Professional Documents

Culture Documents

Remedies Notes

Uploaded by

Christian Albert Herrera0 ratings0% found this document useful (0 votes)

13 views1 pageThis document outlines the guidelines for tax compromise settlements and abatements in the Philippines. It specifies the circumstances under which compromise settlements and abatements are allowed or not allowed for delinquent tax accounts, assessment cases, civil tax cases, and collection cases. It provides the required documents and basis for compromise based on doubtful validity or financial incapacity. It also specifies the approval process and priorities for summary tax remedies. Compromise offers must be paid in full before approval. The Reb and Neb must report every six months on the exercise of their power to compromise.

Original Description:

Original Title

REMEDIES NOTES

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the guidelines for tax compromise settlements and abatements in the Philippines. It specifies the circumstances under which compromise settlements and abatements are allowed or not allowed for delinquent tax accounts, assessment cases, civil tax cases, and collection cases. It provides the required documents and basis for compromise based on doubtful validity or financial incapacity. It also specifies the approval process and priorities for summary tax remedies. Compromise offers must be paid in full before approval. The Reb and Neb must report every six months on the exercise of their power to compromise.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageRemedies Notes

Uploaded by

Christian Albert HerreraThis document outlines the guidelines for tax compromise settlements and abatements in the Philippines. It specifies the circumstances under which compromise settlements and abatements are allowed or not allowed for delinquent tax accounts, assessment cases, civil tax cases, and collection cases. It provides the required documents and basis for compromise based on doubtful validity or financial incapacity. It also specifies the approval process and priorities for summary tax remedies. Compromise offers must be paid in full before approval. The Reb and Neb must report every six months on the exercise of their power to compromise.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

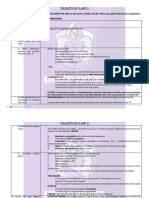

RR 7-2001/ 30-2002/ 8-2004/ 9-2013: COMPROMISE SETTLEMENT GR: SURCHARGE AND COMPROMISE PENALTIES ONLY

POWER: REB/NEB GROUNDS:

ALLOWED: 1. UNJUST/EXCESSIVE ASSESSMENT

1. DELINQUENT ACCOUNTS (FINAL AND EXECUTORY) a. WRONG VENUE FILING/PAYMENT

2. ASSESSMENT CASES (AFTER ISSUANCE OF FAN/FLD) b. MISTAKEN PAYMENT DUE TO RO’S WRONG

UNDER ADMIN PROTEST ADVISE

3. CIVIL TAX (ASSESSMENT) CASES DISPUTED BEFORE THE c. DUE TO DIFFICULT INTERPRETATION OF LAW

COURT 2. ADMIN AND COLLECTION COST IS HIGH

4. COLLECTION CASES DISPUTED BEFORE THE COURT 3. TP IS DEAD WITH NO DISTRAINABLE PROPERTY

5. CRIMINAL VIOLATION NOT FILED IN COURT 4. PRESCRIBED COLLECTION CASES

NOT ALLOWED:

1. WITHHOLDING TAXES (#) DOCUMENTS REQUIRED

2. CRIMINAL CASES FILED IN COURT A. BIR FORM 2110

3. DELINQUENT ACCOUNTS WITH APPROVED INSTALLMENT B. REQUEST LETTER WITH LEGAL AND FACTUAL BASIS

4. RECON/REIN AND TP AGREED WITH REDUCED ASSESSMENT FOR REQUEST

5. FINAL AND EXECUTORY CASES FROM COURTS (DECIDED C. WAIVER OF PRESCRIPTION

CASES), STILL ALLOWED IF BASED ON FINANCIAL

INCAPACITY ONLY

6. ESTATE TAX, STILL ALLOWED IF DOUBTFUL VALIDITY ONLY (!) REPORT ON EXCERCIS OF POWER TO COMPROMISE (REB & NEB)-

EVERY SIX MONTHS TO CONGRESSIONAL OVERSIGHT COMMITTEE

BASIS FOR COMPROMISE:

