roche Counselor Field United States President of America Clinton Jack Quinn, Counsel or the United States Attorney General United States Department of Justice Jeffrey Axelrad Eric H. Holder, United States Attorney Federal Deposit National Corporation Nations Title Life Insurance of New York Federal Home Loan Mortgage National Corporation All States Insurance National Corporation Crestar Mortgage Corporation Richard T. Cregger, Trustee Forclosure Jessie B. Wilson, Iii, Commissioner of the Act Fairfax County Atlas Assurance of America--Dean, Homer Homer W. Smith John M. Deutch Central Intelligence Agency (Ciaoprt) United States State Department Emp Marilyn MacAfee Dala F. Sibay v. Mounzer F. Sibay Magda Sibay Johnston & Roche Counselor Field United States President of America Clinton Jack Quinn, Counselor the United States Attorney General United States Department of Justice Jeffrey Axelrad Eric H. Holder, United States Attorney FeScribd Government DocsNo ratings yet

- Taitz, Hale Complaint 05 04 2009Document85 pagesTaitz, Hale Complaint 05 04 2009haneno100% (11)

- CRPC Case LawsDocument16 pagesCRPC Case LawsIshita SethiNo ratings yet

- General Michael Flynn Seeks To Withdraw His Guilty Plea One Week Before SentencingDocument157 pagesGeneral Michael Flynn Seeks To Withdraw His Guilty Plea One Week Before SentencingJim Hoft100% (1)

- Jaime U. Gosiaco, vs. Leticia Ching and Edwin CastaDocument33 pagesJaime U. Gosiaco, vs. Leticia Ching and Edwin CastaClaudia Rina LapazNo ratings yet

- Tetangco V Ombudsman (Crim)Document7 pagesTetangco V Ombudsman (Crim)J.N.No ratings yet

- Critical Analysis of The Evidentiary Value of Confession Before A Police OfficerDocument5 pagesCritical Analysis of The Evidentiary Value of Confession Before A Police Officerss shakilNo ratings yet

- New Evidence Casts Doubt On Macon Murder Case: Café On Main Listed For SaleDocument12 pagesNew Evidence Casts Doubt On Macon Murder Case: Café On Main Listed For SaleThe DispatchNo ratings yet