1. DOUBTFL VALIDITY [40% OF BASIC TAX] (!) 100% OF BASIC TAX SHOULD BE PAID PRIOR TO APPROVAL

a. JEOPARDY ASSESSMENT

b. ARBITRARY ASSESSMENT RMO 20-2007: TAX REMEDIES

c. FAILURE TO PROTEST DUE TO FAILURE TO

RECEIVE NOTICE/ LACK OF LEGAL BASIS A. ABATEMENT

d. FAILURE TO PROTEST ON FAN/FLD WITH LACK OF RDO > TWC > CIR

LEGAL BASIS (!) 100% OF BASIC TAX SHOULD BE PAID PRIOR TO APPROVAL

e. FAILURE TO PROTEST WITH CTA WITH LACK OF

LEGAL BASIS B. COMPROMISE

f. BEO ASSESSMENT WITH PROOF OF LACK OF RDO > TWG > REB/NEB > CIR (NEB)

LEGAL BASIS

g. QUESTIONABLE WAIVER AGAINST PRESCRIPTION (!) PAY COMRPOMISE OFFER BEFORE APPROVAL

(#) DOCUMENTS REQUIRED RMO 33-2018: AUTHORITY TO CANCEL ASSESSMENT (ATCA)

A. BIR FORM 2107 1. FOR PROTESTED FAN/FLD CASES ONLY

B. REQUEST LETTER WITH LEGAL AND FACTUAL BASIS a. REDUCED ASSESSMENT

FOR REQUEST b. COMPROMISE SETTLEMENT

C. WAIVER OF PRESCRIPTION i. INSOLVENCY

c. ABATEMENT

2. FINANCIAL CAPACITY [GR: 10% OF BASIC TAX] d. AMENSTY/CONDONATION

a. CORPORATION CLOSED/DISSOLVED [20% OF e. DECLARED ASSESSMENT AS NULL AND VOID

BASIC TAX] f. PRESCRIBED CASES

b. NON-OPERATING CORPORATION FOR 3 YEARS g. WRITE-OFF

OR MORE i. DEAD WITHOUT ANY PROPERTY

c. NON-OPERATING CORPORATION FOR LESS THAN ii. PERMANENT CESSATION

3 YEARS [20% OF BASIC TAX] iii. DISSOLUTION

d. 50% IMPAIRMENT ON ORIGINAL CAPITAL [40% iv. GPP WITH DEAD PARTNERS

OF BASIC TAX] v. AR/DA CASES BELOW 20K

e. NET WORTH DEFICIT (LIAB > ASSET) [20% OF GCRO

BASIC TAX] PRIORITES FOR SUMMARY REMEDIES

f. PURE COMPENSATION INCOME EARNER WITH 1. PRESCRIBING COLLECTION CASES WITHIN 1 YEAR

NO OTHER PROPERTIES AND SOURCE OF INCOME 2. RATE AND FRADULENT CASES

g. DECLARED BANKRUPT [20% OF BASIC TAX] 3. WITH MULTIPLE PROPERTIES

4. NO INTENTION TO PAY

(#) DOCUMENTS REQUIRED 5. OTHER DELIQUENT ACCOUNTS FROM RDOs

A. BIR FORM 2107 6. FALIURE TO PAY 2ND INSTALLMENTS

B. REQUEST LETTER WITH LEGAL AND FACTUAL BASIS

FOR REQUEST

C. WAIVER OF PRESCRIPTION

D. LASTEST FS FOR PREVIOUS 3 YEARS

E. CERTIFICATION OF MONTHLY SALARIES

F. SWORN STATEMENT OF NO OTHER INCOME

G. COPY OF ORDER OF BANKRUPTCY

H. CERT OF NO PROPERTY HOLDINGS

I. WAIVER ON SECRECY OF BANK DEPOSITS

J. SWORN OF NO TCC: NOT FINANCIAL INCPACITATED IF

WITH TCC

NEB- BASIC TAX ABOVE P500K, BELOW MINIMUM RATES (!) ALL NEB

DECISIONS NEED CONCURRENCE OF CIR

REB- BASIC TAX OF P500K AND BELOW, MINOR CRIMINAL

VIOLATIONS, WITHIN MINIMUN RATES

(!) PAY COMRPOMISE OFFER BEFORE APPROVAL

(!) REPORT ON EXCERCIS OF POWER TO COMPROMISE (REB & NEB)-

EVERY SIX MONTHS TO CONGRESSIONAL OVERSIGHT COMMITTEE

RR 13-2001/ 4-2012: ABATEMENT

POWER: CIR ONLY

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Refund of Taxes: in GeneralDocument3 pagesRefund of Taxes: in GeneralAileen Love ReyesNo ratings yet

- Tax Remedies Quiz ReyesDocument4 pagesTax Remedies Quiz ReyesMary Therese Gabrielle Estioko100% (2)

- Taxation Law 2: Case DigestDocument155 pagesTaxation Law 2: Case DigestJosh Napiza100% (1)

- Aratuc V ComelecDocument1 pageAratuc V ComelecLaura R. Prado-LopezNo ratings yet

- Preview: Information or Instructions: Special AppearanceDocument4 pagesPreview: Information or Instructions: Special AppearanceJohnnyLarsonNo ratings yet

- TAX - Quiz 1Document6 pagesTAX - Quiz 1KriztleKateMontealtoGelogo100% (1)

- Registration of Domestic Corporation - SecDocument6 pagesRegistration of Domestic Corporation - SecJuan FrivaldoNo ratings yet

- Income Tax 2021-22Document3 pagesIncome Tax 2021-22nawazz1No ratings yet

- Sworn Statement (RMO 15-2018)Document2 pagesSworn Statement (RMO 15-2018)Christian Albert HerreraNo ratings yet

- Taxation Law II SyllabusDocument4 pagesTaxation Law II SyllabusVikki Mae AmorioNo ratings yet

- Attachment To State Tax Including Cpa Cert PDFDocument4 pagesAttachment To State Tax Including Cpa Cert PDFBradNo ratings yet

- Danda. Sample Spot, Progress and Final Report AssignmnetDocument4 pagesDanda. Sample Spot, Progress and Final Report AssignmnetGADOR JEEZYL100% (1)

- Unlimited Power of AttorneyDocument2 pagesUnlimited Power of AttorneyAdina BusteaNo ratings yet

- TAXREV SANTOSsyllabusDocument7 pagesTAXREV SANTOSsyllabusJoma CoronaNo ratings yet

- Legal Office ProcedureDocument3 pagesLegal Office Procedureyes1nthNo ratings yet

- Caras Vs CADocument2 pagesCaras Vs CADayday AbleNo ratings yet

- OM No. 2018-04-03Document2 pagesOM No. 2018-04-03Christian Albert HerreraNo ratings yet

- Tax Rev SyllabusDocument14 pagesTax Rev SyllabusIanLightPajaroNo ratings yet

- Syllabus UCC Business Law and Taxation IntegrationDocument9 pagesSyllabus UCC Business Law and Taxation IntegrationArki Torni100% (1)

- Test BankDocument36 pagesTest BankJaybie John Palco EralinoNo ratings yet

- ACCTAX3 SyllabusDocument5 pagesACCTAX3 SyllabusEi Ar TaradjiNo ratings yet

- Taxation Law 2: Case DigestDocument155 pagesTaxation Law 2: Case DigestLala ManzanoNo ratings yet

- Cielo Tax Remedies DiagramDocument2 pagesCielo Tax Remedies Diagrambelinda dagohoyNo ratings yet

- Iv. Tax Remedies Under The National Internal Revenue CodeDocument3 pagesIv. Tax Remedies Under The National Internal Revenue CodeRenzil BalicudcudNo ratings yet

- TAXATION LAW REVIEW TopicsDocument13 pagesTAXATION LAW REVIEW TopicsKimberly RamosNo ratings yet

- Estate Tax-Handout 2Document4 pagesEstate Tax-Handout 2Xerez SingsonNo ratings yet

- Amatola Darktrace Cybersecurity AI Immune System Platform For 12 MonthsDocument36 pagesAmatola Darktrace Cybersecurity AI Immune System Platform For 12 MonthsSibusiso NondodaNo ratings yet

- Tax Remedies: I. Remedies in GeneralDocument10 pagesTax Remedies: I. Remedies in GeneralSettee ZetteNo ratings yet

- I. Remedies in GeneralDocument8 pagesI. Remedies in Generaljohn vincentNo ratings yet

- Tax 1701 Cir PDFDocument22 pagesTax 1701 Cir PDFHeva AbsalonNo ratings yet

- Usiness AW Axation: Easy RoundDocument5 pagesUsiness AW Axation: Easy RoundYllana GierNo ratings yet

- Usiness AW Axation: Easy RoundDocument5 pagesUsiness AW Axation: Easy RoundYllana GierNo ratings yet

- Federal Emergency Management Agency Annual Report of Foia Activity For Fy02 I. Basic Information Regarding ReportDocument9 pagesFederal Emergency Management Agency Annual Report of Foia Activity For Fy02 I. Basic Information Regarding ReportpolitixNo ratings yet

- LTZ 2 Tax Law 1 Discussion Guide 2. Sept 2022Document15 pagesLTZ 2 Tax Law 1 Discussion Guide 2. Sept 2022Bestie BushNo ratings yet

- Pre Trial Brief For Plaintiff - Breach of ContractDocument4 pagesPre Trial Brief For Plaintiff - Breach of ContractParalegal JGGCNo ratings yet

- 2021 Remedies of Government PDFDocument44 pages2021 Remedies of Government PDFGideon Tangan Ines Jr.No ratings yet

- TAX - Review Remedies ExDocument6 pagesTAX - Review Remedies Exduguitjinky20.svcNo ratings yet

- Tax Ii 3DDocument16 pagesTax Ii 3DEmilio PahinaNo ratings yet

- Form No. Chg-1: English Hindi Form LanguageDocument7 pagesForm No. Chg-1: English Hindi Form LanguageKunal ObhraiNo ratings yet

- Mark Brickell vs. The NPCADocument35 pagesMark Brickell vs. The NPCAGrant LaFlecheNo ratings yet

- Taxation Law 2: InterpretDocument42 pagesTaxation Law 2: InterpretJulia ManriqueNo ratings yet

- Araullo University Cabanatuan City Nueva EcijaDocument14 pagesAraullo University Cabanatuan City Nueva EcijacryzelNo ratings yet

- NIRC Rem NotesDocument15 pagesNIRC Rem NotesSherwin LingatingNo ratings yet

- 310-Deutsche Knowledge Services v. CIR G.R. No. 197980 December 01, 2016Document8 pages310-Deutsche Knowledge Services v. CIR G.R. No. 197980 December 01, 2016Jopan SJNo ratings yet

- Araullo University Cabanatuan City Nueva EcijaDocument14 pagesAraullo University Cabanatuan City Nueva EcijacryzelNo ratings yet

- Tax Review Syllabus A.Y. 2019-2020Document6 pagesTax Review Syllabus A.Y. 2019-2020Kelvin Culajará100% (1)

- 1M 183 AdjudicationofTaxRel - Disputes (Hons-8 - 20190415083537.975 - XDocument6 pages1M 183 AdjudicationofTaxRel - Disputes (Hons-8 - 20190415083537.975 - XdeepaksinghalNo ratings yet

- Multiple ChoiceDocument9 pagesMultiple ChoiceRonnelson PascualNo ratings yet

- REPUBLIC ACT NO. 8424 As Last Amended by REPUBLIC ACT NO. 10963Document20 pagesREPUBLIC ACT NO. 8424 As Last Amended by REPUBLIC ACT NO. 10963Shiela MarieNo ratings yet

- BIR Ruling No. OT-026-20 (RMO 9-14)Document4 pagesBIR Ruling No. OT-026-20 (RMO 9-14)Hailin QuintosNo ratings yet

- Taxrev SyllabusDocument12 pagesTaxrev SyllabusDiane JulianNo ratings yet

- Rae 2Document12 pagesRae 2SAS EXAMNo ratings yet

- CIR v. Phil Daily InquirerDocument5 pagesCIR v. Phil Daily InquirerNichol Uriel ArcaNo ratings yet

- Taxation Law: I. General PrinciplesDocument11 pagesTaxation Law: I. General PrinciplesCnfsr KayceNo ratings yet

- TaxRev Bar OutlneDocument43 pagesTaxRev Bar OutlneTricia GrafiloNo ratings yet

- RFQ Warehouse Supply FurnitureDocument12 pagesRFQ Warehouse Supply FurnitureAdnan NajemNo ratings yet

- 38646rr No. 2-2008 - Annex A-2Document2 pages38646rr No. 2-2008 - Annex A-2Awala AmagicNo ratings yet

- TAX May2021 1st Preboard Questions PDFDocument7 pagesTAX May2021 1st Preboard Questions PDFGoze, Cassandra Jane0% (1)

- 2007 Revised Rules in The Availment of Income Tax HolidayDocument2 pages2007 Revised Rules in The Availment of Income Tax HolidayKhay-Ar PagdilaoNo ratings yet

- Taxation PDFDocument8 pagesTaxation PDFleighNo ratings yet

- Taxation PDFDocument8 pagesTaxation PDFleighNo ratings yet

- Quizzer rfbt1 PDFDocument8 pagesQuizzer rfbt1 PDFleighNo ratings yet

- SYLLABUS Tax FOR 2023 BARDocument3 pagesSYLLABUS Tax FOR 2023 BARJournal SP DabawNo ratings yet

- TAX - LEAD BATCH 3 - Preweek 1 PDFDocument28 pagesTAX - LEAD BATCH 3 - Preweek 1 PDFMay Litt0% (1)

- Bir LectureDocument4 pagesBir LectureTomoko KatoNo ratings yet

- Subic Bay Freeport Zone (SBFZ) Requirements For Business RegistrationDocument1 pageSubic Bay Freeport Zone (SBFZ) Requirements For Business RegistrationInquiry PVMNo ratings yet

- FEEDS Corp ChecklistDocument5 pagesFEEDS Corp ChecklistjeorgiaNo ratings yet

- Rmo2000 42Document1 pageRmo2000 42Christian Albert HerreraNo ratings yet

- Transmittal Sheet (RMO 15-2018)Document2 pagesTransmittal Sheet (RMO 15-2018)Christian Albert HerreraNo ratings yet

- Mission Order (Rmo 15-2018)Document1 pageMission Order (Rmo 15-2018)Christian Albert HerreraNo ratings yet

- Schedule of Findings (RMO 15-2018)Document1 pageSchedule of Findings (RMO 15-2018)Christian Albert HerreraNo ratings yet

- Report On Violations (RMO 15-2018)Document12 pagesReport On Violations (RMO 15-2018)Christian Albert HerreraNo ratings yet

- Matrix of Activities (RMO 15-2018)Document5 pagesMatrix of Activities (RMO 15-2018)Christian Albert HerreraNo ratings yet

- Letter To Police - Barangay (RMO 15-2018)Document1 pageLetter To Police - Barangay (RMO 15-2018)Christian Albert HerreraNo ratings yet

- Notice To TP (RMO 15-2018)Document3 pagesNotice To TP (RMO 15-2018)Christian Albert HerreraNo ratings yet

- Letter To TP (RMO 15-2018)Document1 pageLetter To TP (RMO 15-2018)Christian Albert HerreraNo ratings yet

- Annex E - Self Certification of No Pending Admin - Crim CaseDocument1 pageAnnex E - Self Certification of No Pending Admin - Crim CaseChristian Albert HerreraNo ratings yet

- Annex I - Certification of AssumptionDocument1 pageAnnex I - Certification of AssumptionChristian Albert HerreraNo ratings yet

- Annex F - Request For Publication v2Document1 pageAnnex F - Request For Publication v2Christian Albert HerreraNo ratings yet

- Annex H - Oath of OfficeDocument1 pageAnnex H - Oath of OfficeChristian Albert HerreraNo ratings yet

- Annex G - AppointmentDocument3 pagesAnnex G - AppointmentChristian Albert HerreraNo ratings yet

- Annex B - Standard Functional RequirementsDocument6 pagesAnnex B - Standard Functional RequirementsChristian Albert HerreraNo ratings yet

- Rmo 41-2011Document51 pagesRmo 41-2011Christian Albert HerreraNo ratings yet

- Annex C-1 - Summary of System DescriptionDocument4 pagesAnnex C-1 - Summary of System DescriptionChristian Albert HerreraNo ratings yet

- People v. Escano PDFDocument5 pagesPeople v. Escano PDFHeidiNo ratings yet

- Bowden's Response To The AllegationsDocument4 pagesBowden's Response To The AllegationsHouston ChronicleNo ratings yet

- Case DigestsDocument24 pagesCase DigestsMa Nikka Flores OquiasNo ratings yet

- Nazaire's Apoplectic ResponseDocument20 pagesNazaire's Apoplectic ResponseJ DoeNo ratings yet

- Clinical Iv Case Brief: 86 F.3d 1447, 39 U.S.P.Q.2d 1161, 1 ILRD 634 (7th Cir. 1996)Document4 pagesClinical Iv Case Brief: 86 F.3d 1447, 39 U.S.P.Q.2d 1161, 1 ILRD 634 (7th Cir. 1996)Mohamed RaaziqNo ratings yet

- 07-06-2016 ECF 1 9th Cir. - in Re Cliven Bundy - Petition For Writ of MandamusDocument154 pages07-06-2016 ECF 1 9th Cir. - in Re Cliven Bundy - Petition For Writ of MandamusJack Ryan100% (1)

- Proc No 110 1998 Stamp DutyDocument7 pagesProc No 110 1998 Stamp Dutyzynab123100% (1)

- O.P. (CRL.) Nos. 608 & 609 of 2022 1Document40 pagesO.P. (CRL.) Nos. 608 & 609 of 2022 1Madhusudan AloneyNo ratings yet

- Lasting Power of Attorney Health and Welfare The InstrumentDocument13 pagesLasting Power of Attorney Health and Welfare The InstrumentTony CoatesNo ratings yet

- The Problem of Youth Offenders FactsDocument5 pagesThe Problem of Youth Offenders FactsKarl Chan UyNo ratings yet

- Contract 1.1 PDFDocument7 pagesContract 1.1 PDFDunstan ShetuiNo ratings yet

- United States v. Harp, 4th Cir. (2005)Document7 pagesUnited States v. Harp, 4th Cir. (2005)Scribd Government DocsNo ratings yet

- Application For File InspectionDocument2 pagesApplication For File InspectionAnuj TomarNo ratings yet

- In Re Witness Before The Grand Jury. United States of America v. Witness Before The Grand Jury, 791 F.2d 234, 2d Cir. (1986)Document13 pagesIn Re Witness Before The Grand Jury. United States of America v. Witness Before The Grand Jury, 791 F.2d 234, 2d Cir. (1986)Scribd Government DocsNo ratings yet

- Future Business Leaders of America State of Louisiana BylawsDocument7 pagesFuture Business Leaders of America State of Louisiana BylawsTestNo ratings yet

- Defeating Defense Discovery Games MaterialsDocument37 pagesDefeating Defense Discovery Games MaterialssimonNo ratings yet

- OCAFAM0920Document165 pagesOCAFAM0920Ye KhaungNo ratings yet

- Shinji Higaki (Editor), Yuji Nasu (Editor) - Hate Speech in Japan - The Possibility of A Non-Regulatory Approach-Cambridge University Press (2021)Document526 pagesShinji Higaki (Editor), Yuji Nasu (Editor) - Hate Speech in Japan - The Possibility of A Non-Regulatory Approach-Cambridge University Press (2021)Nicole HartNo ratings yet

- Land Law 1Document14 pagesLand Law 1terathereshaNo ratings yet

- AGATHA MSHOTE - It Is Settled Law That Parties Are Bound by Their Own Pleadings.Document29 pagesAGATHA MSHOTE - It Is Settled Law That Parties Are Bound by Their Own Pleadings.Fredy CalistNo ratings yet

- Teves v. COMELECDocument3 pagesTeves v. COMELECAndrea RioNo ratings yet

- Privity of ConsiderationDocument6 pagesPrivity of Considerationd33naNo ratings yet

- J P Mukherji & Associates PVT LTDDocument55 pagesJ P Mukherji & Associates PVT LTDAnonymous 7ZYHilDNo ratings yet

- Parliamentary Privileges in IndiaDocument1 pageParliamentary Privileges in IndiaAnshul YadavNo ratings yet